Key Takeaways:

- Push notifications are mostly absent in Web3 today, despite being a critical component of Web2.

- Web3 organizations manage a scattershot of social media accounts to interact with their communities.

- Ethereum Push Notification Service (EPNS) aims to solve this problem by offering a multichain, Web3 approach to push notifications and decentralized wallet-to-wallet communications.

- The EPNS protocol incentivizes community engagement through its governance token PUSH and a network of delegates.

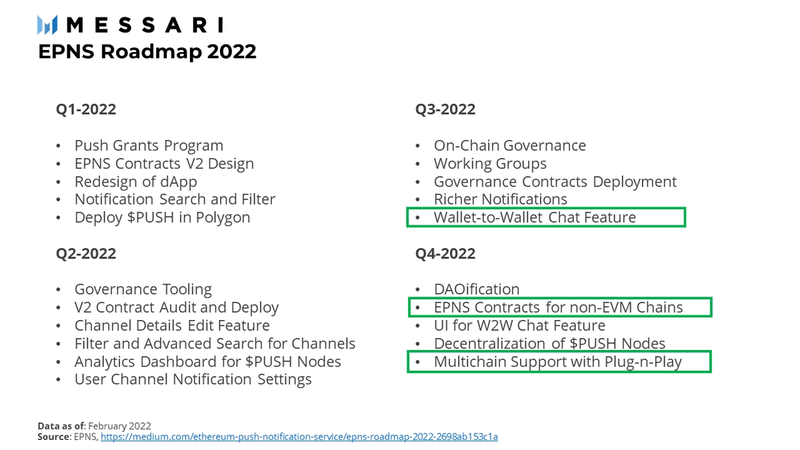

- The company’s roadmap for 2022 dictates a rich set of features including multichain support and direct wallet-to-wallet communications.

Push notifications are ubiquitous in digital life today, but in Web3’s current state, targeted push notifications are mostly absent. Instead, companies manage a scattershot collection of fragmented social media accounts to communicate with their users. When it comes to new feature sets, margin calls, governance votes, or even potential hacks, Web3 companies today find it difficult to simply reach their users. Ethereum Push Notification Service (EPNS) aims to solve this problem by offering a multichain, Web3 approach to push notifications and decentralized wallet-to-wallet communications. The project combats fragmented Web3 communications by enabling and incentivizing direct communications between decentralized services and users, without simultaneously compromising on features like user anonymity.

It’s hard to imagine a world without push notifications. First introduced to mobile via the Apple Push Notification Service in 2009, the average American now receives 45+ daily pinged notifications to a phone, browser, or tablet. Perhaps unsurprisingly, roughly 60% of users opt-out of receiving push notifications, allowing generally only the most critical pings from financial and utility applications.

Decentralized and Web3 platforms, by nature of their permissionless-ness, neither receive nor store typical user data, like names, emails, or phone numbers, which is a feature rather than a bug. It’s meant to protect users from situations like a corporate data leak. Rather than permitting a company to store their data centrally, the Web3 user takes this responsibility and controls her own data, deciding when and whom to trust with that data. For companies seeking to engage and re-engage their users, though, the Web3 paradigm presents new challenges. Especially in a multichain world, where user activity spans tens or hundreds of applications across multiple blockchains, companies are finding it increasingly difficult to adequately communicate with and retain their users. On the user side, this is an equally challenging problem: interacting with multiple DeFi products requires users to constantly check metrics like liquidity margin, implied impermanent loss, or the sundowning of specific rewards programs. Look no further than the “close call” from January 2022, as MakerDAO vault owner “7 Siblings” narrowly missed a $600 million ETH liquidation.

Source: EPNS

EPNS is building a detailed roadmap to alleviate this exact pain point,, incentivizing both companies and users to opt-in rather than opt-out and solving for communications fragmentation and asynchronicity in a multichain world.

