Key Insights

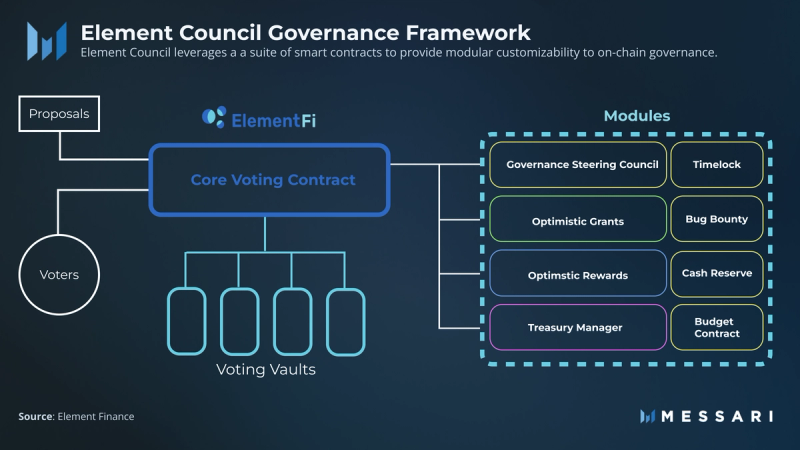

- Element Council’s release represents the next evolution of on-chain governance by building a smart contract-based modular governance framework. These contracts enable builders to use the security of on-chain governance while allowing for unprecedented contract flexibility.

- While a Core Voting Contract functions as a central node, the modules surrounding the contract make the new governance framework adaptable for many different use-cases. These modules use smart contracts to overcome specific shortcomings of DAO operations. The new vaults include voting vaults, the Governance Steering Council (GSC), optimistic grants, and optimistic rewards.

- The Element Council V1 Release Plan promises to highlight further announcements such as early partner announcements, further custom voting vaults, and detailed resources for DAO builders.

Introduction

On-chain governance employs blockchains to encode their governing rules via data storage and execute their operations autonomously. To date, on-chain governance contracts represent the closest realization of the DAO name. However, the current state of on-chain governance is often a monolithic contract with little room for adaptability, customization, or scalability.

Most on-chain contracts require large transaction and audit costs. Monolithic on-chain contracts also create significant friction in conducting routine operations. Each transaction, update, or change to the core protocols requires the consensus of the entire DAO, leading to governance fatigue, slow-moving operations, and overall inefficiencies.

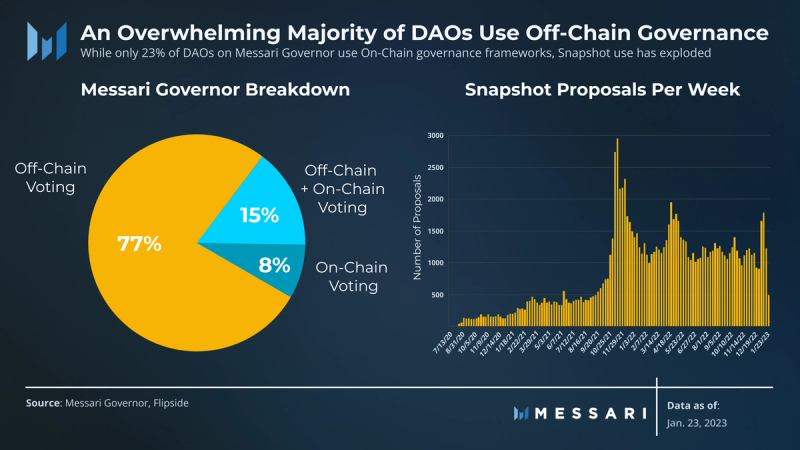

For these reasons, DAO governance has skewed heavily towards hybrid governance, which foregoes on-chain execution in favor of off-chain signaling tools such as Snapshot. These DAOs verify the chain’s status to endow voting power. Once consensus is achieved, they often depend upon trusted community members to manually execute those decisions using multisigs, introducing a single point of failure for operations and a potential security risk.

On-chain contracts such as Governor Bravo and OpenZeppelin allow projects to customize specific parameters. These parameters include deciding how voting power is determined, setting up a quorum, the number of available voting options, how votes are counted, what type of token is used to vote, and the inclusion and parameters of an execution timelock. Despite the customizability, these systems require each governance decision to be approved through the same contract with the same parameters, limiting the feasibility of on-chain governance for many typical DAO operations.

