Key Insights

- While ecosystem growth strategies continued to catalyze Solana network adoption, challenges regarding network reliability persisted during Q2.

- Core developers focused on network updates and building out QUIC and a novel fee prioritization mechanism to improve the network’s reliability.

- The network updates mitigated the issues that persisted during the quarter as degraded performance stopped in early June.

- Solana’s Neon Ethereum Virtual Machine (EVM) is expected to launch on mainnet over the near term.

- The open sourcing of the Solana Mobile Stack (SMS) for Android and Solana Mobile’s Android phone, Saga, will be significant developments over the months ahead.

A Primer on Solana

Solana is a public, open-source blockchain that aims to deliver scalability and support smart contracts without sacrificing decentralization and security. It accomplishes this through a novel timestamp mechanism called Proof-of-History (PoH). Using PoH, the network can order and batch transactions before they’re processed through a separate Proof-of-Stake (PoS) consensus. Additional design goals include sub-second settlement times, low transaction costs, and support for all LLVM-compatible smart contract languages, including Rust, C, and C++.

As a follow-up to the State of Solana Q1 2022 report, this report will revisit developments and events from the prior quarter, analyze the network’s most recent quarterly performance, and give insight into the coming months. A complete appendix of data tables is available at the end of the report.

The Second Quarter Narrative

Following unprecedented growth in 2021, the Solana network experienced continued growth in some areas but challenges in others during Q1 2022. Volatility was prevalent across metrics, but stabilization of network usage, financial performance, and network infrastructure occurred by the end of the first quarter. A growing NFT marketplace reached billion-dollar sales volumes, TVL diversified across an increasing number of DeFi applications, and strategies to launch applications across several new sectors were underway as the quarter came to a close. At the same time, growing pains persisted with periods of unstable network conditions, and as a result, the outlook for Q2 2022 was unclear.

Ultimately, chaos arrived at the onset of Q2 as Layer-1 network activity declined dramatically across the space. Macro forces such as hawkish monetary policy and the $60 billion collapse of terraUSD (UST) and LUNA set the market into a tailspin. Solana, like most networks, felt the macroeconomic environment as we saw declines in financial and network usage metrics.

However, the bear market has not stopped Solana from implementing solutions to improve network stability and expand its ecosystem. In Q2, core developers focused on building out QUIC and a novel fee prioritization mechanism to improve the network’s reliability and reduce downtime during periods of congestion. Further, strategies to expand ecosystem adoption became more evident with the continued expansion of NFT marketplaces, progress towards EVM compatibility, advancement of Solana Pay, and the roll-out of Solana Mobile.

