Key Insights

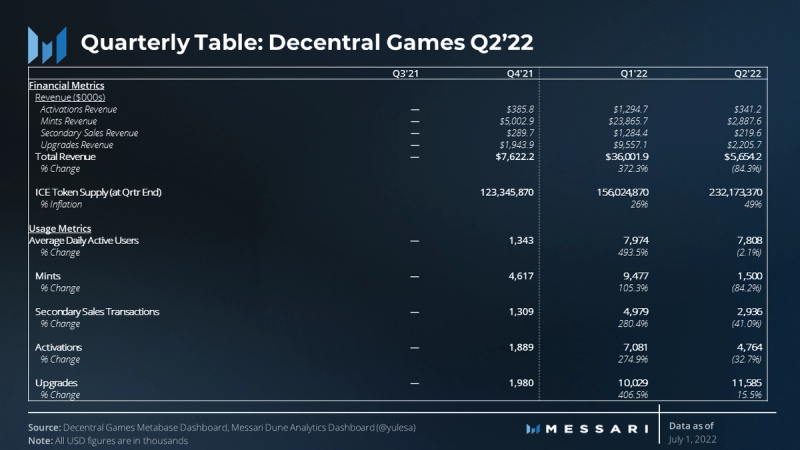

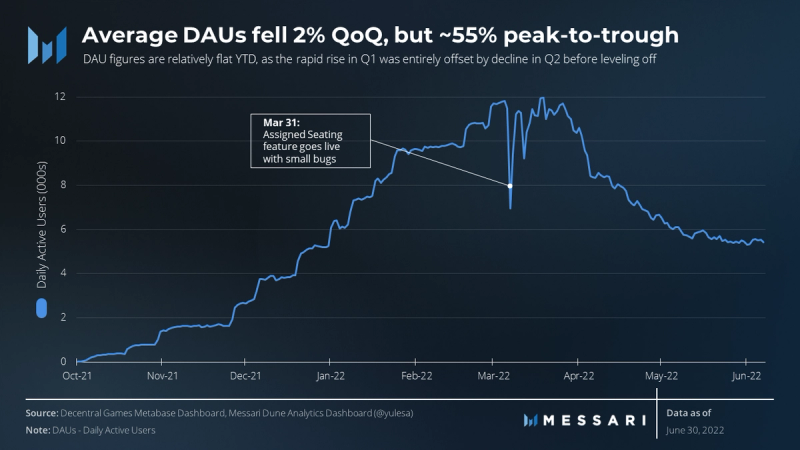

- Average daily active users fell ~2% QoQ and ~55% peak-to-trough in Q2 2022.

- ICE Poker is DG’s primary focus currently; it earned $5.6 million in Q2 2022, down 84% QoQ due to a pause in minting activity, despite a 15% growth in wearable upgrades.

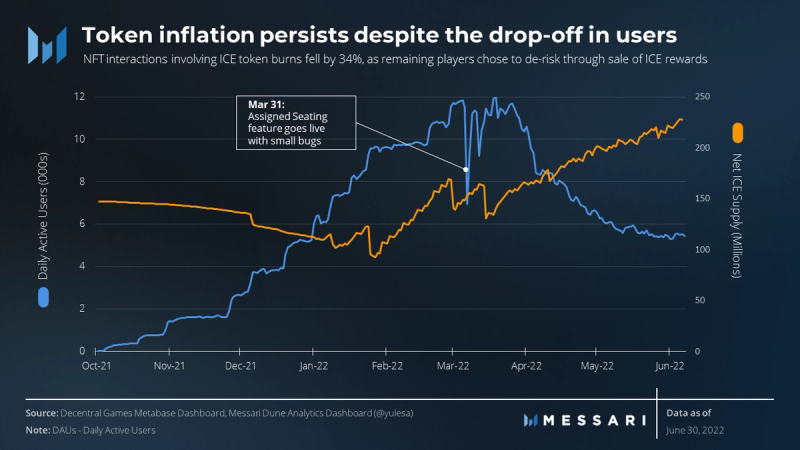

- ICE token inflation accelerated in Q2 2022, up 49% QoQ and 88% since Q4’21.

