Notable Messari Intel Updates

- Circle Internet Financial, the issuer of USDC, announced that it has agreed to raise $400 million from BlackRock, Fidelity Management and Research, Marshall Wace LLP, and Fin Capital in a funding round expected to close in Q2 2022. In addition to the strategic investment, BlackRock has entered into a broader strategic partnership with Circle to explore capital market applications for USDC, among other use cases.

- The Acala team has announced that they are working to integrate LDOT and LKSM, Acala and Karura’s yield-bearing staking derivatives, as collateral assets on Anchor. The teams will also work together to establish deep liquidity pools for aUSD and UST on Acala to serve as a gateway into the Polkadot ecosystem for UST users.

- Uniswap has announced the launch of Uniswap Labs Ventures. The announcement said that “Uniswap Labs Ventures will invest in teams at different stages and levels of the Web3 stack, from infrastructure to developer tools and consumer-facing applications.”

- The Yearn Finance Team, via Twitter, endorsed the adoption of the ERC-4626 token type, a new standard for tokenized Vaults and yield-bearing tokens. The team stated, “In a word, ERC-4626 will be the gold standard for any sort of interest-bearing token… from Yearn Vaults to AAVE deposits and Balancer linear pools.” Currently, contributors are working to implement the ERC – 4626 standard for Yearn V3 Vaults with no stated timeline for completion.

Notable Messari Governor Updates

- BitDAO has submitted a proposal that aims to approve a partnership between BitDAO and PleasrDAO in which BitDAO will invest $6.5 million (95% ETH/USDT and 5% in BIT). PleasrDAO is a collector DAO that buys and funds culturally significant digital art pieces. The partnership will diversify BitDAO’s investment into art/NFTs. Voting is currently active.

- After the Balancer team discovered that the current gauge system does not perform as intended in the original veBAL tokenomics proposal, the Balancer DAO submitted a proposal that aims to determine whether the Balancer community prefers to deploy a new veBAL gauge system or use the current gauge system. Voting will start tomorrow.

- The Idle DAO succeeded in passing a proposal that aims to initiate the process of enabling external contracts to integrate with the stkIDLE module. The current whitelisting process has resulted in multiple whitelisting proposals being halted due to failed voting sessions. The new approach would implement the SmartWalletWhitelist contract to manage all contracts interacting with the staking module.

- The Balancer DAO succeeded in passing a proposal that aims to authorize Bancor 3 Beta Release to observe an operational deployment of the system in a limited capacity. The Beta release will run for 28 days concurrently with a $30 million BNT rewards program (13,043,478 BNT) and a $1 million bug bounty supported by the Bancor Foundation.

- The DODO DAO failed to pass a proposal aimed to solve the issues of multichain voting rights and low voter turnout for the DODO governance. To solve the multichain voting rights, it seeked to approve creating a new governance framework for use in place of Snapshot. The new voting system would be similar to Snapshot, using an off-chain signature collection and a decentralized storage system to count votes. However, it would account for DODO held in multiple chains when assigning voting power to users, unlike the current strategy that only accounts for DODO on Ethereum.

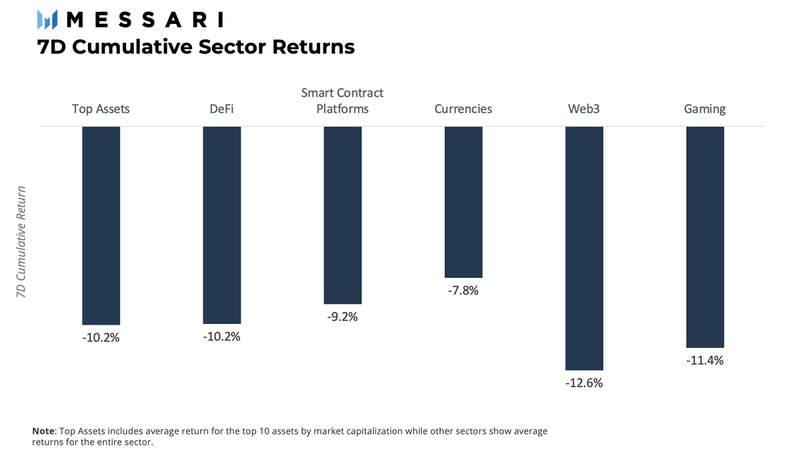

Sector Returns

The crypto market has tumbled again, marking the second week in a row where all sectors covered return drawdowns. Four of the six sectors covered returned double digit-losses, with Web3 being the biggest loser. The Web3 sector has been among the hardest hit during the recent weeks — this week losing 12.57%. Gaming also had a rough week, trading places with Web3 as the sector with the biggest decline most recently. It returned -11.41% on the week.