Performance Analysis

Network Overview

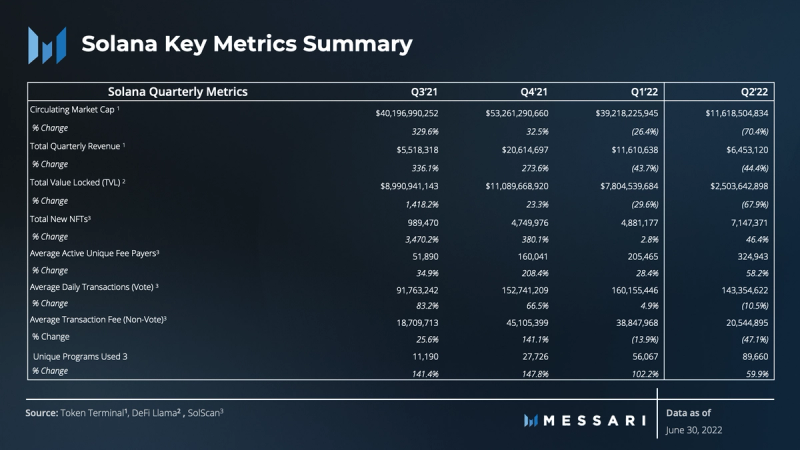

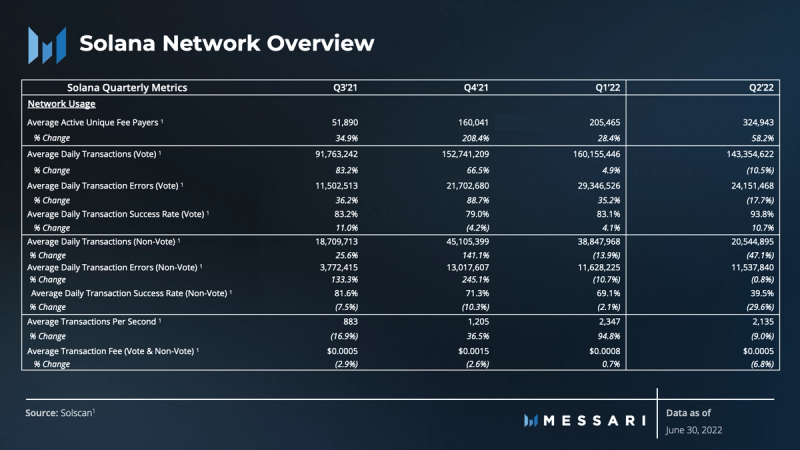

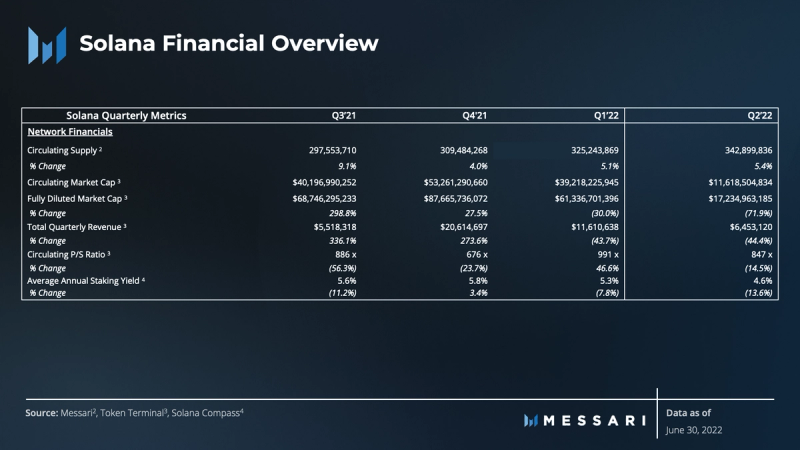

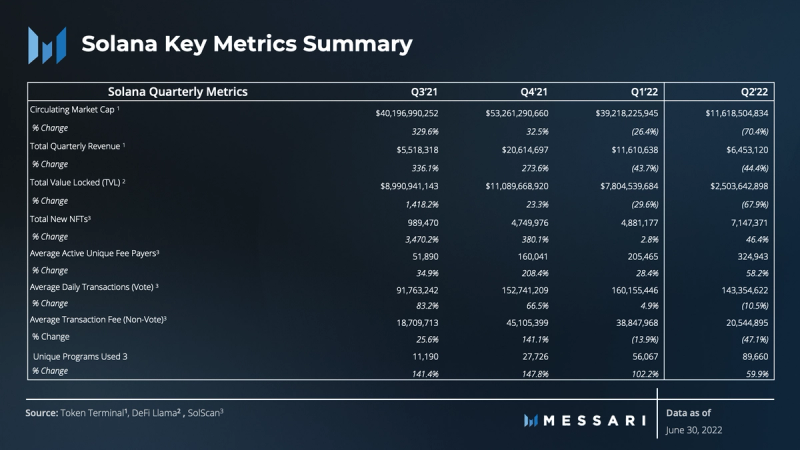

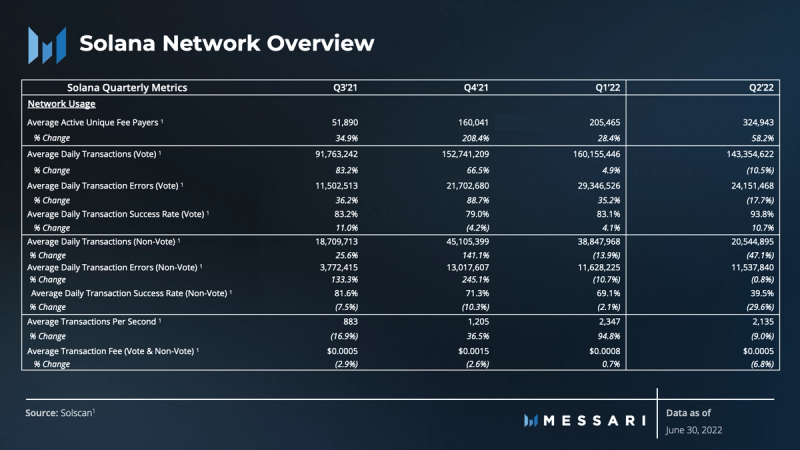

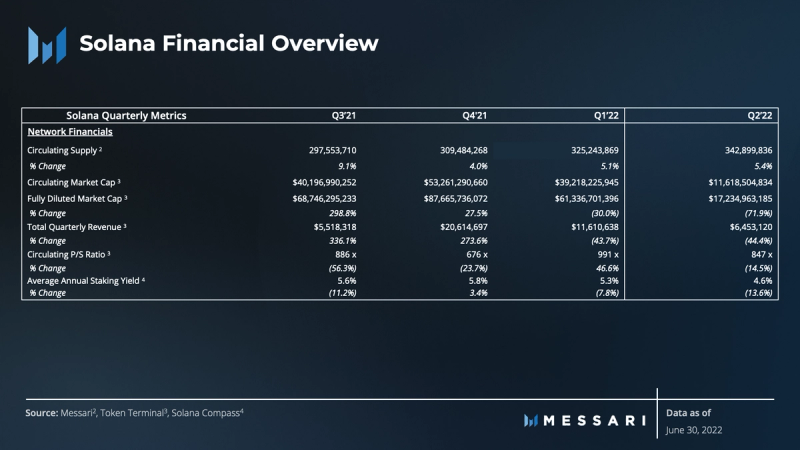

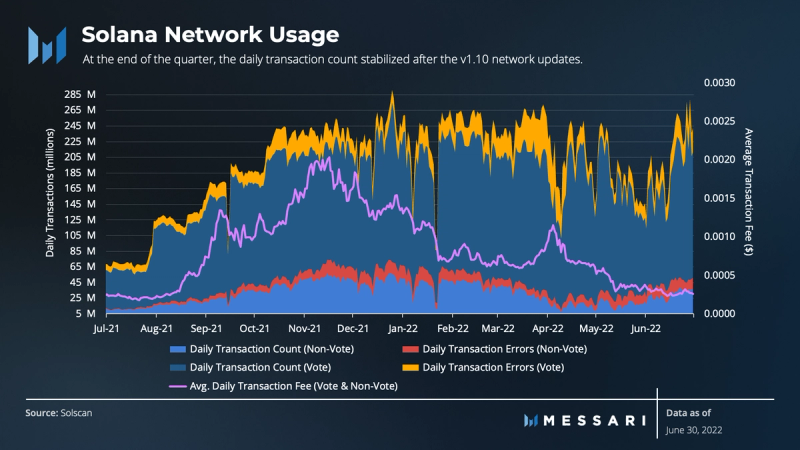

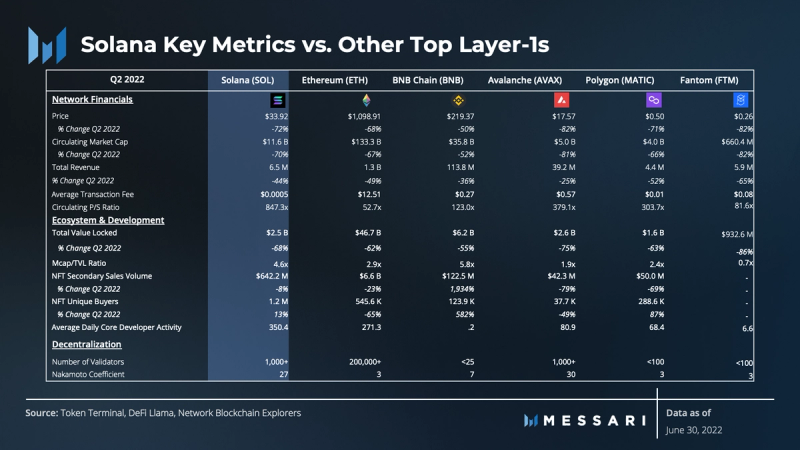

Solana experienced declines in network usage (except for unique fee payers) and financial performance for the first time in over a year. The average number of daily transactions decreased by 17.6%, while revenue decreased by 44.4% due to degraded network performance. Average transaction fees (-40.6%) declined in line with revenue (measured by user expenditure on transactions). Notably, Solana’s average Q2 transaction fees were the lowest amongst a peer group (defined later in this report). Consequently, the trend of price-to-sales (P/S) reversed course, and the ratio of price to revenue improved to 847x, down from 990x at the prior quarter end.

