Key Insights

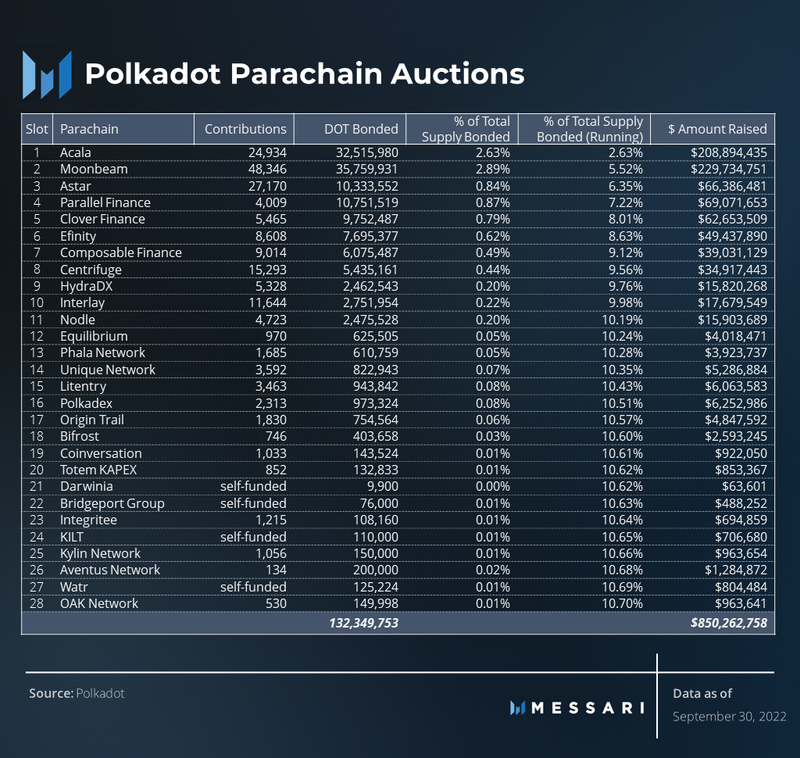

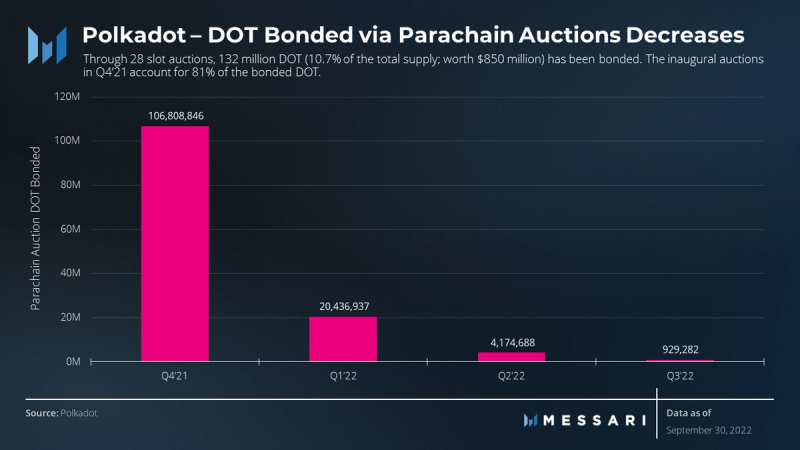

- Parachain slot auctions continued with eight new winners. Through 28 auctions, 132 million DOT (10.7% of the total supply; worth $850 million) has been bonded.

- The Cross-Consensus Message Format (XCM) adoption continued to increase. Parity Technologies announced the next version, XCM V3.

- Further details surrounding Polkadot Governance V2 were released. It will increase the number of proposals eligible to be voted on at once and further decentralize the network.

- Fundamental metrics like validator count, nominator count, and percentage of total supply staked remained consistent.

