Download the PDF version of this report by clicking here.

State of Friktion Q2 2022

July 22, 2022

Key Insights

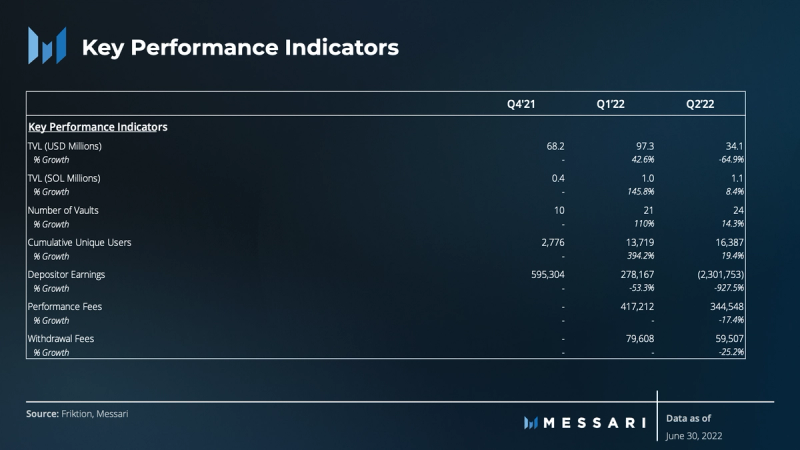

- Friktion remains the largest options protocol on Solana, passing $2 billion in options volume traded this quarter. Transacting an average of $72 million of notional each week in Q2, the protocol continues to innovate on options execution (on-chain liquidity) and diverse strategy construction.

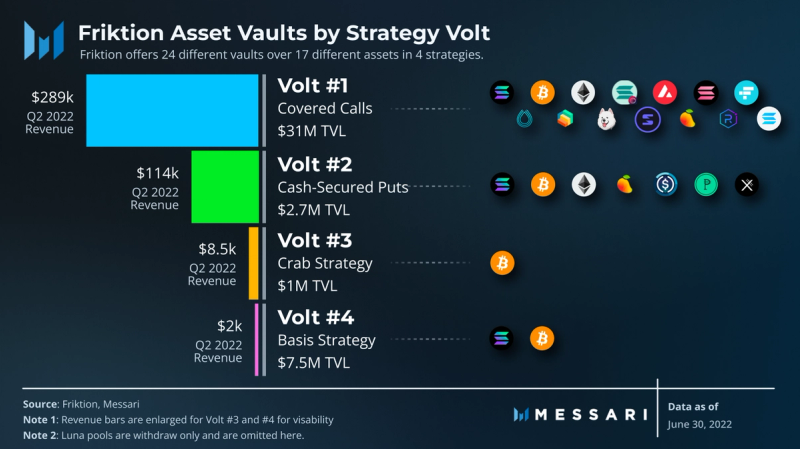

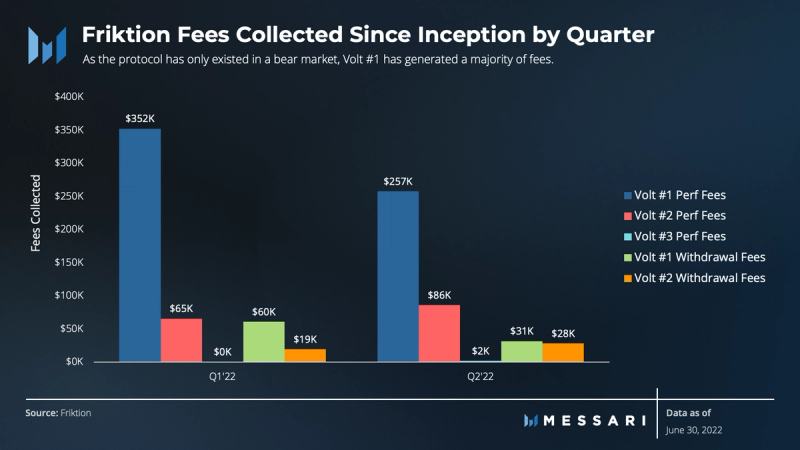

- The protocol has generated almost $1 million in revenues in its first six months. 86% of revenues are from performance fees.

- Friktion launched two delta-neutral (not bullish or bearish) yield strategies (Volt#03 and Volt#04) this quarter, attracting over $8.5 million of TVL.

- Friktion’s largest Volt – #01 Covered Calls – continues to grow and returned 4.75% in the quarter. Volt #02, Cash-Secured Puts, got hit hard, losing 31% in the quarter.

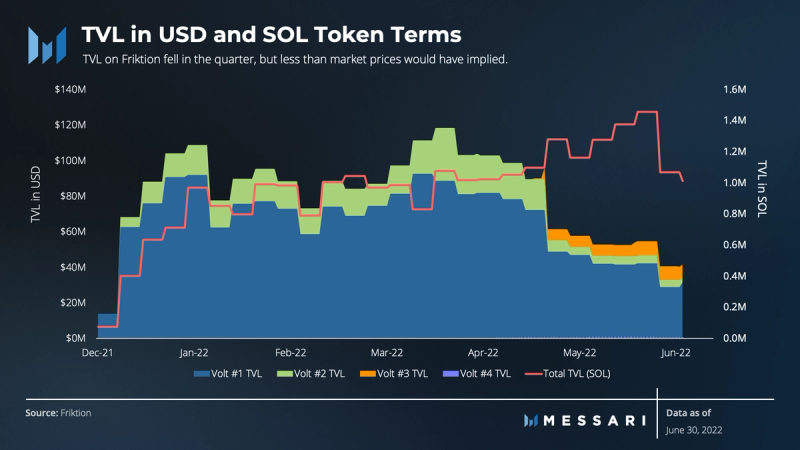

- A bear market hurt USD-measured TVL, while 8-out-of-19 existing vaults increased TVL in token terms.

