Key Takeaways

- On-chain DeFi options protocols have been catching retail buyers’ eyes recently because of the attractive yields they offer, and the core hedging properties they possess.

- Premia is the only on-chain options protocol on EVM offering American-style options, bypassing the rigid expiry date structure associated with European-style options.

- Premia leverages a peer-to-pool architecture, which aggregates liquidity, allowing for efficient pricing of options.

- On-chain options pricing requires developing implied volatility surfaces and levers around supply and demand. Premia is designing its architecture based on these principles.

- The protocol Smart Deposit Optimization Framework aims to make options strategies more accessible to a broader range of buyers.

- The market that Premia operates in is in its infancy and its success will be dependent on protocols’ ability to attract options buyers at scale.

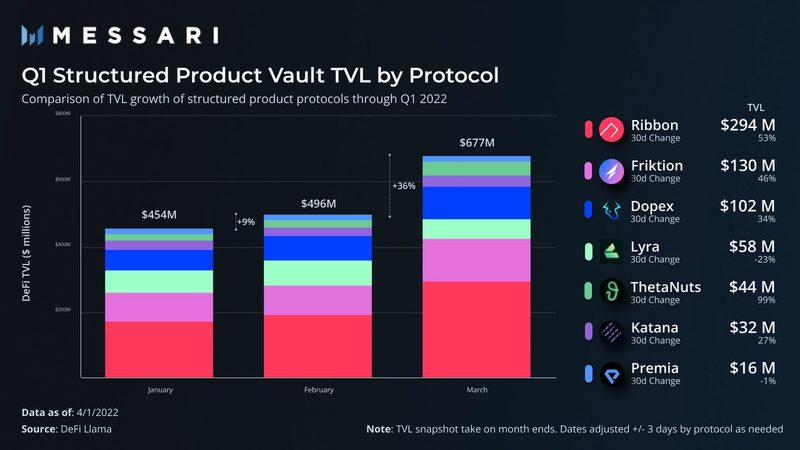

Options are an important part of TradFi markets but have seen slow adoption in DeFi. However, DeFi options protocols have seen a general increase in interest in the last year, and particularly in the last month. On March 1st, the total value locked (TVL) across all option protocols was $446.6M and on March 31st, the TVL was $665.6M. While there were minimal fluctuations throughout the month, the TVL on option protocols increased nearly 50% in March.

DeFi options vaults – think Yearn for options – in particular have become popular with retail investors. This is for good reason. They are accessible, relatively simple to use, and provide a high organic yield. By simply depositing their assets into a vault, ordinary investors get access to option premiums without having to deal with options directly. On top of the yield from option premiums, users may earn token rewards, and staking yield.

DeFi options vaults come in two flavors, standalone and packaged with an AMM (peer-to-pool). The latter aims to aggregate liquidity across options series. However, AMMs were designed for spot trading. As such, these “peer-to-pool” protocols had to modify the AMM pooled liquidity model to make it suitable for the convexity of options.

Premia is a DeFi-native options protocol that has been generating particularly attractive returns for its users. Think mid-to-high double digits. It is taking an innovative approach to both AMM design and making DeFi options retail user friendly.

In this report we will give an overview of the Premia protocol, its secret sauce, tokenomics, traction, competitive landscape and risk factors. Let’s start with a lay of the land on DeFi options protocols.

Lay of the Land on DeFi Options Protocols

There are two types of on-chain options protocols: market places and structured products. So far, structured product vaults have driven the large majority of the adoption.

Marketplaces create the actual option contract and facilitate buying and selling. Protocols like Opyn, PsyOptions, and Zeta all operate a traditional order book.

Structured product protocols sit on top of options marketplaces and offer vaults for users to deposit funds into. Each vault executes a defined options-based yield strategy. Similar to Yearn, these protocols are abstracting complexities away for the user. The most prominent structured product vaults engage in selling covered-calls and/or cash-margined puts.

Liquidity pool marketplaces combine the two approaches, sourcing liquidity and underwriting options in the same protocol. They are also called “peer-to-pool” marketplaces and typically utilize a liquidity pool (AMM) method vs. an order book.

Premia falls into this category with its DeFi-native approach to options.

