Hello,

TL:DR – Web3 games tend to get hated on for bad graphics and terrible user experience. I break down why they are here to stay due to economic shifts, changes in game business models and the evolution of labor markets.

It is easy to bash on Web3 gaming in its current form. They are broken experiences. Users are expected to store keys, go through on-ramps and then spend thousands of dollars before they can have fun. Why bother with any of it when console gaming has far better experiences at a fraction of the cost? Who wants to deal with a crowd screaming WAGMI while they lose money on a broken product? Well, not me. I love my GTA 5 and red dead redemption, and it would be far fetched to think web3 games in their current form can compete with them.

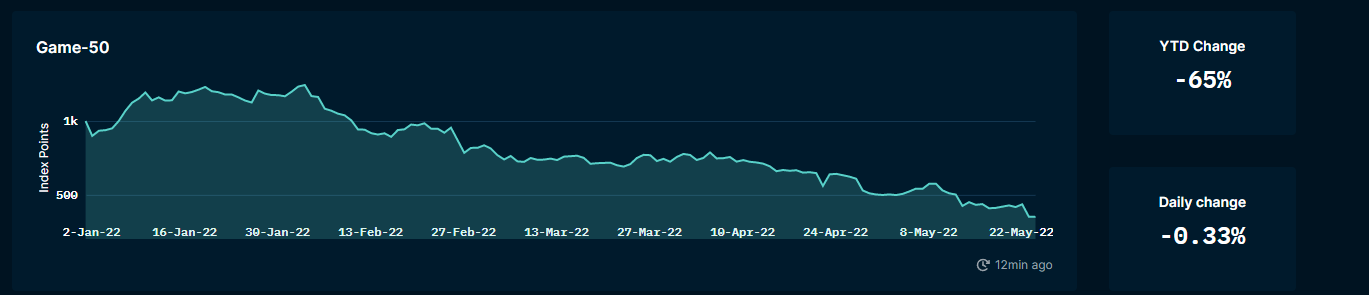

But as an investor that spends hours in-game, I think there are aspects of Web3 gaming we don’t look at. So I wanted to take a while today to explain why the sector is not a fad that may die in the years to come. This topic first intrigued me while checking through Nansen’s sectorial NFT Indices. I noticed that the index consisting of some 50 games has been down 65% since the beginning of the year. The S&p500 is down 17% in comparison. Bitcoin? 37%. Good thing we have Stepn helping people make a living through walking.

Why Nobody Cares

Sarcasm aside, the arguments against web3 gaming are relatively straightforward. First, there’s a high entry barrier in terms of technical skills and money. The graphics are nowhere close to traditional AAA titles when you get onboarded. Assuming the graphics can be ignored – there is generally a lack of a storyline. Who plays games for stories these days anyway. Perhaps, there’s a strong community? Maybe not. Web3 game communities may be riddled with users looking to make a quick buck. Okay – maybe there is a lot of money to be made? Likely not. Markets have saturated, and capital income from play to earn economies has dwindled since Q2 2021.

Part of what makes web3 games strange is that we have created financial instruments out of something that was historically “fun”. Nobody generally cares when land is sold at hefty prices in the metaverse. Because historically, ordinary people go for walks in real-life parks and don’t hang out in their digital avatars over the weekend. Although, according to Financial Times – that is now changing. People are supposedly partying in “virtual nightclubs” in the metaverse. ( I still prefer to be home alone reading books. Offline. With my warm cup of coffee)

People would naturally be mad if we jacked up prices to visit local amenities such as parks using digital instruments and somehow called it the future for good and justified reason. That is what happens when studios like Ubisoft try to hardcode NFTs in the gaming experience. Except, the commercialisation is on digital realms instead of actual physical spaces. The slimy, dirty hands of commerce creep upon what was historically a function of skill, talent and dedication. Pay-to- win models remove any resemblance of equality and fairness from games and make people annoyed.

Don’t worry. I don’t plan on tricking you into reading a long form on all the reasons why Web3 games in their current state are terrible. I think Web3 games are hated so much because we look at them from a very traditional lens. These new breeds of gaming will matter because they focus on (i) ownership and (ii) asset liquidity. We are not trying to re-invent the wheel. The attempt is to create hoverboards.

Why You Should Care

I learned why ownership matters in gaming from a talk given by @Ancient001 . It essentially boils down to three factors – verifying scarcity, an asset’s provenance and a user’s ability to truly “own” an asset. When a gaming studio releases a limited edition asset, there are very few ways to verify that claim. In the ticketing world, it has become common for concert tickets to be purchased by the issuers to sell at a mark-up in secondary markets. There’s nothing stopping gaming studios from doing that today.