- The growth map is ambitious, and includes helping DAOs manage their treasuries, the launch of an institutional credit arm, and decentralization.

A Primer on Friktion

Launched in December 2021, Friktion offers systematic portfolio management strategies (called Volts) for on-chain assets. The protocol offers a balanced portfolio of investing tools for users – including bullish, bearish, long volatility, and short volatility strategies. Friktion’s products allow users to deposit an asset into a Volt that is locked on weekly epochs. Volts are segmented by strategy and by asset, totaling 24 options. The protocol currently offers a Covered Call Strategy (Volt #01), Cash-Secured Put Strategy (Volt #02), Crab Strategy (Volt #03), and Basis Strategy (Volt #04) and recently announced Volt #05: Capital Protection.

Key differentiating factors between Friktion and other systematic option strategies are its execution infrastructure and strike-selection process. Friktion utilizes an on-chain, gradual Dutch auction process (using Channel RFQ, the protocol’s novel liquidity platform). For strike selection, an algo informs the protocol of the optimal strike range and timing. The key factor is flexibility – in the case where implied volatility levels are meaningfully below recent realized volatility the auction can be delayed. This can be both an advantage and a disadvantage, depending on user preferences. Friktion has 20+ market-makers on Channel, with typically 5-7 winning trades each epoch.

Friktion Labs supports the protocol, with the goal of building a full-stack portfolio management solution. The protocol is built on Solana, with a UI that allows for multi-chain deposits including Ethereum and Avalanche.

Introduction

Friktion grew quickly out of the gates, starting the year with over $70 million in TVL. The protocol differentiates itself with a breadth of solutions, better UX, and importantly, less slippage. By the end of Q2, you could hedge a bearish stance on 14 different tokens and collect yield using their covered call strategy (Volt #01). You can remain in stablecoins and take a slightly bullish view, playing for yield generation from their cash-secured put strategy (Volt #02). The crab strategy (Volt #03) does not require a directional view, it is a short volatility strategy that earns yield on stablecoins when the market moves less than is implied by derivative pricing. The basis strategy (Volt #04) is a way to receive yield on stablecoins when demand for short leverage is greater than long leverage. Each strategy has unique risks, and none (yet) offer principal protection. But each gives traders and portfolio managers new tools to earn yield using derivatives.

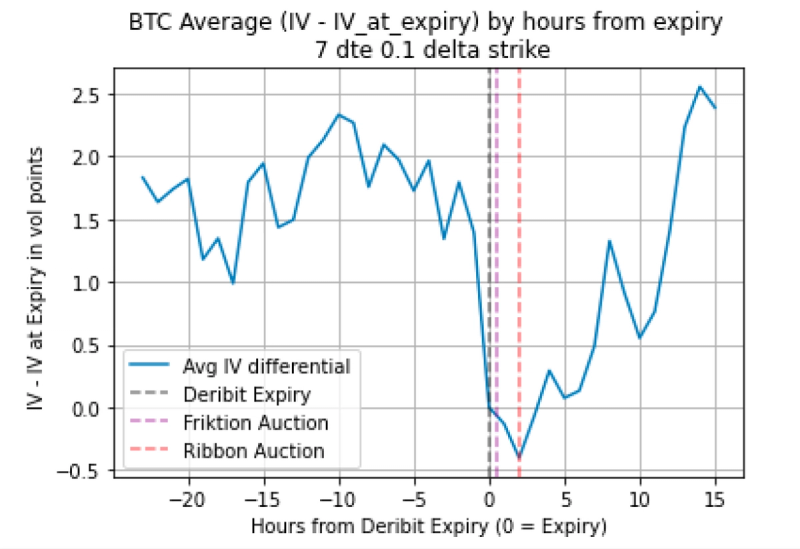

Friktion Labs, the team contributing to the protocol, has placed an emphasis on less slippage on these systematic trades. The team moved vault expiration and auction times up (to Friday at 2am UTC), 6 hours ahead of the weekly Friday expiry that most options adhere to. Their research informed them of large swings around expiry, which would typically make for worse prices for users and vaults. Friktion also enabled more flexibility on execution, depending on the realized-implied volatility spread at time of auction. This spread can be severely impacted by the weekly expiry, so added flexibility allows the protocol to reduce this noise.

Source: Friktion Research

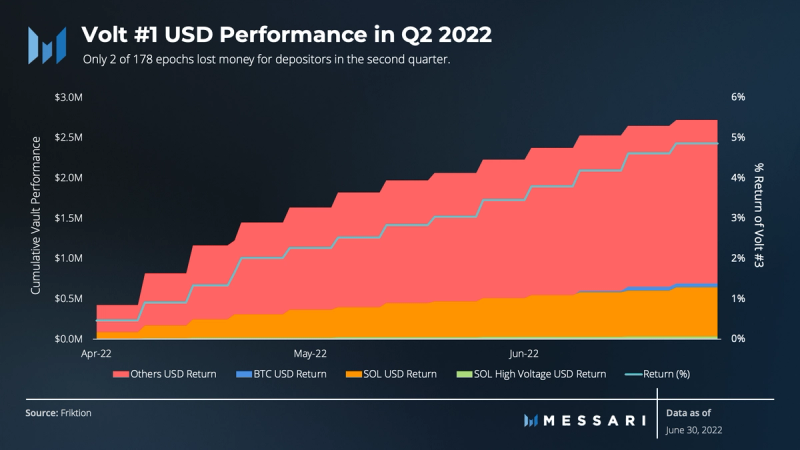

Friktion Volts continued to execute their strategies without a hitch in a volatile quarter. Due to the direction of the markets, the covered call strategies returned an average of 4.75% in the quarter, while the cash-secured put strategies lost 31%. The Covered Call strategy (Volt #01) was Friktion’s largest strategy with over $31 million in TVL at the end of the quarter.

