This piece was made possible with a sponsorship from Nansen. The platform saves analysts and traders hundreds of hours each month by allowing them to grab network level data with a simple click. No APIs, no going through network scanners or pulling contract addresses. Nansen visualises network level data on user behavior & transactions in a fraction of the time their peers do. Get started with a trial here or simply play with their dashboards here.

___________________________________________________

Hello,

If you are a gamer, the image above likely sparked fond memories. GTA San Andreas was almost therapeutic for my generation in how it helped release post-school annoyances. So why is it the banner for today’s email? It represents one of the most iconic land spots in gaming history. We could argue about whether that is true another time, but for today, I wanted to explore the concept of metaverse land as an asset class and how it is evolving. For context, someone recently spent $450k just to be Snoop Dogg’s neighbour in the metaverse. I spent my weekend thinking about it. What does it mean to be a ‘neighbour’ in the metaverse? Why does it even matter? What if Snoop Dogg had multiple houses in the metaverse? Do land prices near all those houses get a premium? Frankly, nobody knows. So here are some thoughts breaking down the concept and a few ideas on how it may evolve.

Land as an asset in the metaverse is relatively nascent. It has done only about $1.9 billion in volume compared to the $22 billion towards NFT purchases in the past few years. For a sense of scale, a single NFT (Bored Apes) has done more in volume ($2.2 billion) than all land-related transactions across every metaverse platform. The collective market capitalisation of all land available across the metaverse is at around a mere $3.6 billion compared to the multi-trillion market-cap that token assets command. As of January 2022, there are about ~57,000 wallets holding land-related assets in their wallets. Compare that to the estimated 4 million wallets engaging with DeFi, and you may get a sense of how early the theme is. Part of the entry barrier here is the high capital commitment required to buy a plot of land in the metaverse. Unlike tokens which can be divided to smaller parts, they take a significant amount of capital to buy. The average price of a plot of land in Sandbox is around $10,399. The figure is approximately $11,954 for Decentraland, according to data from MetaMetriks. Why are people spending so much? To understand that, we have to define a plot of land in the metaverse

A plot of land in a metaverse-based project like Cryptovoxels, Decentraland or Sandbox is a plot where you can express anything digitally. Think of it as a fixed space where users can customise a digital experience. This could be an art gallery-like Sotheby’s in Decentraland. Or it could be a place where digital concerts are performed like Snoop Dogg has set up on Sandbox. Land is a digital plot on which you can make anything that is visually expressed and developed. Even Domino’s pizza vending machines. Might sound stupid, but a mental model for metaverse land is comparing it with space on a quickly growing website such as Reddit. If you could own a small banner (about 3×5 inches) in the top left corner of the website for perpetuity, would it be a good investment? I would argue that it would be a good investment as long as you can acquire it early and inbound traffic to Reddit increases over time. The flaw here is that when it comes to metaverse land, everything on Reddit (in this hypothetical example) is owned by a different person, each with unique ways of expressing themselves.

This may sound far fetched, but it did happen in 2006. An individual named Alex Tew, who was 21 at the time, set up a website that sold 10*10 pixel blocks for $100. He managed to sell a million dollars worth of pixels to random advertisers (as shown above) and eventually dropped out from university. This is somewhat similar to an early vision for what land in NFTs eventually became. (Trivia: Alex eventually dropped out and went on to be the founder of the Calm app). You may not have a unified experience in metaverse land assets unless neighbouring users coordinate – much like real-life neighbourhood prices are determined by the local behaviour and quality of living. Land in the metaverse combines user-generated content blending with 3D or VR experiences and asset ownership that is verifiable through on-chain proof. Present-day metaverse land is not too far from Club Penguin or Farmville. The critical difference is that you own the plot of land, and you can use it to build unique experiences depending on what you want it to be. Want to explore how this works? You can visit the most visited plot of land on Cryptovoxels from this link on a desktop. Click on the ‘visit’ button (top left) to enter the Cryptovoxels version of the metaverse. According to the website, it has had some 187k visits. That plot of land was sold for 100 ETH last year. But why? What drives value to land in the metaverse?

