If you would like to view the full recording of the live Crowdcast event, you can find it on our Youtube channel. You can also read the full Quarterly Report by Mason Nystrom here.

Ryan Selkis (00:08): And we are live! GM! Everybody GM, and welcome to another amazing Crowdcast with one of our favorite founders in web3, Doug Petkanics from Livepeer. We got Mason from our team, who authored a terrific year end recap on Livepeer and Livepeer ecosystem. We’re going to deep dive today, but as a starting point for those that are new to Messari, or new to these presentations. Messari is a data and research aggregator, and we spent a lot of time over the last four years helping to work on data structures and standards for decentralized communities and the assets powering them. We, at this point, have covered several hundred assets in our research library, in depth. And everything from project history, the token economics, the security, the roadmaps, the governance structures. And one of the new things we’ve been engaging various communities on is actually taking the role of a quarterly analyst and synthesizing every new development on-chain and off-chain for a given community to help people get a snapshot on a somewhat regular basis of how these ecosystems are progressing and evolving. One of the core reasons that we’ve been doing this is to demonstrate the power of the interlaying ledgers themselves. You no longer need an investor relations team, or CFO or an internal finance team responsible for “disclosures”. This is open, public information and it really just matters, who’s looking and who’s ultimately only summarizing, aggregating this information. And as evidence today, we’re going to do this as the third report of this kind that we’ve done. We’ve done similar reports and calls with Compound, Uniswap, and of course excited to branch out into a killer web3 application and video transcoding and everything the Livepeer community has been doing today. But importantly, Mason and our research team and data science team at Messari, created this report from scratch with basically no input from the Livepeer community other than the call we have today, for a kind of look ahead and discussion around some of the key community conversations, some of decision points, that the Livepeer community, and Doug and his team have been thinking through and maybe what to look for in the year ahead. So important starting point there. And I think one of the most exciting things in crypto, in general, is this dynamic can exist and you can essentially disaggregate an overview of an asset, or even quarterly update on an asset, completely from the core development team. Which is something that we’ve never seen before in finance and it’s obviously one of the killer apps we are excited to continue to build up infrastructure around at Messari. So with that plug over, the plug, slash, I guess disclaimer, Doug, for you. Just to be very clear about how we structure this and exactly you know, what we representing and what Mason is going to present as authoritative, and I think it is a jumping off point. We’ll let Mason go through the broad stokes of this annual report and we’re excited to bounce around not only some of the questions and clarifications that he had that would interesting for this community but also dig into direct user questions as well as during the Q&A segment. So Mason take it away!

