Key Insights

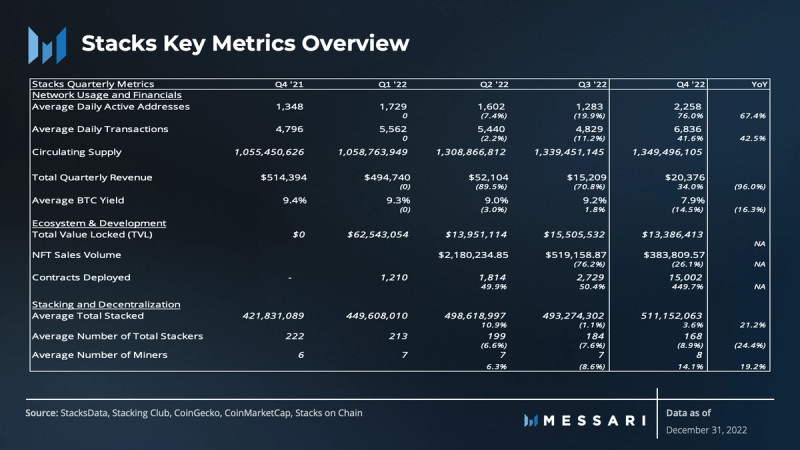

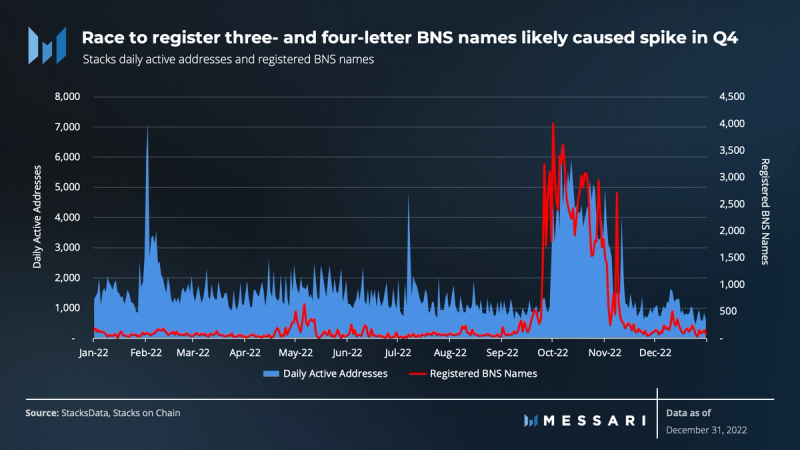

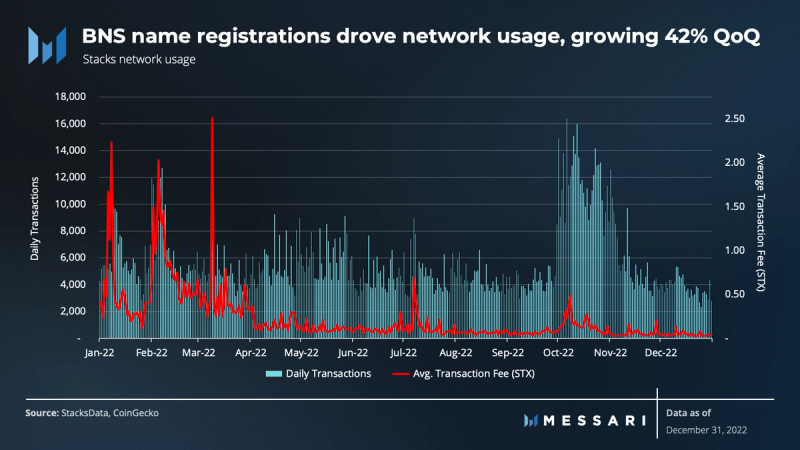

- Stacks network usage metrics, defined by average daily active users and addresses, increased by 76% and 42%, respectively, in Q4’22.

- The surge in BNS registrations (.BTC addresses) during the quarter was the primary catalyst driving network usage to Stacks. It resulted in over 97,000 new BNS names in Q4, representing approximately 70% of total BNS registrations in 2022.

