Key Insights

- The Solana NFT ecosystem demonstrated resilience in Q3 despite worsening conditions across global risk assets more broadly.

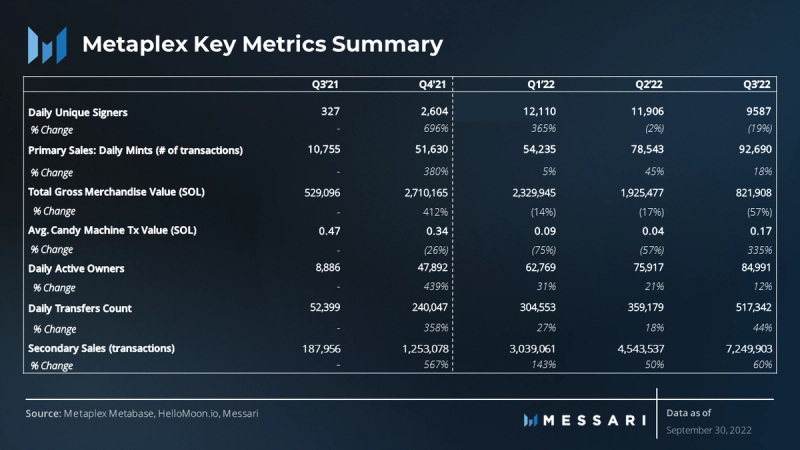

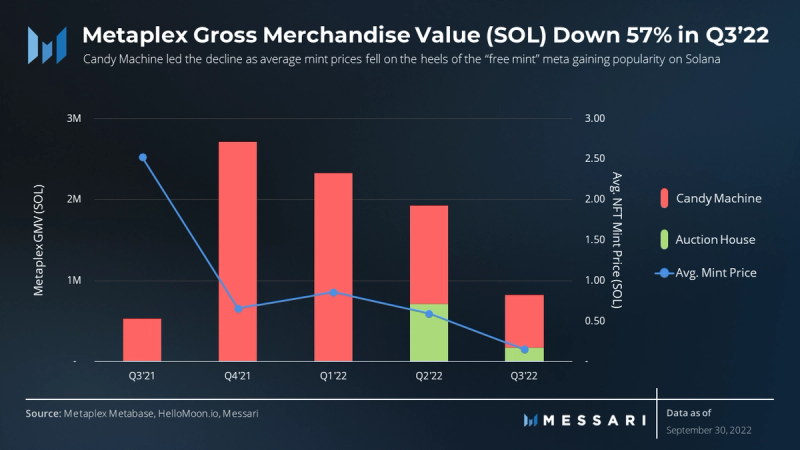

- Metaplex experienced a sharp 57% QoQ decline in GMV largely due to reduced average mint prices and “free mint” collection launches to entice risk-averse NFT collectors.

- Despite declining GMV, growth in daily NFT mints, metadata unique signers, and transfer count signal organic usage is being driven by increasingly more utility from NFTs.

- The deployment of new tools such as Creator Studios, enhanced compression, and Candy Machine V3 is laying the groundwork for further ecosystem expansion.

- Metaplex launched its DAO governance and utility token, MPLX, achieving another milestone on the path toward decentralization.

Primer on Metaplex

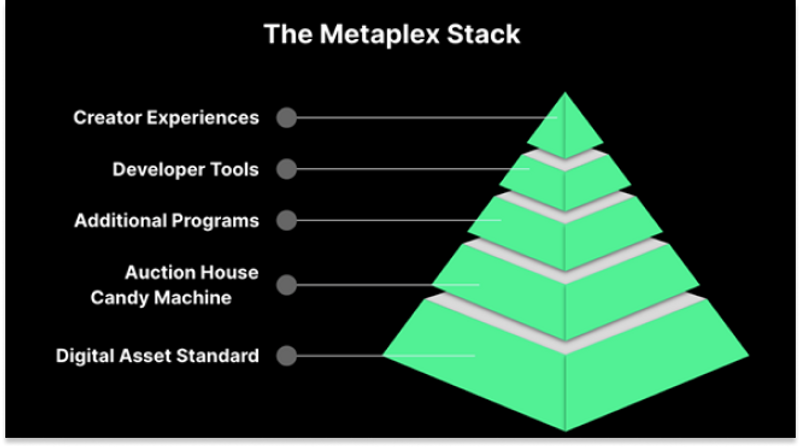

Since its launch in June 2021, Metaplex has become the main protocol and permissionless infrastructure layer for NFTs on Solana. It provides NFT communities with development tools and open standards for digital asset issuance and ownership on-chain. Metaplex maintains several programs and standards that it has developed over time to meet the needs of its community:

