Polkadot Ecosystem Overview

“The parachain model was created with the belief that the future of Web3 will involve many different types of blockchains working together. Just as the current version of the internet caters to different needs, blockchains need to be able to provide a variety of services. Parachains solve this.” – Polkadot founder Gavin Wood

Key Takeaways

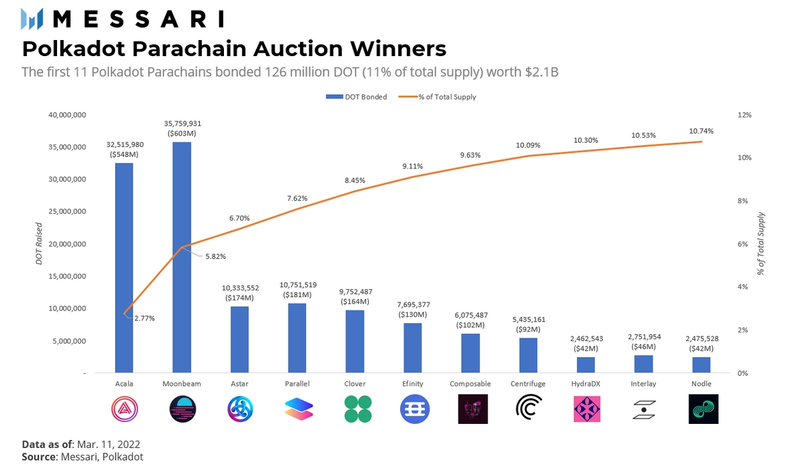

- Polkadot’s first 11 parachains are live.

- The first 11 parachains bonded 126 million DOT (11% of the total supply; worth $2.1 billion) for the two year lease periods.

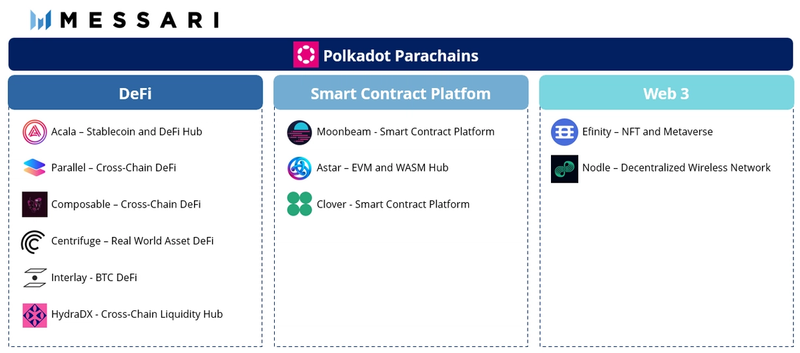

- Each parachain brings unique functionality and use-cases to the ecosystem.

- The next major technical task is the buildout of the Cross-Consensus Message Format (XCM).

Introduction – Parachains Are Live

On Dec. 17, 2021, five years after conception, Polkadot successfully completed its multi-stage launch with the launches of the inaugural parachains. Now that parachains are live, end users are finally transacting on Polkadot.

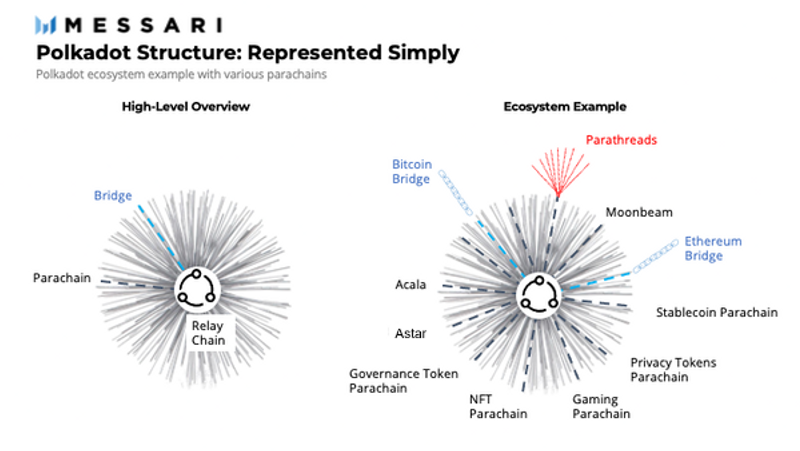

What’s a parachain? A parachain is an application-specific, highly customized Layer-1 developed with Polkadot’s blockchain development framework Substrate. It has its own economy, token, governance, and users like legacy Layer-1s. However, unlike legacy Layer-1s, a parachain is not siloed. Instead, it is connected to the Relay Chain, Polkadot’s other major technical component.