EPNS Enabling the Web3 Push Notification

EPNS was founded in 2020 by Harsh Rajat and Richa Joshi, who together have over two decades of experience in founding and operating tech startups. Harsh and Richa are based in Mumbai, but the company employs a globally distributed team of over 30 people across development, product, and marketing. EPNS successfully closed a seed round in December 2020, raising $750 thousand at a $5 million valuation via a SAFT agreement, with participation from 25 angel investors and VCs, including Balaji Srinivasan, BlockRock Capital, LD Capital, and others. In March 2021, the company extended its SAFT offering to take on further investment, and raised $660 thousand from strategic and existing investors at a $12 million valuation.

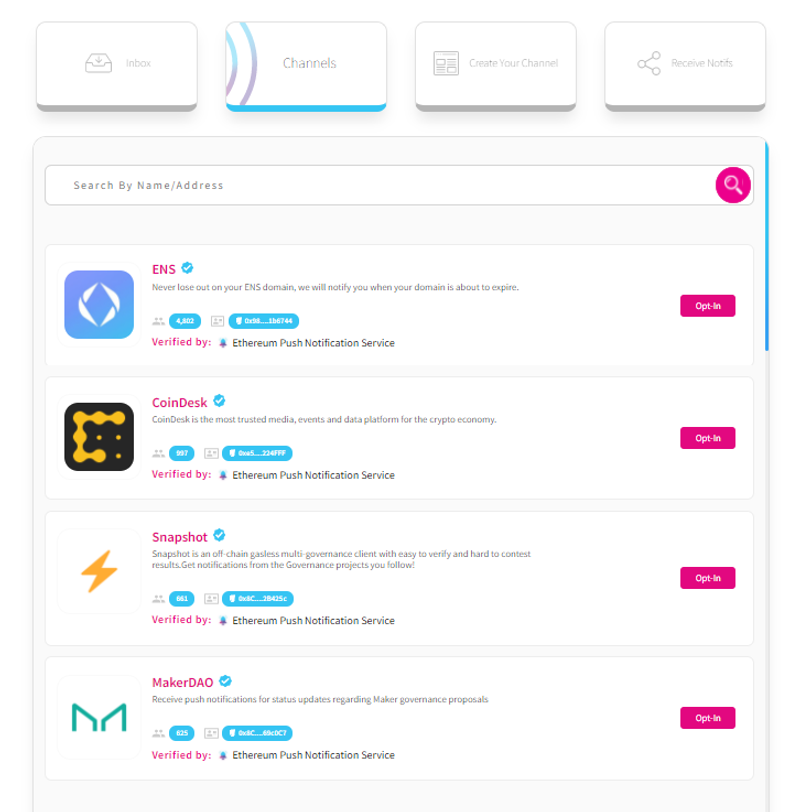

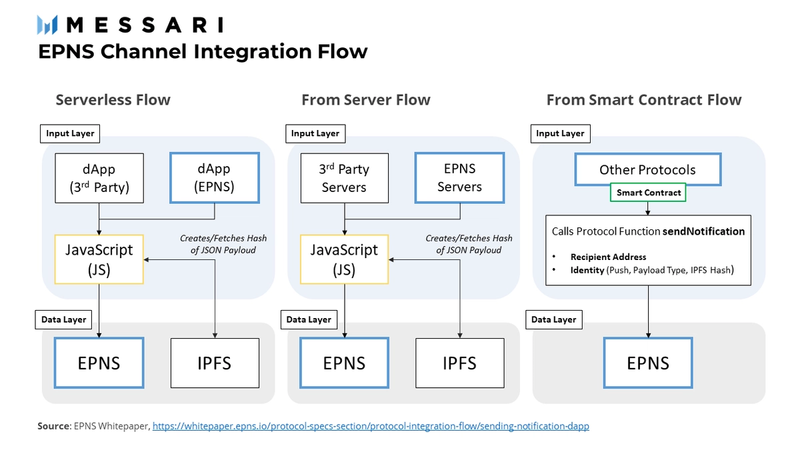

In the company’s own language, “EPNS is a protocol for blockchain-based notifications that are chain agnostic, platform independent and incentivized.” The protocol enables users (wallet addresses) to receive notifications and obtain token incentives through active participation. EPNS can be thought of as a wallet-to-wallet or service-to-wallet communications network, which enables pertinent off-chain events (e.g., Snapshot proposals) and on-chain information (e.g., block confirmations) to be transmitted to specific addresses (see this post on all the ways EPNS can integrate into DeFi). The protocol is a partially permission-based system, meaning all users – i.e., contract owners, channels, or users receiving notifications – must opt-in to receive or send notifications. EPNS maintains a public key registry of all opted-in users, which it considers non-invasive information because public keys are by nature publicly searchable.