Source: Metaplex Docs

- Token Metadata – attach additional data and utility to Fungible or Non-Fungible Tokens

- Candy Machine (V1-V3) – used to launch generative and PFP collections

- Creator Studios – no-code tools to create, sell, and manage NFTs on Solana

- Auction House – a decentralized sales protocol for NFT marketplaces

- Gumdrop – allows for massively scaled airdrops of NFTs and tokens

- Token Entangler – links two NFTs together so only one is accessible on-chain at a time

This comprehensive program library is used by creators and developers to interact with an NFT at various stages of its life cycle, from design (Token Metadata), mint (Candy Machine), resale (Auction House), Airdrop (Gumdrop), and beyond. Metaplex is best known for its fully on-chain minting solution, Candy Machine. The Candy Machine contract, along with the recently launched Creator Studios, empowers creators to build highly adaptable NFT minting sites where digital assets can be designed, minted, and resold. Unlike many unintuitive Web3 applications, the UI and overall experience of these websites are comparable to traditional e-commerce applications, such as Shopify. Though it does provide solutions for the secondary market, Metaplex’s strength and central focus lie in primary sales and minting solutions for creators.

Metaplex stems from an internal Solana Labs initiative in May 2021, aimed at bringing NFT compatibility to Solana’s network. Because of the explosion of NFTs and their functionalities in 2021, the Metaplex team was established to support the Solana NFT ecosystem through the development of this NFT protocol.

Since Metaplex’s launch, all ~21 million NFTs minted on Solana conform to its Digital Asset Standard and have been powered by one or more of Metaplex’s programs. Metaplex offers a streamlined experience for users and creators — it pairs its NFT specifications with the greater speeds and affordability of transacting on Solana. In September 2022, Metaplex launched its utility and governance token MPLX.

Performance Analysis

Measuring demand across Metaplex’s programs and products requires a variety of proxies, including unique signers of NFTs, minting contracts, secondary sales transactions, usage, and supply of creators.

Signers

The signing of NFT metadata can be used as a proxy to account for the number of unique creators leveraging Metaplex. The underlying NFT metadata — such as mutability, creator, and embedded royalties — makes each NFT a useful digital asset. Once the minting is complete, the creator is verified by signing the NFT metadata.

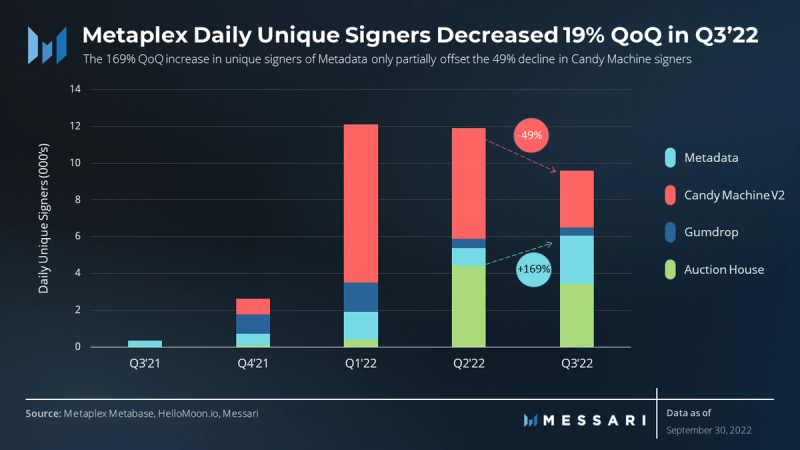

In Q3 2022, daily unique signers across Metaplex’s program library decreased 19% QoQ, extending from the 2% drop in Q2’22. This decline was driven primarily by a decrease in Candy Machine signers, down 49% QoQ, given the fall in NFT minting activity during the bear market. Daily unique signers on the Auction House and Gumdrop programs also fell 23% and 7%, respectively, due to slowing secondary market activity and projects choosing to delay their launch in anticipation of the next bull market.

The Metadata program, used to embed and interact with the metadata within Solana NFTs, experienced the only rise in signers this quarter. It was up 169% in Q3 compared to Q2, achieving a historical peak in quarterly usage. This usage growth appears to be entirely organic, driven by several independently existing NFT collections experiencing updates to their underlying token metadata. Metadata is used to enable NFT utility, whether it be for a game or used as an access token. Thus, the growth in usage may signify a key inflection point: NFT utility and usage are increasing even as the bear market drives down sales volume.