What’s the Relay Chain? The Relay Chain is the nucleus of Polkadot. It is the Layer-0 base chain housing all validators and responsible for securing, governing, and connecting the parachains. In addition to the Relay Chain governance, the parachains also have sovereign governance, which is further explained in the analogy below. The Relay Chain can support an estimated 100 to 250 parachains. The parachain cap is primarily driven by the costs associated with scaling Polkadot’s Cross-Chain Message Passing (XCMP) and abiding to the optimal 10:1 validator-to-parachain ratio to maintain decentralization and performance quality.

**Analogy: The United States. The Relay Chain is the federal government, and parachains are individual states. The federal government secures, governs, and unites the individual states. At the same time, states secure, govern, and coordinate themselves. Should a dispute ever arise, the federal government outranks state governments.**

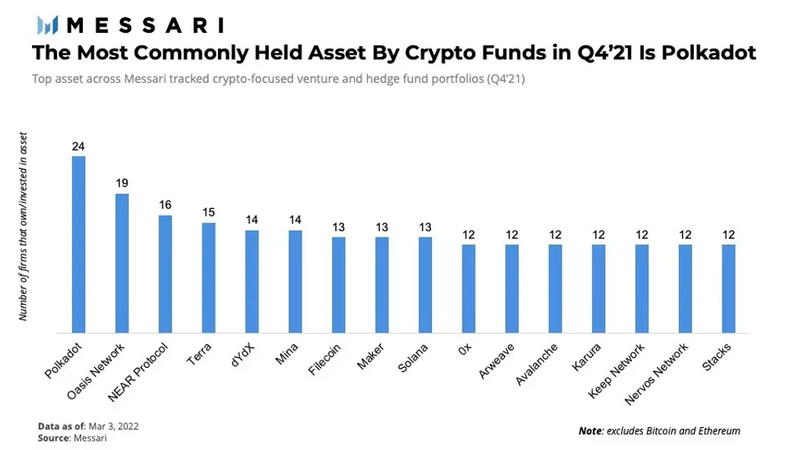

What does the Polkadot token (DOT) do? Polkadot’s native token DOT is a utility and governance token used for participating in governance, transaction fees, security via staking, and bonding for parachain slots. As of March 2022, DOT is the most commonly held asset among crypto funds.

** For a deeper dive into Polkadot, please see our previous reports Polkadot Primer One and Polkadot Primer Two **

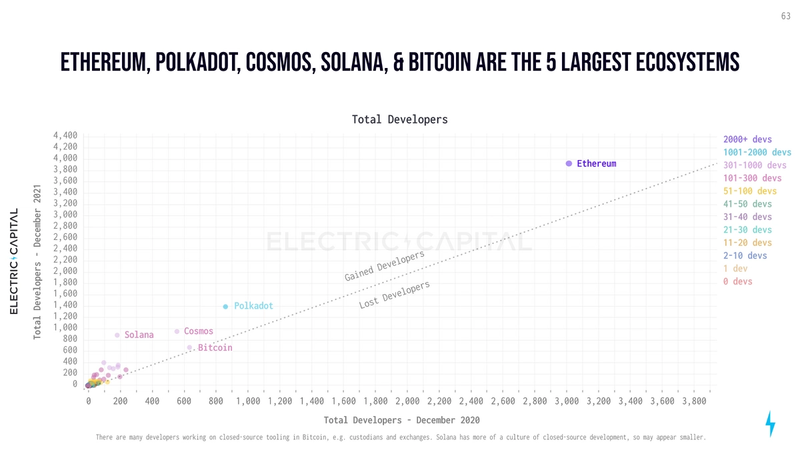

In addition to the VC funding, Polkadot’s unique architecture paired with the flexibility of Substrate has attracted the second largest developer community. Now that parachains are live and the massive VC funding is secured, the fruits of the developers’ labor are accessible to the masses. In this report we will delve into Polkadot’s first 11 parachains.

Ecosystem Overview – The First 11 Parachains

As noted above, the Relay Chain can support an estimated 100 to 250 parachains. For a parachain to gain access to the myriad of benefits offered by the Relay Chain, it must win a candle-style parachain slot auction by bonding the most DOT.

Prospective parachains raise DOT, often via their communities, in exchange for their native tokens. At random times in the candle auction, the parachain with the most bonded DOT wins the slot. At the conclusion of the lease period, the lender’s bonded DOT is returned (and they keep the parachain token).

After 11 auctions, 126 million DOT (11% of the total supply; worth $2.1 billion) has been bonded. The first batch of winners (auctions 1–5) were onboarded to Polkadot on Dec. 17, 2021. The second batch of winners (auctions 6–11) were onboarded to Polkadot on Mar. 11, 2022. Each of the winners brings unique functionality and use-cases to the Polkadot ecosystem.

