Download the PDF version of this report by clicking here.

Key Insights

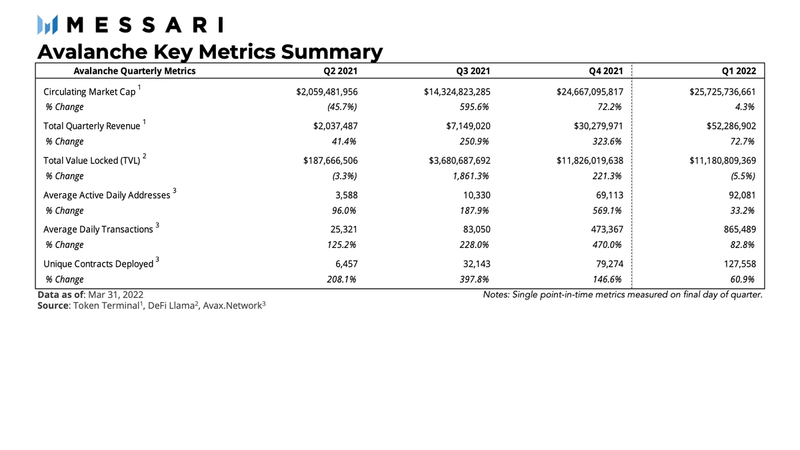

- Q1 2022 consisted of continued growth and the stabilization of network usage, financial performance, and network infrastructure.

- Quarterly growth can be attributed to the continued deployment of Avalanche Rush, the Blizzard ecosystem fund, Ethereum Virtual Machine (EVM) subnet development, and the introduction of the Multiverse subnet incentive program and Culture Catalyst fund.

- With further releases of Apricot and the launch of subnets anticipated, average transaction fees should continue to stabilize and trend downwards.

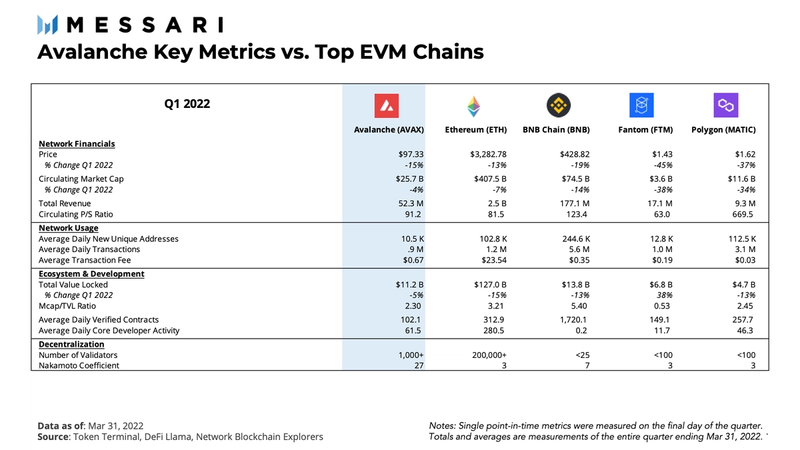

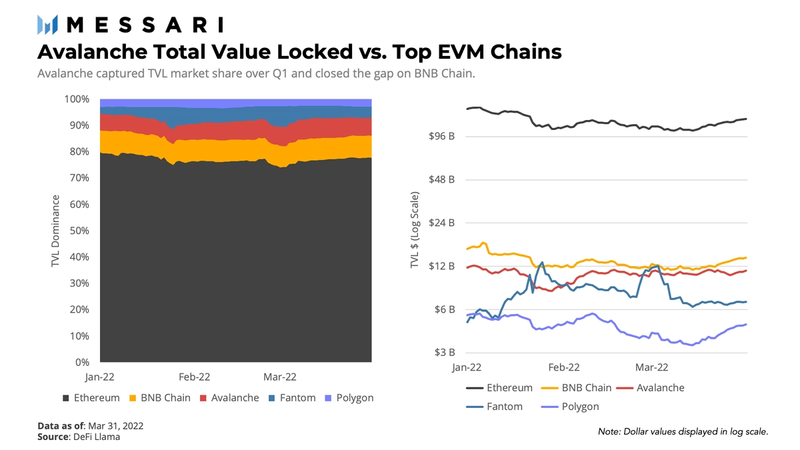

- Avalanche showed signs of capturing market share versus top EVM-compatible chains across several key metrics over Q1.

- The user experience is expected to improve with the launching of a browser extension and a mobile wallet, set to be released in Q2.

- Along with the continued development of subnets, the launch of the browser extension and a mobile wallet will enable native bridging between subnets.

A Primer on Avalanche

The Avalanche network is a Proof-of-Stake (PoS) smart contract platform for decentralized applications. Whereas most competitors use consensus mechanisms in the Classical or Nakamoto families, Avalanche differentiates itself through its creation and implementation of a new consensus family known as “Avalanche consensus.” Following years of research, the Avalanche mainnet was launched in September 2020 and featured the release of a multichain framework utilizing three chains (the P, X, and C chains). Each chain plays a critical and unique role within the Avalanche ecosystem while providing the same capabilities of a single network.

As a follow-up to the State of Avalanche Q4 2021 report, this report will revisit developments and events from the prior quarter, analyze the network’s most recent quarterly performance, and give insight into the coming months. A full appendix of data tables is available at the end of the report.

The First Quarter Narrative

Q4 2021 was a period of high growth for the Avalanche network. With the Ethereum–Avalanche bridge, major exchange listings, high-profile partnerships, and the Avalanche Rush liquidity program, the network was positioned to grow its user base and welcome new participants into its economy. As individuals and institutions piled in, Avalanche recorded all-time-highs in active addresses, daily transactions, total value locked (TVL), and market capitalization. As we moved into the new year, additional growth strategies and developments were on the horizon, but it was unknown whether the network would continue growing, experience a downturn, or show signs of stabilization.

Ultimately, Q1 2022 consisted of continued growth and the stabilization of network usage, financial performance, and network infrastructure. The outcomes were attributed to several key developments: the continued deployment of Avalanche Rush, the Blizzard ecosystem fund, Ethereum Virtual Machine (EVM) subnet development, and the introduction of the Multiverse subnet incentive program and Culture Catalyst fund. As existing enterprise partners such as Deloitte began to implement business solutions, new partnerships were formed over the quarter.