Primer on Polkadot

Polkadot is a Nominated Proof-of-Stake (NPoS) blockchain network designed to support various interconnected, application-specific Layer-1 chains known as parachains. Each chain built within Polkadot uses Parity Technologies’ blockchain development framework Substrate, which allows developers to select specific components that best suit their application-specific chain. Polkadot refers to the entire ecosystem of parachains that plug into a single base platform known as the Relay Chain. This base platform does not support application functionality but instead houses all validators and is responsible for securing, governing, and connecting the parachains.

Performance Analysis

Financial Overview

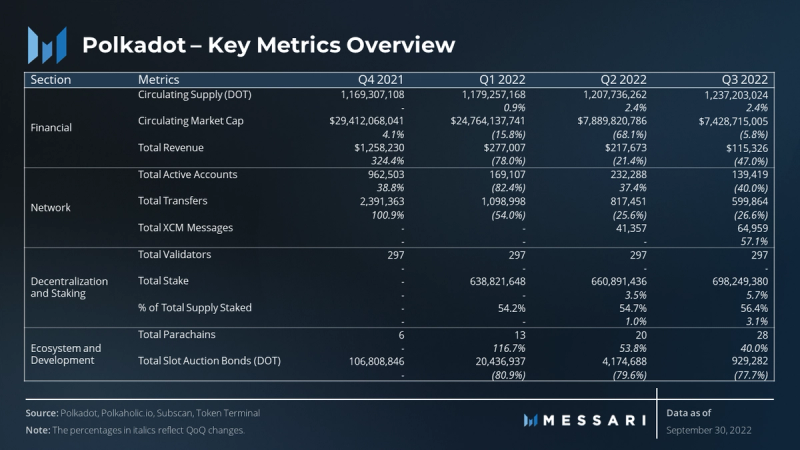

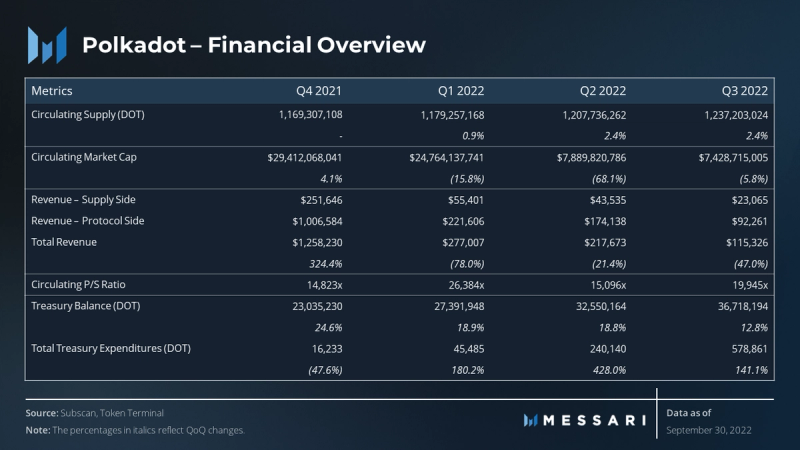

The crypto market continued to be at the mercy of the erratic global macro environment. During Q3, the broader market rallied 36% before returning to opening levels because of hawkish central bank rhetoric. Polkadot’s market cap followed with a higher beta rallying 39% before fully retracing and ending the quarterdown 6%.

Intramural metrics like DOT circulating supply and DOT treasury balance continued to increase steadily as expected. The DOT token is inflationary, with a targeted 10% annual inflation rate. The treasury is funded primarily through block rewards and transaction fees. Meanwhile, extraneous metrics like revenue and treasury expenses saw fairly large fluctuations. Overall, Polkadot’s Q3 2022 financial performance was relatively stagnant.

