Key Insights:

- The XRP Ledger’s primary use case is facilitating and settling cross-currency transactions.

- The XRP Ledger has processed over 2.6 billion transactions.

- XRP is currently the sixth largest cryptocurrency by market capitalization.

- The XRP Ledger natively enables NFTs, Issued Currencies, escrows, and a DEX.

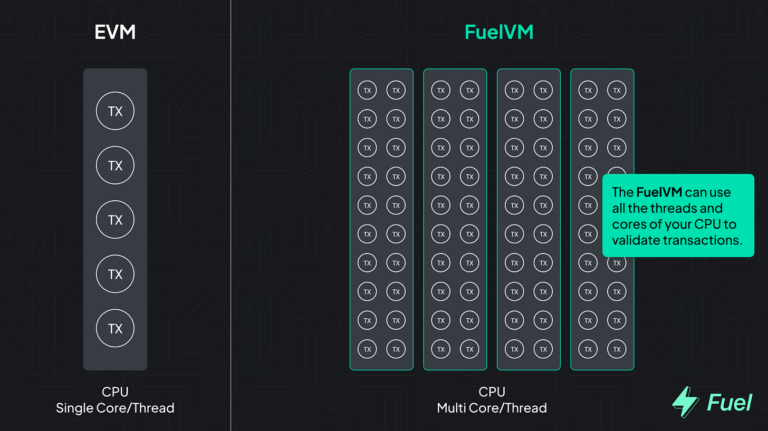

- Another dimension is being added to the XRP Ledger through the development of an EVM sidechain and Hooks. The XRP Ledger does not natively support smart contracts of arbitrary logic.

- NFTs and metaverse are being further supported through the Root Network in collaboration with FLUF World.

The XRP Ledger (XRPL) has been running for over a decade, offering fast, energy-efficient, cross-currency, and cross-border payments, among other features. The XRPL offers native Issued Currencies, a decentralized exchange (DEX), escrow functionality, and token management. With these native capabilities, the XRPL can execute many of the same functions that other networks do, even though it does not support smart contracts. Arbitrary smart contracts are not enabled on the base layer as a design choice to ensure maximum security and stability.

XRP, the native token on the XRPL, is the sixth largest cryptocurrency by market capitalization at ~$19 billion. The XRPL averages ~15 transactions per second, although it can support up to 1,500. Transactions on the XRPL are deterministic in cost, with most transaction types costing 10 drops. A drop is a millionth of an XRP, worth a fraction of a cent at XRP’s current price of $0.34.

The XRPL – supported by Ripple, the XRPL Foundation, XRPL Labs, and other developers around the world – aims to go beyond other networks’ narrow focus of peer-to-peer transactions. It provides a digital payment infrastructure not just for individuals, but also for existing financial entities such as central banks.

Background

The XRPL is a Proof-of-Association (PoA) blockchain ledger. XRP is the native token, and one of many that can be used to transact on the ledger.

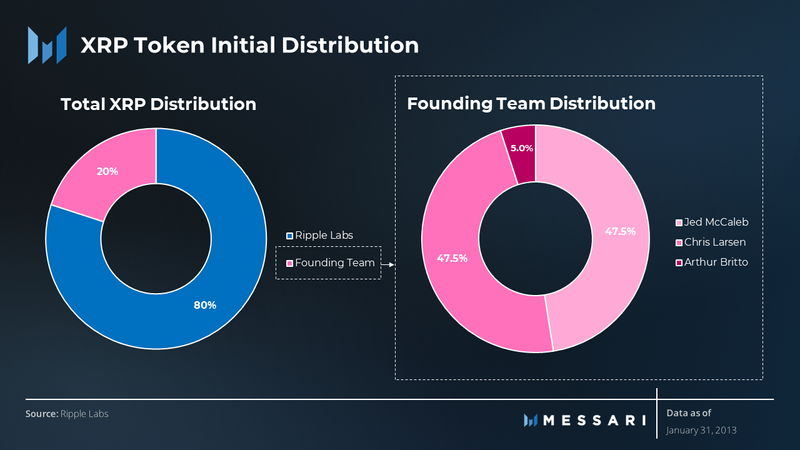

The XRP Ledger existed in some form as early as 2004 when Ryan Fugger created RipplePay, a decentralized payment system. This system lacked a decentralized asset and did not become a blockchain ledger until after the release of Bitcoin. Fugger handed the project to Jed McCaleb in 2011, who co-founded Ripple in September 2012 with Chris Larsen and Arthur Britto. In June 2012 McCaleb, David Schwartz, and Britto launched the XRPL, and in December 2012, the XRP token was launched and distributed among Ripple and the founders.