Overview of Premia

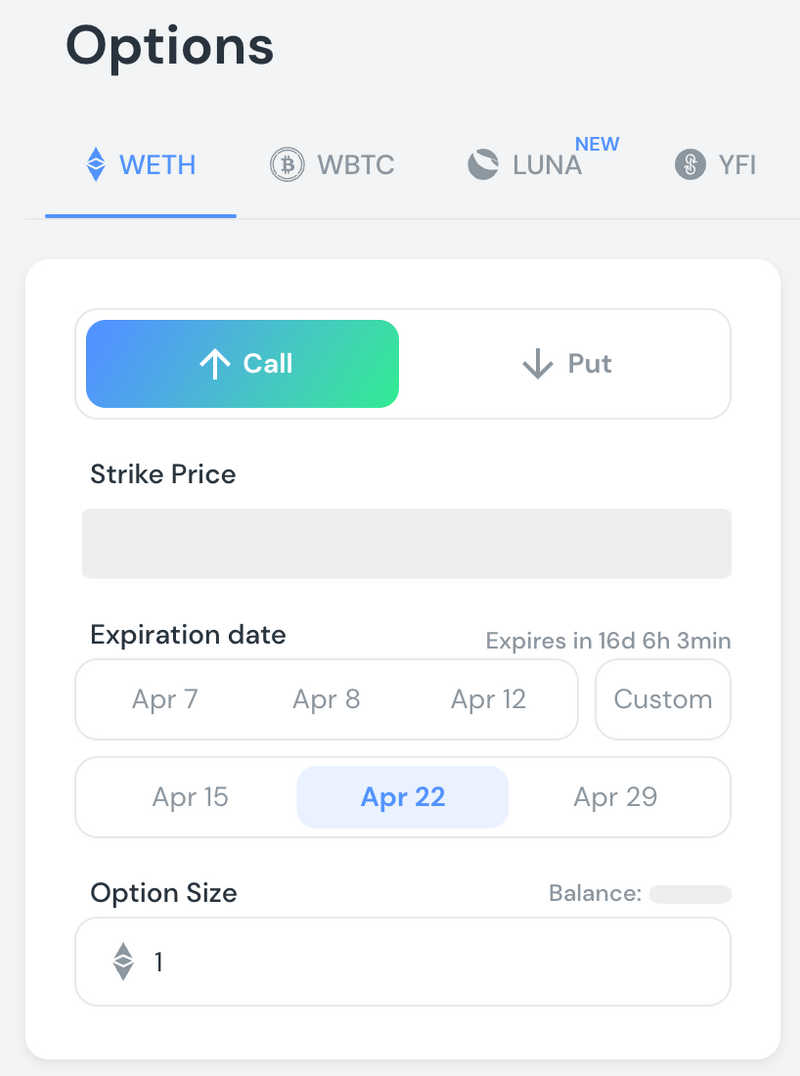

Premia’s mission is to enable anyone to buy and sell American options in a fair and liquidity efficient way. It offers call and put underwriting through its vaults that are attracting retail investors looking for yield. The other side of the trade is taken by traders. Premia currently offers call and put markets for ETH, BTC, LUNA, YFI, LINK, ALCX, and alETH. The protocol is deployed on Ethereum, Arbitrum, and BSC. Its total value locked (TVL) on Ethereum, Arbitrum, and BSC is $6.34M, $8.81M, and $11.03K, respectively.

The Mechanics

Liquidity Pools

Each available asset pair has a call and a put pool. Call pools are underwritten in the underlying asset and put pools are underwritten in DAI. The two-pool structure gives LPs control over which strategies to underwrite. In other words, demand from buyers and sellers (strike price, expiration date, size) doesn’t have to match. This is in stark contrast to the traditional order-book model where these parameters typically must align.

Transaction Flow

Users simply specify the desired option details (option type, asset pair, strike, expiration date, quantity) and the pool returns a quote. Users then execute the trade in an on-chain transaction. The option is represented as an ERC-1155 token, allowing transfer or exercise at any time on or before expiration.

The ERC-1155 standard allows protocols to map unbalanced option rights and obligations between buyer and seller. It supports operations on unlimited numbers and types of non-fungible tokens within the same smart contract.

Exercising and Settlement

Options can be exercised at any time after purchase, in full or in part. If at the time of expiration an option is in-the-money, the payoff is locked in. It can then be claimed by the holder at any time post expiration. Options are cash-settled.

