Notable Messari Intel Updates

- The Lido team announced that liquid staking for DOT is now available on Polkadot and Moonbeam. stDOT is a rebasable token similar to stETH with rewards reflected through a daily balance increase.

- On June 1, 2022, block production on Solana Mainnet Beta halted. The chain halt lasted for 4 ½ hours. Block production has since resumed following a restart.

- Offchain Labs has released Arbitrum v1.4.1. This release fixes an issue with block tracing that caused some skipped transactions, improves error handling in the broadcaster, and ensures the validator won’t boot without a smart contract wallet.

- According to the Block, Mirror Protocol has suffered a $2 million exploit, with the pools for mBTC, mETH, mDOT, and mGLXY having been drained. The exploit occurred via a bug in the pricing oracle, which is incorrectly telling the system that Luna Classic (LUNC) is worth around 5 UST when its actual value is a fraction of a cent.

- Kava Labs has shared Kava V0.17.4, an EVM Co-Chain patch release, which contains an asynchronous software upgrade at block 138,592, expected to arrive on June 4, 2022. Validators should upgrade their nodes before the activation block height. This release updates the default account type from EthAccount to BaseAccount, which was the behavior before the V0.17 series.

Notable Messari Governor Updates

- The Merit Circle DAO succeeded in passing a proposal that aims to remove YGG and Gabby Dizon’s seed tokens for Merit Circle by refunding YGG’s $175,000 USDC investment and returning their locked Merit Circle seed tokens to the Merit Circle DAO. This would cancel their SAFT investment. The motivation for this proposal is due to the perceived lack of value that YGG and Gabby Dizon have provided as seed investors. The Merit Circle team told the community and the DAO that they were selecting seed investors based on the value they could bring to Merit Circle.

- The Stargate Finance DAO has submitted a proposal that aims to amend SIP 3. Optimism deemed the Bonding Auction an ineligible option for Stargate to distribute tokens. The following changes to SIP 3 are:

-700,000 OP tokens for liquidity mining, an increase of the previously requested 400,000 OP.

-300,000 OP tokens for partner integrations, an increase of the previously requested 100,000 OP.

-Both OP token distributions will happen over six months. Voting is currently active. - The SuperRare DAO has submitted a proposal that aims to allocate 5 million RARE towards a funding pool dedicated to product development bounties. Once approved, SuperRare Labs will adopt a Request for Proposal (RFP) process where developers can apply for bounties. The first bounty will address the replacement of the Token Race product (provided by Mirror Labs) that is being sunset in Q2 2022. Voting is currently active.

- The Klima DAO succeeded in passing a proposal that aims to reserve $1,500,000 of Klima DAO’s USDC treasury for payroll funding and extend the development runway. It is proposed that contributors be paid with USDC and KLIMA. The core team will decide the exact ratio of USDC and KLIMA payments and will start at a 50:50 split. With the current runway at four months, it is expected that this change will extend this runway to eight months.

- The Friends With Benefits DAO has submitted a proposal that aims to approve a partnership between Hennessy to launch the Cafe 11 NFT project. The project grants in-person events called Cafe 11 in LA and NYC in October 2022 and 1,765 Cafe 11 NFTs will be sold at $450 (transacted in ETH), and 257 Cafe 11 NFTs will be allocated for the FWB community free for mint.

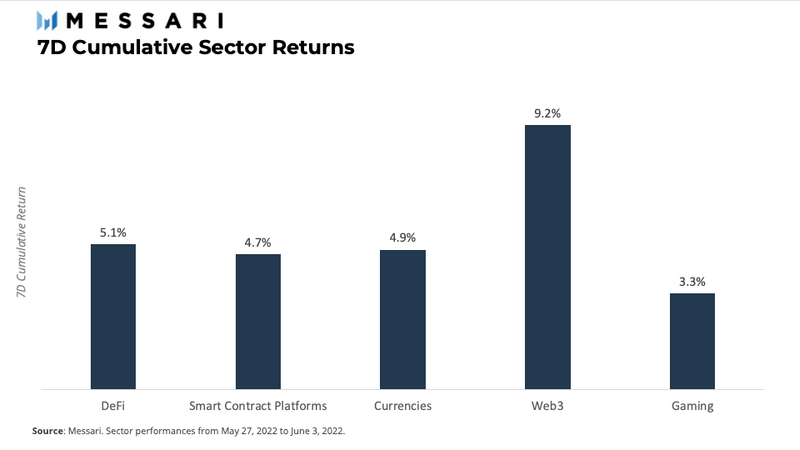

Sector Returns

This week saw a complete trend reversal in the crypto markets from what was seen in the previous week. Last week’s losses have been recovered for the most part when seen at the sector level. Web3 had two of the best-performing assets this week, which boosted its overall sector performance and catapulted it to the first spot with a 9.18% return. DeFi was the second best performing category with a 5.06% return, while smart contract platforms followed closely with a 4.7% gain.