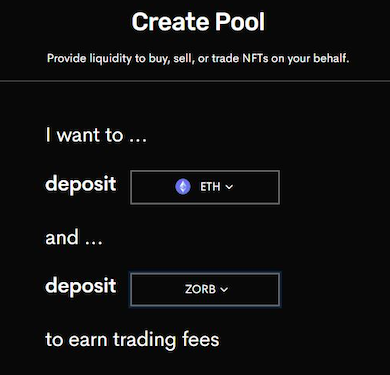

Any user can create what is called a channel. A channel exists to coordinate and send notifications to the channel’s subscribers. Each channel’s key information, such as description, organization website, and image, are input and stored as a JSON payload on IPFS. To successfully launch, each channel also requires a staked pool to fund its operations and incentivize subscribers. The protocol regulates the minimum and maximum $DAI deposit required to stake; currently, the staked pool requirement is minimum 50 $DAI with a cap of 250,000 $DAI. Each channel’s pool is directly deposited to Aave (or in the future, a similar open-source lending protocol). The yield from this deposit is distributed to channel subscribers based on a time-based distribution model. Deactivating a channel comes with a minimum 10 $DAI penalty, which is set to disincentivize users from spoofing channels. The penalty fee is ultimately deposited into a separate fee pool operated by the treasury. According to the company, the specifics around staking requirements are subject to change in future versions of the protocol, ultimately to be decided via governance vote.

Source:EPNS

EPNS envisions three types of channels: open, closed, and mutual. Open channels are open to all users without restriction and can indirectly subscribe users by paying them a small fee (e.g., CoinDesk). Closed channels cannot be freely subscribed to and instead pay subscribers to opt-in. Mutual channels require both parties to approve a user subscription. Once the channel is established, the EPNS protocol algorithmically maintains the appropriate incentives via its public registry by distributing staked tokens and adjusting spam ratings across its user base.

EPNS operates two universal channels, “EPNS Channel” and “EPNS Alerter Channel”, which are intended to only send out notifications of extreme importance to all its protocol users and channels. These notifications include for instance mainnet downtime, hacks, or similar events. For universal channels, users are required to opt-out if they wish to no longer receive protocol-wide notifications.

EPNS takes spam into careful consideration, as mobile notifications have historically been overly exploited for retargeting and advertising. To combat spam at the protocol level, a rating is attributed to every channel based on time since launch, user growth, and unsubscribes due to spam. This rating is from 0 to 1 (1 = bad actor), with automatic notification throttling above a score of 0.8. The throttle mechanism is intended to systematically punish spam-like behavior at the channel-level. It is currently unclear exactly how the protocol will handle disputes around specific spam ratings.

Though EPNS utilizes a semi-centralized infrastructure to provide its notification and message service to decentralized applications and users (see Whitepaper “Integration Flow”), the vision is to further decentralize its infrastructure over time. For instance, the company is researching the possibility of enabling a static EPNS file stored directly on IPFS that could point to a channel’s website hosted on IPFS. This could enable user-to-user communication, like hashed chat feeds and even decentralized video messaging. The following diagram shows how dApps and services can integrate with EPNS today.

Source: EPNS Whitepaper

Further information for integrating services with EPNS can be found under the company’s smart contract documentation, which stipulates further criteria around the activation and deactivation of channels.

