Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

As the NFT ecosystem continues to evolve and zero- or low-fee marketplaces keep coming to the fore, many creators are facing lower royalty payments from their secondary sales.

The challenge, then, is generating sustainable revenue streams in this new environment where royalties increasingly go unpaid.

The good news here is that there are multiple strategies that NFT creators can use to compensate for these downtrending royalty revenues.

In this article, I’ll share four such avenues that creators can turn to in order to better position themselves in this changing landscape of NFT royalties.

-WMP

🙏 Sponsor: Kraken — the most trusted and secure crypto exchange in the world✨

As DCinvestor has explained before, NFTs are best understood as “permissionless, censorship-resistant bearer assets.” In other words, NFTs are decentralized digital things that can be moved directly between individuals without interference from centralized intermediaries.

As the NFT space has been grappling with the recent downtrend in royalty payments, which lately has been driven largely by the NFT marketplace war between Blur and OpenSea, a number of approaches — like blocking transfers, burning tokens of non-royalty paying holders, and marketplace blocklists — have been put forth as potential ways to stem the declining revenues.

The problem with the approaches mentioned above is that they’re all centralizing strategies that eat away at that fundamental value proposition of NFTs, i.e. being decentralized bearer assets.

All that said, though, NFT creators still have a range of options to consider when it comes to compensating for downtrending royalties. Here are four increasingly go-to avenues you’ll want to keep in mind.

The first and most basic approach a creator or collection team can consider here is holding some of their NFT project’s supply back for themselves.

The idea? As a project grows, this retained supply can later be used for primary sales, whether that’s in drip-like fashion over time for further funding or all at once like Larva Labs’s Mach 2022 sale of its CryptoPunk supply to Yuga Labs as part of a wider IP deal.

There are two general variations of this tactic, which is holding back unminted supply (think mint-on-demand collections like Chromie Squiggles, of which +250 NFTs can still be minted for special occasions out of the collection’s 10k max supply) or holding back minted supply (e.g. Larva Labs minted the first 1,000 NFTs from the CryptoPunks smart contract and sold from that batch over time).

Of course, just because a project retains some of its supply for itself doesn’t mean it can’t try to rake in royalties too, downtrending as they may be lately.

For example, the creators of Terraforms took the 0% royalties approach and just opted for holding back unminted supply for later primary sales and to align themselves long-term with their community, but in contrast when goblintown.wtf team did its free mint in May 2022 they retained 1,000 NFTs and started with a 7.5% royalty on secondary sales (They’ve since moved to their own bespoke marketplace where a 5% royalty is enforced.)

In the NFTfi scene, there’s a growing wave of NFT automated market maker (AMM) protocols that creators or collections can provide NFTs to in order to earn trading fees from swaps.

The gist, then, is that a project can add its NFTs to a liquidity pool (liquidity providing, a.k.a. LPing) and then earn a cut every time people buy or sell through the team’s liquidity. An interesting advantage of this strategy is that it allows a team to earn revenues from their NFTs without conducting primary sales.

For example, the Sappy Seals team acquired 50 of its own NFTs and then started LPing with these NFTs on sudoswap in August 2022. Since then, the team’s earned many thousands of dollars’ worth of revenue courtesy of trading fees. Other projects that have used this LPing strategy with similar success include Based Ghouls, Finiliar, and Allstarz.