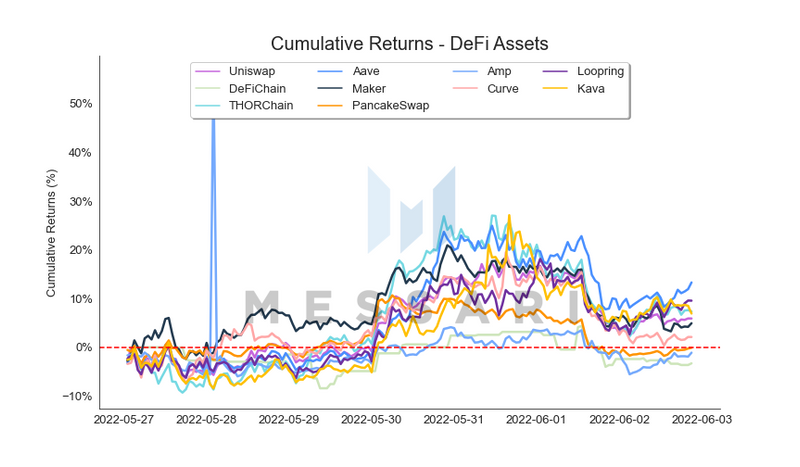

DeFi Assets

DeFi assets traded with fairly high unison, as a calmer environment coupled with a lack of catalyst events among the top assets graced the sector this week. Aave was the sector leader this week and the only top DeFi asset that returned double-digit gains. The decentralized money market protocol’s token, AAVE, finished the week with a 13.3% gain. Next up was Loopring (LRC), posting a 9.6% return and THORChain securing third with 7.4%. Revisiting DeFi TVL, total value locked on DeFi seemingly fell off a cliff following the recent massive declines in the markets. It currently sits at the $85.6 billion level, previously seen exactly a year ago.

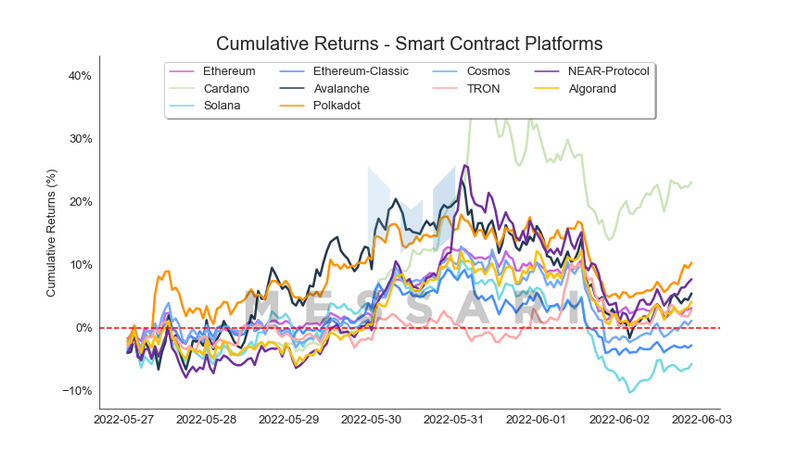

Smart Contract Platforms

Cardano and Polkadot led gains this week within the smart contract platforms sector. The two Layer-1 platforms’ native tokens were the only top assets within the sector to secure double-digit returns. ADA took the first spot with 23.1% while DOT followed with a return of 10.3%. Towards the end of the week, the markets took a tumble, leaving some assets with the possibility of ending the week underwater. Two of the four assets were able to regain lost territory, but ETC and SOL lagged behind. They ended the week with -2.8% and -5.7% returns, respectively.

