Key Insights

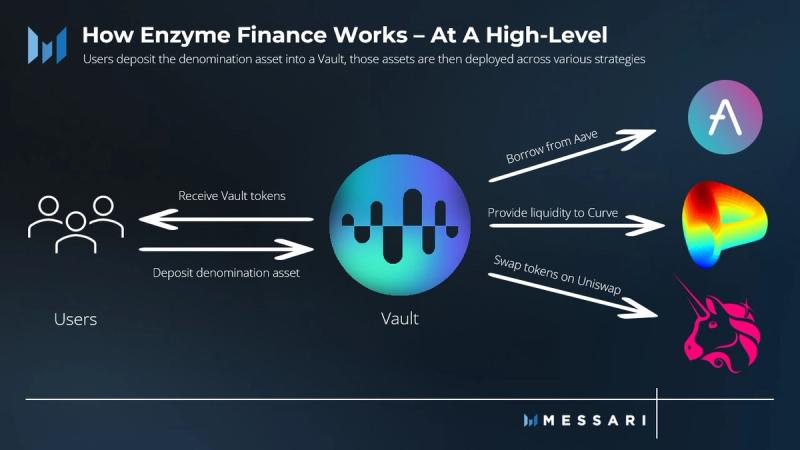

- Enzyme is an asset management platform, originally built on Ethereum, that allows individuals and groups to create custom investment structures known as Vaults.

- Vaults allow users to customize parameters and choose which DeFi protocols to interact with.

- Platform users can deposit their crypto assets into non-custodial Vaults and allow more experienced individuals or groups to make investment decisions for them (eg. DAO treasuries, funds, indexes etc).

- Despite the drawdowns of the bear market, Enzyme has maintained its position as the largest active asset management protocol by total value locked.

- Enzyme has continued to ship new upgrades and implementations in 2022 and extended its reach to other chains such as Polygon.

Investors generally prefer more experienced institutions and individuals to handle their investments for them. As a result, one of the biggest markets in the traditional finance world is the asset management industry. As of 2021, there are approximately $112.3 trillion in global assets under management (AUM). With global wealth at $463.6 trillion, approximately 24.2% of all wealth is managed by the global asset management industry.

By comparison, the asset management industry for decentralized finance (DeFi) is quite small. Altogether, the decentralized asset management (Yield Aggregator and Indexes) has a total value locked (TVL) of $1.3 billion. Given that the total market cap of all of crypto is ~$909 billion, only about 0.15% of all crypto wealth is managed through decentralized asset management. In other words, decentralized asset management’s share of wealth is ~161x smaller than traditional finance’s share of wealth.

Although decentralized asset management is lagging far behind its traditional finance counterpart, there is certainly an investor base that wants exposure to DeFi and its yield. That investor base was previously serviced by a plethora of CeFi companies, such as Celsius, Voyager, BlockFi, etc., that gained popularity over the 2021 bull run. Part of their popularity was due to their relatively simple and convenient interfaces. However easy-to-use these CeFi solutions were, they came with some complications in regard to their opaqueness and custodial nature.

Decentralized asset management may stand to benefit from CeFi’s failure. The recent FTX implosion has evaporated the trust of many users in centralized custodians. As such, decentralized non-custodial solutions are necessary to help regain the trust of so many that were negatively affected by FTX. In decentralized asset management, users don’t have to worry about a custodian losing their crypto. Moreover, users can verify, on-chain, the health of the products they choose to invest their money in.

Although decentralized finance’s asset management industry may be small, numerous protocols and projects are working to scale the nascent industry. Enzyme is leading the charge as the largest on-chain active asset management platform by TVL.

Background

The private company behind Enzyme, Melonport AG, was founded in July 2016 as a privately domiciled company in Switzerland. Its founders, Mona El Isa and Reto Trinkler, aimed to develop an asset management protocol on Ethereum called Melon, the predecessor name for Enzyme.

Melon V1 went live in March 2019. It allowed users to create and invest in crypto structures through the use of smart contracts. Upon the launch of Melon V1, Melonport AG wound down and handed control of the Melon protocol to the community through the Melon Council, in an effort to decentralize the project. The Melon Council was a governing body initially selected by Melonport AG prior to its dissolution.

In December 2020, Melon Protocol announced that it would be rebranding to Enzyme. The Melon Council was additionally rebranded to the Enzyme Council. On Jan. 21, 2021, Enzyme V2 introduced new smart contract architecture and enabled new features such as lending and synthetic assets. In Q1 2022, Enzyme launched the latest release, Sulu, and deployed the protocol on Polygon.

How Enzyme Works

Vaults

Enzyme revolves around its flagship feature, “Vaults.” Vaults are on-chain investment structures. Any individual can create a vault, customize its parameters, and select an investing or trading strategy.

