Notable Messari Intel Updates

- Terra will be launched on THORChain this week following the upcoming hardfork. The node launcher for terra-daemon has been merged on chaosnet, and node operators should begin syncing their chain daemons now in anticipation for chaosnet’s launch.

- Ava Labs has shared details about Core; a free, non-custodial wallet explicitly created for applications on Avalanche with native support for Subnets. The first iteration of Core will be a browser extension that is expected to be released at the end of March 2022. A Core mobile application is expected to be released in early Q2 of 2022.

- Electric Coin Co. has announced that they have delayed the NU5 upgrade until mid to late May. During testing, the ECC core team found a consensus bug that caused the testnet chain to fork. A fix has been implemented and will be included in the upcoming Zcashd release 4.7.0.

- THORChain halted at block 4,786,559 to perform the scheduled hard fork. More info can be found here on the events that happened during the hard fork.

Notable Messari Governor Updates

- The Cream DAO succeeded in passing a proposal that aims to end an ongoing bounty payment of 2,576.25 ETH to whitehat hackers that helped recover funds exploited from Cream platform in August 2021. The remaining ETH from the bounty payment will be used to compensate depositors impacted by losses from the platform in another exploit in October 2021.

- The Quickswap DAO succeeded in passing a proposal supporting a QUICK token split; the winning outcome came in favor of a 1:1000 split.

- The ApeCoin DAO submitted a proposal that aims to establish the ApeCoin DAO’s governance process and outlines the DAO’s values and mission. ApeCoin DAO will be governed by ApeCoin tokenholders who are able to both submit and vote on APE Improvement Proposals (AIPs). The submission process will be administered by a special counsel within the Ape Foundation called the “Board”. The Board will be composed of DAO members as elected on an annual basis. Voting is currently active.

- The Bancor DAO submitted a proposal that aims to assess sentiments about decreasing the vBNT pool fee from 1.5% to 1.0%. The proposal follows community members’ concerns about the vBNT pool performance after the fee was initially increased from 0.75% to 1.5%.

- The Sushi DAO submitted a proposal that aims to implement an Omnichain native asset bridge into Sushi, called Stargate, that is built on top of LayerZero and allows for token swaps across chains. Stargate allows for streamlined transfer of funds across chains and implements UX improvements over traditional bridges. For example, Stargate can take some of the users’ native source gas, and drop some native gas to the user on the destination chain eliminating the need for gas faucets. Stargate on Sushi will support 7 networks on launch: Ethereum, Polygon, Avalanche, BSC, Fantom, Arbitrum, and Optimism

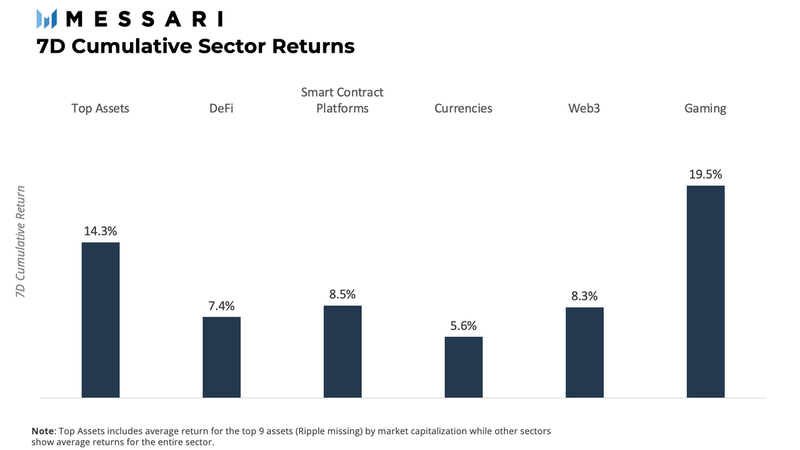

Sector Returns

The month-long pattern of weekly trend reversals seems to have been broken. This week marks two consecutive weeks where all sectors covered have finished in green territory. The gaming sector has seen some solid performance over the past two weeks, finishing top second last week and now leading the pack with a 19.51% return. Top assets by market capitalization were next up, gaining 14.28% on the week. The rest of the sectors covered brought in single-digit returns ranging from 8.49% for smart contract platforms to 5.61% for currencies.