Gross Merchandise Volume

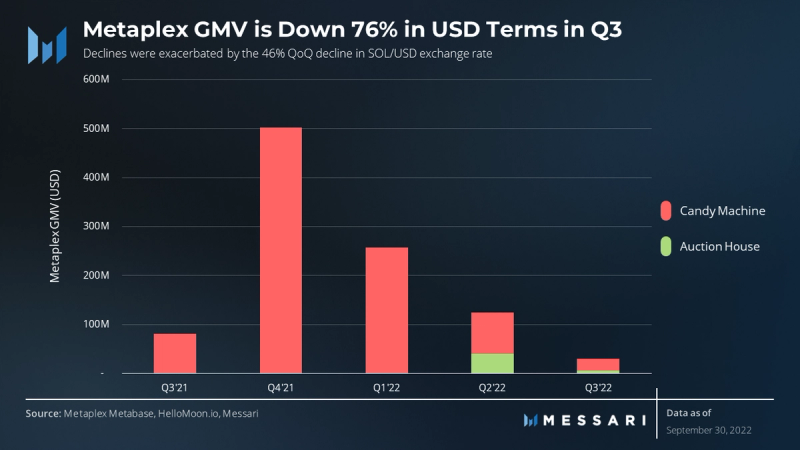

The total gross merchandise value (GMV) represents the sum of sales figures across all of Metaplex’s programs (currently only Candy Machine and Auction House have quantifiable sales figures). In Q3 2022, GMV decreased 57% in SOL terms QoQ amid the overall market downturn. Candy Machine drove the majority of the nominal decline in GMV, down 46% QoQ, while Auction House saw a sharper 76% drop.

GMV was primarily impacted by the decline in the average mint price of Solana-based NFTs, which fell 75% QoQ to ~0.15 SOL. This decline in price reflects the demand slowdown impacting the broader crypto market, after reaching the speculative peak in November 2021. Lower mint prices result in lower pricing on secondary sales. This relationship explains the decline in overall GMV despite a continued increase in the number of NFTs minted per day. The resilient growth in NFT mints despite cooled speculative demand indicates that this activity may be more organically driven by underlying utility.

This inverse relationship between GMV and total NFTs minted is best explained by “free mint” projects, which have been especially popular during this bear market. These free mints attract NFT collectors who might otherwise be more risk-averse and selective. The resulting drop in average selling price explains the decrease in GMV, even when pricing in the native mint currency (SOL). The declines are significantly worse in USD terms (down 76%) because they were compounded with SOL’s sharp decline (down ~46% QoQ to $37 in Q3’22).

Candy Machine Transactions (Minting)

Since its launch in June 2021, Candy Machine has powered over 21 million NFTs minted on Solana. Thanks to Candy Machine V1 (launched in August 2021), V2 (December 2021), and V3 (October 2022), developers on Solana’s NFT ecosystem have a critical piece of infrastructure at their disposal. Like many of Metaplex’s programs, Candy Machine is a free, highly adaptable application that acts as a core component to many third-party applications. In fact, Magic Eden’s NFT minting solution “Launchpad” is based on a fork of the Candy Machine smart contract.

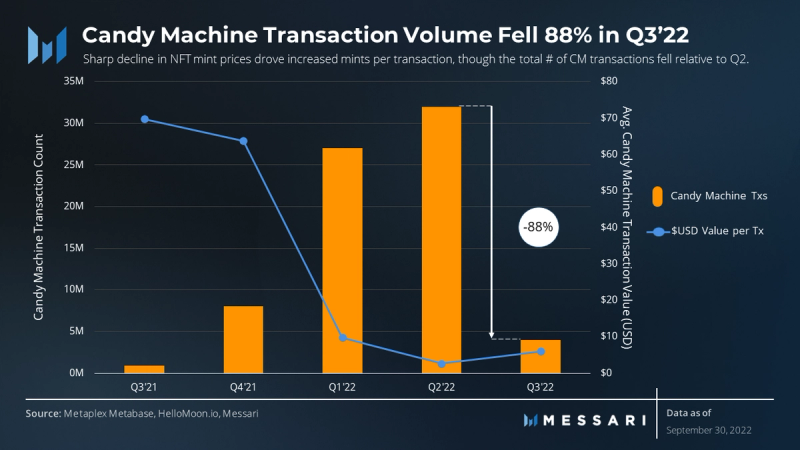

Candy Machine transaction volume can be used as a proxy for general NFT primary sales activity on Solana. In Q3 2022, transaction volume sharply declined 88% QoQ, after peaking at 32 million transactions in Q2. The uptick in Q2 volumes was largely driven by a steep increase in the number of “free mint” launches post-collapse of the late-stage bull market. The dropping average mint prices is reflected in an average Candy Machine transaction value of $2.58 (0.03 SOL), which bounced off the lows set in Q2 to an average $5.97 (0.16 SOL) per transaction in Q3.