- “Banked ICE” mechanic from the approved “Delegation V2” proposal will be implemented in mid-August; it’s expected to reduce the sell pressure on the ICE token.

- Launch of the highly anticipated ICE Poker Flex mobile web app is planned for mid-August.

- New fast-paced Sit-N-Go (SNG) tournament mode will go-live during the Flex launch, adding a unique net-deflationary reward dynamic for the ICE token.

A Primer on Decentral Games

Decentral Games (DG) is a game operator within Decentraland, a 3D browser-based world. It rewards users through a play-to-earn mechanism. Those who commit time to play the game are given the tools to build a collection of assets worth real-world money. Both fungible and non-fungible assets are incorporated within Decentral Games — users can self-custody assets, earn yield-based rewards, and take ownership of their in-game items.

Decentral Games uses Polygon as its scaling solution. A multifaceted partnership exists between the two entities: Decentral Games deploys its games on the Polygon network and is a member of Polygon Studio’s ecosystem. The game platform also runs its own Polygon node.

The most successful game offered in the Decentral Games ecosystem is ICE Poker. The ICE Poker game was launched in October 2021 and is based on Texas hold’em, one of the most popular poker variations. Hold’em was chosen to bring in more users through its large existing player pool and simple, widely-established rules.

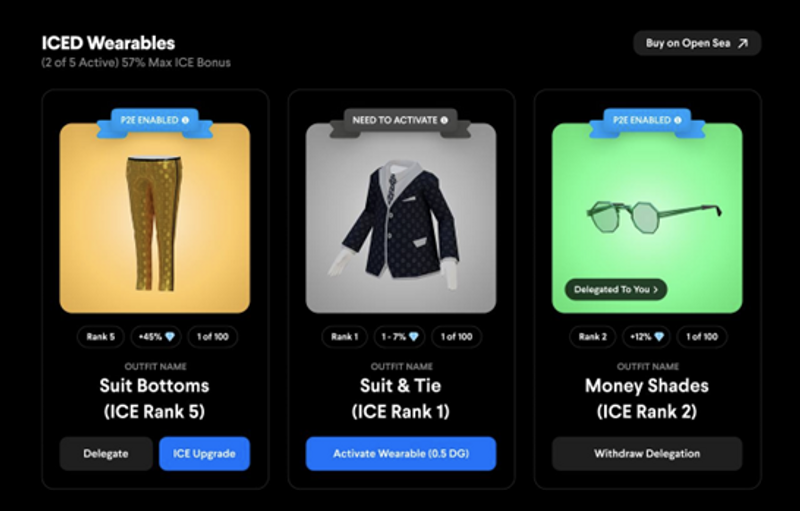

To play ICE Poker, users need to own or rent at least one in-game digital asset, i.e., a wearable NFT. Each wearable NFT starts as an ICE Rank 1 item (beginner) and can be upgraded up to ICE Rank 5 ( known as “diamond hands”). Higher-ranked NFTs collect more rewards, which are paid out in ICE, the native in-game token. To move from one rank to a higher one, owners must spend both ICE tokens and XP earned from completing challenges to level up their assets.

Source: Decentral Games

Players have the option of owning wearable NFTs outright (i.e., player-owner) or renting them (i.e., delegated player) from other NFT owners. Those with outright ownership may either acquire newly minted wearable NFTs or purchase them on secondary marketplaces like OpenSea (secondary sales).

Ultimately, the decision is a personal one. Poker players who are invested may want ownership of their own assets; meanwhile, metaverse “tourists” can choose to play without making any initial financial commitment.

In return for the lower risk, delegated players split some of their earnings with NFT owners. Some delegated players save up their earnings over time in order to purchase their own wearables. Generally, however, these delegates — most of which have few financial ties to the underlying ecosystem — are seen as the primary value extractors within the game economy and a constant source of selling pressure on the in-game currency, ICE.

By accessing a wearable NFT, a player gets a daily allocation of chips that can only be used for playing ICE Poker. Players themselves don’t need to wager bets to play ICE Poker. Winning is measured in the number of ICE tokens earned. This gives players a risk-free seat at the table: a player’s upside potential is entirely based on in-game performance.