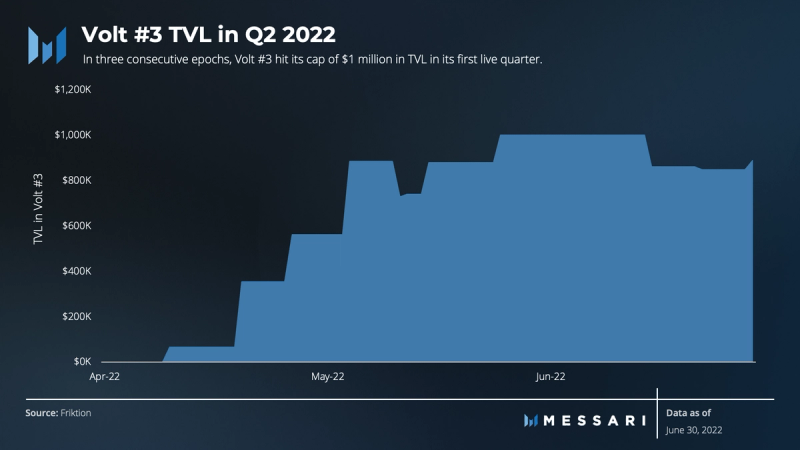

The protocol added two new strategies during the quarter. The Crab Strategy, Volt #03, is a tool to earn yield from shorting volatility. It was up 5.58% and closed the quarter with over $888,000 in TVL. The Basis Strategy, Volt #04, is a tool to earn yield from the funding rate of perpetual futures. It has been nearly flat since inception, only up 22 basis points.

As a young protocol, Friktion has an ambitious roadmap. The team has hinted at least two new systematic strategies to be launched this year (Volt #05 just announced this week). They are also in beta on a DAO-focused treasury portfolio management suite, called Circuits. Additionally, the recently released UX improvements for users like portfolio tracking are an effort to drive continued growth.

Performance Analysis

TVL in dollar terms fell from over $111 million on April 1 to roughly $32 million on July 1. In native SOL terms, TVL was actually increased by 8.4%, given the token’s 75% drop from ~$135 to $33. In local token terms, Friktion’s TVL resiliency outperformed Ethereum competitors Ribbon and Opyn whose TVL both fell by 36% in ETH terms in the quarter.

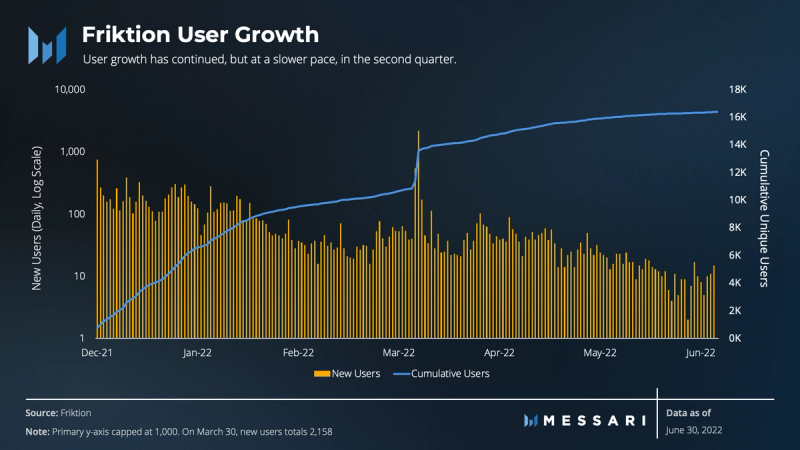

Friktion new user growth slowed in the second quarter. In Q1 2022, ~11,000 new users tried Friktion on the heels of its December launch. As the novelty waned and the bear market dampened user activity, only 2,668 new users tried the protocol in Q2.

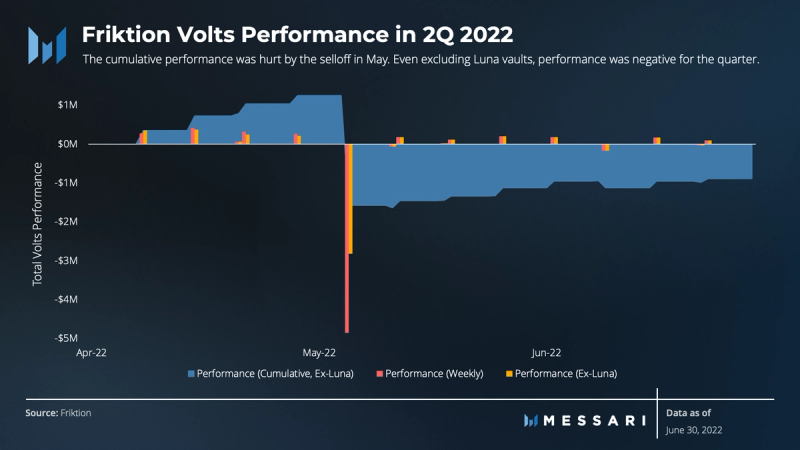

As a proxy for the market, SOL volatility averaged 104% in Q2 versus 90% in the previous 3 quarters. This extreme volatility in the market made it a bad quarter to be a seller of volatility. While covered calls fared well, cash-secured put vaults lost $5 million in May, of which $2 million came from the Luna vault. Given the downward direction of the markets, the covered call strategy was the best performer, earning depositors 4.75%, good for almost $2.3 million in the quarter.