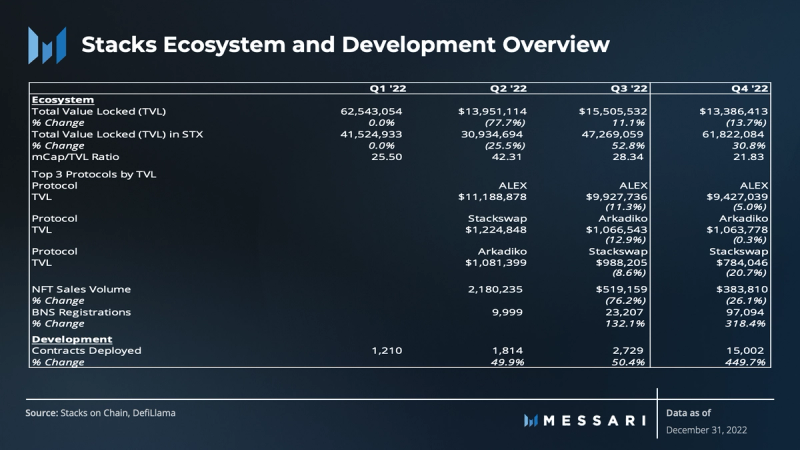

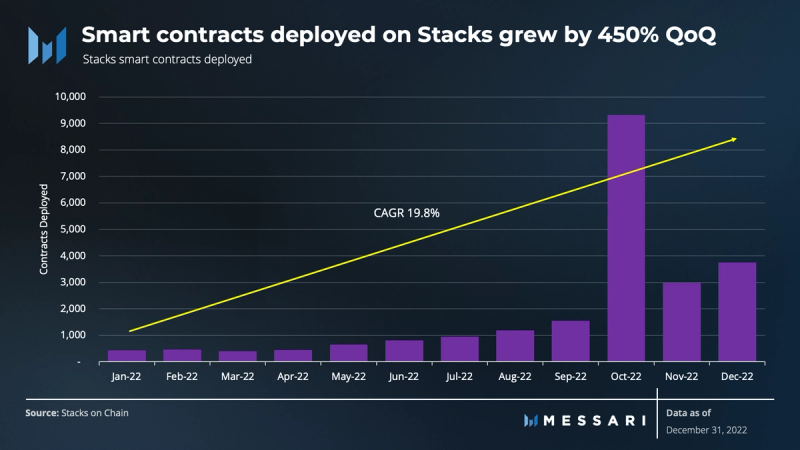

- Smart contracts deployed had strong momentum in 2022 with a compound annual growth rate (CAGR) of 19.8%.

- On December 16, the Stacks 2.1 upgrade was approved, queuing up several upgrades. These changes will go into effect in Q1 2023.

- New Stacks whitepapers published in Q4 revealed sBTC, a “trust-minimized” two-way bitcoin peg. This would enable Bitcoin capital inflow from Bitcoin L1 to contracts on the Stacks layer and enable smart contracts to programmatically write to Bitcoin L1.

Primer on Stacks

Stacks is a Bitcoin layer that utilizes a novel consensus mechanism, Proof-of-Transfer (PoX). Instead of miners burning BTC as a proxy for computing resources, miners commit BTC to eligible Stacks addresses that participate in consensus. PoX runs parallel to Bitcoin’s Proof-of-Work (PoW) consensus, using it as a settlement layer. Metadata from newly mined Stacks blocks are anchored to every Bitcoin block, allowing users to verify the canonical Stacks chain via Bitcoin blocks.

Stacking launched as part of the Stacks Mainnet launch in January 2021. Stacks miners commit BTC in exchange for a chance to mine a Stacks block. Miners who produce new blocks are rewarded with STX block rewards (newly minted STX) and STX fees, whereas eligible Stackers receive yield denominated in BTC.

Key Metrics

Performance Analysis

Network and Financial Overview

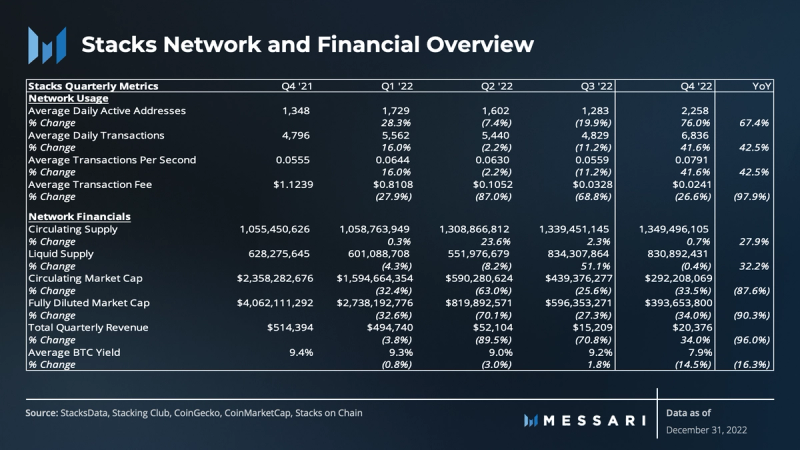

The Stacks blockchain experienced growth in various key metrics in the face of adverse macroeconomic factors and FTX’s collapse in Q4. Despite the continued shift in market sentiment, Stacks’ average daily active user base grew by 76% quarter-over-quarter (QoQ), driving nearly 600,000 transactions in the quarter.

The increase in users is strongly correlated to the growth in BNS names. The registration of BNS names grew by 318% QoQ from 23,000 to 97,000. Approximately 71% of these registrations in 2022 occurred in Q4.

Currently, a Stacks address can only support one registered BNS name, resulting in the creation of new addresses to secure more BNS names. Similar to Ethereum Name Service (ENS), the race to register three- and four-letter names likely caused a significant spike in both active addresses and registered names in Q4. Now that all these names have been claimed, BNS activity will likely be more reflective of its fundamentals going forward.

Average daily transactions grew significantly QoQ and year-over-year (YoY), with an increase of 42% and 43%, respectively. The demand for blockspace increased in October as thousands of registered BNS names were minted, contributing to a surge in average transaction fees. However, the average transaction fees in USD terms decreased by 27% QoQ and were down 98% YoY, due to the STX’s drop in value relative to the dollar.

