Key Insights

- ShapeShift launched as a centralized but non-custodial cryptocurrency exchange.

- In July of 2021, ShapeShift announced that it was dismantling its corporate structure and completely decentralizing its operations to create a DAO.

- ShapeShift is searching for potential project partners across various verticals, including DeFi, NFT marketplaces, and Web3 applications. Partnerships range from integrations with app.shapeshift.com to funding through ShapeShift’s subDAO, vFOX.

Introduction

When ShapeShift launched in 2014, most cryptocurrency exchanges were centralized and the most popular tokens were Bitcoin-like variants: Litecoin (LTC), BTC Cash (BCH), or asset-backed stablecoins like Tether (USDT). Since 2014 and particularly after the 2020 Decentralized Finance (DeFi) Summer boom, some traders have stepped away from centralized exchanges (CEXs) in favor of decentralized platforms. Centralized cryptocurrency exchanges like ShapeShift have evolved to meet new market demands.

Jon ShapeShift and Erik Voorhees developed ShapeShift as a centralized, but non-custodial, cryptocurrency exchange in 2014. In 2017, the project acquired the cold-storage wallet KeepKey, and in 2018, it integrated with Ledger and Trezor’s hardware wallet collection. The project began decentralizing its trading platform by removing itself as an intermediary in early 2021. The decentralization process included an integration with a DEX aggregator, 0x, resulting in the discontinuation of KYC requirements. In July 2021, ShapeShift announced that it was dismantling its corporate structure, releasing its code as open source, and completely decentralizing its operations.

ShapeShift Platform

ShapeShift is no longer a centralized exchange. Instead, the platform is a portfolio tracking and asset management tool that aggregates protocols and services for trading and earning yield. The platform partners with 0x and cross-chain swapping protocol THORChain to compile over 50 DEXs and around 1,000 trading pairs into one interface. ShapeShift users do not pay commissions on their trades, meaning that users pay the same rate as the protocol. The interface will notify the user of the DEX aggregator, 0x or THORChain, that is providing the rate. ShapeShift also plans to integrate with Osmosis, CowSwap, and other DEX aggregators to increase the trading pairs available on its platform. The motivation to pivot from a centralized exchange to an aggregated DEX is two-fold. In addition to escaping KYC requirements, the platform can operate as a DAO instead of relying on a centralized governing party.

Liquidity Providing and Staking

FOX holders can also provide liquidity in different liquidity pools on the website or mobile app. Liquidity providing on ShapeShift is relatively simple: users deposit equal amounts of two tokens into the pool and withdraw their funds whenever they want.

ShapeShift DAO

ShapeShift DAO is a decentralized community of FOX holders. The DAO is responsible for making decisions on numerous initiatives regarding the platform’s rewards programs, product roadmap, and more. The community coordinates and communicates its initiatives through its public Discord channel, which has around 9,000 members. ShapeShift DAO collects revenues from protocol partners that share a percentage of revenues generated from ShapeShift’s platform.

FOX Foundation

The ShapeShift team formed the FOX Foundation as a non-profit organization to ensure ShapeShift’s smooth transition from a structured corporation to a DAO. The Foundation acts as an independent entity from the ShapeShift company or ShapeShift DAO. Its main responsibilities include administration and financial management. The Foundation will eventually disband after handing over its operations and finances to an established ShapeShift DAO.

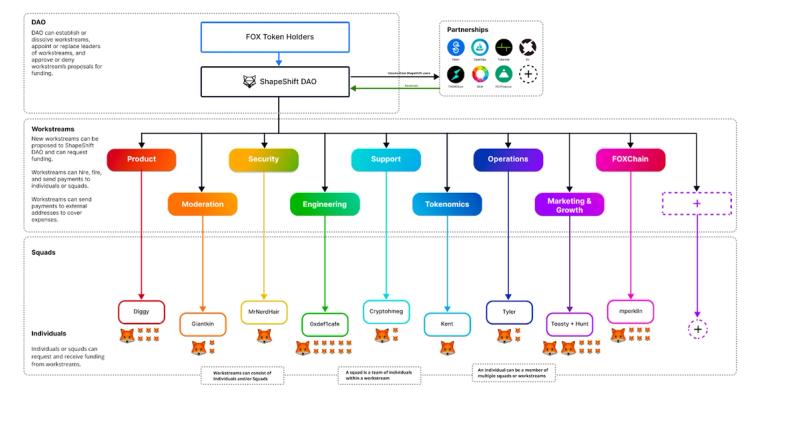

ShapeShift DAO Organizational Structure

ShapeShift DAO’s organization is currently split into nine distinct workstreams: Product, Moderation, Security, Engineering, Support, Tokenomics, Operations, Marketing and Growth, and FOXChain. However, this organizational structure may change based on community sentiment. The independent workers or groups within each workstream can ask for financial support from their respective workstreams. ShapeShift’s supporting structures include SafeSnap, SnapShot, Gnosis Safe, and Colony. SafeSnap allows community members to include multiple transactions in a single proposal. SnapShot facilities voting on community proposals. Gnosis Safe refers to ShapeShift DAO’s treasury, which is triggered when a proposal from SafeSnap is approved. Colony enables workstreams to manage their own treasuries and allocate funds autonomously when the community has voted to approve their budget.