The decline in average NFT mint prices has also induced growth in the number of NFTs minted per transaction, highlighted by the 18% QoQ growth to 92,680 NFTs minted daily on average in Q3. Additionally, the average daily NFT mint count was skewed by a three-day period (Sep. 6th-8th) of elevated minting activity due to the launch of two highly anticipated collections (y00ts and ABC). Although average NFT prices are much lower than they were last year, active members in the Solana NFT community have continued to fill their digital asset vaults nonetheless.

Thus far, the demand for Metaplex has been measured according to a suite of development tools and open standards for digital asset issuance. Besides issuance, Metaplex enables the on-chain ownership of digital assets. The number of daily active owners of Metaplex-enabled NFTs is also a proxy for current network activity.

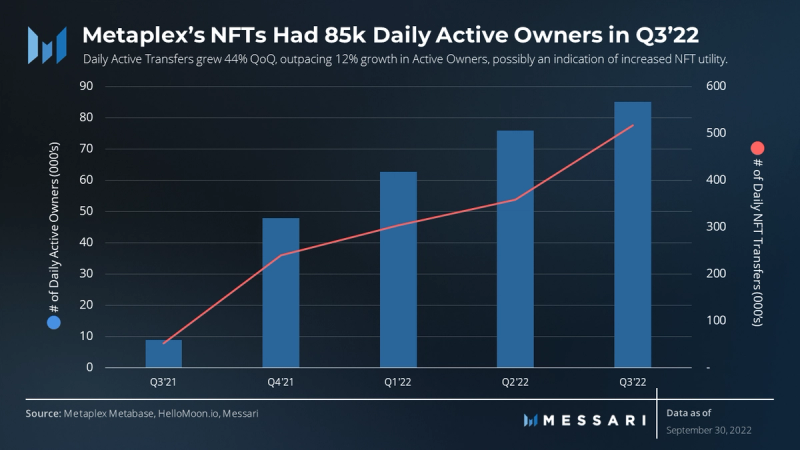

Activity

Daily active owner counts, the daily tally of unique wallets that transacted via purchase or sale of an NFT, averaged nearly 85,000 unique wallets in Q3 2022. The metric was up 12% compared to the previous quarter. Though unique wallet count is not a perfect proxy for unique individuals, the latest measurement indicates that the Solana NFT ecosystem continues to actively expand.

Within the same vein, average daily transfer count materially rose in the latest quarter, up 44% compared to Q2. Amongst a number of factors potentially driving this growth, heightened market volatility during the quarter is a likely contributor. Additionally, rising transfer volume may indicate increasing use cases for NFTs outside of simple secondary sale transactions. Overall, the increase in the number of daily active owners and NFT transactions occurring on Solana demonstrates healthy usage activity for the ecosystem built on the Metaplex NFT standard.

Secondary Sales

Sitting at the center of the NFT ecosystem, the Metaplex protocol is leveraged by all Solana NFT marketplaces, with Magic Eden, Hyperspace, and OpenSea being some of the protocol’s closest partners. Despite its current primary focus on building NFT minting solutions for creators and developers, Metaplex has also deployed an open-source secondary marketplace contract called Auction House.

