Bankless premium members get full access to the August edition of Bankless Token Ratings. This month, we’re rating OP, RPL, SNX, GMX, AAVE and LDO. 👀

You can also ccess the Inner Circle Discord, claim your community badge, and enjoy exclusive Token reports and airdrop guides when you subscribe!

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the second week of August.

The recent sanction of Tornado Cash from the U.S. treasury has had a windfall of effects on crypto.

A developer was arrested and a string of “decentralized” applications have banned wallets that have touched Tornado Cash.

People are afraid of OFAC. These guys are nothing to mess with. If you don’t comply with their demands, there’s a really good chance you go to jail.

This collective fear and action from OFAC are sparking debate among the community.

On one hand, protocol teams are worried. For most, prison time is not an option to consider (understandably). Companies will comply if threatened with jail time.

At the very least, if these companies are working in the best interest of crypto, they’ll fight it in the legal system. But that will take years and millions (and millions and millions) of dollars.

On the other hand, crypto is about open, unstoppable access to money and finance. The idea that “DeFi” apps are banning access because certain wallets directly (or indirectly) used a sanctioned code goes against the ethos and mission of crypto.

Satoshi would be pissed. This isn’t what we’re here for.

Regardless, this looming threat becomes a serious issue when looking at Ethereum’s validator set.

A handful of companies are responsible for operating a majority of the validators on Ethereum.

What happens if OFAC starts demanding these companies to censor specific transactions via their validators (or go to jail)?

Will they bend the knee?

Will they shut down their staking services?

Will validators accept it and get slashed by the network, losing user deposits?

This is a big unknown right now, but any of these outcomes are possible.

Before you say “Ethereum would never support censorship”, there are a lot of nuances behind this, primarily with Flashbots and block building, that go above my head.

Regardless, this was a major discussion on the Ethereum Core Devs meeting this week, and there’s a lot to unpack here. I recommend listening to the discussion and reading Tim Beiko’s thread on the topic to get the full rundown.

Starts at 18:11.

Is Ethereum’s censorship resistance under attack?

The honest answer is that it’s not entirely clear right now.

Four weeks from now, Ethereum will be in a post-merge world. Issuance will be reduced by -90% and net inflation will virtually become neutral, if not negative.

This creates a compelling case for ETH as a monetary asset in an increasingly inflationary world.

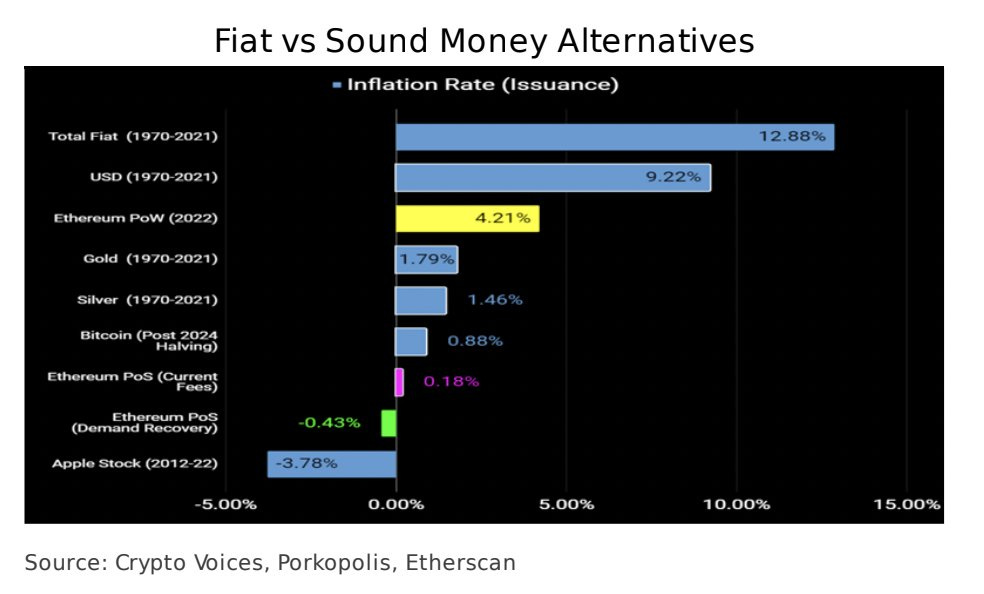

Fiat is currently inflating at 12.8% per year.

Gold sits at 1.79%

After the next Bitcoin halving in 2024, BTC’s inflation rate will be 0.88%.

Post-Ethereum Merge?

ETH issuance falls to 0.18% based on current demand levels where it could potentially go negative if demand recovers to same the levels as a few months ago.

Most people looking at this graph might respond “But Apple is sitting at -3.78%! That’s the better store of value”

True—sort of.

But Apple stock is not a monetary asset. You can’t instantly transfer it to anyone in the world. You can’t buy anything with it. You don’t have global access to lending, borrowing, trading, or earning yield.

Apple stock has no credible neutrality. There’s no decentralization.

It’s not a Medium of Exchange or a Unit of Account.

Issuance is just one part of it.

But when you factor in all of it, ETH becomes a highly favorable monetary asset in the current landscape.

Celsius owes $6.7 billion in crypto tokens and only holds $3.8 billion; Genesis CEO quits amidst job layoffs; Mailchimp cracks down on crypto newsletters; The SEC sues Dragonchain; Canada lays new crypto regulations; The NFT market faces a potential liquidity crisis?

Here’s what we have lined up next week:

-

Demetri comes on the podcast for his second appearance.

-

Jordi Alexanders tell us what we need to watch out for Post-Merge.

-

Ben answers if the fee switch is bullish for Uniswap.

Have a great weekend.

– Lucas

🙏 Sponsor: Circle—Use code Bankless for $100 off Converge22 tickets 👀

🎙️ Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed

-

📘 The Tornado Cash Chilling Effect

-

📘 The Essential Guide to GMX

-

📘 The Best Report on the Merge

-

📘 What’s the Best Token Model?

-

💬 Is the merge priced in?

Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you.

🗞️ Latest Weekly Rollup! Download the week in crypto to your brain in one show.

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

✨See all listings on the Bankless Job Board✨

Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

Join us for Circle’s Converge22, a gathering for change makers looking to build what’s next in Web3. Converge22 is an unprecedented opportunity to dive deep, learn, collaborate and establish a shared vision of the crypto economy. Featuring wide-ranging demos and developer workshops, plus guest speakers including Aave’s Stani Kulechov, Compound’s Robert Leshner, Jill Gunter of Espresso Systems and more. And don’t miss an unforgettable after-hours at SFMOMA! Register with code Bankless for a discount!

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.