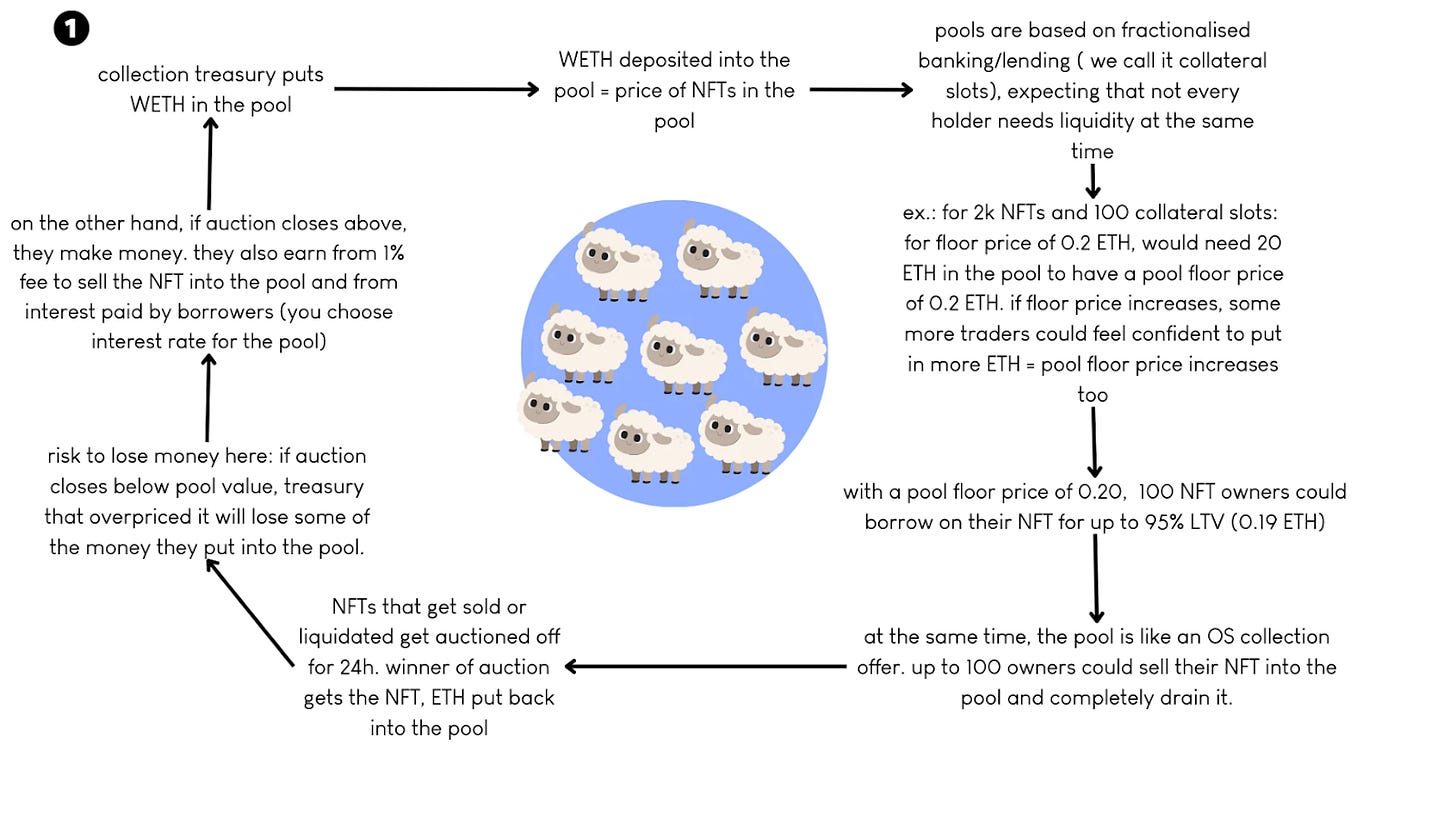

Another more advanced variation of this approach that we haven’t seen just yet is LPing in an Abacus spot pool. Abacus is a new NFT appraisal protocol focused on pricing NFTs. The team has proposed a new way of NFT LPing that involves a project linking some of its treasury funds to its own liquidity pool on Abacus in order to generate revenues and accurately price all the NFTs in the pool. Learn more about this concept here.

Sometimes when you need something done, you’ve got to do it yourself. In the contemporary NFT marketplace scene, projects that want to enforce royalties are increasingly rolling out their own native marketplaces and focusing activity there in order to draw trades away from Blur, OpenSea, etc. where royalties are currently unreliable.

Fortunately, NFT infra projects like Reservoir are making it increasingly easy for creators and collections to deploy their own custom, royalty-friendly marketplaces with aggregated NFT listings.

