Tax season is coming in the United States, and if you are like us, the odds are high that you are unprepared. Do you know the tax liability on the 50 ugly JPEGs and two trillion tokens you traded last September? What about the margin call you had when you were out on that one particular date? We get it. Accounting is tedious and painful.

Descrypt helps with that. They plug into your exchange data and calculate what is precisely owed. The product supports over 20 exchanges and generates IRS Form 8949 with a couple of clicks.

For a limited time, readers of this blog get a 40% off.

Get an export of your tax liability by taking Descrypt for a spin here.

Hello!

Some news from our side. Saurabh Deshpande is joining us to help with all things research. He was formerly at The block and has a wealth of experience operating out of Asia. Read this report on Layer-2 scaling solutions for a sense of his depth of understanding. And make sure to follow him on Twitter here. He co-authored today’s piece. Back to the article now.

It is a strange time to be working in tech. One of the biggest banks had ‘liquidity issues’ over the weekend, Circle’s stablecoin was unstable, and Signature Bank, a prominent on-ramp for digital asset purchasers in the US, shut down unexpectedly, predominantly due to a duration mismatch between assets and liabilities, among other reasons. But apart from the ticking financial time bombs, one more thing happened: Meta just shut down its non-fungible token (NFT) integrations.

Yep, that just happened. One of the largest distributors in the Web2 world figured that pursuing NFTs is about as futile as trying to make their privately owned enterprise metaverse a thing. We will dig into the reasons behind the financial scare and NFTs being removed from Meta at another point. Today, we will look at a new primitive that has been all the rage in the NFT ecosystem over the past few weeks: Ordinals.

Blockchains are efficient consensus machines working on a global scale. That is, it takes little effort to verify whether a transaction occurred at a certain point in time on Ethereum or Bitcoin. I can go back in the record and see when I sold ETH for $7. But things get murky if you have to store large amounts of data, especially images on-chain. This is where solutions like IPFS and Arweave come into play.

When the average, unknowing user buys an NFT, they assume they have purchased the “image” itself on-chain. But they are buying a token containing metadata pointing to a file that could be hosted on-chain or off-chain. According to YourNFTs and Right Click Save, only ~9% of Ethereum NFTs were stored on-chain, 36–50% on IPFS, and 40–55% on private servers. (Yes, I know the ranges don’t add up. The two data sources have different ways of interpreting where an NFT is stored).

This is especially relevant in the context of games. We tend to think that in-game assets issued by gaming studios are user-owned, but the truth is, in most instances, games could choose to host the data on HTTP servers in-house. If, at some point in time, they decide that a user’s ‘assets’ should be seized or changed in the game, they could change data on the servers they run – the equivalent of leaving a Lamborghini in a garage only to return and receive a Corolla.

The reasoning is that storing trivial data on-chain can have costs piling up too quickly. Do you want the plot of land from Farmville on Bitcoin?

The use case is irrelevant to the technology.

What about the half that is on IPFS? Well, the way it works is similar to torrents. For the Gen Z reading this, torrents are what Netflix, Spotify, and Steam combined used to look like for the emerging world for a long time. (Now I feel old.) It is what would happen if socialism came to file sharing. Users download files on a decentralised network from others holding the same file instead of downloading from a single server as you do when waiting miserably for Microsoft’s servers to complete downloading games for your Xbox.

This decentralised approach means two things. Firstly, a centralised issuer cannot change attributes of an NFT like they would if it were on a private server. Secondly, when seeders – the users on IPFS hosting your file – have no incentive to keep storing your data, it may go entirely offline.

What does that look like? One way to think of it is like buying a Lamborghini. Say you made a lot of money trading crypto, moved to Dubai, and managed to buy a Lambo. Then you decided you missed home and flew back, leaving the car in someone’s garage. Unless you pay the garage owner sufficiently, they may have no incentive to keep storing it for you. In fact, at some point, they may even sell the Lamborghini off, assuming there will be no legal repercussions. (Maybe they will use the money on shawarma and karak.)

This is what happens with IPFS. Users are not legally bound to store their data on the P2P network without incentive. And since there are no service agreements, contracts or even identities involved in the whole process, there is very little to lose if you no longer store the data. But what if there was a way around it?

What if you could store data directly on-chain? Remember when I said that 9% of NFTs on Ethereum have their data on-chain? It is possible. But what if you could do it on one of the oldest networks? That is where Ordinals enter the picture.

