This piece was made possible with a sponsorship from Nansen. The platform saves analysts and traders hundreds of hours each month by allowing them to grab network level data with a simple click. No APIs, no going through network scanners or pulling contract addresses. Nansen visualises network level data on user behavior & transactions in a fraction of the time their peers do. Get started with a trial here or simply play with their dashboards here.

_______________________________________________________

Hello,

Late last week, Jar, an app from India, announced that it had raised $32 million with Tiger Global. I have been a seed investor (in a personal capacity) in the venture since last year, and I reached out to ask whether they would mind me sharing their tale with my readers. They agreed, and this is what came from the conversation. We will step aside from web3, gaming and tokens today to understand how they have been blitzscaling their app in India. Why? Because I believe that insights about how they went to the market and scaled might reveal what could be done differently by DeFi founders to find product-market fit in the non token-based economy.

How It Began

Jar was started in 2020 by Nishchay and Misbah Ashraf in Bangalore. Misbah started tiptoeing into the venture world by taking early product-related roles in a number of ventures. In 2017, he started a social-buying venture call Marsplay. It allowed users to buy clothing, fashion and beauty apparel that was displayed by influencers. The app scaled to a million users and 25,000 creators. It was eventually acquired. Nishchay, on the other hand, started his career as a consultant. In 2016, he joined Bounce, a bike rental venture from India, as the head of engineering. He eventually became the head of monetisation for the venture. The two were looking for a new challenge when COVID took over, and their shared passion for financial inclusion brought them together to build Jar.

What does Jar do? It reduces the cognitive load required to make a financial investment down to its bare minimum. According to the Reserve Bank of India, only about 27% of Indians are financially literate. Only about 2% of the population have exposure to mutual funds. This matters in a nation of 1.3 billion, where some 29% of the GDP goes towards savings. The figure is distinctly higher than the United States (18%) and the United Kingdom (16%). The high savings combined with an inflation rate of 6% (2020) means individuals seek new investment avenues. A common instrument of ownership in the region is land. However, the vast majority of the regional population could no longer afford to invest in land due to rising prices. An alternative is to buy gold, but it comes with its limits, risks and capital commitments. Investing in public equity is a good way to hedge against inflation risks, but barely 70 million Indians have an equity linked account to begin with.

How It’s Going

The app built by Misbah and Nishchay does not do much. And that is what makes its growth so impressive. In a market flooded with apps trying to bundle all banking services, Jar lets users come in and just buy digital gold. That’s all it does: no mutual funds, no insurance, no loans and no money transfer. Gold has long been an aspirational product that also acts as a store of value in multiple parts of the world. For a sense of scale, Indians buy as much gold as the nation’s government holds reserves every year. As of February 2022, the nation held 754.11 tonnes of gold. In comparison, consumers in the region purchased 771 and 760 tonnes of gold in 2017 and 2018, respectively. Users verify their account and make their first purchase of gold on the platform in less than ten minutes. You may think – ah, okay, that’s cool, but why does this matter?

The chart above compares how a series of fintech-related apps compare with Jar as of today. Coinswitch is a regional crypto on-ramp, while Cred allows users to repay their credit card debt. Kite, Groww and upstox allow users to get exposure to equity markets. In case you are searching for Jar – its line is represented up top, at an almost 100% open-rate on the daily in comparison to other fintech apps. Why is this the case? Users buy a small amount of gold each day through the app. Instead of deploying large sums of money in a single go, Jar users deploy smaller sums. About 93% of the nation runs in the informal economy. The government’s push for demonetisation in 2016 forced many users to begin using digital payment apps, but the frequency at which they get paid is still not in monthly lump sum amounts. The app functionally makes it easier to save in a regionally accepted instrument (gold), at a fraction of the cost (as it is digital) without the risks involved with custodying it with oneself. Since these transactions occur once every day – the habit of allocating a portion of daily income to a growing asset is formed. That is at the crux of what Jar does. A simple and almost stupid proposition, you may say. But for a sense of growth of financial applications in the region, consider the following chart.