Each player is incentivized to perform a daily check-in, complete three daily challenges, and play well in exchange for ICE tokens and XP rewards. Gameplay rewards are calculated as follows:

- Based on each player’s ranking on the daily leaderboard, a performance multiplier is applied to their earnings, which are paid in ICE. The higher a player ranks, the higher their ICE earnings.

- Players may also get ICEbased on their wearable NFTs. There are five different wearable NFT ranks, each with corresponding rewards.

- At the end of each month, players who are at the top of the leaderboard can earn additional DG tokens, granting them increased governance and fee share in the DG ecosystem.

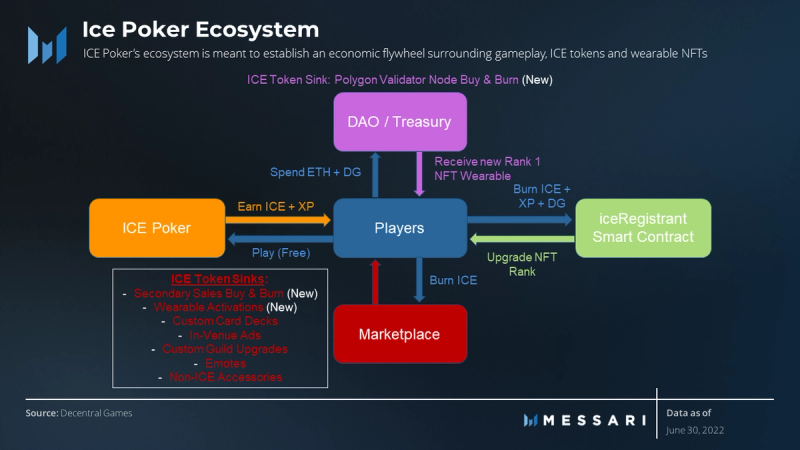

Almost all “play-to-earn” games with in-game economies suffer from inflationary pressure. ICE Poker is no exception — in fact, it has faced increasingly severe levels of inflation in recent months, as general player enthusiasm drops off amidst a deepening bear market. The DG team has made addressing the ICE token inflation issue their top priority, primarily through the use of “token sinks” that serve to promote a “play-to-own” game philosophy.

Token sinks are in-game incentives for players to spend/burn the in-game currency and retain value within the ecosystem, rather than fully extract value out. The “Delegation V2” proposal that recently passed DG governance will deliver a significant token sink opportunity called “Banked ICE”. Scheduled to launch in mid-August, this new token dynamic is expected to materially reduce the ICE token inflation and may even shift the supply issuance net-deflationary. This proposal, along with several other token sink opportunities, are further explained under the Qualitative Analysis section of this report.

Performance Analysis

Daily Active Users

In its life span since the Q4’21 launch, ICE Poker has been among the most active and fastest-growing decentralized virtual worlds. Though like most other Web3 platforms, this growth was not enough to be spared from the overall market downturn.

ICE Poker hosted 7,808 daily active users (DAU) on average in Q2 2022, down ~2% QoQ. This comes after the platform experienced a ~500% QoQ increase in DAU in Q1 2022 compared to Q4 2021, when the game initially launched. This trend reversal in DAU is jarring, considering the steep incline seen just a few months prior. In fact, the peak DAU since launch (11,976) was recorded in Q2 2022 on April 11, 2022.

The peak occurred less than two weeks out from a sharp decline in DAU on March 30 caused by a software glitch post-launch of the much anticipated Assigned Seating feature. The recovery in DAU was short-lived. However, weakness in DAU followed increasing volatility in markets, ultimately influencing players toward “risk-off” behavior. DAUs fell to 5,435 by the end of June, down ~55% from the April peak.

Daily Active Users vs. ICE Supply (Inflation)

Juxtaposed against the accelerating growth in ICE inflation, there could be several factors contributing to increased inflation. Among these factors are increased earnings from wearable upgrades and bonus multipliers and a reduction in user reinvestment driven by reduced appetite for “risk asset” exposure. Some players chose to “de-risk” in response to uncertainty, selling their ICE rewards immediately for assets perceived to be “safer” — currently a theme felt broadly across global markets.