Vault creators can customize a number of parameters including:

- Name and token ‘ticker’ (ERC-20 token that represents Vault ownership).

- Access (who can deposit into the Vault).

- Fees (all Vaults must charge at least an AUM-based fee that is implemented at the protocol level). Performance, management, entrance, and exit fees are customizable.

- Share transfers (if the ERC-20 token representing the Vault can be traded).

- Redemptions (lockup periods and what asset redemptions are conducted in).

- Asset management (various other parameters mainly dealing with what the Vault can and cannot do).

With Enzyme’s Sulu upgrade, certain Vault settings are changeable even after the Vault is created. If a Vault’s settings are changed, depositors in the Vault have 7 days to withdraw their assets before the change is implemented.

Additionally, fund managers’ behaviors can be enforced and regulated by Enzyme’s smart contract architecture.

The largest Vault by AUM is the USF Fund 1 Vault. This private Vault is Unslashed Finance’s treasury that holds positions in stETH and ETH. As of Dec. 9, 2022, the Vault has an AUM of ~$22.9 million.

Depositors

Once a Vault is created, users can deposit capital. Users can deposit the denomination asset into either public Vaults or private Vaults they have been whitelisted for. Additionally, the Vault must not be at its maximum limit, and the depositor must be able to afford the entrance fee, if any.

Once a user has deposited the denomination asset, the user will receive ERC-20 tokens representing their share of the Vault. Users can later redeem these ERC-20 tokens for the pro rata amount of AUM they are entitled to.

Vault Information and Financials

Enzyme also tracks key information and financials related to each Vault, allowing both managers and depositors to better evaluate their options. While basic stats such as the share price, AUM, the number of depositors, etc., are tracked, Enzyme also tracks some other intriguing stats that allow for more comprehensive evaluations of the Vaults. More advanced stats, such as Sharpe ratios, volatility, monthly performances, etc.. are readily available for Vaults.

In addition to performance stats, Vaults also display information related to Vault strategies and management. Users can easily find which address manages the Vault, what DeFi applications the Vault can interact with, and what addresses are allowed to deposit.

Integrations

Enzyme’s Vaults distinguish themselves by their interoperability within the DeFi ecosystem. Enzyme Vaults can interact with 17 DeFi protocols on Ethereum, including Aave, Uniswap, and Curve. For Polygon, Enzyme has five integrations.

These integrations allow Enzyme’s Vaults to enact trading and investing strategies for its users that are more complex than simply buying and holding. Vaults can borrow to increase leverage, provide liquidity, vote lock tokens, and more. For example, the Guttastemning Vault provides FXS/WETH liquidity on Uniswap V3 and has also locked its CVX as vlCVX (vote-locked CVX).

In addition to its integrations, Enzyme also tracks over 200 cryptoassets for its Vaults. Even more exotic tokens, such as the yearn.finance 1INCH yVault token or the curve.fi a3CRV Guage Deposit token, are tracked. Any asset with a Chainlink price feed is eligible to be tracked by Enyzme’s Vaults.

Lastly, Enzyme plans on integrating more protocols in the future. Currently, they are working on integrating Notional Finance and PoolTogether.

Further Use Cases

Through its comprehensive Vaults, Enzyme has built out a product that can be used by a wide selection of ecosystem participants, namely retail crypto investors, DAO treasuries, and portfolio managers.

Crypto investors tend to find managing their crypto positions and investments an impossibly time-intensive and difficult task. Enzyme caters to these users by offering an easy-to-use UI that can delegate away investment responsibilities in a non-custodial way.

Enzyme’s Vaults are also specialized for DAO treasuries. Because Vaults are compatible with Externally Owned Accounts (EOAs) and multi-sig wallets, DAOs can utilize Vaults to manage their treasuries. With Vault’s built-in risk management parameters and integrations with third-party protocols, a DAO treasury could build out a robust Vault that safely manages risk, integrates with the greater DeFi ecosystem, and earns a yield on the treasury’s assets. For example, Nexus Mutual’s Treasury Yield Vault lends ETH using Maple Finance.

Lastly, Enzyme also caters to managers lacking the technical expertise to build smart contract architecture. Portfolio managers could use Enzyme’s Vaults to execute a personalized strategy and source capital for their strategies.