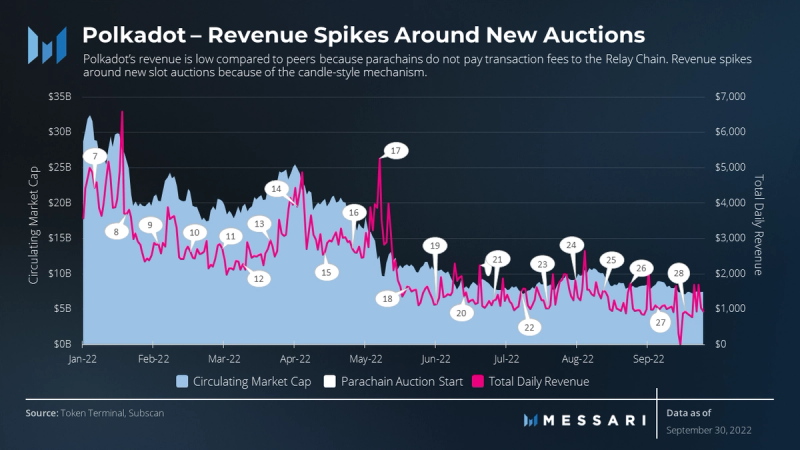

While the Relay Chain serves as Polkadot’s core connective layer, parachains provide the functionality to attract and cater to end-users. As such, the majority of network activity occurs on parachains. However, parachain transactions are not subject to Relay Chain transaction fees. Instead, parachains have full autonomy over their fee structure. Most parachains have opted to require transaction fees denominated in their native tokens. They also have chosen to pay a percentage of generated fees to collators to avoid network spam.

The Relay Chain does support some end-user functionality (primarily token transfers, staking, validator elections, governance voting, and parachain slot auction participation) with fees paid in the form of DOT. This native Relay Chain activity generates Polkadot’s revenue. Revenue tends to spike at the start of most auctions because of the candle-mechanism.

In Q3, Polkadot’s revenue was $115,000 with a circulating P/S ratio of 19,945x. For comparison, Avalanche’s revenue was $2.3 million with a circulating P/S ratio of 665x, and the Cosmos Hub’s was $142,000 with a circulating P/S ratio of 4,965x. By traditional standards, each of these base layers have abysmal metrics. The poor revenue-centric metrics paired with high valuations highlight the difficulties in valuing base-layer protocols.

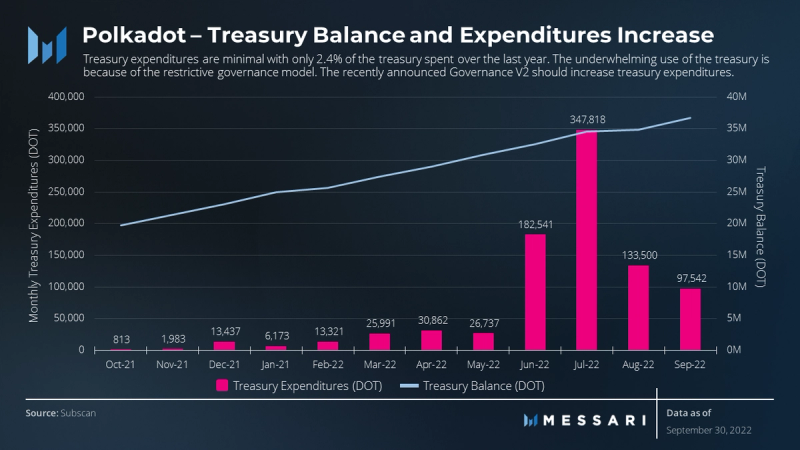

The Polkadot Treasury is funded by block rewards, validator slashing, transaction fees, and staking inefficiencies. In the future, parathreads will also generate treasury funds by participating in per-block auctions for block inclusion. At Q3 close, the Polkadot treasury had a massive warchest of 36.7 million DOT equaling roughly $236 million.

Despite the substantial treasury, its treasury expenditures only amounted to 881,000 DOT (2.4% of the treasury) over the last year. Of the total expenditures, roughly 66% came in Q3 2022, with most going towards supporting developer tooling. The treasury was so underused due to the limited bandwidth of the Council and the restrictive governance model only supporting one public proposal every 28 days. The recently announced Governance V2 will improve on these deficiencies and should increase treasury expenditures to support the ecosystem.