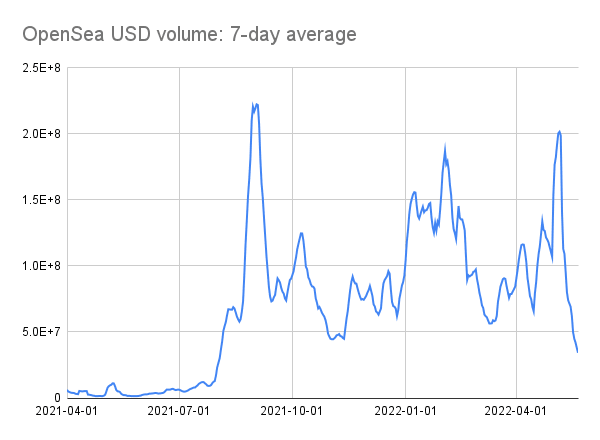

Mason Nystrom (03:50): Awesome, let’s get to it. We’ll drop the report in chat so everyone can access it on your laptop. Also, I’ll share my screen really quick so that we can kind of just walk through it broadly. So when we talk about the state of Liverpeer, there’s a variety of metrics that are important to the Livepeer network. And so you know, hopefully, for those who are maybe less familiar about Livepeer, there’s a few core ecosystem members and that really has to do with the demand side of Livepeer and supply side. So Livepeer as a video transcoding network, has broadcasters or essentially applications that need to get video transcoded. And that process is operated by the video miners in network who provide the actual computational transcoding services. These miners or node operators are referred to as orchestrators in the Livepeer network. And similar to how you have Bitcoin mining pools there’s also transcoding mining pools, where computational power is directed at the demand generation side that comes into the network. So with a broad overview of Livepeer we kind of get into what we defined as the core metrics of Livepeer. And that comes from the core metric being the amount of video transcoded on the network. So that’s individual network—or total network usage. And you can see the quarter over quarter growth in this video transcoded usage has been quite impressive. And you know, Doug I would love your take. I think one of the kind of core improvements that happened in 2020, was this streamflow upgrade which added GPU bandwidth and since that point, we’ve seen this rapid evolution in terms of usage of the protocol. And then as we get into the other are metrics, we have orchestrator fee revenue, we have steaking rewards, which we can dive into, and then we have other important steaking metrics of the Livepeer network, such as the total Livepeer LPT that is distributed both the value of it, in quantity and in terms of the LPT itself, but also the USD rewards. And then also the net staked and percent total staked of the Livepeer ecosystem. And so with that as the framing of this report, we can dive into some of the data itself. And so kind of outlining the growth that I was discussing a little earlier, we’ve noticed the total video transcoded rapidly evolve and Livepeer has actually hit all time highs in network usage, each consecutive quarter for the year. Doug, I think it would be really quick, would love to hear where you’ve seen a lot of that usage come from, and expand into what types of applications are most utilized in the Livepeer network?

Doug Petkanics (07:09): Sure thing. Thanks for having me here. Thanks for the overview and introduction to the project and for all the work on this report. And even before diving into like what these minutes are where they come from, just to help people understand what is this transcoding “thing” like why does that matter? Video streaming is 80% of the bandwidth on the internet. It’s how we’re broadcasting this call today. It’s how people are working, learning, interacting in real time. It’s a huge amount of the infrastructure on the internet goes to video streaming and a lot of it all runs through kind of the same big, centralized cloud providers, Amazon, Google, Microsoft. Livepeer’s an open video infrastructure that lets developers build video streaming applications for a variety of use cases, right? And so people use the Livepeer network to power this video streaming and one of the core pieces of functionality that needs to occur, that technical level is this thing called transcoding and that’s taking input video like the video for this call today and converting it into different bitrates and formats that can play on your cell phone or your laptop, on a high bandwidth connection, on a low bandwidth connection, on a smart TV, et cetera. And that’s what the kind of nodes and workers on our network are doing. And so Mason highlighted the metric that we care most about is not the market cap of the Livepeer token or anything speculative around crypto financial primitive its actually how much the fundamental usage is this network being used for, in terms of minutes and unique video, that are being encoded for distribution through the applications. So it’s been good to see that growing. Back to your question Mason, where’s this usage coming from? A lot of it’s coming from the creator economy. It’s coming from video streaming applications that allow users to go live and create and generate content stream what they want. Popular applications that are not built on Livepeer that people are familiar with are YouTube and Twitch, those are typical creator economy applications. They let their user stream for free, and Livepeer we see people building kind of independent products and services that look like YouTube or Twitch but maybe aren’t beholden to that the attention economy an ad models of Google and Amazon who own those platforms, but instead help creators monetize by connecting directly with their fans are having ownership of their work from creation of NFTs, these sorts of things. And so we see this usage from apps that enable streaming for DJs, for musicians, for artists and their communities. A lot of these creative community specific streaming use cases. We also have seen users in eSports and gaming, competing with things like Twitch. We’ve seen users and kind of more B2B centric, like users of power sports streaming for local high schools and colleges, people that power events and screenings for conferences and meetups they can build on Livepeer infrastructure and use the network to power it. That’s where a lot of the growth is coming. And it’s been being driven by growing more maturation of our products and more marketing and awareness of our products, our intense streaming products, and a media server we can talk about called Mist. And it’s also interesting it’s beginning to come from the web3 world and exciting to talk about, you know, the use cases we’re seeing through streaming in the web3 world too.

Mason Nystrom (10:53): Yeah, definitely. Before we get into that I would love if you could maybe outline the benefits that these developers these applications get from using and leveraging Livepeer versus something like YouTube or Twitch. I know Livepeer is significantly cheaper in terms of infrastructure costs and so I’d love if you could briefly touch on why that is and how that enables developers or content creators or whoever they are to leverage this network.