Network Overview

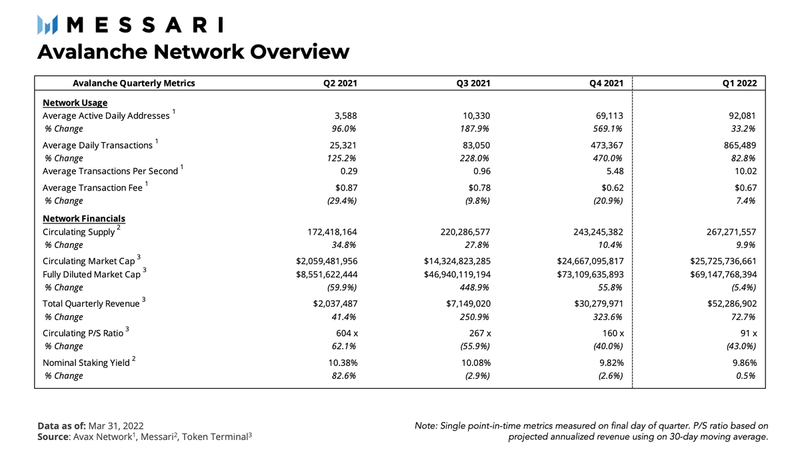

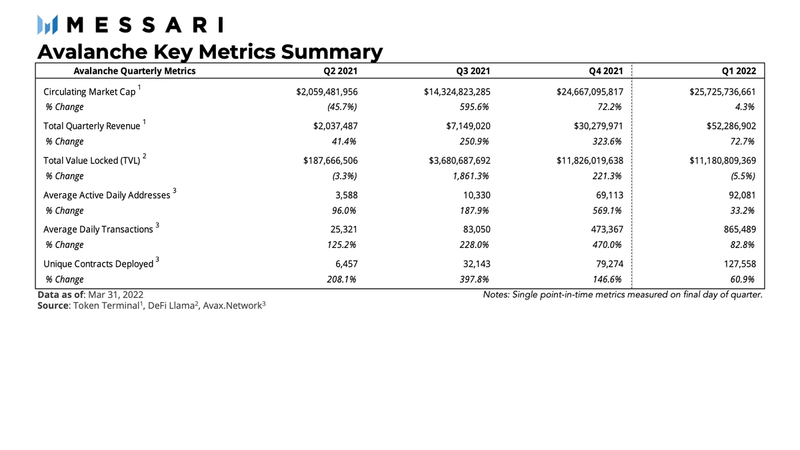

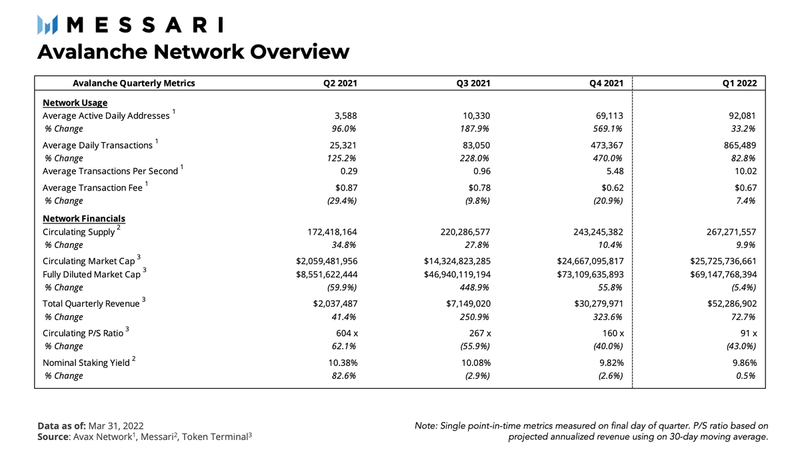

Across the board, Avalanche experienced modest growth compared to the prior quarter, and its key metrics stabilized across the network. While the market cap was relatively flat (-5.4%), the network experienced continued uptrends in usage, revenue generation, and a move towards favorable fundamental valuation. Average daily transactions nearly doubled over the quarter (+82.8%), total revenue grew by 72.7%, and the price-to-sales (P/S) ratio continued to settle down, with the ratio of price relative to revenue moving from 160x to 91x.

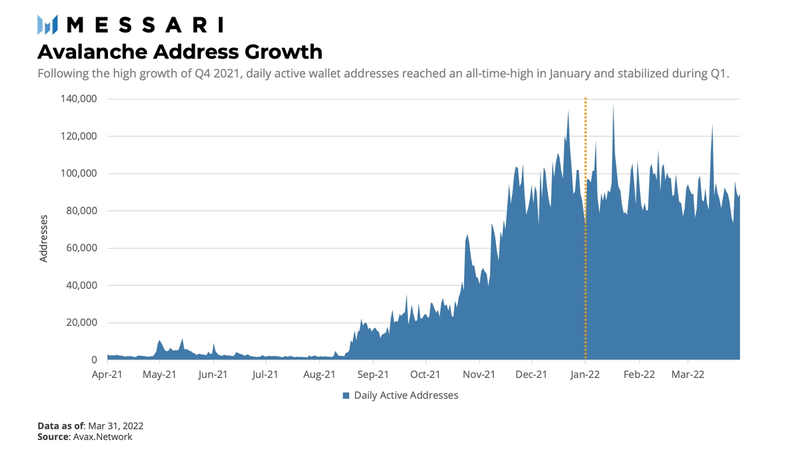

As a result, daily active addresses did not reverse course, and instead, adoption continued as active addresses reached an all-time-high of 140,000 in January. For perspective, Avalanche had more active users in the first week of January than in all of October 2021. The network averaged around 70,000 daily active addresses during Q4 and reached a stable range with an average of 92,000 during Q1.