Enzyme Token (MLN)

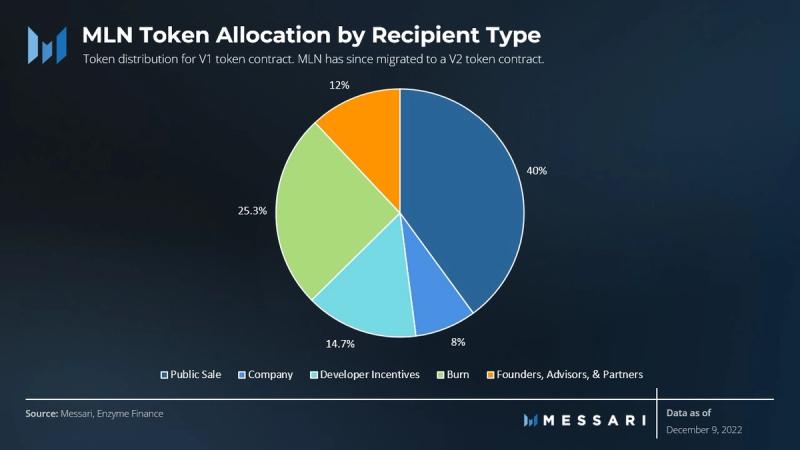

MLN is Enzyme’s Ethereum-based, ERC-20 utility token. The distribution breakdown of the initial supply of 1.25 million is as follows:

- 40% to investors who participated in a public token sale

- 8% to Melonport AG, 14.7% to developer incentives

- 12% to the founders, advisors, and partners of the project

- 25.3% was unallocated and subsequently burned

Of note, this initial distribution was for the old MLN token contract. On Feb. 1, 2019, the project migrated to the current MLN token contract, and old MLN holders were able to convert on a 1:1 basis.

MLN is used for the payment of fees within the Enzyme system. In V4, each Vault charges an annual fee based on the Vault’s AUM. If Vault managers choose to pay the fee in MLN, the fee applied is only 25 bps of AUM. If the fee is not paid in MLN, then the fee applied is 50 bps.

The MLN used to pay for fees are subsequently burned by the Enzyme Council. Additionally, fees not paid in MLN will later be converted to MLN by the Enzyme Council and then burned. MLN burns by the Enzyme Council are tracked by a subgraph, which shows that ~382,565 MLN have been burned to date.

MLN also incentivizes network participants, particularly those who wish to further develop the Enzyme protocol. The Enzyme Council can mint up to 300,600 MLN tokens each year to pay developers to work on Enzyme. Some organizations and individuals that have received MLN tokens as incentives include: Avantgarde Finance, Exponent, Theo.eth, and Atlantis DAO.

Unlike most DeFi tokens, MLN is not a governance token. Enzyme is governed by the Enzyme Council, which was established by Melonport AG, the founding company behind the protocol. Melonport AG dissolved after the establishment of the council. The Enzyme Council is made up of 11 people with backgrounds ranging from former employees of Melonport AG to investors and smart contract engineers. The Council has full governance capabilities over the Enzyme protocol. The Enzyme Council comprises two groups: The Enzyme Technical Council (ETC) and The Enzyme User Representatives (EURs).

Traction

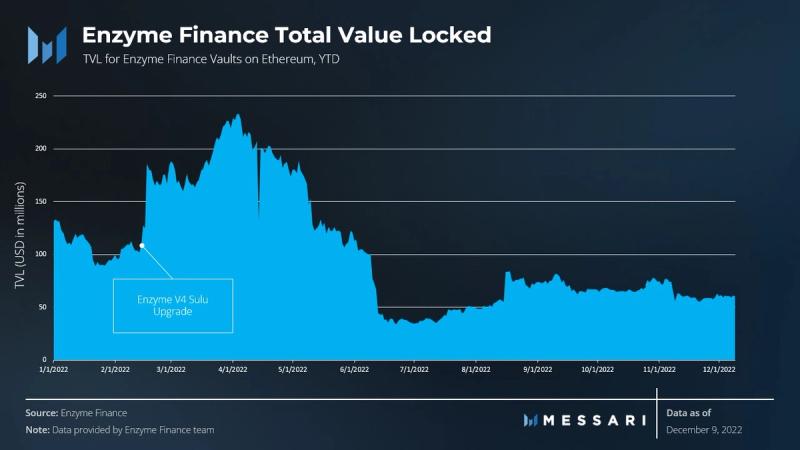

Since the release of its Sulu V4 upgrade in Q1 2022, Enzyme has seen its TVL slowly fall in USD terms, from its height of ~$233 million on April 5, 2022, to its current ~$62.0 million (down ~73.4%). However, the falling TVL may not necessarily be an indictment of the protocol itself, but rather a reflection of the current bear market in which the crypto ecosystem finds itself. In terms of ETH, TVL hit a high of ~68,000 ETH and is now ~49,019 (down ~27.9%).

Enzyme has seen some growth in 2022. At the beginning of the year, there were 954 Vaults. Since then, Vaults have grown by approximately 27% YTD, with 1,241 Vaults as of Dec. 9, 2022. Additionally, deposits have grown by 57% from 2,032 at the start of the year to 3,322 as of Dec. 9, 2022.

