Key Insights

- Osmosis is a decentralized exchange built on its own sovereign, interoperable Layer-1 blockchain in the Cosmos ecosystem

- It was the first app-chain to see significant IBC transfer volume and kickstarted DEX activity in the ecosystem

- Notable features of the DEX include highly customizable pool parameters, superfluid staking, and plans to incorporate MEV resistance into its underlying architecture

- The protocol is powered by the native OSMO token, which can be used for staking and governance. OSMO rewards are also issued via liquidity incentives for LPs

Introduction

Investors’ belief in a multichain world as an answer to blockchain’s scaling problems has drawn interest towards the Cosmos Network ecosystem, where an “Internet of Blockchains” exists to accommodate a universe of independent, sovereign app-chains. Each app-chain in the network functions as its unique Layer-1 blockchain designed to add to the functionality of the Cosmos Network.

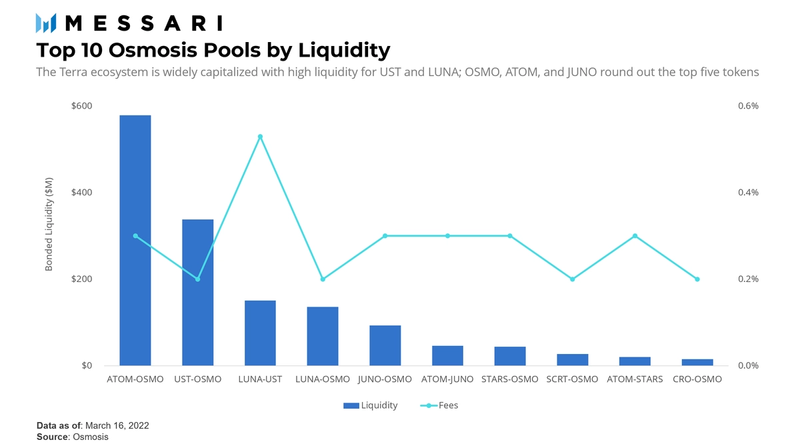

To connect such an ecosystem of blockchains, a healthy financial exchange is necessary. Through these exchanges, capital allocators gain the liquidity to foster a healthy market, invest in growth projects, and drive investment to promising opportunities. The Cosmos Network supports its own native DEX, but it is the Osmosis Protocol that leads the pack in terms of liquidity, trading volume, and fees. In this report, we’ll take a look at Osmosis and understand the features that make it stand out compared to other like-minded automated market makers (AMMs) in this multichain world.

Overview of Osmosis

Background

Osmosis is an Inter-Blockchain Communication (IBC)-supported DEX in the Cosmos ecosystem. It was founded in January 2021 by Sunny Aggarwal, Josh Lee, and Dev Ojha, with the parent company Osmosis Labs being responsible for code development.

The co-founders each share experience working in the blockchain space. All three began at Tendermint, known for its byzantine-fault tolerance consensus engine. During that time, they worked on the underlying architecture of the Cosmos ecosystem and afterward split to work on various projects including the Keplr wallet. It was during this time they rejoined to start Osmosis, with the intention of building a fully-customizable DEX.

How Osmosis Works

On a functional level, Osmosis operates similarly to other AMMs. Liquidity pools lock tokens into a smart contract that self-executes trades via token swaps. Counterparties to traders come in the form of liquidity providers (LPs), who provide the underlying tokens, i.e., liquidity, to those pools. In return, those LPs receive designated LP tokens denoting their contribution to the pool, thereby measuring a share of the accrued fees generated. All traditional stuff.

Furthermore, like many other AMMs, Osmosis relies on a deterministic pricing model to ensure the respective weights of tokens in each pool remain consistent. In fact, almost all AMMs use deterministic pricing because it helps determine the number of tokens in each trade. Although market pricing of any token may change, opportunities for arbitrageurs are minimized when the underlying pricing formula is maintained.

Liquidity Incentives

To ensure abundant liquidity, the DEX institutes two mechanisms to help institute long-term viability: bonded liquidity gauges and exit fees.

Longtime DeFi users may recognize the former as traditional liquidity incentives. The mechanism for bonded liquidity gauges is simple: LPs who add liquidity to a pool for a minimum period of time are rewarded with the native OSMO tokens.

LPs can choose the period of time for which they willingly want to bond their tokens. The exact amount of OSMO rewards earned depends on the length of bonding time and the number of bonded tokens, all decided by protocol governance. Interestingly, not all pools receive rewards either; OSMO holders decide which pools earn liquidity incentives. Certain pools receive “allocation points,” and subsequent OSMO rewards are issued proportionally based on each pool’s points count.

