Have you heard about the Bankless Token Bible?

It’s a living document that we update every month with up-to-date analysis on dozens of tokens and protocols.

The whole point is to make it as easy as possible for our Premium members to stay on top of the Bankless takes on what tokens to buy, hold, or sell (for entertainment purposes only).

Not already a Bankless Premium member? Upgrade now to get immediate access.

Dear Bankless nation,

For Christmas this year, all we want is for crypto users around the world join their hands and share the good word of self-custodying their assets. Is that too much to ask for?

Today, we look at how users can get into crypto without ever putting their funds in the custody of a central exchange. Here’s our guide to crypto onramping without a CEX.

– Bankless team

👉 Explore the FuelVM and discover its superior developer experience!

Bankless Writer: William M. Peaster

A centralized crypto exchange, or CEX, custodies your money. If a CEX abuses this custodial relationship, à la FTX, you can lose all of your funds.

But did you know there are fiat-to-crypto “onramps” for topping up your wallet and getting right into non-custodial DeFi without ever having to store funds on a CEX?

Well there are! As such, this Bankless tactic will show you how to simply buy crypto without using a CEX.

-

Goal: How to onramp without a CEX

-

Skill: Beginner

-

Effort: Less than one hour

-

ROI: A new way to top up your crypto wallet!

Central exchanges are popular because these companies provide easy venues for fiat-to-crypto and crypto-to-crypto trading.

Such ease comes at the cost of a custodial relationship, though, where the exchange is ultimately the controller of any funds you store there.

Of course, a CEX should always maintain customer holdings on a 1:1 basis. The nightmare scenario, though, is a situation like the FTX debacle where the CEX’s leadership got wiped out trading with customer funds.

For many of us in crypto, DeFi is the promised land here in contrast. DeFi makes possible decentralized exchanges (DEXes), which are transparent and non-custodial. With these new venues, you can see and control for yourself what happens with your money.

To get into DeFi people have traditionally bought crypto on a CEX and then sent the ensuing funds over to a self-custody wallet they control. Yet this process entails temporarily storing funds on a CEX, like before and after making trades.

Indeed, it’s safe to assume many FTX users who used the CEX as a quick pass-through gateway for crypto got caught up in the exchange’s collapse. When things turned ugly, that gateway went from being relatively quick to permanently closed.

The good news is we now have fiat-to-crypto onramps that don’t custody your funds at any point. Accordingly, these onramps are compelling because they offer people ways to quickly go from cash to crypto, right to their personal wallets, and all without having to give up control of their funds along the way.

To be sure, onramps still have centralized elements, and many require Know Your Customer (KYC) info. Yet if you want to be able to get crypto directly without money layovers on CEXes, onramps are a great resource.

Not long ago, the crypto onramp scene barely existed.

However, now the onramping scene is much more lively. Some of the more recognizable crypto onramps in action today include, though aren’t limited to, the following services:

-

🏛️ Banxa — a financial technology platform that provides fiat-to-crypto onramp services plus offramping services for stablecoins

-

🌕 MoonPay — another financial tech company that provides crypto onramp and offramp services, currently active in +160 countries

-

⛰️ Mt Pelerin — a non-US, no-KYC crypto onramp based out of Switzerland

-

⤴️ Ramp — a crypto onramp and offramp service that specializes in facilitating in-app crypto purchases for web3 projects

-

🦊 ShapeShift — a fiat-to-crypto onramp aggregator that supports buys through Banxa, JunoPay, Mt Pelerin, and OnRamper

-

🔀 Transak — another onramp and offramp service that supports +130 cryptocurrencies across +125 countries

Which of these services would be right for you depends on your needs. They respectively vary in the money limits, payment options, and geographic jurisdictions they support, so some may be better fits depending on your specific situation.

If you’re wanting to use an onramp, you’ll need a crypto wallet at which to receive your purchased funds and then self-custody them. A great option for this is Argent, a smart contract wallet, for a range of reasons:

All that said, two of the onramp services that Argent currently works with include MoonPay and Ramp, with the former facilitating Argent’s Ethereum L1 onramping and the latter facilitating the wallet’s zkSync L2 onramping.