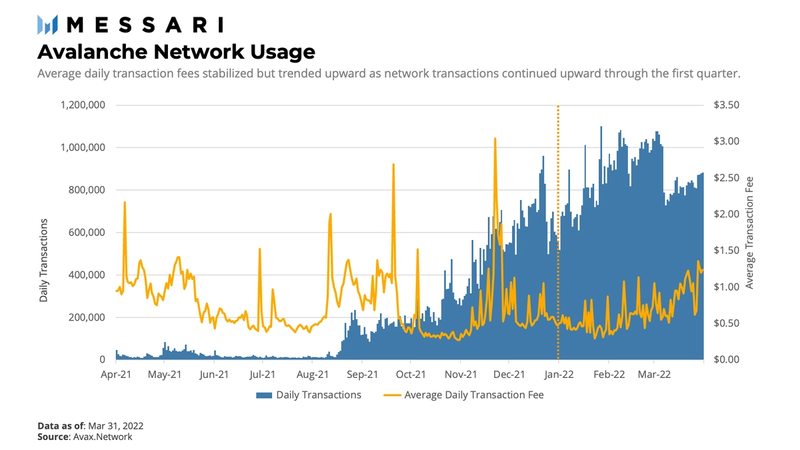

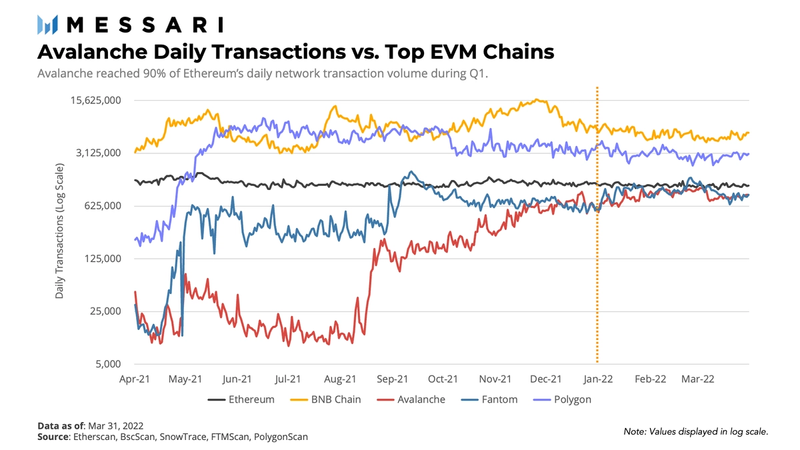

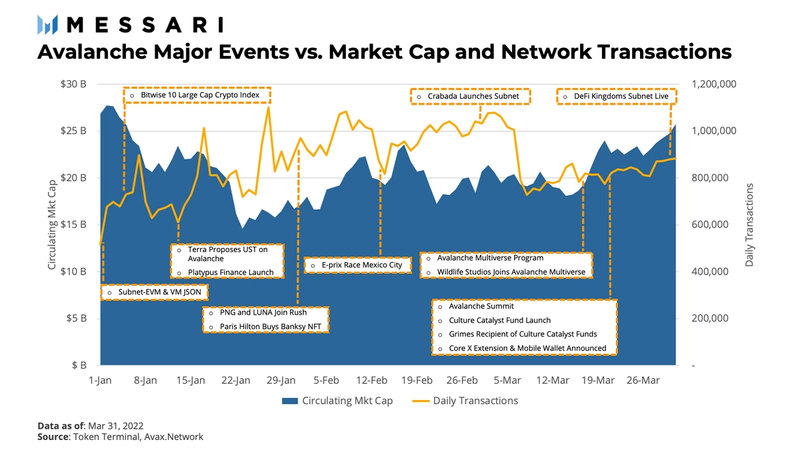

Similar to Q4, transaction activity on the network followed a similar pattern to daily active address growth. On aggregate, Avalanche’s average daily transactions rose from 473,000 last quarter to 865,000 in Q1, which is ~ 74% of Ethereum’s roughly 1.17 million. Daily transactions continued their upward trend with additional DeFi application launches and the rollout of GameFi subnets such as DeFi Kingdoms Crystalvale and Crabada. Ultimately, while on testnet, Crabada would become the top transaction driver on Avalanche during Q1. Beyond DeFi and GameFi, total 24 hour NFT volume surpassed $1 million for the first time, while the NFT market cap broke $110 million.

Throughout 2021, the network experienced volatility in average daily transaction fees. With further releases of Apricot, transaction fees have since stabilized, averaging around $0.67 per transaction. Apricot is intended to facilitate “verifiable pruning,” a process where nodes can securely compact historical transactions. It features a fee mechanism that enables transaction costs to be low and predictable for users. While stable, transaction fees have been trending upward in tandem with daily transactions. With more anticipated releases of Apricot, we should expect to see average transaction fees continue to stabilize and trend downwards.

Further, the continued launch of subnets should put downward pressure on transaction fees. Subnets are a horizontal scaling strategy that aims to validate Avalanche blockchains running in parallel, enabling transaction order, and increased performance by splitting up network traffic allowing for optimization and more control over transaction fees.

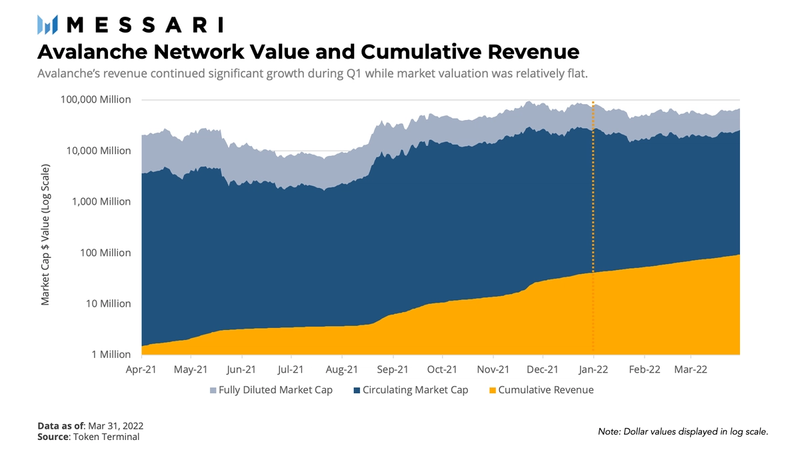

Intuitively, as daily active addresses and transactions grew, total revenue increased. Revenue grew by 72.7% over the quarter, and cumulative revenue became a more significant fraction of the network FDV. To put it into perspective, cumulative revenue as a percentage of FDV is 20x from a year ago, which signals that fundamentals like network revenue are moving more in line with market value.

Avalanche’s network revenue (transaction fees) is atypical for smart contract platforms. Rather than distributing transaction fees to validators, 100% of fees are burned from the network’s circulating supply. This drives value to all token holders through increased scarcity rather than compounding the balances of validators and delegators. In other words, revenue growth should put upward pressure on the market value of AVAX. The question is just how statistically significant the spread between revenue and market value is. With that in mind, as fundamental value (as opposed to speculative value) becomes a more substantial part of market value, a strong correlation between revenue and market value should theoretically exist.

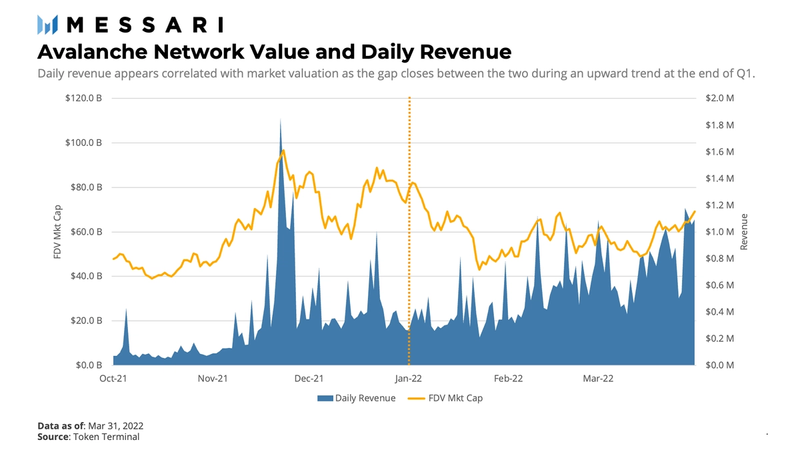

Most notably, a spike in daily revenue on November 22, 2021, was accompanied by a spike in FDV. The same relationship exists between circulating market cap and price. Additionally, the spread between the two variables tightened during Q1, with occasional spikes in revenue once again accompanied by spikes in FDV. As the spread tightens, the network usage becomes more correlated to the market value. This correlation could indicate that the network is moving closer to fundamental value versus speculative value. If the relationship holds, then revenue will have a significant relationship with network value.