Fortunately for the pools without internal incentives, OSMO tokens are not the only eligible rewards. External incentive providers, such as those traded within a pool, are able to distribute their own rewards. Just as with internal liquidity incentives, the external provider chooses which variables to set, such as the time needed for eligibility or the number of rewards.

Exit Fees

If bonded liquidity gauges are the carrot for long-term liquidity, exit fees are the stick. When LPs withdraw capital from liquidity pools, a small fee is charged in the form of LP tokens. This exit fee is determined by the pool creator and is designed to benefit the remaining contributors of the pool, seeing as the exit fee is burned. In total, when LPs decide to withdraw their liquidity, they get back their initial capital plus accrued transaction fees minus exit fees and impermanent loss.

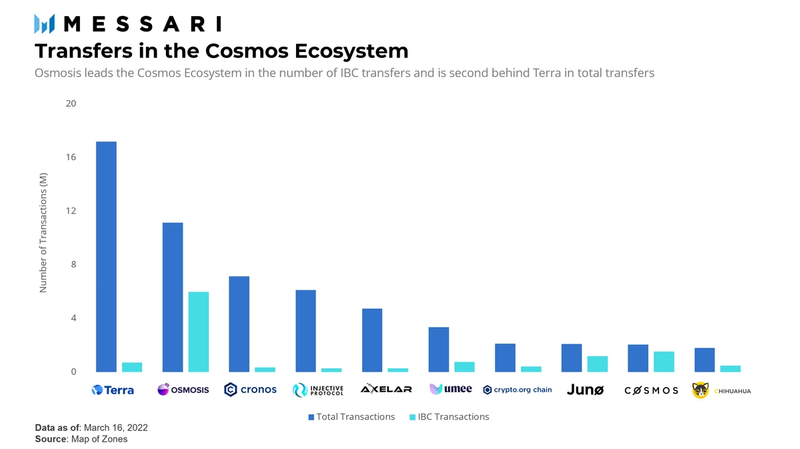

Traction

Notably, Osmosis was the first IBC-enabled DEX in the Cosmos ecosystem. Although other DEXs such as Gravity DEX and Injective Protocol now exist, Osmosis was the first Cosmos-based app-chain to see a high volume of IBC transfers. Due to its first-mover advantage, Osmosis continues to rank first in IBC transactions and second in total transactions, behind the Terra ecosystem.

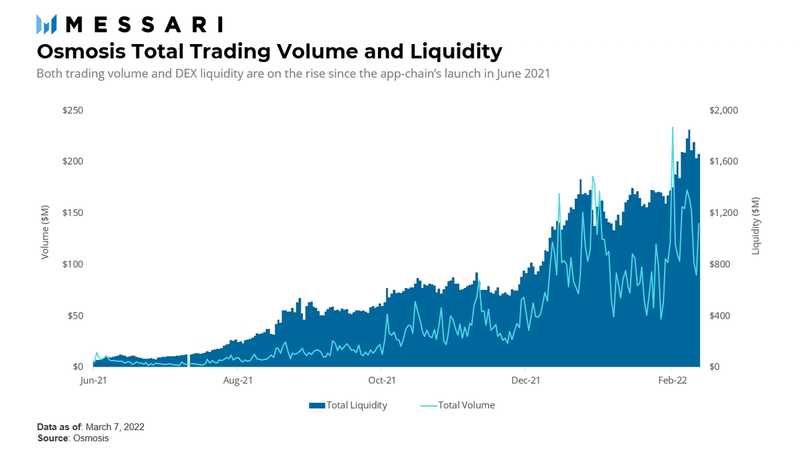

Osmosis has benefited from the growing interest in the Cosmos ecosystem. Total trading volume and locked liquidity have both been on the rise since its launch. In fact, both metrics saw all-time highs within the last 30 days. And given past Osmosis activity or ownership of the OSMO token as a rumored qualifier for airdrops in the Cosmos ecosystem, there are no immediate signs of slowing down.

Protocol Features

Liquidity Pool Customization

Much of the inspiration behind Osmosis came from an Ethereum-based DEX, Balancer, and its ability to offer multi-asset liquidity pools. In the eyes of the Osmosis Labs team, blending assets into liquidity pools was the first of many customizable options. Through this level of customization, the role of the DEX evolved from only being able to trade spot-priced assets to be able to support an options market, interchain staking, and more.

Osmosis pools offer flexible market-maker functions. Unlike Uniswap’s constant product, Balancer’s constant mean, and Curve’s hybrid functions, Osmosis’s functions are variable, thus realizing its goal of becoming an “AMM laboratory.” The DEX encourages liquidity providers to experiment with different market-making functions of their own choice. Osmosis spurs increased experimentation because new variations can ultimately lead to innovative solutions for reducing slippage or impermanent loss costs.