Doug Petkanics (11:28): Yeah, sure thing. The traditional attributes that a video developer would be looking for when they choose an infrastructure are, cost, reliability and quality, right? You have to deliver high quality, so you know the open-source software that we build in others contribute to leads to quality video experience. But cost is actually where Livepeer has the opportunity to make a huge impact as I mentioned, doing live streaming is difficult. You need servers standing by all around the world that have enough capacity for any streams that your users create, right? If you’re creating something that looks like a Twitch, you don’t know how many users are going to show up at any moment to start streaming. You have to have these servers provisioned all around the world. It’s very, very expensive to have them standing by sitting idle. And as a result, you see these cloud services charge typically like $3 per hour per input stream of video. So if you’re letting a thousand users stream that’s pretty expensive like $1,000 per hour, $1,000,000 per week or per month. What Livepeer does is it enables anyone with a GPU and bandwidth that happens to be sitting there to just be available such that if anyone shows up to stream and you’re Livepeer enabled, your GPU can earn money for doing this video encoding. And there’s this really cool opportunity where there happens to be millions of GPUs deployed in data centers all around the world that are being used for mining cryptocurrency, so they’re already around the world, they’re already distributed, they’re already paid off and a working business model. But here’s the cool thing. Those GPUs happen to have video encoding chips on them that can’t hash crypto; they just sit there doing nothing, while the rest of the GPU is hashing crypto. And so what the Livepeer software does, is it says, “You don’t have to disrupt your crypto mining. You can keep mining Ethereum or Z cash or whatever GPU coin you’re mining, but when there’s video encoding work to be done, you’ll get additional revenue for doing that encoding at the same time.” And so that’s a cool value proposition So they’re cost, these miners, pennies per day in electricity or bandwidth, to use this component of their GPU, and that allows them to charge a price in the open Livepeer marketplace, that’s more than pennies so they can actually made a profit, but still way less than $3 an hour or $72 a day that a cloud provider would be charging for video encoding. And so the Livepeer network at its core can be 10 to 100 times cost disruptive to the prices charged by a lot of cloud providers and that is pretty powerful.

Mason Nystrom (14:18): And as a follow up to that, what is the GPU capacity of the Livepeer network today?

Doug Petkanics (14:25): Because it’s open and decentralized I can’t put an explicit number on it because you don’t know how much capacity people have sitting here, but we know that there’s some large miners, some large infrastructure providers on it who have publicly stated the amount of GPUs they have, you know, in their network that they spread across on data centers, a number of you said is over 70,000 GPUs are available on the network. Keep in mind there’s not infinite live video being created at any given moment because it takes human beings to be holding an event like this to create it. And so just that number of GPUs alone would be enough to encode all the video for Twitch,YouTube, and Facebook combined at any given moment. So not saying it’s all sitting there ready to be Livepeer enabled and in the moment, but the partners that are running on the Livepeer network and operators on the Livepeer network have this capacity at their disposal. And because the video encoding tasks pay so much more than mining or other forms of usage for your GPU, it becomes a no-brainer for that supply to be available as demand warrants it.

Mason Nystrom (15:39): Yeah, thank you for that context and so now moving into like anything that is a good framing of the current use of the Livepeer network, as we get into the next forward looking the next year. I know that the Livepeer team has stated a variety of types of applications or use cases that you believe Livepeer would be incredibly suited for, whether it’s video printing or recognizing songs in terms of licensing. I would love if you could outline two or three of the use cases you’re most excited about how Livepeer might serve that use case or that customer base.