Factors That Determine Price

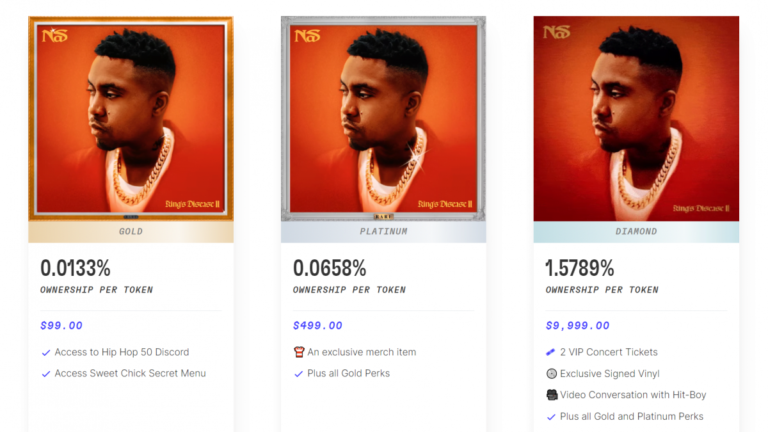

The data above gives an idea of how land-related revenue has been in the four prominent metaverse platforms. For context, Sandbox does 77% of the volume in metaverse land-related transactions. Decentraland trails at around 16% in terms of market share between the four platforms. What may be driving the differences?

Here are some assumptions I made based on my observations

Overall footfall – Consider Times Square in New York or Burj Khalifa in Dubai. Part of what drives value to both properties is their amount of footfall. The greater the number of individuals spending time in these properties, the higher the value of a square foot of land within it. This is part of the risk with metaverse land plots. You are primarily betting on your ability to create experiences to attract individuals in large troves. This is similar to speculating whether a blog (like mine) will attract eyeballs in the long run.

Memetic proximity – In my piece on Bored Apes from last year, I mentioned that NFTs are an interesting asset class because they reduce the cost of being ‘linked’ with a celebrity. Someone like me sitting in Dubai could historically not claim that I am close to Snoop Dogg unless he decided to set up base in the Middle East. (I presume he would never give up his love for smoking weed). Suppose I threw enough money on a plot of land next to Snoop’s. In that case, I could not only claim proximity to his property but also attract eyeballs from individuals going to his metaverse property. This is why individuals would buy up land next to celebrities’. But what if a celebrity decided to buy land everywhere? In my view, value comes as a function of footfall/eyeballs in the metaverse being concentrated. Buying property endlessly dilutes the amount of attention they can drive to individual properties. Therefore, it would be counter-intuitive to buy land assets needlessly.

Geospatial context – Memetic proximity hinges on individuals gaining a reputation by owning the same asset a known individual does. Geospatial context comes through the virtue of being close to a commercial entity in the metaverse. One hinges on reputation, the other on money flowing through these commercial outlets. For example, consider the screenshot above from JP Morgan’s office in Decentraland (I have no clue why they have a tiger walking around). If you hop into this metaverse, you will notice that CoinGecko’s office is right next door. Presumably, anyone going to JP Morgan will see CoinGecko’s plot right opposite (You should visit it by clicking on the hyperlink above to see what I mean). This is somewhat similar to traditional real estate. As more brands join the metaverse and their users use these platforms to access experiences, it will become standard for land close to those owned by brands to shoot up in price. We could see collectivist groups coordinating to buy plots next to enterprises to troll them for all we know. I am not seeding ideas here; I am just saying that it would be funny if folks did this. By the way, Syndicate might be an excellent tool to use if folks decide to do this.

Financialisation – I keep mentioning to game developers that Axie Infinity’s core innovation was bringing the most prominent financial organisations (e.g. hedge funds) and gamers from emerging markets together through guilds. Financialisation for metaverse assets will likely be a critical factor for land prices going forward. Organisations like Everyrealm have been strategically buying pockets of land in different metaverse assets, intending to hold them or generate a yield from them. Yield from metaverse-linked land will come from renting the land out in the short run or allowing individuals to own fractions of the land at a higher price. Certain pockets of land with access to resources in games could generate revenue in microtransactions. Game developers could consider selling a strategic plot of land instead of equity to investors to bootstrap funding. Similarly, artists may consider selling access to a plot of land that hosts events to a third party to fund their events early on. The third-party, in exchange, can sell tickets in the metaverse-linked concert to recoup capital. Think that’s nonsense? Consider that artists like Justin Bieber and Travis Scott have already made millions from doing so. Note: It is worth mentioning that a major part of what helped these artists monetise through the metaverse is their current distribution. I am not entirely sure if an indie artist with a small fan base can pull off a concert in the metaverse yet. Also – metaverse concerts sound quite boring in their current format.

Art – This is more so to do with emerging games than user-generated content metaverses. If a game is launched with pre-existing graphics and the internal art is stunning (like Red Dead Redemption 2), there is a credible case for the game’s developers to auction off specific locations in the game. The land owner could advertise, charge or communicate updates to users passing through there. This may seem outrageous right now, but a few weeks back, I had the pleasure of meeting a team developing an Indian variation of Fortnite (of sorts) with gorgeous art backing the gaming experience. Given the depth of thought behind the assets shown in the game, I would not be surprised to see a bidding war for assets in their game if they decided to pursue it. In this case, the incentive to buy land in the game early on would be to bet that a large userbase will eventually pass through the game’s specific plot because of the art depicted. Far-fetched, I know. More on the team and the game soon!