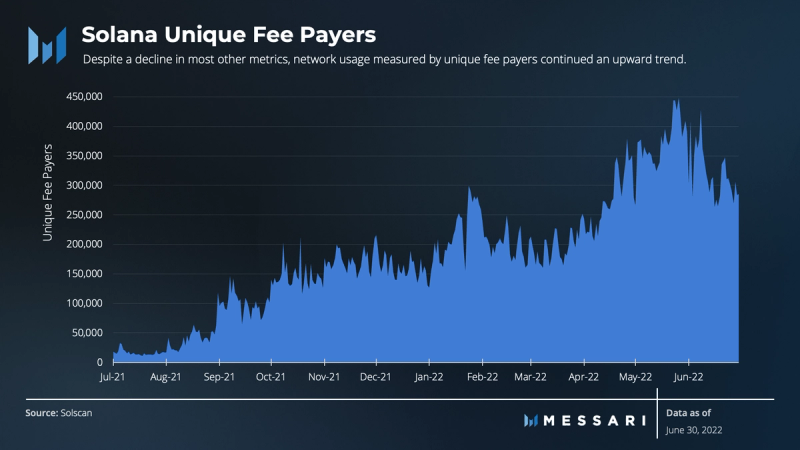

The “daily unique fee payers” metric consists of the number of unique accounts that pay for at least one transaction per day. Despite market conditions and a decline in most other metrics, network usage measured by unique fee payers continued an upward trend. Unique fee payers reached an all-time high of 450,000 in May, almost double the previous all-time high of 280,000 in January 2022. The network averaged around 205,000 unique fee payers during Q1 and stabilized at about 320,000 during Q2. The growth in unique fee payers was consistent with the growth in newly minted NFTs, NFT sales, and unique NFT buyers.

Transactions on Solana can be divided into two categories: 1) consensus and 2) token transfers and smart contract logic. Solana’s PoS consensus process is unlike other smart contract platforms because its consensus votes are registered as on-chain events. Non-vote transactions are analogous to EVM transaction counts and represent the actual economic activity on the network. The sum of both is considered total transactions.

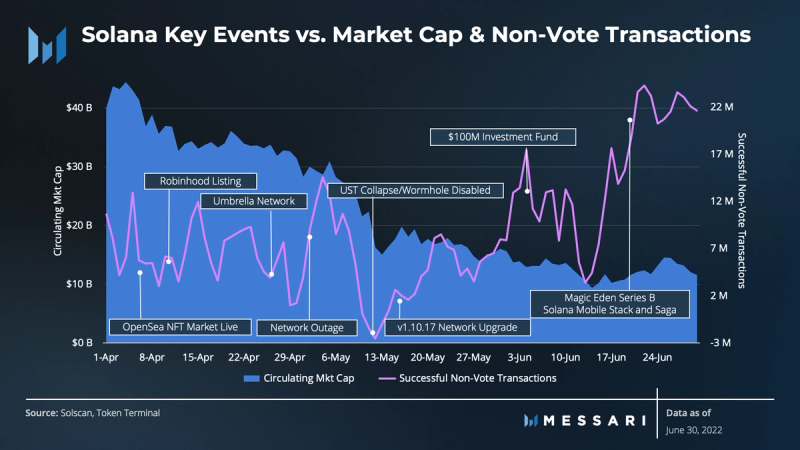

Unlike Q1, total transaction activity on the network did not follow a similar pattern as daily unique fee payers. While the unique fee payer trend moved steadily upward, transaction activity was volatile primarily due to degraded network performance throughout the quarter.

However, two aspects of network performance are notable:

- Despite the transaction volatility and network performance issues, a greater number of unique fee payers continued to use the network.

- Solana implemented the early stages of the Mainnet Beta v1.10 Series at the end of May, and subsequent network stability appears to have followed.

The v1.10 series adds various stability and performance improvements to address the network congestion experienced on mainnet over the last several months. The series introduces QUIC and Quality of Service (Qos) packets by stake weight and fee prioritization. The v1.10 series continues to roll out slowly, and the subsequent release series, v1.11, will focus on making QUIC default and optimizing the other features included in the v1.10 series.

Though not perfectly quantifiable, it appears that the network showed signs of stabilization post v1.10 as lower transaction fees occurred and the daily transaction count reversed trend between the middle of May and the end of June. Further, the trend in TPS also revered course. For perspective, average daily TPS fell to as low as ~700 during times of degraded network performance. After v1.10 began to roll out, TPS reached all-time highs above 3,000 and averaged closer to 2,300 per day.

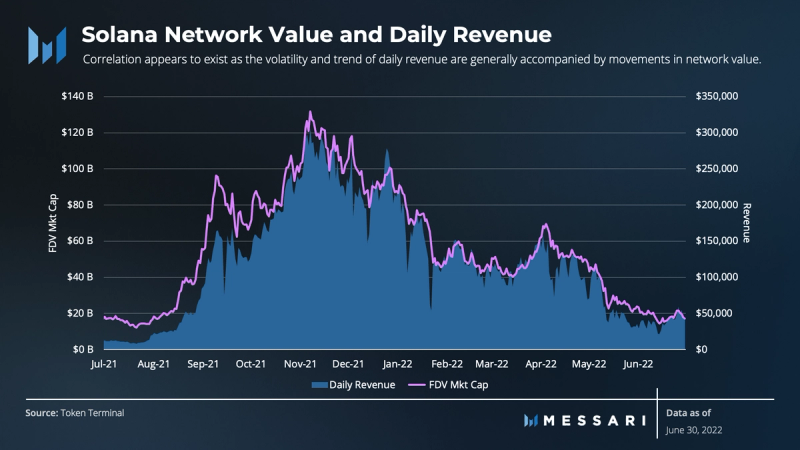

The significance of growth in fee payers and stability in daily transactions is because they drive revenue and, therefore, fundamental value accrual to the network. This matters because fundamental usage and related metrics are becoming a more significant portion of market value (i.e., network value). The big question is how statistically significant the relationship between fundamental metrics like revenue and network value is.

Looking at the numbers, the correlation appears to exist as the volatility and trend of daily revenue are generally accompanied by movements in network value. Additionally, the spread between daily revenue and network value has tightened since late 2021, with occasional spikes and declines in revenue accompanied by spikes and declines in value.

If the relationship continues to hold, an area of concern is network reliability. As seen in 2021 and throughout Q1 and Q2, degraded network performance decreases network usage and reduces the network’s continued flow of revenue. If Solana were to continue to experience degraded performance that lasts for a material amount of time, a resulting drag on fundamental usage may catalyze volatility and drag on network value. However, if implementations of v1.10 and subsequent versions continue to drive stability along with successful ecosystem growth strategies, fundamentals will likely move in a positive direction, and network value may too.

