Earn 8.5% fixed rate APY on USDC with Notional Finance. Rate is locked in for 1 year!

Dear Bankless Nation,

“In war there are no winners, only widows.”

This week has been a harrowing one as Russia launched an invasion against Ukraine.

Lives will be lost, homes will be reduced to rubble, and millions will be displaced on the whims of a power-hungry maniac stuck in decades past.

Our heart goes out to our brothers and sisters in Ukraine. ❤️

War is the ultimate human coordination failure.

I’m no geopolitical expert. I’ll leave it to them to read between the lines around why this is happening, what the future may look like, and its implications for the world.

Bankless has a history of offering up mental models and frameworks to understand institutions and systems, so that is where I’ll focus today.

Specifically, I’ll borrow from a book I’ve been reading recently, Ray Dalio’s Principles for Dealing with the Changing World Order.

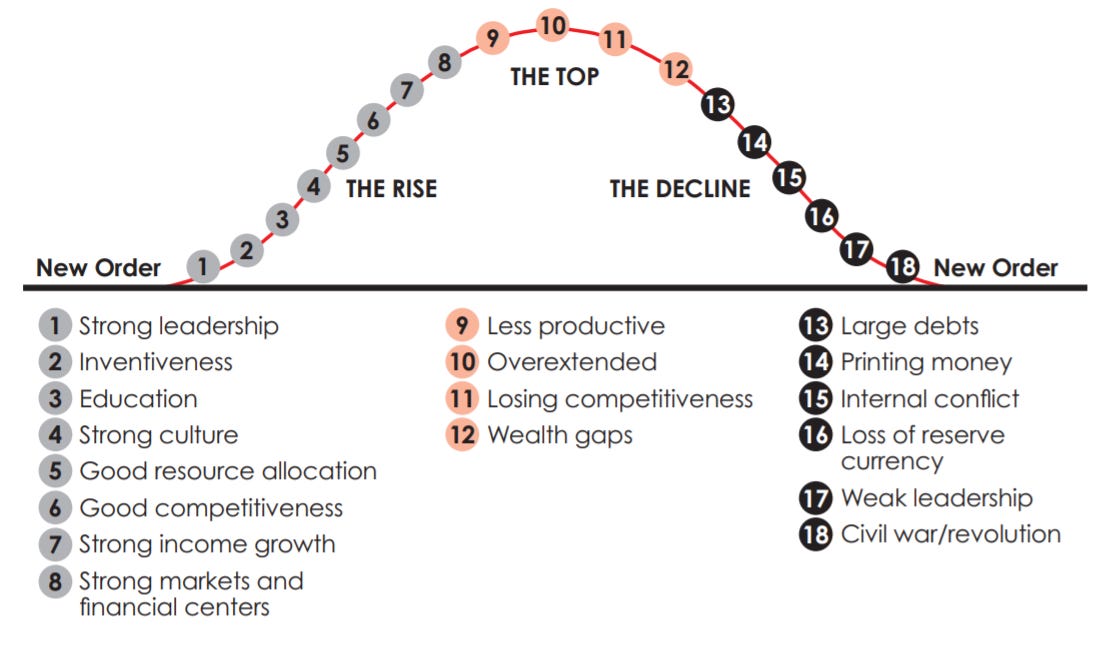

In it, Dalio lays out his mental model for how empires rise and fall, which he chalks up to three pillars that operate in cycles:

-

The Debt Cycle

-

The Internal Order Cycle

-

The External Order Cycle

When all three of these cycles are simultaneously in their late stages, the world can expect to see turbulent times as we transition from one world order to the next.

We’re currently in a U.S.-led world order set up after WW2, but this structure is now in decline and in the process of being tested across each pillar.

Debt Cycle Test

The dollar is currently the world’s reserve currency, meaning that foreign banks hold significant quantities of USD in their reserves and the dollar is the world’s primary medium of exchange and unit of account.

But currencies reigns do not last forever. Before the dollar the pound sterling reigned supreme. Before that was the dutch guilder. Currency reigns move to late stage when debt is aggressively monetized and government bonds are issued to pay for expanding budgets, and in extreme cases, fiat money is printed to cover debt issuance.

The U.S. printed $13 trillion for Covid and QE over the past two years.

Internal Order Cycle

Political ideologies within a nation converge and diverge over time, but I can’t remember a time when politics has been so divisive. Not only in the US, but we see strife in many Western nations—last week it was Canada.