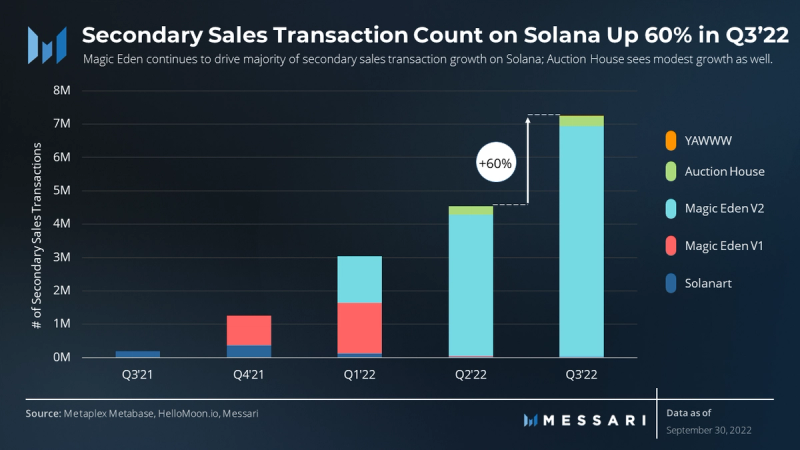

Overall secondary (marketplace) sales transaction growth strengthened in Q3, increasing 60% QoQ. This growth continues to be dominated by Magic Eden V2, a forked closed-source version of Metaplex’s permissionless Auction House program. Over 95% of the secondary sales transaction volume in Q3 is attributable to Magic Eden, while ~4% of transactions were captured through smaller marketplace operators utilizing the original Auction House smart contract since Q2 2022.

As its open-source code is utilized by new independent third-party marketplaces, Auction House will likely facilitate an increasing number of transactions between buyers and sellers. This dynamic may further facilitate escrowless transactions, boosting the Web3 ideals of trustless networks and reducing the need for rent-seeking middlemen.

However, market share gains may remain muted until third-party marketplace entrants deem the market favorable. Though pressured by fewer active market participants, the combination of NFT prices and heightened volatility may continue to drive secondary sales transaction growth on Solana over the next several quarters.

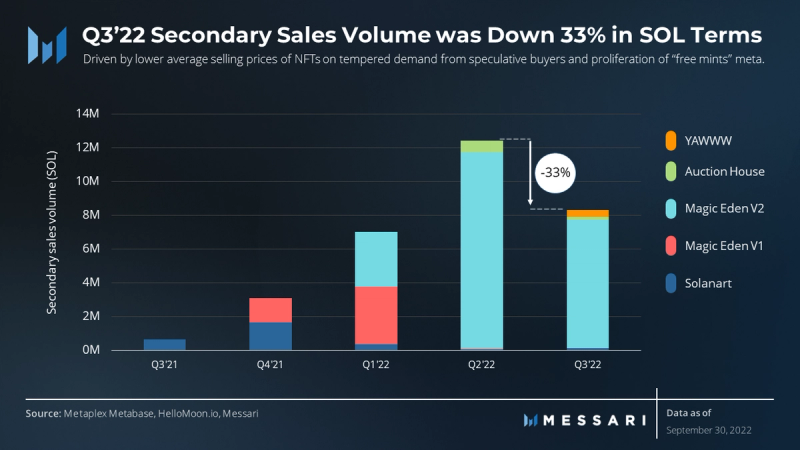

While transaction counts rose, NFT sales volume fell 33% QoQ in SOL terms in Q3 2022 relative to Q2. This broad-based decline in volume can again be attributed to lower average selling prices, which were only partially offset by the increase in secondary transaction counts. Depressed NFT prices in SOL terms were exacerbated by a decline in the SOL/USD exchange rate in Q3, resulting in an even steeper 65% decline in USD terms.

Magic Eden’s marketplace accounted for over 91% of secondary sales volume in Q3, down from 94% in Q2. Smaller independent third-party marketplaces utilizing the Auction House program accounted for only 2% of Q3 sales volume, down from a 6% share in the previous quarter. These declines in market share came primarily as a result of a newly launched OTC NFT marketplace, YAWWW, which accounted for 5% of sales volume during the quarter. Solanart represented 1.4% of Q3 volume, up from 0.5% in Q2.