Player NFT Interactions

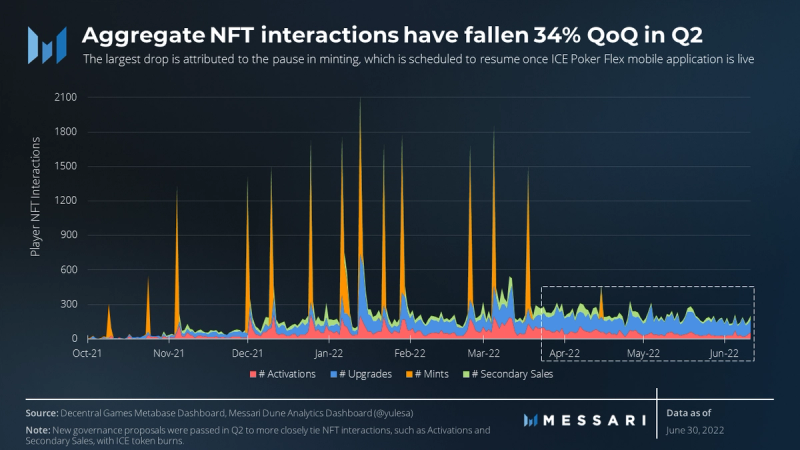

At the very least, these players are likely not taking full-advantage of the many “token sinks” (e.g., wearable upgrades/activations, accessory purchases, secondary sales, etc.) put in place to mitigate ICE emissions.

Nearly all player interactions with ICE Poker NFTs have declined QoQ. With fewer daily active users (DAU), the number of activations fell 33% QoQ. Secondary sales transactions decreased 41% QoQ. Per recent governance proposals explored in depth in the Governance Updates section below, both activations and royalties from secondary sales would result in ICE tokens burned. The fact that these transactions occur less frequently does not help the effort to reduce ICE inflation.

Notably, only 1,500 NFTs were minted in Q2 2022, down 84% compared to 9,477 in the previous quarter. The “ICE Viking” drop (1,250 supply) that took place in April 2022 was also one of the game’s first collections to require ICE tokens as payment, instead of ETH. The decision to price this collection in ICE came after the passing of a community-driven governance proposal in Q1 2022. The proposal called for future minting events to be used as another token sink to combat ICE inflation. The DG team announced that all future mobile tournament mints will be priced in ICE (instead of ETH), to solidify mobile minting as a permanent token sink. No further mints are expected until the ICE Poker Flex app goes live in mid-August 2022.

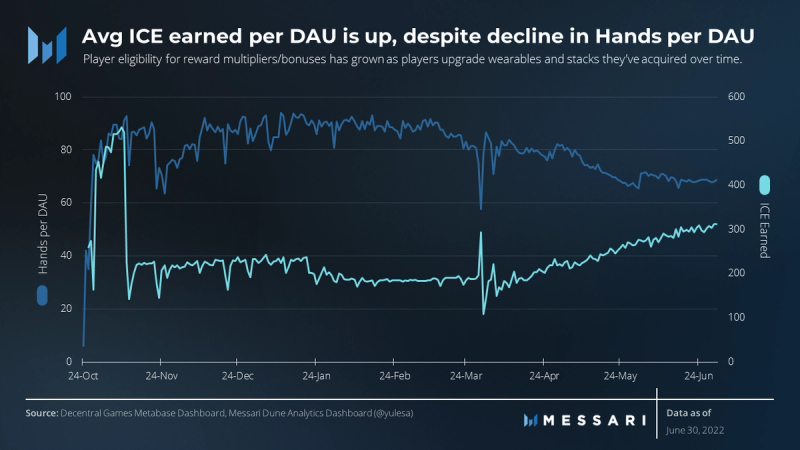

ICE Earned per DAU vs. Hands per DAU

As player NFT interactions shrink, the average ICE earned per DAU continues to grow. Notably, hands per DAU is moving in almost the opposite direction. Once considering the game dynamics, the movement could be explained by an increasing number of ICE Poker players being eligible for reward multipliers and bonuses from upgraded wearables and stacks that players have acquired over time.

While gameplay requires a certain time investment, lending out wearable NFTs requires managing the performance of delegated players. The better those delegated players perform, the more revenue is accrued by player-owners. Guild owners may find the second option attractive by choosing to delegate their guilds.