Noob League of Legends player, Sam Bankman-Fried, was an expert on how to run an exchange until he (allegedly) became an expert on how not to run one. When probed about how he (allegedly) got customer deposits mixed up with his investments, he famously said, ‘Dollars are fungible.’ Now, there are multiple lessons in finance to be learned from him, and I’m sure the folks at B-schools will get their case studies ready by next year, but the fungibility is what I want to focus on.

When you split a dollar into a hundred cents, there’s no real way to track each cent. It makes sense because the cents are not unique. A bank can trace dollar notes using the serial numbers on the bills, but how do you trace $0.01 that is represented digitally? You cannot. This is partly because the modern world has not needed the traceability of such minuscule sums.

But when it comes to Bitcoin, each satoshi can be traced uniquely. Much like each dollar is split into cents, every bitcoin is divided into 100 million satoshis. And each of those satoshis (sats) can have unique identifiers.

Ordinals theory by Casey Rodarmor is a ranking system for satoshis depending on where they rank in a block and, by extension, every satoshi that exists since we already have a ranking system for blocks.

Every ten minutes or so, a new Bitcoin block is mined. Each of those blocks, in turn, rewards miners with 6.25 bitcoins. So, 6.25 * 100 million = 625 million sats are released every block. If you could rank these sats based on their rarity, some would be more desirable than others, even while the monetary value of every bitcoin is the same.

Think of it this way. As I write, every bitcoin trades in the open market for the same price, at about $24,000. But what if I were offered a bitcoin that could be directly traced to Satoshi Nakamoto? Would its value be what a bitcoin trades for? Or would it have a premium attached to it due to its provenance and age?

The naming system behind Ordinals gives a method to rank sats based on their rarity. Here is how it is structured:

-

Common: Any sat that is not the first sat of its block

-

Uncommon: The first sat of each block (1 per 625 million sats)

-

Rare: The first sat of each difficulty adjustment period (1 per 625 million * 2016 sats since the difficulty is adjusted every 2016 blocks)

-

Epic: The first sat of each halving epoch (1 per 625 million * 210,000 sats since halving takes place every 210,000 blocks)

-

Legendary: The first sat of each cycle (a cycle is when difficulty adjustment and halving coincide, 1 per 625 million * 210,000 * 6 sats since the cycle repeats every 6 halvings)

-

Mythic: The first sat of the genesis block

Let’s return to our garage example (where we lost the Lamborghini). Ordinals are similar to creating a mapping system to find your garage. We now have a mechanism to map out empty spaces and rank them based on rarity. Now, how do we get cars into these garages? That is where the concept of inscriptions kicks in.

NFTs on Ethereum use a TokenID to identify the NFT. Now that Ordinals can identify digital assets on Bitcoin’s blockchain, we need to figure out how to upload content there. Casey refers to digital mediums linked to Ordinals as a ‘digital artefact’. They differ from an NFT on Ethereum in that their file storage is on-chain and the asset is permissionless, uncensorable and immutable – effectively, NFTs with the ideals of a true Bitcoiner.

The SegWit (Segregated Witness) activation in 2017 split the Bitcoin block space into two parts – the UTXO part that contains transaction-related data, which is typically information about who sent what amount of money to whom at what time, and the witness part that contains nodes’ signatures that authenticate transactions. Because nodes have already confirmed transactions related to these signatures, witness data can be pruned and is not as ‘important’ as the transaction data.

