Build safer smart contracts with 20+ Web3 DevTools from ConsenSys’ security tooling guide.

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the third week of November.

When a financial catastrophe like FTX happens, its figureheads typically fade out of the public eye.

Not SBF. The now-vilified man fired off a series of cryptic tweets with no meaning, adding fuel to the still-raging flames from last week.

It gets worse. A Vox journalist leaked her private correspondences with SBF where he brazenly admitted that his regulatory activities were “just PR” and regulators “don’t protect customers at all” (he reverts on this stance in a later tweet). He also claimed that filing bankruptcy was his “biggest single fuckup” and that “everything would be ~70% fixed right now if i hadn’t”.

FTX’s bankruptcy filings are also revealing the company’s day-to-day operations to be completely haphazard.

Alameda Research was giving personal loans to SBF ($1B) and Director of Engineering Nishad Singh ($543M), records of payments or even employees hired weren’t properly kept, corporate funds were used to purchase real estate assets, there was no formal management system in place to keep track of cash flows, regular board meetings never took place and perhaps the worse: customer deposits into FTX weren’t recorded on any balance sheet. You can read the full document here.

The WSJ reports that $300M of a $420M sum fundraised last October went directly to SBF, who then sold his personal stake.

FTX’s newly appointed CEO John Ray who previously oversaw the restructuring of Enron has this to say:

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

The real surprise is that FTX went on for as long as it did.

FTX invested into almost every corner of the industry and the contagion from its collapse has only just begun to reveal itself.

Genesis Trading reported on 11 November that though they had ~$175M locked in FTX, that loss doesn’t impact their active operations. Yet, just five days later, Genesis suspended withdrawals. According to its official website, Genesis has $2.8B in total active loans as of Q3 2022.

Genesis is owned by Digital Currency Group (DCG), who also owns CoinDesk, the largest crypto fund Grayscale, the Luno exchange and crypto-mining provider Foundry Digital.

At present, Grayscale is distancing itself from Genesis, citing no exposure to Genesis and that all its Grayscale products are safe. Cathie Wood of Ark Investment reportedly purchased 315,259 shares of Grayscale’s GBTC fund, which is currently trading at the largest ever discount (~43%) relative to Bitcoin.