Network Overview

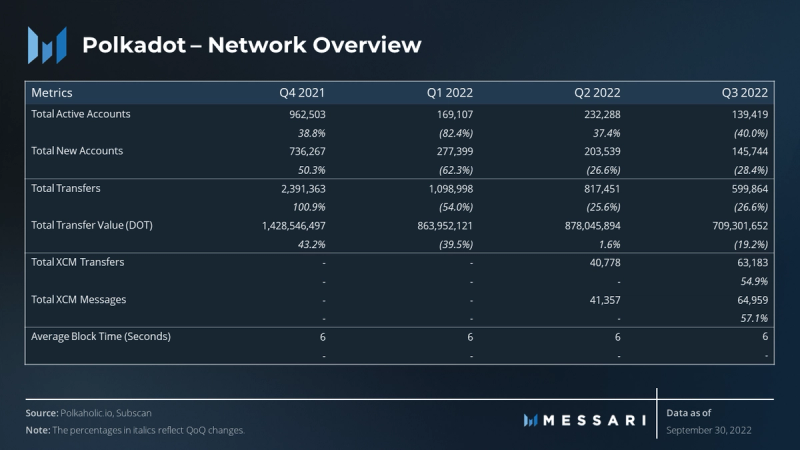

As mentioned in the revenue section, the Relay Chain supports account creation and token transfers for governance and slot auctions. During Q3, both metrics experienced rather substantial declines for the third consecutive quarter. The declines were likely driven by less parachain slot auction participation and fewer crypto users because of the bear market.

Although the Relay Chain supports functions like account creation, token transfers, parachain auction participation, etc., its sole purpose is to relay information between parachains and coordinate the validator set. To remove these ancillary functions, Polkadot is rolling out new “common good” parachains (more on this later in the report).

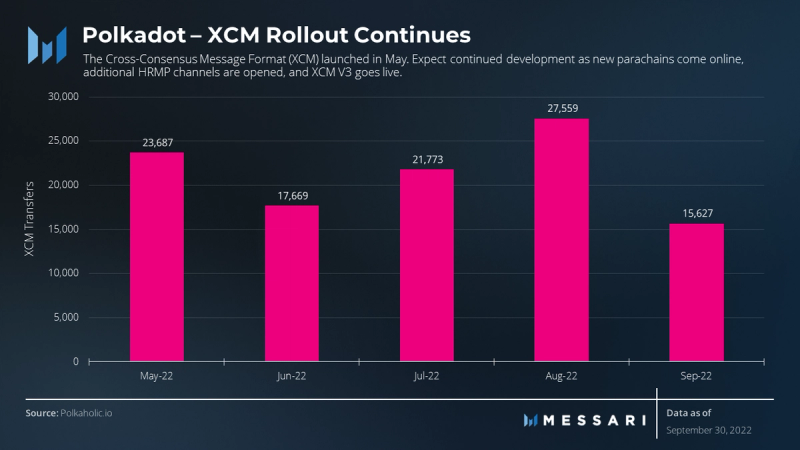

The majority of activity in the Polkadot ecosystem happens on parachains. Each parachain is a Layer-1 blockchain with its own community, economy, and governance model. Unfortunately, it is difficult to aggregate parachain user activity because of the network’s infancy. Members of the Polkadot community are currently building improved data sources to monitor holistic activity. In the interim, XCM messages can serve as a proxy for ecosystem wide activity.

The Cross-Consensus Message Format (XCM) is a communication language that allows parachains to exchange messages. An XCM message can be sent via parachain-to-parachain HRMP channels, between the Relay Chain and parachains, and outside of the Polkadot ecosystem to other applications and base-layers. XCM messages can be used for specific operations, asset transfers, and asset teleportation, to name a few use-cases. In the future, Polkadot anticipates having more granular data on the specific parachain activity.