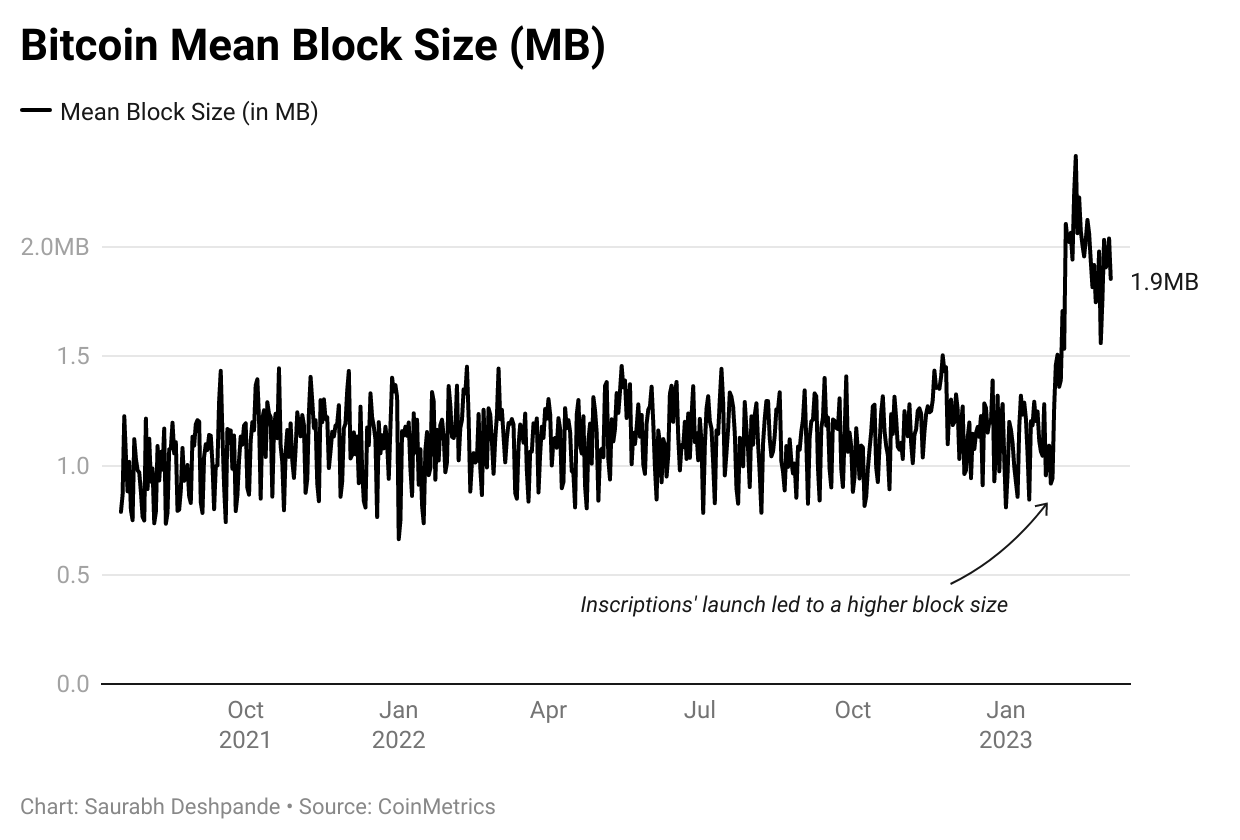

SegWit soft fork reduced the witness data cost to a fraction (25%) of transaction data. A Bitcoin block could now have ~4 times more data since the witness data became lighter. But there was a limit to how much data a single transaction could use. With the Taproot upgrade, filling the entire block with one transaction was possible. Luxor Mining mined a 4MB block (Block 774628) with ~99+% space taken by the Taproot Wizards image.

The large blue square represents the image’s block space, while the small squares around it represent the size of other transactions in the block. (You may have to look carefully to see the non-blue parts.)

Some interesting characters on the internet figured out how to put images on Bitcoin’s blockchain. Cool. You may even dismiss it because similar innovations have existed in the past through side-chains. But why does any of it matter? Does this mean Bitcoin will begin serving purposes beyond hard money? To understand where all this is headed, it may be helpful to examine how the emergent ecosystem around Ordinals looks today.