After downloading the Argent app and setting up your wallet, you could make a fiat-to-crypto purchase to your Ethereum address by following these steps:

-

Open your Argent Vault and press the “Receive” button

-

Select your country of residence and then the “Credit/Debit Card” option before inputting your desired purchase details

-

Next sign into MoonPay with an email address or Google account and choose between the “Bank account” and “Bank card” payment options

-

Enter your basic personal details — the starter Lvl. 1 KYC allows up to €150 of purchases per month, higher levels allow for more

-

Lastly enter your bank account or bank card details and complete the buy

That’s all it takes to fund your L1 Argent account! Just keep an eye on MoonPay’s fees so you know exactly how much you’re getting.

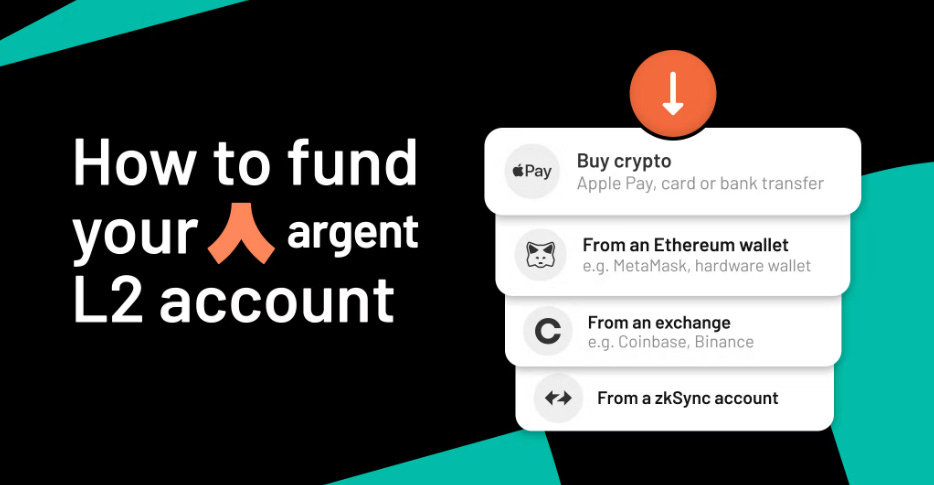

As for onramping to your L2 zkSync account, you would follow similar steps to the ones above albeit through Ramp instead:

-

Open Argent and click over to your zkSync wallet

-

Press the “Buy crypto” button and input your desired purchase details in Ramp

-

Create a Ramp account by supplying an email and accepting Ramp’s terms of service and then confirm your email with the provided verification code

-

Press proceed and pick your desired payment method

-

Enter your payment details and complete the buy

Remember how I mentioned earlier that the crypto onramping scene has expanded considerably in recent times?

Indeed, now some of the biggest payments companies in the world are diving deeper into fiat-to-crypto services. For example, earlier this month financial services powerhouse Stripe unveiled its own embeddable crypto onramp solution.

Even more recently, popular crypto wallet MetaMask announced a partnership that lets users (initially US only) fund their crypto wallets with ETH via digital payments giant PayPal. These sorts of big advances from big players suggest the fiat-to-crypto space has plenty more room to grow from here.

As for major DeFi projects, Uniswap also just notably launched “direct to DeFi” support by enabling crypto buys directly in the Uniswap web app. The support comes via MoonPay, which means traders can now use card purchases or bank transfers to onboard straight to Uniswap without having to go through a CEX first. Out of the gate, the initially supported assets are ETH, DAI, USDC, USDT, WETH, WBTC, and MATIC, with minimum purchase sizes as low as ~$15 USD depending on market conditions and your region.

A great goal? Eventually get every exchange, including CEXes, to become non-custodial.

That reality is far away for the time being, so onramps to self-custody wallets are solid avenues in the meantime to help more people get directly into crypto without ever giving up control of their funds.

Moreover, look for these onramp services to get increasingly advanced and easier to use as crypto’s importance continues to grow over time!