A demat account is a facility to hold equities linked instruments digitally in India. They are required for anyone looking to invest in publicly listed stocks. They are also a good measure of how economic behaviour evolves in the region. The number of demat account holders in the region has roughly doubled (70 million), and the number of new accounts being opened quadrupled to about 20 million last year. Blame it on pandemic-induced boredom combined with heightened savings, especially among gen-Zers; users are flocking to avenues that allow them to deploy their capital meaningfully. Fintech apps in the region are primarily competing for a fraction of this inbound and ever-expanding user base.

Data from App Annie shows that monthly downloads of Coinswitch and Jar have both trended at around 1.25 million for the past month. The dip in the number of users downloading Coinswitch last month may have been to do with how digital assets performed during December. In my experience, new entrants in the market are either looking for exposure to a high-growth asset class (like Bitcoin) or searching for investment avenues that require very little decision-making (like gold or mutual funds). This is something the founders of the app are cognizant of. Building financial applications at scale in emerging markets requires building something that can appeal to individuals at very different ends of the socio-economic spectrum. You need to cater to the user in a small town who saves $2 a day and appeal to someone who wants to buy a large quantity of gold from the comfort of their couch. Apps like Jar bring together the aspirations of users in emerging markets at scale.

Unlike what happens in traditional banks, the cost of servicing new users does not increase as more users begin using the app. You are not spending money hiring clerks, accountants and customer-facing personnel. You only invest in servers and processes to watch over compliance and fraud. This makes it possible to service millions of users without cost overheads rising exponentially. This is something most proponents of banking the unbanked tend to forget. The reason why banks were not able to service someone in remote India was not the lack of physical infrastructure but rather the human cost of servicing them was higher than the revenue generated through them. Assuming assets under management are a constant – fintech apps have reduced costs to serve the unbanked while traditional alternatives have costs that pile up.

Jar did not emerge from thin air. There are multiple factors that contributed to their success, in my opinion. The founders had spent a good five to seven years working at startups and learning from others before setting out on their own. This is a common theme I see in many of India’s unicorns. The founders almost always have a decade of experience. Instead of hiring a large team early on, the team mostly worked remote. Some of the early hires were working part-time until the app had its first venture raise. Even here – there were some contrarian decisions made. Some of the early engineers in Jar were not hired from Bangalore but rather from Eastern Europe. A rarity given how most of us assume Bangalore is a sea of engineering talent. Instead of trying to make everyone work remotely, the team was put together in an Airbnb. Working together used to help them detect bugs and roll out updates much faster, a necessity when you are a new app going against multi-billion dollar peers that could simply make you a ‘feature’ in their app. Lastly – the team’s focus was not on selling the most financial products they could. They mentioned a term I rarely hear in my professional career: financial wellbeing. Instead of focusing on what accelerates revenue through sales, they focused on the lowest-hanging fruit to onboard 100 million Indians. That happened to be buying gold in units as cheap as $0.02. Before moving to Dubai, I happened to meet the two founders over coffee for a brief while in October 2021. Nishchay was busy keeping an eye on total transactions for the day. They amounted to around 50k. I presume that it is likely trending towards a quarter million by now, if not more.

What does this mean for DeFi ?