Volt #01: Covered Calls

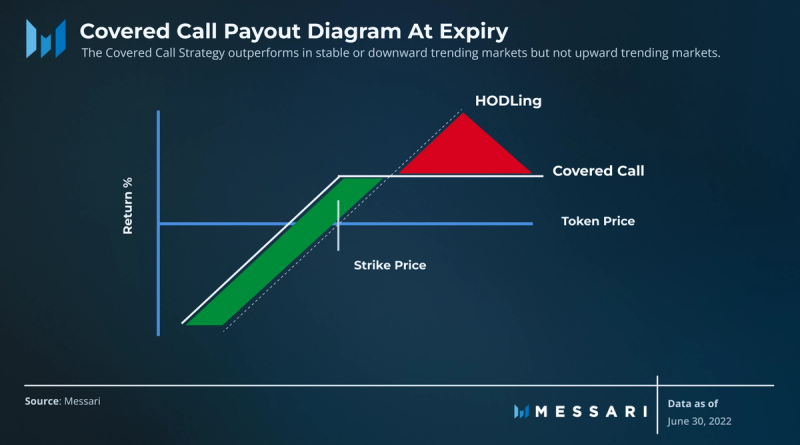

A covered call strategy is a yield-generation strategy for asset holders. Option premiums are collected from selling call options against their assets. However, the option seller forgoes upside in exchange for collecting the premium yield. If the asset goes above the strike price, the holder will not participate in gains.

In Volt #01, users deposit tokens into the vault and lock them for weekly epochs (Friday to Friday). At the start of an epoch, Friktion sells an equal notional amount of 1-week calls with strikes in the 5-10 delta range to maximize yield while minimizing the chance of closing in-the-money. At the end of the epoch, the contracts are cash-settled.

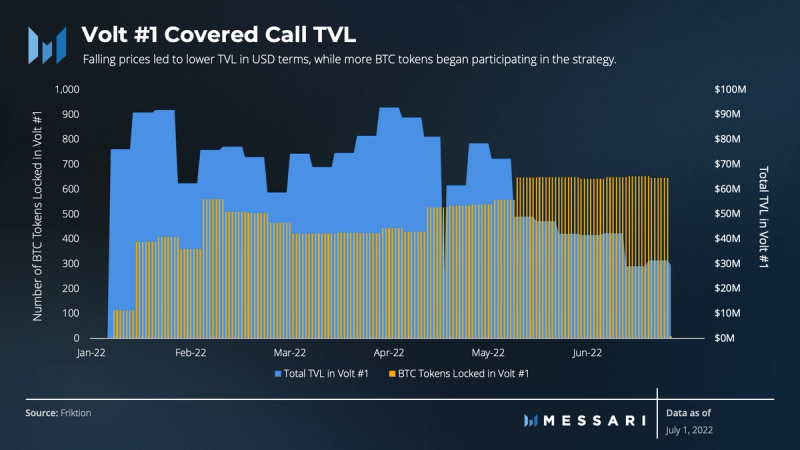

BTC and SOL are the two largest vaults in the Covered Call strategy with over $12 million and $5.6 million locked, respectively. While prices fell, the number of BTC in the vault increased by 46%, giving the protocol the largest BTC options vault in DeFi. The other big gainers in the quarter were AVAX and ETH, increasing 674% and 69% respectively after Friktion enabled cross-chain deposits on its platform. Native SOL deposits, however, fell 34%.

Volt #01 was extremely successful this quarter, given the downward trending markets. The strategy returned 4.75% for the quarter, annualizing a 20% yield. Only 2 of the 178 epochs in Volt #01 this quarter experienced a negative return (STEP lost $4,380 on May 13 and SAMO lost $39,006 on June 24). The best performing vault was the SOL high voltage vault, which gives depositors the option to increase risk and potential yield. It generated 8.43% for depositors. The lowest was MNGO, yielding 2.62%.

Volt #02: Cash-Secured Puts

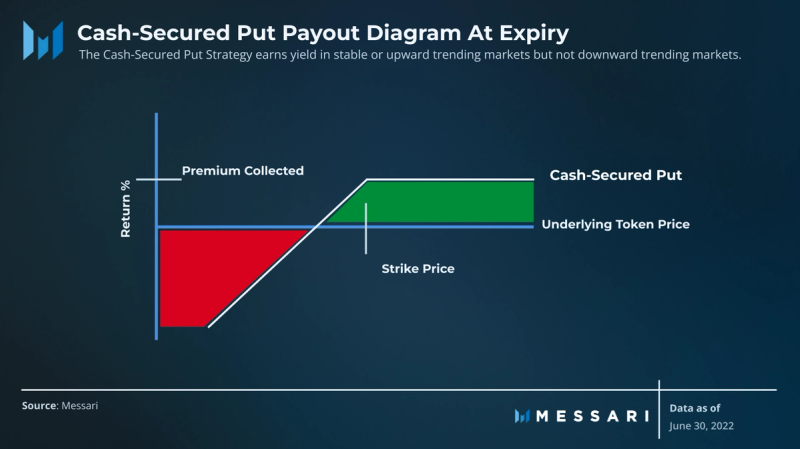

Similar to the cover call strategy, cash-secured puts are designed to generate yield for depositors by selling options. The key differences are that the assets deposited are stablecoins and put options are sold rather than calls. This results in a financial product that earns positive yield in flat or upward markets and performs poorly in downward markets like the one experienced this past quarter.