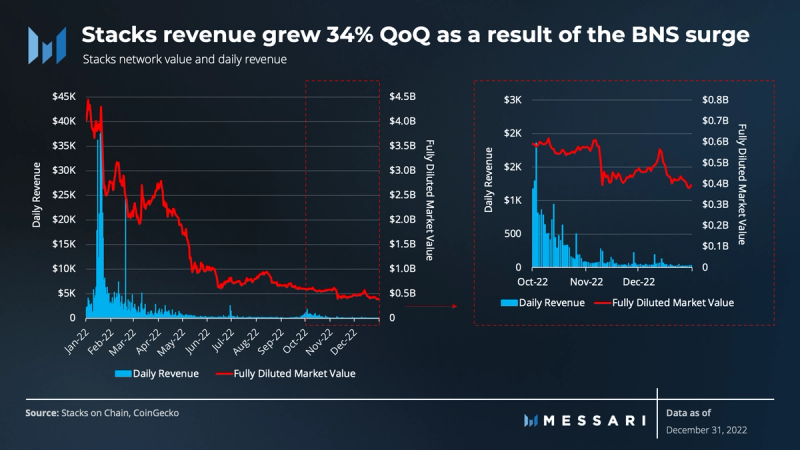

The Stacks’ fully diluted valuation (FDV) fell (-34% QoQ) from $596 million to $393 million in Q4 and has since fallen by 90% YoY. However, quarterly revenue in USD grew from $15,000 to $20,000, or 34% QoQ, but it was down 96% YoY. The growth in revenue despite declining FDV in Q4 signals an increase in network usage during the period, evidenced by the BNS registrations.

Ecosystem and Development Overview

Stacks is still a very young chain, with only a fraction of applications compared to other ecosystems. Across the broader DeFi ecosystem, Stacks represents less than 1% of the total value locked (TVL). Stacks applications are built using Clarity, its smart contract language.

Clarity is a human-readable and interpreted language optimized for security and predictability. It allows users to know where a code will terminate before executing it, thus removing additional attack vectors that have been exploited in other popular smart contract languages. Because of Stacks’ unique smart contract language, it may take some time before developers can build enough apps to rival other ecosystems.

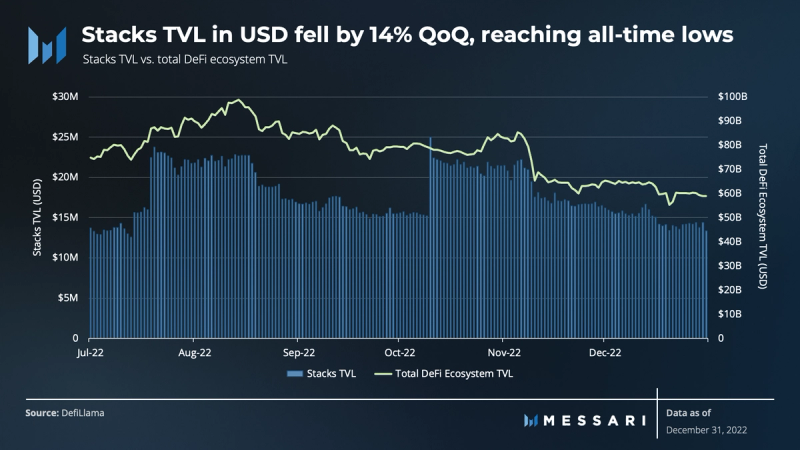

Unlike the broader DeFi ecosystem, the Stacks ecosystem was relatively stable in Q4. Although it reached its lowest in TVL during the quarter, the Stacks ecosystem TVL only fell by 14%, while the broader DeFi ecosystem TVL fell by 26%.

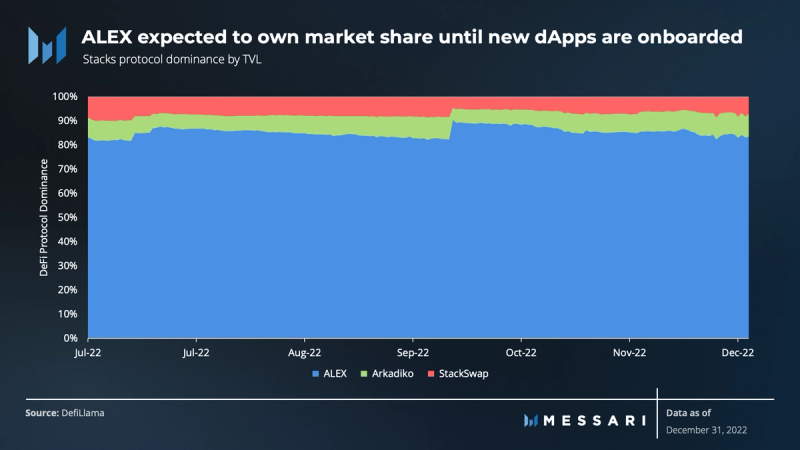

ALEX, a full-service DeFi protocol launched on Stacks earlier this year, has dominated TVL. Stackswap’s 21% decline in TVL QoQ amplified this trend. Stackswap is the first DEX built on Stacks, which leverages liquidity pools, yield farming, and staking. ALEX’s dominance in market share could present ecosystem risk to Stacks, which is expected given the limited applications at the moment. As more applications are onboarded and attract more users, a healthier distribution of protocol market share should develop.

Additionally, Arkadiko’s change in TVL was muted (-0.3%) QoQ. Arkadiko is one of the first major DeFi applications to allow users to access self-repaying loans and functions as a decentralized exchange (DEX).