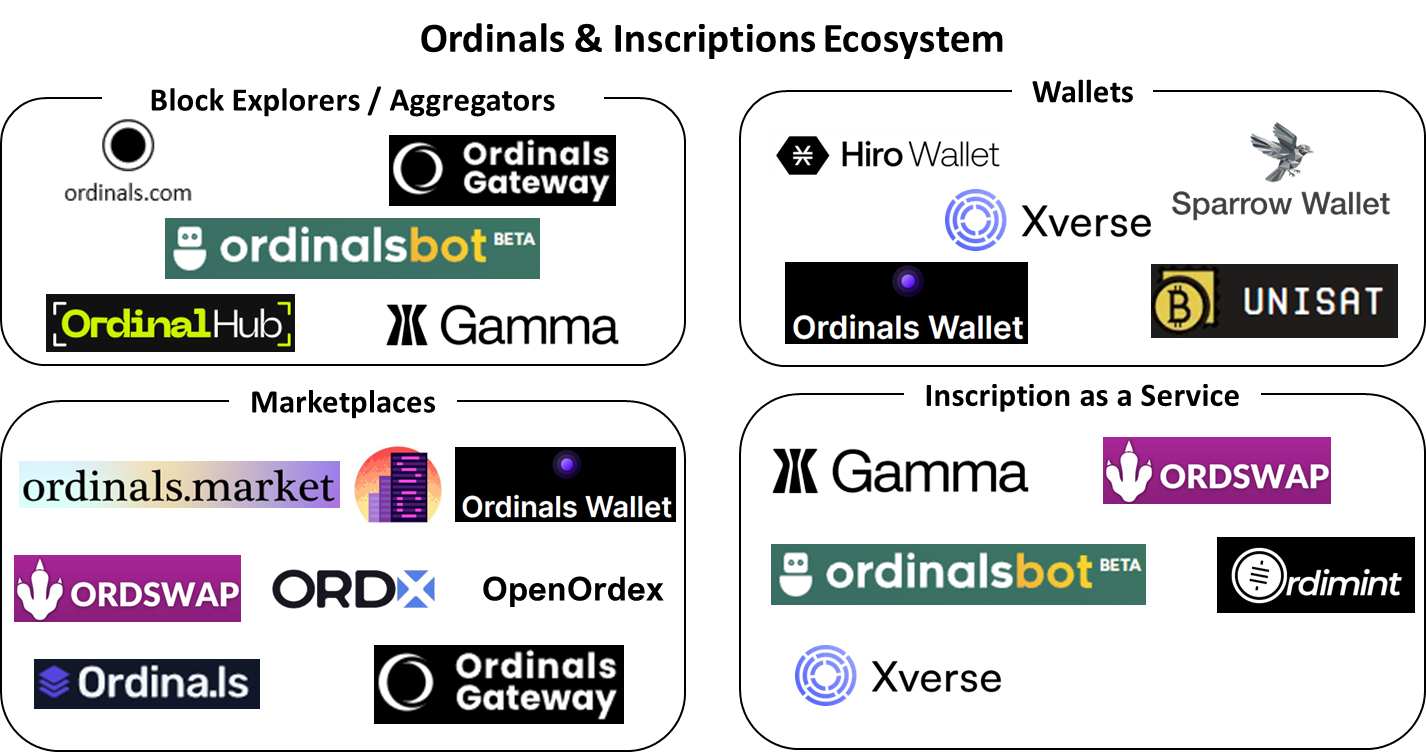

Back in 2014, when new chains like Bitshares and NXT were launched, networks used to first release a blockchain explorer. You used it to track your balances and who sent money. As ERC-20 became the standard for releasing new tokens through 2017, the norm became using Etherscan or Ethereum’s ecosystem for new digital assets.

We are in Ordinals’ early days. So early that most native Bitcoin explorers today cannot display the existing inscriptions. Running ordinal-related service requires adding ord – a utility that interacts with Bitcoin Core wallets and provides a lens to distinguish between different sats. Even inscribing (uploading custom data) to Bitcoin’s network requires running a full node.

The key explorers in the wild were Ordinal Hub and Gamma. Most explorers today are product add-ons. In the future, some explorers might convert to marketplaces for digital artifacts. The most money is currently being made in the area of Inscriptions as a service, which allows you to upload data to Bitcoin’s blockchain directly. I tried using Ordinal Hub to estimate the cost of uploading some images, totaling ~$60 for several MB of data.

Most of the time, you cannot directly upload an inscription without a node. So creators often work with miners (pay them off-chain) who include their transactions in a block. Taproot Wizards got the wizard image I showed earlier into a block with Luxor Mining’s help. In February of this year, Luxor mining acquired Ordinal Hub in what is the Ordinal ecosystem’s first acquisition.

Wallets like Xverse and Hiro are making it easier to interact with Ordinals. Of course, much like Lightning (remember that?) in the past, Ordinals-related UX is in its earliest days. As a result, most of the services we see enabling support for Ordinals come from Stacks-related products (We will come back to why I mentioned that in a bit.).

It is so early that trading for NFTs on Ordinals requires the use of what’s called an Emblem vault. Most markets enabling trading for NFTs have relied on the vault model. A ‘vault‘, in this instance, is an ERC-721 token that lives on the Ethereum blockchain. Whenever people trade an inscription on Bitcoin for Ethereum, the ERC-721 token (representing the vault) changes hands.

What does this token give you access to? It contains the private keys to the Bitcoin address that owns the inscription. A buyer of the said vault can claim the inscription and move it to their wallet. It is an interesting workaround for the lack of infrastructure on Ordinals today. But what impact does all of this have on Bitcoin?