Doug Petkanics (16:23): Cool yeah, I think there’s two tracks that are interesting. One is like the additional futuristic video capabilities, right? We have and the other, I think, let’s pull it back to web3 a bit and talk about what we see in that web3, decentralized tech space. So for video capabilities, we talk about smart video tasks. This is like AI based compute on video in real time to do things like identify what type of video is this? Is it violent content, adult content, copyrighted content, because people are building consumer streaming applications need that information to do things like moderation, and make sure users have a good experience. And it just so happens these GPUs that are processing video on the network happen to be the same things that are used to do these AI based computations. So that’s like identifying what type of video it is. Use cases are really excited about are object detection. So it’s detecting what objects are appearing in a video stream, and making it actually interact with a clickable so that people can do interactive video experiences, whether that’s game centric use cases like hosting a game show that the audience is clicking on video in order to interact with or E-commerce type experiences where you’re selling and showcasing a product and allowing to show more information as you’re hovering over it. I think there’s cool NFT use cases. I’m imagining all these NFT communities that use their profile pic NFT as their avatar. Imagine any video like this if your avatar was actually like, could be identified by AI and be hoverable and could show who owns it, what was it last sold for, what’s the link to OpenSea. So you need GPUs that are doing, kind of running algorithms on streaming video to be able to augment the video with that information. So I think those use cases that are in the R&D world are super exciting. The things are a little more here today that actively being worked on with design partners are like things that people like the crypto native projects are doing with video that is kind of unique, and needs these web3 native connections. So these are things like token gated streaming, where your DOAs and projects are like streaming content that they only want to be accessible to members of the community who maybe hold a social token, a membership token, or specific NFT in a collection. And so that’s integrating wallets with access to output video streams. We saw five different projects built on that with Livepeer last weekend with the EthGlobal NFT hackathon. I think Metaverse streaming is really interesting like these metaverses like Decentraland are growing. People are gathering in these metaverses to view video streams from the real world like concerts that are being put on. Similarly, streaming video out of metaverses so what’s it mean to have virtual cameras in these things and the hot sports that are showcasing to the real world what is going on at the casino or the concert hall or gaming venue in the metaverse. So seeing use cases around that. I think video NFT, live video NFT minting, there’s a whole creative canvass, I don’t know what the killer product there is but I know that creators interacting with their fans in real time and letting them mint and own some of the moments that are occurring is a way that creators are able to better monetize than just slapping ads on top of their stream, and so making sure that Livepeer can be integrated for those use cases. And the last one I would mention is—I think you guys highlighted this at Mainnet really well—we’re not in a world where every single thing is built on Ethereum anymore. There’s all of these developer ecosystems across layer 1 and layer 2 scaling solutions and making sure they all leverage Livepeer as their video infrastructure. Even though Ethereum is the core payments mechanism today, so doing work to think about cross chain support.

Mason Nystrom (20:50): And given those applications— there’s obviously—since Livepeer is a public network anyone can build on top of it and Liveper.com is one such hosted application. Could you kind of explain a little bit about Livepeer.com and I’d love to get into the important acquisition you guys made back in November of Mist server. And dive a little depper into why that’s important and what it’s going to enable the Livepeer team, and just in general the Livepeer ecosystem to do.

Doug Petkanics (21:28): Livepeer is an open project and an open public network, like you said anyone can participate and build anything. For the first two years of the project, a lot the core team just focused on building that out. And then we reached this moment, we built it, we have this bootstrapped supply side of global node operators, it’s working, but we need to actually build products and services that make it easy for the demand side to adopt this network without worrying about blockchain, crypto, decentralization, and that’s when, even though we always have this company that Eric Tang and I co-founded, called Livepeer Inc. and our mission was to kind of steward the Livepeer project and focus on growing the adoption of the Livepeer network. This company can take an active role in building the product services and commercial relations to onboard demand into the network. Livepeer Inc. is just one actor in this network, but an important one. Decentralizing over time through other people building various key components that users use to interact with it. The product, the first product that we built, was called Livepeer.com, it was end to end streaming APIs. Any developer could show up, register an API key and stream and leverage the power of the Livepeer network. And we did things that made it easy for them to do that. [We] hosted Livepeer nodes all around the world to serve for them for their video. We allowed for credit card payment. This is when you show the growing adoptions of minutes steamed on the network going up and to the right this year. We launched the first version of that product in January, and then it got better in Q2, and we onboarded more users in Q3, and in Q4 we had just gotten to this important milestone and moment that you referenced, which was the first acquisition that Livepeer the company did of this great company in the Netherlands called DDVTechnical, the product is called MistServer. And MistServer is this piece of video software that developers all around the world from indies to enterprises use in their video workflows, and they’ve been a partner for a long time. They had integrated with Livepeer, so their users could use the Livepeer network for their transcoding. A lot of our usage was coming through those users. We also use their product to build this Livepeer.com, this global intense streaming service. And so really excited to join forces with a great technical team there right outside Amsterdam. And the end result of this is we believe we’re going to have, continue to invest in their technology and innovation and we’ll be able to pair the world’s best open video software that anyone can use to build a video application with the world’s most scalable affordable reliable open video infrastructure that they use to scale their streaming application and provide the infrastructure that the software runs on and that is a really powerful combination that in enabled that because of token incentivized models and token coordinated models where we all collectively benefit from increased usage of this network. That is the business model as opposed to just charging people when you sell your software to them or licensing like this close proprietary thing and I think that it’s powerful it’s hard to compete with if you’re saying, “you have to buy our software, and you have to pay Amazon “x” amount for every server you run it on.” Where it’s like, you can use this software, this open software, and you have this more cost-effective open network to run it on. So tons of work to do to actually like, make sure the product is amazing, meets developer needs, but just from a positing perspective, I think it’s super powerful in crypto and blockchain networks enabled.