**Note not all functionality described below is active**

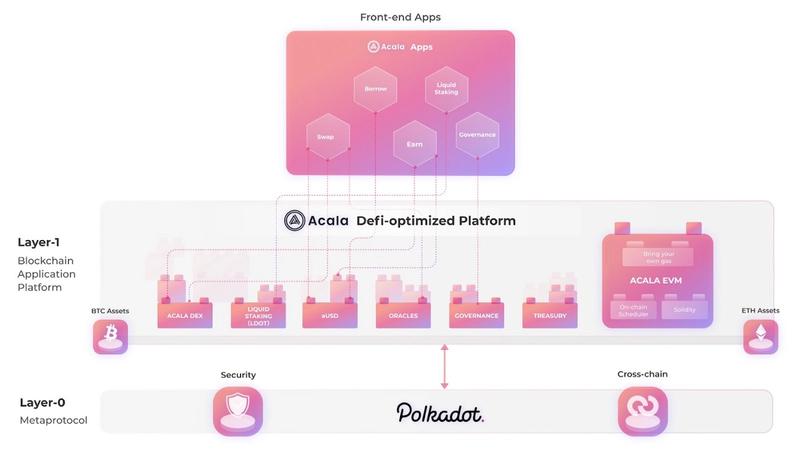

Acala

Acala won Polkadot’s first auction with 32,515,980 DOT raised. Acala is a decentralized finance network built on Polkadot, which powers the aUSD stablecoin ecosystem. Acala boasts a suite of financial functionality centered around aUSD:

Acala Dollar (aUSD)

The Acala Dollar (aUSD) is a stablecoin generated by the Honzon protocol – a Maker DAO (DAI) inspired mechanism. Users mint aUSD by creating an over-collateralized debt position with approved reserve assets like DOT, LDOT, and ACA. The team plans to expand collaterals to BTC, ETH, and native tokens of other parachains. Acala, along with an initial nine Polkadot parachain teams and several supporting venture funds, has launched a $250 million aUSD Ecosystem Fund. As of Mar. 8, 2022, 6.17 million aUSD have been issued.

Liquid Staking (L-Token)

Acala boasts liquid staking functionality via the Homa protocol. Users stake their tokens and receive L-Tokens (e.g. LDOT) which represent the principal staked asset plus the staking yield continuously accruing. L-Tokens are accessible as ERC-20 and Substrate based tokens and can be used across Acala’s DeFi protocols.

Acala Swap

Acala Swap is a constant-product AMM DEX supporting ERC-20 and native Substrate based tokens. Acala Swap is running a liquidity bootstrapping event to celebrate its kick-off. Users can pay gas fees on Acala swap in any token.

Acala Token – ACA

The Acala token (ACA) is a utility and governance token used for participating in governance, transaction fees, and incentivizing Acala collator nodes.

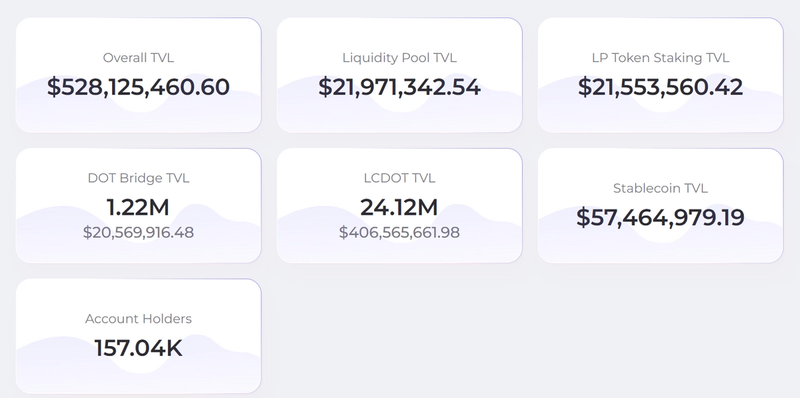

Additionally, Acala has a partnership with fintech unicorn Current, a community-run treasury, and Acala EVM+ enabling full-stack composability between EVM and Substrate. As of early March 2022, Acala has $528 million in TVL. You can find the Acala roadmap here.

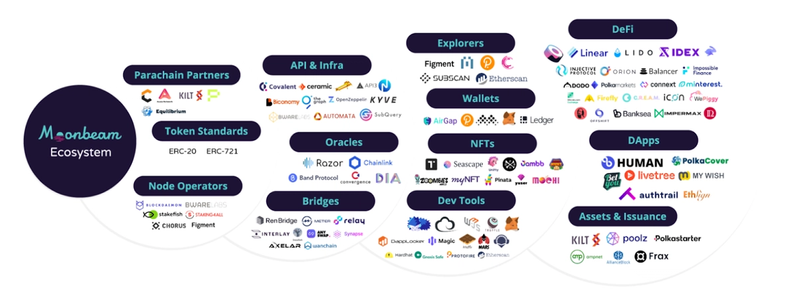

Moonbeam

Moonbeam won Polkadot’s second auction with 35,759,931 DOT raised. Moonbeam is an EVM-compatible, cross-chain smart contract platform. Moonbeam allows developers to port their projects with minimal to no code changes, and provides a developer friendly environment for launching new projects:

Ethereum-Style Unified Accounts

Any parachain can offer an EVM implementation by enabling the frontier pallet designed by Parity and Moonbeam. However, parachains with an EVM implementation require users to have private keys for both the EVM and Substrate account. Moonbeam offers Unified Accounts – users only need one private key (the EVM style key) to interact with EVM and Substrate. The Unified Account functionality allows users to use their existing accounts on Moonbeam, and use the Metamask wallet.

