Key Insights

- Saddle Finance was developed to address a gap in the market: low-slippage AMM-DEXs designed specifically for wrapped BTC.

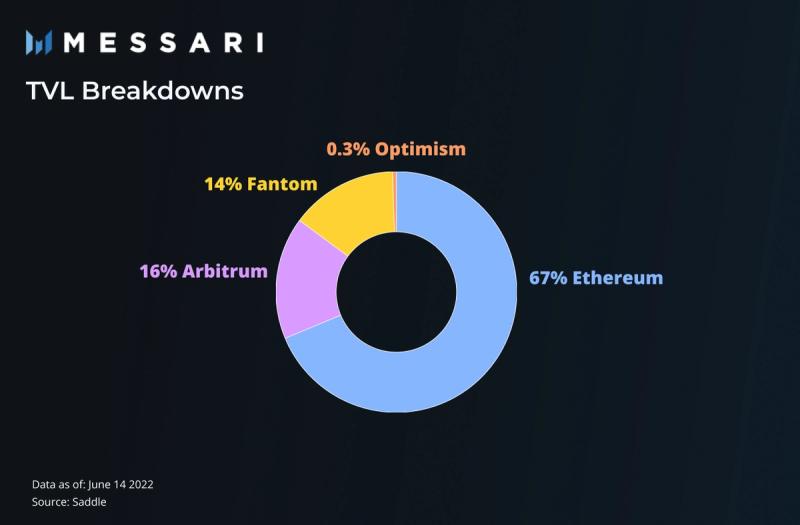

- Saddle Finance has a cumulative TVL of $57.49 million across all of its networks and a trading volume of around $27 million at the time of this writing. Around 70% of its TVL is on Ethereum. The protocol is also built on Arbitrum, Fantom, and Optimism.

- The protocol’s most popular pool is the D4 USD-pegged stablecoin pool with alUSD, FEI, FRAX, and LUSD.

- Saddle’s team plans to introduce new pools and include permissionless pools that are voted on by SDL token holders.

- Saddle Finance is also building its own metaverse and NFT ecosystem, including a credit score-based NFT that ranks users’ creditworthiness.

Introduction to Saddle Finance

Despite Bitcoin’s (BTC) enormous success, BTC lacks the ability to engage in decentralized finance (DeFi) activities. BTC holders can’t use staking or yield farming to earn high yields on top of the appreciation (or depreciation) of the asset’s price. To meet this need, wrapped Bitcoin (wBTC) was created. wBTC and other wrapped BTCs are tokens that are pegged to the price of BTC and exist on DeFi-supporting blockchains like Ethereum. Wrapped BTCs allow their tokenholders to transact, earn yield, and participate in other DeFi market activities on Ethereum and other blockchain networks.

However, there was one unaddressed issue: most liquidity pools are not designed for pegged assets like wrapped BTC. They adopt the constant product model to support more volatile token pairs. When wBTC traders and liquidity providers use pools intended for more volatile assets, they experience higher slippage and more impermanent losses than necessary. To solve this issue, Saddle Finance seeks to offer an attractive AMM-DEX for wrapped BTC traders and liquidity providers.

Saddle Finance for BTC in DeFi

Saddle Finance aims to be a low-slippage, easy-to-use AMM-DEX for wrapped BTC (wBTC) holders. However, its most popular pools by volume and TVL are for USD-pegged stablecoins and Ethereum. The protocol resides on Ethereum, Fantom, Arbitrum, and Optimism, with Ethereum being its most popular network. The platform’s UI/UX, features, and support are designed to transition to being an AMM-DEX for wBTC.

Low Slippage

Powered by StableSwap

Saddle Finance adopts Curve Finance’s StableSwap algorithm for stablecoins. Saddle decided to adopt StableSwap instead of developing their own model for pegged assets for two reasons. From the R&D and technical perspective, there’s no need to reinvent the wheel by designing and coding an original algorithm to ensure low slippage for pegged asset trading pairs. From the business perspective, StableSwap is easier to sell than a brand-new, unproven alternative. The StableSwap algorithm is market-tested and well-trusted in the DeFi community.