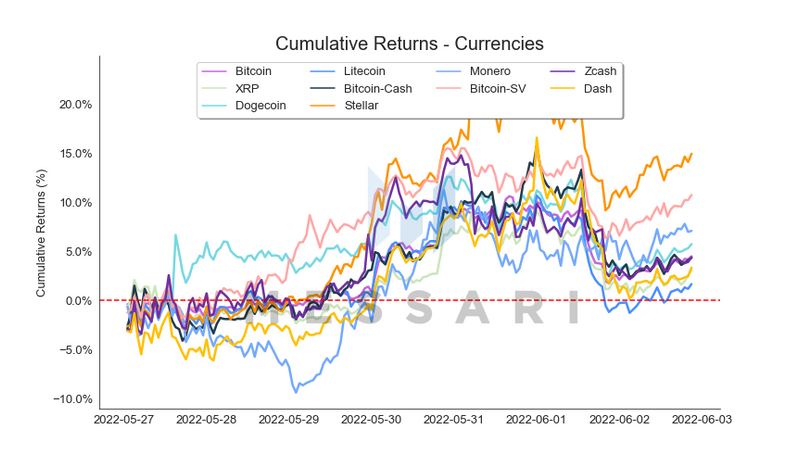

Currencies

Similar to the smart contract platform sector, currencies also had two assets lead the group with double-digit gains, albeit with slightly more conservative returns. Currencies was also the only sector covered that had no top assets end the week in the red. Stellar (XLM) was the best performer among the pack, securing a 15.0% return while Bitcoin SV (BSV) followed with a 10.8% gain. Monero (XMR) took the third spot, returning 7.1% on the week.

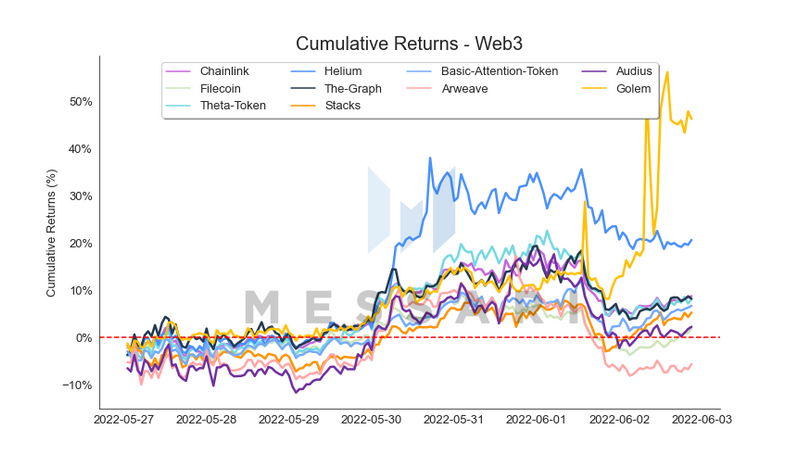

Web3

Top Web3 assets traded with high correlation for the entire week with the exception of two outperformers: Golem and Helium. The broader Web3 sector benefited from the performance of the two as they carried the sector to first place on the leaderboard this week. Golem (GNT) made its way up to the top 10 Web3 assets list following more than a 60% rally this week. The decentralized computation network’s native token has since given back a good amount of those gains, but it was still enough to secure its spot as the best-performing top asset of the week with a 46.2% return on the week. Helium (HNT) was the second best performer, posting a 20.7% gain.

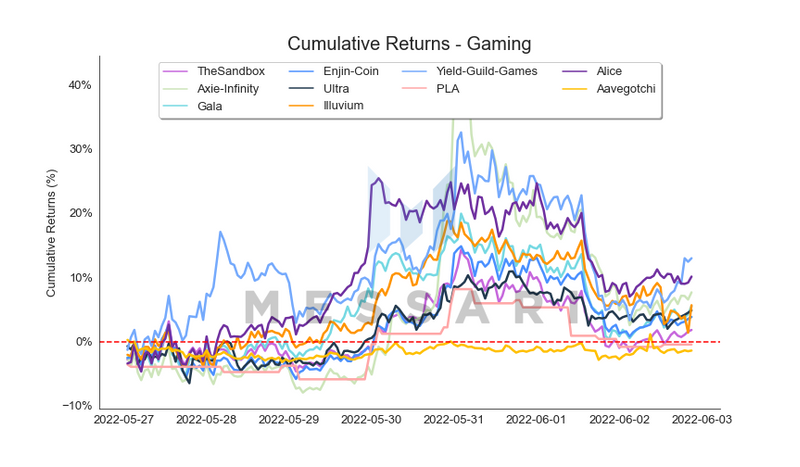

Gaming

Gaming had a substantial rally towards the middle of the week that saw some of its assets visit over 40% gains territory. However, the rally was short-lived and left a trend line resembling that of a bell curve. Yield Guild Games (YGG) led the pack this week with a return of 13.0%, followed by Alice (ALICE) which posted a return of 10.1%. Axie Infinity (AXS) took the third position, securing a 7.7% return.