Detect on-chain threats in real-time in Maker, Lido, Compound, dYdX, and more with Forta.

Dear Bankless Nation,

There’s a new DeFi project in the limelight.

It’s Velodrome – an Optimism-native liquidity protocol that is pushing the frontiers on capital efficiency.

The protocol has recently been blowing up as it’s starting to compete with Uniswap in terms of volume on the network.

Protocol fees are also skyrocketing as of recent.

The project has been described as a combo between leading stable liquidity protocol Curve, Andre Cronje’s infamous Soldily, and Votium (a protocol for earning bribes on Curve/Convex).

All three of these projects have pioneered innovative new mechanisms for liquidity and token economics. Now, Velodrome is tapping into it.

Put this together and there’s a compelling case for the project that’s worth digging into.

And given its recent success, the protocol is offering some very attractive yields for Layer 2 pioneers.

William Peaster teaches you what you need to know about Velodrome and how you can earn some insanely high yields with it.

– Bankless Team

P.S. Check out the new Web3 Fact underneath “Action Steps” to help build your crypto investment thesis! 🔎

🙏 Sponsor: Aave—decentralized, open-sourced, and community governed✨

🎙️ Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed

Bankless Writer: William M. Peaster, Bankless contributor & Metaversal writer

Velodrome is a decentralized exchange and liquidity marketplace on Optimism that’s grown rapidly over the past two months. This Bankless tactic will introduce you to the basics of the protocol and show you how to earn in the project’s Stable Pools.

-

Goal: Learn how to use Velodrome

-

Skill: Intermediate

-

Effort: 1 hour of research and effort

-

ROI: Up to +30% APR at current Stable Pool rates

Velodrome is a DEX and liquidity marketplace on the Optimism layer two (L2) scaling solution.

DeFi outlet Stakingbits has previously noted how Velodrome is like a mix of “Curve, Solidly, and Votium with ve(3,3) tokenomics,” and that’s the perfect framing to understand the project.

-

Curve because Velodrome is similarly designed to offer low fee, low slippage trades and similarly uses a CRV-like vote-escrowed gauge system for facilitating its token emissions.

-

Solidly because Velodrome has adopted Solidly’s innovative use of gauge voting to incentivize trading fees (as opposed to how Curve’s CRV emissions incentivize passive liquidity) and Solidly’s “vote-escrowed NFT,” or veNFT, model.

-

Votium because Velodrome has an in-built bribe system where people or projects can deposit tokens to incentivize gauge votes for their liquidity pools of choice.

Taken altogether, Velodrome is akin to a “Solidly 2.0” on Optimism, a public goods-focused L2 that directly inherits Ethereum’s security guarantees, rather than on Fantom, the EVM-compatible alt-L1 that was the home of the original Solidly project.

In January 2022, DeFi pioneer Andre Cronje introduced the ve(3,3) token model. He then accelerated the development of Solidly, an automated market maker (AMM) protocol on Fantom that would be the first to implement this ve(3,3) approach.

However, after launching in February 2022 Solidly immediately ran into various issues, and then a decisive death spiral ensued after Cronje departed from DeFi altogether in March 2022. The project now has less than $5M worth of total value locked (TVL), making it the 29th-largest protocol on Fantom at the time of this post’s writing according to DeFi Llama.

When the dream of Solidly was still alive, a group called veDAO formed. Incubated by decentralized venture studio Information Token (IT), veDAO blitzed onto the scene in an effort to become influential Solidly contributors.

So when Solidly started to disintegrate, elements of veDAO and IT banded together to build out a Solidly 2.0 on Optimism. This effort led to the Velodrome protocol we have today.

Launched on June 1st, 2022, Velodrome has gone on to amass a +$123M TVL in less than two months and become one of Optimism’s most popular dapps in that span.

At the heart of Velodrome is the protocol’s ERC20 utility token, VELO, and its ERC721 governance token, veVELO — a.k.a. a veNFT.

VELO, like CRV, is emitted on a rolling basis and is used to reward Velodrome’s liquidity providers. Holders can vote-escrow, i.e. lock up, their VELO to receive veVELO and participate in the project’s governance, which entails voting for which liquidity pools should receive VELO rewards.

Like CRV, you’re able to lock your VELO for up to four years, and the longer you lock for, the more voting power you receive.

So let’s break it all down one more time:

-

Velodrome liquidity providers earn VELO emissions

-

veVELO holders vote on which liquidity pools receive these VELO rewards, and pools earn in proportion to the voting power they accrue per epoch, i.e. each week

-

veVELO holders then earn from the trading fees generated by the pools they voted for in proportion to their voting power

-

Finally, veVELO holders also earn from the bribes paid out to the pools they voted for, as well as from veVELO rebases which are non-dilutive, meaning veVELO holders receive veVELO from them rather than VELO

There are two kinds of pools on Velodrome:

-

“Variable Pools” for uncorrelated assets, like its VELO/ETH pair.

-

“Stable Pools” for correlated assets, like its USDC/sUSD stablecoin pair or its WETH/sETH stable asset pair.

I think the Stable Pools are particularly interesting, since 1) they’re currently offering some of the best yields on stables in DeFi right now, 2) they’re on an L2, and 3) it’s possible to enjoy their yields without facing the price volatility and impermanent loss prospects that come with the Variable Pools.