The developers behind the XRP Ledger believed that Proof-of-Work (PoW) suffered from energy waste and was only truly useful for initial distribution and solving double-spend. Concluding that Bitcoin’s real allure was the publicity of transactions and state, rather than the PoW consensus mechanism, the core developers challenged the dominance of PoW by building an energy-efficient alternative: the XRPL.

The XRPL was open-sourced in 2013 and XRP became the second largest cryptocurrency by market capitalization for the first time in 2014.

Ripple was fined in 2015 by U.S. regulatory authorities (specifically FinCEN) for selling virtual currencies without registering with FinCEN, among other reasons. Ripple subsequently paid the fine, properly registered, and installed and implemented the required controls. In 2020, the SEC charged Ripple with conducting an unregistered security offering for the XRP token. This legal battle is still ongoing as of March 2023. Despite the external pressure, the XRPL has persisted: the ledger has been running for over a decade and has processed over 78 million ledgers and 2.6 billion transactions.

Today, Ripple is headed by Brad Garlinghouse, Monica Long, David Schwartz, and others.

Technology

Consensus Mechanism

The XRPL uses a Proof-of-Association (PoA) consensus algorithm – formerly known as Federated Byzantine Consensus Protocol. PoA requires each node to set a list of trusted nodes, which it will rely on for consensus. This list of trusted nodes is known as a unique node list (UNL). A validator cannot rely on financial means alone to be granted access to the consensus process and must first gain trust from other nodes.

Many nodes use one of the default UNLs to set their own trusted nodes. The default UNLs are lists of nodes recommended as trustworthy by the XRPL Foundation, Ripple, and Coil, though a node can choose whatever list of validators they deem to be trustworthy.

Nodes

All nodes on the XRPL, also known as servers, run the same free, open-source software rippled.

Validators are nodes involved in reaching consensus and voting on improvement proposals, also known as amendments. Validators are not given any rewards in PoA. Their main incentive is to support the decentralization of the network, similar to a full node for Ethereum/Bitcoin rather than a validator/miner.

Stock nodes receive, relay, and process transactions. They allow API calls for however much of the ledger history they store. These nodes are typically used by developers that need to reference or broadcast to the network. They do not participate in consensus or voting.

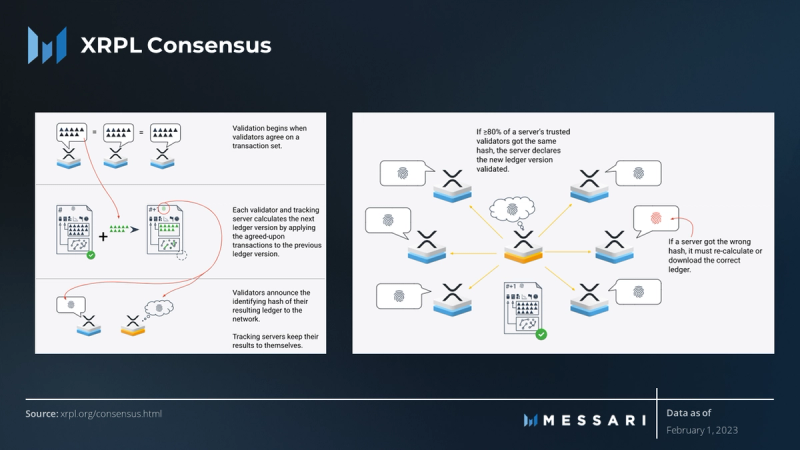

Nodes rely on their UNL to finalize the state. A new block, known as a ledger on the XRPL, is created every 3-5 seconds through this process. The addition of a new ledger happens in two stages: consensus and validation.