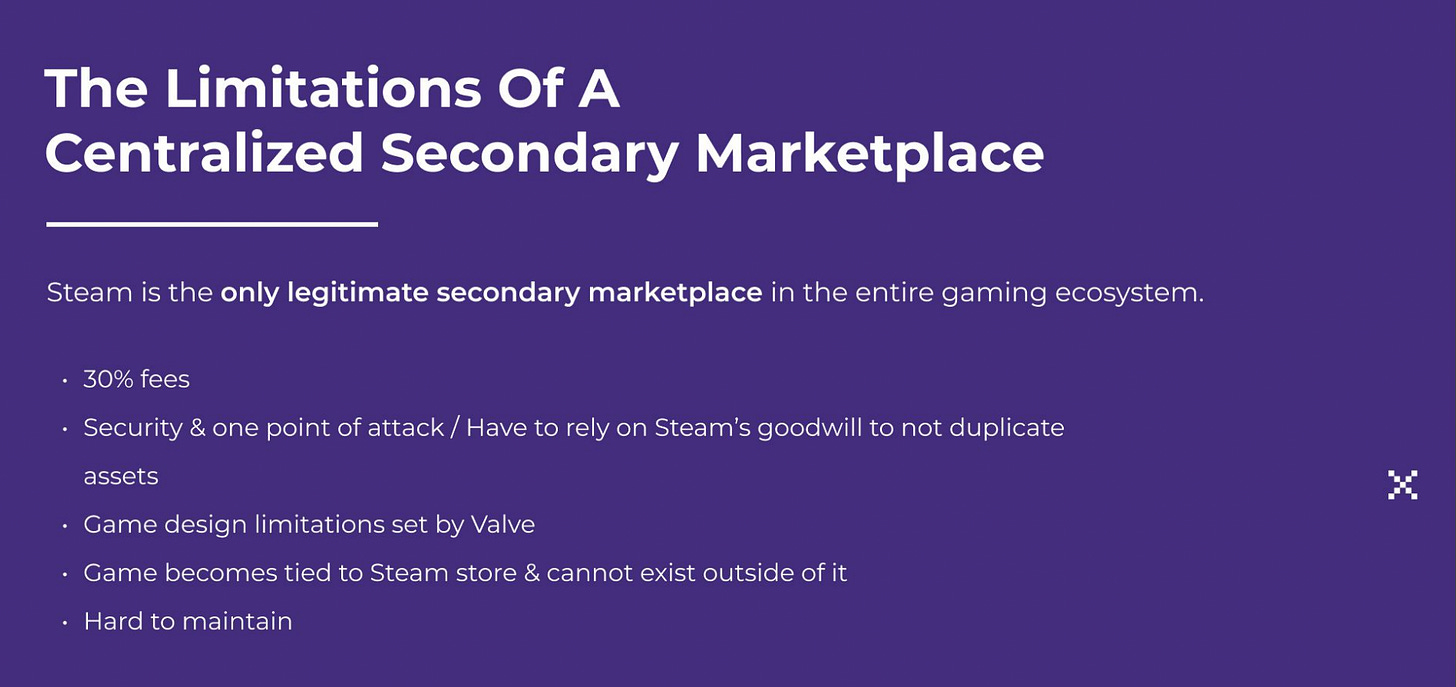

When you buy an NFT today, verifying its historical ownership from Ethereum’s ledger is pretty simple. Try doing that on Steam’s marketplace today. You can see a record of who purchased the item in the past, but it is barely verifiable. Why does this matter? Because occurrences of fraud and money laundering are high with in-game assets. This is a problem acknowledged by Valve recently.

Lastly – the concept of ownership. What makes digital assets that run on immutable ledgers interesting is that it is harder to seize them without due process. One can argue that USDC can “blacklist” addresses today, but that happens only when a significant event like a hack or extortion occurs. Allowing users to own digital assets without the risk of them becoming invalid allows historically under-banked segments of society to partake in ways that were not previously possible. Games have had marketplaces for over 20 years now, but the ability to withdraw returns to an account that won’t get blocked (by PayPal or banks) has not been around for long.