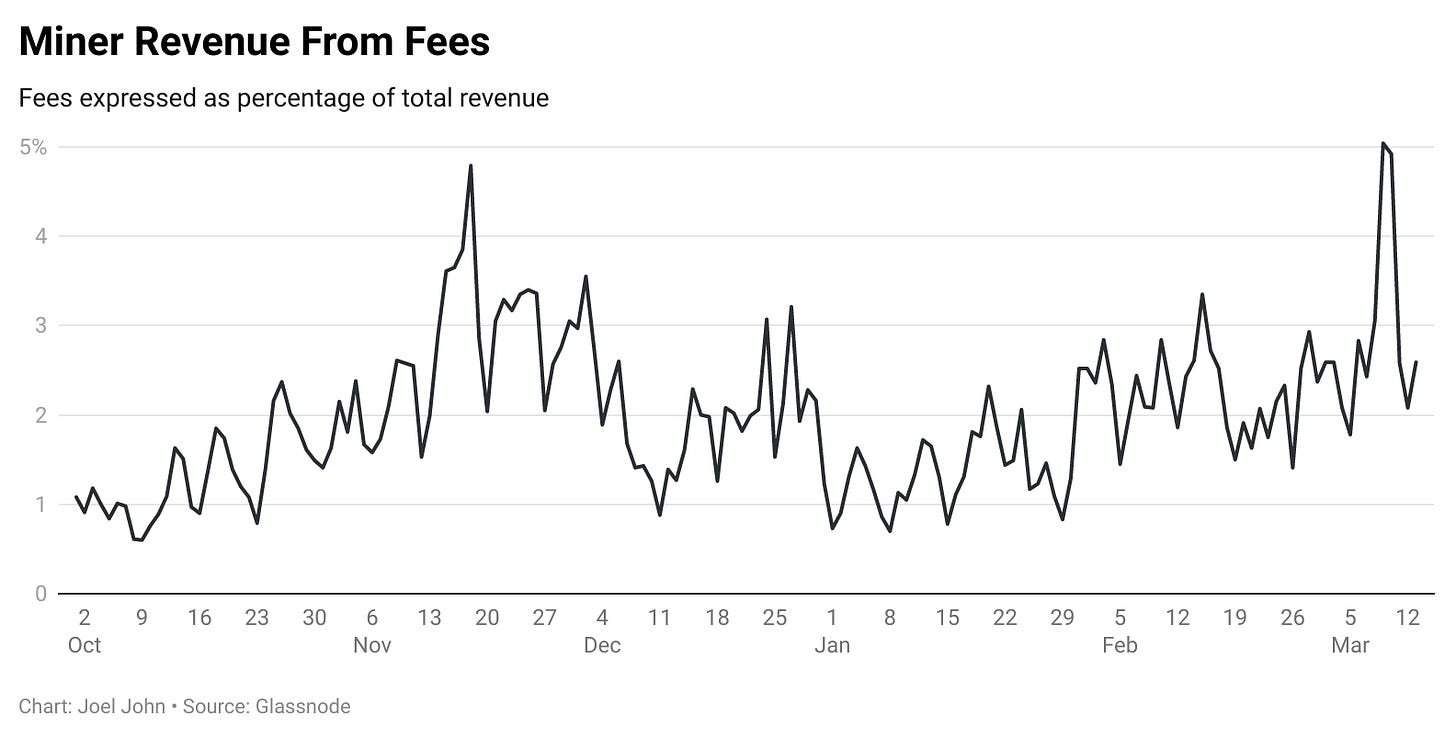

To understand the economic impact of Ordinals, it’s best to start by discussing how fee markets on Bitcoin work today. Miners on the Bitcoin network receive fees from two sources. The first fee comes from block rewards. These are the 6.25 bitcoins that are rewarded per block (every ten minutes or so). The second fee comes from users paying to prioritise their transactions on the network. Historically, the second portion has been a small component of the total revenue miners see. Ordinals change that equation, though.