Stage 1: Consensus

Consensus ensures that all nodes process the same transactions and ultimately agree on a single ledger comprised of them. The XRPL uses federated consensus. Under this consensus mechanism, no single party proposes or dictates what is valid, unlike many other consensus implementations where a single party is randomly chosen to propose a block of transactions.

Nodes iteratively communicate with each other to agree on the set of candidate transactions to include. Each node adds or removes transactions from its proposal to match the proposals of its UNL. A node that has not gained the trust of other nodes or been added to UNLs has no influence in this system. Any non-Byzantine node that is on the UNL of others will not jeopardize that trust by associating a malicious node.

When a node sees 80% agreement on a proposal, the proposal moves to validation. There can potentially be more than one consensus round occurring at the same time.

Stage 2: Validation

The transactions from the proposal are placed in canonical order and processed individually by each node to create a candidate ledger. From there, the XRPL takes a similar approach to PoW and PoS systems when a proposed block is ready to be validated. If there are multiple consensus rounds happening at the same time, then the results of each round are looking for 80% agreement of the whole network to become the validated ledger.

Only validators can communicate their candidate ledger hashes with each other. Although multiple candidate ledgers can be proposed, only one is accepted to become the new ledger. These hashes may vary due to miscalculations or a high throughput of transactions.

If 80% or more of a node’s UNL shares the same candidate ledger, it is accepted as the new ledger version. Otherwise, the consensus process is repeated. Both consensus and validation require 80% thresholds. During times of high activity, the time between ledgers may increase as the process repeats.

Proof of Association

Advantages of PoA, compared to PoW and Proof-of-Stake (PoS), include:

- Lower hardware requirements that lessen the costs of electricity and overhead, making validators cheaper to run than PoW miners.

- Block production doesn’t directly depend on which actor has the most capital as it does in PoS.

- There are no reorgs (changing a block after its validation).

Additionally, PoA is subject to a few potential downsides.

- PoA’s freedom from high external costs and locked capital means that PoA would not have the same ability to financially punish bad actors.

- Validator connections can be severed, and nodes can be removed from UNLs as retaliation, but there would be no financial repercussions for an attack.

- The XRPL’s implementation of PoA is not as decentralized (in terms of block-producing nodes) as the most popular PoW/PoS chains, which could be due to the absence of a financial incentive to participate.

Issued Currencies

The XRPL has built-in functionality for multiple assets. Issued Currencies, also referred to as IOUs, are on-chain representations of arbitrary currencies, commodities, units, etc. Because the XRPL does not have smart contracts with arbitrary logic, the XRPL uses a trusted third party to issue a currency such as USD or BTC. Similar to USDC/USDT, Issued Currencies hold value because users trust the issuer to make good on their promise to redeem for the original.

This trust system is dissimilar to wBTC and other wrapped tokens in which the trust is placed in a smart contract vault/issuer rather than a company/entity.

Issued Currencies also allow users to deploy fungible and non-fungible tokens on the XRPL. Since the release of XLS-20 in 2022, NFTs have a native unified standard to follow.

Trust Lines are structures for holding tokens that protect accounts from being sent unwanted tokens. Authorized Trust Lines can also allow further gaming at the asset level and enable issuers to choose which wallets can interact with their tokens. Stablecoin issuers such as Circle have had to manually implement compliance solutions due to regulation, so Authorized Trust Lines may become an attractive feature for stablecoin issuers on the XRPL looking to remain compliant with AML/KYC regulations.

Native DEX

The XRPL has a built-in central limit order book. Unlike other networks where DEXs are established using smart contracts, the XRPL’s DEX is native. The native DEX comes with the benefit of fewer trust assumptions and consolidated liquidity, rather than the inherent vulnerabilities of smart contracts.

Gateways are marketplaces that act as user interfaces. They allow users to access the DEX without needing to directly reference the XRPL APIs or libraries. Rather than smart contracts, new gateways are built as front-end integrations to APIs/libraries, and they share liquidity with the existing gateways rather than fragment it.

