Ethereum’s transition from proof-of-work (PoW) to proof-of-staking (PoS) may be putting the cryptocurrency back into regulators’ sights.

Speaking to the press after the Senate Banking Committee, SEC chair Gary Gensler reportedly stated that digital currencies could be classified as securities if they meet the Howey Test.

From the coin’s point of view, that’s another indicator that under the Howey framework, the investing public is expecting profits from the efforts of someone else.

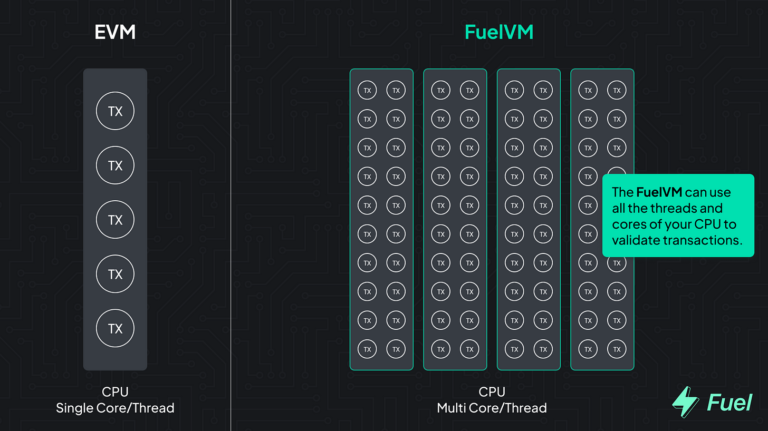

The comments were posted on the same day as the transition from Proof-Of-Work (PoW) mining to Proof-Of-Stake (PoS). This means that the network will no longer require miners to use their computing power for verifying transactions and creating new ones. Instead, validators will be able to validate transactions using their own resources.

Gensler believes that allowing investors to stake their own cryptocurrencies would result in “investors expecting profits based on the effort of others.”

Gensler said intermediaries offering staking (or lending) services to its clients look very similar — with some differences in language — to traditional banking.

The SEC has previously stated that Ethereum isn’t a security under U.S. law. Both the CFTC and the SEC agree that Ethereum acts more like a currency than an investment.

The U.S. Securities Exchange Commission (SEC) has been closely watching the cryptocurrency market, particularly those that it claims are securities. It has been involved in a lawsuit against Ripple Labs regarding its XRP token.

The SEC has also been pushing firms that offer cryptocurrency loans to register with them, even though they consider these types of investments to be securities.

Gabor Gurbacz, a senior portfolio manager at American investment firm Van Eck, has been telling people for over six years that “POW to POS transitions can attract regulatory attention.”