All that said, let’s say you have some stables on Optimism and you’re keen to park them somewhere on-chain and earn some yield.

Here’s how you’d do that in one of Velodrome’s Stable Pools:

-

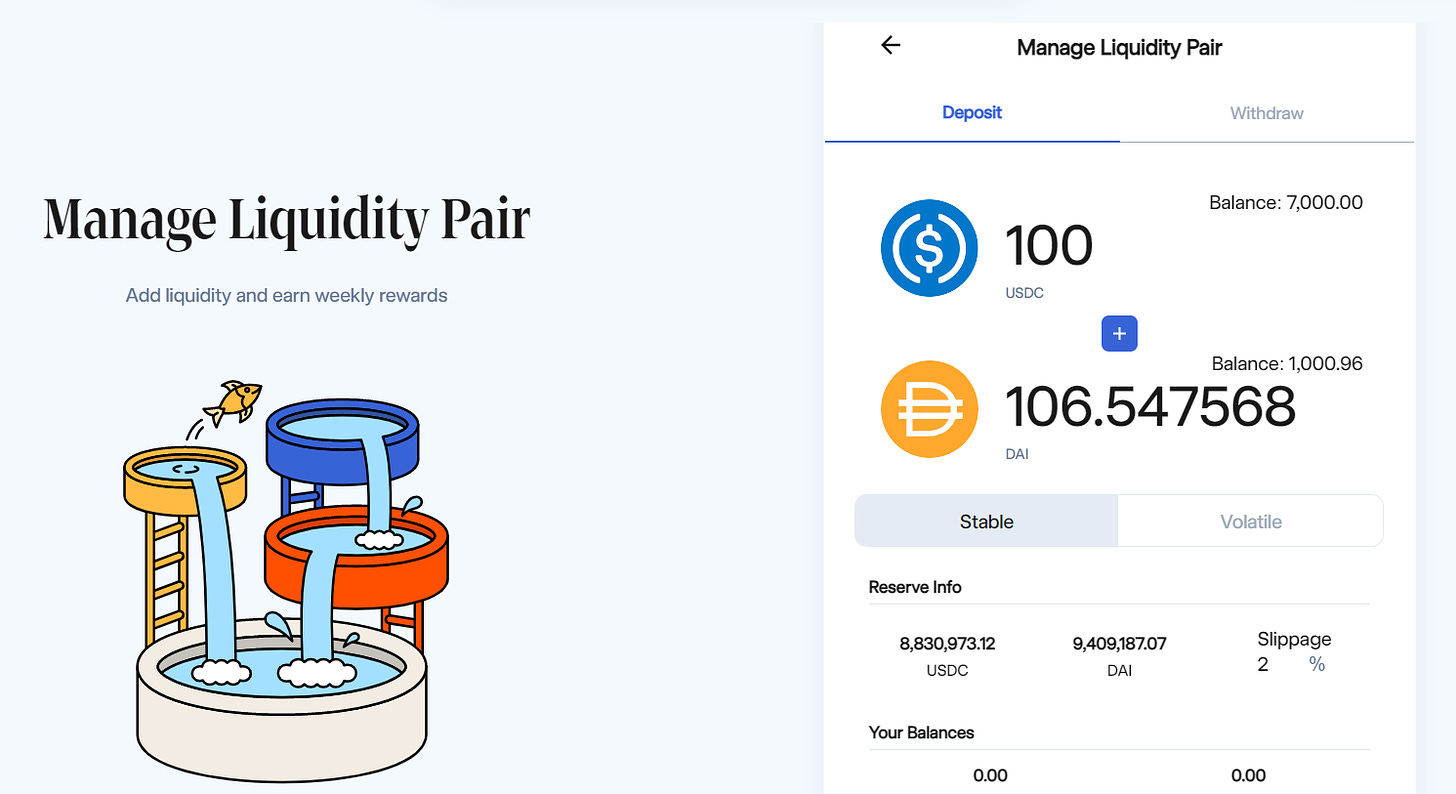

Head to app.velodrome.finance/liquidity and connect your wallet to the Optimism network

-

Scroll down to your desired pool and click the “Manage” button

-

On the ensuing screen, input how much liquidity you want to provide

-

Scroll down and press the “Deposit and Stake” button

-

Use your wallet to allow Velodrome to access your funds, after which your liquidity will be deposited and staked

-

Manage your position (i.e. deposit or withdraw funds) from the Pools page and claim your VELO rewards over time from the Rewards page using your pool’s “Claim” button

Velodrome is a DeFi underdog story that’s coming to fruition on Optimism.

It’s also a testament to the open-source nature of crypto, insofar as where Solidly failed, Velodrome picked up the pieces and has risen like a phoenix from its progenitor’s ashes.

If you’re in the market for decent yields, you’ll want to make sure you’re tracking Velodrome for the foreseeable future.

Why this matters: ETH open interest options just leapfrogged Bitcoin for the first time ever, indicating bullish sentiments around the upcoming Merge as investors go long on ETH calls.

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Aave is the leading decentralized liquidity protocol. The latest deployment, V3, was launched on 6 networks (link) and introduces new features like Isolation Mode, Efficiency Mode and Portals. If you’re building in the ecosystem, apply for a grant from Aave Grants – a community run grants program.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.