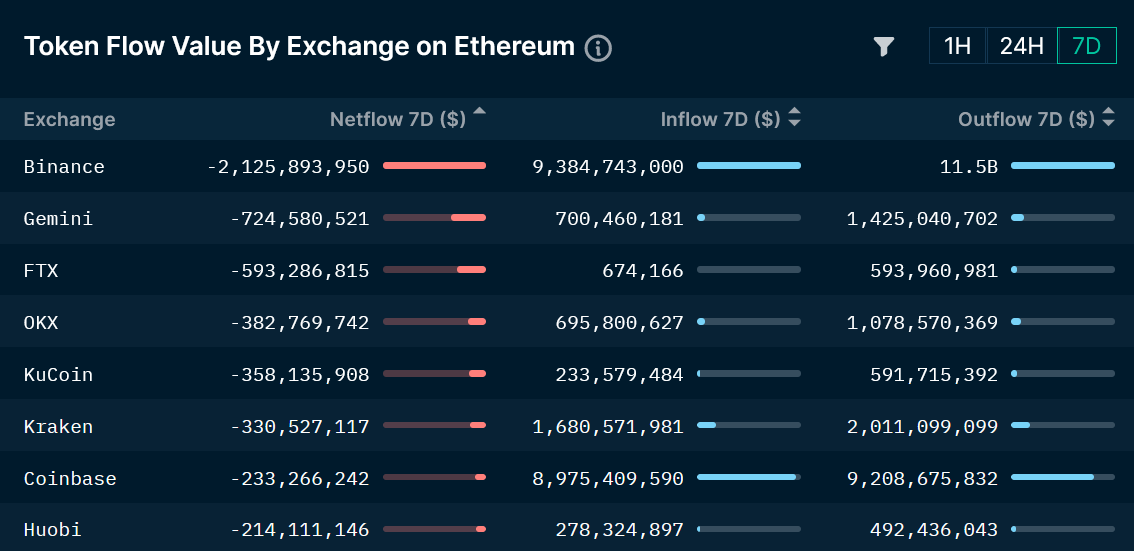

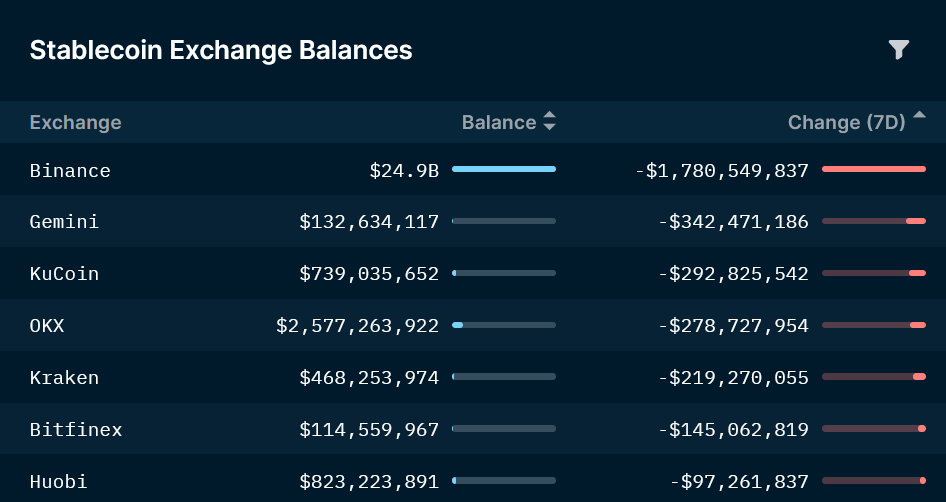

Genesis’s withdrawal halt has also directly impacted the Gemini exchange, a partner in the Gemini Earn program. In response, Gemini has paused Earn, leading to a rush in outflows on Gemini’s exchange. Nansen data shows Gemini having the second highest net outflows of all exchanges for both Ethereum tokens and stablecoins in the past seven days.

The contagion elsewhere:

When’s the best time to apologize and seek forgiveness if you’ve previously lost millions in dollars of investors money? When people’s anger is focused on something else of course.

Emerging out the woodwork this past week was the disgraced founders of Three Arrows Capital who lost billions of dollars in investor money.

The Luna Foundation Guard also took this opportune time to release a report by a third-party auditor that proves all efforts that could be taken to defend UST’s peg were taken, and there were no embezzlement or misuse of funds.

Bankless is launching podcast collectibles! These are limited edition NFTs for the 100 true fans of Bankless’s most iconic podcast episodes. The first collectible was released this past Friday for the SBF vs Erik Voorhees debate that we hosted just two weeks ago, with 100% of proceeds going to CoinCenter. See here for full details.

We’re also kicking off Permissionless 2023 in Austin, Texas September 11-13!

Premium Bankless subscribers can enjoy a 30% discount code here. Prices start at $199 and increase every two weeks. Don’t wait.

Cosmos’ ATOM 2.0 governance proposal offers to overhaul the Cosmos ecosystem into one that puts ATOM at the centre of its universe. I’ve written about it previously in Here Comes Cosmos 2.0.

That governance proposal was surprisingly shot down this week with ~37% vetoing the proposal against ~48% in favor, and ~13% abstaining.

General sentiment among vetoers in the Cosmos community felt that the Cosmos 2.0 white paper was lacking in details, lacked risk analysis and needed further deliberation.

Our lineup next week:

-

It’s time to build back better… Optimism has the answer with OP Stack

-

William Peaster is showing us how to double down on DeFi

-

Christopher Leonard joins us on the pod!