Pool parameters, including swap costs, initial token weights, and time-weighted average price calculations, are set by the pool’s original creators. However, all Osmosis pools are self-governing by LP token holders. Voting power is distributed in accordance with fractional ownership of the capital in the pool. Longer capital commitments receive a boost in voting share. Since Osmosis expects the market to determine optimal capital efficiency, self-governing pools are merely another parameter to tweak to build the most competitive liquidity pool. The end game is a competitive market that provides greater skin-in-the-game for capital allocators.

Superfluid Staking

Compared to a rollup-centric ecosystem like Ethereum’s, multichain ecosystems like the Cosmos ecosystem face the challenge of bootstrapping their own security. Thus, for Zones in the Cosmos ecosystem, the issue of bootstrapping security becomes of utmost essence.

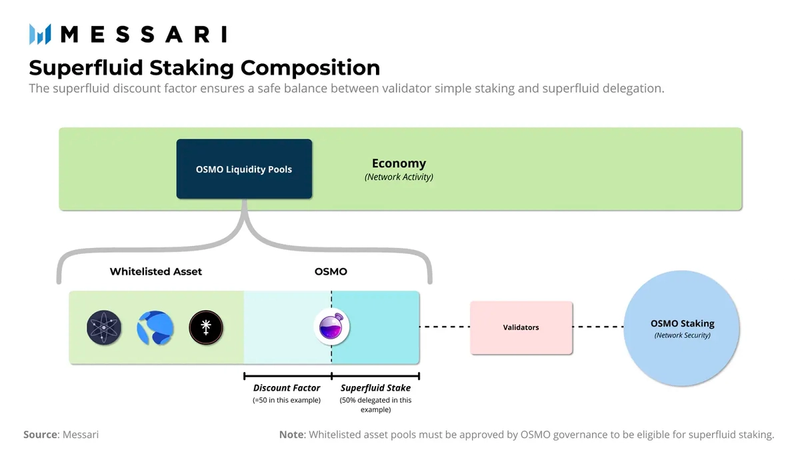

Osmosis has designed a clever solution for this problem: superfluid staking. Considered one of the biggest advancements in proof-of-stake since liquid staking, this staking method allows LPs to provide liquidity with their native OSMO tokens while simultaneously using those same tokens to bring security to the underlying network. A visual representation of the Osmosis superfluid staking platform is below.

The superfluid staking model flips existing liquid staking solutions upside down. Instead of providing liquidity to a bonded asset, superfluid staking takes bonded liquidity from an asset and stakes it to the network. The fact the asset is already bonded to local liquidity pools only helps simplify the network’s balance between security and economic liquidity.

Whitelisted liquidity pools are the only ones eligible to participate in superfluid staking. That’s because Osmosis wants to limit the minting of risky assets by malicious actors who can then drain staked liquidity pools for the underlying OSMO token. Preventing this from happening is crucial for strong security, and the decision to determine whitelisted pools are eligible is left up to Osmosis governance.

The benefit of superfluid staking should be clear: it allows LPs to double their rewards through yields generated from trading fees and through staking rewards for securing the network. Meanwhile, the underlying network benefits from the extra security, leading to a win-win situation for all parties. Even more exciting, Osmosis doesn’t have to be the only beneficiary. The protocol can offer staking-as-a-service to help other app-chains bootstrap their security too. The end result is a mesh network of intertwined security backed by this superfluid staking feature.

CosmWasm Integration

In early March, Osmosis announced it had successfully worked with blockchain devtool company, Confio, to integrate the CosmWasm inter-blockchain smart contract engine into the Osmosis Protocol. By doing so, Osmosis can now access an untapped pool of resources because CosmWasm hosts one of the largest developer ecosystems outside of Ethereum and Solana.

CosmWasm offers a WebAssembly virtual machine (Wasm) for developers familiar with Go and Rust. Developers receive a toolset to build new permissioned smart contracts which can run across multiple Cosmos SDK blockchains. Think of it as a framework intended to boost interoperable smart contract functionality between various Cosmos app-chains.

The announcement potentially hints at additional features coming to Osmosis, such as yield aggregators, liquidity management tools, and more. While this is exciting news for those looking to maximize yields, the Osmosis Labs team has made it clear its end goal is to remain an interoperable DEX-focused protocol – with additional bits and pieces from other contributors.