Competitive Landscape

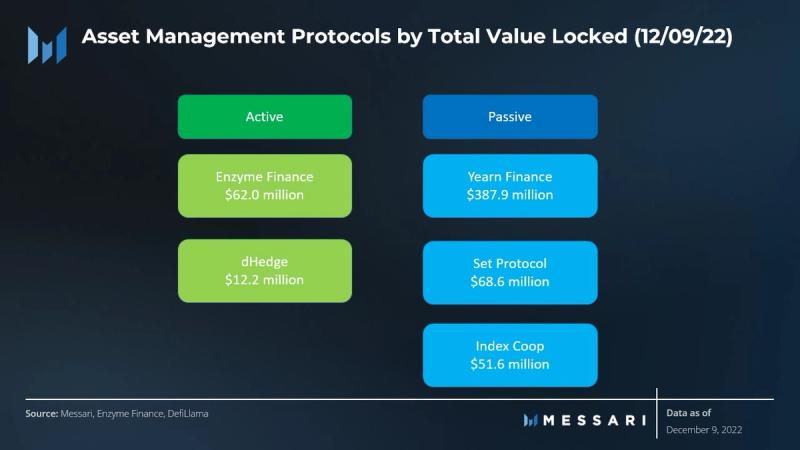

Given how massive the asset management industry is in traditional finance, it is no surprise that other protocols are unsurprisingly trying to carve out market share on the decentralized finance side of asset management. These competitors can be grouped into two categories: active and passive management.

Enzyme’s main competitor on the active management side is dHedge. dHedge operates similarly to Enzyme, with its “Pools” products resembling Enzyme’s Vaults. Although dHedge only has $12.2 million in TVL, it is outpacing Enzyme in L2 rollup deployments. In addition to deploying on Ethereum and Polygon, dHedge has deployed to Optimism. Another main difference with dHedge is its integration with Toros Finance, a passive asset management protocol built on top of dHedge. However, Enzyme’s SDK enables a Toros-like passive asset management protocol to be built on top of Enzyme.

Enzyme finds much larger competitors on the side of passive asset management. Most notable is Yearn, one of DeFi’s largest protocols. As of writing, Yearn has nearly $388 million in TVL, which is approximately 6.25x larger than Enzyme’s TVL. Whereas Enzyme relies on humans to make investment decisions, Yearn uses automated smart contracts to seek out the best opportunities. Other notable passive asset management protocols include Index Coop and Set Protocol. Currently, passive active management eclipses active asset management by both TVL and market cap, but the total addressable market should be large enough for both approaches to coexist.

Roadmap

The Enzyme roadmap is currently working towards two main objectives:

- Expanding the protocol through new integrations and supporting new assets

- Various front-end improvements that bring greater customization and accessibility.

In the near future, Enzyme plans to integrate new DeFi protocols such as Notional Finance, PoolTogether, and Balancer. As for assets, Enzyme is working on a V5 protocol upgrade to support a greater variety of assets, including NFTs, real estate, pre-ICO, and venture deals. V5 also plans to introduce automatic support for Uniswap or Balance pool assets.

As for customization and accessibility, Enzyme has both front-end and backend improvements planned. Front-end changes may include a public API and an analytics dashboard to better monitor statistics related to Enzyme. In the V5 upgrade, Enzyme will continue building out third-party developer tooling that will make it easier for external projects to build on top of Enzyme.

Risks

Enzyme primarily faces risks manifested in other protocols and integrations.

Enzyme treats protocol security seriously and has conducted audits for all its implementations. The most recent audit occurred on Aug. 15, 2022, and was conducted by Chain Security. Enzyme also runs a bug bounty program to ensure security.

The other main risk for Enzyme comes through its integrations. Since Enzyme integrates with 17 different protocols, any risks associated with those protocols could also affect Enzyme’s users. This risk is much harder to mitigate, and Enzyme must be able to craft a careful balance between DeFi integrations and security.

Closing Thoughts

From its height of nearly ~$234 million in AUM to a current AUM of ~$62 million, Enzyme has taken a hit during the crypto bear market, though in ETH terms the protocol has outperformed the wider market decline.

The crypto market also seems to have expressed a preference for passive asset management over active asset management. Looking at traditional finance, this may not necessarily be a detriment as the market for active asset management has plenty of room to grow. Moreover, the crypto asset management sector as a whole is still in its infancy compared to its traditional finance counterpart.

Despite this year’s challenges, Enzyme has continued to build in 2022. The implementation of Sulu and deployment on Polygon have plenty of growth potential. Additionally, the case for non-custodial solutions to crypto management has never been stronger due to the failures of FTX and other CeFi solutions. Enzyme provides a novel solution by allowing investors to have their assets managed without taking on unnecessary custodial risk. As more and more of the world goes on-chain, Enzyme stands to benefit because of its simple UI and non-custodial Vaults product.