Axie Infinity was controversial because never before did we have a mechanism that allowed the most sophisticated financial players to interact with retail participants. You have Robinhood and Citadel, but those interactions were within a single part of the world and focused on assets with regulation and historical precedent. How do you evaluate which NFTs in a game will surge in price?

Axie’s assets soared because it connected an underpaid labour market, primarily organised through guilds with sophisticated traders and hedge funds. Web3 games are simultaneously avenues for leisure and financial engineering. The incentives are no longer a community, fun or distraction alone. Life-changing sums of money or a livelihood are now in the mix. That changes the dynamics of what games historically have been and how users interact with them.

Capital Markets Play Sculptor

According to a report by the Blockchain gaming alliance – some $4 billion went into web3 gaming infrastructure in 2021. In Q1 2022 – some $2.5 billion has gone into the sector. When we talk about the industry, we fail to realise that founders have an incentive to transition from the old ad-driven model and transition to a token-based model as they can get readily available capital and higher valuations.

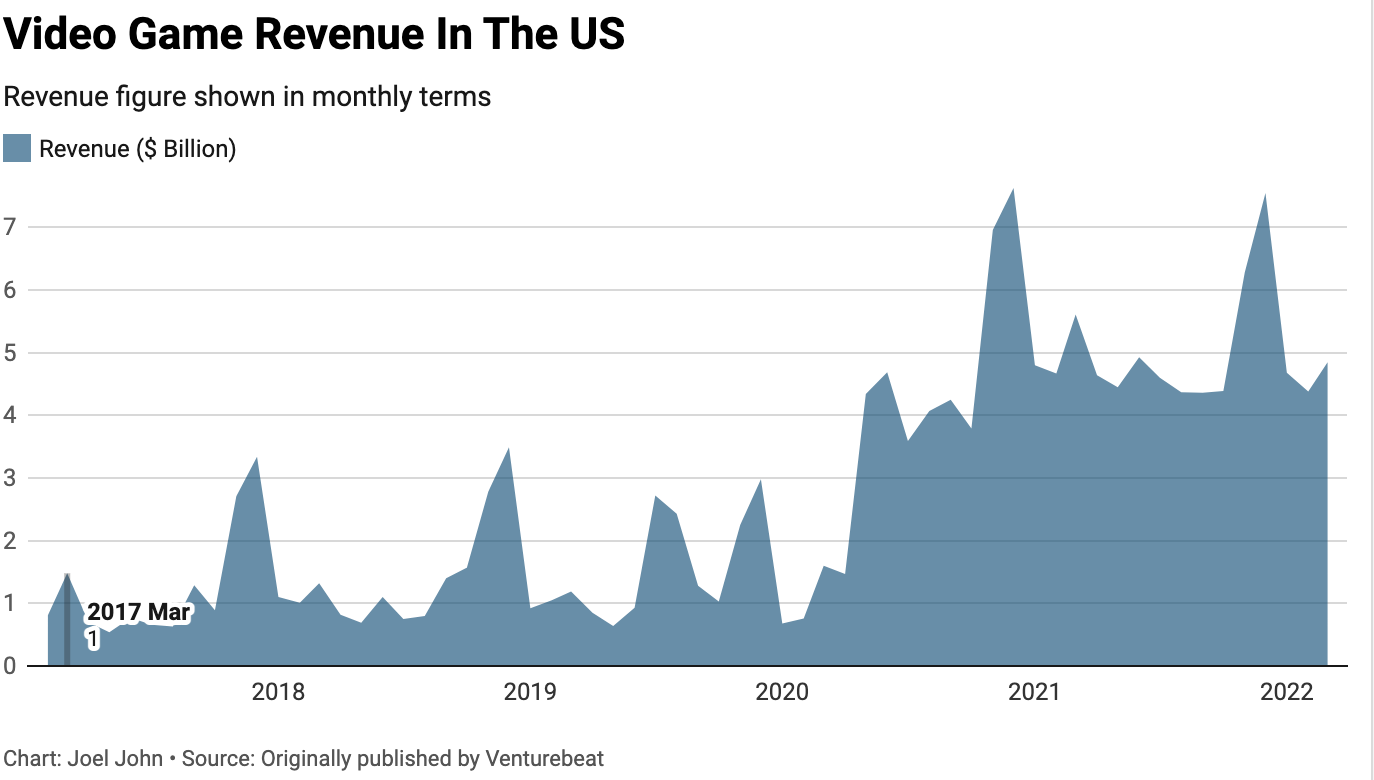

For a sense of scale – In 2021, $30 billion is how much was spent by gamers across hardware, streaming donations, subscriptions and game purchases in the United States. According to a report by EY, India has about $1.5 billion being spent on online games in the past year. So we are in an environment where there are almost as many investment dollars flowing into the ecosystem each quarter as there is revenue each month. That can’t be healthy in the long run.

