Download the PDF version of this report by clicking here.

Key Insights

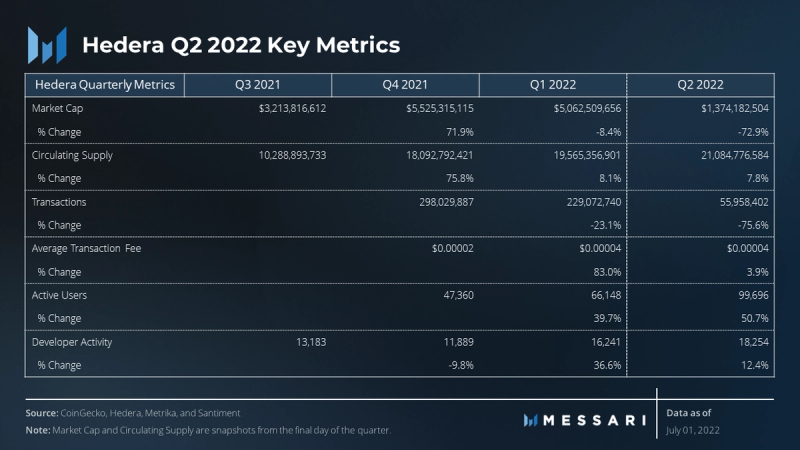

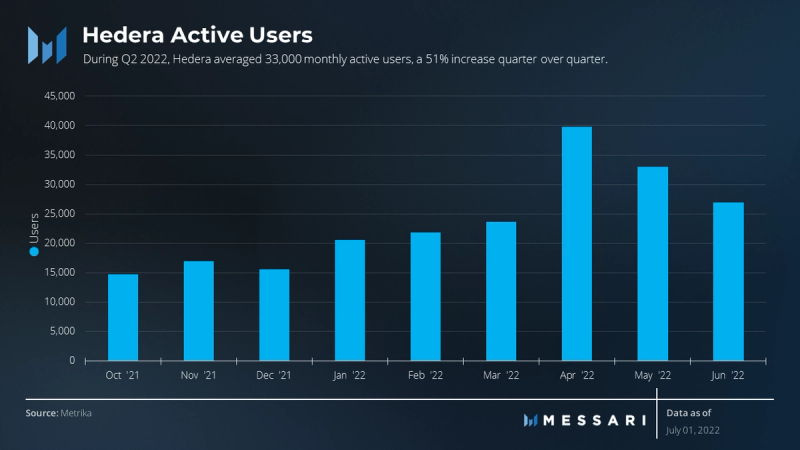

- Hedera averaged 33,000 active users per month, a 51% increase quarter over quarter.

- Transaction fees are consistently low, averaging less than $0.0001.

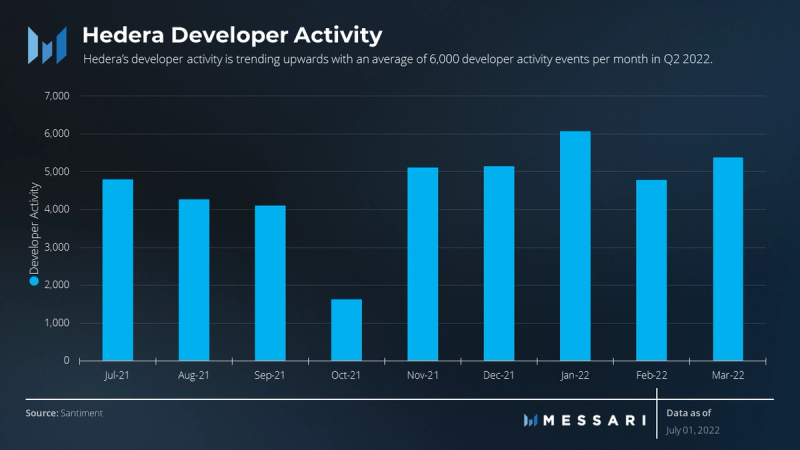

- Developer activity is trending upwards, with an average of 6,000 developer events per month.