The expansion of XCM is critical to the continued advancement of the Polkadot ecosystem. XCM brings Polkadot’s multichain capabilities to life and opens the door to novel application development. As a communication language, XCM allows parachains to exchange messages with other parachains, similar to Inter-Blockchain Communication (IBC) on Cosmos. At Polkadot Decoded in early July, Gavin Wood announced XCM V3, the next generation of XCM.

Decentralization and Staking Overview

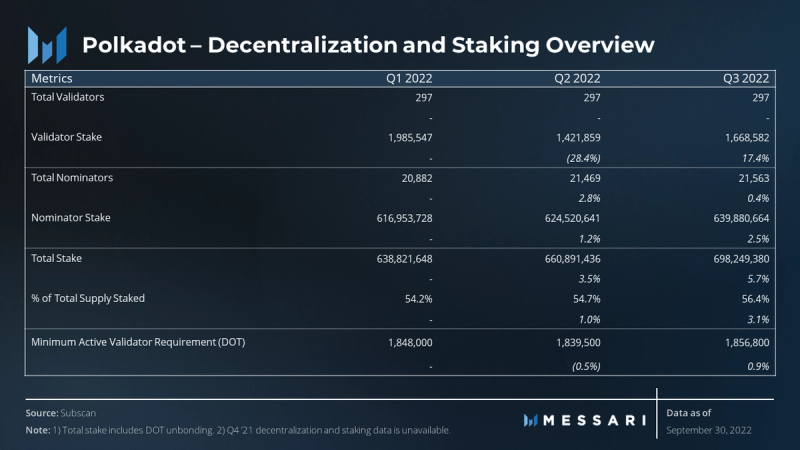

Q3 was another consistent quarter for Polkadot’s decentralization and staking. Fundamental metrics like validator count, percentage of total supply staked, and the minimum DOT required to run an active validator were stable. The consistency in metrics related to decentralization and staking point to a functioning and healthy ecosystem.

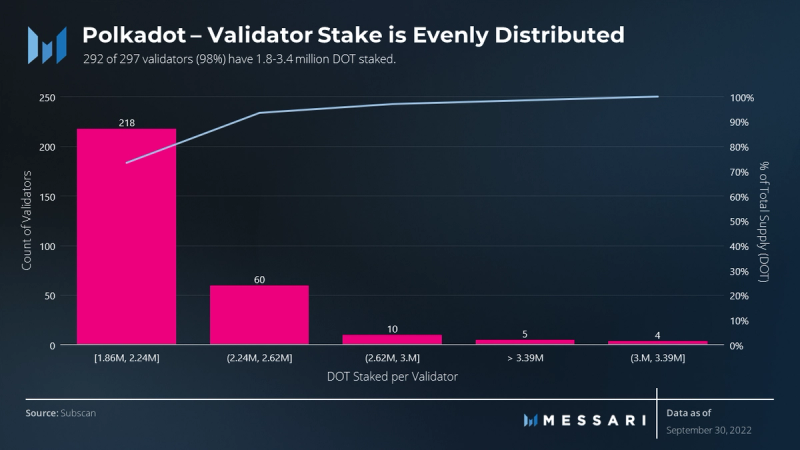

As described in the Q1 2022 and Q2 2022 reports, the validator payout scheme results in a probabilistic guarantee that all validators earn nearly identical rewards. The equally dispersed DOT staking yield creates an environment where nominators are incentivized to stake with lower-staked validators to maximize yield. During Q3, the payout scheme worked: 292 of 297 (98%) validators had 1.8–3.4 million DOT staked.

The relatively even validator stake distribution strengthens Polkadot’s decentralization. Although difficult to calculate, Polkadot likely has a very competitive Nakamoto Coefficient relative to peers because of the evenly distributed validator stake. Eventually, Polkadot plans to expand the validator set to 1,000 to support 100 parachains. However, Polkadot must first improve network storage and scalability to support additional validators.