Qualitative Analysis

Metaplex Ecosystem: Notable Events

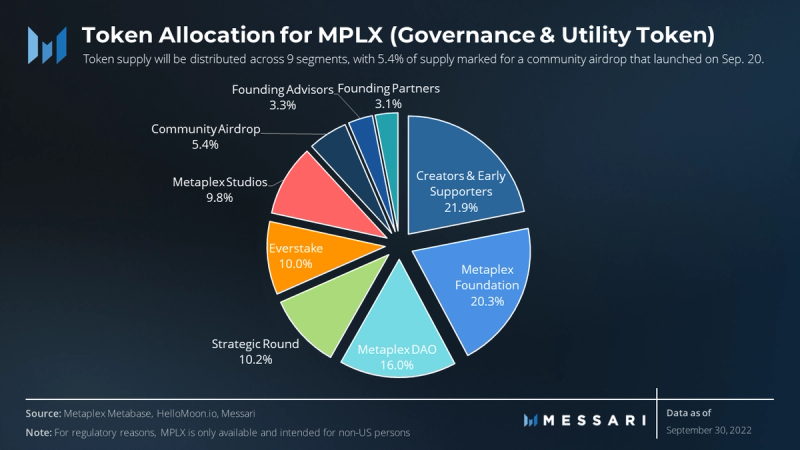

MPLX Governance Token Launched on 9/20/22

Metaplex launched its long-awaited governance and utility token as the protocol took its next step towards decentralization. Thus far, over 73,000 wallets have claimed approximately 16.5 million MPLX. If Metaplex continues down this path, it could become the first NFT standard to be entirely community-owned. The individual creatives and collectors who built the vibrant NFT ecosystem on Solana from scratch will now be members of the DAO that drives the protocol forward. As detailed in the newly released whitepaper, the token supply allocation is as follows:

Creators & Early Supporters — 219,000,000 MPLX (21.90%)

- Key early supporters and contributors who bought tokens in an early financing round while developing the ecosystem.

- 50% of each participant’s tokens will be delivered 1 year from the first token airdrop (Sept. 19, 2022) and the remaining 50% will be delivered on a monthly pro-rata 12-month basis.

Metaplex Foundation — 203,057,143 MPLX (20.31%)

- Will administer the ongoing operation of the protocol and nurture growth of the Metaplex ecosystem. Administrative activities may include hiring, funding, and grants, which are meant to establish growth initiatives for the broader Metaplex DAO and NFT community.

- Foundation tokens are not subject to vesting and are immediately usable.

Metaplex DAO — 160,000,000 MPLX (16.00%)

- The Metaplex DAO is used for protocol changes, ecosystem grants, and strategic initiatives. Tokens held by the DAO are subject to MPLX governance and may be distributed over time through proposals from community members.

- Metaplex DAO tokens are not subject to vesting and are immediately usable.

Strategic Round — 102,042,857 MPLX (10.20%)

- Announced back in January 2022, the strategic round allocated tokens to strategic capital providers as well as pop culture, entertainment, sports, and cultural leaders to advocate for Metaplex and the growing role of NFTs.

- Same unlock schedule as the Creators & Early Supporters (21.90%) allocation.

Everstake — 100,000,000 MPLX (10.00%)

- A development shop and Solana staking service, Everstake was part of the founding development team behind Metaplex in coordination with the Metaplex Foundation.

- Tokens are subject to a 2-year cliff followed by a 1-year linear vesting schedule.

Metaplex Studios — 97,500,000 MPLX (9.75%)

- As the core developer team contracted by the Metaplex Foundation, Metaplex Studios exists to further development of the Metaplex Program Library and Digital Asset Standard via protocol development, developer tool creation, commercial partnerships, community support, and app development.

- Tokens are subject to a 1-year cliff followed by a 2-year linear vesting schedule.

Community Airdrop — 54,000,000 MPLX (5.40%)On April 29, 2022, the

- Metaplex Foundation offered the Genesis Developer NFT to developers who contributed to the Metaplex Protocol. With the launch of MPLX, the Metaplex Foundation allocated 0.8 million MPLX to the holders of the Genesis Developer NFT (“the Developer Airdrop”).

- An additional 13.2 million tokens were allocated to creators who have launched NFT projects using Metaplex’s program library (“the Creator Airdrop”).

- Finally, 40 million MPLX was marked to be allocated to heavy minters or early adopters of Metaplex NFTs (“the Collector Airdrop”). This token allocation was subject to a governance proposal submitted by the Metaplex Foundation to be voted on by the DAO in the days after the initial launch. The proposal passed on October 8.

- Airdrop tokens are not subject to vesting and are immediately usable.

Founding Advisors — 33,400,000 MPLX (3.34%)

- The Founding Advisors act as advocates for Metaplex to creators and developers in Web3. This group will continue to advocate on behalf of Metaplex and the broader ecosystem.

- Advisor token grants are subject to a 1-year cliff, after which point there is a 1-year linear vest. The tokens are subject to a 1-year lock-up period from the first token airdrop.

Founding Partners — 31,000,000 MPLX (3.10%)

- The Founding Partners are early supporters and partners of the Metaplex Protocol. They launched some of the first storefronts and continue to be a sounding board for additions to the program library, NFT standards, and developer tools.

- Subject to the same lockup schedule as the Founding Advisors allocation (3.34%).