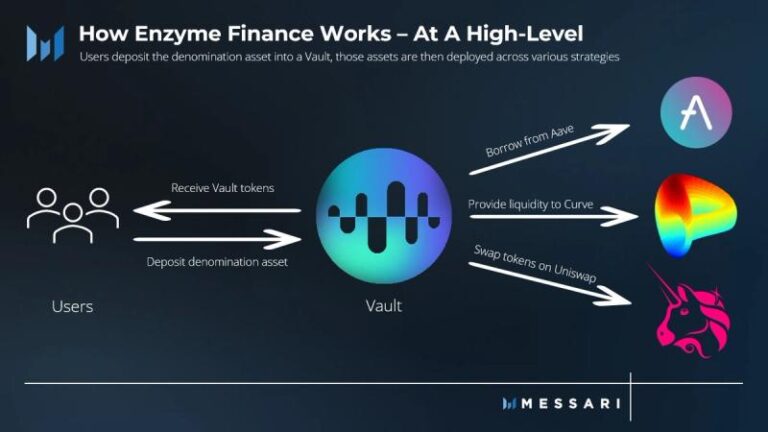

I got into crypto in 2013, trying to build a remittance solution on Bitcoin for low income workers in the Middle East. Back then, the total remittance sent to India annually was around $70 billion, and it seemed far-fetched to be able to support that kind of volume on-chain. You barely had stablecoins back then, so the volatility alone made remittances impossible in the absence of an active derivative market for the asset. The chart above is from Chainalysis’s geography of cryptocurrency report for the past year. May alone saw $100 billion+ being transferred to South East Asia as a region. The same report suggests that some 80 billion is flowing through from India to CeFi and DeFi exchanges today. These are mind-boggling numbers because we keep thinking the market in the region is much smaller. One of the leading P2P exchanges in the region commands a volume of $40 billion annually. Long story short, there is enough liquidity of capital flowing in the region to support large-scale ventures today. But what product categories would truly stick? If I had to extrapolate what I have learnt from Jar, it would likely be products with a mix of the following feature subsets

1. Low Cognitive Load: Users don’t have to think much when they buy gold. Compare that with signing up to an exchange today. There are a few thousand tokens, the properties of which you barely have a clue about. Index-based products that give access to a basket of tokens in a curated fashion may take off so long as the branding is done well.

2. Habit Formation: Most of the users on Jar are repeat customers. They have to manually open the app and do a transaction. An emotional bond emerges from doing something every day. The dopamine hit of realising you are inching closer to a goal has value. A user base of sticky users forming healthy financial habits should command a premium. In comparison, crypto purchases are one-off purchases made in lump sums followed by a roller coaster of emotions. The next generation of crypto apps will likely be low-touch, repeat transaction experiences instead of ones requiring constant monitoring.

3. Lower Buy-ins: This number is an estimate, but the average wallet owner in India has likely less than $150 of crypto in their balances. The same wallet has aspirations of wanting exposure to premium NFTs (like Bored Apes), blue-chip tokens (Bitcoin, Ethereum) and early-stage opportunities, like those on Coinlist. Teams that can repackage these instruments to appeal to someone with just $100 to invest will likely have an edge. There is already a tremendous amount of innovation towards fractionalising high-priced NFTs today.

There was something distinct Misbah mentioned when we first met: Users in small towns in India experienced both the internet and the web3 space in the wrong way. Porn lead to demand for the internet, and an appetite for gambling may be the reason for digital asset adoption. I disagree with that statement, but it does warrant a call for attention towards how we educate and integrate the next billion into the ecosystem. Do we expect all of them to ‘ape’ into random ventures, or do we make platforms that sustainably help them have exposure to the industry? Jar’s value proposition is in building an application that makes it possible for anyone at the start of their financial lives to begin saving money. Mutual funds and equities could be confusing so they focused on the simplest of assets. Gold. Historically, investment grade products were not available to the vast majority of Indians unless they held a large deposit at the bank. Jar is fascinating to me because it takes a very premium part of the financial ecosystem and makes it accessible at scale to middle-class Indians. Their philosophy is to on-board individuals with zero exposure to investment grade products and make savings a habitual aspect of their lives. This is partly what has empowered Jar to carve a niche of its own in an age that is fixated on turning investing into entertainment.

If you are building web3 native financial applications for emerging markets – please make sure to drop in your decks to joel@decentralised.co. Building in South-East Asia or Africa and have numbers you want to share? Drop me an email. Also feel free to come hang out with us in our Telegram channel. Jar’s founders are there to answer any of your questions. Make sure to check their Angel.co link in case you are looking for the next big opportunity in the Indian fintech ecosystem.

See you soon with a breakdown on buying real-estate in the metaverse.

Regards

Joel

Disclosure : As stated in the article, I am a very proud investor in Jar.

None of this is financial advice.