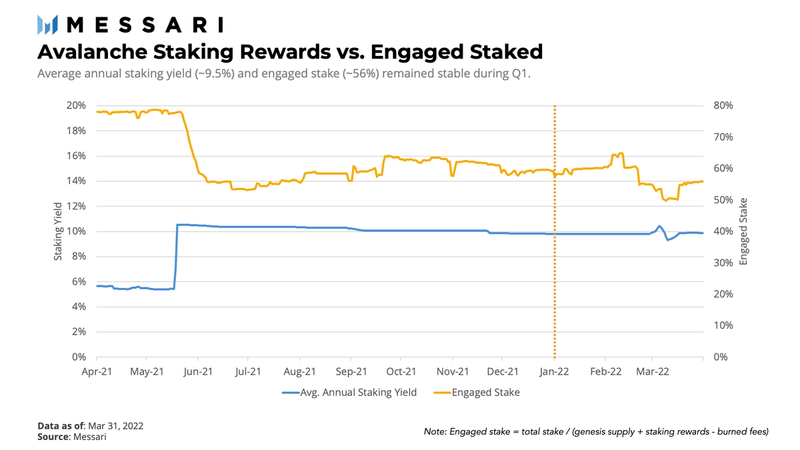

Since June 2021, engaged stake and nominal staking yields have been stable, with an average annualized yield of ~10%. One of the last significant token unlocks occurred during March, but there was no indication of a change in engaged stake. Should those tokens engage or disengage in staking, there could be additional volatility in yield over the near term.

Ecosystem & Development Overview

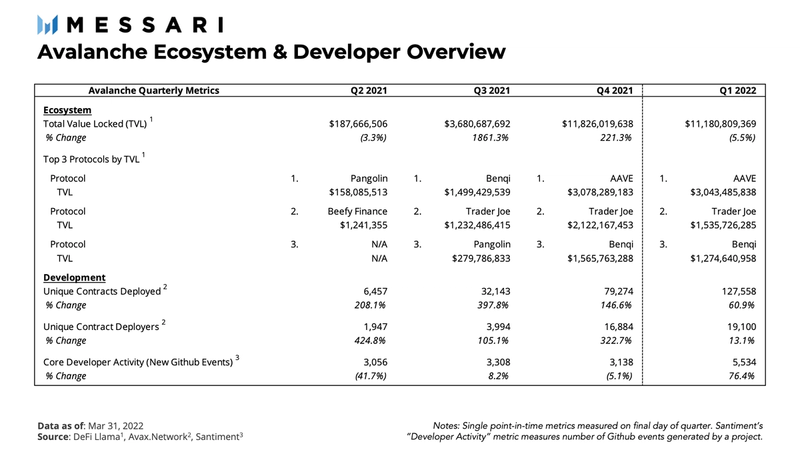

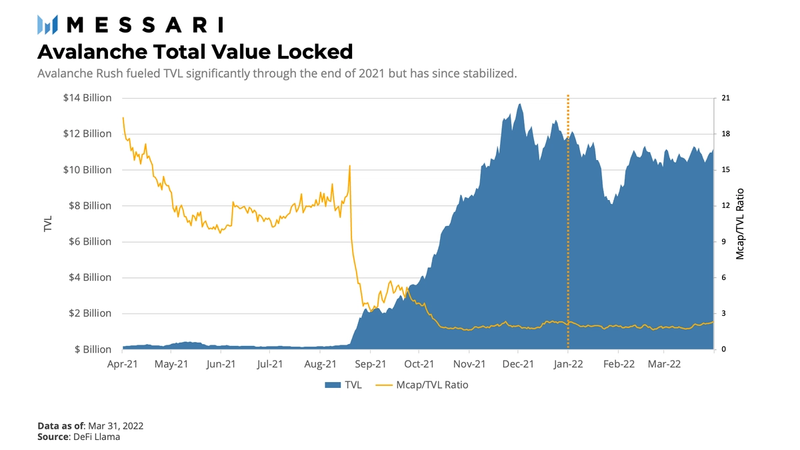

Heading into 2022, Avalanche DeFi was expected to be fueled by the ongoing Avalanche Rush program and the new $200 million Blizzard ecosystem fund. Over the course of Q1, Pangolin (PNG), an Avalanche native DEX, and Terra (LUNA) joined the Rush program and combined to bring TerraUSD (UST) to the Avalanche ecosystem. In total, $2 million in AVAX incentives were combined with additional LUNA and PNG rewards to incentivize usage.

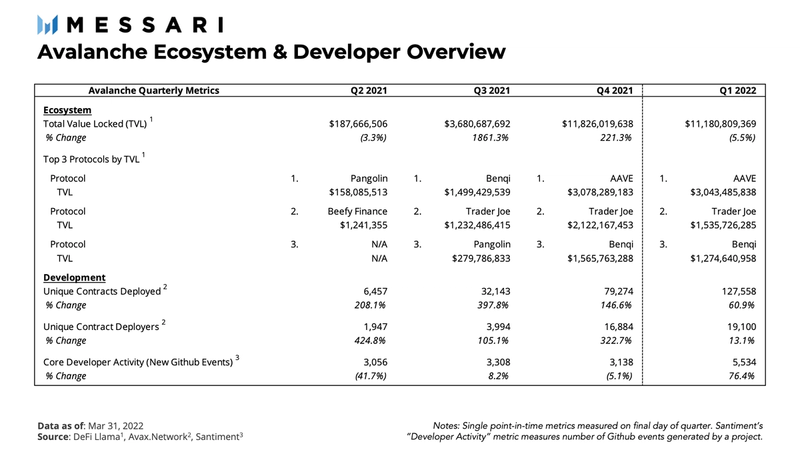

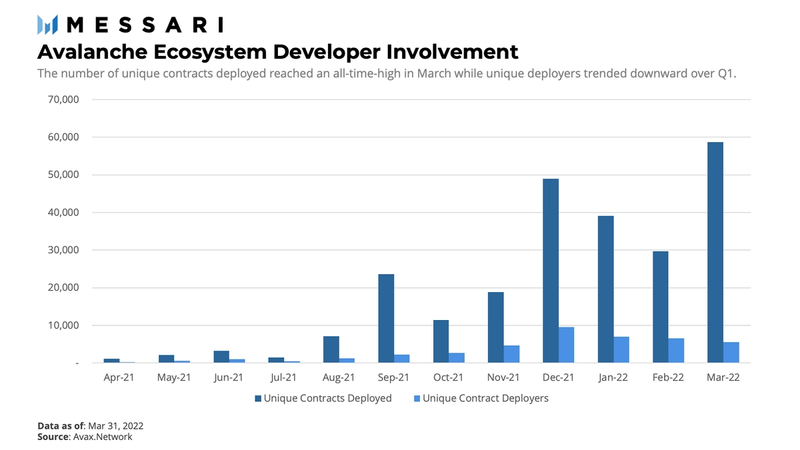

Continued network adoption was also evident in Avalanche development activity with unique contracts deployed and contract deployers having grown by 60.9% and 13.1%, respectively. Although development marched forward, TVL declined by 5.5%.