Pathfinding

Pathfinding, also known as auto-bridging, assists the DEX in matching orders. It determines the most efficient path for a payment, utilizing multiple assets and all orders on the DEX. Pathfinding involves finding lines of liquidity between the sender and recipient to fulfill a transaction across different currencies. This process ensures that even lower-liquidity Issued Currencies can support fast and low-cost payments across currencies.

Pathfinding relies on open orders between currencies. Each order acts as a connection similar to the way that trusted recipients act as a path for funds in payment channels. It also facilitates cross-currency payments.

Accounts

The XRPL has an account-based accounting model. However, accounts on the XRPL differ from those on many other chains. Accounts are flexible in both the number of users they can represent and their hierarchy.

Accounts have two types of keys:

- Master key pairs, which can authorize any transaction and can be disabled but not revoked.

- Regular key pairs, which function almost the same as master key pairs but can also be assigned, updated, or revoked. A key difference here is that regular key pairs cannot disable master key pairs or send key reset transactions.

If all keys are revoked or disabled, including all master keys, an account is rendered inaccessible. This feature could ensure the immutability of an account by using it to issue something on-chain and then publicly revoking all of its keys.

Signer lists are whitelisted key pairs or accounts with the ability to contribute to multi-signed transactions, a native feature for the XRPL that’s only possible through smart contracts on many other networks. A quorum and weighting for each signer must be set for multi-signing, and signer lists cannot be nested. ed25519 and secp256k1 are used for this threshold cryptography. These account management features are similar to some aspects of account abstraction.

Destination tags allow a single account to represent multiple purposes/users. In addition to an account’s address, a destination tag is included as a 32-bit signed integer to differentiate between the total value in an account. If a user doesn’t wish to reference two separate values (account address and destination tag) to send funds, they can instead use the X-address format as a single value.

Businesses and exchanges could use this feature to have a single account receive funds from multiple users. Users could also use destination tags to differentiate between deposits to the same account. This system keeps funds very organized because of its unique portrayal of network usage metrics.

Federated and Private Ledgers

Ripple built a private ledger based on the public XRPL for creating and managing central bank digital currencies (CBDCs) and stablecoins. While there are not yet any CBDCs in production using this platform, many nations are exploring CBDCs in some capacity.

Tokenomics

The XRP token has several use cases on the network.

- Wallet reserves: A set amount of XRP (currently 10 XRP) is required as a deposit to create a new wallet on the ledger. The XRP is released upon wallet destruction.

- Trust Lines: A set amount of XRP (currently 2 XRP) is needed to create a Trust Line.

- Transaction fees: Transaction fees on the XRPL are paid in XRP.

The XRP token has a total supply of 100 billion, created at inception when the Ledger was launched in 2012. Of the original 100 billion XRP, 80 billion was given to Ripple for the company to continue contributing code and services to the Ledger, and 20 billion was given to the three founders with various lockup agreements.

XRP’s circulating supply is subject to inflationary (escrow unlocks) and deflationary (burn mechanism) pressures. Due to these pressures, the circulating supply has had an inflationary rate of ~5.4% since 2021, and the total supply is slightly deflationary, as no more XRP will be created but some will continue to be destroyed by the burn mechanism. The inflation rate of XRP varies depending on how much XRP is distributed by Ripple:

In 2017, Ripple placed 55 billion of its XRP into escrow. The other 25 billion XRP from the initial allocation to Ripple was either distributed, sold, or held onto. Each month, 1 billion XRP is made available to Ripple to use as they see fit. At the start of the next unlock, unspent XRP is placed back into escrow rather than rolling over. This system allows Ripple to use XRP without any risk of flooding the market. It is also the reason for the variation in inflation of circulating supply.

Just over 50 billion XRP are in circulation as of February 2023. With each transaction on the XRPL, some XRP is used as a transaction fee and is destroyed, applying deflationary pressure. Over 10 million XRP have been burned since inception. While the overall supply is deflationary, the circulating supply will remain inflationary until the last XRP are added to circulation via Ripple’s escrows and founders’ distribution.

