Fears are spreading among the NFT community, because BendDAO, a cryptocurrency lending platform, is facing insolvency and may have to liquidate 600+ NFTs that are being held in escroe. Some believe that a large number of NFTs were sold to fund the company’s operations. Others think that the entire NFT market was manipulated, and that the price of NFTs dropped drastically after the announcement. Regardless of what happened, there are rumors that the NFT marketplace may soon be shut down completely.

BendDAO is an Ethereum based decentralized lending platform where borrowers can earn interest by pledging their digital assets (NFTs) as collateral. Bidders who lend out funds can also earn interest by being repaid in Ether. It’s a great opportunity for anyone interested in getting involved in the crypto space without having to deal with volatility issues, until its not. These liquidation events are catastrophic to projects and have set the NFT space back quite a bit.

Liquidations are occurring because of falling prices of certain blue chip assets. When this occurs, the health factor of the asset backing the debt becomes too low to justify continuing the lending process. In the case of BendDAO, they have only 12.8% of their entire supply of tokens remaining. Due to this, borrowers who take out a borrowing contract through them cannot get their funds back. At present, there are around 13,000 ETH currently outstanding, meaning the amount of debt owed to lenders far exceeds the value of the assets pledged as security.

What Happens Next?

🚨 BendDAO founder has proposed emergency changes to the protocol 🚨

If the vote passes theres a high likelihood of 600+ liquidation auctions of BAYC, MAYC, Clone X, Azuki, and Doodles over the next month

A quick thread to dumb it down + how you can capitalize… pic.twitter.com/HczbLeQuW8

— Cirrus (@CirrusNFT) August 22, 2022

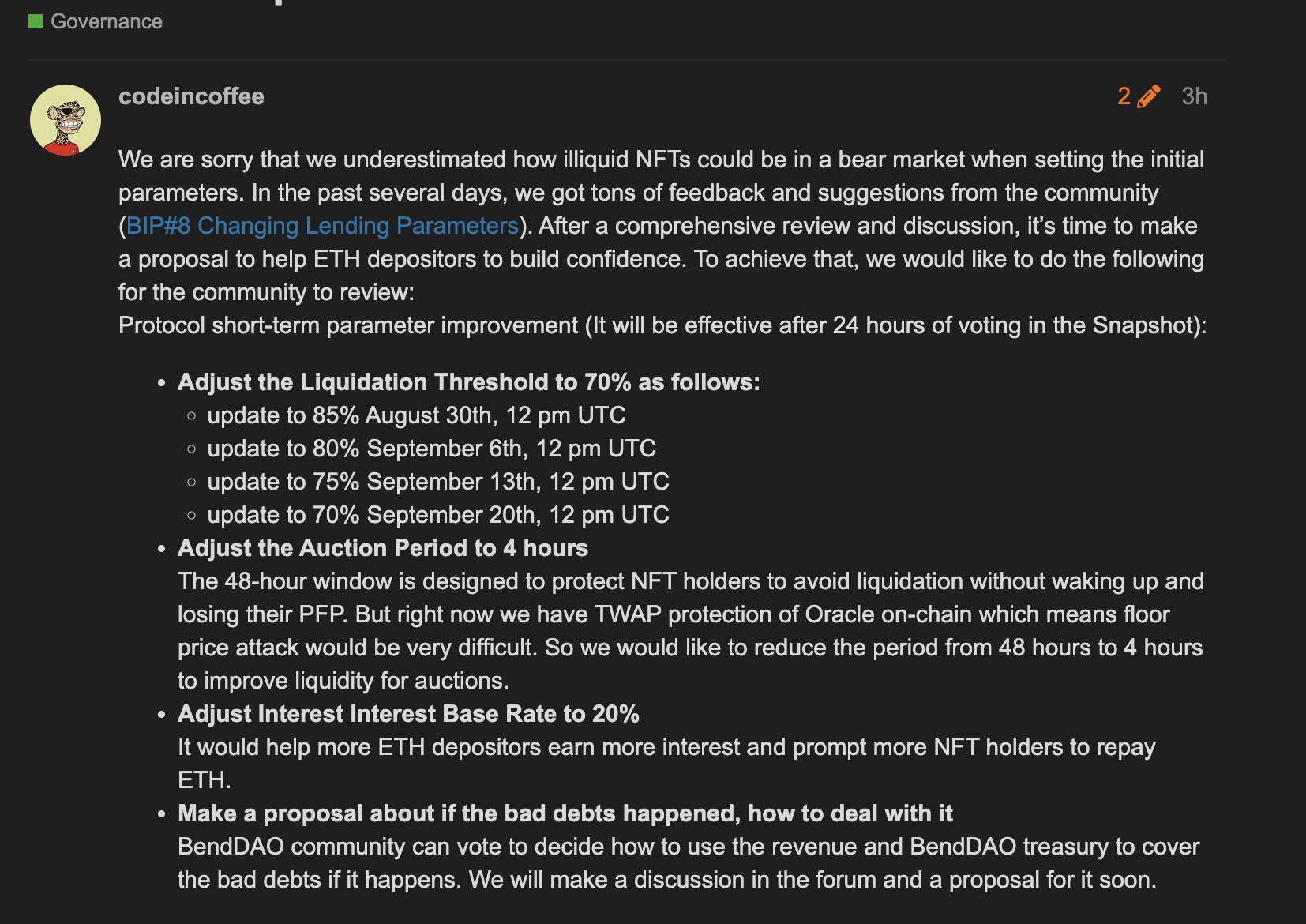

With no one bidding on defaulted NTFS, the DAO is forced to hold them with a greater debt than they are currently valued. The DAO must figure out how to get back the ETH from these NTFS to pay off the loan. To prevent this, BendDAO proposes changes to the lending protocol. One proposal is that auction duration would be reduced to four instead of forty eight, reducing the risk of losing your ETH for two days. Another proposal is that the minimum start bid could be set equal to the total amount owed on the NTFS, meaning that the difference between the lowest offer and the current price would be much larger, encouraging more bids.

The result, like so many lessons- Bend DAO is teaching us about how to prepare for the bear markets during the bullish times. Although it feels safe to hold onto your NFTs during a bullish period, the models used by many NFT lending platforms are still very basic. Therefore, many within the NFT community are anticipating the upcoming sales. After all, who wouldn’t love a great deal on a high-quality NFT?

About BendDAO

BendDAO is the best NFT liquidity protocol supporting instant NFT-backed loans, Collateral Listing, and NFT Down Payment. The seamless experience of down payment, borrowing, and listing creates a perfect closed loop for users, a one-stop NFT liquidity solution.

NFT holders/sellers can choose to instantly get up to 40% of the floor value of the listing before it even sells. The instant liquidity is actually provided by the instant NFT-backed loan. The buyer will pay off the loan including interests after the deal.

Existing borrowers can list the collateral directly on the BendDAO. The balance after deducting debt with interests will be transferred to the borrower (seller) after the deal.