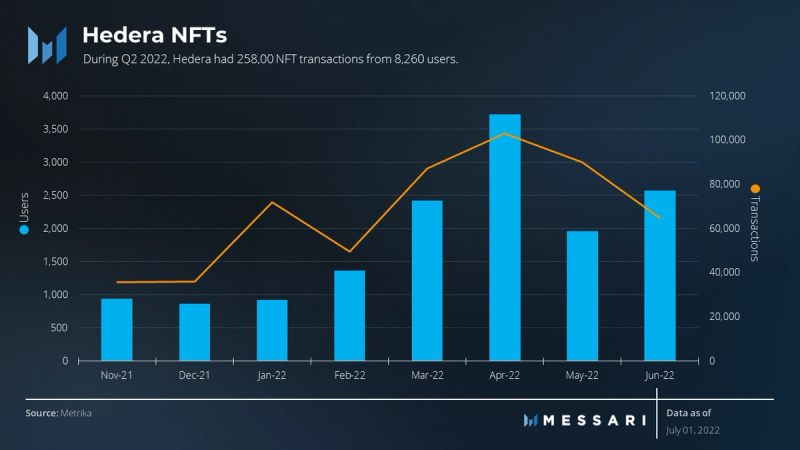

- NFT activity continues to increase, with 258,000 NFT transactions.

- The Smart Contract and File Services increased activity, while the Consensus Service and Cryptocurrency Services saw a decrease.

- $555 million in ecosystem funding was announced: $250 million dedicated to the metaverse, $155 million to DeFi, $100 million to sustainable development, and $50 million to Fintech.

A Primer on Hedera

Hedera is a permissioned Proof-of-Stake (PoS) blockchain network. It is governed by 26 global enterprises, known as the Hedera Governing Council, with input from the community via Hedera Improvement Proposals (HIPs). Members of the Governing Council operate Hededra’s validators as the network transitions to a decentralized, user-owned network. Hedera offers developers core services, known as the Hedera Network Services, to build decentralized applications. The network is powered by the Hashgraph Consensus Algorithm, which offers high throughput, fair ordering, and low-latency consensus.

Performance Analysis

Network Financials

Q2 2022 was a historically bad quarter for crypto, with the total crypto market cap decreasing by 58%. Hedera ended the quarter valued at $1.4 billion, down 71% ($3.3 billion) for the quarter. The drop puts it in line with the broader market.

Hedera has faced similar declines before. On Dec. 31, 2019, Hedera’s market cap dropped to an all-time low of $17 million before gaining 41,000% (400X) to reach an all-time high of $6.9 billion on Nov. 13, 2021.

