Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

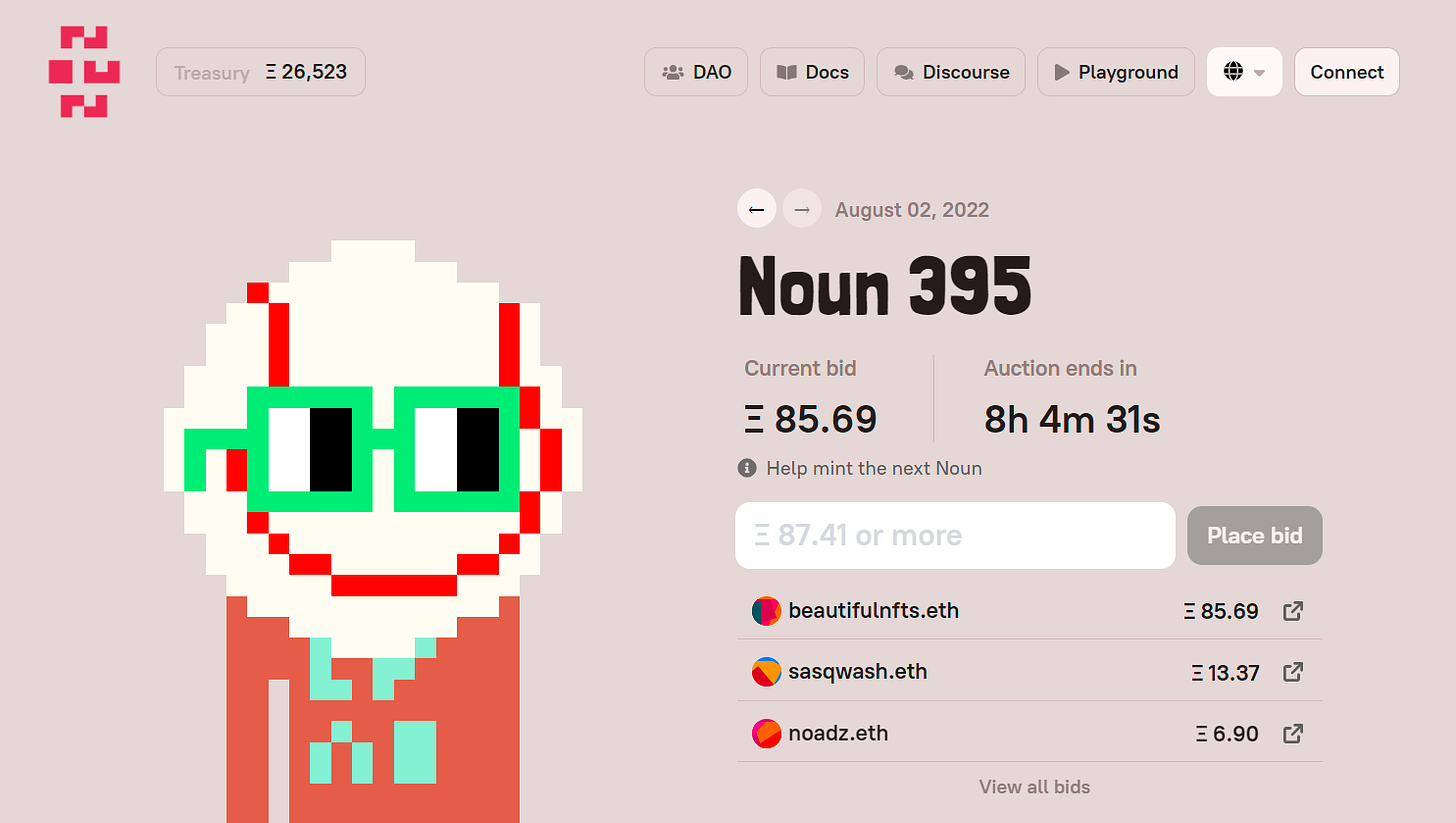

What Nouns DAO has been able to accomplish since its launch on Ethereum on August 8th, 2021, is incredible.

Devised as a CryptoPunks 2.0 of sorts, the Nouns have become the NFT space’s leading CC0 NFT brand. They’ve raised a 26.5k ETH treasury. They’ve pioneered the Nounish distribution model and the Prop House funding system and have inspired hundreds of additional creative projects and counting.

That’s a lot to celebrate. As for Nouns DAO, the group is specifically celebrating its birthday next week by adding new traits, like the 8 heads seen below, to the project.

So while the Nouns look to the future and the next year of possibilities, I think it’s also a great time for NFT observers to look back on how the Nouns arrived where they are today.

Toward that end, below I’ve curated some insightful quotes from this week’s epic Bankless livestream with 4156, Vapeape, and Seneca, who are three of Nouns DAO’s founders, a.k.a. Nounders. Enjoy!

-WMP

🙏 Sponsor: Nexo – Buy BTC, ETH, and 40+ cryptocurrencies and keep your assets safe.✨

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

“I’d been spending a lot of time in the CryptoPunks community … and had been thinking for a while about what could CryptoPunks 2.0 look like? What were the sort of primitives missing from that project that could make it more crypto native? What could potentially kind of elevate it so that it could do things beyond mostly just cheerleading around the price?

[…] One day, I just had this moment of inspiration where I decided that I was going to write everything down, tweet it out in a Twitter thread format, and just see if anyone wanted to work on it. So the white paper, if you want to call it that, for Nouns was that Twitter thread, you can still find it on my Twitter … It basically describes a lot of the properties and very high level ideas that Nouns DAO has today. And kind of at the end, I said ‘does anyone want to work on this with me?’ Of course, Vapeape and Seneca are two of the people that said yes.”