Introducing Element Finance’s Council Governance Framework

While many projects have settled for the existing array of on-chain contracts or a hybrid (off-chain) model, Element Finance has opted for a more innovative approach. With the introduction of the Council Protocol, the Element team hopes build a universal on-chain governance solution that meets the practical needs of both day-to-day and long-term governance.

The framework introduces a set of foundational contracts with designed modularity. In doing so, the team aims to balance the accessibility and functionality of a well-designed smart contract system. Modular governance frameworks allow for customization, enabling Element Finance to add and remove modules according to the protocol’s evolution.

The Core Voting Contract

Central to the Council Protocol is the Core Voting Contract. Like OpenZepplin and Compound Governor, the Core Voting Contract defines voting power, tracks proposals, and measures voting power before the execution of any proposal. However, the Core Voting Contract expands on those principles by allowing detailed granularity and modularity to contract parameters:

- Dynamic Voting Strategies: When a user votes, the Core Voting Contract will reference a pre-approved list of voting strategies. These strategies define the calculation of voting power and validate a user’s voting power for that particular strategy, enabling multiple methods to exist simultaneously.

- Dynamic Quorum: The Core Voting Contract allows for a dynamic quorum threshold which checks the threshold needed for a contract call to be executed. This means that governance can vary the security threshold on any on-chain action with very high granularity, giving a broad spectrum of possible access control.

- Optional Timelock: With the optional timelock feature, the Core Voting Contract utilizes a timelock only for security-critical votes, allowing increased efficiency for more minor proposals and measured protections for sensitive proposals.

The Modules

While the core contract functions as a central node, the modules surrounding the Core Voting Contract make the new governance framework adaptable for different use-cases. These modules are designed to solve specific shortcomings of current DAO operations by leveraging smart contracts.

There are four specific modules, each with their associated use case:

- Voting vaults

- Governance steering council (GSC)

- Optimistic grants

- Optimistic rewards

Voting Vaults

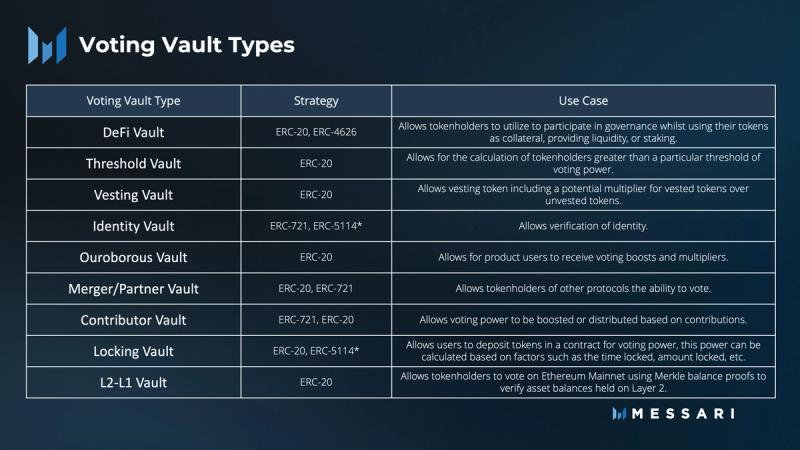

Unlike Snapshot and off-chain strategies, most on-chain governance contracts are limited by the number of methods they can accept for voting power. Most DAOs default to token-weighted governance, which has well-documented downsides, including cartelization and self-serving whales.

Voting vaults address this limitation by allowing protocols to define accepted strategies. Protocols can then integrate multiple voting vaults across multiple use cases, as the vaults are both upgradeable and removable via the core voting contract. Voting vaults allow governance to scale with a DAO and its protocol; as new token primitives and voting strategies are created, new vaults can arise to meet those use cases. This customization unlocks the potential for entirely new methodologies, strategies, and power structures for on-chain governance.

In their simplest form, voting vaults can serve as locking or vesting vaults, which give governance power to locked or vested tokens. There are also more complicated vaults. DeFi vaults, for example, enable tokens held in specific protocols or contracts (such as a lending protocol or LP) to vote, and L2-L1 synthesis vaults can verify L2 voting power on L1 Merkle balance proofs.

DAOs can also use vaults to enable tokenized identity-based membership for council-like positions. These positions can function with special authority delegated by the ultimate authority of the Core Voting Contract of the DAO. This is an obvious fit for Optimism Citizens’ House or the Aave Grants DAO. Further, it opens the door for more experimental identity-based voting schemes, as proposed in the original Sushi Meiji proposal or as discussed in Pocket DAO.