ShapeShift DAO Treasury

Notably, 24% of ShapeShift FOX’s total token supply is allocated to the ShapeShift DAO. The DAO will receive 250,000 tokens daily from the Sablier stream until it reaches 240,000,320 tokens on June 1, 2024. The Treasury Management and Diversification Committee (TMDC) oversees the treasury and intends to prioritize FOX’s long-term success. The community budgeted 60,000,000 FOX tokens for TMDC to improve yield farming opportunities, provide liquidity, and explore other DeFi strategies. The committee is also responsible for producing weekly reports on the treasury’s overall performance.

ShapeShift DAO Partnerships

ShapeShift offers services from other protocols through established partnership affiliate programs and other collaborations. The open-source platform allows other protocols to easily integrate, providing bounties and other offerings to the ShapeShift community.

One of ShapeShift’s first partnerships is with Yearn Finance, a yield aggregator that distributes liquidity across DeFi pools. Through Yearn Finance’s affiliate program, ShapeShift offers all 62 Yearn vaults on its platform. ShapeShift has similar collaborations with Idle.Finance, and other DeFi platforms. Other ShapeShift affiliations include a joint bounty with Osmosis and Perp Protocol. ShapeShift is also offering a fiat on/off ramp in collaboration with Banxa and Gem.

Token

FOX

FOX is an ERC-20 governance and utility token. Tokenholders can propose and vote on amendments in ShapeShift DAO’s management and operations, including treasury decisions. FOX is available to trade, stake, and farm on the ShapeShift platform. Tokenholders can stake FOX for FOXy to earn additional FOX tokens through ShapeShift DAO revenue streams. The total capped supply for FOX is 1,000,001,337 tokens. ShapeShift intends to distribute 34% of the total supply to ShapeShift’s community, 32% to ShapeShift employees and stakeholders, 24% to ShapeShift DAO, and 7.5% to its Foundation. ShapeShift will reserve the right to own 1.3% of FOX’s total supply.

Traction

ShapeShift garnered the most attention when it announced its plans to completely decentralize in July 2021. Since then, they have onboarded reputable investors to the ShapeShift DAO. Most notably, Coinbase Ventures announced that they were purchasing Success Tokens from ShapeShift DAO through a partnership with the data oracle UMA. Unlike the project tokens that are sold at a discount during private round investments, Success Tokens accrue value when the project meets pre-specified objectives.

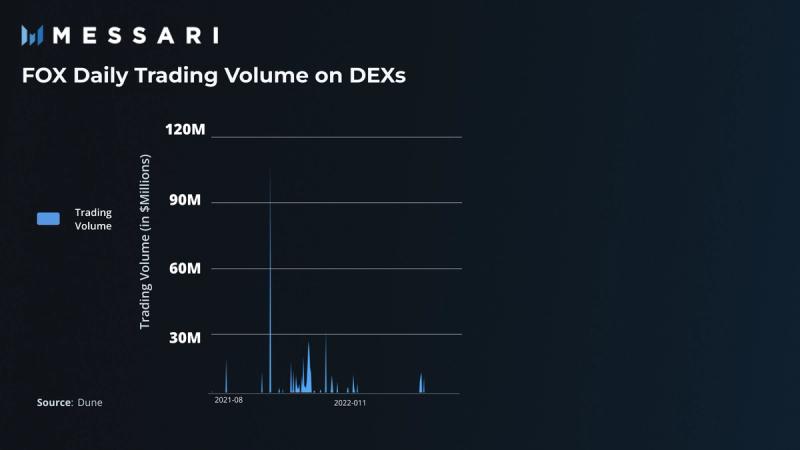

Traction for FOX

Following an airdrop that coincided with ShapeShift’s announcement to transition into a DAO, FOX tokens experienced a trading surge on decentralized exchanges. The airdrop attracted over a million users and increased trading for FOX tokens. While the trading surge tapered off in summer 2021, there is a marked increase of FOX token trades compared to its previous levels before the July 2021 announcement. This increase could largely be attributed to FOX’s utility as the governance token for ShapeShift DAO. The graph below shows the daily trading volume in US dollars from August 2021 to June 2022. Trading volumes have generally stayed under $25 million aside from some sporadic trading volume highs. There is no public information on what may have caused the trading volume to spike to $90 million for one day in Q3 2021.

