Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

If you want to determine the quality of a physical collectible, you look at things like signs of damage or wear from aging.

But when it comes to determining the quality of a particular NFT, an intangibly-tangible digital thing, where should you start?

For today’s post, let’s explore the main criteria to use when evaluating the quality of an NFT, regardless of whether you’re a seasoned NFT user or a newcomer!

-WMP

🙏 Sponsor: Kraken — the most trusted and secure crypto exchange in the world✨

If you’re interested in analyzing, collecting, or trading NFTs, it’s important to have a good understanding of the factors that contribute to their quality and value, and assessing the quality of an NFT requires a nuanced approach that takes into account a range of factors, from artistic merit to rarity to historical significance.

In this primer, I’ll outline six key criteria you can use to assess the quality of an NFT and better hone in on its cultural and market values. Let’s dive in, starting with…

When evaluating the quality of an NFT’s metadata, you want to consider how that metadata is stored and the uniqueness of the underlying smart contract.

The crème de la crème when it comes to NFT metadata storage is onchain storage, meaning the metadata is indefinitely stored on the blockchain making it permanently retrievable. There’s a spectrum of onchainness to consider here, but a totally onchain NFT poses essentially zero risk with regard to loss of metadata short of the underlying blockchain itself being permanently ground to a halt.

Of course, most NFTs store their metadata offchain, e.g. externally on private servers or public storage networks like IPFS. Thus in contrast, the availability guarantees that come with NFTs stored onchain gives these NFTs a certain prestige and premium compared to their more offchain counterparts. That’s because at its worst, offchain storage done wrong (e.g. private servers close, IPFS pinning costs unpaid) can lead to total loss of an NFT’s media.

For example, during the 2017-2018 era NFT platforms like Ascribe, Digital Objects, and Editional gained traction and many notable early cryptoart pieces were traded thereupon, including XCOPY’s genesis glitch mints like the one seen above. Though since these platforms have shuttered, only screenshots survive of their mints and not the actual tokenized media.

Furthermore and zooming ahead again to contemporary times, NFTs minted through a bespoke smart contract with custom metadata are often perceived as higher quality compared to those using shared contracts, i.e. a platform’s singular contract where many artists mint alongside one another.

However, the distinction is not always black and white. Consider the NFTs minted on the initial SuperRare shared contract. They’re on non-bespoke infra and store their data offchain on IPFS, and yet these factors haven’t hampered many of these pieces from becoming seen as high-quality cryptoart classics over time. Altogether, it’s important to consider metadata nuances on a project-by-project basis.

Provenance is the history of an item’s origin, ownership, and any other significant events directly associated with it.

In the context of NFTs, provenance serves as means for establishing the authenticity and legitimacy of a digital asset — e.g. with the history of the collections as they are, V1 CryptoPunk #1234 is authentic but V2 Cryptopunk #1234 is authentic and more legitimate, so to speak.

All that said, judging for provenance in the world of NFTs involves examining two main aspects:

-

👛 The creator’s wallet — The provenance of an NFT is closely tied to its creator’s wallet. If an NFT is minted directly to the creator’s wallet and then auctioned or transferred to other wallets, its provenance is considered more desirable.

-

🔗 The ownership history — The chain of ownership is an essential aspect of an NFT’s provenance. An NFT held by well-known collectors or public figures may have a higher perceived value.

There are some edge cases to consider here, too, like if you’re assessing a dynamic NFT whose visuals evolve upon every wallet transfer (one with its base visual intact will be seen as more pristine than one that’s been transferred 20 times), or if the NFT has been annotated with onchain messages, say, from the token’s creator. These sorts of things will bolster provenance.

Additionally, some NFT platforms offer verification and authentication services. For instance, Zien is a contemporary art platform whose recent Sentimentite release with artist Agnieszka Kurant featured “expanded NFTs” whose physical counterparts come with certificates of authenticity. Such authentication confirms the legitimacy and value that comes from the work’s provenance.

If someone mints a piece they painted on their tablet, it may look stunning and iconic on a webpage, but it may not visually scale well for larger viewings if not set up properly. In contrast, artists who mint on Art Blocks must submit pieces that are dimension agnostic, i.e. they can readily scale to any dimension, even massive ones for IRL viewings.

This particular aspect may not be a big deal for some collectors, particularly for those who do most of their NFT activities on mobile devices. In the very least, though, visual quality is something to take stock of when it comes to assessing an NFT holistically.

When it comes to determining the wider historical significance of an NFT, there are many questions you can explore. For example:

-

With regard to the creator, within what period of their personal body of work did it occur? Within what art movement and/or from what era of the NFT space did it spring from?

-

What is the piece’s artistic merit? Is it visually stunning, thought-provoking, or groundbreaking in some way? Does it push the boundaries of what’s possible in the mediums of digital art and NFTs?

-

What is the cultural relevance of the NFT? Does the piece of art comment on current events or social issues in a meaningful way? Does it tap into the zeitgeist of the moment, and if so how?

-

Are there any underlying important technical innovations at hand, e.g. how Nouns DAO’s smart contract architecture is not only expansive and elegant but has also advanced a new, unprecedented way for decentralized collectives to operate?