Ecosystem & Developer Overview

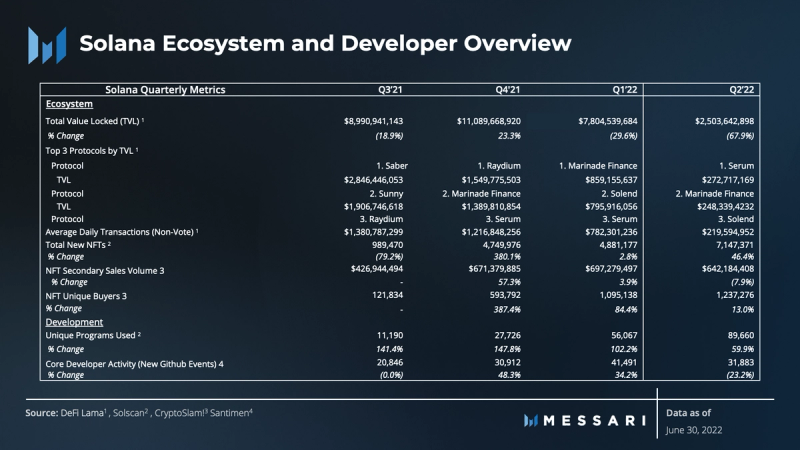

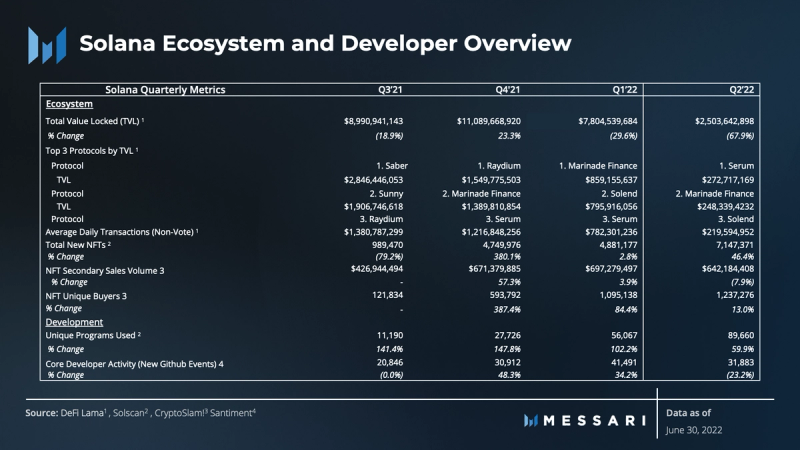

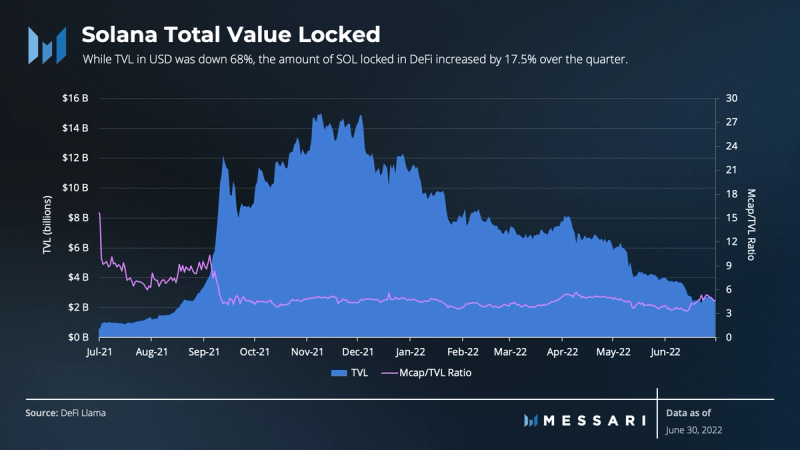

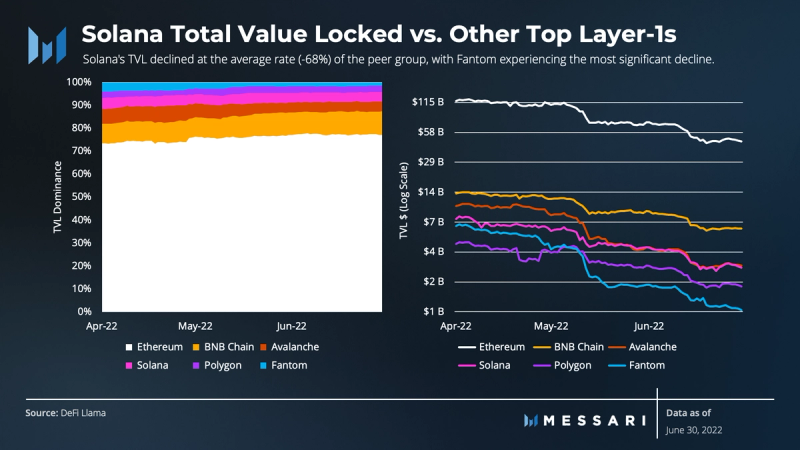

Like other Layer-1 networks, Solana’s Q2 TVL fell roughly 68% in USD terms quarter-over-quarter. However, just as in Q1, the downturn was isolated to DeFi as Solana’s growing NFT sector accelerated.

A notable trend across Q1 and Q2 was the steady long tail of DeFi protocols on Solana with at least $1 million TVL. In addition, there has been an equal distribution of TVL across the top protocols. Except for Mango Markets and Atrix, the USD decline in TVL across the top 10 DeFi protocols was similar (~70%), and their market share dominance remained approximately equal (5%-10%). Further, all other protocols beyond the top 10 make up ~50% of the TVL across the Solana DeFi ecosystem. Collectively, this suggests a healthy distribution of TVL across applications, resulting in a greater level of diversified TVL that mitigates overall ecosystem risk compared to others.

Comparatively, 50% of BNB Chain’s TVL is in a single application (PancakeSwap). If PancakeSwap were to collapse, it would have a significantly negative impact on the BNB Chain ecosystem. In contrast, no single Solana application appears to be “too big to fail,” with only 10% of TVL captured by Serum at the end of Q2.

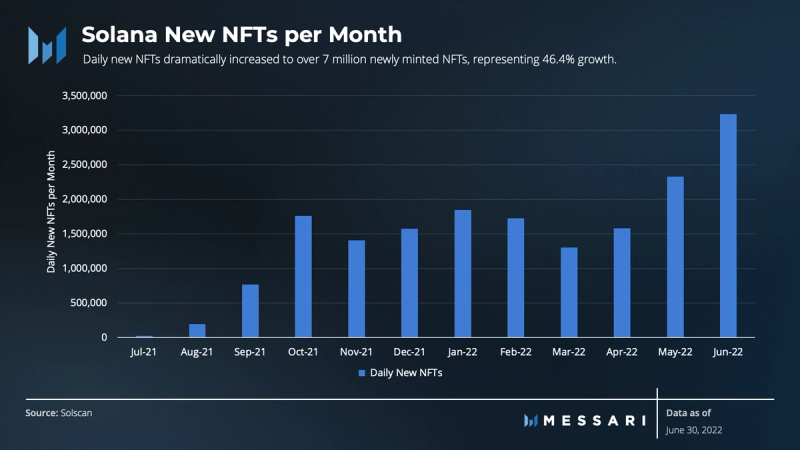

Following a breakout end to 2021 and beginning of 2022, Solana NFT activity accelerated amidst the network’s decline in usage and DeFi activity during Q2. Daily new NFTs dramatically increased to over 7 million newly minted NFTs, representing 46.4% growth. For perspective, newly minted NFTs over the first six months of 2022 are twice the amount minted during all of 2021.