Easy-to-Use

For Traders

Saddle Finance offers a simple, self-explanatory UI/UX for token swaps. The UI includes a “swap from” and “swap to” dropdown menu where users select the type of asset and the amount they wish to trade. Saddle’s swapping platform includes the following trading options:

- Maximum slippage — This feature allows users to set limits on their slippage. Saddle offers suggested slippage limit orders of 0.1% and 1%, but users are free to customize their maximum slippage tolerance.

- Transaction deadline — A transaction deadline forces an order to execute within a specific timeframe. Although 20 and 40 minutes are the default options, users can also customize their timeline.

- Infinite approval — When traders select the infinite approval feature, they allow Saddle to place trades using any amount of tokens from their wallet. Traders choose to give Saddle unlimited access to their wallets out of convenience. For example, after selecting this feature, traders would only need to approve gas fee consumptions once for future transactions. However, infinite approval is often viewed as a possible security risk and even more so after Saddle’s hack in April 2022.

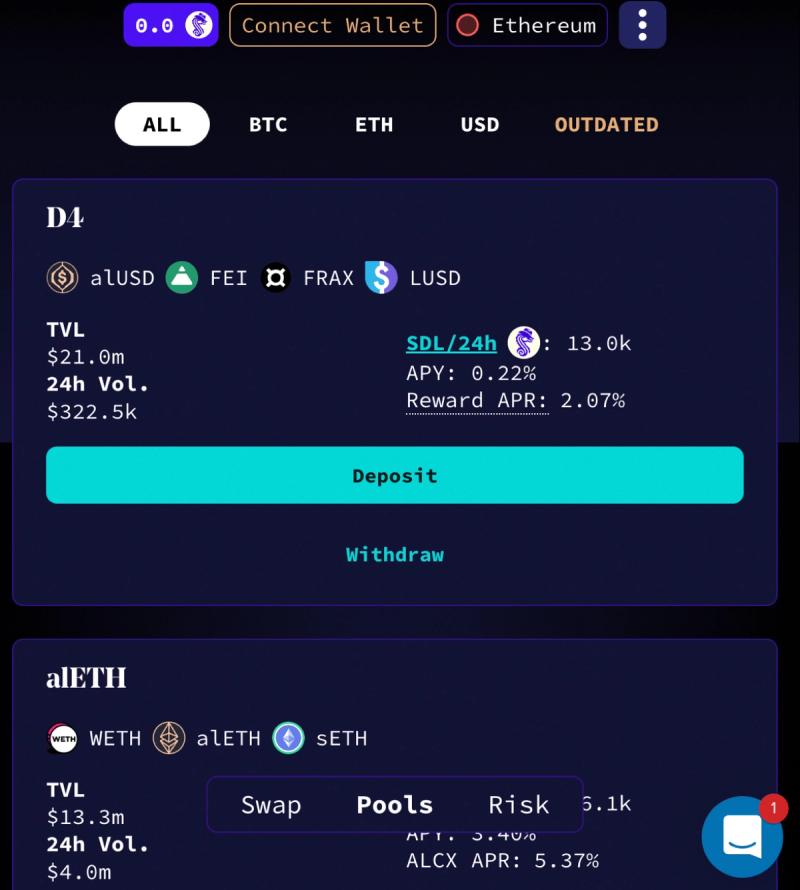

For Liquidity Providers

The UI/UX for liquidity pools is optimized for ease of use. Active liquidity pools on Saddle Finance are split into three pool categories: BTC, ETH, and USD-pegged stablecoins. The user can view all active pools on one page or filter by a single asset category. Each pool has easy-to-find “deposit” and “withdraw” options.

On the Ethereum network, Saddle Finance offers two BTC pools, one ETH pool, and five USD-pegged stablecoin pools. The tBTCv2-BTCv2-v3 pool with tBTC and saddleWRenSBTC sports the highest APY at 4.58%. Following behind this pool is BTC V2, which offers an APY of 3.44%. After the wrapped BTC pools, the pool with the highest APY is alETH. This pool includes WETH, alETH, and sETH and offers a 2.92% APY. Many of the USD-pegged stablecoin pools offer 0% APY, and the highest APY for a USD-pegged stablecoin pool is 2.06%. However, the most popular pool by TVL is the D4 USD-pegged stablecoins pool with $21 million in TVL and 2.06% APY. The second most popular pool by TVL is the alETH pool with a $13.4 million TVL and 3.4% APY. Although Saddle prides itself in its wrapped BTC pool offerings, the most attractive pools to market participants are the USD-pegged stablecoin and ETH pools. The following tables list the available pools with TVL, APY, and other awards as of this writing.