Depending on the source you go with – the largest web3 games today have about a million users. According to this Dune query by Richard Chen, there have been about 4 million DeFi users in total. For a benchmark of NFT adoption – consider that OpenSea sees about half a million active traders each month at their peak. In other words – we are still exploring how blockchain-based application’s userbase can hit the 100 million mark.

The largest game studios have an edge in that they will likely be able to be the first retail-focused application with tens of millions of users. Free to play games, by default, require large user bases to run sustainably. If these studios can convert a fraction of that userbase to web3 native users, they could command an extremely high valuation. They are incentivised to focus on where the money is and what can help them deliver the most value for shareholders.

Games As Platforms

A different reason why Web3 games may stay is that they unlock entirely different economic agents. Traders, speculators and guilds can contribute to creating self-sustaining ecosystems that are beneficial to both publishers and gamers. Instead of selling items only once, an ideal game will have evolved to become a platform. Independent third party users will be able to create services, develop experiences and sell them. Think that’s far fetched? Consider the interaction below on Twitter

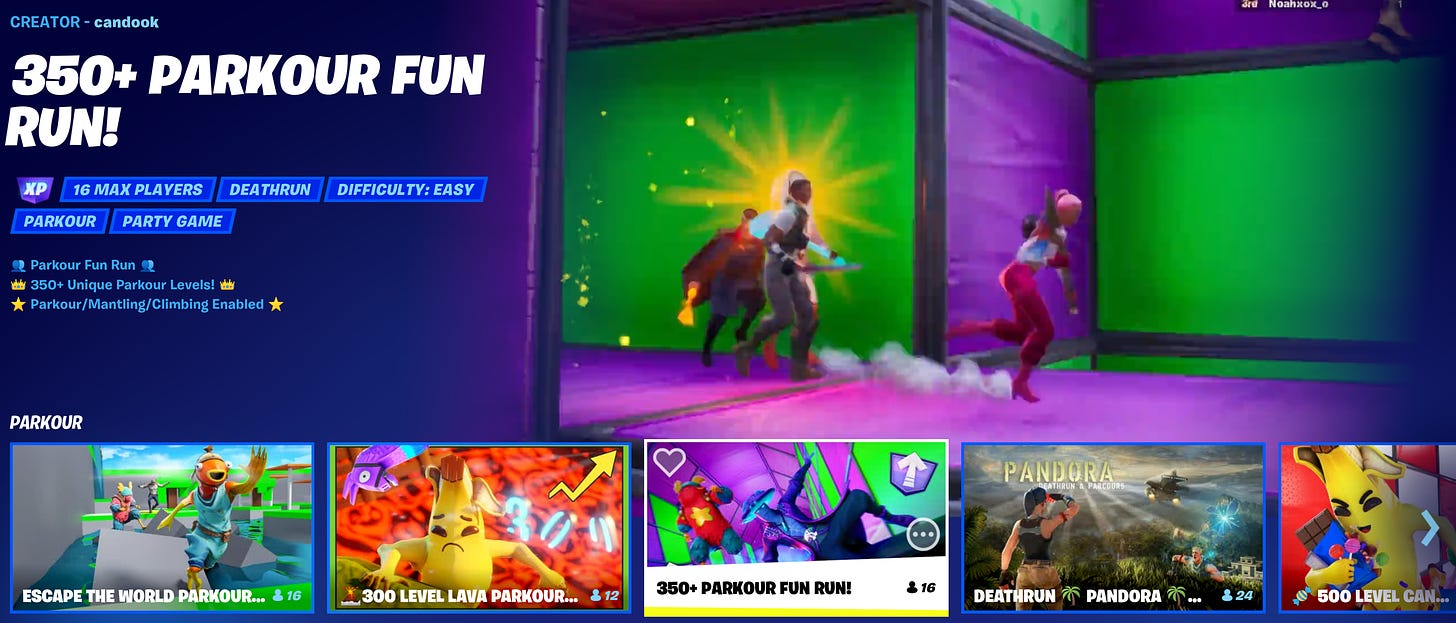

Tim Sweeney is the CEO of Epic Games. The firm behind Fortnite. It occurred to me quite recently when opening the game that it is likely that in an NFT driven world, we will have stand-alone artists selling clothing items, game maps and modifications for the game itself. The pathway to this already exists. Games like GTA 5, Battlefield 2042 and Age of empires have custom servers or mod-based game plugins. These changes to games currently do not allow the creator to be paid. A web3 based game could ideally allow both the studio (eg: Epic) and its mod creators to be rewarded.