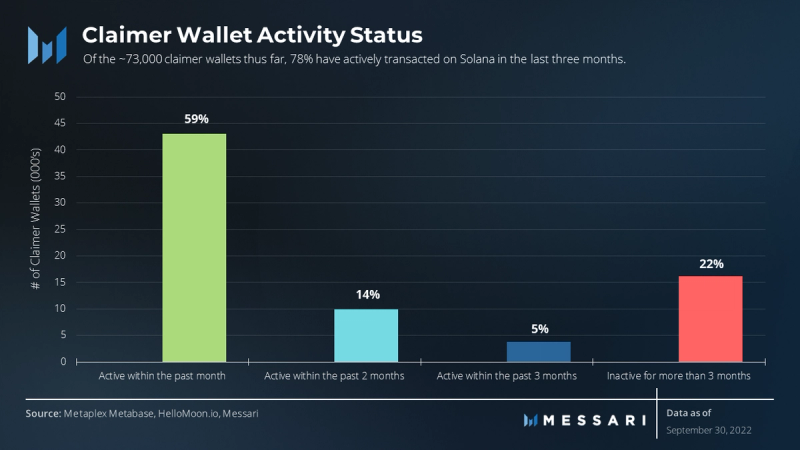

Of the ~73,000 wallets that have claimed the airdrop to date, 59% have actively transacted on Solana in the past month and 78% in the past 3 months. This type of solid activity from its DAO members, even during a bear market, is a positive indicator for the long-term health of the DAO. In addition to empowering artists, creators, and developers through influence and governance participation over Solana’s NFT standard, the Metaplex Foundation has plans to introduce various forms of utility within the Metaplex ecosystem. For example, the token may be integrated as a form of payment for developers to use certain features within the program library, and staking initiatives may be implemented in the future. Via the DAO, tokenholders can vote on strategic decisions such as these that the Metaplex Foundation will execute.

Revamped Collector Airdrop Governance Vote Passed

As noted in the whitepaper, a governance proposal was immediately submitted post-token launch to determine whether the 40 million MPLX “Collector Airdrop” would be implemented. Despite a “Yes” vote greater than 80%, the first governance proposal ultimately failed as a quorum of token supply was not reached. Given that the token was only launched days before the governance vote, a second proposal was submitted. It removed the quorum requirement and lowered the mint count eligibility threshold to reach a wider set of Solana NFT collectors, per feedback from the Metaplex community.

The second governance vote ultimately passed, and airdrop eligibility has since been made available to collectors. Full eligibility criteria can be found here, and eligible addresses can claim their MPLX allocations at the official claim site.

Compression via Implementation of the Digital Asset Standard 2.0

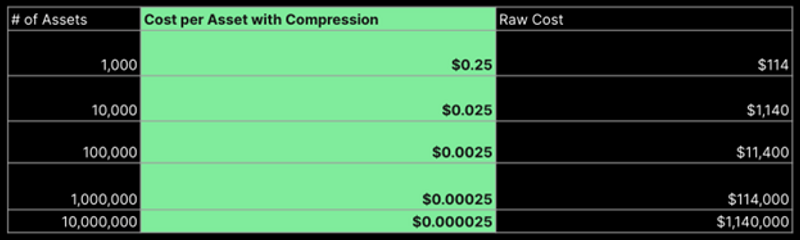

Metaplex implemented its enhanced compression feature, which has been part of the gradual rollout of the Digital Asset Standard 2.0. By storing NFT metadata in off-chain Merkle trees instead of directly on-chain, the new compression mechanic enables the capacity to mint up to 1 billion NFTs for just 507 SOL using one Merkle tree. Solana rent costs scale sublinearly, with the number of compressed NFTs minted allowing creators and builders to reduce their costs to ~6 SOL for 1 million NFTs and ~50 SOL for 100 million NFTs:

Source: Metaplex Docs

Through this implementation, Metaplex has become the only widely used NFT protocol ready for more than 1 billion users. This level of scale is what’s needed to unlock use cases such as fully on-chain item libraries for MMO games, on-chain live event ticketing, and general mainstream blockchain integration across every industry. Compression makes Metaplex metaverse-ready by fostering new hyperscale use cases, delivering Web2-to-Web3 experiences that would otherwise be impossible on other L1s.

Roadmap and Opportunities

Initially announced at Solana’s “Vancouver Hacker House” event, Candy Machine V3 launches in early October with the goal of providing developers with more flexibility and control over their minting contracts. In its third iteration, the Candy Machine program will be separated into two separate contracts. One program will hold the minting logic, while the other will hold the access controls. By separating access control into what will be called “Candy Guard,” developers can implement changes to access without breaking the minting logic.