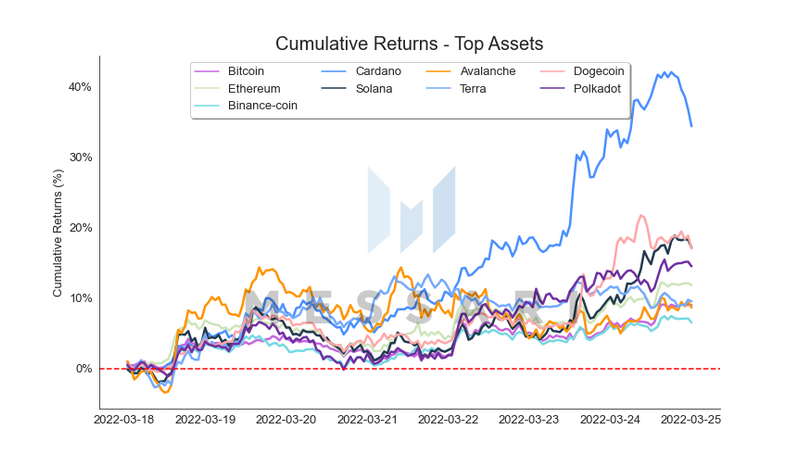

Top Assets

After some time out of the spotlight, Cardano (ADA) is back. This time leading the group by a large margin and securing a 34.4% gain on the week. Catalysts behind the alternate Layer-1 asset’s recent performance could be related to the token making up the largest percentage within Grayscale’s “Smart Contract Platform ex Ethereum Fund” and Coinbase recently announcing support for ADA staking. All other assets within the category ended the week with positive returns. Solana (SOL) took the second spot, returning 17.2%, followed by Dogecoin (DOGE) with 17.0%, Polkadot (DOT) with 14.5%, and Ethereum (ETH) with 11.8% amongst the double-digit gainers.

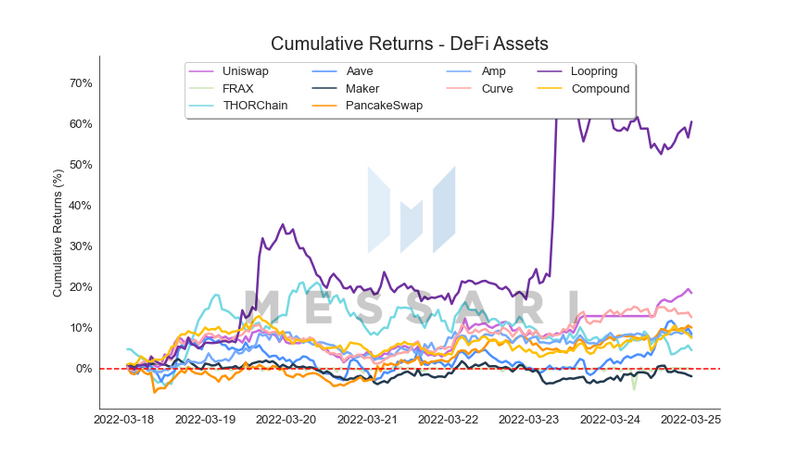

DeFi Assets

Loopring has rocketed to the number one position this week within the top ten DeFi assets category after news of its integration with GameStop for their upcoming NFT marketplace. Through this partnership, GameStop will build their NFT marketplace on top of the Loopring L2, a scaling solution that will enable users to mint and trade NFTs at a fraction of the cost of transacting through the Ethereum mainnet, whilst inheriting its security. Other notable performers within the top DeFi assets by market capitalization were Uniswap (UNI) which returned 18.5%, Curve (CRV) with 12.6%, and PancakeSwap (CAKE) with 10.1%.

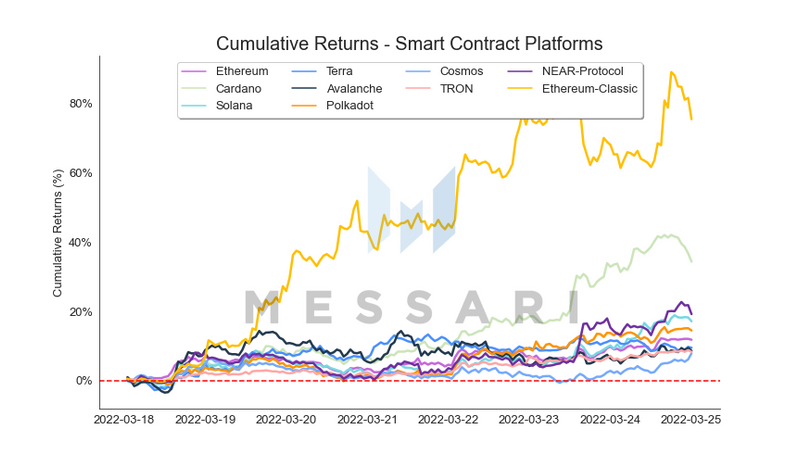

Smart Contract Platforms

Ethereum Classic (ETC) has secured its spot as the best performing asset within the top 100 assets by market capitalization this week. The Ethereum Classic blockchain’s ETC token saw its price increase by 75.5% on the week, driven around speculation that current ETH miners will embrace ETC mining after the upcoming Ethereum merge. Among the other smart contract platform assets with double-digit returns were Cardano (ADA) returning 34.4%, NEAR Protocol (NEAR) with 19.2%, Solana (SOL) with 17.2%, Polkadot (DOT) with 14.5%, and Ethereum with 11.8%.