A recently introduced Sell Feature allows traders to sell options back to the pool at any time. Previously, traders had to find a counterparty to accept the trade on an NFT marketplace to sell their options prior to expiration. This feature also benefits liquidity providers because they can pull their capital out early or place their capital in a new position, enabling them to earn on several positions.

Pool Accounting & LP Returns

FIFO accounting. LPs select a pool and the amount they would like to deposit. Deposits are sequenced on a first-in, first-out basis. To facilitate this, all of the available liquidity (or “Free Capital”) in a pool, is sequenced in terms of intervals. Each interval is defined by: (1) LP wallet address, (2) interval number, (3) interval size (in monetary terms).

A buy order will scan as many liquidity intervals as are needed to cover the position size. The transaction will mint ERC-1155 tokens for all LP interval owners involved. Once the option is purchased, each liquidity interval is updated. The transaction also mints an ERC-1155 token for the buyer, embedding all option parameters.

Option exercise & settlement. When an option is exercised, the position is settled in the same transaction. The option holder receives the payoff, and the newly freed capital is returned to the pool.

Withdrawals. Liquidity providers can withdraw their un-utilized free capital in a pool at any moment in time. If an LP would like to remove active (underwritten option) capital from a pool, they have two choices:

- Pay the pool price to sell the option to another underwriter in the pool;

- Use the “Gradual Withdrawal” feature to prevent their capital from being used to underwrite future options after expiration.

How does the protocol make money?

Premia is charging fees to support the growth and long-term sustainability of the protocol:

- Option buyers are charged a 3% Protocol Fee at the time of purchase charged on the option’s base price and included in the quote;

- LPs are charged a 2.5% Utilization Fee (see below).

A successful proposal recently replaced a 3% Exercise Fee with the Utilization fee. The problem with the Exercise Fee was that (1) it charged option buyers for a second time for the same transaction, and (2) there were no fees for options that expired out-of-the-money but did utilize capital. All of this resulted in unbalanced fee incentives.

The new Utilization Fee is a 2.5% annualized interest rate. It is calculated taking into account both the amount of capital locked and the period of time the capital was utilized. It is paid by the LP at settlement (exercise, secondary sale, or expiry) and taken from the collateral stored in the option.

To reward long-term supporters of the protocol, 80% of fees are paid as a protocol fee to $PREMIA stakers. The remaining 20% of fees go to the PREMIA treasury.

Protocol expenses include Chainlink services (price feeds, nodes, keeper), The Graph’s on-chain indexing and open-source DB/API service, and contract deployments. All of these must be maintained on a per-chain basis.

Premia’s Secret Sauce

The problem with using a spot AMM model for options

Pooled liquidity (AMM structure) has benefits. However, a simple bonding curve AMM only accounts for changes in token reserve. Options pricing takes multiple variables into account: spot price, volatility of the underlying asset, the risk free interest rate, and the strike price and duration of the option. All of these are dynamic and change on a trade by trade basis.

TradFi options are typically priced using the Black-Scholes Model (BSM). To establish a robust equilibrium price in options AMMs it is important to both establish an accurate input for volatility and take into account market flows.

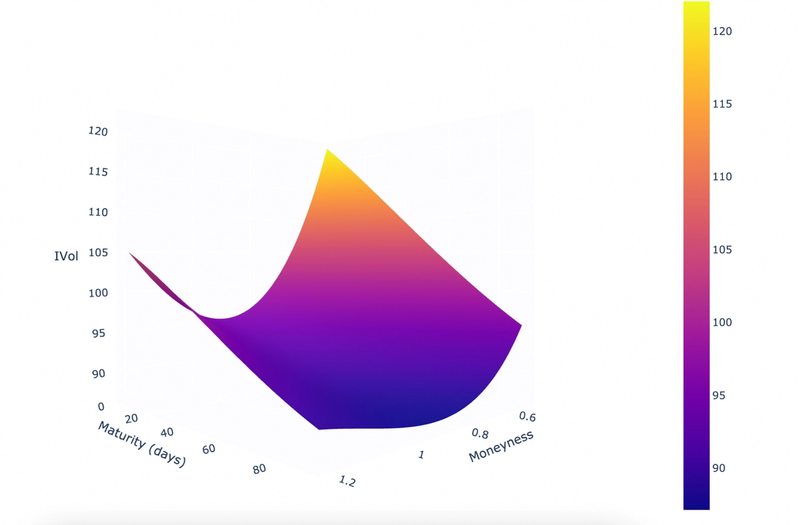

Volatility is typically estimated by looking at both historical volatility and a live “volatility surface.” The latter is a three-dimensional representation of the observed implied volatility of existing options on the asset from a range of strike prices and expiry dates. Volatility surfaces are complex to establish on-chain and either need to be held off-chain or approximated.