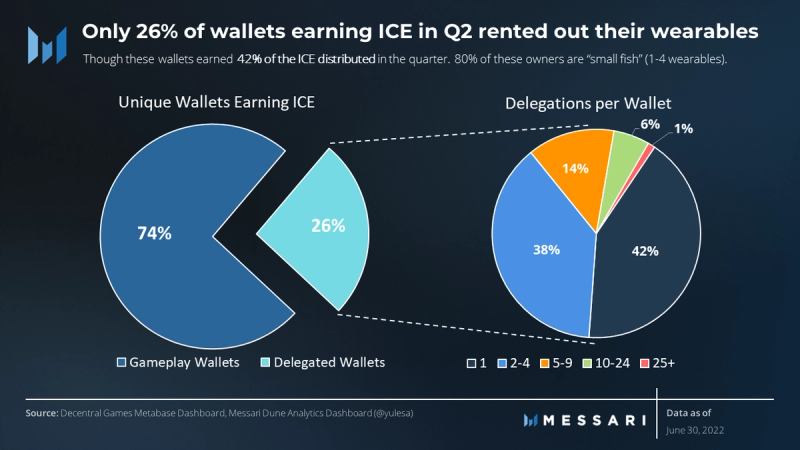

NFT Wallets by Category

Guild Owners

ICE Poker enables guild owners to maximize their returns by tracking the performance of the delegated players via the Delegation Dashboard. Guilds don’t necessarily need to be wallets with dozens of NFTs; in the ICE poker ecosystem, a wallet with a single delegated NFT counts as a guild for the game’s tracking purposes.

On-chain data shows there are more than 2,500 guild wallets, making up 26% of all ICE Poker NFT-owning wallets. Approximately 1,100 of those guild wallets delegate one wearable NFT; another ~1,000 wallets delegate out two to four; and 360 rent out five to nine wearables. The final ~180 guilds manage more than 10 wearables.

This data confirms Decentral Games’ aim of ensuring the gameplay ecosystem remains healthy in the long term. In this sense, ICE Poker did not do any pre-sale over-the-counter deals for industry insiders. Instead, ICE Poker wearable NFT drops were designed with a wide distribution in mind to incentivize gamers instead of tokenholders. That is, the goal is to incentivize the 74% of gameplay wallets to acquire their in-game wearable NFTs through organic mints or secondary sales. In doing so, the revenues generated by ICE Poker can be better sustained.

DG Revenue Streams from NFT Interactions

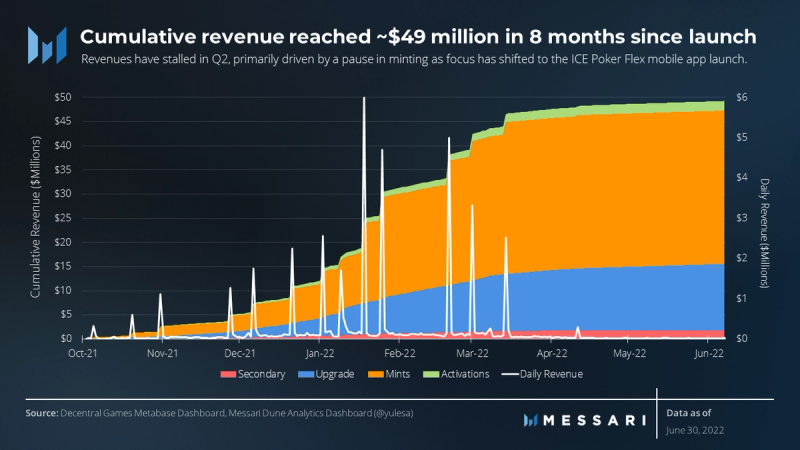

Cumulative NFT Revenues

Approximately 8 months after the game’s launch, cumulative revenue derived from ICE Poker wearable NFTs reached over $49 million in Q2 2022. Minting has historically accounted for the majority of ICE Poker cumulative revenue and revenue growth, though upgrades have gained traction as the benefits to owners become more lucrative. In fact, almost 92% of ICE Poker revenue corresponds to mints and upgrades. The remaining 8% accounts for secondary sale royalties and activations.