Interface Support and More

In addition to a self-explanatory UI/UX, Saddle Finance includes support features that allow new users to familiarize themselves with concepts on the platform. Features like the infinite approval option include a convenient pop-up definition. The entire Saddle platform UI/UX is equipped with a support chat plug-in to answer user questions. When the live support team is away, a chatbot will inform the visitor when the live support team will return and ask for an email address to submit responses. Saddle also includes easy-to-find risk documentation that highlights basic DEX risks like permanent losses from de-pegging, a link to Saddle’s backend code, evidence of previous audits, and a list of admin keys.

Token

SDL Value Proposition

SDL is Saddle’s native utility and governance token. It is designed to 1) capture and retain liquidity, 2) increase buy pressure and decrease sell pressure, and 3) motivate staking on Saddle’s platform. To capture and retain liquidity, Saddle Finance offers a compounding interest rate for liquidity providers that lock up their SDL for longer periods of time. SDL holders can also use their SDL as collateral to borrow stablecoins. LP tokens can be used to purchase SDL at a discount per the Olympus Bonding Mechanism. To enhance the value of holding SDL and decrease sell pressure, Saddle gives tokenholders voting rights for various governance proposals, including but not limited to Saddle’s treasury, buybacks, staking rewards, and protocol partnerships.

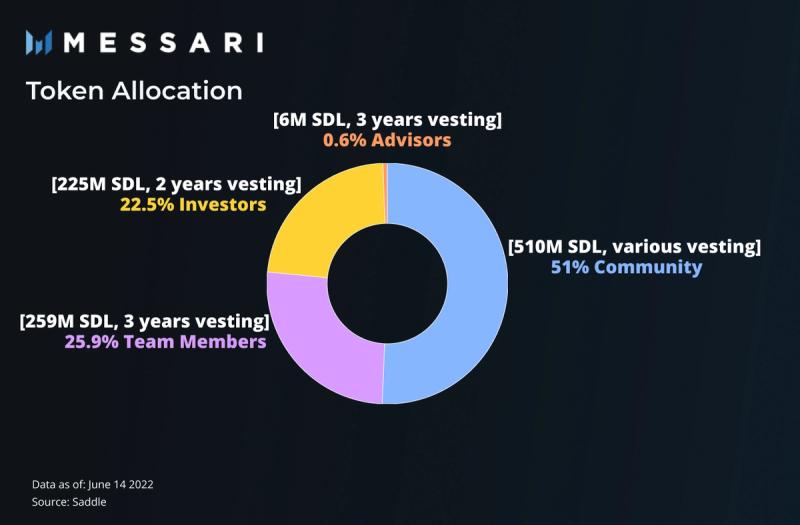

SDL Tokenomics

SDL has a total capped supply of 1 billion tokens. The charts below present the initial allocations to Saddle’s community, investors, team members, and advisors. Allocations for Saddle’s community are broken down to: past liquidity providers and users, liquidity mining, incentives programs, and the governance treasury.

Traction

Saddle Finance has a TVL of $57.49 million across all networks, making it the 11th most popular DEX on Ethereum by TVL. That said, the protocol has only garnered mild traction compared to the average AMM-DEX, due to intentionally limiting its trading pairs to pegged assets. Saddle Finance has a particular focus on wrapped BTC pools. However, a USD-pegged stablecoin pool and ETH pool together make up $34.4 million of the TVL on Saddle Finance. In other words, two non-wrapped BTC pools contribute to the majority of TVL (60%) on Saddle’s Ethereum network.

Wrapped BTC usage on smart contracts has yet to experience significant traction. At the beginning of 2022, reportedly around 1.4% of the total Bitcoin supply was transacting on the Ethereum network, which is still the most popular smart contract platform. While the majority of wrapped BTC on Ethereum (66%) was locked in smart contracts, the percentage is relatively low considering wrapped BTCs were created to interact with smart contracts.