MEV Resistance

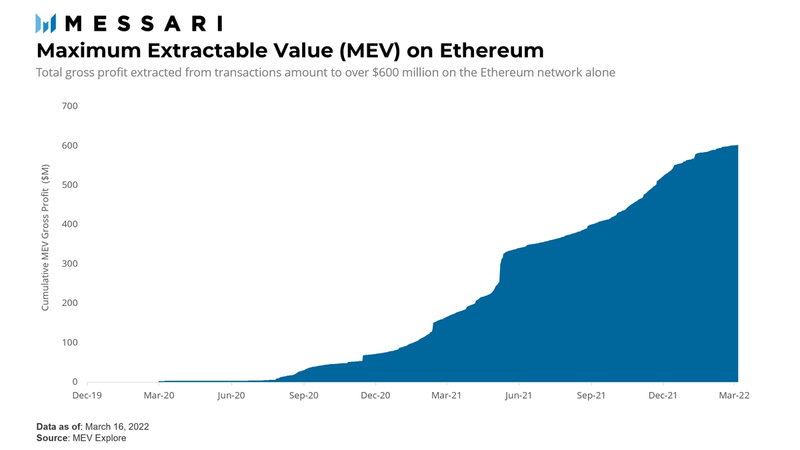

Osmosis’s upcoming roadmap includes the tackling of maximum extractable value (MEV), one of the largest challenges seen in decentralized transactions. Since all trades are facilitated through the blockchain – meaning they’re available on the public ledger – miners are able to rearrange transactions within their block to their own benefit. Miners would have an advantage over ordinary users in situations where it is important to get a transaction approved first, such as for front-running trades or acquiring a prized NFT. This type of MEV behavior disadvantages DEX users in favor of those with privileged access to the blockchain.

MEV originated as a privacy issue only to evolve into a financial one. According to MEV Explore, over $600 million has been extracted away by miners since January 2020 on Ethereum alone.

Osmosis’s solution to MEV is to implement a form of encryption called threshold cryptography.

The process for threshold cryptography begins before transactions hit the mempool. Encrypted transactions hide transaction details from validators, preventing validators from figuring out which transactions to prioritize first. Only after the transactions are finalized and executed can validators see the details. Note that only the trade detail is encrypted during this process; the fee amount will continue to remain public. As a result, pending transactions continue to get added to the blockchain in order of fee amount.

OSMO Tokeneconomics

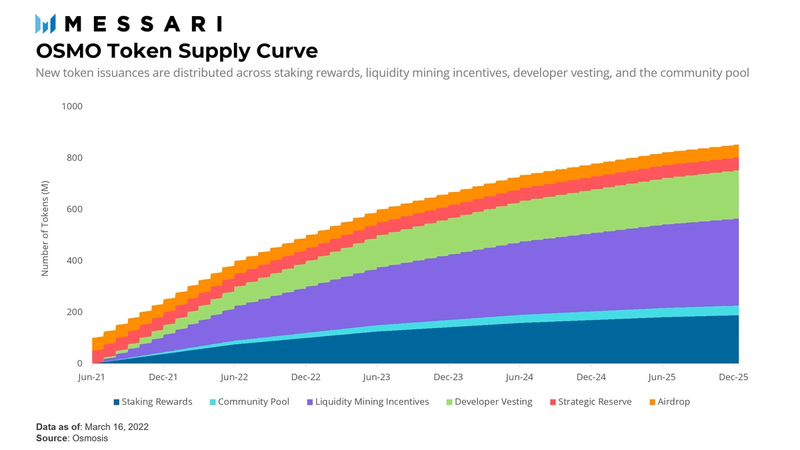

As the native governance token, OSMO is behind all the features of the Osmosis app-chain. A maximum supply of 100 million tokens will be set in circulation daily epoch-based issuances. The emissions schedule is similar to Bitcoin’s famous “halvening,” except Osmosis will follow a “thirdening” schedule, reducing the number of new tokens by a third every year. The tokens applicable for issuance will be split among staking rewards, developer vesting, community pool allocations, and liquidity mining incentives. The full supply curve schedule can be found below.

The OSMO token launch was a fair launch distributed across airdrop recipients and the protocol’s strategic reserve. Notably, 50% of the supply was airdropped to ATOM holders, and the remaining 50% was set aside for a strategic reserve, which will support the ongoing development of the protocol. The reserve tokens could be used to fund open-source projects, make investments, or provide grants.

Conclusion

Competition for transaction volume is fierce. At the end of the day, successful applications must continuously innovate to keep attracting liquidity providers. The Osmosis community believes the exchange has a strong chance to corner the market. With its position as a multichain centerpiece, status as a host to flexible pool parameters, reputation as a staking innovator, and exciting MEV-resistant roadmap, Osmosis is prepared to capture a significant amount of liquidity and protocol revenue. Only time will tell how successful it’ll be – but early indicators look promising.

This report was commissioned by Osmosis, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in the Hub does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which is updated monthly and published here. Crypto projects can commission independent research through Messari Protocol Services. For more details or to join the program, contact hub@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our terms of use for more information.