Why would games become platforms? For starters, it reduces the studio’s effort to keep users engaged. Gamers can find new experiences developed by other gamers and stay vested. Secondly, a big game’s distribution would mean standalone, creative developers can generate revenue without worrying about finding a userbase. Thirdly, it paves the way for more revenue to be generated through in-game subscriptions and purchases. Games becoming platforms would mean we see more user generated content emerging. This in turn will keep players (and viewers) engaged for longer.

Financial Primitives For The Emergent Web

Web3 native games come at the intersection of financial infrastructure and gaming experiences. If stand-alone communities can use tools like DAOs and multi-sigs or collect in-game assets as payments, it would unlock new avenues for users in previously unavailable ways. These would be communities that use non-conventional forms of incentives too. For example, instead of using cash payments, users will reward one another through in-game assets.

Essentially, a web3 game-related DAO can abstract the “boring” aspects of a DAO and show the average retail person that alternative coordination tools matter. DeFi recreated financial markets. Web3 games essentially gamify them where 8-year-olds are trading against veteran traders from Wall Street. This is equal parts elegant and risky.

The idea that the same NFT could be used in multiple games is somewhat flawed. I do not believe that the interoperability of assets in games will happen as soon as many of us hope it would. Studios today have no incentive to make in-game reputation or assets interoperable. Walled ecosystems would mean users who come into a game stay there for long as they can no longer take all their assets elsewhere.

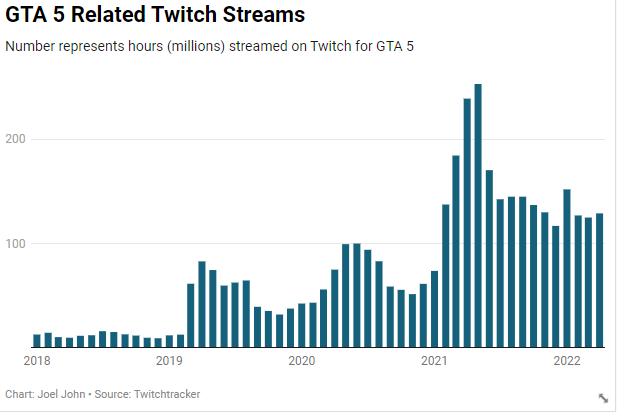

This is why GTA 5 has not seen a significant upgrade for quite some time. The developers understand that users that have spent hundreds of hours will not jump ship and go elsewhere even if they only release incremental upgrades. The chart above is proof of this trend. Inspite of no new releases from Rockstar Games, viewers continue to flock toward streams related to the game.

How would a transition occur then? In my opinion, interoperability is not the way ahead. Liquidity is. Remember when I suggested games have an incentive to introduce financialisation to attract traders? Games stand to benefit by charging a fee on a percentage of transactions, like on NFTs today at OpenSea. If a standard (like Erc 1155) is used for game assets, it is only a matter of time before marketplaces for these assets emerge.

Instead of trying to port assets – gamers will trade them. There will be a lag in price discovery as the data around the raribility and utility of these assets will initially not be clear. For example, when games launch with new characters and weapons, gamers have a learning curve evaluating weapons cost vs stats and try playing with different character-weapon combinations. With a marketplace model, these types of weapons will become super rare and expensive rather than the game developers assigning an arbitrary cost. Think of the efficient market hypothesis becoming applicable to digital economies in games.

Community & Identity Trails

So far we have looked at the capital markets and business angle of why Web3 games are here to stay. We believe there is one more reason, and that has to do with the people. I keep mentioning that play-to- earn models take off because they offer better pay. But the idea that money alone is the motivation could be flawed. Digital-first forms of labour such as those enabled by P2E models also bring a sense of community, dignity, and options that traditional jobs do not allow today.

It is utopian to believe playing to earn will fix everything wrong with today’s labour markets, and I would not argue for it. But it is fair to say digital-first forms of labour such as grinding in-game pave the way for people to pick up on crucial skills such as communication, collaboration and coordination. Traditional forms of schooling have likely failed to equip students within an increasingly digital workforce.