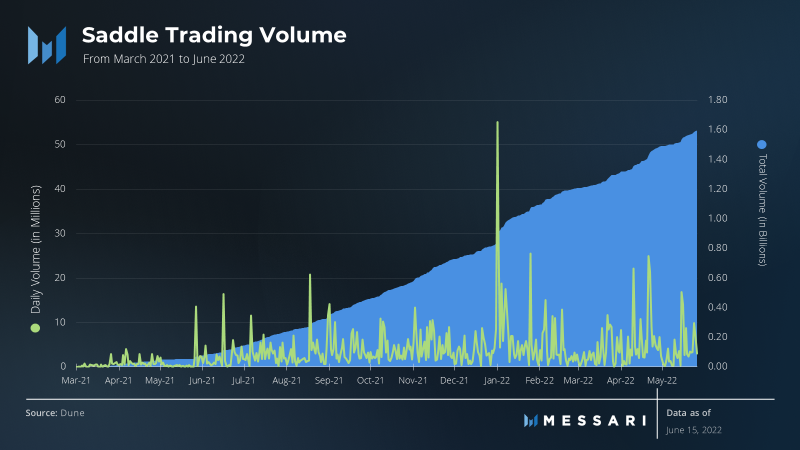

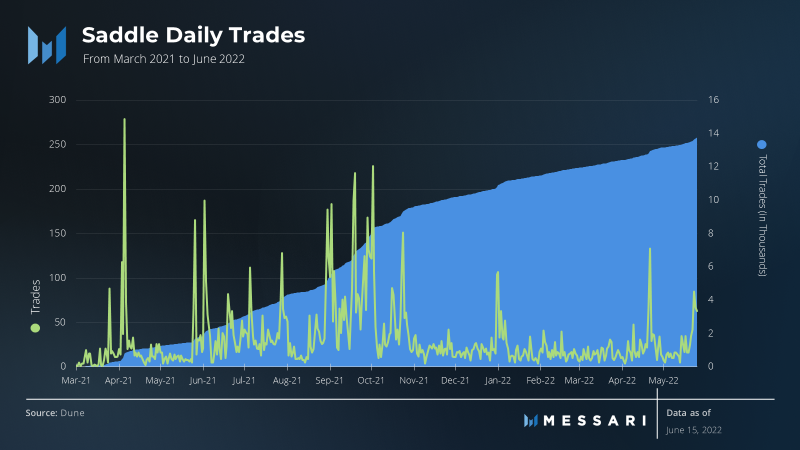

Saddle Finance may not be experiencing monumental traction, but the daily trading volume and the number of daily trades have held steady since early 2021.

Trading activity has slowed steadily on Saddle Finance since late November 2021, with daily unique traders hovering around 20 currently. However, this trading activity slowdown follows general DeFi market and AMM-DEX trends. As of June 15, 2022, Saddle has had 5,774 total unique traders on its platform.