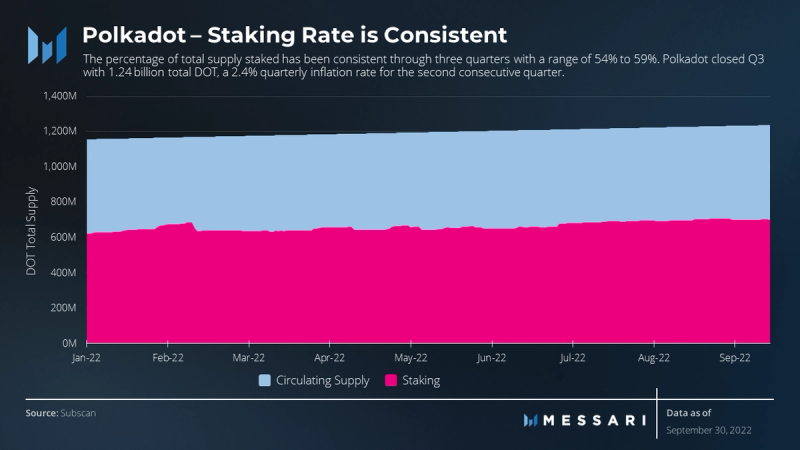

The Polkadot Network has an ideal staking rate of 50%, subject to change with the number of parachains, to secure the network while maintaining ample liquidity. Year to date, the percentage of total DOT staked has been greater than the ideal staking rate. It has ranged from 54% to 59% of total DOT tokens staked. When the system staking rate is above the ideal staking rate, nominator rewards are reduced and the extra rewards are routed to the Treasury.

During Q3, Polkadot released two new staking-related products: nomination pools and a staking dashboard. The nomination pools allow users to create permissionless staking pools and enable anyone with at least one DOT to participate in staking. The staking dashboard provided a more user-friendly navigating and viewing experience. These new products induced a 3.1% increase in staked DOT QoQ, the largest increase this year.

Ecosystem and Developer Activity Overview

After commencing in early November 2021, the parachain slot auctions have continued with a new auction every 12 days. The eight new parachain winners in Q3 are:

- Darwinia – A trustless multichain bridge hub using a combination of zero-knowledge proofs and optimistic technology. It provides a general bridging solution between heterogeneous chains without the need for custodial vaults or the wrapping of tokens.

- Bridgeport Group – An early-stage investor in gaming and blockchain technology platforms building infrastructure for Web3, the Metaverse, and the NFT ecosystem.

- Integritee – A scalable public blockchain for securely processing sensitive business or personal data.

- KILT – A blockchain identity protocol for issuing self-sovereign, anonymous, verifiable credentials, and decentralized identifiers.

- Kylin – A modular and configurable decentralized data infrastructure and economy providing accurate, complete, and verifiable data to crypto projects.

- Aventus Network – An enterprise-grade blockchain allowing businesses to easily develop and implement efficient, highly secure blockchain solutions.

- Watr – An ecosystem built to service the end to end of a new class of ethical commodities: from carbon credits to metals, agriculture and energy, their provenance, procurement, financing, and trade for physical delivery — all on-chain.

- OAK Network – A hub for cross-chain automation, enabling multichain applications to schedule and automate any substrate extrinsic or EVM smart contract function.

DOT bonded through parachain slot auctions is locked on the Relay Chain and thus removed from circulation, for the approximate two-year slot lease. Through 28 auctions, 132 million DOT (10.7% of the total supply; worth $850 million) has been bonded. Concurrently, DOT has a targeted 10% annual inflation rate with no maximum supply.

The amount of DOT bonded through auctions has steadily declined. Unsurprisingly, slot auction participation peaked in Q4 2021 largely due to built-up anticipation of the inaugural auctions.

The lower thresholds required to win a slot have led to projects self-funding their slot acquisitions. When projects self-fund their slot, they do not crowdfund DOT from the community in exchange for their native tokens. As a result, they retain a larger percentage of their native tokens which they can sell via another channel, airdrop to the community, or add to the treasury. More parachain teams will likely self-fund their parachain slot acquisitions over the remaining 13 auctions scheduled through February 2023.