All in all, low revenues from secondary sales shows that only a small portion of revenues are accrued from the changing hands of wearable NFTs. Instead, once a wearable NFT is minted, most owners don’t sell them and prefer to use them in-game or rent them out. Additionally, the stagnation in recent months can be tied back to the pause in minting, given that mints make up the vast majority of NFT sales.

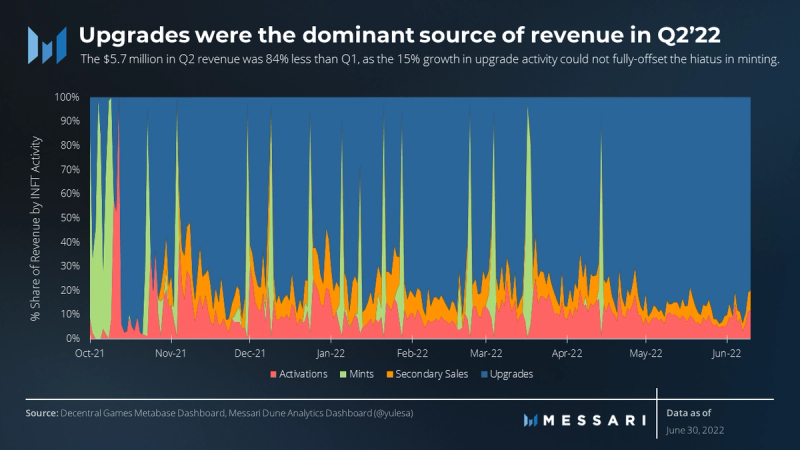

Revenue Breakdown (% Share)

On a daily basis, mint revenue can be overrepresented on NFT drop days. Those particular days are vital for the protocol because revenue from mints comprises more than 64% of ICE Poker’s cumulative revenue — though this is down from 66% share in Q1. For days without mints, the majority of daily revenue is made up by upgrades. Upgrades were especially relevant over the past quarter as mints have been paused since late-April while awaiting the launch of tournament mode. The lack of mints resulted in upgrades becoming the largest ICE sink by far for an extended period of time.

The remaining two revenue streams — secondary sales and activations —make up for only a small fraction of protocol revenue. Combined, they max out to 50% of daily revenue but typically fall around 25% or less. This upgrade-heavy revenue model hints towards positive flywheel effects at play within the in-game economy where users are incentivized to upgrade instead of extract value and/or sell wearable NFTs to the next player.

Holistically, ICE Poker’s monetization strategy still resembles those strategies perfected by high-growth consumer tech companies. The first step is user acquisition, which is where ICE Poker is today. Wearable activations and secondary sales would transition to the primary source of revenue, in the long term, once a solidified base of users remain within the ecosystem and the protocol achieves scale. These recurring revenue streams in turn yield higher valuations and price stability for the protocol.

Qualitative Analysis

Governance Updates

The maintenance of the rules that govern Decentral Games is mostly left up to stakers of the DG token. Governance participants can vote on the use of proceeds, reward distributions, whitelist logic, partnerships, gameplay factors (such as point multipliers), and more. The following is a series of approved governance decisions with high protocol impact:

Jul. 13, 2022 — ICE Poker Delegation V2: Play and Own

In an effort to develop a sustainable in-game economy, Decentral Games made a substantial change to the delegation system. Delegation V2 shifts incentives in favor of player ownership. Delegated players have historically been a source of ICE dumping, as referenced on June 30, due to little incentive to hold the tokens or spend within the DG ecosystem.

This governance decision implements “Banked ICE” rewards for delegated players in place of the original ICE token. With Banked ICE rewards, a player can only spend the tokens in one of four ways. Three paths involve purchasing in-game accessories at a discount, but the fourth path is to redeem the Banked ICE at a 70% haircut (only 30% redeemed). Additionally, Banked ICE claims would be subject to the 2,000 ICE claim threshold. To be able to claim more than 2,000 ICE, a user must have a minimum of 6,667 Banked ICE.

This proposal is expected to result in a ~55% drop in ICE emissions. The projected ICE burn rate should exceed the ICE emission rate. This shift would make the ICE token deflationary with a burn-to-earn ratio greater than 1.0x. Additionally, this system is expected to nudge more delegated players to become “player-owners” by purchasing their own wearables at a discount rather than to lose 70% of the value of their ICE. The proposal will go into effect with the new SNG tournament update expected in August 2022.