Answering these types of questions will help you get a better handle on what, if anything, makes an NFT historically significant. Naturally, newer NFT projects won’t score high here just yet, and that’s perfectly fine — they’re just starting out!

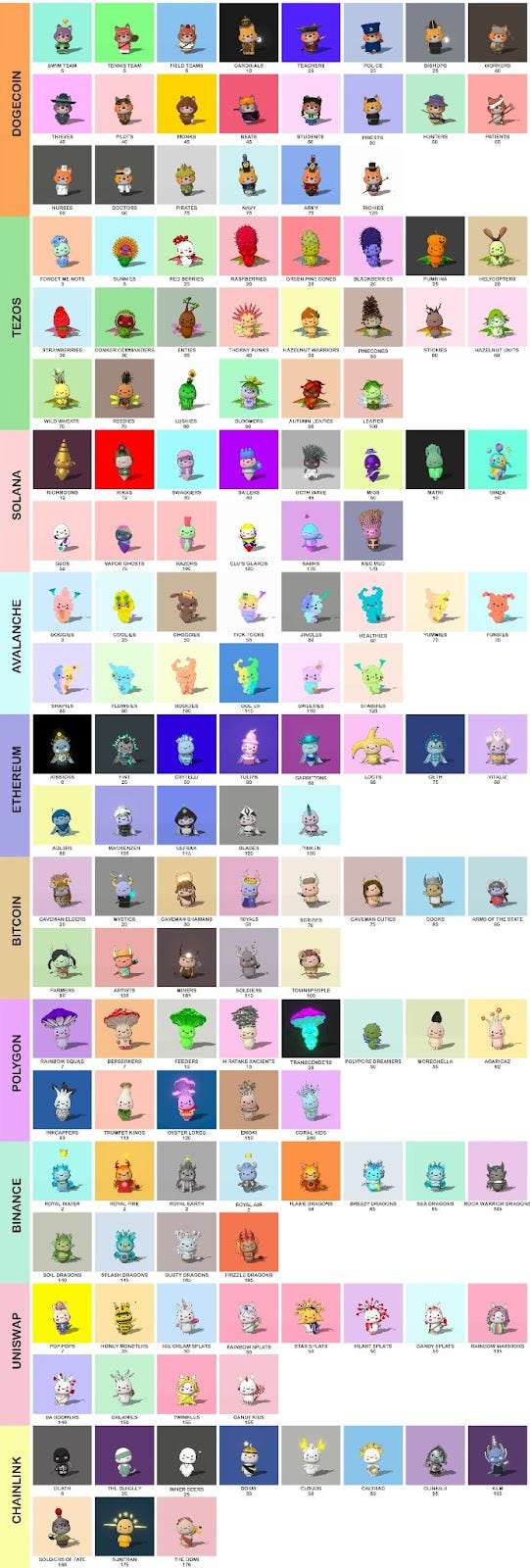

There are also numerous angles to consider when it comes to assessing the quality of an NFT based on its rarity. For instance, if the NFT is not a 1/1 you might start by examining its rarity within its wider collection, e.g. if it has an uncommon trait only seen a few dozen times within a 10k PFP project.

You could also look at an NFT’s de facto rarity. Let’s say, for example, that you own one of the 9 alien CryptoPunks, but over time all the others become no longer retrievable due to lost wallets. The actual rarity of your alien ‘Punk would then be considerably higher than it would appear at first glance via simple rarity analysis tools. On the flip side, if you have the rarest NFT in a collection no one will ever care about, is it really rare at all?

Historical significance factors in here, too. For example, MoonCats minted in 2017 are perceived as considerably rarer and considerably more desirable than ones minted in 2021 because it’s like they’re artifacts that come from a sort of prehistoric period in the NFT world.

Lastly, pure ol’ demand can drive rarity considerations as well. You see this quite a bit in a collection like finiliar, whose rarity perceptions aren’t trait-based but rather are largely aesthetically driven. You can often find a clan who isn’t numerically rarer than another clan trade at a notable premium simply because many collectors prefer its aesthetics.

If an NFT offered certain utilities or functions when it first launched, does it still offer those utilities today? Does the game still exist? Is the token-gated VR space still accessible? Can you still stake your NFT for ERC20 rewards?

Of course, it’s not that an NFT has to offer utility in perpetuity, or even offer utility at all, in order to be high quality and valuable. There are NFTs that exist today that will eventually be highly sought after as digital memorabilia regardless of no longer functioning as they were originally intended to.

Whatever’s the case, be sure to examine the state of an NFT’s utility both as it stands now and as it will be going forward!

-

Do an NFT quality assessment: pick your favorite NFT and use the criteria above to assess its quality for a fun, quick exercise 🕵

-

Catch up on last week: get up to speed on the last week in NFTs with my previous Metaversal roundup 🤳

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Kraken NFT is built from the ground up to make it one of the most secure, easy-to-use and dynamic marketplaces available. Active and new collectors alike benefit from zero gas fees, multi-chain access, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.