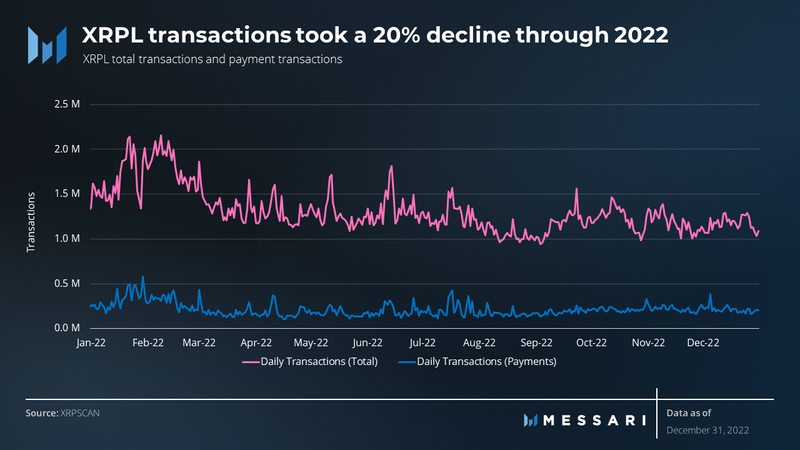

Network Activity

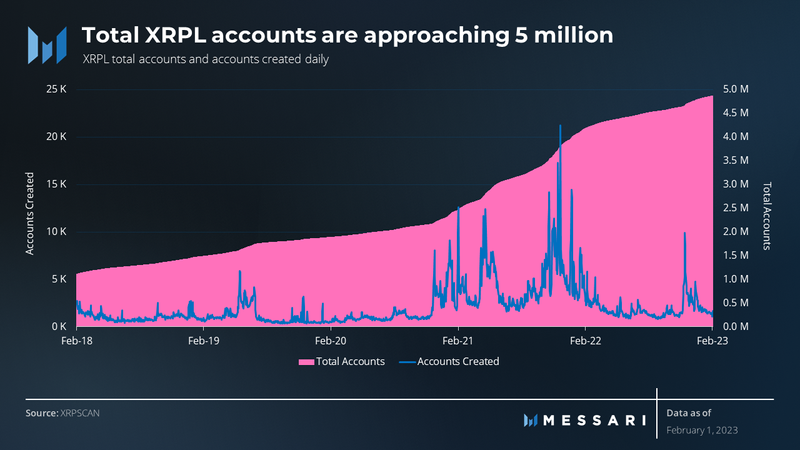

Average daily transactions were down 20% from 1.5 million in Q4 2021 to 1.2 million in Q4 2022. Average daily payments fell 64% in that same time period. Q1 2022 looked healthy, increasing QoQ for both metrics, implying that the late 2022 dips in activity were related to the overall bear market.

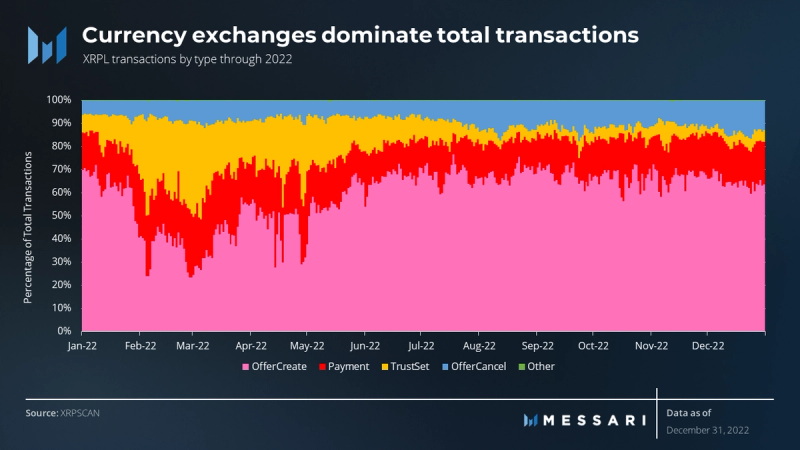

Total transactions is a metric made up of 29 different transaction types, such as payments, escrow creations, and NFT burns.

OfferCreate, which submits an order to exchange currencies, was the most common transaction type through 2022. Payment, a transaction type that actually executes those orders and sends funds to another account, made up a consistent 20-30% of daily transactions.