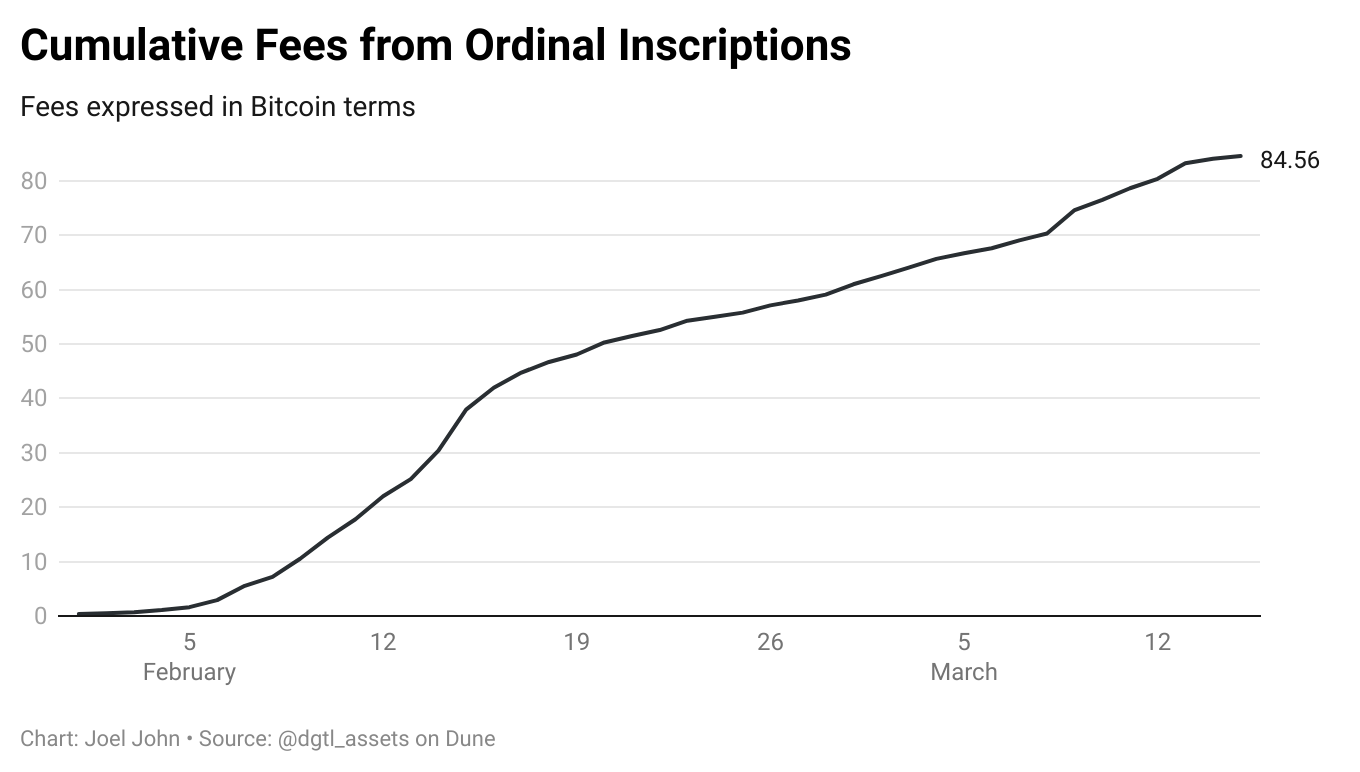

The data above represents the 7-day moving average for the percentage of revenue miners see from transaction fees alone. You can notice a clear uptrend around September when Ordinals came to market. Now, we don’t attribute all of that to Ordinals. According to data from Dune, some $2 million in fees have been paid for Ordinals-related transactions. Since December 14, 2022, some 80,100 bitcoins have been given as block rewards.

In contrast, only about ~84 bitcoins have been paid as fees. So, we are looking at a 0.1% bump in miner revenue based on where things stand today. On days of peak activity, Ordinals-related fees can represent up to 1% of miner revenues. This percentage may seem like nothing, but consider that we are talking about the world’s most decentralised asset with the highest market cap in the industry.