Jun. 17, 2022 — DG Liquidity Provision on Top Centralized Exchanges

Approval of this proposal granted the ability to use DG DAO treasury funds to bootstrap liquidity on at least two centralized exchanges. The names of the exchanges and the exact dates have not been disclosed in order to prevent potential frontrunning. The goal of this proposal is to launch ICE on large fiat on-ramps to onboard a larger cohort of users.

May 22, 2022— Dynamic Chip Allotment

This governance decision enables daily chip allocations to be determined by a formula. The formula takes into account both wearable level as well as stacked item count owned by the player upon checking in. Additionally, the base allotment of chips is set to be reduced in favor of higher variable allotment based-off skill level. This change is expected to improve gameplay, add incentive to upgrade/stack wearable items, and close the gap on the variance of chip value.

May 20, 2022— Use Secondary Sales Revenue to Burn ICE

This governance decision is another effort to curb ICE inflation by granting the conversion of secondary sales royalty revenue to ICE. The resulting ICE will immediately be taken out of circulation (burned). It has been implemented for activation fees, Polygon node commissions, and advertising revenue. However, this is a temporary measure preceding the launch of SNG Tournaments — expected to be a more long-term solution for inflation reduction.

May 1, 2022— Increase XP Earning with Wearable Stacking

This governance decision updated the way in which earned XP is calculated. The previous calculation was [1, 2, 3] XP for completing [Easy, Medium, Hard] challenges. Instead, in the new calculation, XP will be apportioned as [N, 2N, 3N] XP, where N is the number of wearables stacked. This is expected to incentivize further stacking, which is beneficial for retaining value within the ICE ecosystem. Additionally, the proposal would reduce the possibility that someone with enough ICE would not have sufficient XP to upgrade their NFT. This would reduce the friction for players who would otherwise burn ICE to upgrade.

Apr. 30, 2022— Increase Polygon validator node commission to 5% and convert it to ICE

To produce additional token sinks, this governance decision grants the DG team the ability to increase the validator node commission from 0% to 5%. Funds collected from the validator will be allocated to purchase ICE tokens to permanently take out of circulation.

Reputable validator nodes with strong uptime track records charge anywhere between 3% and 100% commission on Polygon staking rewards. Decentral Games will now begin charging a 5% commission, which reasonably reflects its strong track record and trusted brand.

Apr. 29, 2022 — Biweekly Claim Period for Players

This governance decision implements a 14-day hold period on all distributed ICE rewards. This hold period will replace the 2,000 ICE minimum claim threshold. This new proposal was deemed to be a fairer way to combat colluders and chip dumpers and was a popular choice, based on the 99.43% votes in favor.

Apr. 19, 2022— Fidelity rewards: Incentivize upward mobility

Implements a new multiplier on daily ICE rewards using a set of criteria to incentivize positive engagement within the ecosystem.

Apr. 12, 2022— Change the wearable activation fee from DG to ICE

This proposal changes the activation fee charged on wearable purchases from 500 DG tokens to 2,500 ICE tokens to be immediately burnt. This was one of the earliest proposals in Q2 2022 that attempted to address the growing ICE inflation issue.