“Maybe [there were] three things. So the lack of CryptoPunks organizational infrastructure, such that the ‘Punks could coordinate their activities on-chain and do things together. Also, the distribution mechanism … is there a way that’s more fair in terms of distribution for community building that can happen over a longer period of time, rather than just being a function of who happened to be online, you know, on a Thursday in 2017 when all the [Punks] were released and claimed?

Then the third thing was just this idea, and I guess I was probably most vocal about this … that the JPG, the thing that the token is referencing, should kind of have this symmetry with the token itself, where it is as permissionless and open as the token. So effectively putting all of the intellectual property into the public domain and making it CC0 so that people could use it and build on top of it, without worry of what might become of the IP.”

“I think it’s an interesting dynamic, where all the demand for the project really gets funneled through this daily auction each day. And so we’ve seen relatively low secondary market movement, and that usually happens after somebody has been outbid several times on the primary auction and they kind of capitulate and then go to OpenSea and buy a Noun there. This has been a really interesting mechanism for driving demand directly through the primary auction, you sort of get this continuous pricing of the Nouns, as these auctions are happening every day. I think it’s acted as a funnel for a lot of the community to come in the front door, look at the primary auction, and try to compete there first, before they ever go to the secondary to try and score it now in that way.”

“Really, we just started drawing stuff. And one of the early decisions was that it would be pixel art, and that ended up being very important in terms of storing the Nouns actually on-chain, right, and being able to kind of compress them such that they would fit on-chain.

Then we started trying to draw these characters with different kinds of heads. I believe the initial genesis was Gremplin drew this duck man character, and it had those eyes, the very kind of contrast-y and characteristic eyes that the Nouns have. And I just kind of took that image with another prototype I’d made, and I don’t think it was like, a moment of genius or insight or anything, it was just goofing around. So I drew glasses around his eyes and just fired it back into the Discord channel saying, ‘oh, hey, I think this looks kind of cute with your eyes and the glasses.’ And then we all just very quickly agreed that it would be interesting if every single one of them was wearing the glasses and the glasses could be this iconic central meme of the project.

And again, I think the creation of Nouns was this pretty special time, both in terms of the wider NFT space but also just in terms of aggregating 10 really world-class builders in a Discord channel and just going off for a couple of months. So almost everything we did happened very, very quickly. I think within about 24 hours we had sort of defined the Nounish aesthetic. And then we went on Twitter and just started asking people what sort of Noun heads they’d like, and then drawing down heads for them. That was the initial genesis of coming up with the different ideas for the heads.”

“Pre-Nouns the focus of a lot of PFP communities was always the trait rarity, right? So you’d have this hierarchy within the communities. One of the goals with the Nouns was not to emphasize any sort of hierarchy between one member or the or the next, but rather, we’re all sort of more or less the same, right? That said, there are rarer heads, just because one head may pop up once a year and another may pop up five, six, or seven times a year.

[…] Although no Noun is particularly rare, there can be rare Nouns because randomness, right? So not too long ago, we had I think three ‘Void’ heads appear one after the next. If you think about the amount of heads that there are, which correct me if I’m wrong, there’s 230, you’d expect about one appearance a year — more or less one and a little bit more, right. But given randomness, you can see multiple heads happen in one year or three in a row, as we saw recently … It’s chaotic rarity … all Nouns are rare, but then randomness will give us whatever it wants to give us.”

“Our project makes ETH and ETH goes directly in the treasury whereas a lot of other DAOs have sort of minted their own token and the bulk of their treasury is this minted ERC20 token that they’ve created. And they do other things to try to convert that into ETH or stables to do various DAO operations. And I guess what’s interesting about Nouns is there’s no native mechanism to get Nouns into the treasury. So this has been a big topic of conversation of like, how do we get Nouns in the Treasury? Some people prefer to be compensated in Nouns for their governance proposals rather than ETH, or some combination of the two, so I think that’s been another interesting dynamic.

Also, our proposals are, when compared to other DAOs, much less risky, right. So when you’re talking about a Compound or another pretty heavy hitting DeFi protocol, every proposal is under an intense amount of scrutiny. Because if you set these parameters incorrectly on a money market or something like that, very bad things can happen. On the flip side, we can sort of throw a lot of darts against the wall here and try a lot of different experiments. The impact of an individual proposal or individual initiative on us is probably a lot less than going and tweaking parameters down on the smart contract layer for these various defi protocols.”

“To a large degree, the direction of the DAO and where the Treasury is allocated has been left up to the community. That said, I do think there’s a culture, which is what we call a Nounish culture, that is very hard to define. But I think everybody more or less abides by it. And in our votes accordingly, things that are Nounish get, you know, whopping 90% votes, while things that are obviously not Nounish don’t do as well. And so the question then is like, what exactly is Nounish, right? The answer will be a bit different between members and people within or outside the community. But I definitely say it’s something along the lines of optimistic. 4156 mentioned absurdist, it definitely has those components, also trying new things, right. There is a culture that is being defined, but it’s very mushy. It’s very meatspace.

[…] I think at the very beginning, our focus was optimized for getting anything out the door. So we were striving for fun, for whatever proliferates the meme, and so forth. But I feel that as we’ve grown, and as we continue to grow and evolve, the Nounish meme — what started as maybe just the glasses and an aesthetic — becomes something much deeper. And so, for example, while initially you would fund merch with the Nouns glasses, now you see us trying to find more ambitious projects, stuff like public infrastructure that doesn’t necessarily proliferate the Glasses per se, but it does proliferate a sense of meaning that goes much beyond the glasses themselves.”

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Nexo follows a robust business model that safeguards your crypto in all market conditions. The company’s strict overcollateralization policy makes it the go-to platform to safely borrow against your crypto. You can also buy or exchange 40+ assets and earn daily compounding interest.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.