Guilds like IndiGG enable gamers to find others with similar tastes and connect them to potential opportunities to generate income. This has played out through their collaboration with a game named Skyweaver. The game itself is free to play, but those playing through the guild stand to receive monetary benefits from a prize pool of $100k. It may not seem like much for the average knowledge worker reading this piece, but it could be life-changing if you are from a small town and devoid of immediate economic opportunities around you.

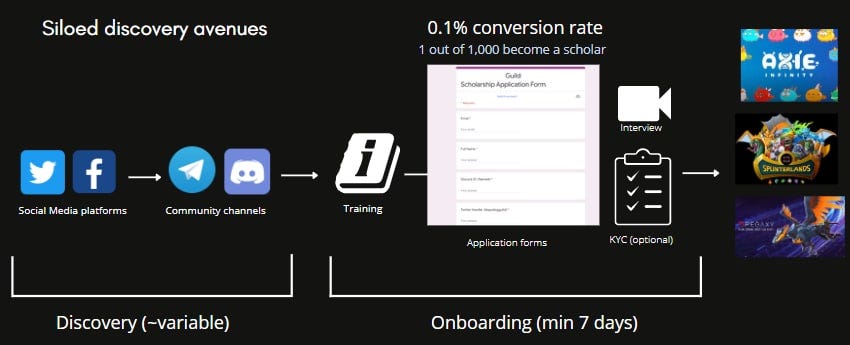

Gamers often struggle with finding the proper guilds. Economic exploitation of labour is a possibility even when it relates to games. It takes anywhere between 7 to 12 days for a person to be onboarded to a guild. Only 1 in 1000 applicants even get accepted to them according to research by Utsav Singla and Srijan Jain (founders of Respct.co). New users have a steep learning curve involving learning how to set up a wallet, engage in discord, filter the suitable game and eventually work with a guild. Respct.co has been building a platform that allows gamers to be supported throughout the life cycle, from discovering games (like you do on Steam) to getting paid to your bank account. Currently, they have a waitlist of about 6500 scholars and are accepting early applicants. You can apply for it here.

We fail to recognize that digital workplaces like games are the richest data source when it comes to employing someone. For example, the average age of a gamer retiring from e-sports is around 26. But over the years they spend within the gaming ecosystem, they leave a robust trail that is generally verifiable. The hours they played, the people they collaborated with, and the levels unlocked within a game are all aspects that can be verified and stored digitally. This can be exceedingly useful in hiring so long as matters of privacy are taken care of.

Web3 native gaming will eventually lead to rich on-chain identity layers. Unlike LinkedIn, many of the claims made will be verifiable instantaneously. Employers will use these data sets as a parallel to university credentials in the future. If you are hiring a community manager – what would be more valuable? A degree or a thousand hours of coordinating gaming communities. I think I know what I would go with.

Pinhole vs Open Boxes

Looking at Web3 games solely through the lens of graphics and user journey is like looking at a pinhole. You have a limited view on what is possible. Instead, one must observe the macro-economic factors bringing people to these games. A contracting labour market, increasing aspirations of young individuals in emerging nations, the rise of parallel financial infrastructures and challenges in monetising existing games.

The amount of capital pursuing Web3 games would mean founders will continue to build them. The vast majority of them will die slow deaths, as with most venture-backed startups. What they will pave along the way will be an alternative way of looking at games. They are not just pathways to leisure but economic ecosystems that could sustain very different user profiles. This could involve traders, streamers, researchers and service providers. In my opinion – Web3 games are the trojan horse that will bring the most users to crypto. They focus on tech-savvy, young users comfortable with digital-first asset ownership.

The challenge for studios and developers building them is to balance economic activities with fun. Make a game too complex – and users would avoid it. Make it devoid of ownership and asset liquidity, and users would instead stick to their traditional AAA titles. Balancing the two is what it would take to bring 100 million users to web3 through gaming.

This article was written with loads of inspiration from Roby John (Supergaming), Ancient001, Abhishek Anand (IndieGG), Utsav Singla and Srijan (Respct.co). Do give them a follow if gaming as a theme interests you. Also, Utsav and Srijan are in Bangalore for a brief visit. Ping me in case you want to meet them over coffee to discuss all things gaming.

This whole article was inspired by a conversation we had on Telegram. Hop on there in case you want to discuss more of this.

Signing out to go raid cafes in Dubai over the weekend,

J

P.s – Yes, the Africa report is pending. I will be sending it out soon.