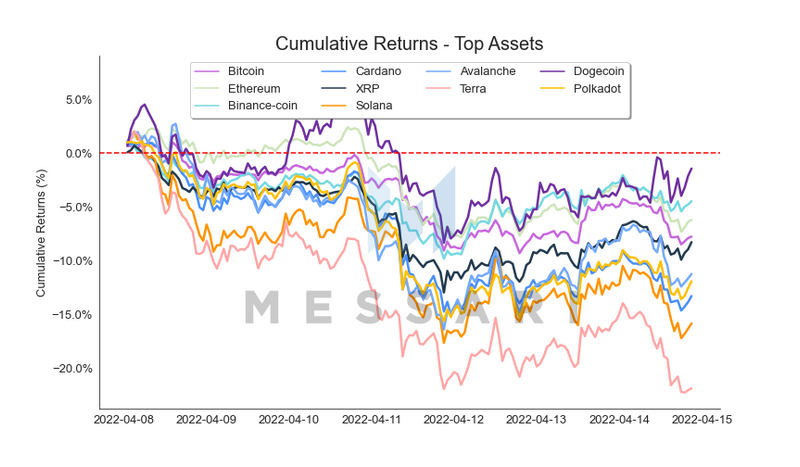

Top Assets

Dogecoin (DOGE) has continued to hold its ground. It was the only asset within the top 10 assets by market capitalization that made it above water last week, and this week, it declined the least. This week, the original dog coin only lost 1.4% in value. Contrast this to Terra (LUNA) which was the laggard of the group and ended the week with a 21.4% decline.

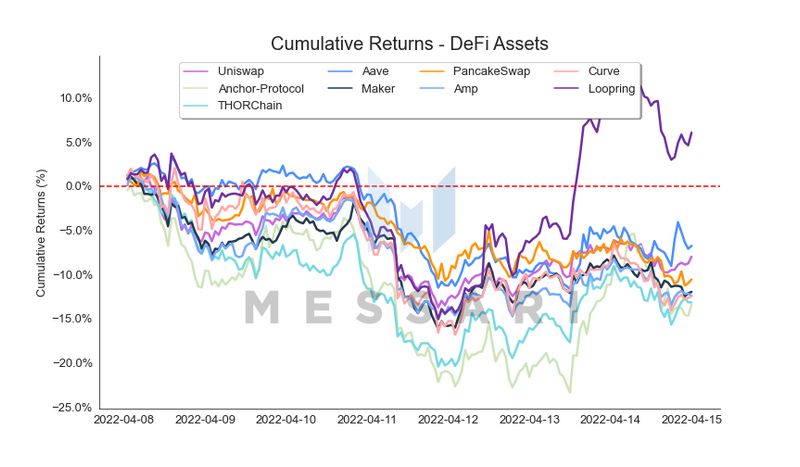

DeFi Assets

All top DeFi assets by market capitalization ended the week in the red with the exception of one — Loopring (LRC). The zkRollup-based Layer-2 platform’s asset saw its price gain 5.8% on the week, while the broader DeFi ecosystem suffered losses. Aside from the one outlier, more than half of the DeFi assets saw double-digit losses. Anchor (ANC), after being the top-performing DeFi asset for last week, gave all of its gains back and now finds itself more than 65% down from all-time-high. The Terra-based lending and borrowing platform saw its token end the week with a 13.5% loss. Impressively, although most DeFi assets are far away from all-time-high territory, DeFi TVL has remained on relatively healthy levels, currently sitting at $159.39 billion.

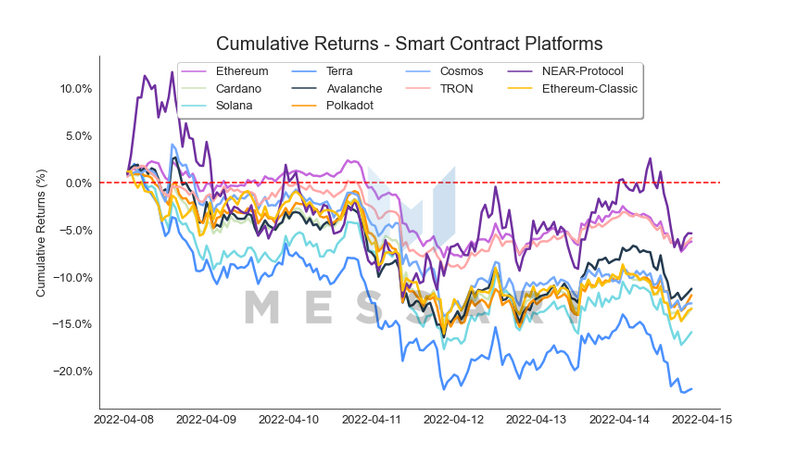

Smart Contract Platforms

All top smart contract platform tokens ended the week in negative territory, with 7 of the top 10 assets by market capitalization seeing double-digit negative returns. NEAR protocol started the week on a high note, gaining 12% in value but then giving it all back and joining the rest of the sector performance wise. The Proof-of-Stake-based blockchain token managed to secure the number one spot for the week by a small margin, having the smallest decline (-5.3%). Terra (LUNA) was the laggard of the group, ending the week with a 21.9% decline.