Competitive Landscape

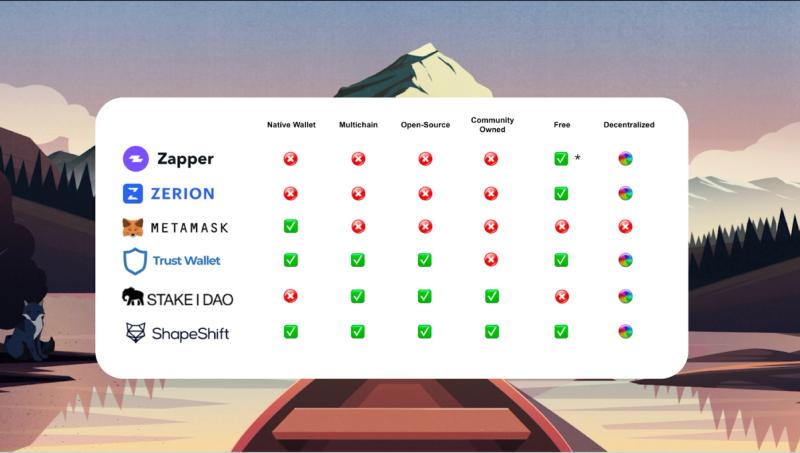

ShapeShift faces competition from various products that serve similar functionalities. The platform is an asset management tool that facilitates cryptocurrency trading. Other products that offer token swapping include DEX protocols, DEX aggregators (both on and off chain), and centralized exchanges. ShapeShift was a centralized exchange but has become an interface for aggregating DEX protocols.

Within the DEX aggregation market segment, the 1inch Network and ParaSwap sport some of the highest numbers in total volume, users, and transactions. ShapeShift requires more growth to catch up with these platforms, but the organization has at least one advantage. Although ShapeShift’s DEX aggregator is young relative to its legacy centralized exchange, the platform has a brand advantage over other new DEX aggregators and trading platforms. The ShapeShift brand has been in the cryptocurrency space since 2014. It is also likely that ShapeShift retained a decent percentage of its consumer base from its centralized exchange.

Furthermore, as an aggregator of DEX aggregators, ShapeShift is leveraging the market advantages of other DEX aggregators rather than directly competing with them. ShapeShift is a niche product, and the team believes that its closest comparisons are other non-custodial portfolio management interfaces. The ShapeShift team compares its product features with other interfaces in the chart below.

Risks

Challenging Transition from Centralized Exchange to Decentralized Platform

While ShapeShift gained new customers from their centralized to decentralized transition, they also risk losing popularity from older users. These users may start to miss the features that SnapShift offered when it was a centralized exchange. For example, the centralized exchange supported bank transfers and credit card purchases. The ShapeShift team is working to bring back the conveniences that the centralized exchange enjoyed, but it will take time to fully execute.

Roadmap

vFOX

ShapeShift DAO announced that they were launching an investment arm, vFOX, for early-stage crypto projects in April 2022. vFOX is a sub-DAO with a $1 million endowment and will invest through token allocations with ticket sizes ranging from $50,000–250,000. The initial $1 million endowment will correspond with 1 million vFOX governance tokens. ShapeShift DAO will receive 900,000, and the vFOX treasury will hold 100,000.

Product Updates

ShapeShift intends to roll out a collection of new offerings, most of which are likely to be co-development features with future partners, including CowSwap and Yat. The ShapeShift platform continues to improve its wallet support and enhance UI/UX to attract DeFi users of all levels but with a particular focus on intermediate and advanced traders. The wallets being introduced on ShapeShift include WalletConnect, XDEFI Wallet, Keplr, and Tally.

Conclusion

ShapeShift is a community that adapts to new market demands. Since 2014, the ShapeShift team has adjusted to fluctuations in market sentiment and industry values to fit an audience that prioritizes decentralization. For example, the platform was introduced without KYC, then adopted KYC due to regulatory requirements, and in early 2021, integrated with DEX aggregator 0x, leaving behind KYC. While ShapeShift is still working towards building out the new app.shapeshift.com and finding strong product market fit, the passion in ShapeShift’s community may drive positive growth for the young DAO.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by the ShapeShift DAO, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.