Kusama is a canary network for Polkadot. It is an earlier release of the code that holds real economic value. For developers, Kusama is a proving ground for runtime upgrades, on-chain governance, and parachains.

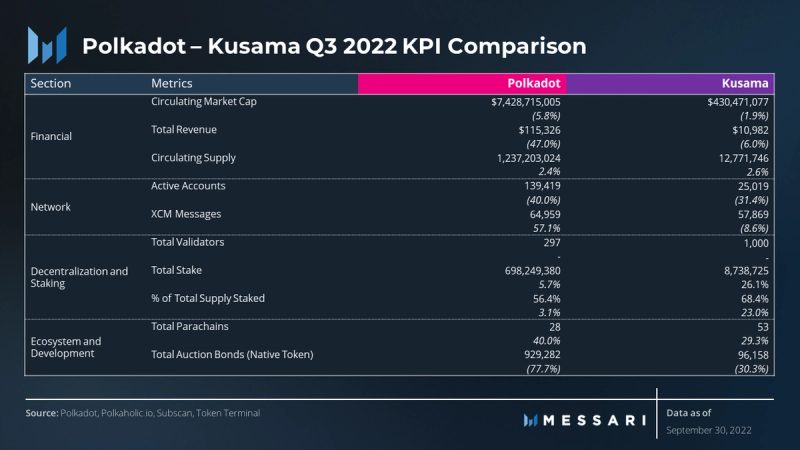

During Q3, Polkadot’s market cap was roughly 17x Kusama’s ($7.4 billion vs. $430 million) and revenue 11x ($115,000 vs. $11,000). Concurrently, network activity was much closer between the sister networks with active accounts on Polkadot at 6x (139,000 vs. 25,000), transfers at 3x (600,000 vs. 209,000), and XCM messages nearly equal (58,000 vs. 65,000). Network activity may be closer for several reasons: Kusama has more parachains (53 vs. 28); XCM was launched months earlier; and / or early adoption was sticky enough that users have not transitioned to the parent chain. From a staking and decentralization perspective, Kusama actually has a greater percentage of total supply staked (68% vs. Polkadot’s 56%).

Qualitative Analysis

Governance

Polkadot uses a tri-cameral governance structure composed of community members, the Council, and the Technical Committee. The construction has helped Polkadot grow through its infancy. However, Polkadot governance suffers from two substantial issues: slow voting (only one community vote every 28 days) and centralization (the Council and the Technical Committee).

To address these issues, Gavin Wood announced Polkadot Governance V2 at Polkadot Decoded. Governance V2 eliminates community input barriers by allowing an unlimited number of proposals at any time. The proposals are bucketed into tiers to streamline the process. Each tier is based on various conditions including a designated voting period, the quantity of votes eligible at once (e.g., in tier two, only two votes are eligible for community voting at once), and a downpayment in DOT. Naturally, more stringent tiers will have higher thresholds.

Governance V2 will also replace the Council and the Technical Committee with a new body, the Fellowship. To mitigate centralization concerns, all users will be eligible to join the Fellowship. Although the Fellowship will have a ranking system, which leads to further centralization pitfalls, Polkadot will use multiple mechanisms to ensure sufficient decentralization. The strategy includes a constitution, community voting for senior positions, and a design that limits leadership’s control. As usual, Governance V2 will first launch on Kusama before launching on Polkadot following community approval later this year.

Strategy and Outlook

Polkadot’s primary focus has been, and will continue to be, improving the network’s capabilities and functionality. The launch of XCM last quarter was a major milestone as parachains finally began communicating. Ecosystem teams envision novel use cases being developed using XCM. To continue building out the network, Polkadot plans to continue developing XCM, introduce new common good chains, optimize the consensus protocol, and launch parathread support.