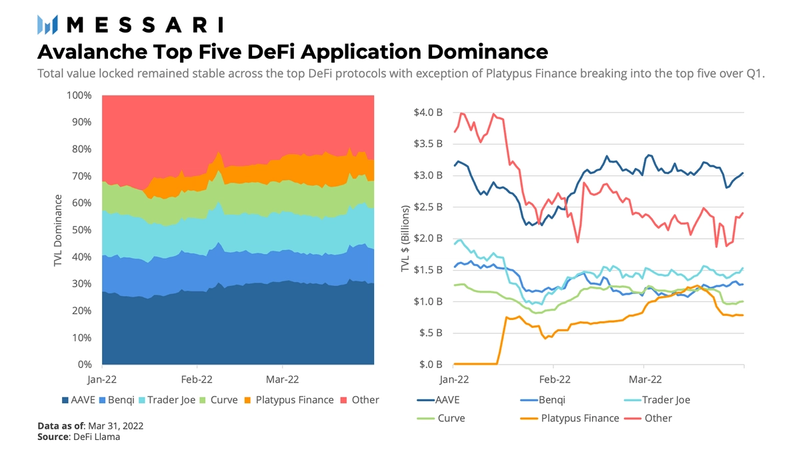

The TVL decline would have been more drastic if not for the continued growth and development in the DeFi sector. TVL is highly sensitive to overall market valuations. While TVL on Avalanche experienced a slight decline, top DeFi protocols Aave, Benqi, and Trader Joe experienced TVL declines of 4%, 18%, and 20%, respectively. Their collective TVL declined by 12% — more than twice the total Avalanche DeFi ecosystem’s decline. Essentially, the continued growth and development of newer and smaller protocols in the Avalanche DeFi ecosystem offset the market forces negatively impacting top protocol TVL. Ultimately, like other metrics in the Avalanche ecosystem, TVL appears to have also stabilized at around $11 billion.

Aave, Trader Joe, and Benqi solidified their positions as the top three DeFi protocols after joining Rush in Q4. Collectively, these three protocols experienced a 12% decline in TVL, which is greater than the decline of the entire Avalanche DeFi ecosystem. The disconnect between the greater decrease in TVL across the top DeFi protocols and the lower decline of the entire DeFi ecosystem can be attributed to additional launches of DeFi services on the network, such as the launch of Platypus Finance (PTP).

Platypus Finance is a stableswap protocol that was the fastest growing DeFi application over the quarter, having grown from just $10 million to over $750 million in TVL, representing a ~7,500% increase. Platypus also became one of the top 10 applications generating network transactions on Avalanche.

Additional launches and Rush deployments, such as Pangolin and Terra, helped prop up Avalanche’s TVL despite overall market declines. The other notable trend across Q1 was the steady long tail of DeFi protocols on Avalanche. Entering Q1, 60 protocols had amassed $1 million TVL, up from just 29 from the prior quarter. Exiting Q1, 60 protocols maintained the $1 million TVL mark. Despite the flat to down quarter, the number of applications with recorded TVL grew from 100 to 150.

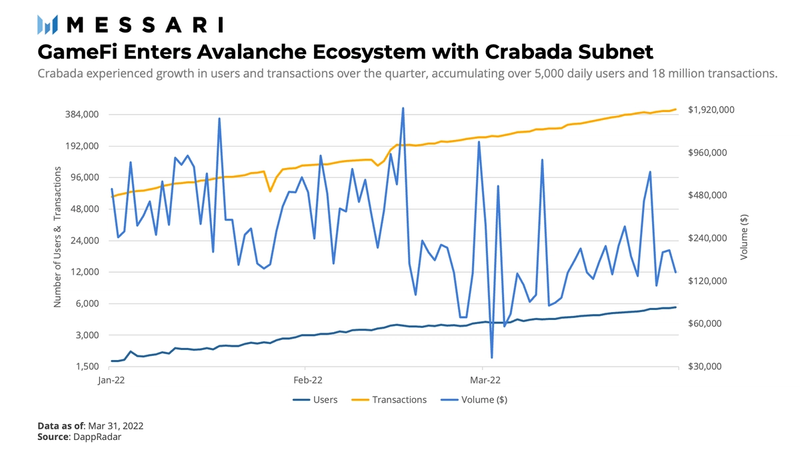

Q1 marked the beginning of Avalanche’s highly anticipated GameFi subnet launches. Crabada quickly passed 5,000 users, measured by the number of unique wallet addresses interacting with the application’s smart contracts. Daily transactions grew from 60,000 to over 400,000 over Q1, measured by transactions made to Crabada’s smart contracts. Daily volume generally ranged between $130,000 and $1.5 million as measured by the total amount of incoming value to the application’s smart contracts. Finally, the TVL in the application’s smart contracts neared $50 million by the end of the quarter. Ultimately, the emergence of new DeFi and GameFi applications was fueled by continued growth in developer metrics.

Q1 developer activity in the Avalanche ecosystem aligns closely with the network’s overall TVL growth and recent entry into GameFi. The number of unique contracts deployed grew by 60.9% quarter over quarter and reached an all-time-high in March, just as Crabada and DeFi Kingdoms launched their subnets. The number of unique contract deployers slowed on a month-to-month basis but still managed to grow by 13.1% quarter over quarter. With the deployment of the Multiverse and Culture Catalyst funds, March’s surge in contract deployments should continue through Q2 2022.

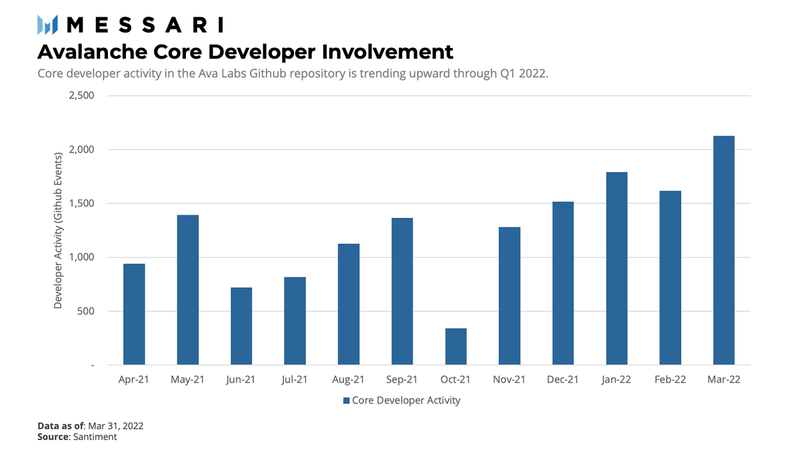

The growth of events in the Ava Lab’s Github repository grew significantly (76.4%) throughout Q1. Given this was the greatest increase to date, the number of events indicates that the network’s core team is accelerating the infrastructure buildout.

Staking and Decentralization Overview

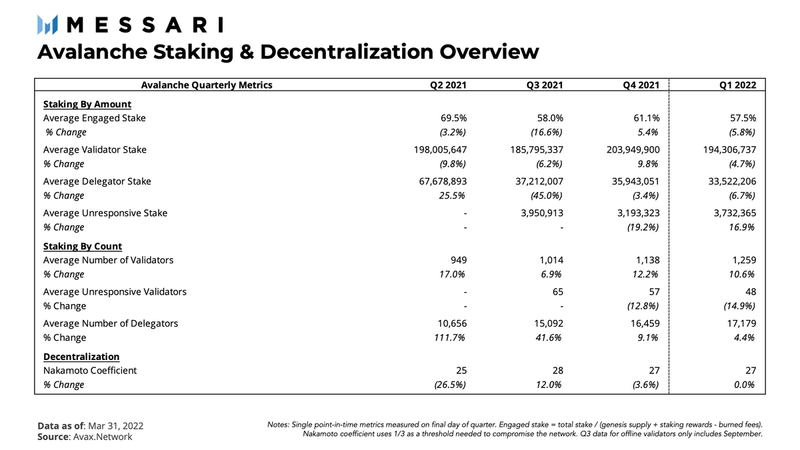

The security of PoS networks like Avalanche requires users to lock up the network’s native tokens and participate in validation duties. A distributed network of validators and active participants can help ensure the network functions as intended.