EPNS is the simultaneous developer of five products on top of the EPNS protocol: EPNS Infra; a mobile application; a dApp; Showrunners; and a JavaScript (JS) Library. EPNS Infra is the name for the middleware which transmits data from decentralized protocols to centralized carriers like iOS, Android, and web browsers. The mobile application is the user interface (UI) for sending and receiving notifications at the user level, while the dApp enables decentralized carriers like Compound or Aave to also receive notifications. Showrunners are meant to be exemplar channels run directly by the EPNS team to show off the full capabilities of the protocol and drive interest. Showrunners include notifications for events like ENS domain expiry, Compound liquidation alerts, and gas fee idiosyncrasies. The JS Library is a product for integrating EPNS simply and efficiently into third-party apps.

On January 11, 2022, after more than a year of development, the EPNS protocol went live on the Ethereum mainnet, meaning the company’s suite of products are open for use. Ahead of the mainnet launch, ChainSafe Systemscompleted an audit of the protocol in October 2021 and identified a number of bugs and issues that the company immediately fixed. As of February 2022, no known bugs or exploits have been reported.

$PUSH Launch and Tokeneconomics

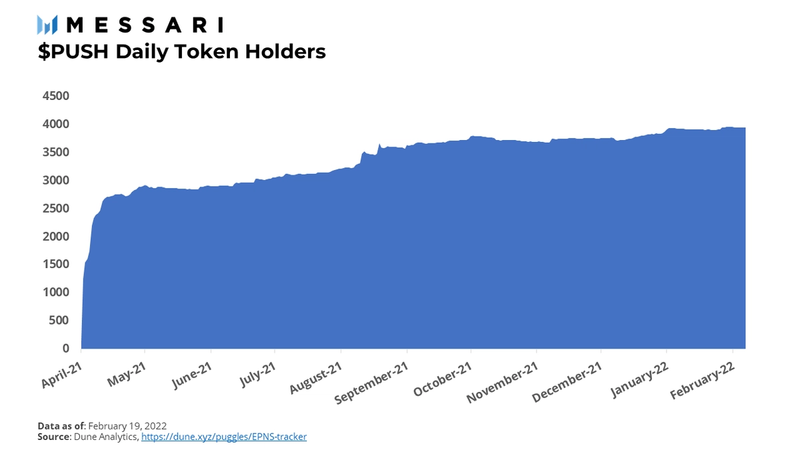

Shortly after closing their extended seed round, EPNS announced details surrounding its $PUSH token generation event (TGE), including an overview of $PUSH tokenomics. According to the TGE press release, $PUSH tokens have been capped at 100 million tokens total, which are to be split among investors, community, team, advisors, and a reserve allocation which EPNS refers to as its foundation. As part of the TGE, $PUSH tokens were sold to the public via Polkastarter ($0.12 per $PUSH), and an emission schedule for liquidity rewards was released for UNI-V2 LPs and $PUSH stakers. Of the early seed and strategic investors, 20.5 million tokens (20.5% supply) are to be allocated over 24 months following the TGE, 20% of which unlock 3 months after the TGE while 80% vest linearly over the following 21 months. The team received 16% of the token supply with a cliff 9-months after TGE plus linear vesting for the following 48 months. Advisors received 3.5 million tokens (40% of the supply), meaning the remaining 60% of the supply was reserved for the foundation (7%) and the community (53%). As both the Polkastarter raise and LP rewards represent less than 10% of community tokens, EPNS will retain a significant amount of unallocated community tokens for future distribution, giving it the flexibility to adapt to future community sentiment with novel incentive strategies.

$PUSH tokens were designed to give economic incentive to tokenholders to maintain the EPNS protocol. As such, the token’s key function is for governance decisions related to the protocol, such as the distribution of protocol fees, user incentives, and voting thresholds. $PUSH tokenholders benefit from receiving 70% of platform fees, while the remaining 30% of fees are distributed to an ecosystem development fund meant for onboarding new partners and providing for rewards pools. Tokenholders can delegate their $PUSH to committed community members rather than directly vote on governance issues themselves; a list of current delegates and nominess seeking to become delegates can be found on the EPNS governance dashboard. Governance proposals and votes are organized on Snapshot, with 75,000 $PUSH being required to submit a proposal and the approval threshold per governance decision varying. One recent proposal approved late January 2022, PIP-02: Incentives for Approved Proposals, provides a 200 $PUSH incentive to tokenholders whose proposal receives approval. A further 100 $PUSH is rewarded for proposals with 50% more total votes than the average of the four prior approved proposals. PIP-01: Push Grants Program (PGP) was also approved in January 2022 and is focused on attracting developers to support the further development of EPNS; PGP intends to allocate $1 million from the EPNS treasury to promising projects.