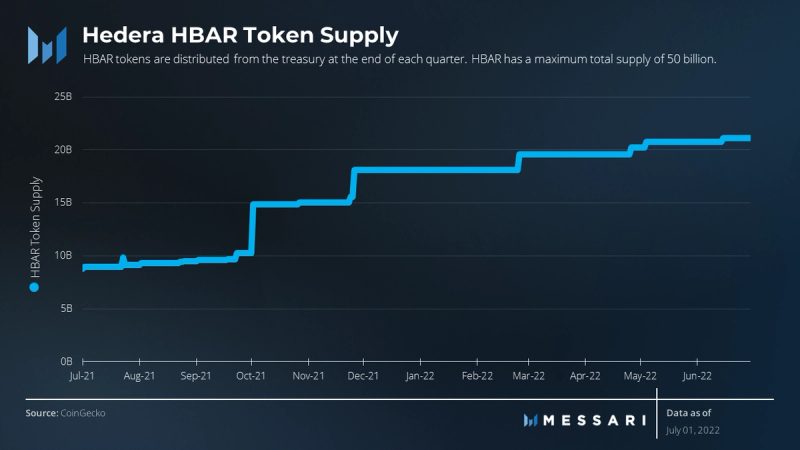

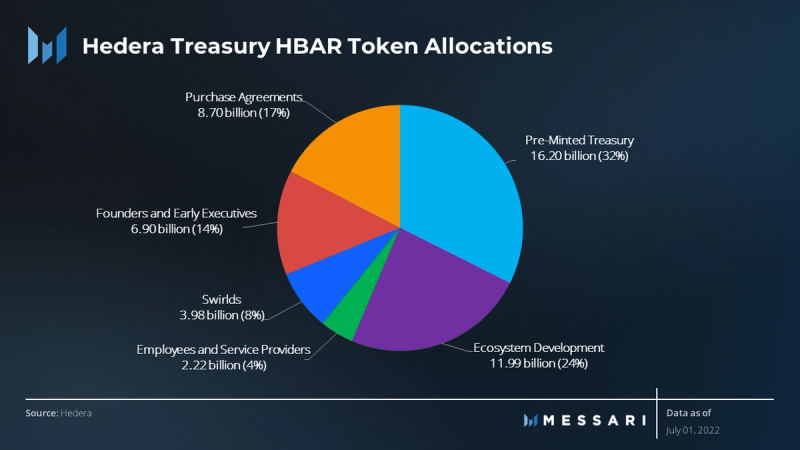

HBAR, the native token of the Hedera Network, has a maximum total supply of 50 billion and is non-inflationary. HBAR is distributed on a quarterly basis by the Hedera Treasury following a distribution schedule running through 2025. At the close of Q2 2022, Hedera had a circulating supply of 21.08 billion HBAR (42% of the total supply).

Network Usage

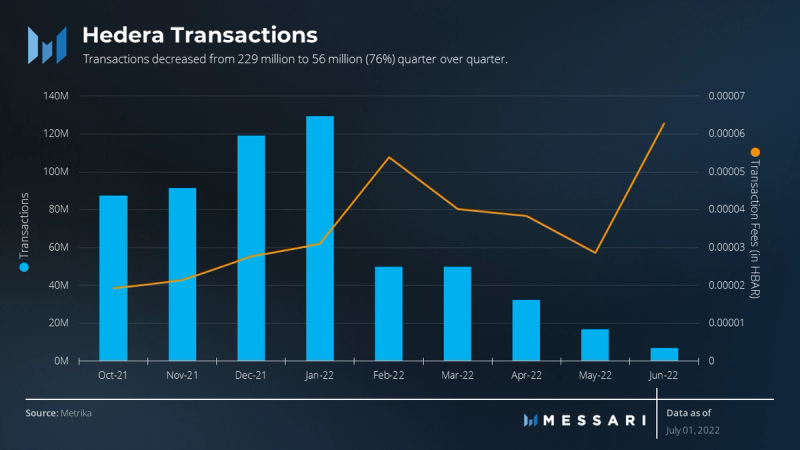

Total transactions decreased substantially. In Q2 2022, Hedera averaged 19 million transactions per month, down from 76 million (-76%) in Q1 2022 and 99 million (-81%) transactions per month in Q4 2021.

Concurrently, transaction fees have remained low. During Q4 2021, when network activity was at all-time-highs, transactions were less than $0.0001. The low transaction fees reinforce the efficiency of the Hashgraph consensus algorithm.

Despite the drop in transactions, active users increased for the second consecutive quarter. During Q2 2022, Hedera averaged 33,000 active users per month, a 51% increase quarter over quarter and a 110% increase compared to Q4 2021. The increase in active accounts signals a healthy interest in the Hedra ecosystem.

Hedera Network Services

Hedera’s core offerings are known as the Hedera Network Services. The services are a set of APIs that allow users to create accounts, mint tokens, write data to the ledger, call smart contracts, and perform a host of additional functions. The Network Services are named appropriately: Consensus Service, Smart Contract Service, Token Service, Cryptocurrency Service (includes account creation and HBAR transfers), and File Service. Transaction fees for each service are fixed, denominated in USD, and paid in HBAR which helps enterprises with predictable operational expense planning.

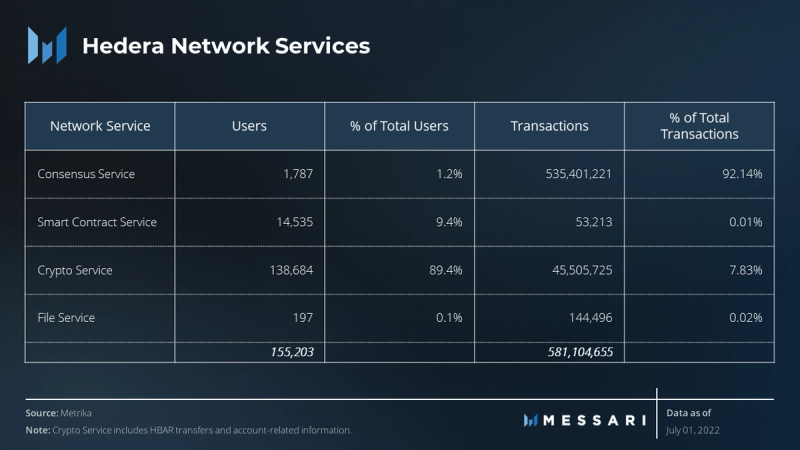

As of Q2 2022 close, the Hedera Consensus Service is responsible for 92% of transactions while only supporting 1% of users. Conversely, the Hedera Cryptocurrency Service supports 89% of users but only services 8% of transactions. The odd relationship reflects the different user bases: the Hedera Consensus Service caters to enterprise customers while the Cryptocurrency Service caters to retail customers.