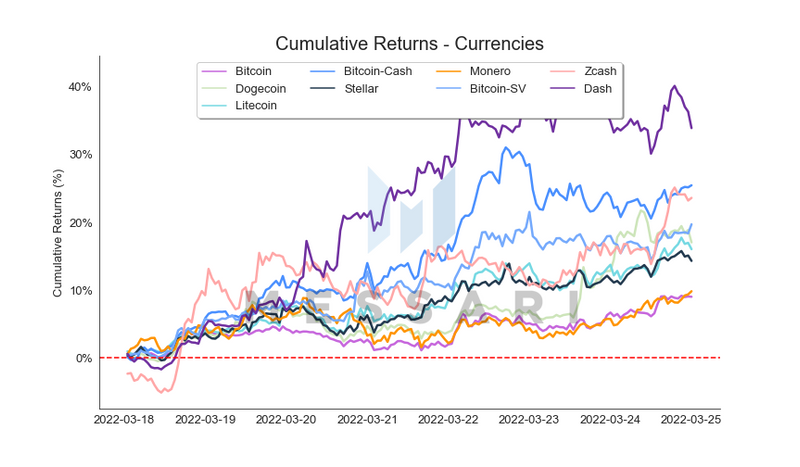

Currencies

The currencies sector had an impressive week, with 7 of its top 10 assets posting double-digit gains. Leading the sector was Dash (DASH) with a 33.9% return. The Bitcoin fork token broke off from the pack early during the week and was able to continue its upwards trend while the rest of the assets in the category flattened out. Bitcoin Cash (BCH) secured the second position with a 25.5% return, and Zcash (ZEC) trailed closely, taking third place with a 23.6% gain.

Web3

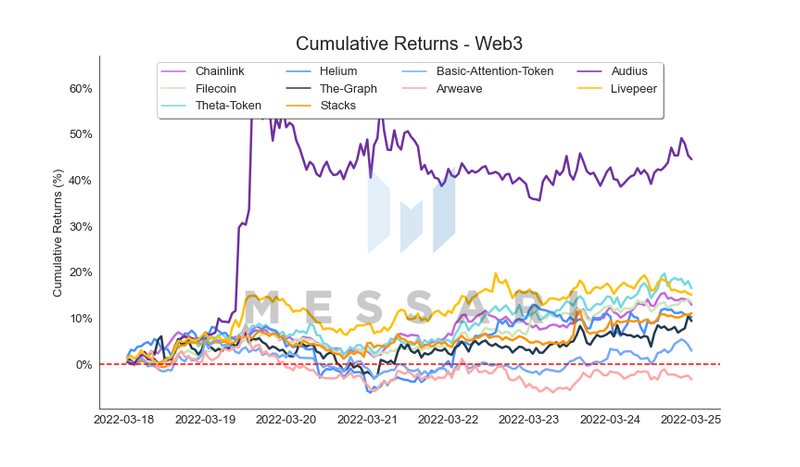

Web3’s outperformer this week was Audius (AUDIO). The decentralized music streaming protocol’s token had a significant jump in price on the 19th which was able to maintain until the end of the week, allowing it to easily secure the first spot at a 44.6% gain. Next up were Theta (THETA) with a 16.5% return and Livepeer posting a 15.1% gain.

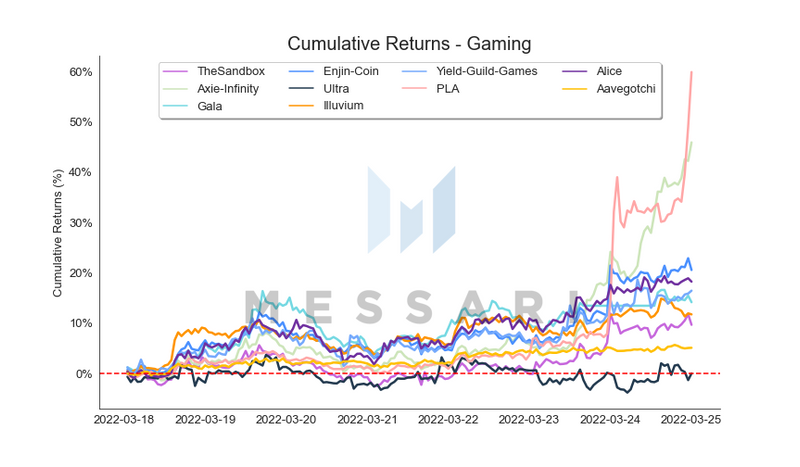

Gaming

PLA (PLA) did not seem poised to have a breakout week as it traded well within the pack for most of the time. The same can be said about Axie Infinity (AXS); however, these two tokens saw their price surge substantially within the last two days of the week. PLA led the sector this week as it secured a 59.9% gain, while Axie followed with a 46.0% return. Enjin (ENJ) was the third-best performer, bringing in 20.6%.