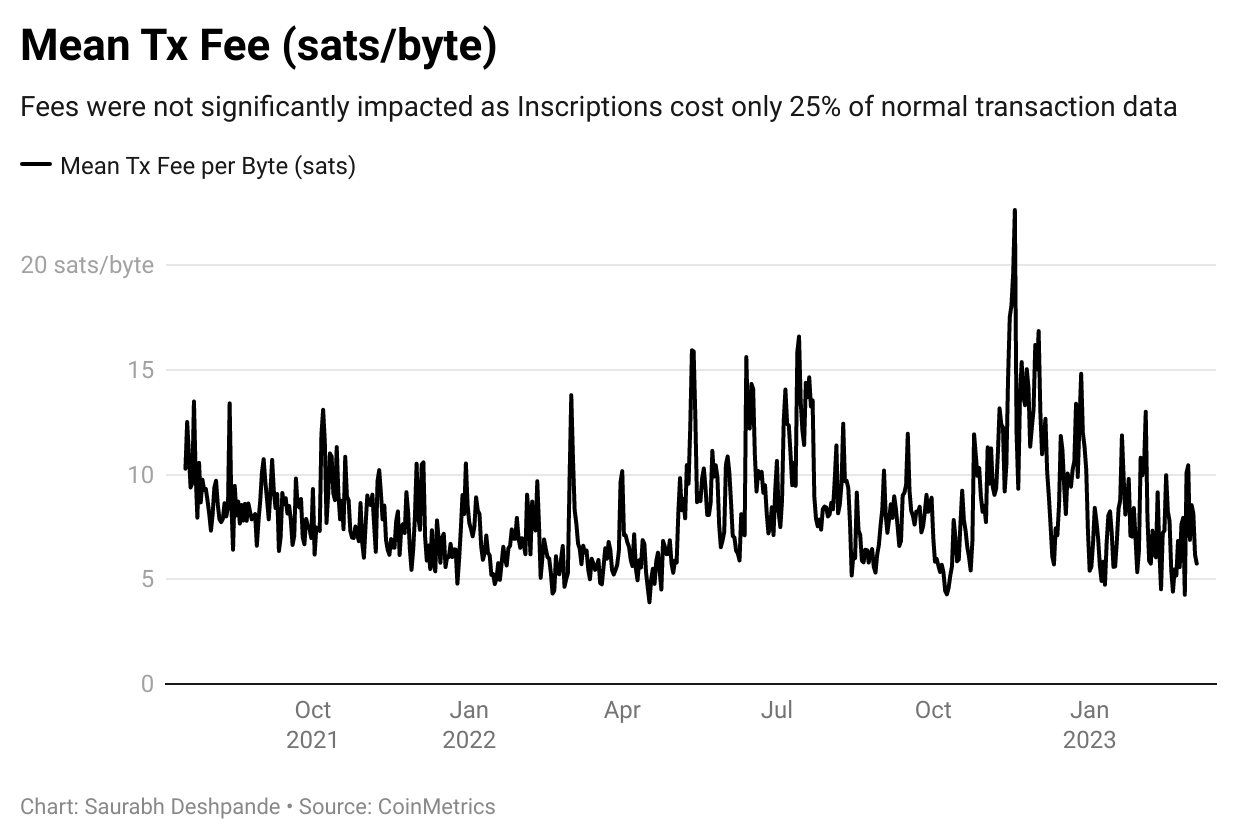

These are exceptionally early days, and we are onto something here as long as the evolution is sustainable. One way to see if things are sustainable is by looking at the sats per byte and the size of each block. Remember, each block can have only 4MB of data in it. If people were spamming on the network, we would have seen a substantial uptick in the sat per byte paid. And block sizes would have also increased considerably. But here is what the data shows.

Now all of this is not without a trade-off. The Bitcoin community does not like change historically. Much of the value proposition around Bitcoin is that it serves the purpose of being decentralised money. It becomes easy to see why that matters when considering everything that happened with banks over the past week.

But let’s consider the arguments against the whole movement.

If each sat can be treated differently depending on how unique or rare it is, the pricing of the commodity (the bitcoin) can become problematic. Remember I mentioned that a Bitcoin with direct traces to Satoshi might cost more?

Casey Rodarmor ran a bounty for the oldest sat he could find, and someone came up with a sat that was mined within two weeks of the genesis block. It is important to note that every BTC can be broken down to 100 million sats. So, even if we have a billion inscriptions, each linked to a different sat, we are looking at roughly 0.00004761904% of BTC.

For a sense of scale, Ethereum has only about 12 million NFTs. Given that there is a cost associated with the process of making an inscription, we do not see it being possible that the fungibility of Bitcoin itself can come into question.

Adding images to Bitcoin’s network means nodes have more data to maintain. One way around it is to prune out the witness data, where the inscriptions are stored. The flip side is that miners are now suddenly making more in fees. We anticipate a market where miners make increasing sums of money for handling niche clients.

Yuga Labs and Taproot Wizards engaged Luxor Mining to mint their inscriptions. Much like MEV today, it is possible that miners compete to release inscriptions based on fee compensations. If Bitcoin stands for censorship resistance, it would be antithetical to block miners from engaging in such a fee market.