The growth in newly minted NFTs, secondary sales volume, and unique buyers came from several sources:

- The continued success of Metaplex.

- As the Solana Q1 2022 report mentioned, Serum launched its NFT Ecosystem Series in Q2. The Serum NFT Ecosystem is a series of Solana-based NFT collections utilizing the launch and mint functionality of the Burnt Finance Ignition Launchpad.

- In addition to Magic Eden raising $27 million in a Series A funding round in March, it followed up with a $130 million Series B funding round in June as it continued to capture market share from OpenSea.

- Magic Eden’s move to capture market share likely sparked competitive forces as Solana NFT markets almost simultaneously went live on OpenSea during Q2.

Ultimately, Solana’s position in the NFT sector remains a strong component of its ecosystem despite a down market. It continues to be the second-largest protocol by secondary NFT sales volume, trailing only behind Ethereum.

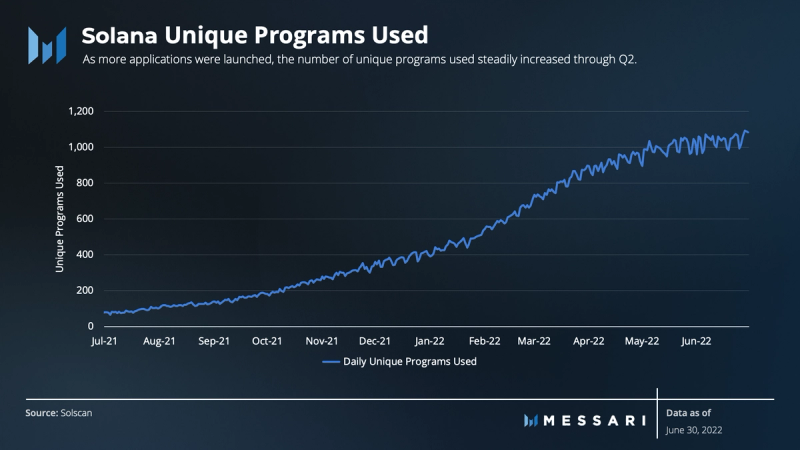

Unique programs used in a given period are another indicator of ecosystem development. The unique program metric represents applications with at least one successful instruction per day, based on a single program address. As more applications launch and grow their user base, the number of unique programs used has steadily increased.

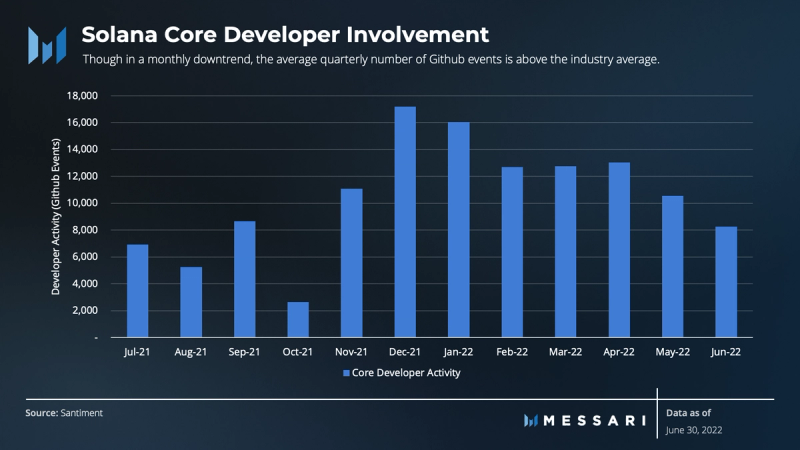

Events in Solana Lab’s Github repository declined 23.2% quarter-over-quarter. Though in a monthly downtrend, the average quarterly number of events is above the industry average.

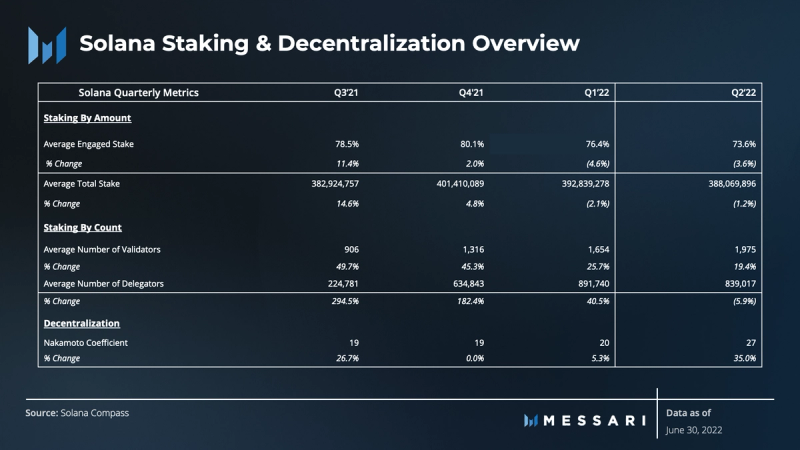

Staking and Decentralization Overview

PoS networks like Solana require users to lock up native tokens (capital) and participate in validation duties. The distributed network of validators and active participants (including stakers) ensures the network functions to minimize the probability of compromising the truth of its ledger and the sustainability of its infrastructural existence.