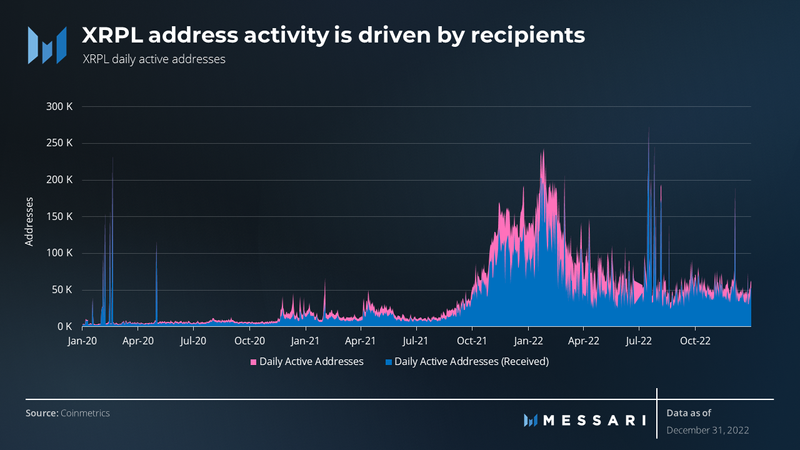

Addresses on the XRPL contain destination tags, skewing the daily active addresses (DAA) metric downward. A centralized exchange (CEX) can use a single address to receive and track XRP deposits for an arbitrary amount of users, but each user would require a unique address to receive other tokens, such as ETH or BTC.

Daily active addresses (received) refers to recipients of transactions. This group was responsible for all major spikes in activity, given that the number of active addresses that sent transactions was more stable. This suggests that activity spikes on the network are generally caused by senders distributing tokens to large groups of otherwise inactive recipients. Exchanges and other custody solutions are likely responsible here, as they would create many active receiving addresses while only counting for a single (or few) active sender addresses.

The Q4 2022 spike in DAA is not seen in daily payments or daily total transactions, but it is seen in accounts created. The spike’s absence from transaction metrics could be due to the relatively large volume of daily payments as well as the FTX collapse.

After FTX collapsed, many users moved their tokens off of CEXs. On CEXs, a single wallet can represent many users differentiated by their destination tags. But once those users self-custody their XRP, every user is represented 1:1 with a wallet and contributes to DAA. The number of accounts created suggests that users moved off of CEXs and into new self-custody accounts in November.

State of the XRPL Ecosystem

Developer Ecosystem

While the XRPL is open-source, core development is primarily contributed by developers from Ripple, the XRPL Foundation, and XRPL Labs. Ripple also facilitates the development of ecosystem services, both directly through its own projects and indirectly by funding ecosystem projects with grants. XRPL Grants was launched in 2021 with 1 billion XRP. So far, it has allocated over $10 million worth of XRP to over 100 projects.

The XRPL does not natively support smart contracts. This design choice aims to increase user safety at the cost of flexibility. NFTs, DEXs, stablecoins, and other programmability are achieved either natively or via external contracts, such as those based on sidechains, Layer-2s, or oracles.

Marketplaces

The XRPL’s native DEX has been running since its inception in 2012 and facilitates all transfers on the network. The XRPL is home to many marketplaces, such as Sologenic, that act as gateways and facilitate access to the native DEX. These marketplaces leverage the DEX and its pathfinding feature for transactions rather than relying on external smart contracts.

Other popular marketplaces include XPMarket, xrp.cafe, and onXRP. Some of these marketplaces include additional services such as fiat conversions and assistance with NFT creation.

AMM

In June 2022, developers from Ripple proposed a standard, XLS-30d for a native automated market maker (AMM) integrated with the native DEX, accessing each other’s liquidity. The proposal is in draft status, and the devnet AMM is live.

The AMM functionality will be native and accessible to developers in the same way the DEX currently is: without the need for smart contracts. The AMM standard aims to distribute arbitrage profits to liquidity providers of AMM instances by auctioning off trading advantages and distributing those profits across liquidity providers. Single-sided liquidity will also be an option. The federated consensus and canonical ordering of transactions in the XRPL’s consensus mechanism remove the possibilities of MEV and frontrunning.