XC-20 Assets

Moonbeam introduced the XC-20 token class, a new token class offering the native interoperability of Substrate based assets, while allowing users and developers to interact through the familiar ERC-20 interface.

Moonbeam Token – GLMR

The Moonbeam Token (GLMR) is a utility and governance token used for participating in governance, transaction fees (80% burned and 20% allocated to on-chain treasury), incentivizing Moonbeam collator nodes, and supporting the gas metering of smart contract execution.

As of early March 2022, Moonbeam has $141 million in TVL with a growing ecosystem. Moonbeam plans on supporting new projects with grants and bounty programs.

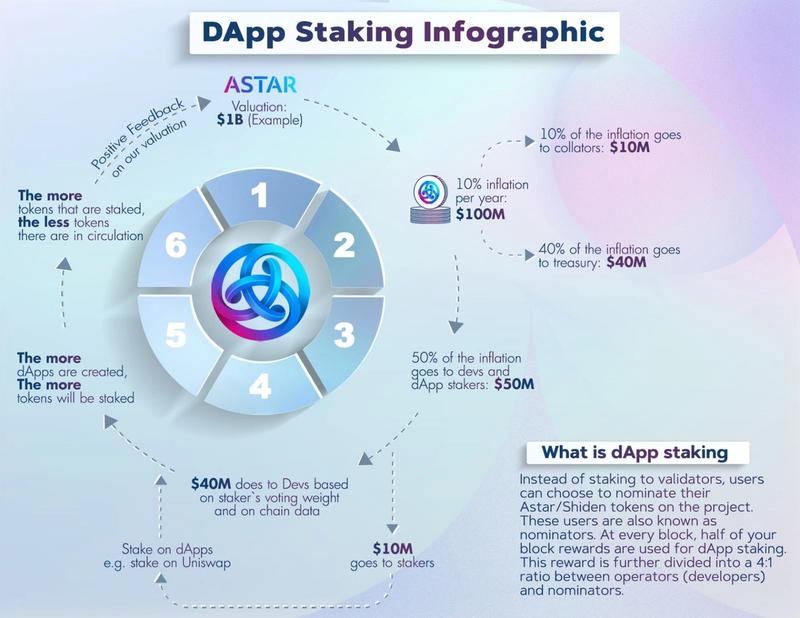

Astar Network

Astar Network won Polkadot’s third auction with 10,333,552 DOT raised. Astar is a multi-chain smart contract platform supporting Web Assembly (WASM) and EVM. Astar provides multiple solutions for developers to build smart contracts:

Cross-Virtual Machine (X-VM)

Today, virtual machines are disconnected and struggle to communicate e.g. the ability to call a Substrate contract within an EVM contract. To unify the various smart contract engines, Astar is developing the Cross-Virtual Machine (X-VM). X-VM allows smart contracts to execute calls and read storage data from different virtual machines and languages.

ZK Solutions

Astar has been developing ZK scaling solutions. In the near future, Astar will implement the ZK plonk pallet (the plonk is called universal ZK Snark).

dApp Staking

When building applications, developers often face a plethora of fees with no offsetting income. dApp staking is a reward mechanism for developers or administrators of smart contracts. Astar staking rewards are sent to application developers based on a dynamic rewards model. Eventually, Astar will allocate 50% of staking rewards to developers. Astar also plans to introduce functionality allowing developers to fund their project(s) directly from supporters.

Astar Token – ASTR

The Astar Token (ASTR) is a utility and governance token used for participating in governance, transaction fees, incentivizing Astar collator nodes, dApp staking, and Layer Two application support.

Additionally, Astar supports Polkadot’s largest DEX by TVL ArthSwap, recently raised a $22 million round led by Polychain, and has two Ethereum bridges. As of early March 2022, Astar has $386 million in TVL. Astar plans on connecting with Cosmos and adding a host of additional functionality.