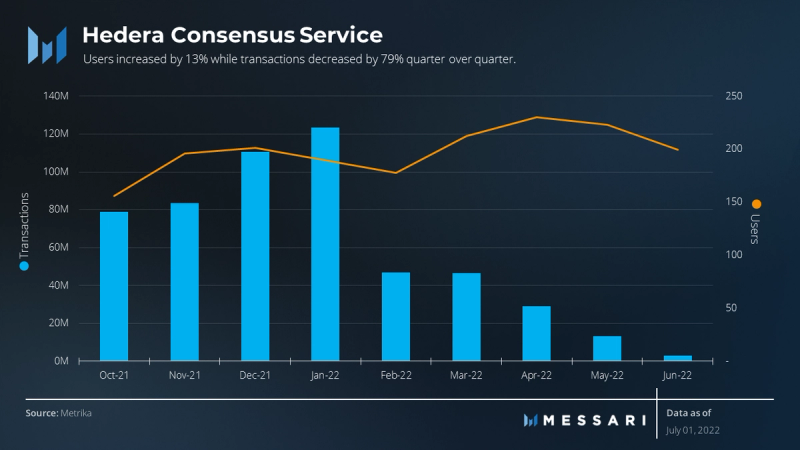

The Hedera Consensus Service allows for the creation of immutable and verifiable message logs. Users, primarily enterprises, submit messages to the Hedera Network where the messages are ordered and time stamped by the Hashgraph algorithm. Over time, the messages form an auditable history of verifiable, trustless events.

Active users of the Consensus Service increased for the second consecutive quarter. During Q2 2022, Hedera averaged 218 active uses per month, up from 193 in Q1 2022 and 184 in Q4 2021 (+13% and +18% respectively). Despite the user increases, transactions decreased for the second consecutive quarter. The decline from Q1 2022 to Q2 2022 was especially severe, with a 79% decrease in transactions (172 million).

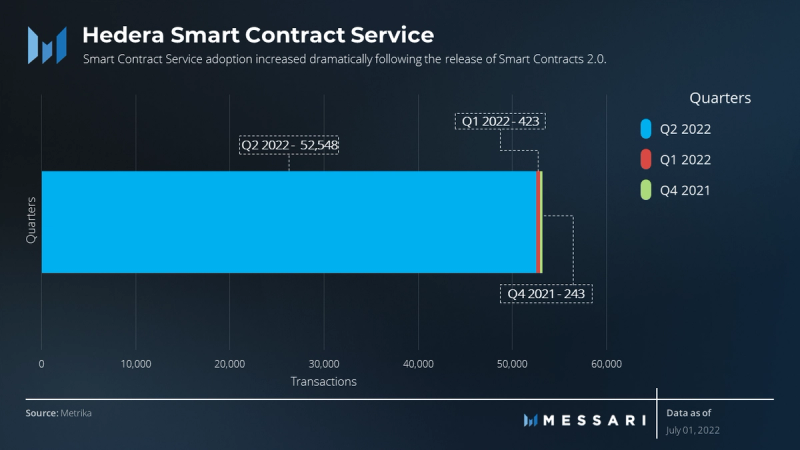

The Hedera Smart Contract Service allows developers to build and deploy smart contracts. In February 2022, Smart Contracts 2.0 brought EVM compatibility and Solidity-based smart contract functionality to the service. In April 2022, the Smart Contract Service’s activity exploded to 8,000 users and 42,000 transactions. Prior to April, the service averaged 20 users and 100 transactions per month. Hedera plans on releasing multiple Smart Contract Service upgrades through H2 2022.