In Volt #02, users deposit USDC into the vault and lock them for weekly epochs (Friday to Friday). At the start of the epoch, Friktion sells an equal notional amount of 1-week puts in the 5-10 delta range. At the end of the epoch, the contracts are cash-settled.

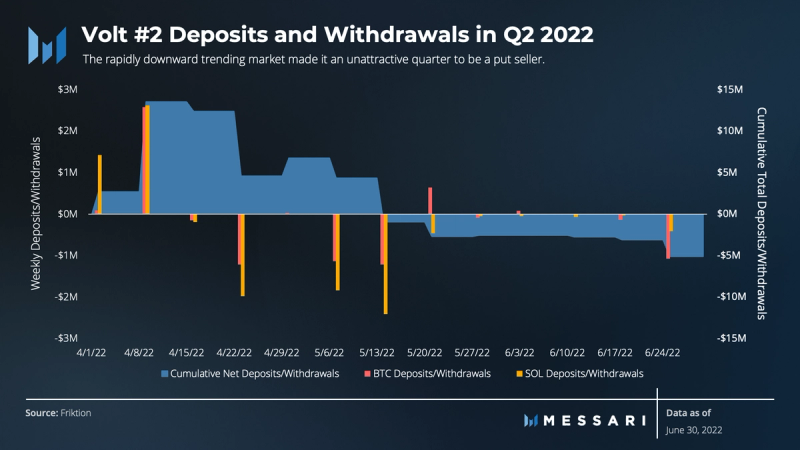

TVL in Volt #02 began the quarter at $18.7 million, rose to a high of almost $30 million in early April before collapsing in the second half of the quarter to $2.1 million on July 1. This includes over $5 million of net withdrawals in the quarter. There was also $5 million of UST deposits in the Luna vault on April 8, these vaults are of course no longer active and only available for redemption.

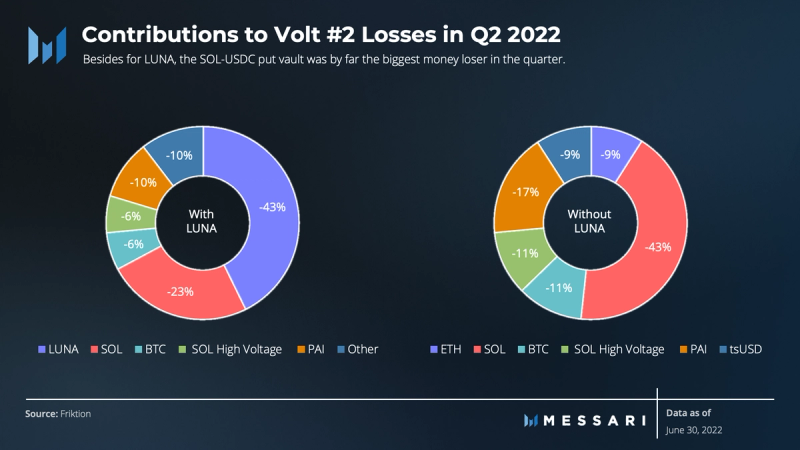

Q2 2022 was certainly a strongly downward trending market, and the performance in Volt #02 reflected it. Excluding Luna, the strategy lost 19% in the quarter. The largest money loser was SOL, losing $1.2 million, with the high voltage vault dropping another $300,000. On a percentage basis, BTC vault nudged out SOL to be the best of the worst, returning -16.42% to SOL’s -16.58%. ETH was the biggest loser (besides LUNA), losing over 30%. The ETH vault underperformance likely reflects a larger mispricing of the downside volatility versus BTC and SOL.

Volt #03: Crab Strategy

A power perp is an idea originally introduced by Paradigm and implemented by Friktion. Friktion Labs built Entropy, a central limit order book (CLOB) designed for exotic derivatives. Entropy creates a marketplace for volatility products. Power perps (e.g. BTC-squared) give holders asymmetric exposure to price moves. For example, the value of the power perp goes up more (21%) for a 10% move higher than it goes down (-19%) for a 10% move lower. This asymmetry does not come free, of course. Funding rates on power perps reflect both leverage funding costs as well as the market’s risk premium to be short this convexity and are always positive.