Parallel Finance

Parallel Finance won Polkadot’s fourth auction with 10,751,519 DOT raised (79% raised through the Parallel Auction Loan Platform). Parallel is a DeFi platform boasting a suite of functionality:

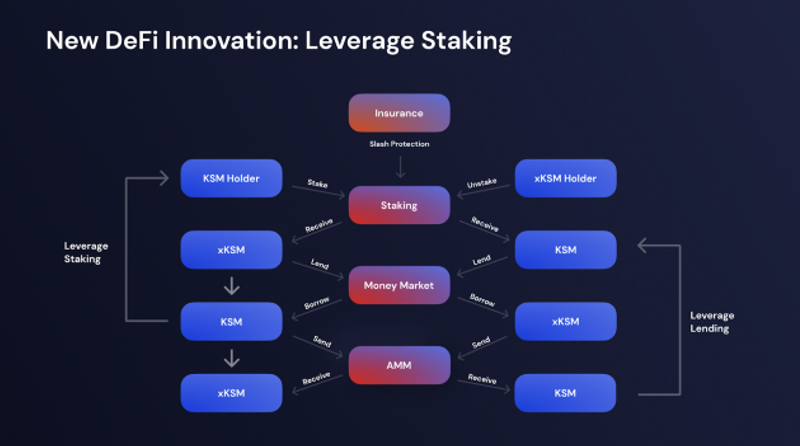

Money Market

Parallel’s decentralized Money Market protocol offers lending, borrowing, and staking functionality. Users who opt to stake can participate in leverage staking. Leverage staking allows users to lend and stake simultaneously, thus earning double yield. How? When a user stakes DOT, they receive a liquid derivative token xDOT. xDOT can be lent back to Parallel to receive a lending fee in addition to the present staking yield. Users can further opt to borrow against xDOT to increase leverage. The Parallel Finance platform algorithmically selects the highest performing nodes to maximize staking yield.

Auction Loan Platform

The Auction Loan Platform raises DOT for prospective parachains. Contributors are incentivized to lend their DOT through the Auction Loan Platform because they receive extra bonuses from both Parallel and the prospective parachain and stay liquid via a liquid staking derivative cDOT. cDOT can be utilized across Parallel’s DeFi protocols.

Parallel Token – PARA

The Parallel Token (PARA) is a utility and governance token used for participating in governance, transaction fees, incentivizing Parallel collator nodes, and staked in the security module.

Additionally, Parallel plans on releasing an AMM with stableswap functionality, a multi-chain wallet, and a host of additional functionality. As of early March 2022, Parallels Auction Loan Platform has raised $553 million commanding 22% market share.

Clover Finance

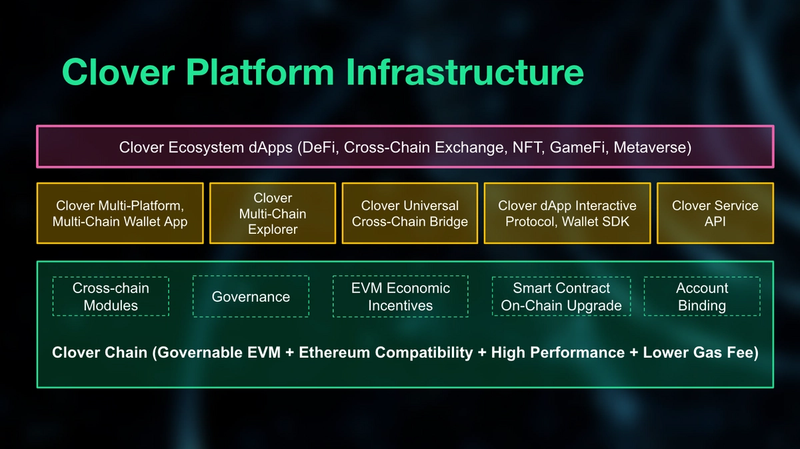

Clover Finance won Polkadot’s fifth auction with 9,752,487 DOT raised. Clover is an EVM-compatible cross-chain infrastructure platform providing the tooling for developers to migrate and scale their applications. Clover boasts a suite of products including:

Universal Cross-Chain

Clover has various wallet implementations for interacting with applications across Substrate-based chains on Polkadot and Kusama, EVM chains, and Solana. Users can send, receive, wrap, and unwrap cross-chain assets across different networks without navigating between them (similar to Zapper).

Clover Wallet

Clover Wallet is a non-custodial, cross-chain wallet helping users manage, track, and interact with assets across Substrate-based chains on Polkadot and Kusama, EVM chains, and Solana. Clover Wallet is available on mobile, extension, and web.

Clover Cross-Chain Explorer

Clover Cross-Chain Explorer is a cross-chain block explorer offering multi-chain indexing across Substrate-based chains on Polkadot and Kusama, EVM chains, and Solana. Users can search through blocks, transactions, and accounts.

Clover Token – CLV

The Clover Token (CLV) is a utility and governance token used for participating in governance, transaction fees, incentivizing Clover collator nodes, and treasury management.

Additionally, Clover plans on releasing a cross-chain bridge, cloud-service API, gas-fee redistribution which shares a percentage of transaction fees with developers, a gasless end-user experience, and identity-based fees to offer reputable users reduced pricing.