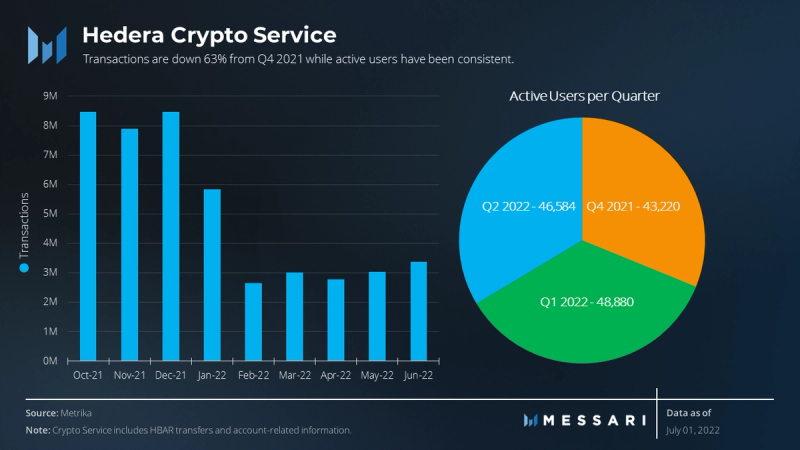

The Hedera Cryptocurrency Service includes HBAR transactions and all account-related information. HBAR is used to pay network service transaction fees and will eventually secure the network via staking. The Token Service enables the configuration, management, and transfer of fungible and non-fungible tokens.

Crypto Service activity has been consistent with an average of 15,000 active users per month. Although users have held steady, transactions are down 63% from Q4 2021.

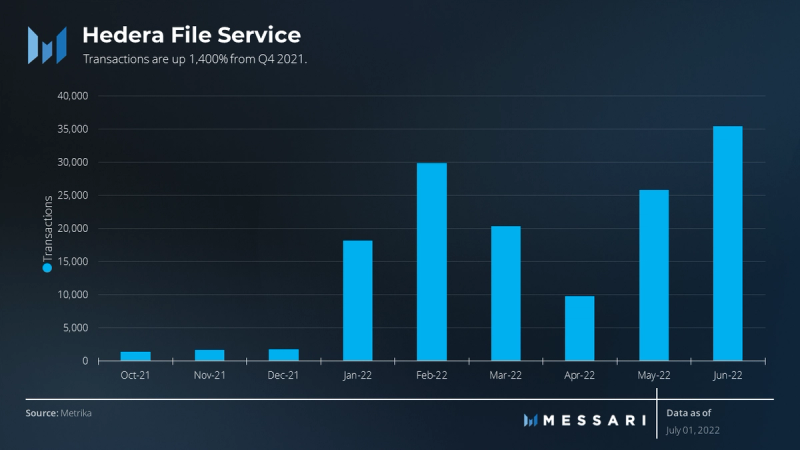

The Hedera File Service stores smart contract data, credentials, and other critical files on the Hedera Network. Over the previous three quarters, user activity has averaged 22 users per month. Transactions are up 1,400% versus Q4 2021.

NFT Ecosystem

Another component of the Hedera ecosystem is the rise of NFTs. During Q2, Hedera had 258,000 NFT transactions from 8,260 users. Leading NFT Marketplaces include Zuse Market, Hash Axis, Turtle Moon, and GoMint. Similar to Network Services, NFT transactions have low, fixed costs.

Treasury

The Hedera Treasury holds the total supply of 50 billion HBAR. HBAR tokens are distributed following a distribution schedule through 2025. At Q2 2022 close, 21.08 billion HBAR (42% of the total supply) is in circulation. Any funds spent by the Treasury must win a majority vote from the Council. The primary strategy is to release HBARs such that the growth of the circulating supply aligns with the adoption of the Hedera Network. The last Treasury Funds Report was published on Sep. 16, 2021.

Developer Activity

Developer activity has been trending upwards since the launch of Smart Contracts 2.0. During Q2 2022, Hedera averaged 6,000 developer activity events per month. A top priority during H2 2022 will be additional updates to the Smart Contract Service.

Decentralization and Staking

Hedera is a permissioned network governed by the Hedera Governing Council, which is operated by 26 entities including Google, IBM, and Boeing. Each council member runs a Hedera node and shares an equal vote in Hedera’s governance. Members of the Hedera community contribute to codebase updates and the development of ecosystem standards, through Hedera Improvement Proposals (HIPs), and can run mirror nodes that allow you to view on-chain activity. In June, staking functionality was approved with the passing of HIP-406: Staking. The introduction of staking is part of Hedera’s broader plans to decentralize the network.