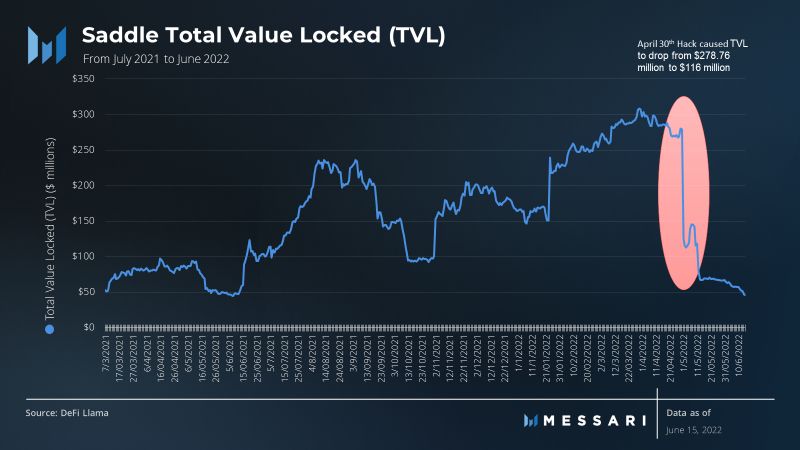

Saddle Finance experienced difficulties retaining TVL after its hack on April 30, 2022 (mentioned under Risk), where the hackers stole around $11 million. From April 29 to April 30, Saddle’s TVL dropped from $278.76 million to $116 million (circled in the graph below). Saddle’s TVL kept dropping to around $57.5 million at the time of this writing. Saddle’s TVL levels are not surprising because it has only been a few months and the hack was significant (almost 4% of Saddle’s pre-hack TVL). Only time will tell if Saddle Finance is able to recover and grow its TVL to pre-hack levels or higher.

Competitive Landscape

Wrapped BTC Smart Contract Sector

The majority of wBTC on Ethereum is held as collateral on MakerDAO to mint DAI stablecoins. A smaller percentage of wrapped BTC on MakerDAO is locked in yield-earning liquidity pools and not used as collateral for DAI. After MakerDAO, UniSwap has the most wrapped BTC held on a smart contract. Both of these protocols cater to a different audience than Saddle Finance. Neither MakerDAO nor UniSwap focuses on pegged assets, although they do also provide pools for pegged assets. UniSwap V3, for example, is updated with the StableSwap algorithm. Because there is a limited supply of wrapped BTC tokens, other DeFi platforms with locked wrapped BTC can be considered indirect and direct competitors with Saddle Finance.

To earn more of the “locked wrapped BTC” market share, Saddle Finance needs to increase market demand for trading and farming wrapped BTCs. Even on MakerDAO, wrapped BTC was mostly used as collateral instead of as a yield earning tool, despite MakerDAO being the market leader for wrapped BTC locked in smart contracts on Ethereum. Curve currently has a TVL of $260 million across its BTC pools, which indicates that Saddle Finance is also struggling to compete for market share within the locked wrapped BTC segment.

Risks

Risks from Liquidity Losses

The StableSwap algorithm is highly reliant on sufficient liquidity. The StableSwap model is an adjustable “happy medium” between a linear invariant model that yields zero slippage but is unable to maintain liquidity and the constant product model that maximizes liquidity but cannot minimize slippage. When liquidity pools are balanced, the algorithm adopts the linear invariant model. When liquidity pools are imbalanced, the algorithm would shift towards a constant product model. Slippage would be higher under the constant product model. Saddle uses the StableSwap model to mitigate low liquidity risks by integrating with liquidity aggregators.