Ryan Selkis (25:40): Doug, how much of the network capacity is getting funneled to the Livepeer Inc. hosted services versus third party video services or interfaces that have been built. I assume during the bootstrapping phase it might have been predominantly Livepeer Inc. powered front ends, how do you think about the scale out of that and where is the mix right now?

Doug Petkanics (26:04): That’s right, it’s the majority. The majority is coming through Livepeer Inc. front ends, whether that be the .com streaming service or Mist itself. I think the things that you see—it’s interesting, if you count it by minutes streamed through the network the majority comes through that. Where you see people begin to build directly on it is more in this experimental, web3 world, which shouldn’t be surprising. You show up to a web3 hackathon, you’re comfortable, you can build directly on the network. And so there you see cool example use cases and experiments and hacks emerge. And those are powerful operational examples, but they may only represent like a hundred minutes of video a week versus the millions of minutes of video a week you might see through scaled applications on Livepeerinc.com. So definitely excited to focus on mechanisms to decentralize that over time.

Ryan Selkis (27:06): One of the things that strikes me as high potential would be mirroring a centralized service. So if there were the ability to one click “add a Livepeer redundancy” to the steam. Have you seen experimentation there? Maybe this is something you’re building at the Inc. or maybe this is something you’ve seen materialize in the community. Because the marginal cost to run that experiment is not too high and there might be ways to incentivize those experiments, number one, because long-term, if people start to trust the reliability of that as an alternative and can see a 50-75%+ cost reduction. That’s one bootstrapping and onboarding mechanism that would have promise. I’m just not sure if that UX is there yet or if that’s in the works.

Doug Petkanics (28:06): We’ve actually seen that technique play out effectively when it comes to getting people to evaluate Livepeer and to build up and gain trust that a decentralized network can deliver on the reliability they need. Getting deep into the weeds about how video works and video engineering, typically like every two seconds of video is another file, and when you’re receiving that, you’re kind of reading, what’s the next file, what’s the next file, what’s the next file. And the way the video tech works behind the scenes is you can have a primary and backup file in that playlist so the player can request a backup if they can’t get the primary. And we’ve seen people, test this out by using the Livepeer encodings as the backup and their existing provider as the primary, and that’s what gives them the trust of “I’ve integrated, it’s working, it actually delivers this video in real time.” And then eventually switch over to using Livepeer, so good suggestion, good sales tactic.

Ryan Selkis (29:10): Well we’re using Crowdcast and I think we’d obviously love to eat our own dog food in general, and if there were integrations or basically ways to install a plug in. I think one of the most underutilized but technically complex things to build would just be a series of extensions for web3 applications to mirror your web2 applications as a slow-motion user vampire attack, whatever you want to call it. Maybe there is a unicorn there for just building the abstraction tools for a number of web3 services, but something that is kind of top of mind. Instead of just trying to compete directly head on. Can you prove the backup works first?

Doug Petkanics (29:55): Keep the vampire attacks ideas coming and the unicorn ideas coming because one of our challenges, the hurdles we’ve had, there’s so many people in the web3 world and the creator world that want to see a web3 disruptor to a Youtube or a Twitch or whatever kind of centralized application, and they come to Livepeer thinking that is what we are. And then they have this slight moment or realization that it’s actually an infrastructure and you still need a product visionary, so I’m going to use that infrastructure to build the web3 Crowdcast or the web3 Twitch or the web3 Youtube, and then that would be the thing that these thousands or millions of creators would latch onto. And by the way I don’t think it looks just like a clone of Twitch or clone of Youtube. I don’t think that’s interesting, I think it needs to be something new and innovative that leverages better creator economics through NFTs or tokenization or crowd-funding or whatever the mechanic is. I think this is the year we will see a lot of those entrepreneurs and product visionaries and hackers actually be able to piece together not just Livepeer, but Livepeer, The Graph, Arweve, Sia, Filecoin, Helium like all these web3 primitives to build some of these cool new applications that reach a million people.