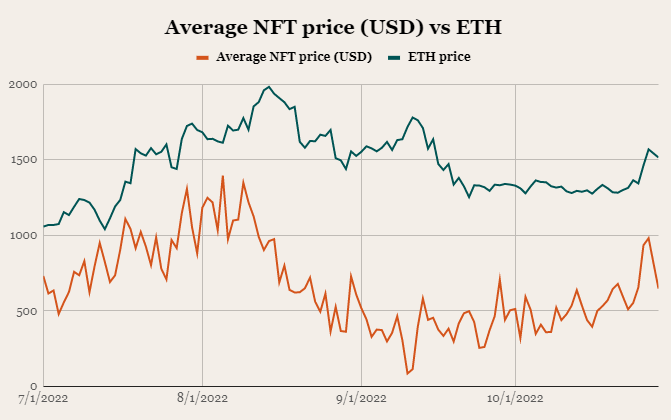

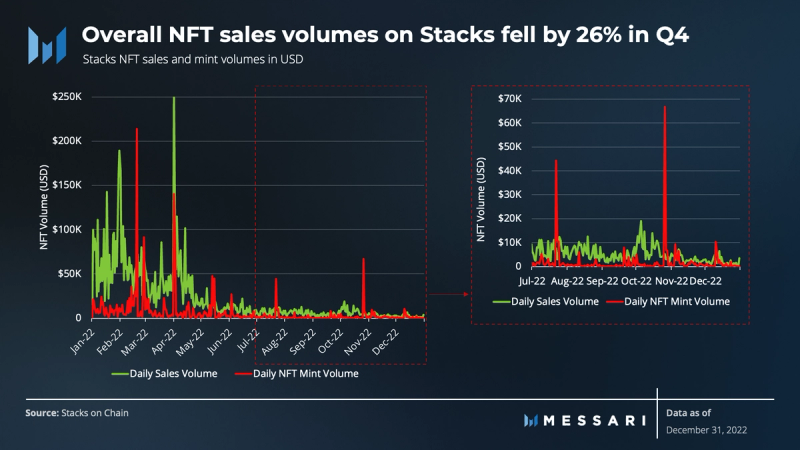

The average quarterly NFT sales volume in 2022 was $2.1 million. However, volumes fell to their lowest at $384 million in sales in Q4. In native terms, quarterly NFT sales volumes grew (4%) to 1.3 million STX. The total minting volume in both native STX and USD terms increased by 53% and 69%, respectively, during the same period. There were over 4,000 NFT minters in Q4, up 10% from 3,600 in the prior quarter. Despite an increase in minters, overall NFT mints were down by nearly 50% in Q4.

Builders rely on using the expressive smart contract language, Clarity, to develop applications in the Stacks ecosystem. According to Electric Capital’s 2022 developer report, Stacks was a top 30 project for developer activity. Additionally, the continuous growth in contracts deployed remains a healthy indicator of building and usage of the Stacks ecosystem. The compound annual growth rate (CAGR) of smart contracts deployed in 2022 was 19.8%.