Sorry, but you cannot have a censored, censorship-resistant chain. It’s a free market. Miners will mine if they are paid. Right?

One could argue that filling Bitcoin with meme jpegs may make it costlier for the average person. But if the data points to anything, fees have not surged substantially. Even if Bitcoin’s fees go up, we believe this would only fuel demand for solutions like Lightning Network.

Much like we have seen with Ethereum, scalability solutions are not desirable when base-chain fees are low. Only when the base chain sees an uptick in demand are users driven to cost-efficient tools like Lightning Network.

We don’t mean to imply Ordinals are the holy grail for Bitcoin adoption. Things may break. It is only a matter of time before someone uploads highly confidential data to the network, and we realise there is no way to take it down.

Ordinals can be used for leaking proprietary IP, but so can traditionally available on-chain NFTs. Bitcoin is often used for ransomware. The bad actors will sooner or later do things we are unprepared for. But these transactions, much like ransomware and hack-related ones, will make up only a tiny portion of the overall activity on Bitcoin as the ecosystem evolves.

Yuga Labs is the behemoth behind many of the largest NFT collections on Ethereum. They did not want to miss out on the emergent ecosystem around digital artefacts on Bitcoin. So on March 7th, they issued a collection of 300 inscriptions. The auction they ran raised some $16.5 million from 288 wallets. However, the way the auction was run raised a lot of eyebrows. Users were expected to send their bids in Bitcoin directly to Yuga Labs. Winners would receive JPEGs while the others would receive refunds.

It is safe to say that Yuga Labs has no reason to run away with $16.5 million since their reputation is worth much more. And the fact that they bothered with a new digital asset (like artefacts) confirms how the ordinals movement is gaining steam. But the challenge is that such auctions also increase the possibility of scams. Future inscription auctions might be run by individuals who steal Bitcoin from community members and disappear. One fix for the situation is through what is emerging on Stacks.

Stacks is not a Bitcoin Layer 2 and has little to do with Ordinals. For any layer to be called an L2, the base layer should be able to override disputes arising on L2. Since Bitcoin does not understand Stacks, it relies on the honest majority of Stacks’ assumptions.

However, Stacks uses Bitcoin cleverly compared to other general-purpose layers based on Bitcoin. State changes on Stacks (everything happening on Stacks) between two Bitcoin blocks are stored in the next block. This scenario makes it difficult to change Stacks’ history. But if the Stacks’ consensus itself is flawed, and an incorrect/invalid state gets stored on Bitcoin, there’s nothing a user can do to challenge Stacks’ submission.

It is to be noted that much of the wallets and user-education around Ordinals today does happen through the Stacks ecosystem.

Ordinals intrigue us because it does not require any change to Bitcoin as things stand today. It is an exciting approach to self-sovereign, on-chain assets secured by Bitcoin as a base chain. We think the use cases Ordinals will have will be distinctly different from what we have seen on other chains. One way to think of it is that as the cost of making inscriptions rise, only high-priced digital artefacts would be desired by users. There’s a precedent for this.

When the fees on Bitcoin rose substantially, users began switching to Ethereum. When gas prices soared, newer chains like Polygon and Tron saw an influx of users. Cost drives user behaviour and use-case. So it is improbable that we see retail-oriented applications like gaming assets emerging on Ordinals.

On the flip side, we found an entire game (flappy birds) inscribed on the chain. You can see it here. (Send me screenshots of your high score. I may have something in store for whoever scores the highest). This means we may see small applications released as inscriptions in the future.

What is clear for now is that Ordinals are bringing elements of Web3 to Bitcoin. Decentralisation matters, but so does being able to “use” things and have fun. A user explained what may happen while we were researching for this piece.

Bitcoiners will get into NFTs and Web3. Eventually, many Bitcoiners will realize that “decentralization maximalism” is not substantial and they will start focussing on “what’s the most decentralized solution I can get into the hands of a significant amount of people?”- Web3_Lord

At the moment, Ordinals and Inscriptions are too small to impact the Bitcoin economy. But they have undoubtedly opened an Overton window as far as Bitcoin development is concerned. They have already attracted developers and users, the two largest customer groups of blockchains, to Bitcoin.

Whether this is just a flash in the pan or if Ordinals will make Bitcoin fun again remains to be seen.

Peace,

Joel John

P.S. – We may be dropping notes on the Substack for subscribers only. These won’t be going out as e-mails to save your inbox. You may want to visit the Substack occasionally between publications.