April 2022 Hack

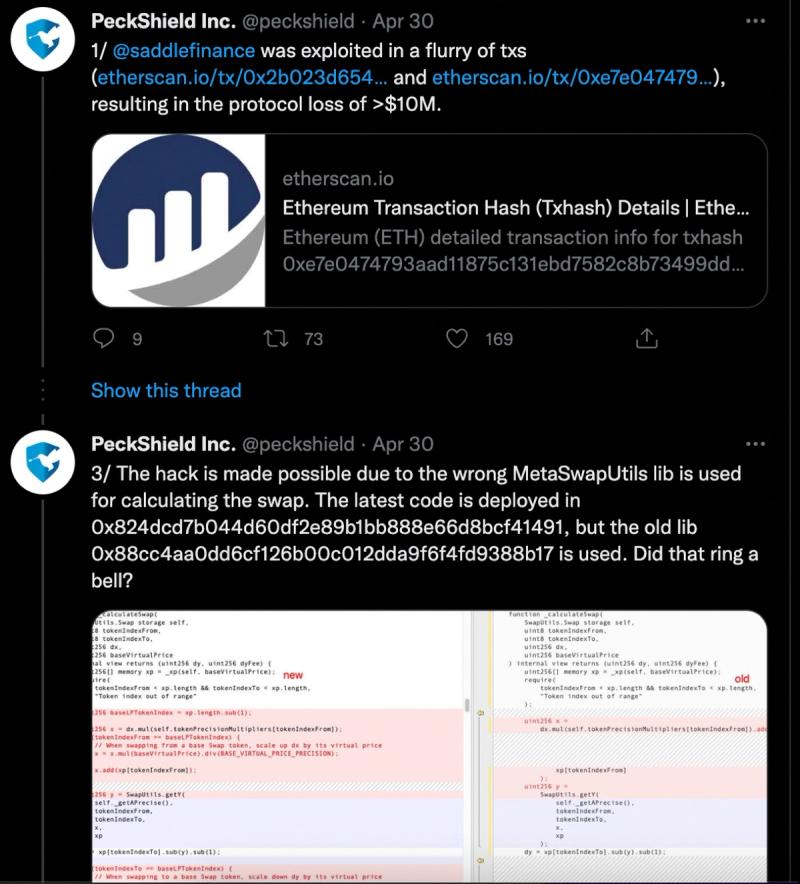

Saddle was hacked for around $11 million in ETH on April 30, 2022, which is about 4% of Saddle’s TVL on April 29, 2022. According to various investigations, Saddle used an older version of the MetaSwapUtils swap calculation in its code, and this allowed hackers to create flash loans and manipulate the prices of LP tokens in Saddle’s sUSDv2 metapool. Security and audit firm BlockSec reportedly recovered $3.8 million with its own front-running bots.

Saddle Finance has since updated its code to the current version of the MetaSwapUtils swap calculation, VirtualPrice, to protect against future hacks of the same nature. The protocol is audited by numerous brand-name auditing firms, including OpenZeppelin, Quantstamp, and Certik. Saddle’s Saddle Improvement Proposal (SIP) is a remuneration plan, which includes compensating all liquidity providers for their losses, funded by $3 million in FRAX. Additionally, the team plans to offer the hacker a bounty for returning the assets. Looking forward, Saddle will develop stronger security infrastructures that help protect against similar hacks.

Roadmap

Virtual Swap V2

Towards the end of 2021, Saddle Finance developed Virtual Swaps with Synthetix’s Synths to swap tokens between different pools. Synths are similar to financial derivatives in the traditional market, representing a store of value for another asset. Using Synths to bridge cross-chain liquidity could be a way to mitigate the risks from insufficient liquidity explained in the Risk section of this article. However, the mechanism can be risky when there is a price differential between the Synth and its underlying asset. In this case, the Synth’s price on one chain would differ from the price of the Synth on another chain. This mechanism is comparable to the Curve protocol’s cross-asset swaps and aids in bridging liquidity across chains. Virtual Swap V2 will introduce atomic settlements to support quicker and cheaper transactions. Atomic settlements refer to trades that settle so quickly that the two counterparties are simultaneously receiving their funds. This mechanism could lower the risk of price differentials between Synths that are intended to be priced the same on different chains.

New Pools

Saddle plans to launch new pools on its Ethereum and Arbitrum protocols. Supported assets range from wrapped tokens to DOGE. Because the Saddle team is introducing tokens like DOGE that are more volatile than pegged assets, some pools will adopt the constant product model instead of the StableSwap algorithm. The new Ethereum pools have a good chance of bringing in more traction. One of the most popular pools on the Saddle at the moment is the alETH pool, accounting for around 23% of Saddle’s total TVL on Ethereum. Additionally, SDL token holders will be able to propose and vote on new pools through Saddle’s new permissionless pools program.

Saddle Metaverse and NFTs

Saddle will add additional features to its metaverse and NFT offerings. The Saddle Creators Pilot offers artists the opportunity to create commissioned pieces for Saddle’s metaverse and NFT collection. Saddle is also partnering with the DeFi credit scoring protocol ARCx to develop Saddle-themed DeFi Passport NFTs that rate and rank community members on “on-chain behavior.” The passport ratings will influence the NFT holder’s borrowing power on Saddle’s DEX.

Conclusion

Saddle Finance’s most popular pools are its USD-pegged stablecoin and ETH pools, but the protocol was originally developed as an AMM-DEX for wrapped BTC. The protocol employs Curve’s StableSwap algorithm, which specializes in trading pegged cryptocurrencies. Despite the recent April 2022 hack, a slowdown in overall DeFi markets, and lagging traction in wrapped BTC pools, Saddle Finance continues to build and expand its ecosystem to include new pools and a metaverse.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by the Saddle Finance, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.