For Element Finance, voting vaults allow the protocol to add utility to existing projects and products that precede the Element Council. For example, Element could integrate it’s upgradeable Elfiverse NFT project, allowing NFT holders to boost their governance power by holding tokens from the official Element Finance PFP collection.

Governance Steering Council (GSC)

As DAO governance has evolved, there has been a common trend of returning to some form of representative authority to combat the inefficiencies of plutocratic governance. These representative forms are usually considered councils and are often elected by DAOs. They typically exercise privileged authority over a particular set of contracts, actions, or funds. The Synthetix Council (elected) and the Olympus Policy Team are two examples.

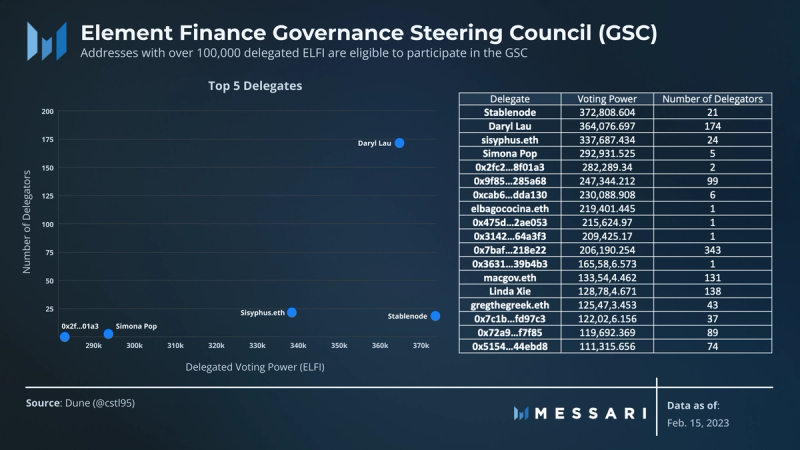

The GSC module introduces Element’s take on corporate governance’s board of directors. Via composability with voting vaults and the Core Voting Contract, DAOs can choose the exact parameters for denoting GSC member status and define the GSC’s inherent permissions. For Element, GSC status can be achieved by any delegate that meets the delegation threshold of 110,000 ELFI via the custom GSC Voting Vault. Rather than being elected or appointed to serve terms, the delegation threshold enables liquid delegation. If an ELFI tokenholder is unhappy with a delegate’s actions, they can redelegate their tokens at any point to another delegate, thereby creating a continuous accountability feedback loop.

Given Element Council’s modularity, the permissions of the GSC are customizable. Some examples of future use cases include the ability to directly propose votes on-chain, specific permissions to conduct treasury management or fund disbursements, and the ability to run bug bounties, grants programs, or emergency powers to protect the protocol.

Optimistic Grants

From the Ethereum Foundation to Gitcoin, grants are an inherent characteristic of crypto culture. DAOs utilize grants to attract builders to their ecosystems, funding them with treasury-held tokens to improve their products and communities.

Many grant programs suffer from bad design. Programs that lack accountability for grantees and diligence in grant reviews are often guilty of superfluous funding, inefficiency, and even nepotism. Others simply suffer from operational overhead, as grant programs must be funded to manage accountability, track dates and funding, and coordinate multisig payments — all while checking grantee accountability and progress.

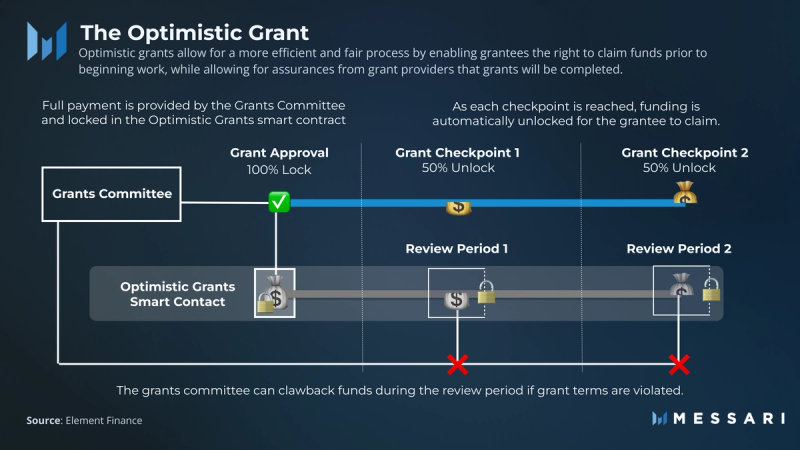

Optimistic Grants tackle these shortcomings by providing a more open grants process with less operational overhead. It works by codifying escrow structures and aligning grantee incentives. As a result, grants committees can approve funds up-front, apply “set-and-forget” operations, and still maintain the authority to claw back funds in the event of grantee abuse.