EPNS operates the $PUSH incentives dashboard for its key token metrics, with up-to-date TVL, rewards issuance, and governance, as well as the Rockstars community incentive program. Current TVL sits at just over $9 million with fewer than half of LP rewards already distributed. There is currently over $3.5 million in liquidity for swaps on Uniswap, and the EPNS token ecosystem continues to onboard prominent projects in the space. The existing group of ecosystem partners can be seen in the following overview:

Source: EPNS

Key Partnership, Integrations, and Current Users

Since launching the company in 2020, the EPNS team has established multiple partnerships within the crypto ecosystem, focusing primarily on applications where an EPNS integration can have immediate impact. As expected, most partners are operating in the Ethereum ecosystem. That said, the company is focused on providing services across multiple blockchains and intends to be adaptive to market dynamics long-term (for instance, the company plans to offer non-EVM support as soon as Q4 2022). Readers might be familiar with the company’s existing and ongoing partnership with ENS, in which ENS domain owners can enable notifications of upcoming domain expiration dates. More recent integrations include Digible, an NFT marketplace, and mStable, an Ethereum-based stablecoin AMM. In January, the CEX Huobi Global partnered with EPNS to enable notifications for its users of upcoming token launches. Although a CEX like Huobi typically interacts with its users directly via email or a mobile app, EPNS offers Huobi a secondary touchpoint and opens the exchange to a further set of Web3 users. In a recent blog post covering the protocol’s functionalities, EPNS mentioned MakerDAO, Crypto Volatility Index, Bancor, Oasis, Mover, ENS, Snapshot, and Coindesk – all as existing users of the EPNS protocol. The total number of projects displayed on the EPNS channel dashboard stands today at 41 (see channel dashboard), but the number of soon-to-be-integrated projects is likely much larger, considering the growing number of partnership announcements.

Accounting for users, the EPNS universal channels, EPNS and EPNS Alerter, show 2,796 and 797 subscribers, respectively (as of March 4, 2022). The largest channel, Ethereum Name Service (ENS), has 4,697 subscribed users; this partnership is a strong signal for EPNS user growth, as users who register ENS domain names are prompted during the registration process to enable notifications in the event their domain expires. Without EPNS, ENS users would have no way of receiving similar alerts. Looking at the number of $PUSH token holders is another approach to assessing total users on the platform today: this number currently sits at 3,926 accounts holding $PUSH tokens.

Direct and Indirect Competitors

There are numerous push notification service providers operating within Web2. In fact, Facts and Figures projects the global notifications software market to grow to north of $31 billion by 2025. This market is made up of companies like Airship, CleverTap, One Signal, and others, which primarily offer SaaS solutions for the management and automation of push notifications on desktop and mobile. Andrew Chen from a16z wrote on the topic several years back with the help of companies like Leanplum, and reported some interesting data after analyzing over 670 million push notifications. While over 60% of users opt-out of mobile push notifications, certain categories greatly outperform in terms of opt-in and engagement. Moreover, engagement with push notifications is relatively time-sensitive, in that the highest engagement occurs in the evening after work. Financial services applications have been shown to perform the best in terms of push engagement, presumably due to users typically perceiving banking or financial information as critical.