Premia is offering a novel solution to these problems withs its implied volatility surface and c-level features. In addition, it aims to make DeFi options yields accessible to a broader audience. Through its smart deposit optimization framework, the protocol provides example portfolios to liquidity providers.

Let’s have a look at these key elements of Premia’s “secret sauce.”

Implied Volatility Surface

A live implied volatility surface is crucial to providing an accurate approximation of the market-clearing price of an option based on the liquidity conditions present in DeFi markets. In absence of such a tool in DeFi, Premia launched its own Volatility Surface oracle. It is calculated off-chain and periodically reports the updated surface via Chainlink. To construct the surface, Premia uses a volume-weighted combination of the most liquid CEX options data, together with data from trades executed on the Premia platform.

The image above depicts the volatility surface of a BTC call option circa October 2021. Source: Premia Gitbook

C-Level

The C-level is an equilibrium mechanism to address shortcomings of the BSM, which uses simplified assumptions that ignore (1) market supply and demand, (2) “American” style exercise, and (3) asset-specific volatility dynamics. The mechanism is a coefficient that fluctuates based on real-time liquidity and demand for buying options. When the coefficient is multiplied by the BSM-determined option price, it adjusts the price levels in option pools to market supply and demand.

Smart Deposit Optimization Framework

The smart deposit optimization framework provides portfolio optimization for LPs. This framework gives LPs example portfolios which may help optimize yield according to local market supply and demand conditions. It allows users to automatically optimize their pool deposits to have the minimum impact on pool price levels.

The $Premia Token

Premia’s $PREMIA token is an ERC-1155 utility and governance token.

Premia’s token’s supply is fixed at 100 million. The initial token distribution of 10 million PREMIA tokens was conducted on February 7, 2021. Of the remaining 90 million tokens, 10 million were allocated to its founding team. Furthermore, Premia allocated 20% to its Development Fund, 5% to marketing and education, and 5% to ecosystem grants.

According to CoinGecko, the circulating supply is currently $10.6M. The circulating supply does not include the 10 million allocated to the founding team as these are still locked in a vesting schedule. Premia’s fully diluted market capitalization, which is the value of the entire token supply at current prices, is $167million at the date of publication.

$PREMIA accrues value to token holders through its liquidity mining program and staking mechanisms. Premia’s Cross-Chain Liquidity Mining Fund received the highest token allocation at 30%. Liquidity providers receive $PREMIA tokens as compensation for lending their assets. $PREMIA stakers collect the bulk, an estimated 80%, of the protocol’s fees. All $PREMIA holders receive governance rights, which means that they can vote on new proposals and protocol decisions. Those who own at least 100 $PREMIA tokens can submit Community Proposals regarding changes to Premia’s features and the protocol’s future roadmap.

Traction and Competitive Landscape

Traction

Premia’s TVL is comparatively lower than top options protocols like Dopex and Ribbon Finance. However, Premia does seem to optimize capital efficiency effectively. Taking Dune data for Premia’s ETH, WBTC, and Link pools it produces 25% annualized return on assets (ROA) for March 2022. This compares to 3.6% for Yearn and 30% for Ribbon over the same period.