– Donovan

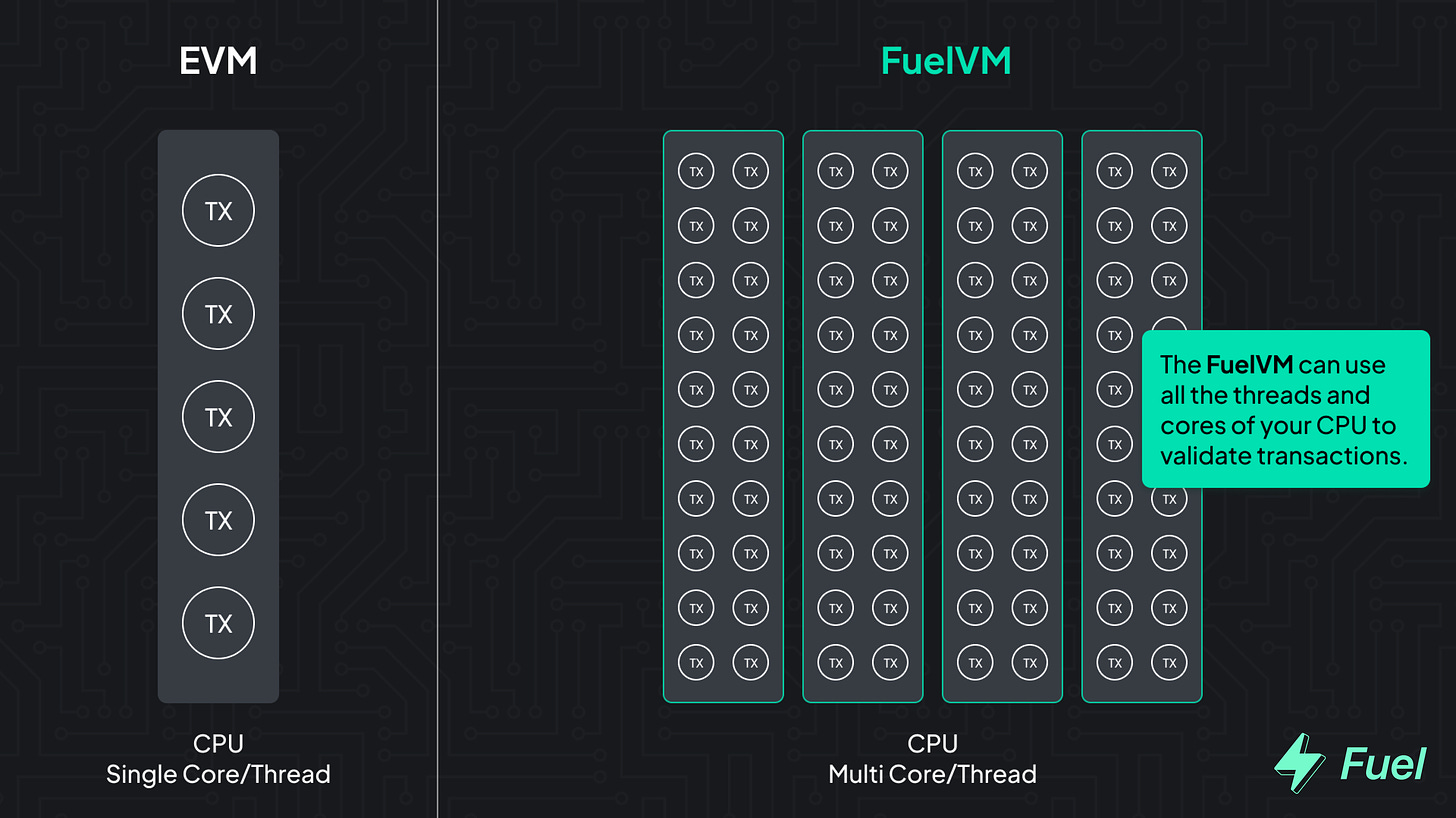

👉 Explore the FuelVM and discover its superior developer experience!

-

📘 FTX Is Why We Need More DeFi, Not Less

-

📘 How to take custody of your crypto keys

-

📘 Ultimate Guide to Undercollateralized Lending in DeFi

-

📘 5 Reasons This Could Be The Crypto Bottom

-

📘 Announcing Bankless Collectibles ✨

-

📺 Is Crypto Good for the World? with David Hoffman & Juan Benet

-

📺 Novel Coordination Architectures with Awa Sun Yin | Green Pill #64

Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you.

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

✨See all listings on the Bankless Job Board✨

Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

👉 Go beyond the limitations of the EVM: explore the FuelVM

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.