Mason Nystrom (31:20): I think you bring up interesting points around just making these applications easier across the board for the demand side is a key driver of growth. A lot of these networks, Livepeer included, the supply side is largely there and it’s just how do we make the consumption easier on some of these networks. Maybe pivoting a little to scalability, and Livepeer has made some key decisions in terms of the future of the protocol, specifically in regards to the Confluence upgrade. So we would love to talk briefly about the Confluence upgrade, I know it was part of that Livepeer is migrating to Arbitrum. I would love to hear how you guys went about deciding that process, why Arbitrum versus another L2, and some of the benefits that migration is going to bring.

Doug Petkanics (32:23): Yeah, sure thing. Really excited about this. It is a huge pain point in our network as the Ethereum fees have risen so much over the last year was that it was kind of too expensive for a new node operator to join the network and get started or too expensive for token holders to, or stakers to claim their fees and whatnot. So we’ve really been doing all the research and whatnot to figure out all the right scaling solution that mitigates some of these impacts. Confluence is the codename of the upgrade we have been working on for a while, it’s actually really close to going live, it’s on a test net right now. We’re on phase two of the test net, which means we’re actually live on Arbitrum ranked B test net. And the audit process is nearly complete so we’re literally in the last couple of weeks before we should be live on Arbitrum. The impact that we’re looking for here is dramatic 10x cost reduction for participation in the network. Which should really open up more access to more node operators, more delegators to take an active role to move their stake around from node to node and respond to network events, and grow the community as a result. We’ve always been a huge partner and believer in the Ethereum ecosystem, we’ve been built on Ethereum, great developer experience, we have a lot of expertise there. Evaluating scaling solutions we thought it was important that there was great developer tooling, testing capabilities, a huge developer ecosystem that’s battle tested and found support around these things. So that has kept us looking at solutions that were very Ethereum integrated. We also really valued practicality and usability today or soon over theoretical gains you will get in the future. So the way the timing lined up it wasn’t looking to make a huge migration that makes a bet on an entirely other immature ecosystem, it wasn’t waiting for general purpose ZK computation even though that might ultimately be a super scalable path. It wasn’t waiting for ETH2 roadmap to play out, it was looking, how can we deliver incremental value gains to our users in the short term and so Arbitrum was a great choice, excited about the progress there. It is not going to represent 1000x cost savings, it’s not going to make transactions free, there’s always iterative stuff that comes beyond that, but it’s delivering a big win to users in the near term.

Mason Nystrom (35:08): I think an important point you bring up is, it will be easier for some of the interesting economics of Livepeer to become more prevalent, and so delegators specifically, being able to switch their delegation more freely, move to different orchestrators if they think someone is providing a better service because right now it is a little prohibitive for any small delegator to allocate capital differently each week just because of the Ethereum gas fees. And so do you think there will be any type of change to which orchestrators have the most delegation given that it will be easier to redelegate from the longtail from potential stakers?

Doug Petkanics (35:55): I hope so, and I think it will. To give a little background, the reason this matters is in Livepeer the more stake that a node has, the more security it is providing to the network and therefore the more work it can perform and the more fees it can earn. So the nodes that have more stake are kind of competing and able to do more work and earn more fees. There’s a second concept that’s interesting, we call it inflation funding. It’s the notion these node operators, they actually everyday, they get to mint new Livepeer tokens according to how much stake they have and some of that flows back to the token holders who have delegated towards them, but the node operators keep a cut, they keep a commission if you will. And the notion is, “hey Livepeer is going to able to fund things in a decentralized way through this inflation.” If someone is running a node and campaigning on the contributions they’re making to the network, maybe they’re building an application, maybe they’re helping onboard demand, maybe they’re investing in hardware to provide this great service. People can help fund those efforts by staking towards them and helping them keep a little bit of the future earnings. And a barrier to this is it has just been too expensive to split my stake into ten different accounts and support ten different nodes, and move it around and do all these transactions because you have thousands of dollars of Ethereum fees and overhead. But as you have cost effective staking with the click of a button for a couple cents, and you can move stake around and you can split it to support different nodes. The role that I want to see token holders and delegators play is let’s activate new nodes that are high performing, help them earn more work because they are going to be sharing more fees back to me, and they’re helping the network succeed. Let’s move some stake in the inflation fund, people are making great contributions and let’s work together collectively to make sure this network has global coverage and service in every region and high performing orchestrators in every region. Bringing down the cost and opening up that accessibility is going to be a big, big game changer for all three of those factors that I’m excited about.