XCM V3

To recap, the Cross-Consensus Message Format (XCM) is a communication language that allows parachains to exchange messages. XCM is a format for how messages can be sent, but it cannot actually send messages. For parachains to message each other, they need to use Cross-Chain Message Passing (XCMP) channels. XCMP is like a telephone, and XCM is the language spoken while on the call. Because XCMP is still under development, Polkadot is using a temporary solution in XCMP-lite (or HRMP).

Parity Technologies announced that the next version of XCM, XCM V3, is slated for release in late 2022. It will introduce new features including enhanced programmability, bridging to external networks, improved fee payments, NFTs, and more.

Common Good Chains

In addition to protocol parachains, the Polkadot Relay Chain has space reserved for common good parachains, i.e., parachains which benefit the entire Polkadot ecosystem. Common good chains are allocated Relay Chain access through on-chain governance, not the traditional parachain slot auction process. The first common good chain, Statemint, supports the creation and management of fungible and non-fungible assets.

In August, Parity announced that two new common good chains are nearly ready for launch. The first will be known as the Collective, and it will allow groups to trustlessly work together. The initial users of the Collective will be the Fellowship and the Alliance. The second common good chain will be a bridge hub connecting Polkadot with other blockchains.

Asynchronous Backing

Polkadot is planning the first major optimizations to parachain consensus since launch in what has been termed “Asynchronous Backing.” It is designed to do three things:

- decrease parachain blocktime to six seconds,

- increase the amount of blockspace by a factor of five to 10, and

- allow parachain blocks to be reused if they do not make it onto the Relay Chain.

Parity Technologies estimates asynchronous backing will increase the network’s transactions per second to between 100,000 and 1,000,000. It is scheduled for release on Kusama by EOY.

Parathreads

Parathreads are pay-as-you-go parachains which can be launched and operated without participating in a parachain slot auction. They are just as secure as parachain blocks and serve as an alternative entry into the ecosystem for fast-iteration developer teams. Parathreads are scheduled for release in H1 2023.

Closing Summary

Compared to a historical second quarter which saw the combination of the Terra Luna collapse, 3AC insolvency, escalating Russia-Ukraine war, and aggressive Federal Reserve interest rate hikes wreck the markets, Q3 was relatively mundane. The broader market grinded through a short-lived 36% bear market rally before fully retracing because of a continued hawkish central bank. Polkadot’s valuation tracked the broader markets with a higher beta while key performance indicators and network fundamentals yielded mixed results.

Polkadot’s financial and network activity largely reflects native Relay Chain activity. Closely correlated KPIs like active accounts, new accounts, revenue, and token transfers all experienced double-digit percentage declines. The declines were likely driven by the expected declines in parachain slot auction participation and bear market woes.

Despite reporting on native Relay Chain activity, most activity in the Polkadot ecosystem happens on parachains. Each Layer-1 parachain has its own community, economy, and governance model, making it difficult to aggregate data. Members of the Polkadot community are currently building improved data sources to monitor holistic activity. In the interim, XCM messages serve as a proxy for ecosystem-wide activity. Since launching in May, over 100,000 XCM messages have been sent across a variety of channels for different use cases. The forthcoming rollout of XCM V3, the opening of additional HRMP channels, and the onboarding of new parachains should result in accelerated adoption.

Polkadot’s decentralization and staking remained consistent. Fundamental metrics like total validators, total nominators, and percentage of total supply staked were either flat or slightly up, suggesting a functioning and healthy ecosystem at the foundational layer. Polkadot also released two new staking related products, nomination pools and a staking dashboard, which now allow anyone to participate in Polkadot staking and vastly improve the staking UX.

In the coming months, Polkadot will release an assortment of products to further decentralize the network and improve its capabilities and functionality. Upcoming product releases will include governance V2, XCM V3, common good parachains, asynchronous backing, and parathreads. To further drive adoption in an increasingly competitive market, a developing Polkadot needs to birth powerful cross-chain applications that excite the community and attract new users to the platform.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

This report was commissioned by (Polkadot), a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report. Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our Terms of Use for more information.