After a downwards trend at the beginning of 2021, engaged stake settled at around 60%, which has been maintained through Q1 2022.

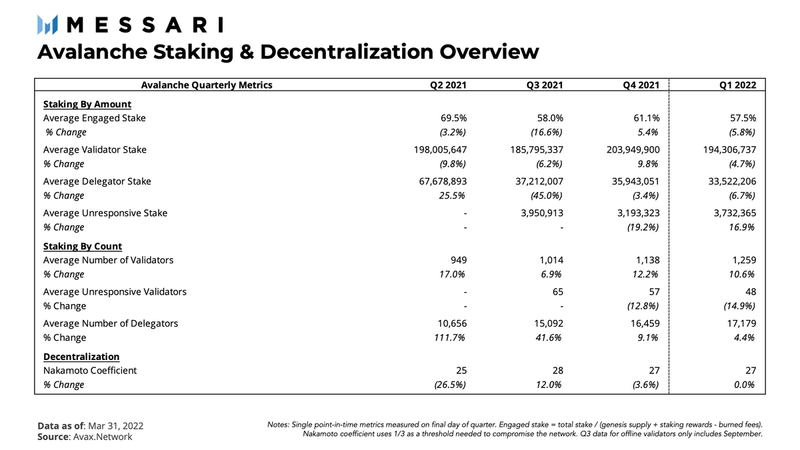

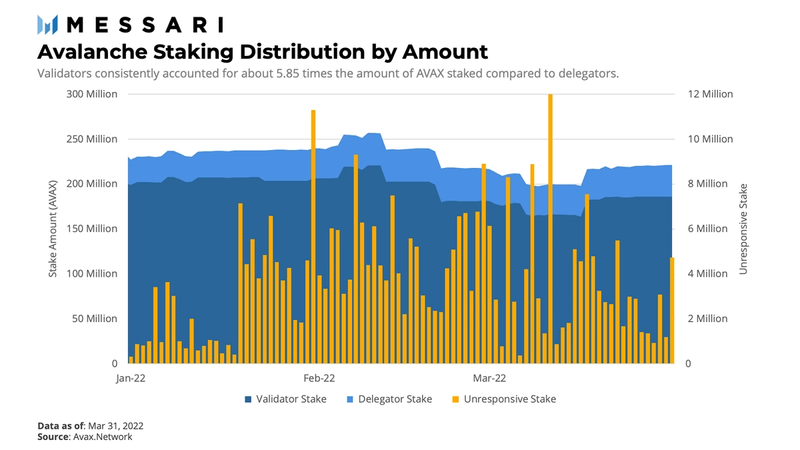

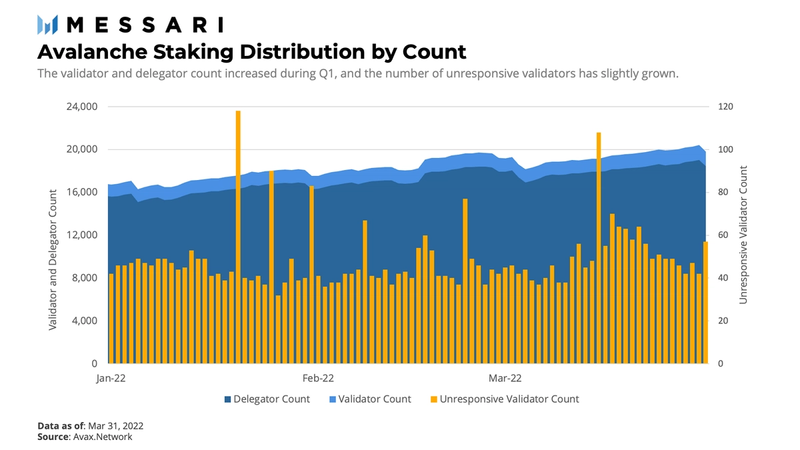

Staking amounts during Q1 were relatively uneventful, with average stake changes in the single digits quarter over quarter. Such predictability and lack of volatility are generally good for network health. Validator stake was consistently about 5.85 times greater than the amount of delegated stake. The amounts of unresponsive validator stake were higher than average on a few days, but the total amount of offline stake never came close to levels that could compromise the network.

While the average staking amount was relatively flat, there was a material increase in the average number of validators and delegators. The average validator count grew from 1,138 to 1,259, representing a 10.6% increase in network security participants. The number of average validators joining the network stayed at about 11% growth each quarter. This stability is indicative of a growing, decentralized network.

Each new Avalanche subnet will be required to validate on the Avalanche P-chain. As more subnets launch, the average number of validators should increase in tandem. The average number of delegators also grew from 16,459 to 17,179, representing a 4.4% increase. The number of delegators consistently outnumbered the number of validators, consistent with other PoS networks that support native delegation. The average number of offline validators continued to decline, decreasing by 14.9% over the quarter. Ultimately, low volatility in the network’s staked AVAX combined with an increase in validators and delegators is a sign of healthy decentralization.

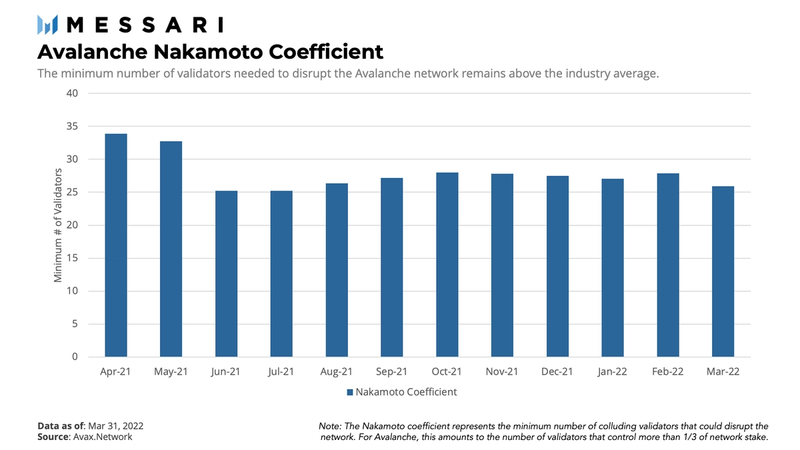

The Nakamoto coefficient is a metric first introduced by Balaji Srinivasan to quantify the decentralization of blockchain networks. The coefficient represents the minimum number of actors who can collude to disrupt the network. For Avalanche, the Nakamoto coefficient equals the number of validators that control one-third of the network’s stake. Avalanche’s Nakamoto coefficient hovered in the low 30s to begin 2021 but fell to 25 in June. Since this decline, the coefficient has remained stable in the upper 20s, putting Avalanche above the industry average for other Layer-1 networks.

Competitive Analysis

Currently, the Layer-1 space is a competitive race between new and legacy protocols to achieve the maximum possible network speed at the lowest possible cost and with the greatest degree of security. Each competitor has focused on maximizing these activities while making a range of trade-offs regarding centralization. The ideal blockchain would be fast, secure, widely used, and adequately decentralized.