Qualitative Analysis

Key Events

Despite the bear market, Q2 2022 was a busy quarter for the Hedera ecosystem. Key developments include:

Ecosystem Funds

Hedera announced $555 million in ecosystem funding. In early March, the HBAR foundation announced a $100 million Sustainable Impact Fund focused on environmental, nature-based, and sustainable development. The Sustainable Impact Fund is the first of its kind and signals a heavy focus on green markets. In late March the HBAR Foundation announced a $155 million DeFi-focused fund. The announcement said that $60 million would be used as liquidity mining rewards, while the remainder would go to infrastructure-focused grants. Shortly afterward, the HBAR Foundation announced a $250 million Metaverse fund with a focus on enterprise use cases and a $50 million Fintech fund.

HIP 406: Staking

HIP-406: Staking was accepted on June 3, claiming its spot as the most discussed Hedera Improvement Proposal in history. Hedera plans to use staking as a way to decentralize the network.

Swirlds

Swirlds Labs formally launched on May 1. Swirlds is composed of the development and management teams from Hedera Hashgraph LLC, and it will support the development of the Hedera ecosystem. The Hedera Governing Council will outsource essential services to Swirlds so the Council can prioritize network governance.

Other Events

- Hedera announced major gaming partnerships with Ubisoft and Liithos.

- Held a Hackathon with 2,500 participants and 116 submitted projects.

- Wrapped HBAR (wHBAR) was deployed on Ethereum and Polygon.

- The HBAR Foundation launched a privacy market development fund.

- The Swiss Hashgraph Association launched the Hashgraph Innovation Program.

- Avery Dennison integrated the Hedera Consensus and Token services.

Governance

The Hedera Governance Council is an elected group of organizations supporting the development and growth of Hedera. The Governance Council currently has 26 members out of a maximum of 39, and members share an equal vote in the direction of Hedera. Council members currently operate the Hedera validator nodes, but at scale, Hedera anticipates thousands of public nodes supporting the network. All members have a three-year maximum term, with up to two consecutive terms and an equal vote on network and platform decisions. Swirlds, the creator of Hashgraph, has a permanent seat and equal vote. The Council is primarily focused on ensuring network stability and managing the Hedera Treasury. The Council holds a monthly meeting and publishes notes from the meeting.

Challenges

Hedera must successfully decentralize the network. The path to decentralization began with the emergence of the HBAR Foundation and continued with the passage of the staking proposal, but it still requires many additional steps. Challenges through the decentralization process could include bootstrapping the validator set, community buy-in, and Hashgraph constraints.

Hedera also faces unsteady network activity, with a 76% drop in transactions in Q2. The protocol must scale adoption of the Hedera Network Services and develop an ecosystem of applications to jumpstart activity. The ecosystem funds should help incentivize users and bootstrap protocol development.

Lastly, Hedera faces tough competition in the Layer-1 wars. During Q2, Hedera had a total of 100,000 unique users and 56 million transactions, both just fractions of the leading ecosystems. Hedera’s focus on enterprise use cases could help it bypass the competition.

Roadmap

The second half of 2022 is going to be busy for Hedera. One of the priorities will be the successful rollout of staking. Testing is expected to commence in Q3 and community nodes will be enabled in Q4.

Hedera will also be focused on the Smart Contract service. The service has seen elevated activity since the launch of Smart Contracts 2.0. Planned updates for the smart contract service include enabling expirations and renewals, adding traceability capabilities, the creating of a JSON-RPC relay for integration with EVM-based wallets, developer tools, and environments, and improving performance.

Closing Summary

Q2 2022 will be remembered as one of the worst quarters in crypto history. Despite the carnage, Hedera continued to build and positive trends emerged like monthly active users increasing 51% quarter over quarter, transaction fees remaining low with an average fee of less than $0.001, and NFT usage continuing to rise. The Smart Contract Service saw a spike in adoption following the release of Smart Contracts 2.0, File Service transactions were up 1,400% versus Q4 2021, and developer activity is trending upwards.

However, KPIs were mixed as total transactions dropped 76%. The loss was driven by the Consensus Service down 79% and the Crypto Service down 63%. Overall, adoption of the Network Services remains low.

Hedera is a nascent network built with a powerful, novel consensus algorithm in Hashgraph, and taking a unique approach to governance with the enterprise led Governance Council. The launch of $555 million in ecosystem funding, the pivot to Swirlds, and the passage of staking signals a shift to a more decentralized, user-focused network. These are the early days for Hedera, but the grand vision is beginning to develop.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by Hedera, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report. Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.