Efinity

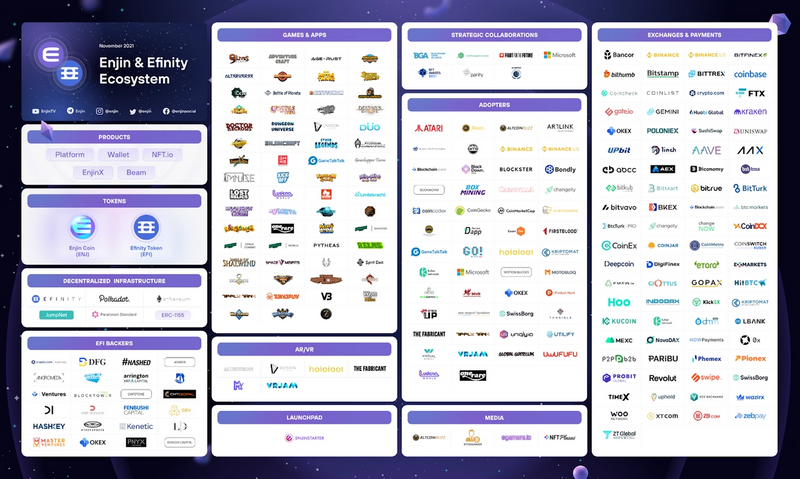

Efinity won Polkadot’s sixth auction with 7,695,377 DOT raised. Efinity is a purpose-built blockchain for NFTs developed by the Enjin team. Efinity is designed to support NFTs from any blockchain:

Token Standard

Efinity is introducing a new standard for interoperable, cross-chain tokens. It will be compatible with Substrate based chains Polkadot and Kusama, ERC-20, ERC-1155, ERC-721, and other chains and their standards. The token standard supports fungible tokens, non-fungible tokens, and grouped NFTs.

Fuel Tanks

Fuel Tanks are used purely for transaction fees. Developers deposit EFI into their Fuel Tank(s) to subsidize costs for their users/players.

Discrete Accounts

Discrete accounts enable easy onboarding by not requiring new users to have a crypto wallet. On-chain items can be placed in a developer controlled wallet that players can claim at a later time when ready.

NFT.io Marketplace

Efinity and Enjin are developing a new NFT marketplace called NFT.io, slated for closed beta in March. NFT.io is a cross-chain NFT marketplace offering novel price discovery mechanisms via Efinity.

EFI

The Efinity token (EFI) is a utility and governance token used for participating in governance, transaction fees, facilitating liquidity, rewarding network participants, funding fuel tanks, and increasing transaction limits on Enjin’s JumpNet EVM chain.

Additionally, Efinity will roll-out novel user-friendly features and leverage Enjin’s existing infrastructure. Over 100 projects have committed to building applications and games on Efinity and Enjin.

Composable Finance

Composable Finance won Polkadot’s seventh auction with 6,075,487 DOT raised. Composable is a DeFi infrastructure platform designed for cross-chain interoperability. Composable is building a comprehensive technical stack:

Cross-Chain Virtual Machine (X-VM)

The Cross-Chain Virtual Machine (XCVM) is a virtual machine providing an environment for developers to run cross-chain smart contract functions. The XCVM connects Substrate to other networks via its Innovation Availability Layer. It determines the optimal route for instructions using the Routing Layer.

Mosaic

Mosaic is a cross-chain transfer availability layer integrated with EVM-compatible chains including Ethereum, Arbitrum, Avalanche, Polygon, Fantom, Moonriver, etc. Mosaic uses multiple assurances to ensure transfers are delivered including liquidity forecasting, rebalancing of liquidity vaults, and community-run liquidity bots. Developers can build with Mosaic by using the Mosaic SDK.

Mural

Mural facilitates the cross-chain transfers of NFTs leveraging Mosaic.

Composable Token – LAYR

The Composable token (LAYR) is a utility and governance token used for participating in governance, transaction fees, and incentivizing Composable collator nodes.

Additionally, Composable was highlighted in the yearly Electric Capital developer report for its increase in developers. You can find Composable’s roadmap here.

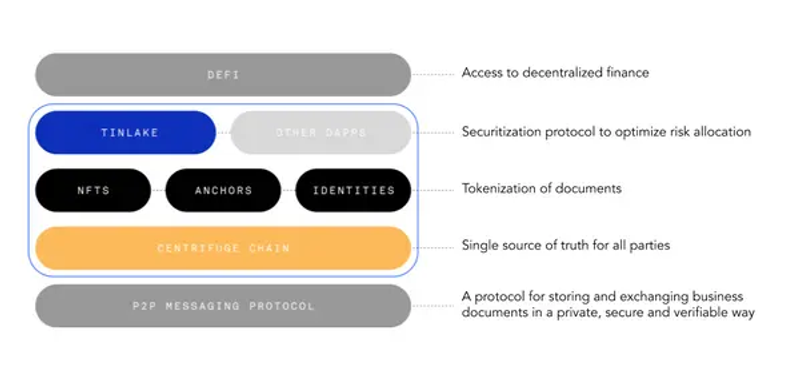

Centrifuge

Centrifuge won Polkadot’s eighth auction with 5,435,161 DOT raised. Centrifuge is bringing real-world asset financing to DeFi to bring down the cost of capital for small-businesses and provide DeFi investors with a stable source of yield uncorrelated from the crypto markets. Centrifuge leverages a multi-pronged technical stack:

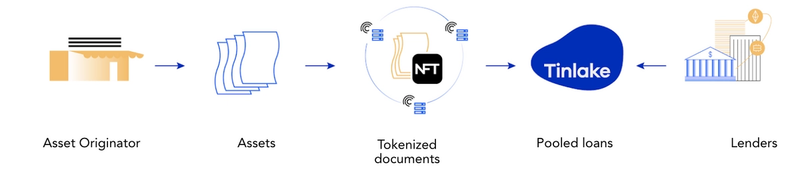

Peer-to-Peer Network

Centrifuge’s peer-to-peer network provides a secure method to create, exchange, and verify asset data between collaborators and tokenize the assets into NFTs. Asset Originators can selectively share asset details with service providers who can assess the data and contribute information to the minted NFT. The data origin can be verified using cryptographic signatures.

Tinlake

Tinlake is an application acting as an open market-place for real-world assets. Businesses tokenize their financial asset(s) into NFTs and use the NFTs as collateral in their Tinlake pool. Users have access to all pools and invest DAI in their pool of choice. Each pool contains two tranches with varying levels of risk-reward.

Centrifuge Token – CFG

The Centrifuge Token (CFG) is a utility and governance token used for participating in governance, transaction fees, incentivizing Centrifuge collator nodes, and rewarding network participants.

Additionally, Centrifuge leverages existing legal and commercial frameworks to securely finance real world assets. As of early March 2022, Centrifuge has $76 million in TVL.

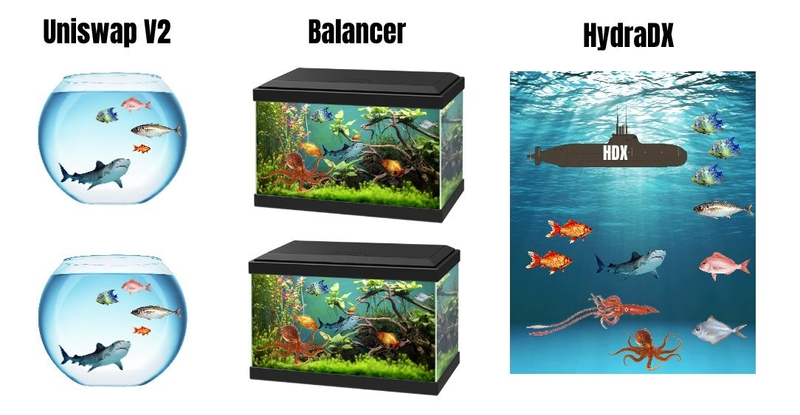

Hydra

HydraDX won Polkadot’s ninth auction with 2,462,543 DOT raised. HydraDX is a cross-chain liquidity protocol reducing liquidity fragmentation by accommodating many crypto assets into a single trading pool.

Omnipool

The HydraDX Omnipool is a liquidity pool servicing all assets. All trades in the Omnipool are denominated in LERNA (LRNA), meaning LRNA allows assets to be priced against each other. The quantity of LRNA available in the pool fluctuates in relation to the total liquidity – as liquidity is added LRNA is minted, and as liquidity is removed LRNA is burned. Since the Omnipool mints LRNA to match every addition of liquidity, LPs are able to provide liquidity in whichever assets they wish, and accrue trading fees whenever those assets are purchased from the pool.

HydraDX Token – HDX

The HydraDX Token (HDX) is a utility and governance token used for participating in governance and to stabilize the LRNA value.

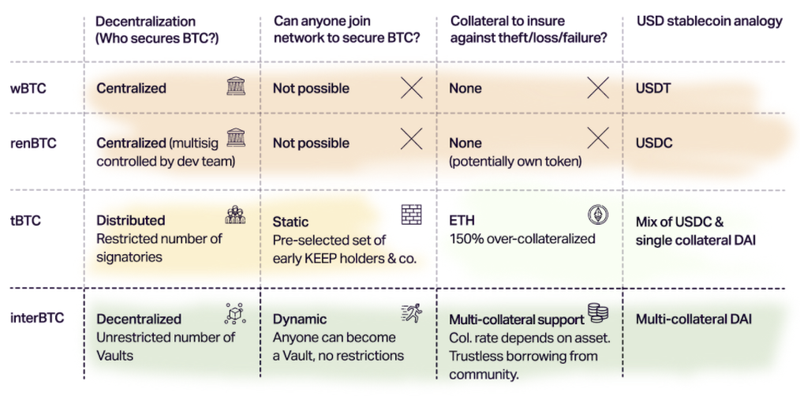

Interlay

Interlay won Polkadot’s tenth auction with 2,751,954 DOT raised. Interlay brings Bitcoin to any blockchain.