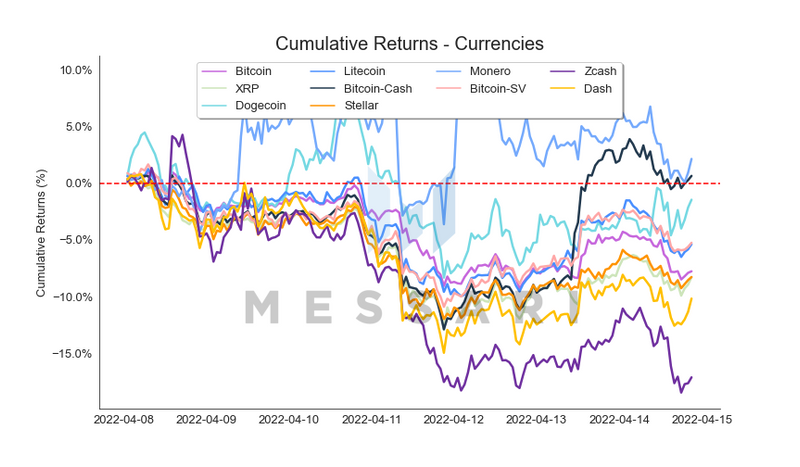

Currencies

Only two currencies ended the week in green territory, with Monero (XMR) leading the pack and Bitcoin Cash (BCH) taking the second spot. XMR traded above positive territory for most of the week, which was enough to help the privacy-focused coin secure the first spot with a moderate 2.2% gain. Bitcoin Cash on the other hand slumped mid-week with the rest of the sector but was able to recover the 10% loss in order to secure its second place with a 0.7% gain. Zcash had the largest decline within the top currencies by market capitalization, ending the week with a -17.1% return.

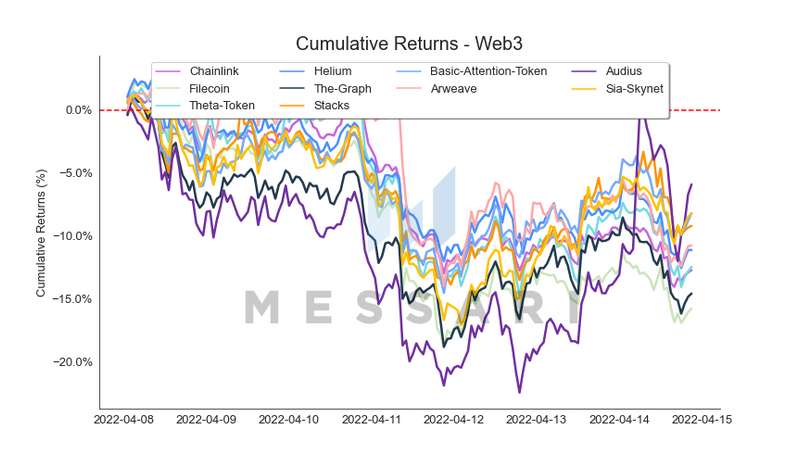

Web3

The worst performing sector of the week saw six of its top ten assets end the week with losses in the double-digits. Interestingly the biggest losers were among the highest by market capitalization within the sector. The asset that declined the least within the category was Audius (AUDIO), returning -5.9% on the week. Filecoin (FIL) secured the endmost position of the group with a 15.8% decline.

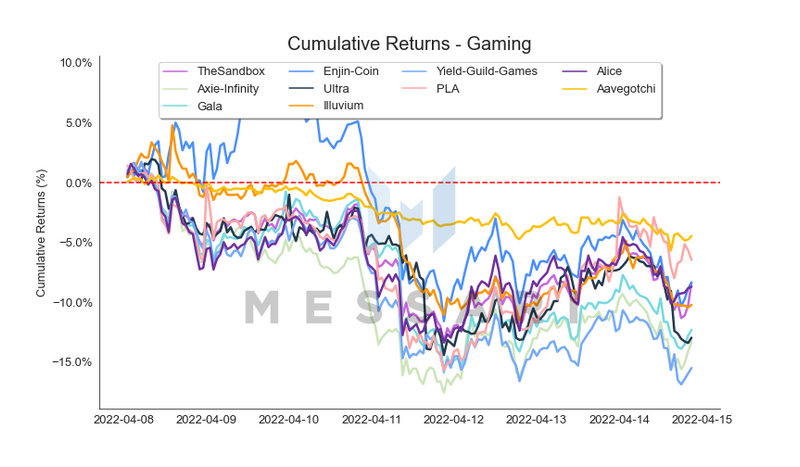

Gaming

Gaming was the second worst performing sector of the week, with losses ranging from -4.5% to -15.5% and half of the top assets returning double-digit losses. Aavegotchi (GHST) is one of the less volatile assets within the gaming ecosystem and sustained the least drawdown for the week with a 4.5% decline. Yield Guild Games (YGG) held the rear position this week with a 15.5% loss.