Issued Currencies

Sologenic’s token, SOLO, is the largest Issued Currency on the XRPL by market capitalization at ~$80 million. It also has the most holders with over 200,000. This holder metric is very reliable because Trust Lines prevent users from receiving unapproved tokens, avoiding inflation of metrics via spamming tokens.

Coreum’s CORE is the next largest token with a market capitalization of ~$63 million. SOLO and CORE combined account for nearly 75% dominance of all Issued Currencies.

XPUNKS is the all-time leader in NFT sales volume with 14.2 million XRP in volume. Top collections like XPUNKS and RipplePunks are doing 200-300,000 XRP in monthly volume (almost $100,000 as of March 1, 2023).

Stablecoins

The XRPL is home to many stablecoins, originally called IOUs. USD stablecoins alone account for over $10 million in market capitalization, mainly in the Bitstamp and Gatehub stablecoins. Trading volumes for the Bitstamp and Gatehub USD stablecoins average around $100,000-150,000 per day. Stablecoin volumes for other currencies, such as the euro, are an order of magnitude lower.

Lower liquidity relative to other stablecoin-enabled networks may be responsible for volatility in the tokens. Although the aforementioned USD stablecoins have historically seen price volatility of north of 5% through the years, they’ve generally stabilized since the start of 2022. They are, however, still more volatile than larger stablecoins on other networks, such as USDC or USDT.

Nodes

There are 669 total nodes on the XRPL across six continents, with at least 100 each in North America, Europe, and Asia. Of the ~120 validator nodes, 34 are on Ripple’s default UNL, all run by separate entities. All nodes on the XRPL run the same rippled software, with ~97% of validators running v1.9.4, the latest stable version.

The 30-40 validators on the three default UNLs are the entities with the greatest influence on consensus and amendments due to their presence on so many nodes’ UNLs. Notably, 46 amendments have been passed by voting nodes and applied to the XRPL, most recently in January 2023.

Decentralization of blockchains is expressed through different components including lenses of nodes, block production, geographic distribution, governance, and more. Although the XRPL doesn’t have the same number of block-producing nodes that the most popular PoW/PoS chains have, it has also never suffered a consensus attack. Decentralization is a spectrum, and at some point, there are diminishing returns or even negative effects of increased node/validator counts, such as slowing down consensus.

Sidechains

Peersyst’s EVM sidechain proposal, expected in Q2 2023, will grant the XRPL ecosystem access to EVM developers, a group that makes up over 90% of Web3 developers. The sidechain is being built on the Cosmos SDK, specifically Ethermint, and connects to the XRPL through the XRPL bridge. The devnet is currently live and is creating blocks every ~5 seconds using Tendermint, a PoS consensus mechanism.

The Root Network is a blockchain-based NFT system with a focus on UX and metaverse, run by FLUF World. FLUF World and Ripple announced in 2022 that the Root Network will leverage the XRPL, specifically XRP which will be a native currency. The Root Network:

- Will use XRP as the default gas token.

- Will integrate the XRPL’s XLS-20 NFT standard

- Is being built from a fork of Substrate

- Will have EVM support for smart contracts

- Will use a delegated-Proof-of-Stake (dPoS) consensus mechanism

Ripple developers proposed a standard, XLS-38d, in February 2023 for a cross-chain bridge between the XRPL mainnet and sidechains. Bridges built by this standard will lock tokens on the XRPL to mint a wrapped version on the sidechain and then later burn the wrapped tokens to unlock the original assets on the XRPL. A new node type called a “witness server” will communicate between chains. They are the authorities in this multisig setup. This bridge standard will likely be implemented with Peersyst’s upcoming EVM sidechain.

B2B Services

Ripple leverages the XRPL and XRP to offer two main B2B services:

- On-Demand Liquidity (ODL): A messaging and settlement layer that enables customers (financial institutions, money transmitters, and enterprises) to leverage XRP to bridge two currencies in seconds. Users on each end can send or receive fast, scalable transactions with their own native currencies.

- CBDCs: A solution for central banks to issue digital currencies.