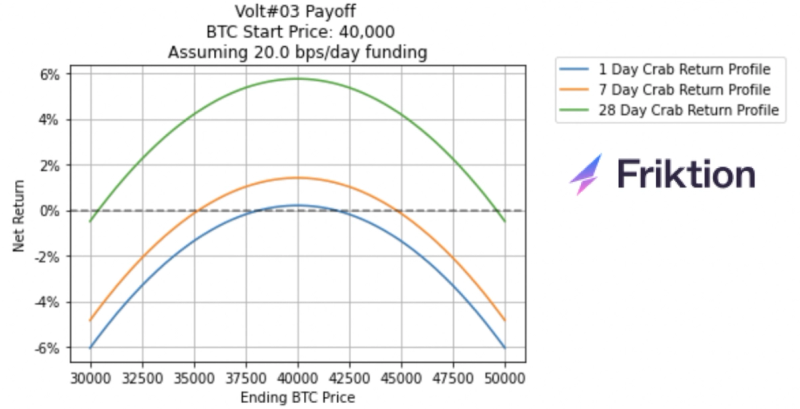

The Crab Strategy sells a power-perp short and hedges the price (delta) risk with two long perps (short power-perp, long 2 perps). This isolates the convexity premium, creating a payoff similar to an options strategy that sells at-the-money options (called a straddle) while constantly hedging the delta risk. Higher funding rates on BTC-squared create a wider “profit range,” or BTC price range in which the strategy is profitable. Lower funding rates create a smaller “profit range.”

Source: Friktion Research

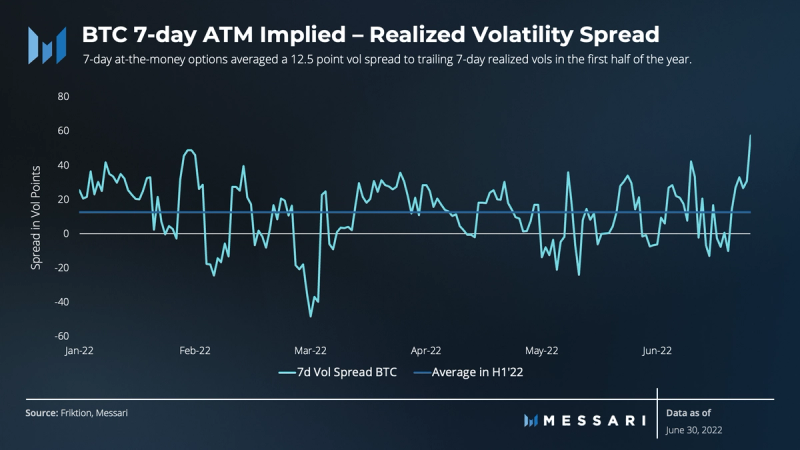

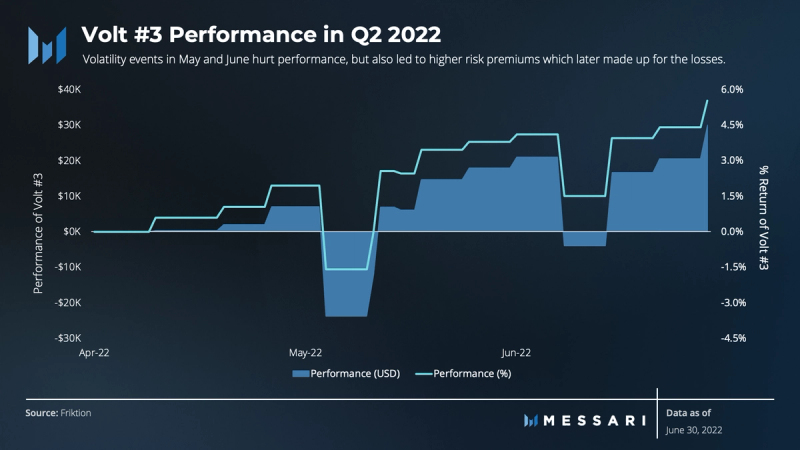

Volt #03’s performance is heavily impacted by the implied-realized volatility spread as the strategy attempts to profit by capturing the difference between the implied volatility it sells and pursuant realized volatility. BTC at-the-money 7-day implied volatility is used here to track the risk premium the Crab Strategy aims to collect. This is a conservative measure that understates the premium received due to volatility skew – it does not take into account that the implied volatility of strikes away-from-the-money typically have a higher implied volatility than at-the-money.

Launched in the second week of April, Volt #03 has experienced some volatile markets. In periods where the implied volatility that the strategy is selling is higher than the pursuant 7-day realized volatility, the strategy should have positive returns. As the chart above shows, in more volatile periods like parts of May and June the spread goes negative, but in normal times it is comfortably positive.

Volt #03 requires USDC deposits, which are used as collateral for the perps and power perps. Bitcoin is the only vault actively running this strategy today. The strategy has been nearly fully funded for the majority of its young life. The Volt capacity limit was recently increased from $1 million to $1.1 million.

Volt #03 closed the volatile quarter with an impressive 5.58% gain (24% APY). A short volatility strategy, the Volt suffered in mid-May around the Luna collapse and again in mid-June during the CeFi lender liquidations. Given these events also led to increased volatility premiums, the strategy bounced back quickly.

Volt #04: Basis Yield

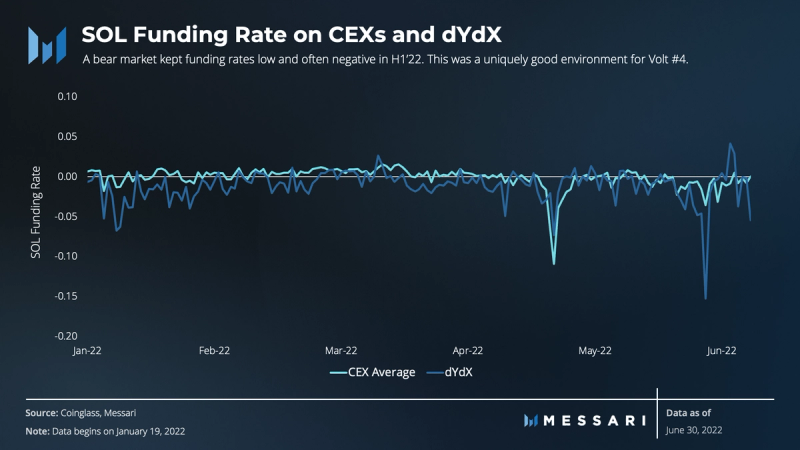

Using perpetual futures, the basis strategy is another way for cash holders to generate yield. Users deposit stablecoins into one of the currently live vaults; BTC and SOL. The strategy is long perpetuals and hedges the price (delta) exposure by shorting spot of the underlying token. Therefore, returns for the strategy are dependent on directional demand for leverage.