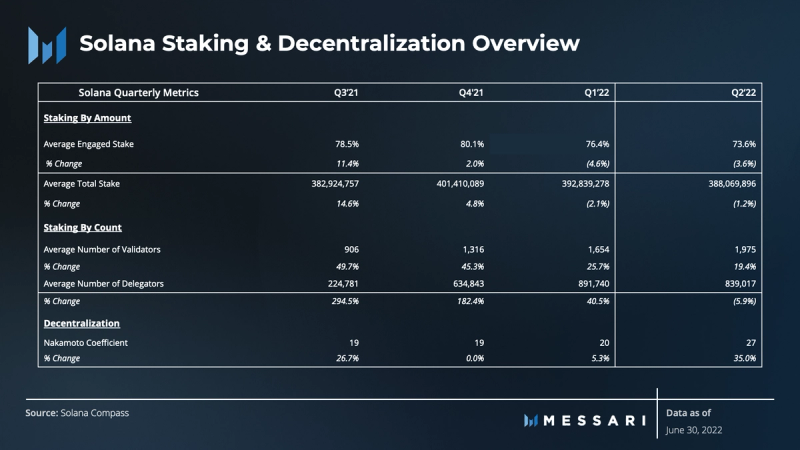

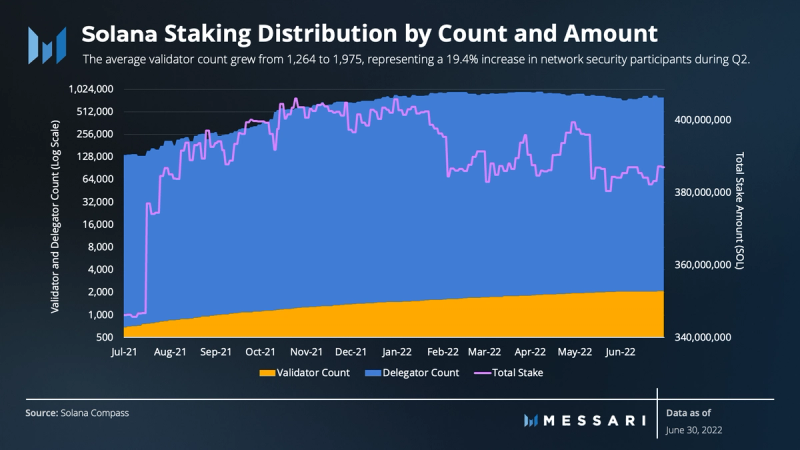

The average engaged stake on Solana has held strong at ~75% over the last year. This stability mitigates network value volatility to some extent. The stability has also allowed network infrastructure to expand with the number of validators and delegators (i.e., active stakers). Growth in infrastructure paired with a relatively flat total stake amount suggests greater stake distribution and, therefore, decentralization.

Staking amounts during Q2 were relatively uneventful, with average stake changes in single-digit percentage points quarter-over-quarter.

The average number of delegators was also relatively flat over the quarter. Regarding Solana, delegators are referred to as active stakers, measured by the number of accounts that received staking awards. Because most wallets only have one stake account, delegator count is a rough indication of the number of individuals staking.

Q2 did see a material increase in the average number of validators. The average validator count grew from 1,264 to 1,975, representing a 19.4% increase in network security participants over the quarter.

Ultimately, the lack of volatility in the total stake amount and number of delegators, paired with an increase in validators, are generally good for network health.

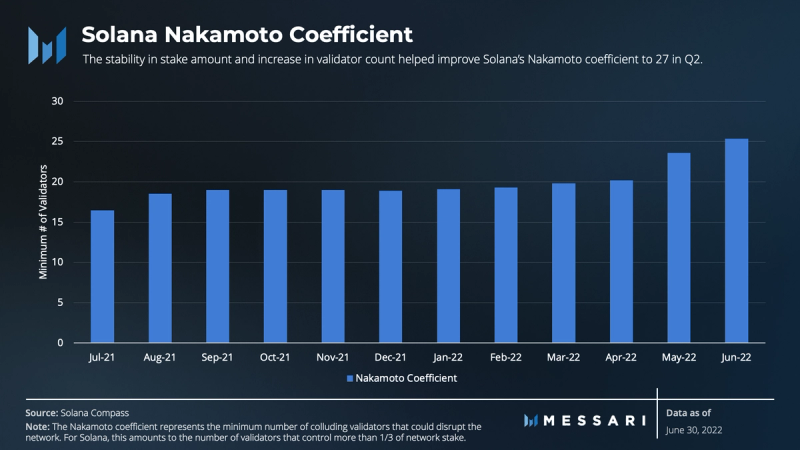

Solana’s Nakamoto coefficient hovered around the mid-teens throughout 2021. During Q1 2022, it improved to 20. But because of the stability in stake amount and increase in validator count, it improved to 27 in Q2. The improvement continues to put Solana above the industry average compared to other Layer-1 networks.

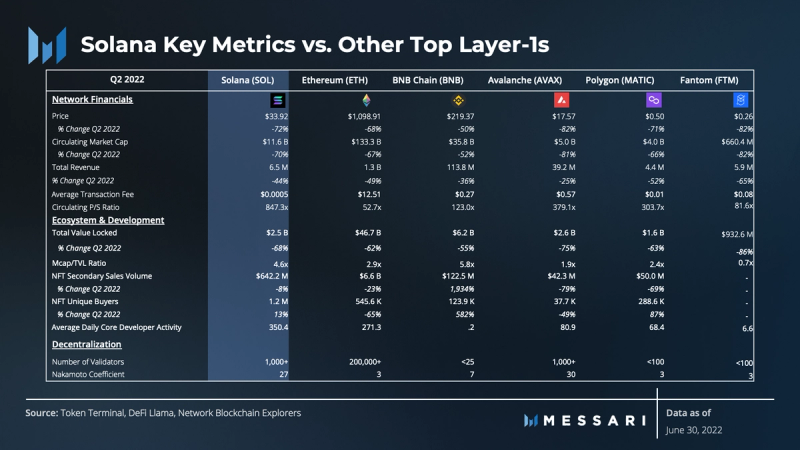

Competitive Analysis

The Layer-1 smart contract sector has been competing for market share since the launch of Ethereum. The goal of capturing market share has brought competitive forces to the marketplace and has triggered new alternatives. The competition has led to different approaches to network architecture, strategies for going to market, and new use cases. It has also turned into a race to be the fastest, cheapest, and most secure network. Each competitor has focused on maximizing these activities while making a range of trade-offs.

Solana is an alternative to Ethereum that has witnessed high growth since its inception. It has successfully maintained its position as one of the most valuable Layer-1 networks. Here, we evaluate Solana’s progress versus the top five Layer-1s by TVL (including Solana) and those with the largest number of DeFi protocols. The methodology used to derive this peer group is simply by grouping the top five chains with the largest TVL and number of protocols.

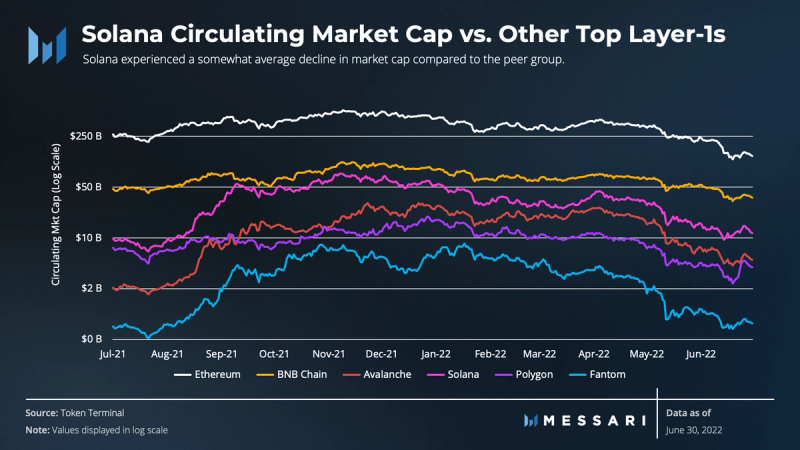

Solana experienced a somewhat average decline in market cap compared to the peer group. Much of the market value decline occurred during times of degraded network performance. Following the release of v1.10, network value stabilized and began to trend upward by the end of the quarter.