The core technical advancements, developer activity, and ecosystem growth strategies may separate one L1 from another. Here, we evaluate Avalanche’s progress versus the top five EVM compatible chains (including Avalanche) by TVL. The methodology used to derive this peer group is simply by grouping the EVM chains with the largest TVL, seeing as today, DeFi is the sector driving the majority of each network’s economic activity.

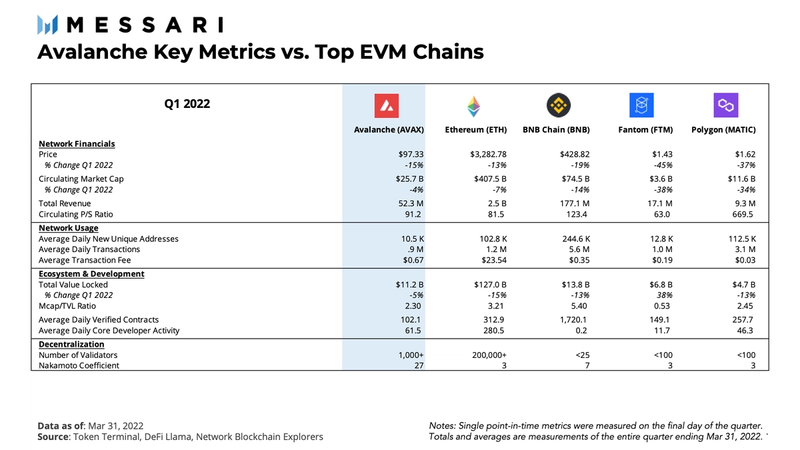

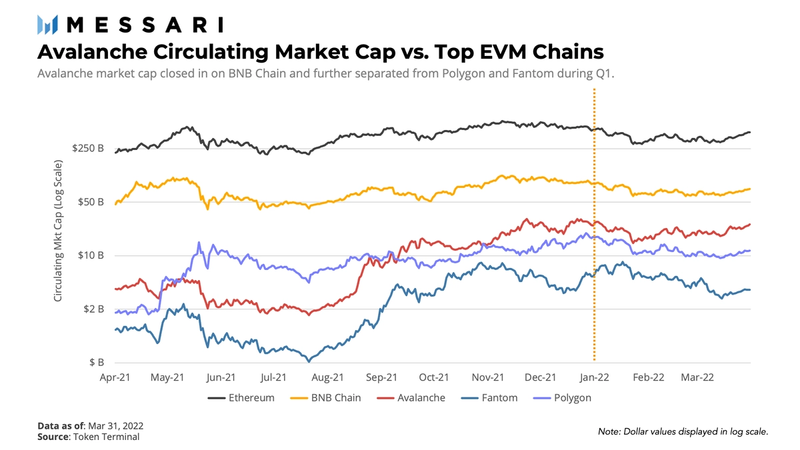

Avalanche experienced the lowest decline in value in terms of market cap and closed in on BNB Chain market share while further separating itself from Fantom and Polygon.

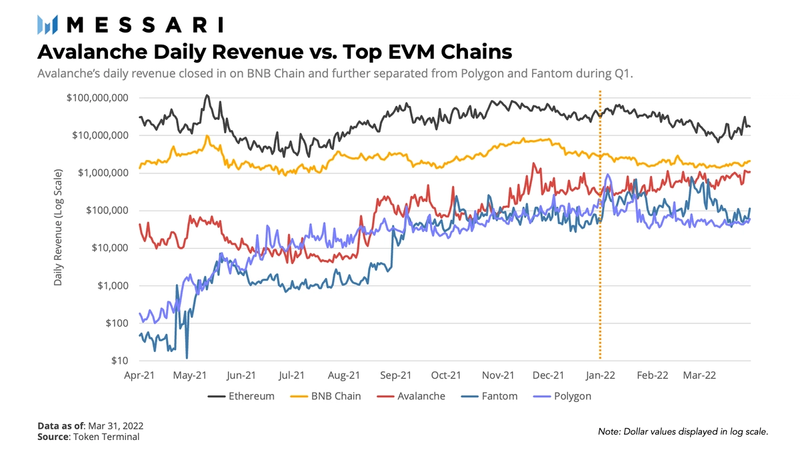

Similarly, Avalanche’s daily revenue trended upward. At the same time, all other EVM chains experienced a decline, allowing for Avalanche to close in on BNB Chain and further separate from Fantom and Polygon.

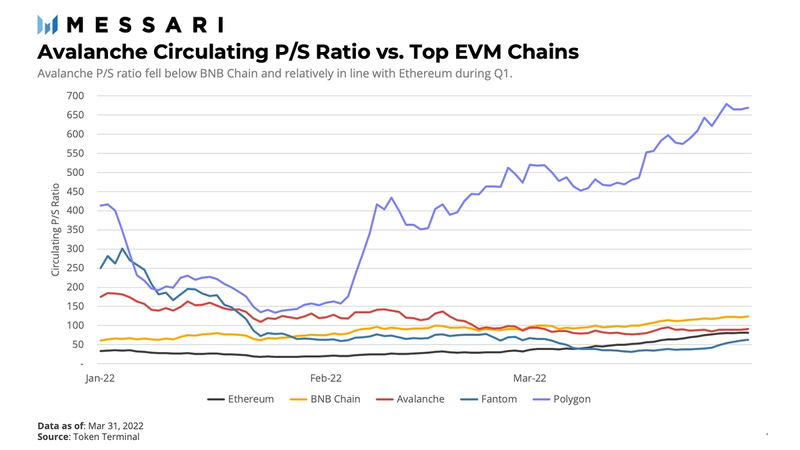

Avalanche’s P/S ratio declined over the quarter, while other chains aside from Fantom experienced an increase in this valuation metric. From a relative valuation perspective, Avalanche is now more in line with Ethereum with a P/S of 91x versus Ethereum’s 81.5x.

Both Avalanche and Fantom reached similar levels in Q1 daily transactions. Ethereum has held steady at ~1.17 million transactions per day, with Avalanche now reaching ~74% of Ethereum’s average daily transactions. With the incentive programs taking hold and subnet launches on the way, Avalanche has an interesting opportunity to surpass Ethereum over the next quarter.

Q1 was a flat to down quarter for the crypto market, with aggregate TVL decreasing from $240 billion to $230 billion. Avalanche’s TVL declined at the second slowest rate among the top EVM chains, only trailing behind Fantom. A significant portion of Avalanche’s stability came at the expense of Ethereum, BNB Chain, and Polygon, each declining by double-digit percentages. As the above chart illustrates, Avalanche closed in on BNB Chain in this area. The Avalanche Mcap/TVL ratio also ended among the lowest. As a measure of network value relative to TVL, it signifies a closer relationship between the network value and the DeFi economic activity occurring on the network.