Optimistic Grants function on the assumption that a grantee will deliver an agreed-upon result. Once approved, awarded funds can be locked in the Optimistic Grants smart contract with an expiration date. This on-chain commitment will then distribute the funds upon completion of the grant, after which the grantee can withdraw the funds. However, these grants include a clawback that allows the DAO to take measures at any point of the process if the grantee does not deliver on the agreed-upon deliverables.

Optimistic Rewards

In addition to grants, the same optimistic approach to funding can be applied to rewards. By implementing an “approval by default” mindset, actors with permissioned power (councils, subDAOs, etc.) can facilitate greater operational efficiency while still being held accountable. This concept is not unlike the Easy Track module adopted by Lido DAO using Aragon Governance.

The optimistic rewards contract focuses on the rewards use case to make the contracts process more secure and upgradeable. Traditionally, most rewards systems are deployed via smart contracts. These systems required DAOs to update complex mathematical formulas and contract integrations whenever they wished to update their rewards formula. To limit the inherent smart contract and security risk, optimistic rewards instead allow a proposer to run a deterministic program that calculates rewards off-chain and then submits rewards on-chain for review. The result is a more accountable rewards program capable of leveraging smart contract governance to improve decentralization and efficiency.

Beyond the Contracts

Finally, Element Finance has gone beyond smart contracts as the core focus of Council in order to position Council as an all-in-one governance framework. Council provides the community with smart contract deployment templates, which ease configuration and the full suite of UI interfaces. As such, developers can leverage the Reference UI using React, TypeScript, NextJS, and SDK to adopt Council contracts for their DAO.

Conclusion and Looking Ahead

Element Council provides an optimistic outlook and an important evolution for on-chain governance. Since the execution and rollout of its smart contracts (developed and audited in 2021) and the first implementation of the Council Protocol (launched with Element DAO in March 2022), the Council has been improved and packaged as an all-encompassing DAO framework. The official Council V1 Release Plan will occur in waves:

Wave 0

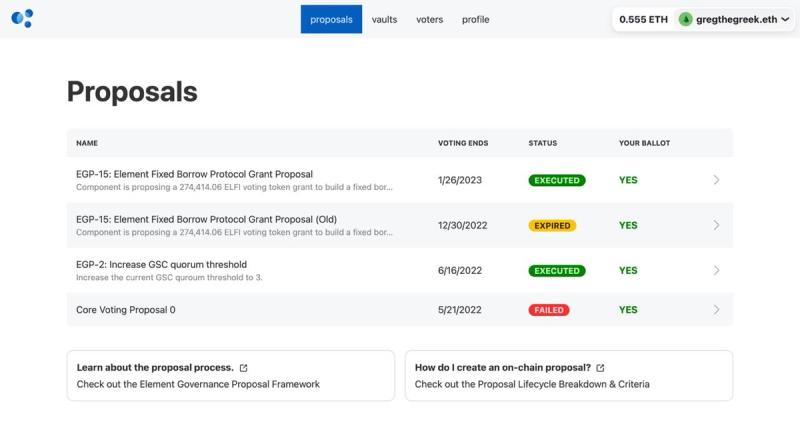

Using the Council framework’s reference UI, the governance UI for Element DAO governance was completely overhauled, as covered in Element’s recent announcement. It complements the legacy gov UI, which will be decommissioned at the end of Q1. The new UI is available here.

Source: Element Council website.

Wave 1

Wave 1 encompasses the first release of early adopter projects that will announce their intention to integrate Council as they become more decentralized. In addition to contemplating initial governance architecture (i.e., modules and parameters used at the outset), some are building custom voting vaults on top of the Council Protocol. This wave is continuous as early partners will make announcements on a rolling basis and individual announcements will be contingent on each project’s own governance timelines.

Wave 2

A full public release entails open-sourcing the Council Kit repo, a dedicated educational landing page with links to all documentation, tutorials, deployment template, and a contributor guide. The Element team will continue its product discovery by engaging users and contributors in the community to shape the product roadmap with new features and improvements that ensure future Council releases meet the evolving needs of DAOs, their stewards, and governance practitioners more broadly.