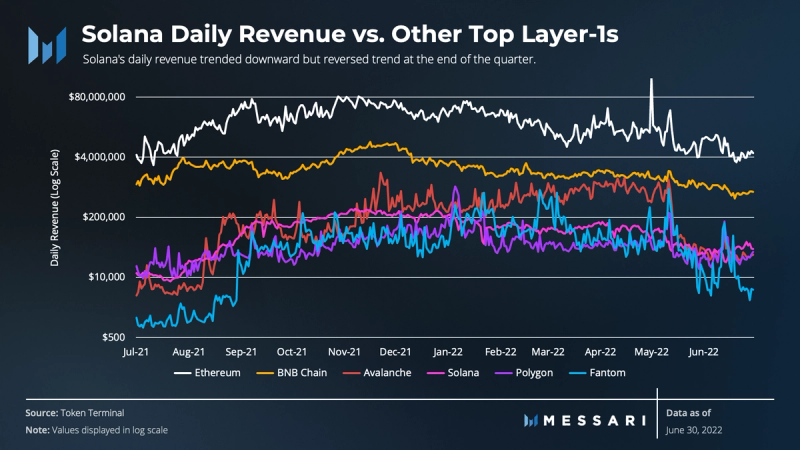

Similarly, Solana’s daily revenue trended downward and experienced volatility throughout the quarter but reversed the trend between the middle of May and the end of June. The peer group also experienced similar declines throughout the quarter, likely due to some of the same macro conditions and market sentiment that Solana faced.

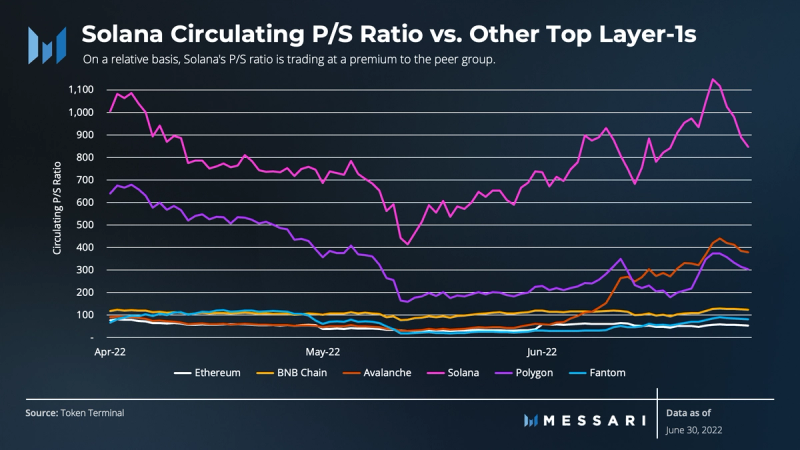

Solana’s P/S ratio decreased over the quarter, while the change in the ratio was mixed across the peer group. Avalanche and Fantom moved towards a less favorable valuation based on this metric, while Polygon and Ethereum became more favorable. On a relative basis, Solana’s P/S ratio is trading at a premium to the peer group, as the peer group ranges between 50x and 400x vs. Solana’s 847x.

Q2 was a down quarter for the DeFi sector, which led to aggregate TVL decreasing from $228 billion to $75 billion, representing a 67% decline in USD terms. Solana’s TVL declined at the average rate (-68%) of the peer group, with Fantom experiencing the most significant decline. Some portion of Solana’s decline in TVL may have come from its exposure to terraUSD and the interruption of Wormhole and Terra transfers.

On a final note, as mentioned earlier while TVL in USD was down, the amount of SOL locked in DeFi went up.

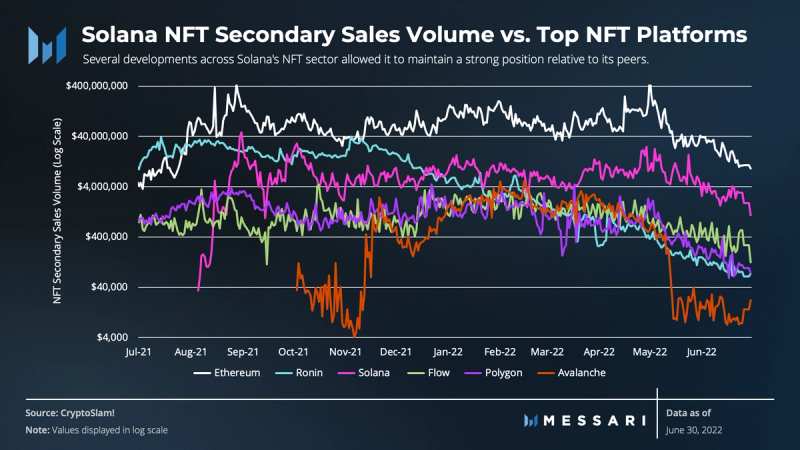

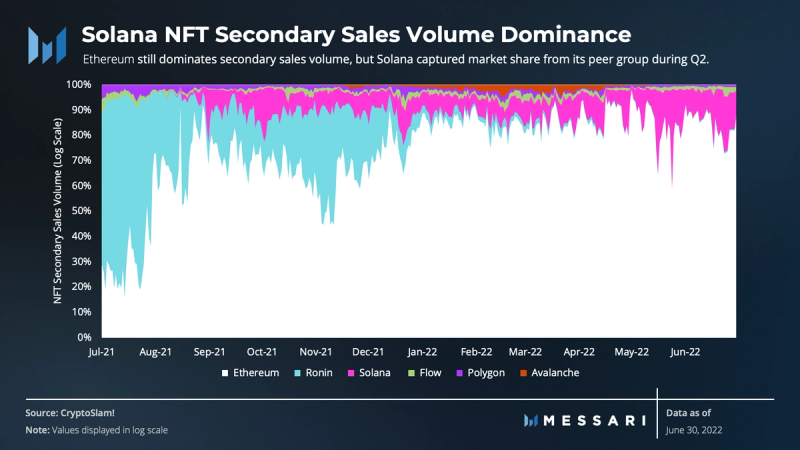

Several developments across Solana’s NFT sector allowed it to maintain a strong position relative to a peer group of the top L1s by secondary NFT sales volume. Solana’s path to attracting unique buyers followed a similar pattern.

Although Ethereum maintained 85% dominance and controlled the number one position of NFT secondary sales volume, Solana continued to capture market share compared to the alternative L1s in the peer group.

Qualitative Analysis

Key Events, Catalysts, and Strategies for Ecosystem Growth

Despite the unfavorable macro forces and persistent network issues, Solana’s expansion strategies and network upgrades were effective throughout Q2. The continued catalysts for growth can be attributed to several key events over the quarter.