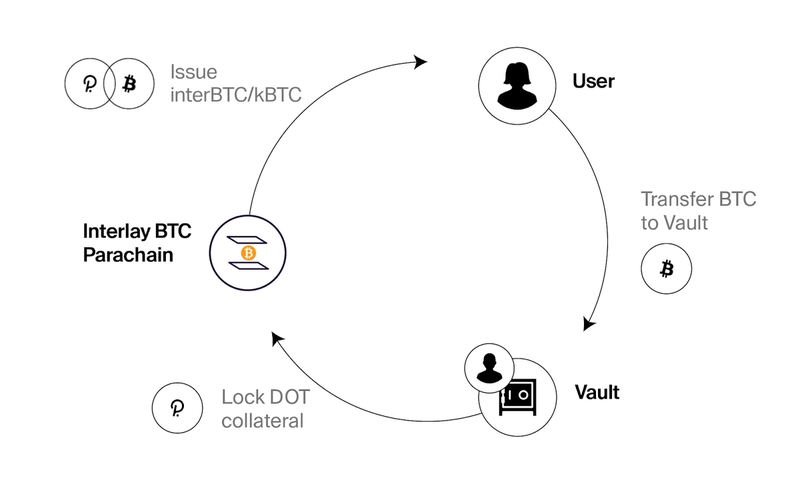

InterBTC

InterBTC is a fully-collateralized and interoperable BTC pegged derivative. To mint interBTC, users lock their BTC in a vault. The vault can be an existing one or one the BTC owner ops to create. All vaults are over-collateralized with a specific asset. The over-collateralized asset acts as insurance should malicious activity occur within the vault. If malicious activity does occur, the BTC depositors are reimbursed in slashed collateral at a premium rate. The first vaults will be collateralized with DOT.

InterBTC v. Competitors

InterBTC is a decentralized and trustless BTC pegged derivative. How? Anyone can become a vault in InterBTC (decentralized), vaults cannot prevent users from minting InterBTC (censorship resistant), vaults lock collateral in different assets (capital efficient), and if BTC is lost or stolen users are reimbursed in collateral at a beneficial rate (trustless).

Interlay Token – INTR

The Interlay Token (INTR) is a utility and governance token used for participating in governance, transaction fees, and incentivizing Interlay collator nodes. The team plans to tightly integrate INTR into interBTC to enable premium features, better rates, and higher insurance coverage.

Additionally, Interlay plans to add new vault collaterals and connect with other blockchains including Ethereum, Cosmos, and Solana. Interlay is aiming to become a decentralized Bitcoin bank enabling vaults to re-use custodied BTC and deposited collateral for structured financial products.

Nodle

Nodle won Polkadot’s eleventh auction with 2,475,528 DOT raised. Nodle is a decentralized wireless network providing secure, low-cost connectivity and data liquidity to IOT devices. The Nodle Network leverages Bluetooth Low Energy (BLE) via millions of smartphones and routers to allow enterprises and smart cities to connect IOT devices to the Internet at low-cost while maintaining privacy and security.

Nodle Cash App

Nodle Cash App is a mobile application enabling users to connect to the Nodle Network, known as the Citizens Network. Once the application is downloaded, users must turn on Bluetooth and location services in the phone’s settings. The Nodle Cash app will detect sensors and smart devices and connect to them anonymously. For the service provided, the app user receives Nodle Cash, also known as the NODL token.

Nodle Token – NODL

The Nodle Token (NODL), also known as Nodle Cash, is a utility and governance token used for participating in governance, transaction fees, rewarding participants of the Nodle Network, and incentivizing Nodle collator nodes. NODL is distributed every six seconds to participants of the Nodle Network.

Additionally, the Nodle Network is has 5 million daily active smartphones with 30 million IoT devices moving approximately 100 GB of data across 100+ countries on a daily basis.

Conclusion – Only the Beginning

Looking forward, Polkadot has 30 new slot auctions scheduled through February 2023 (bringing the total to 41). Arguably the most important technical task during this time will be the buildout of Polkadot’s Cross-Consensus Message Format (XCM). Today, a light client version, HRMP, is being tested on Kusama. A core tenet of Polkadot’s value proposition is to ensure a successful rollout of XCM to enable fluent cross-parachain communication. Polkadot will continue to build its unique modular architecture and make a significant push for market share in 2022 and beyond.

** This report was commissioned by Polkadot, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in the Hub does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which is updated monthly and published here. Crypto projects can commission independent research through Messari Protocol Services. For more details or to join the program, contact hub@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our terms of use for more information.**