Enhanced modularity is becoming more popular across decentralized applications. Demonstrated time and again, the added flexibility nurtures innovation among community builders and participants. In the case of Candy Machine V3, the contract will be prepackaged with standalone modules, making contracts more adaptable to specific NFT use cases. For example, the allow-list guard allows users to specify mint date and discount price. In addition to the prepackaged modules provided, the contract can be easily customized by developers seeking to introduce unique functionality into their NFT launches without modifying the core Candy Machine contract.

No-Code Creator Tools via Creator Studios

After initially teasing a no-code NFT tool for creators, Metaplex has finally opened a waitlist for early access to this powerful new program. The waitlist has already reached over 55,000 applicants in the first week since launch. Creator Studio will allow artists and creators without technical backgrounds to launch their own digital assets. By simply uploading art and selecting from an array of setup options through a web-based user interface, artists can create 1/1s, open/limited editions, and generative collections without any coding experience.

On top of creating the NFTs, Creator Studio will also allow artists to establish customizable mint pages. Like the rest of the platform, this tool requires no coding experience or even external web hosting. Early access will roll out gradually. Creators can join the waitlist here.

Taking Solana’s NFT Ecosystem to the Next Level

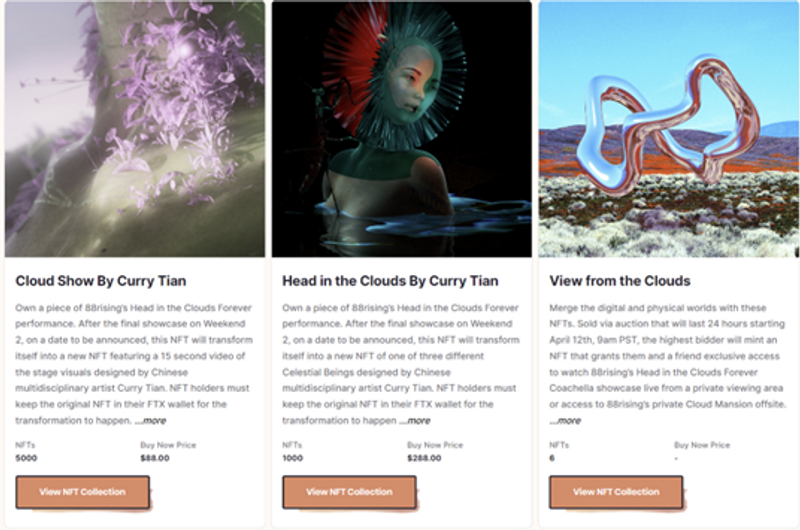

Source: Coachella x Metaplex

Metaplex is determined to drive the Solana NFT ecosystem forward. There are several avenues being explored to bring future mainstream adoption. For example, the protocol partnered with Live Nation in 2021 to provide exclusive NFT collectibles to Lollapalooza festival attendees, with an additional collaboration planned for 2022. Similarly, Metaplex powered three separate NFT collections and an IRL experience at Coachella’s 2022 festival.

The Metaplex is looking to gaming as another vertical for mainstream adoption. Though they have yet to reveal specifics, the Metaplex Team has noted they are working closely with at least one popular gaming studio interested in developing blockchain-enabled games. As Web3 games and NFTs continue to spread across the gaming industry, Metaplex will likely play a large role in welcoming game developers to the Solana blockchain.

Closing Summary

Despite the bear market’s effects, the relative resilience of the Solana NFT ecosystem continues to impress. When examining Q3’s headline metrics, the decline in GMV and secondary sales volume might look somewhat discouraging. However, these metrics reflect only a limited picture of the current outlook. Other barometers of protocol health, such as mint counts, metadata signers, and active owner activity, highlight areas of growth. These areas ultimately indicate increasing organic activity driven at least partially by more utility in the underlying NFTs.

Metaplex continues to fire on all cylinders irrespective of the market cycle. Q3 saw breakthroughs in compression, simplified creator tools, and advancements in the organizational structure of the protocol. Given the protocol’s long-term directive to support the Solana NFT community, Metaplex is committed to developing the tools and applications to drive mass adoption through gaming, live events ticketing, and more. The progress made in just the past quarter highlight the fact that more NFT utility and use cases are in the works.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by Metaplex, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.