April 2022

The quarter began with the successful implementation of strategies announced in Q1. Neon, a Solana project building a smart contract layer that utilizes the Ethereum Virtual Machine (EVM) released Neon Alpha. Neon Alpha is being used for battle testing functionality. Once live on mainnet, Ethereum developers will have a place to integrate their applications on Solana.

In addition to Neon, plans went as intended when Serum’s NFT Ecosystem went live, the Phantom wallet officially integrated with Android, and OpenSea opened Solana NFT marketplaces. Progress towards rolling out Solana Pay also continued as mtnPay debuted on-chain commerce to hundreds of new users in Miami.

April rounded out with events that weren’t on the radar during Q1. Robinhood, the well-known mobile application that offers commission-free trades, listed SOL. At the same time, the popular outdoor journal, Outside Magazine, announced that it will be building NFTs on Solana after doing in-depth research on the network’s energy consumption. Finally, the much-anticipated oracle, Umbrella Network, went live on Solana. Umbrella immediately brought 3,800 data pairs to Solana developers and became the network’s largest oracle by transaction volume.

May 2022

In May, the strategies outlined in Q1 progressed, and additional users were captured. As Solana Pay’s popularity continued, the protocol added a transaction request feature enabling 2-way interactions between merchants and consumers.

While Solana Pay continued its strategy for adoption, Magic Eden surpassed OpenSea in daily NFT transactions. At the same time, social media giant Instagram announced support for Solana NFTs. Instagram intends to support widely used crypto wallets such as MetaMask, and Phantom.

Project launches continued in May. Circle introduced Verite, an open-source framework for decentralized identity. Verite-enabled DeFi projects will be able to tap into over $52 billion in USDC liquidity across eight blockchains, including Solana. Further, crypto-friendly web browser Brave announced its support for Solana, which will enable transactions of SOL in the Brave Wallet.

June 2022

As Q2 came to a close, the Solana growth strategy brought more integrations, partnerships, and the announcement of significant project launches in the future.

In early June, popular blockchain developer platform Alchemy announced its support for Solana. The platform’s mission is to drive Web3 mass adoption by making it easy for developers to build on networks like Solana. Further, leading price feed oracle Chainlink announced its integration with Solana, enabling developers to leverage seven different Chainlink Price Feeds.

By the middle of June, proactive investment strategies also came to light. Solana Ventures and the Solana Foundation announced a $100 million investment fund to invest in South Korean Web3 startups and to grow into new sectors such as GameFi. In addition, the Magic Eden team received its $130 million Series B funding to expand marketplaces, and invest in advancing user experience through improved analytics and trading tools.

The most notable event in June came when Solana Labs announced the Solana Mobile Stack (SMS) launch for Android and Saga. Saga is an Android smartphone that will natively incorporate SMS.

Ultimately, despite the macroeconomic environment, Solana’s expansion strategies pressed on, fostering new integrations, partnerships, and project launches during the quarter.

Ecosystem Challenges

As strategies for ecosystem growth continued to catalyze adoption of the Solana network, challenges regarding network reliability also persisted. As a result, the network continued to experience periods of degraded performance. Throughput deteriorated in each instance, leading to a material decrease in TPS and a rise in failed transactions. These events negatively impacted network fundamentals, which appear to have negatively impacted network value.

As highlighted last quarter, the main issue arises from Gulfstream, Solana’s alternative to the mempool for pending transactions. Gulfstream has persistently allowed bots to propose an arbitrary number of transactions, forcing block producers to check all transactions before making a block. Ultimately, because bots proposed an overwhelming number of transactions, block production continued to suffer, and the network experienced even greater degraded performance throughout Q2.

With that in mind, the network congestion mitigation strategy that was previously outlined became a reality at the end of May. As mentioned earlier, the Mainnet Beta v1.10. series began to roll out slowly. Notably, the series includes QUIC, a feature that allows block producers to instruct bots to propose only a small number of transactions at a time. As a result, producers can parse through all transactions and select the valid ones. After several versions of the v1.10 series rolled out, the network stabilized as degraded performance issues slowed and eventually stopped by the end of the quarter.

To that end, QUIC is not intended to solve the network congestion issues alone. Details regarding the fee prioritization mechanism also surfaced during the quarter. Essentially, the fee prioritization mechanism will allow users to jump ahead of the transaction queue by paying a fee. In addition, each application on the network will function independently. Fees will be used to prioritize transactions within a given application rather than being imposed on the entire network. Therefore, unlike the current state of Ethereum, an increased fee for an application will not impact the network as a whole. Solana’s fee-priority method works and is slated to be included in the upcoming v1.11 series updates.

The Road Ahead

A public roadmap is not maintained by Solana at this time. Nonetheless, the Solana ecosystem will continue efforts to grow by incorporating growth strategies and implementing network upgrades to increase network health and efficiency.

Implementations of v1.10 will continue to roll out slowly. Further, the fee prioritization mechanism is under active development and is targeted for inclusion in the upcoming v1.11 series. Expect to see continued improvement in network performance as these upgrades are implemented.

Another significant development on the horizon is Neon. While the project has released Neon Alpha (the development network), it has yet to go live on mainnet. The project has highlighted that the EVM will be able to process 4,500 TPS. Once live, we could see significant growth similar to how we saw other EVM Layer-1s acquire developers, users, and considerable market share in the past. Solana’s Neon EVM is expected to launch on mainnet soon.

Lastly, the open sourcing of the Solana Mobile Stack (SMS) for Android will be a significant development over the months ahead. The SMS will enable native Android Web3 applications on Solana. In addition, Saga, the first Solana Mobile Android phone, will begin shipping with the SMS by Q1 2023. These developments are aimed at bridging smartphones and unique functionality and features that will tightly integrate with the Solana blockchain.

Closing Summary

The second quarter of 2022 was challenging for Layer-1 networks and cryptoassets as a whole. User activity decreased across the board as macro forces pressed downward on networks. Despite these drawbacks, the building process continued forward.

The macro-environment affected the Solana ecosystem but didn’t stop it from implementing solutions that improved network stability or growing its user base. Core developers focused on building out QUIC and a novel fee prioritization mechanism to enhance the network’s reliability and reduce downtime during periods of congestion. Further, strategies to expand ecosystem adoption became more evident with the continued expansion of NFT marketplaces, progress towards EVM compatibility, advancement of Solana Pay, and the roll-out of Solana Mobile.

Ultimately, the Solana ecosystem and community will press on as it has since its beginning. Investment strategies and incentive programs are expected to drive growth while the core platform continues to be upgraded. The releases of v1.10 and 1.11, EVM compatibility, and Solana Mobile Stack are critical events on the horizon. Collectively, they may serve as the tailwind for cutting through challenging macro forces and bring significant activity and value to the network.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by the Solana Foundation, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report. Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Appendix