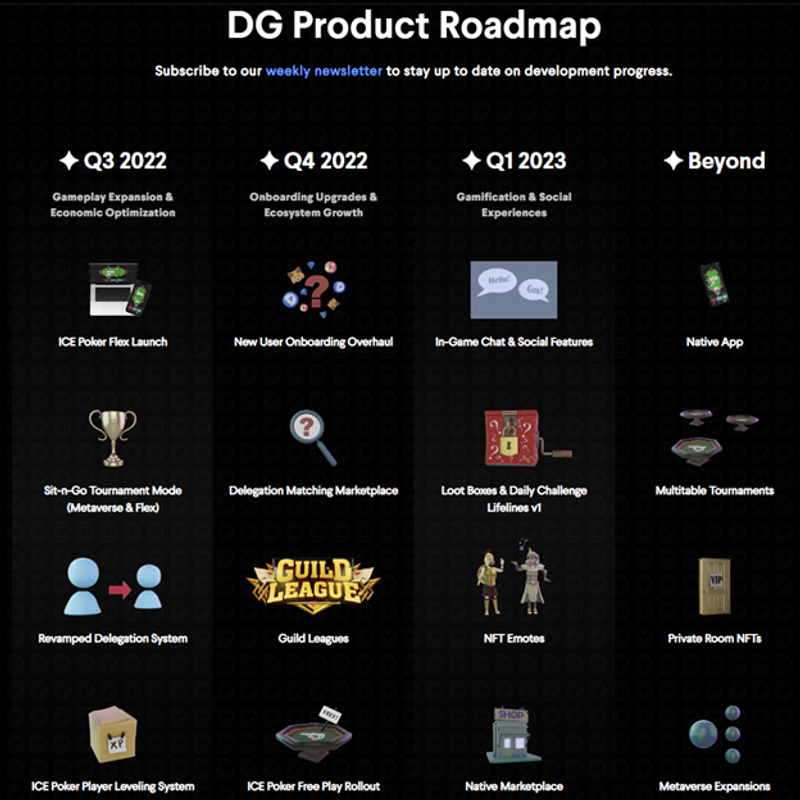

Though not 100% complete, the above graphic gives a high-level overview of the product roadmap. In step with the focus of the recent governance proposals, the Decentral Games team prioritized “long-term sustainability” of the in-game economy over the past quarter. The following are milestones planned in the near term.

ICE Poker Flex

Launching in mid-August, ICE Poker Flex will bring ICE Poker to web browsers, tablets, and most notably mobile devices. The web app will allow users to play from any device, bypassing the restrictions of mobile app stores. Players will be able to join a table directly without needing to enter through Decentraland, which is a desktop-only environment.

Given that the Flex web app closely resembles that of a Web2 UI, enhanced reliability from the underlying tried-and-tested techstack can be expected. Flex will attract users who would typically avoid the clunky and complex setup required to play within a Web3 “metaverse” app such as Decentraland. By providing more avenues to play ICE poker, this update is expected to increase user acquisition, remove friction, and enhance the sustainability of the in-game economy.

Sit-n-Go (SNG) Tournaments

Decentral Games will be introducing ICE Poker SNG (Sit-n-Go) tournament mode, which will launch in tandem with the mobile app expected in August 2022. ICE Poker SNG is a fast-paced, single-elimination tournament that begins immediately once six players join a table. SNG tournaments will have larger prizes that differ from the rewards won in normal ICE challenges, thus not directly inflationary to the ICE token.

Winners will be able to collect badges to redeem for prizes including ICE Poker Wearables, accessories, ICE tokens, and xDG. The push to reward badges rather than tokens directly is part of a wider initiative to recapture more value back into the ecosystem and reduce the amount of immediate “dumping.” This update also includes a new form of currency used to enter tournaments, called “Shine.” Shine can be acquired by holding special “tournament wearables” which come with a Shine allocation or by burning ICE to add Shine to an existing wearable.

Implementation of Delegation V2 Governance Proposal

The proposal passed on July 13 is expected to take effect once the new SNG tournament update is fully live (mid-August). Community members should watch to see if this change drives the ICE token into a net-deflationary state, as forecasted.

Closing Summary

Q2 2022 was a true test of the DG community’s conviction to the underlying in-game economy of ICE Poker. There have been no shortage of challenges for the DG team — from taking on the role of the Federal Reserve to beat back inflationary pressures, to balancing the needs of the “player-owners,” the delegates, and the long-term prospects of the game ecosystem. These challenges were exacerbated by the bear market continuing to drive volatility and unpredictability in crypto as well as in global markets.

Nonetheless, ICE Poker continues to claim a strong community. The users have shown the resilience to withstand sudden shocks on both the governance side (per the new delegation mechanism) and in-game economy (with the addition of novel token sink enhancements). All the while, the DG team displayed persistence in their innovative mindset and dedication to transparency through their regular “DG roundtable” community update calls and blog posts. Given their community-centered approach and commitment to sustainable tokenomics, the DG team should be able to resolve the challenging issues they’ve set out to fix, making way for greener pastures ahead.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by Decentral Games, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.