The basis strategy is profitable in markets where the perpetual funding fee is driven negative by demand for short-side leverage outweighing leverage demand from the long side. While the strategy profits from a negative funding rate, the opposite holds true when the funding rate flips positive. Historically, funding rates have been positive due to excessive long demand but with the recent bear market this has shifted. Funding rates are now on average negative and thus earning yield for Volt #4 depositors.

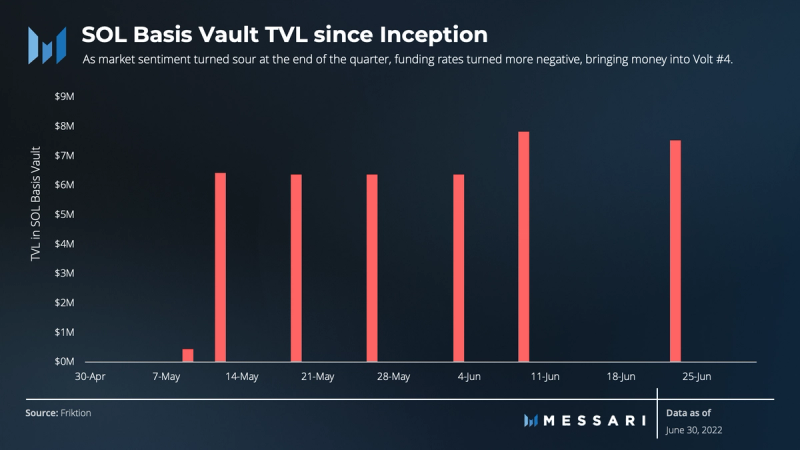

The most recent Volt to launch, Volt #04 does not have much historical performance yet. Performance in both the SOL and BTC vaults were relatively flat in the quarter. The SOL vault was the first to launch, and it benefitted from the bearish sentiment. Towards the end of the quarter, demand to short SOL increased, driving down funding rates and making Volt #04 a more attractive strategy.

Revenue

Friktion earns fees in the form of a one-time withdrawal fee and a per-epoch performance fee, only during epochs with positive net returns. Currently, withdrawal fees are 0.1% and performance fees are 10% for Volts 01-03. Volt #04 has a 1% withdrawal fee and the same performance fee.

As of June 30, 2022, Friktion has earned just over $950,000 in fees in its first six months. The protocol earned $443,000 in the second quarter. 86% of the earnings have come from performance fees, with 75% of those ($257,000) coming from Volt #01.

Qualitative Analysis

Q2 2022 New Volts

Friktion launched two new Volts in the quarter and recently announced the launch of Volt #05.

The Crab Strategy, Volt #03, began accepting deposits on April 9th. The strategy has been a huge success in its short life so far. As of July 18, the pool is at max capacity of $1.1 million USDC funded. For the quarter, the strategy yielded 5.58% for depositors, annualizing a yield over 24%.

The offering is quite unique in its directionless behavior. In fact, power perpetuals don’t even exist in traditional finance. Though there are similar payoff structures in TradFi using derivatives.

The Crab Strategy also shows the opportunity for and execution by Friktion. In order to implement it, the team needed to create a marketplace for power perps. It did so with Entropy. Now their scope grows, as they look to attract liquidity to a DEX designed for exotic derivatives. Deeper liquidity would improve the execution of the strategy and allow the maximum deposits limit to grow. The use of treasury fees to grow the Friktion ecosystem is a big opportunity for the protocol.

The last strategy launched is the Volt #04 Basis Strategy. It began with Solana on April 30 and then added BTC on June 3. From a performance perspective, this strategy has not been as successful. The SOL vault has seen pretty strong adoption, currently with over $7 million in deposits, despite breakeven returns. The much newer BTC vault has not had the same success, sitting with only $26,628 of deposits a month since launch, as BTC funding rates have not been as negative as SOL.

Volt #04 currently offers a long basis strategy which profits in negative funding environments. Historically, the funding rate is strongly correlated to the direction of the market. Meaning the need for a strategy that benefits from negative funding rates will depend on the market environment. This strategy has a slight structural advantage though. UXD is a stablecoin project native to the Solana ecosystem. It enters a short basis position each time it mints a new stablecoin. If UXD adoption outpaces available perp liquidity on Solana DEXs, this should create a mispricing that Volt #04 depositors would benefit from.

Execution Infrastructure

To trade a large amount of options in a short period of time requires deep, concentrated liquidity. Without it, price slippage and trade impact can turn a winning strategy into a losing one. Historically, this has been solved with an RFQ process. RFQ stands for Request-For-Quote. A user sends out trade details and timing to many market makers, and they send back prices during a designated time window. The design of this auction and RFQ process is integral to successful execution.