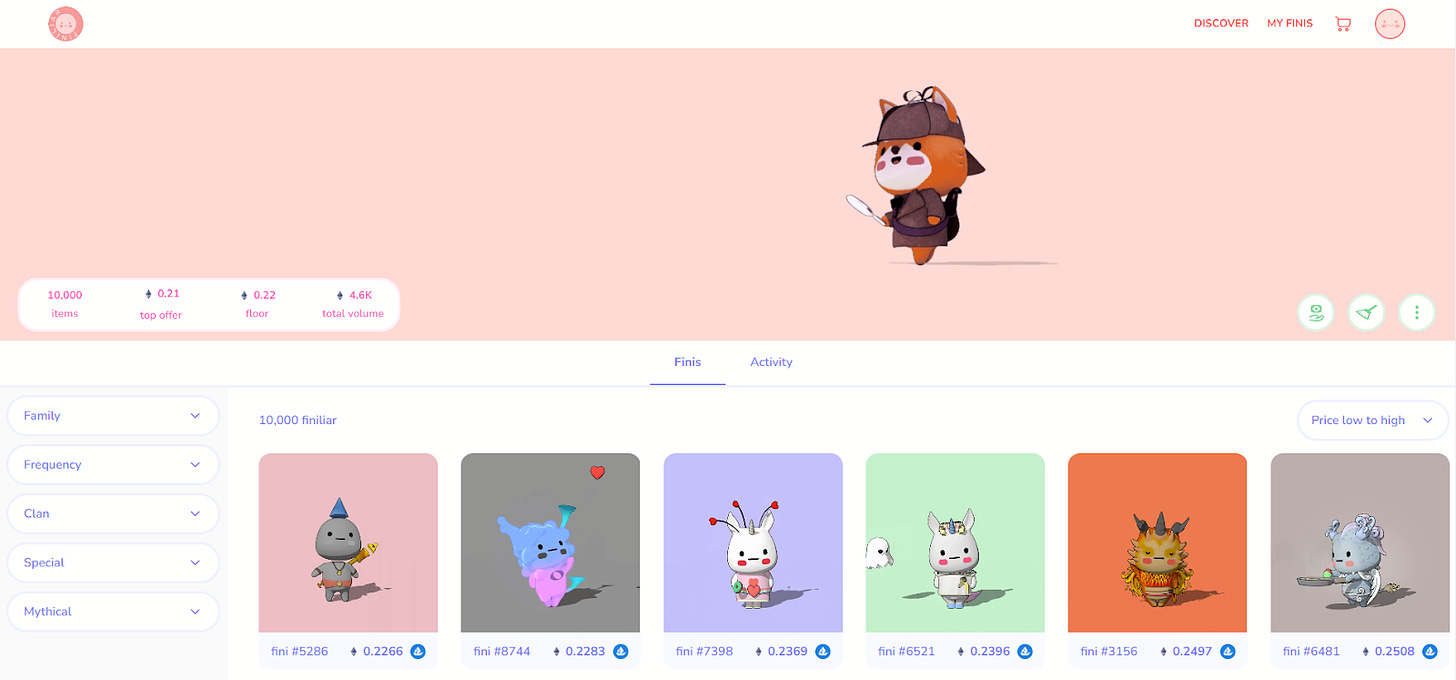

For instance, Finiliar is one such collection that uses Reservoir to underpin its native marketplace system on finiliar.com. They’ve set up the frontend how they like, and then Reservoir takes care of all of the actual market actions under the hood so to speak.

Just because royalties are generally downtrending in NFTs lately doesn’t mean we have to abandon all hope for them. In fact, one approach available is to double down on royalties by directly incentivizing them.

There’s a number of different ways this incentivization can be accomplished. Maybe an NFT team uses an indexer system to identify all of their collectors who have honored royalties over the past year and then rolls out unique perks for these pro-royalty collectors, like allowlist spots, NFT airdrops, token-gated chats, leaderboard competitions, and more.

This avenue is interesting because it can readily be used with other approaches above (e.g. holding back supply, focusing attention to a DIY marketplace), and it steers NFT holders toward being more active and helpful community members!

-

Study your options: if you’re working on your own NFT project, consider how to succeed in this evolving royalties landscape!

-

Learn about MetaMask x Unity: see my previous write-up on MetaMask’s arrival in the Unity Asset Store!

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Kraken NFT is built from the ground up to make it one of the most secure, easy-to-use and dynamic marketplaces available. Active and new collectors alike benefit from zero gas fees, multi-chain access, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.