One of the core arguments most individuals make is that metaverse land can’t be worth much because it can be generated infinitely at will. This is the same as saying blogs are not worth much because there are countless blogs. The value of a plot of land in the metaverse is directly proportional to how much attention it gets at different points in time. To retain a price, publishers will have to cap the amount of land available in their variations of the metaverse. This has already played out. Cryptovoxels, Sandbox and Decentraland each have caps on their plots of land available for purchase. As demand for metaverse properties increases, the price of each plot increases in proportion. But what happens if, tomorrow, there are 50 different metaverses, much like we have different games today? I think that, in the long run, two things may happen. First, land plots will become so prohibitively expensive that they will be owned only by specialist financial organisations. Like streaming rights to certain music is held today. This would mean the average user would not pay a hefty sum but conduct microtransactions. The tail end of metaverse platforms without userbase or financial incentives to own them will die valueless if they cannot command human attention. This is the key risk with investing in metaverse real estate. The other, more idealistic, outcome is that collectives that emerge from a userbase will end up owning the assets in the metaverse platform. It will empower users to have a say in how the game evolves while simultaneously allowing developers to have a source of income early on by auctioning in-game land assets.

Several DAO-based initiatives are already exploring this model. One of them is PangeaDAO. Users in the DAO pool assets to buy land in different metaverse projects. You can read about how they assess land prices from this article. At its crux, there are two core reasons why metaverse-based land ownership will matter going forward. One would be to enable platform ownership by users. Empowering users to own a platform unlocks unique business models through user-generated content so it won’t be a single gaming studio creating content but an entire userbase. This can be powerful if you consider gaming experiences users create on present-day games like GTA 5. In this case – the game itself becomes a platform and individual gamers release micro-apps within the game. This could unlock an entirely new way to monetise AAA games in the future. The other reason would be that it allows indie gaming studios to raise capital directly from their users .Raising capital pre-emptively from a userbase also means the cost of acquiring customers trends lower as landowners become customer-acquisition channels. Think of it as tokens, but for metaverse experiences.

Where is all this headed?

When I sat down to write this piece, I wondered why anyone would buy land in the metaverse, if it would ever be an asset class and whether it could create new opportunities for creative individuals. In my observation, metaverse real estate will not trade the same way tokens do. These plots have a high entry barrier, and even when a collective owns them, they are incentivized to develop them instead of reselling them immediately for a quick buck. The most prominent entrants in the metaverse real estate economy will likely hold these properties until they see a massive uptick in the value of what they own. Because value comes from developing digital experiences and attracting users to them, not from merely holding. Does this mean retail users will be priced out entirely, given the high barrier to entry for purchase? Likely not. Fractionalisation of NFT land will likely be an emergent theme quite soon. I would not be surprised to see mobile-first apps allowing users to invest small sums into different plots of land. A collective REIT-like model with index-style investing across prominent metaverse land plots may find substantial interest. ( Hit me up if you are building that)

The other emergent, underexplored factor here is the role of collectives. LobsterDAO – one of my favourite NFT communities – has some 3500 members. I would not be surprised to see new metaverse platforms offering discounted plots of land to the community to bootstrap activity on the platform soon. As for enterprises, the vast majority that engages with the metaverse today are likely doing it to research. Spending even $20k on a few small plots of land gets exponential press coverage and interest from potential clientele. I think an entirely new crop of investment banks focused on the metaverse will emerge in the next few years. They will help traditional asset allocators buy and custody metaverse assets. Similar to how Falcon X and Fireblocks does for tokens today. A major factor here is the likes of Microsoft and Facebook trying to execute a metaverse strategy. With the average Facebook user age trending higher each day, Zuckerburg and his crew have good reason to focus on the metaverse as a theme. Their ownership of Oculus also gives them an edge. The challenge for incumbents is choosing between the old way of monetisation (data-mining on users and targeting ads) and the new (allowing user-ownership and generating revenue through commission on sales like OpenSea). Trending in either direction is difficult because they have to choose between appeasing Wall Street or retaining users – quarter after quarter. In my eyes, present-day metaverse lands governed through DAOs are symbolic of where the internet may trend in parts and pieces—decentralised, user-owned and slightly crazy. The future – in my eyes, is a remix of the past.

Here are some documents to consider reading if you want to explore further on the theme.

1. Opportunities in the metaverse – JP Morgan

2. DCG’s breakdown of Decentraland – Travis Scher

3. Virtual Cloud Economies – Grayscale Research

4. A breakdown of metaverse lands – Impossible Finance

I will see you guys next with a breakdown of all the interesting ways NFTs are being used in retail applications. Make sure to come hang out in our Telegram group if you enjoyed reading this.

Peace,

Joel John