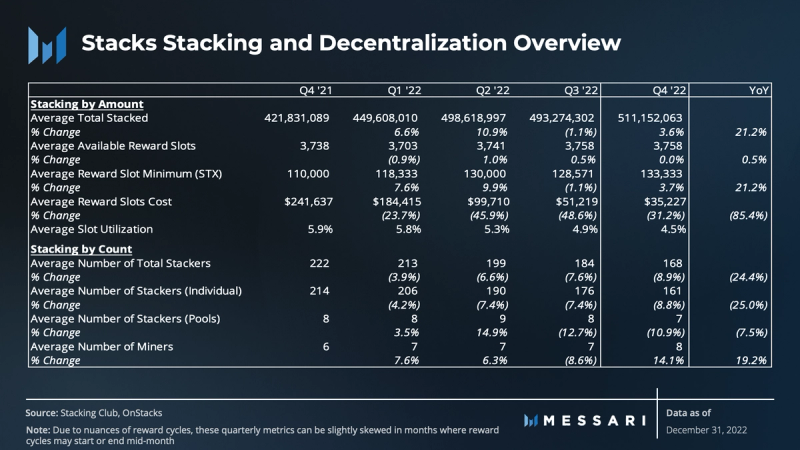

Stacking and Decentralization Overview

Technical Primer

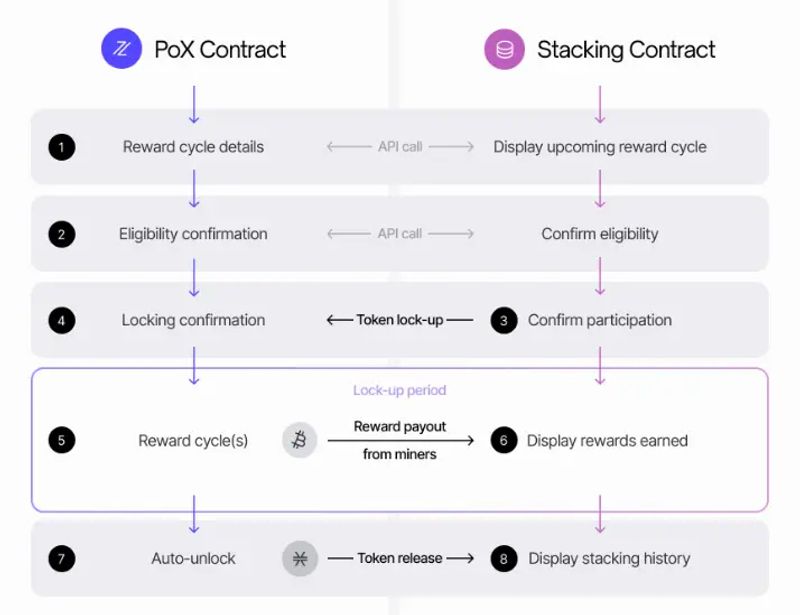

Before diving into the Stacking and Decentralization metrics, it is essential to bring more context to the underlying mechanics, nuances, and relationships of PoX. As mentioned in the Primer, there are two key participants in the PoX consensus mechanism: Stacks miners and Stackers.

Source: Stacks.co

PoX occurs over reward cycles in the Prepare and Reward phases. The Prepare phase identifies a new reward cycle and takes a snapshot of Stackers, confirming their eligibility. Then in the Reward phase, this snapshot is used to determine which Stackers will be included in the reward cycle, and all confirmed Stacker addresses are then broadcasted to active miners.

Following the snapshot, active miners must commit an equal amount of bitcoin to two Stackers’ addresses for every block. These addresses are chosen randomly using a verifiable random function (VRF).

The miners’ minimum recommended commitment is 11,000 satoshis (0.00011 BTC), or 5,500 satoshis per Stacker address. Miners can increase their odds of winning by making larger commitments. After all active miners broadcast their commitments, a VRF randomly chooses a miner for each block.

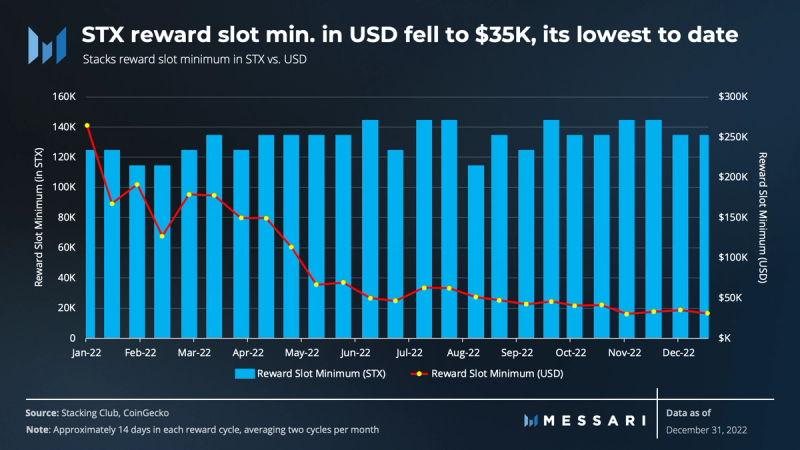

Each reward cycle spans approximately 2,000 Bitcoin blocks (~14 days) and 4,000 reward slots. Reward slots are filled by confirmed Stackers who have met the minimum requirement. For example, if a confirmed Stacker locks up the minimum 150,000 STX, they get one reward slot. Any unused reward slots during a reward cycle are filled with burn addresses.

The Stacks consensus mechanism attracts participants by generating BTC yield. Yields are based on the reward cycle as a whole and not on individuals or pools. Although participation does not guarantee rewards, roughly 95% of reward slots do see rewards.

After a miner produces a block, BTC rewards are released to either of the two Stackers’ addresses. If either address were a burn address, BTC would be burned. Miners only receive newly minted STX tokens and accrued STX fees (released after 100 blocks) after releasing the BTC to Stackers. The active miner who produces a block is rewarded accordingly. Conversely, every active miner who loses a block forfeits their BTC commit for that block.

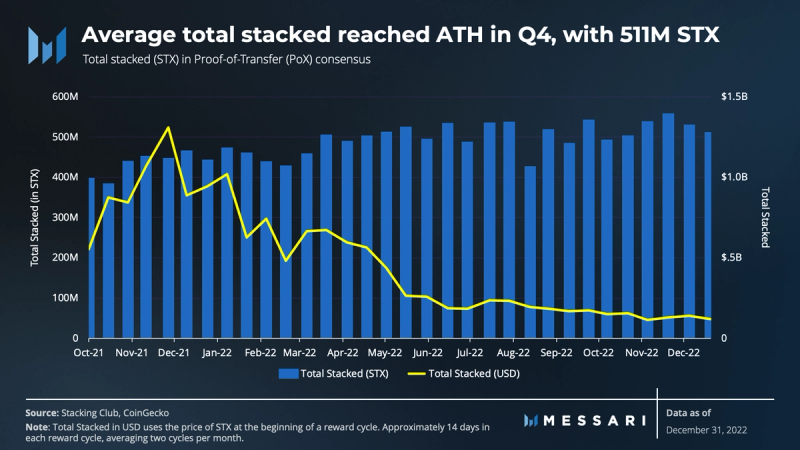

The total value of STX locked in PoX consensus in USD terms declined, reaching new lows in Q4. However, the average amount of total stacked STX reached new heights, hitting 511 million STX in Q4, an increase of 3.6% QoQ. Granted, in USD dollar terms, the total value Stacked fell by 31% from $196 million to $135 million during the same period. Stackers clearly remain committed to participating in Stacks consensus, signaling market demand for BTC yield-generating products.