In February, Friktion acquired Channel RFQ. Integrating the team and liquidity platform allows the protocol to support larger option strategies. It also allows for derivative exposure on assets that don’t have deep, liquid options markets. Entropy and Channel RFQ are two examples of custom solutions that benefit users and will help grow the ecosystem.

Roadmap

Q3 2022 New Volts and Friktion Learn

On July 20, Friktion announced their fifth strategy, Volt #05: Capital Protection. Volt #05 accepts deposits in SOL or USDC. It uses Tulip, a Solana-native lending yield aggregator, to earn interest. With the interest earned, it buys a basket of options, giving the strategy long volatility exposure as well as directional upside. An exciting new piece to the portfolio, Volt #05 should outperform in volatile markets while giving depositors principal protection.

Volt #06 is expected to launch in Q3 2022. It is expected to bring a new asset class to the Friktion portfolio: credit. Friktion is designing an under-collateralized credit risk management system to enable depositors to safely fund lenders. This will also bring the protocol closer to institutional users of DeFi.

Friktion Learn is billed as a DeFi education academy. It is expected to launch in Q3 as well. Designed to be a 0 to 1 education platform for onboarding new DeFi users, it will have an incentive system for creators and consumers.

Circuits

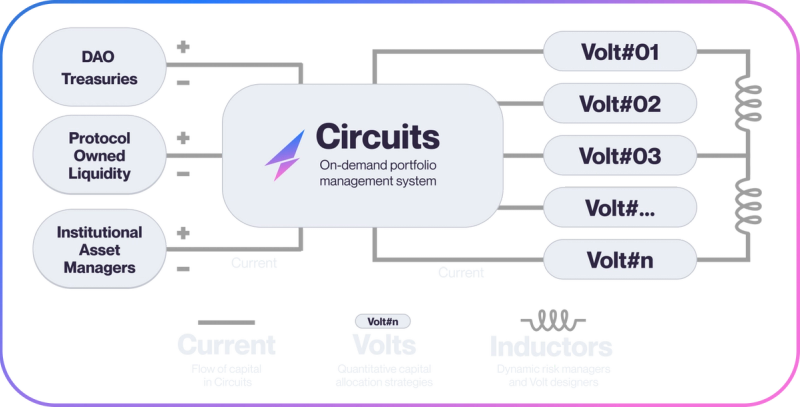

Currently in beta, Circuits represent an on-demand portfolio management solution for on-chain assets. The program is currently targeting DAOs. The Genesis Circuit (the first test), began with around $15 million in TVL.

We know that Volts are the yield strategies designed by Friktion. Circuits also require Inductors. Inductors are the portfolio architects. The final component of Circuits are the DAOs, or really anyone seeking a portfolio management solution. Though currently centralized, the core team has expressed plans to decentralize the process.

Source: Friktion

How it works is, DAOs apply to the Circuit. They must provide data around their assets, liabilities, desired risk parameters, target returns, liquidity needs, etc. Inductors then take this information and design a portfolio using existing Friktion Volts and potentially building new ones. This can be an iterative process, where Inductors work with the protocol/DAO to explain risks and ways to get to a desired outcome. Once the final portfolio construction is completed, it becomes its own unique Volt.

DAO’s manage over $10 billion today. Treasury diversification and portfolio management has taken on new importance given the bear market. Even in good times, it is likely these lessons will pervade and new treasury management tools will be required. Friktion could play an important role for DAOs going forward.

Other Notable Events

April 19, 2022 – Volt #03: Crab Strategy Launches

May 10, 2022 – Partnership with Paradigm to Increase Options Liquidity

Friktion announced a partnership with Paradigm, a leading institutional options liquidity network for traders. The partnership aims to unlock more efficient price discovery and execution for Friktion auctions.

May 24, 2022 – Volt #04: Basis Yield Launches

May 31, 2022 – Cross-Chain Deposits

Friktion announced cross-chain deposit functionality for two of its vaults. In its Volt #1 Covered Call strategy, users can now deposit ETH from Ethereum or AVAX from Avalanche.

The new functionality uses Protal Bridge (by Rainbow Bridge). This allows users to deposit ETH and AVAX straight from Friktion’s App, without having to bridge first. The UX improvement should help increase adoption and increase the protocol’s TAM.

June 16, 2022 – Kudelski Completes Smart Contract Audit

As much of Friktion’s codebase is not yet open-sourced, a security audit is an important step. The team is in the process of open-sourcing the code and will include bug bounties thereafter.

“This report summarizes the engagement, tests performed, and findings. It also contains detailed descriptions of the discovered vulnerabilities, steps the Kudelski Security Teams took to identify and validate each issue, as well as any applicable recommendations for remediation.”

July 2, 2022 – Use Lightning OG Royalties to Run a Validator Node

Lightning OGs are NFTs sent out by Friktion to early adopters of the protocol. They are listed on Magic Eden and by the end of Q2 2022 had generated over 100 SOL in royalties. The community discussed what to do with the earnings and it was decided that earning yield by setting up a validator was the preferred strategy.

Closing Summary

Friktion continues to attract new users with its novel derivative strategies, first-class execution strategy, and top UX. Improvements like allowing for cross-chain deposits helped drive new TVL to the Volts. Entropy, Circuits, and decentralizing could be huge growth opportunities for the protocol. Currently, their Volts are operating without issue in a volatile environment. The team continues to give traders and portfolio managers new tools to invest in any market.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by Friktion Labs, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Note that, Ryan Selkis, CEO of Messari, Inc. has personally invested in Friktion.