Mason Nystrom (38:05): Definitely. For a little more context on the L2 migration that’s specifically for the Livepeer staking contracts, is Livepeer thinking about having multiple instances of the same contact running on different L2s or is it going to be more convenient to have everything in one specific scaling solution?

Doug Petkanics (38:32): So for the supply side of the network, the people who run nodes, receive payments, and stake tokens, we think it is most convenient to have one point of access for that and inform one network that is coordinated in one place, so that’s on Arbitrum. By the way, when unstaked tokens can cross back over the bridge, back to Ethereum to get that composability with existing DeFi, with exchanges for deposits with withdraws et cetera, so it is that Arbitrum and Ethereum connection and bridge. I want to highlight though, for users, for people that want to build and leverage Livepeer as developers, this is where we are really interested in the cross chain. And so what’s it look like for you to be able to off your wallet on any chain or layer 2 and establish credits for payment that you have for streaming whether that is making deposits directly or for tapping into an off base credit system from your ecosystem fund or whatnot. [These] ideas are being shaped and explored now, but I think from a user’s perspective you should be able to build on this network from any chain.

Q&A:

Mason Nystrom (39:50): I think that gives us, considering the first question we have in the chat, a good starting point to dive into questions from anyone in the audience and so we can start with Tom’s question, “You talked about being excited about a multichain world. Is Livepeer considering deploying on other L1s, either currently or given over the context of this next year?”

Doug Petkanics (40:20): Yeah, I think as I just articulated I think the, we think about other L1 ecosystems having like crypto native access to use Livepeer to build applications. So if the next killer decentralized social application is being built in the Polygon ecosystem or the Tezos ecosystem like those, those developers should be able to use Livepeer in a way that’s not “swipe your credit card at Livepeer.com”, it’s probably off your wallet and just deposited funds on your native chain—because remember, no video ever touches the blockchain, that’s all kind of done peer to peer through the network. So the key is proving through your signature, through your digital identity, that you kind of have deposited credit in order to stream and then payments can get settled accordingly to the to the node operators, and I think that sort of bridging and access control and payments mechanism is the layer where the cross chain ecosystems come into play.

Mason Nystrom (41:24): Thank you, I think that’s helpful context. And payments are in Eth for transcoding services?

Doug Petkanics (41:32): Yep, yep under the hood, payments are settled in Eth. I actually think, you know, stablecoin might make more sense because it would be less volatile for pricing, I think we just put that on the protocol upgrade priority list as a scaling gets solved and as time allows. Eth is what is used under the hood to settle payments.

Mason Nystrom (41:53): I like that, I think it would definitely make it easier in terms of pricing.

Doug Petkanics (42:01): You guys put together all the reporting information about dollar value of Eth, dollar values of staking rewards and almost be adjusted based on the swings of the price of Ethereum, the price of Livepeer token. You’ve done a nice job. I saw that in the quarterly report you linked to a Dune Analytics dashboard that has all the raw data available. So there’s a nice approach you took.

Mason Nystrom (42:25): And for anyone who is curious about the Dune dashboard, I just dropped it in the chat, you can see real time metrics that we tracked. Pretty much every metric that we’re able to get on chain from Livepeer.

Doug Petkanics (42:41): Following up on that, I know Ryan started this session with what he called a plug for third party research replacing the internal IR or financial reporting function of a company like that’s a plug that is so valuable and true, right? Like we’re a small technical team that builds video infrastructure and not a publicly traded behemoth that has an IR department that can produce like quarterly financial reports but we see so much value in transparently making sure everyone is aware of network fundamentals, usage, core metrics, like there’s so much value in doing that. I like the notion that Messari or a whole community can come together to provide that’s well done.