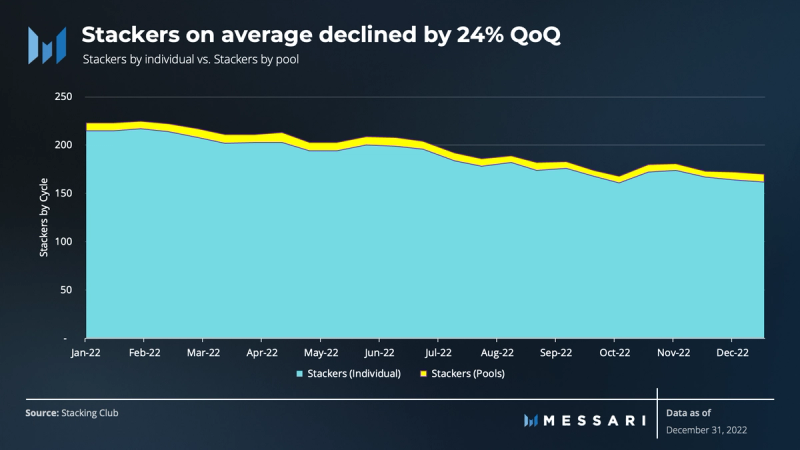

The total number of Stackers fell to its lowest in 2022, reaching 168 Stackers, a 9% decline QoQ and a 24% decline YoY. By the end of Q4, there were, on average, 161 individual Stackers and 7 Stacker Pools. Despite the decrease in individual and pool Stackers, the average total stacked grew, implying Stackers are continuously adding to their stacked STX.

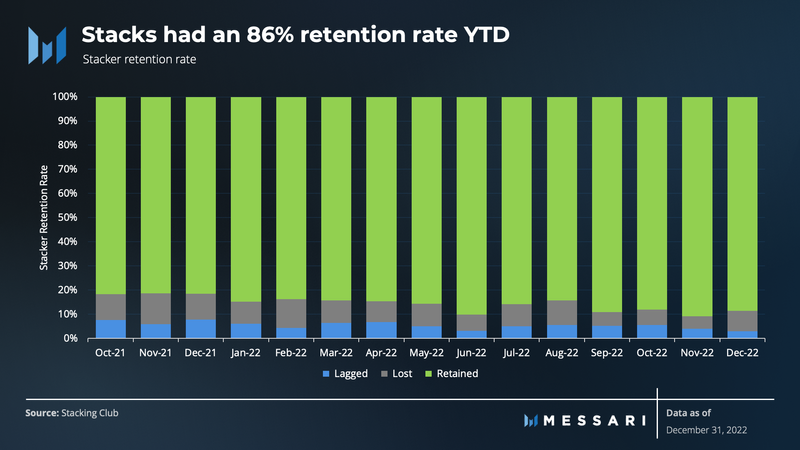

In 2022, on average, 86% of Stackers had continuous participation in consensus locking up STX. The upcoming continuous stacking feature, as part of the 2.1 network upgrade, clearly aligns with many existing participants and removes friction in participating in multiple reward cycles. Lagged Stackers (Stackers who missed a cycle) are a result of users who lost interest, could not fulfill the minimum stacking requirement, or did not participate in the following reward cycle. Data suggests that, on average, 5% of Stackers in 2022 lagged and eventually participated in an upcoming cycle. On the other hand, lost Stackers are eligible users who participated in only one reward cycle during the year. They account for roughly 9% of overall Stackers.

The retention of Stackers in consensus becomes especially important with the rollout of the sBTC two-way peg, at which point Stackers will inherit a new set of responsibilities, discussed later in the report.

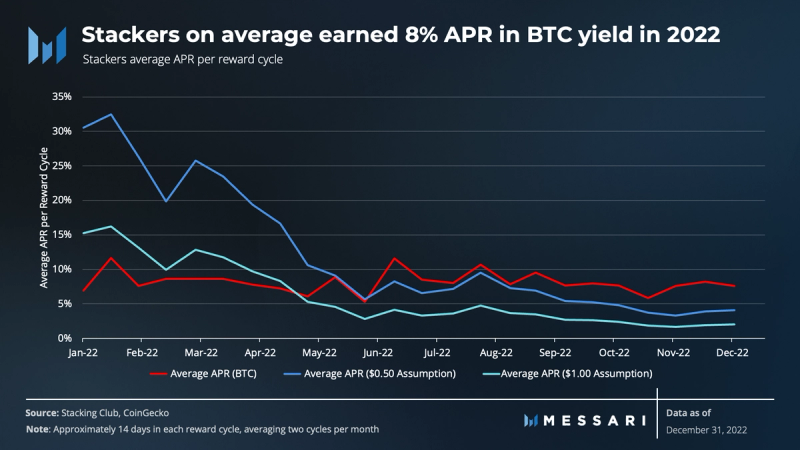

In Q4, the average annual percentage rate (APR) in BTC yield to Stackers was 7.5%, a decrease from 9.1% in Q3. This yield assumption is based on the price of STX at the beginning of a reward cycle and the price of the BTC rewarded at the end of that cycle. The 7.5% yields assume that the cost to secure a slot at the beginning of each reward cycle is the cost basis for a reward slot. Approximately 86% of Stackers have locked their assets for continuous cycles which implies a variable cost in accumulating STX, and Stackers’ APR may vary greatly from the average APR in Q4. Overall, the amount of bitcoin paid out to Stackers on average yielded 8% in 2022.