As far as XRPL activity goes, ODL uses XRP as a bridge currency. CBDCs on the other hand involve minting, burning, and transferring unique Issued Currencies on a separate, federated ledger.

The XRPL is being leveraged by Ripple as a tool to provide better payment rails than any existing money transfer service. Incumbent money transfer services such as Western Union and MoneyGram have a strong grip over cross-border payments. However, the XRPL doesn’t exactly need to compete with them.

In fact, many of these “competitors” have integrated or at least explored integrations with the XRPL. MoneyGram partnered with Ripple for two years from 2019 to 2021 using XRP and Western Union partnered with Ripple in 2017 to test out XRP for instant settlement. In other words, the XRPL’s true competition is arguably outdated infrastructure, rather than the financial institutions themselves. Similarly, Ripple hopes that central banks see the XRPL as an effective infrastructure rather than competition.

Roadmap

For more simplistic functionality on the base layer, Hooks is being developed by XRPL Labs to introduce smart contract functionality included in XRPL transactions. Hooks are not Turing complete and will not enable arbitrary logic, but they will allow conditions and triggers to be attached to transactions. The EVM sidechain, in development by Peersyst, is expected in 2023 and marks a new direction for the ecosystem. The EVM sidechain will support computation equivalent to that of smart contract-enabled chains like Ethereum and Solana while Hooks will support logic similar to that of scripts on UTXO chains like Bitcoin and Cardano (pre-smart contracts).

The Root Network, in development by Fluf World, and the XLS-30d AMM standard, in development by Ripple, are both expected to become amendment votes soon, signaling a new direction for the XRPL community. The Root Network shows a focus on NFTs and metaverse, while the AMM standard represents DeFi and increased financial opportunities for liquidity providers. These are functions outside of the purist vision of cross-border, decentralized money, but they have been accepted and pursued by the community nonetheless.

Ripple continues to use the XRPL for its ODL and CBDC products. ODL, Ripple’s main focus for XRPL usage, has expanded from three payout markets in 2018 to nearly 40 today.

XRPL Grants is in its fifth Wave and is still distributing XRP to builders.

Competitive Landscape

There are other cryptocurrency projects with similar goals to the XRPL in terms of settlement and liquidity capabilities, but they ultimately have key differences. For example, Stellar and its XLM token are forked from the XRPL and XRP. But Stellar is primarily focused on providing effective peer-to-peer infrastructure, whereas the XRPL also aims to provide fast, efficient, cross-border payments for institutions such as banks.

Moreover, XLM’s usage is much lower than XRP’s. XLM has a market capitalization and daily trading volume of $2.2 billion and $63 million, respectively, compared to XRP’s $19.4 billion and $1.6 billion, respectively.

Stablecoins on smart contract-enabled networks do compete with XRP, and other XRPL assets, as cross-border payments. USDC and USDT have market capitalizations of $44 billion and $72 billion, respectively. These figures greatly exceed that of XRP or any stablecoins on the XRPL, but just like their native token ETH, they’re subject to high gas fees. Other smart contract-enabled networks such as Solana are not subject to the same fees, but they don’t have as much liquidity in their native tokens or stablecoins.

Smart contract-enabled networks such as Ethereum and Solana do compete with the XRPL in terms of tokenization of assets and overall liquidity even though they may not provide the same fast, energy-efficient settlement advantages.

The XRPL’s use case of facilitating transfers for large institutions has no direct competition in crypto. However, the XRPL’s volumes and activity for stablecoins and NFTs are firmly behind the competition. These numbers may improve once sidechain efforts like the Root Network and the EVM sidechain reach production.

Conclusion

The XRPL’s use cases are being broadened by the XRP community, with a focus on payments, DeFi through XLS-30d, smart contract-like capabilities through Hooks, NFTs through XLS-20, and metaverse via the Root Network. Initiatives such as XRPL Grants ensure that innovation and growth will continue from the community, not just Ripple, the XRPL Foundation, and XRPL Labs. With its evolving capabilities, the XRPL is an attractive option for both crypto-native individuals and traditional financial entities seeking fast, efficient, and secure settlement and liquidity capabilities.