Ryan Selkis (43:32): Well Doug, my pitch for four years has been we’re better than the SEC. And so we can’t double back on it now. But we’re getting there slowly but surely, and I obviously said tongue in cheek, but I think anyone that actually uses a network like Livepeer would be tough to come with a straight face and see similarities to a publicly traded company on the NASDAQ for instance. I think it’s fundamentally different to be able to extract all this information from an open ledger to know that the control and decision making over that entire network is not completely controlled by one team. And to recognize a reality that if all these are different assets are going to live somewhere on a spectrum from fully centralized, just taking the idea at inception. Bitcoin was centralized when Satoshi wrote the white paper because it was just in his head, and all the way to the whatever the platonic ideal is of full decentralization will never actually hit in any network. And I think one of the important things to call out, Mason linked to the Dune dashboard, the fact that someone like Messari can interoperate with The Graph and Dune and some of the other open information products have been built, I think just going to accelerate that process of getting more information like this structured and disseminated in a way that ultimately, helps us from a public relations standpoint, but also just from general stakeholder communications. And now we’re starting to see alerting functionality built into wallets. So the innovation that’s going to unlock in terms of being able to basically direct message a link to a quarterly update from a protocol team or not even from the team itself necessarily but maybe from the community member like Messari. I think that the amount of innovation that can be unlocked from there is—it just continues to compound. Obviously we’re excited to keep working with good projects. That have been building bull or bear for years now.

Doug Petkanics (45:52): Awesome, completely agree. I don’t know what all the analysts are doing waiting for today’s 5:30pm, Elon Musk quarterly Tesla call when they should be in the world where they’re just looking at the Dune analytics dashboard a couple days in advance.

Ryan Selkis (46:09): Yeah, look, we would welcome other teams to front-run us on other projects, you know, it’s a big market. And I think the way we view this quarterly and ongoing reporting for communities is, there’s going to be a handful of service providers that are embedded with different protocols communities, and maybe the service is analogous to us being one of the big four auditors that’s engaging and in the weeds with different projects. I’d say today, we’re probably in a class of our own but I think we’d obviously expect and welcome others to step up because there’s more projects than we would be able to work with out of the gates for sure. I think this is the stuff that’s going to be important, not only for us to host but important for—to see created and standardized in a way that this information be accessible on Messari on other third-party sites, whether it’s Coinmarketcap, Bloomberg, or anything in-between.

Mason Nystrom (47:15): As we round this out. I think we’ve answered a lot of the questions. But there’s one that I wanted to surface that we didn’t necessarily discuss, and that is “What do video players—What video players and interfaces do the creators use if the transcoding service is powered by Livepeer? Are they using a custom video player or the Livepeer platform?”

Doug Petkanics (47:40): Really good question. Right now they can use whatever video player they want. There’s a series of open-source ones, MistServer, which is a part of the Livepeer project as a player that they could use embed and some browsers they play video natively. So [the] video player is up to them. Going forward I think the world is open video infrastructure, and the world’s best software, you should have a great open player that is decentralized by nature, and that it has these primitive decentralization based features whether that’s integration with wallet faced identities, or tapping into the smart video that can identify digital IDs through profile pics, like I gave examples before I think there’s opportunity there. But for now, it’s pick your own solution.

Mason Nystrom (48:36): Awesome. Thanks for that clarification. Excited about everything Livepeeer has done in 2021. And looking forward to a myriad of upcoming ’22 events, including the full migration of the Confluence upgrade. Is there any final thing that you’re most excited about this next quarter or this next year?

Doug Petkanics (49:03): I think it’s the year that like I said, that we’re going to see like consumer social applications reach the mainstream that are powered with crypto primitives. We’re going to see the next TikTok emerge with crypto primitives built in because it’s better for the creators, it’s better for the consumer to own their platform I think video will be a part of it. So Livepeer’s an open community we want to help people create enable these things, check us out at Livepeer.org. Join our Discord and there’s a lot people there that are building, that are excited to be apart of that, and partner up with you. So that’s the call to action. But thanks so much for hosting this call and having me was great, and I will talk to you all soon.

Mason Nystrom (49:51): Thank you, Doug!

Ryan Selkis (49:53): And thank you everyone for joining. We’ll see you again for another update soon. More coming! Check out Messari.io, subscribe to the newsletter for more updates like this. See ya everyone!

Source link