Competitive Landscape

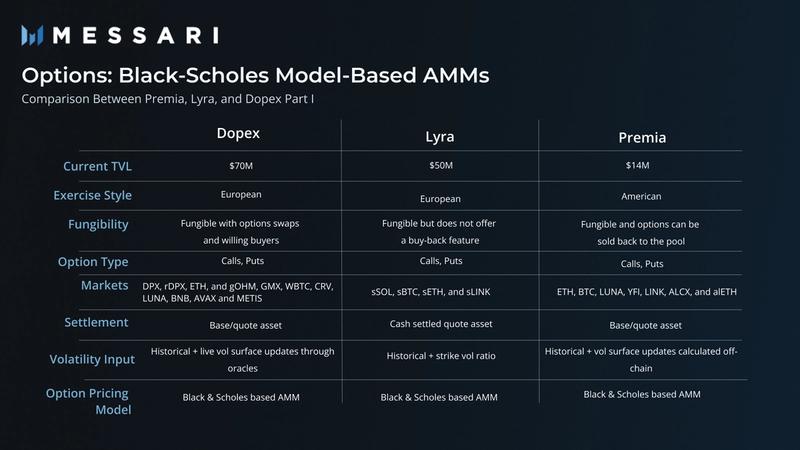

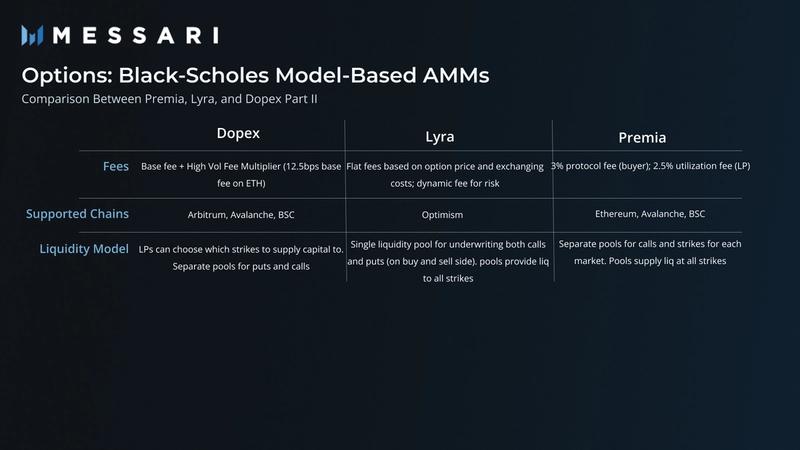

The table below compares Premia to its main competitors that employ a similar peer-to-pool model. Although smaller in terms of TVL, Premia is the only such protocol offering options with American exercise. The fungibility of its tokens also stands out.

The information above was sourced from multiple sources, including the Premia Gitbook, Dopex Gitbook, Lyra Gitbook, Etherscan, and DeFi Llama.

Risks

User adoption

The on-chain DeFi options model is still in its infancy. Although retail demand for yield is strong, the challenge is in finding the other side of the trade on-chain. Protocols like Ribbon find buyers off-chain (typically market makers). Shifts in user behavior are crucial for protocols like Premia to scale.

American-style options are a double-edged sword

American-style exercise is the most popular in TradFi and Premia is the only protocol offering American options on EVM. However, American options are harder to price and also carry more LP risk. American options are more challenging to price because the traditional Black-Scholes pricing model neglects the asset’s fluctuating valuation up until expiry. Other option pricing models designed for American options include the Tree/Binomial pricing model, which could be difficult to incorporate on decentralized platforms. American options incur LP risk from potential liquidity deficiencies as a result of early exercise. The Premia team attempts to mitigate this risk with its incentives structure, which is designed to attract LPs when liquidity is low.

Competition

Premia also faces competition from both alternative DeFi derivatives instruments like perpetual swaps (perps) and competitors that use the more dominant options vault model that Ribbon employs.

Differentiation

Like in any market, differentiation vs. competitors is key in attracting a captive client base. One way for Premia to differentiate could be to support popular tokens before its competitors. This has paid off for Dopex which supported OHM early.

Conclusion

DeFi options markets are still in their infancy. The traction that these options markets have picked up in the last few months are mostly on the supply side. Liquidity providers are discovering that option protocols offer better yields than some legacy DeFi platforms, which is driving up TVL and volume on DeFi options platforms.

However, the demand for options is still lagging. Although this introduces challenges, it also creates opportunities for protocols like Premia to innovate.

If the demand for options in DeFi markets eventually resembles the demand in TradFi markets, then Premia does not need to capture a significant chunk of the market share to do well. Instead, Premia’s future relies on how it adapts to market conditions and develops cutting-edge features.

This report was commissioned by Premia, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.