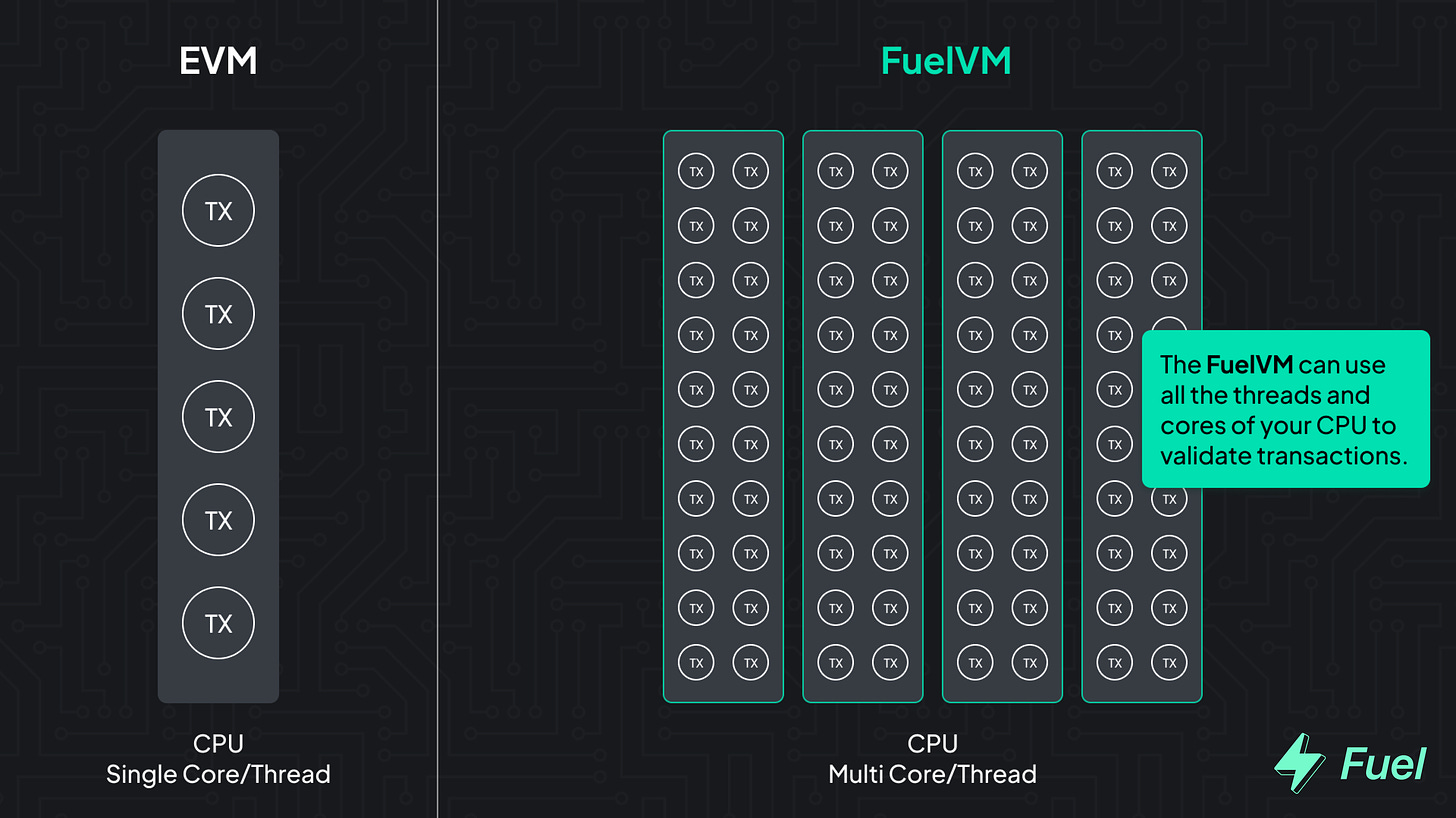

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

👉 Go beyond the limitations of the EVM: explore the FuelVM

William M. Peaster is a professional writer and creator of Metaversal—a new Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.