Key Events, Catalysts, and Strategies for Ecosystem Growth

Q1 2022 proved to be another significant quarter for the Avalanche ecosystem. Indeed, growth strategies and development activity contributed to Avalanche’s ecosystem growth, as evidenced by the data presented in the previous sections of this report. The results can be attributed to several key developments:

- The continued deployment of Avalanche Rush

- Deployment of the Blizzard ecosystem fund

- Custom EVM subnet development

- Introduction of the Multiverse program and Culture Catalyst fund

January 2022

Avalanche’s Q1 began with the launch of the Subnet-Ethereum Virtual Machine, a custom VM that enables users to easily and rapidly create their own, configurable EVM-compatible blockchain. By the end of the first week of January, Pangolin announced plans to launch its own subnet. During the first week of January, not only was the Avalanche ecosystem gearing up for subnets, it was introducing additional enterprise partners. Ava Labs entered into a strategic partnership with Turkey’s electronic vehicle manufacturer Togg to design and build smart contract-based services to improve autonomous mobility.

By the middle of January, Bitwise, a prominent crypto index fund manager, reconstituted the Bitwise 10 Large Cap Crypto Index and added AVAX. Days later, Terra passed a proposal to bring UST to Avalanche with Liquidity Mining Proposal #3. Further ecosystem collaboration came about when Celsius Network announced support for Avalanche, allowing users to borrow against AVAX from a centralized provider. Further, 1inch, a widely used DeFi aggregator, was deployed on Avalanche.

January concluded with the first subnet launches on Avalanche with Spaces, a website allowing users to store and share links, images, and files all on-chain, and WAGMI, a subnet demo that is a high-throughput testbed for EVM optimizations. Finally, to round out the month, Anchor Protocol, the largest DeFi protocol on Terra, proposed and passed a UST borrowing strategy whereby sAVAX entered the platform as its newest collateral asset.

February 2022

As reported in Q4 2021, one of renowned street artist Banksy’s most iconic pieces, Love is in the Air, became a fractionalized NFT on Avalanche. The NFT was made possible by Particle, which partnered with Avalanche to bring fine art on-chain in November. By February, the Banksy NFT generated interest and purchases by celebrities such as Paris Hilton. The Particle Banksy collection would later sell out in March.

Also reported in Q4, a multi-year agreement with Andretti Formula E Autosports marked the first title sponsorship from a blockchain company with a Formula E team with a natural alignment between organizations committed to sustainability. By mid-February, the Avalanche Andretti team made its debut at the Mexico City E-Prix, the Formula E World Championship.

March 2022

March was a pivotal month of Q1. The uptick witnessed in daily transactions was largely due to the launch of the Crabada and DeFi Kingdoms subnets with Crabada running testnet and DeFi Kingdoms live on mainnet. To support the growth and development of subnets, the Avalanche Foundation announced the launch of Avalanche Multiverse, a $290 million (~4 million AVAX) incentive program. The first subnet to receive incentives through the Multiverse program was DeFi Kingdoms. Subsequently, Wildlife Studios joined the Multiverse program and will be expanding its flagship game, Castle Crush, onto its own subnet, intending to integrate NFTs and tokens into the game.

At the end of March, the sold-out Avalanche Summit took place in Barcelona, Spain, with sponsors including Circle, Terra, and Bridge Tower Capital, to name a few. During this time, the Avalanche Foundation and Web3 social media platform Op3n announced a $100 million creator fund called Culture Catalyst. The fund intends to help creative projects launch on Avalanche and Op3n. The program’s first recipient will be musician Grimes, who plans to create an “intergalactic childrens’ metaverse book.”

Ecosystem Challenges

Q1 did not present any drastic challenges like those that came with the growing pains of Q4. As reported last quarter, the Avalanche C-chain recorded new highs for daily transactions which caused the network to temporarily experience higher than usual transaction fees. This quarter, network optimizations known as Apricot quickly became apparent as average daily transaction fees declined and stabilized. With that in mind, transaction fees were trending upward towards the end of Q1 as daily transactions increased.

The anticipated solutions to scaling and lowering costs include governance, pruning, and subnet development, which will involve removing a gas limit mechanism, among other optimizations. The launch of subnets is in motion, and the horizontal scaling approach with subnets takes place will influence how transaction fees trend going forward.

The Road Ahead

Currently, Avalanche does not maintain an updated public-facing roadmap, so the protocol developments are not prescribed. However, it is expected that Avalanche Rush will continue to drive DeFi growth, Blizzard will support overall ecosystem expansion, Multiverse will drive subnet development, and Culture Catalyst will bring creative talent to the ecosystem.

It is also anticipated that core platform upgrades will continue. Significant upgrades (Apricot) are being implemented in six phases, following a successful series of Phase 5 in Q1. All phases of Apricot broadly represent one of the solutions (pruning) to the optimizing transaction fees.

As discussed during the Q4 Analyst Call, user experience improvement is of high priority. As part of this effort, Ava Labs announced details about Core, a free, non-custodial wallet explicitly created for applications on Avalanche with native support for subnets. The first iteration of Core is a browser extension, with the second being the Core mobile wallet expected to be released in early Q2. Ava Labs also announced that the Avalanche Bridge will enable support for Bitcoin, allowing BTC holders to transfer their BTC onto Avalanche securely. Bitcoin support is also scheduled to go live on mainnet in Q2. Ultimately, Ava Lab’s goal is to make the user experience as seamless as possible, and the Core wallets and bridge developments are the first steps.

Avalanche on-chain governance is also still in development. AVAX will, at some point, be used to provide on-chain governance for critical network parameters where participants can vote on changes to the network and settle network upgrade decisions democratically. Some of these parameters will include factors such as the minimum staking amount, minting rate, and transaction fees.

While all Avalanche incentive programs may continue to catalyze ecosystem growth and garner more project launches and partnerships, significant technological advancements are critical for the teams developing the Avalanche infrastructure. The continued development of subnets and the launch of Core will play a key role. For subnets to flourish, Core will need to successfully support extended functionality for subnets, such as native bridging.

Closing Summary

Network usage, financial performance, development activity, and network infrastructure continued to grow and stabilize during Q1 2022. The growth was fueled by Avalanche Rush, the Blizzard ecosystem fund, the Ethereum Virtual Machine (EVM) subnet development, the Multiverse subnet incentive program, and the Culture Catalyst fund. Additionally, partnerships formed in Q4 with enterprises like Deloitte began implementing business solutions on Avalanche while more partnerships were formed. Altogether, Avalanche showed signs of capturing market share versus top EVM-compatible chains across several key metrics over the quarter.

Across the board, Avalanche experienced growth, and its key metrics stabilized across the network. While the market cap was relatively flat, the network experienced continued uptrends in usage, revenue generation, and a move towards favorable fundamental valuation. Further, continued network adoption was also evident in Avalanche development activity, with unique contracts deployed and contract deployers growing significantly.

Avalanche incentive programs may continue to provide a catalyst for ecosystem growth. These programs may attract more project launches and partnerships, however, significant technological advancements are at the forefront of the teams developing Avalanche infrastructure. Significant developments to monitor going forward will be the continued development of subnets and the launch of Core. For subnets to flourish, Core will need to successfully implement its objectives to support extended functionality for subnets, such as native bridging. Ultimately, as with all Layer-1 networks, tracking the growth of the Avalanche network and its progress towards optimization and user experience will be top of mind looking ahead into the next quarter.

This report was commissioned by Ava Labs, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Appendix