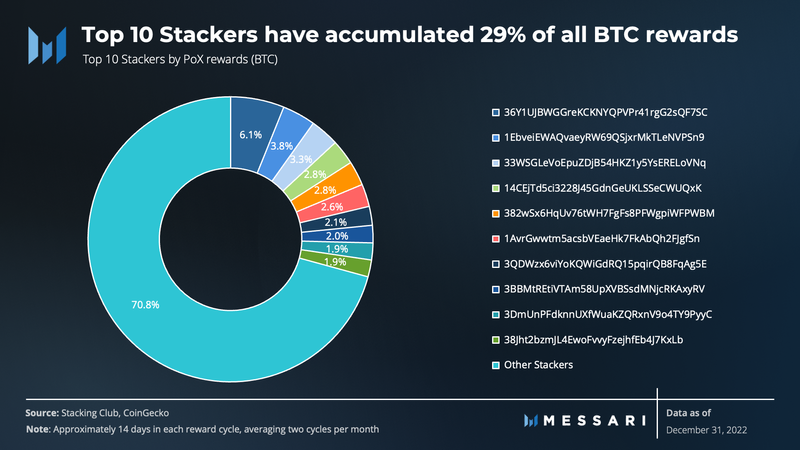

There have been over 1,200 unique Stackers competing for BTC rewards across 49 cycles. When ranking unique addresses that received PoX block rewards, or BTC yield, data shows that the top 10 Stackers accumulated 621 BTC, or 29% of all BTC rewards since the first reward cycle.

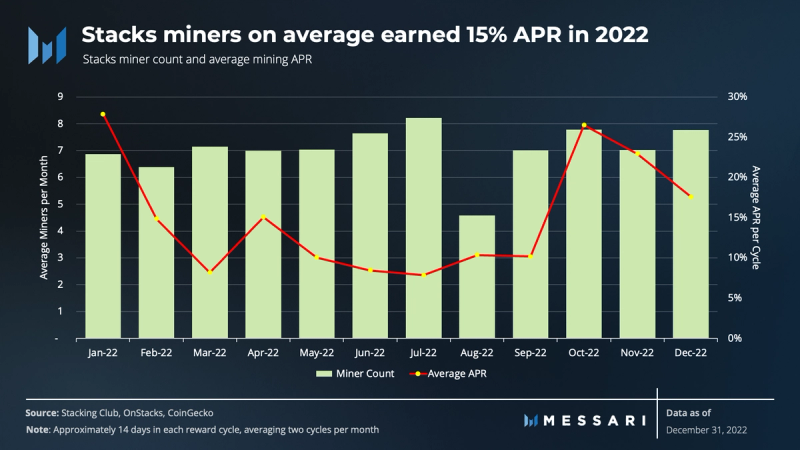

The average number of Stacks miners grew by 14% QoQ, growing to approximately 7.5 miners from 6.6 miners in Q3. The average APR for active miners in Q4 was approximately 22%, up substantially from 9.5%. The APRs are calculated using the daily price of STX and BTC, corresponding with daily BTC commits, STX block rewards issuances, and STX fees. STX fees generated during a reward cycle are also included since miners are entitled to these fees. Notably, fees paid to miners are negligible in the calculation of its average APR.

Using the minimum recommended commitment of 11,000 satoshis (0.00011 BTC) per block, the miner’s likely minimal cost to compete with others is approximately $3,800 (BTC price as of 12/31) per reward cycle (~2,100 blocks). For comparison, the cost at the end of 2021 was $10,900, or 65% higher. As a result, the odds of winning a block increase along with a miner’s commitment, suggesting the cost to miners is likely much greater.

The average number of Stacks miners grew by 14% QoQ, growing to approximately 7.5 miners from 6.6 miners in Q3. The average APR for active miners in Q4 was approximately 22%, up substantially from 9.5%. The APRs are calculated using the daily price of STX and BTC, corresponding with daily BTC commits, STX block rewards issuances, and STX fees. STX fees generated during a reward cycle are also included since miners are entitled to these fees. Notably, fees paid to miners are negligible in the calculation of its average APR.

Using the minimum recommended commitment of 11,000 satoshis (0.00011 BTC) per block, the miner’s likely minimal cost to compete with others is approximately $3,800 (BTC price as of 12/31) per reward cycle (~2,100 blocks). For comparison, the cost at the end of 2021 was $10,900, or 65% higher. As a result, the odds of winning a block increase along with a miner’s commitment, suggesting the cost to miners is likely much greater.