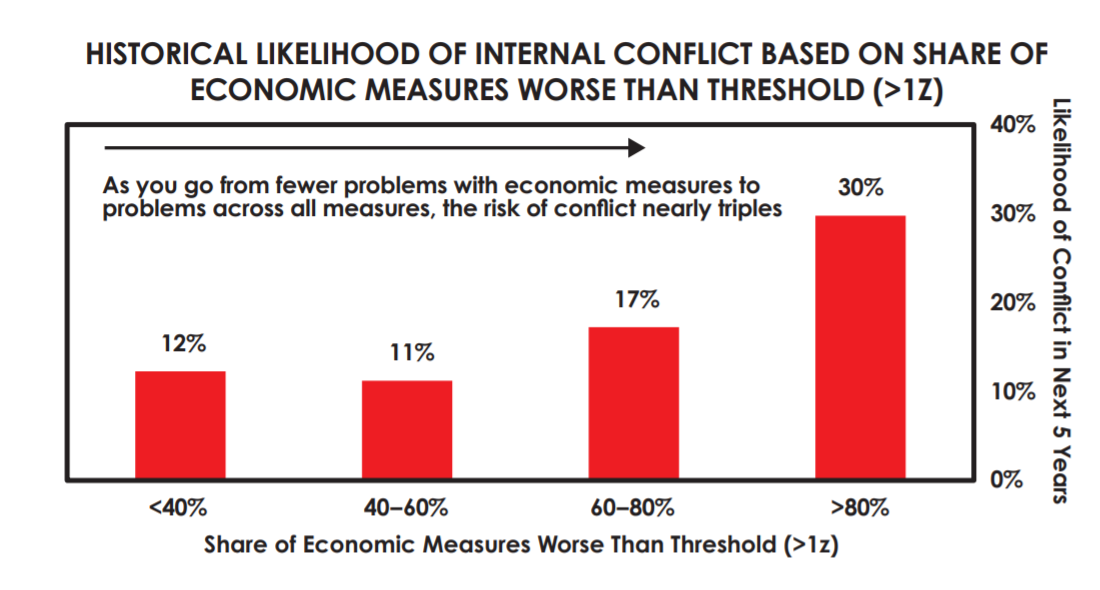

Dalio argues that political strife is often a result of economic insecurity in the late stages of a cycle. And with the wealth gap continually squeezing the middle class, these tensions have teeth.

External Order Cycle

The final pillar of stability in Dalio’s model is the geopolitical landscape between nations. In periods of peace and prosperity, nations work together to increase trade, established international relations, and work productively.

But in periods of strain and declining empires, we see conflict. We see war. Driven by ego, resource shortages, and a desire to militarily expand influence.

My point here isn’t that we’re all doomed and the world is going to combust.

Neither does Dalio:

But it feels like each year the probability of something new increases…

-

Massive printing of the world’s currency reserve

-

Populism on the rise across the world

-

Riots at the US Capitol

-

Increasing wealth inequality

-

COVID-19

Russia invading Ukraine.

Now is a good time to learn how to use crypto and manage your private keys.

Here’s what we have lined up for next week:

-

Podcast episode with Ryan Watt, former head of gaming at Youtube!

-

Our Q1 token airdrop guide (check out last quarter’s guide – free version here)

-

An inclusive guide on earning fixed-rate yields

Have a 🙏 weekend,

– RSA

P.S. if you have the capacity to do so, consider donating to help Ukraine.

🙏 Sponsor: Ledger—Join the wait list for the Crypto Life (CL) Card powered by Ledger. 💳

Recap for the week of February 21st, 2022

🎙️ WEEKLY PODCAST EPISODE

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

ACTION RECAP 📚

📘 8 Things You Missed at EthDenver

TL;DR

-

ETHDenver 2022 was massive, doubling in size from 2020 to 12,000 attendees! But the vibe wasn’t diluted, it was magnified across all those in attendance.

-

8 talks to watch, including conversations with Vitalik, Andrew Yang, Owocki & Voorhees, and more.

-

5 cultural takeaways, including Vitalik in a Bufficorn costume

📘 How to get started in DeFi – 2022 Edition

TL;DR

-

Getting started with DeFi in 2022 starts on L2, which is a much different take than previous guides on DeFi

-

Beginners can get started directly with Argent wallet or indirectly with Layerswap, or intermediate users can get started with MetaMask

-

So what do you do once you’re on L2? Which DeFi protocols to check out? Try our L2 Yield Guide!

📘 Crypto is here to set us free

TL;DR

-

Crypto has fostered a financial system that allows us to imbue value into our money, and not reliant on institutions to tell us that our money has value

-

This open financial system allows value to spread outwards to those that interact with it, not accrue towards the center where only a few hold powers and wealth

-

We go from attract to extract in Web 2 towards attract to enable in Web 3, allowing for human flourishing and cooperation

📘 Guide to Sustainable Yield Farming

TL;DR

-

Sustainable yield farming means yield that doesn’t rely on token emissions. Token-fueled liquidity mining introduces sell pressure and inflationary mechanisms and is highly susceptible to market conditions.

-

Ben introduces three possible strategies that rely on options and perpetual to maximize your yield in all types of markets—no tokens needed.

💬 Where are you in the world?

TL;DR

WATCH & LISTEN 🔊

-

🎙️ Listen How to Become a Whale | Tetranode

-

📺 Watch Rollup | Standing with Ukraine & All Affected | Macro Analyses

-

📺 Watch Overpriced JPEGs | Dr. Sian Proctor on Afrofuturism & NFTs

-

📺 Watch Green Pill | Ether’s Phoenix with Optimism’s Karl Floersch

METAVERSAL 🧙♂️

BANKLESSDAO 🏴

Weekly Subscriber Perks 🔥

Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you.

🎙️ GREEN PILL

iTunes | Spotify | YouTube | RSS Feed

🎙️ WEEKLY ROLLUP

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

Jobs opportunities 🧑💼

✨ See all listings on the Bankless Job Board✨

Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

🙏Thanks to our sponsor

The Crypto Life (CL) Card, powered by Ledger, is a crypto debit card built to be compatible with the Ledger ecosystem.

With the CL Card, you will be able to:

-

Instant exchange to fiat—stay in crypto until the last moment. Only sell your crypto when you make a purchase using your card.

-

All in one place—securely top-up your card using either fiat or crypto deposits. Manage your balance – and more. All in Ledger Live app.

-

Spending without selling—need cash? Now you can increase your spending limit by using your crypto as collateral.

Tag Bankless on twitter and tell us how you’re going bankless for 3 x 🔥

Thanks Anthony! There’s a ton of information for you to catch up on!

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.