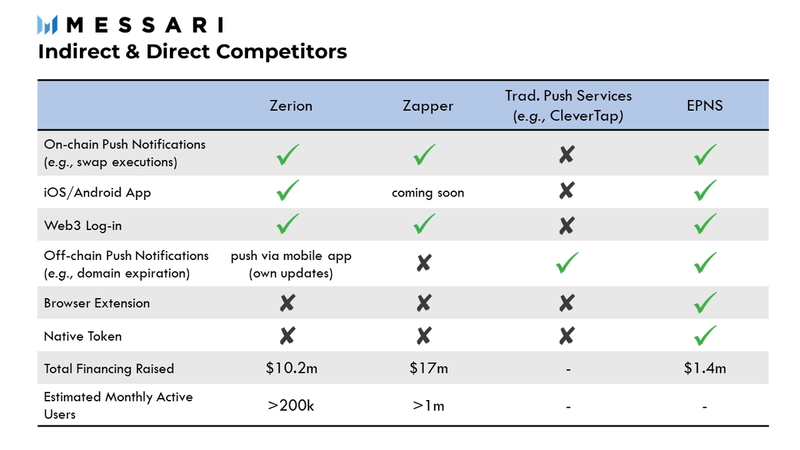

Considering how early EPNS is to the market, there are no clear direct competitors offering a similar solution. The companies that make up the SaaS push solutions are offering an approach based on a Web2 paradigm, where service providers almost always retain user data such as email addresses, phone numbers, and other identifiers and interact with their users directly via SMS, email, or in-app push. However, these companies do not currently have the capabilities to offer push services to decentralized users in any meaningful way.

EPNS indirectly competes with companies like Zapper and Zerion because they offer multichain dashboard and portfolio management to simplify wallet and account management at scale. As companies like Zapper and Zerion roll out mobile applications, they become more likely to develop their own notification systems without relying on EPNS. Nevertheless, it is unlikely these dashboard platforms ship push notifications for off-chain information in the near future, as aggregating and enabling push channels does not appear to be a key focus.

The blue ocean that EPNS is operating in flips the stakes by incentivizing users to opt-in, thus driving higher engagement and likely offering more benefit to the end user. Depending on how quickly EPNS can onboard partners, the protocol could quickly acquire significant market share.

Future Vision and Roadmap

The company’s roadmap for 2022 dictates a rich set of features that are headed to EPNS users. Multichain support will likely be increasingly critical as user demand continues to disperse across L1s and L2s. The company believes wallet-to-wallet communication will be live via EPNS as soon as Q3 2022. Planned updates to the UI and around channel editing functions will be critical to ensure the product matches user expectations going forward; roll-outs can be expected in the first half of 2022.

With the exponential growth of OpenSea users over the last year, enabling push notifications on OpenSea might be worth considering for EPNS, especially in light of the amount of confusion that still exists around dormant listings on the platform. Alternatively, horizontal partnerships or integrations into portfolio managers like Zerion, Zapper, or Gnosis Safe seem like a potential win-win, as these services are already beginning to integrate push notifications for trade executions and token receipts. White-labeling is likely less of a consideration since EPNS intends to decentralize its push operations long-term, meaning companies can integrate EPNS services seamlessly without the need for a tailored white-label solution.

The highest risk to EPNS is likely in its incentive mechanism, as the push business model has traditionally been based on advertising and retargeting, where advertisers pay push service providers who promise increased user engagement and higher conversions. With EPNS, the user incentives are flipped, in the same way that Brave users originally were rewarded for watching advertisements. This is, in turn, the gamble: EPNS channels must continually ensure there is a high enough upside for users who opt in, either through pool incentives or a continual supply of highly critical push notifications.

Conclusion

EPNS is operating at the edge of the new Web3 paradigm by taking a decentralized approach to building a familiar Web2 service. With the acceleration of multichain, user will increasingly demand services that simplify UX and enable easy management of multiple accounts across blockchains. Moreover, with the right balance of incentives for companies and users, EPNS is well-positioned to solve challenges related to fragmented communications in Web3 and ultimately enable more secure and engaged ecosystems across blockchains.

This report was commissioned by EPNS, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in the Hub does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which is updated monthly and published here. Crypto projects can commission independent research through Messari Protocol Services. For more details or to join the program, contact hub@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our terms of use for more information.