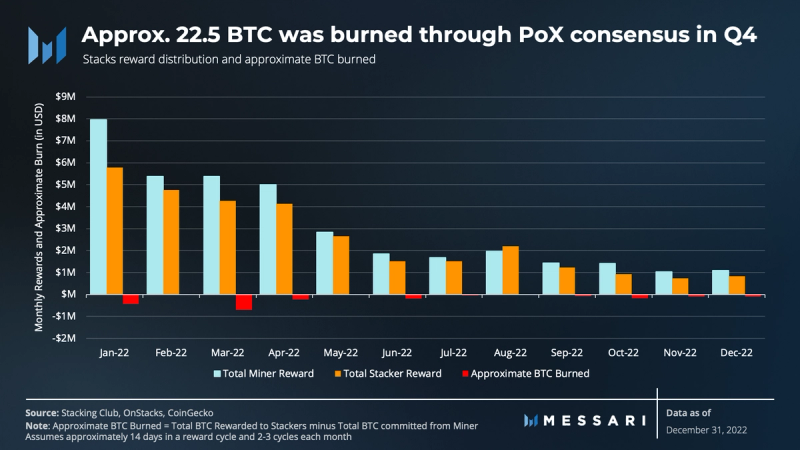

The total rewards distributed to miners and Stackers in USD terms continued to decline into Q4, reaching new lows. Miners earned roughly $3.5 million in STX and fees while expending approximately $2.8 million in satoshis or “sats.” In contrast, Stackers earned about $2.5 million in BTC yield during the quarter. An approximation of $375,000 in BTC was burned in Q4, up from $132,000 in Q3.

Qualitative Analysis

Whitepaper: sBTC and Nakamoto Release

Two new whitepapers were released by the sBTC public working group in Q4, discussing sBTC, a “trust-minimized” two-way bitcoin peg system. sBTC is the first decentralized, non-custodial Bitcoin peg that allows smart contracts to write back to the Bitcoin blockchain.

The whitepapers also described the protocol changes (called the “Nakamoto Release”) required to enable the peg system as well as Bitcoin finality (e.g., forks are allowed on the Stacks network only up to the depth of a set number of Bitcoin blocks, strengthening the security of the Stack chain).

The Nakamoto release highlights the existing and upcoming elements of Stacks and its consensus mechanism while introducing the decentralized bitcoin peg, sBTC. By utilizing the open-source and dynamic set of Stackers and delegating them to be threshold signers, the new release would enable Stackers to inherit the responsibility to fulfill sBTC peg-out requests. Since Stackers already have an economic incentive, peg fees become unnecessary.

Users send bitcoin to a threshold wallet where sBTC is minted and backed by BTC 1:1. When users convert their sBTC, or peg-out to BTC, Stackers (threshold signers) sign and release BTC from the threshold wallet to the BTC address selected by the rightful owner, subsequently burning the sBTC.

sBTC enables the trust-minimized use of BTC inside of smart contract applications on Stacks. Unlike other synthetic BTC variants, like wBTC (Wrapped BTC) and RBTC (Rootstock BTC), sBTC doesn’t rely on federations or centralized custodians. Instead, sBTC relies on an open network in which anyone can participate and help maintain the peg, and that open membership of users is incentivized to behave rationally as the most profitable course of action. sBTC is somewhat similar in design to tBTC (Keep Network BTC), a permissionless Ethereum-wrapped BTC. However, tBTC is settled on Ethereum, and it utilizes an additional set of signers for peg requests and overcollateralization ratios.

One of sBTC’s unique features is a mechanism called Recovery Mode. Should a threshold signer delay or refuse to fulfill a peg-out request, Recovery Mode kicks in to localize a failure. When this occurs, the consensus mechanism redirects PoX rewards (BTC) to fulfill peg-out requests until all outstanding requests are fulfilled. In turn, Stackers assets (STX) would remain locked up, forfeiting rewards earned during Recovery Mode until all peg-outs are honored. This mechanism incentivizes ongoing peg-out requests to be fulfilled for Stackers to continue receiving rewards and bring stability to sBTC.

Stacks 2.1 Vote

We highlighted many of the upcoming changes that were pending a community vote in the State of Stacks Q3 2022 report. In December, the community voted and approved the implementation of Stacks 2.1. The upgrade includes several improvements to the Stacks network such as enabling users to continuously stack without missing a reward cycle, “top off” and add new STX tokens to their stacked STX, and add support for Stacking to a native Segwit or Taproot address. Additionally, the upgrade introduces new Clarity functions for data and bridge operations, lowers the barrier to entry for decentralized mining pools, and enables the ability to send Stacks assets to bitcoin addresses.

Consideration Advisory Boards (CAB)

In H2 2022, the CAB was reintroduced and activated with the purpose of governing the Stacks Improvement Proposal (SIP) process. The CAB would consider changes to the following: amendments to the SIP Ratification Process, structural considerations (creating or removing various committees or editorial bodies), proposing changes to which committee members are selected, changes that would impact community members and STX holders, and more.

The CAB would consider several changes to the following:

- Amendments to the SIP Ratification Process.

- Structural considerations (creating or removing various committees or editorial bodies).

- Proposing changes to which committee members are selected.

- Changes that would impact community members and STX holders.

Closing Summary

Q4 proved to be productive, with strong growth in network usage and smart contracts deployed while maintaining a relatively stable consensus set. The new ability to bridge BTC to sBTC will offer users a decentralized path to deploy their BTC to leverage Stacks’ smart contract capabilities. Stacks will continue to bring improvements to the network as it implements various proposals in 2023 and focuses on scaling with subnets, bitcoin programmability, and new tooling for users and developers. Stacks contributors continue to make strides in offering unique solutions to unlocking the potential of bitcoin as a productive asset.