Hey,

TL: DR – Today I explain how DeFi Saver scaled as a thin layer venture. Read for context on how the DeFi ecosystem has evolved in the past three years and what “thin-layer” ventures are. Excuse the jargon.

I hope you are doing well through the carnage in the public markets. It gets worse. Then it gets way better. Such is life. When I wrote about aggregators in the context of DeFi – I was wondering if there are businesses that can scale to do billions in transactions with no tokens. Can a venture be built without token rewards for building them?

One of the things smart contracts enable is scale. For example, Instagram and Whatsapp scaled to service millions of users in their early days, focusing on content and messaging. At their times of acquisition, Instagram had 13 employees and Whatsapp 55. Smart contracts enable financial primitives to scale how servers allow the content and distribution to scale. Gem.xyz and Uniswap are good examples of this. These businesses increase revenue, fees and users without directly impacting the number of employees required. They tend to be in losses in their early stages while finding product-market fit, but as volume scales, they tend to be highly profitable ventures.

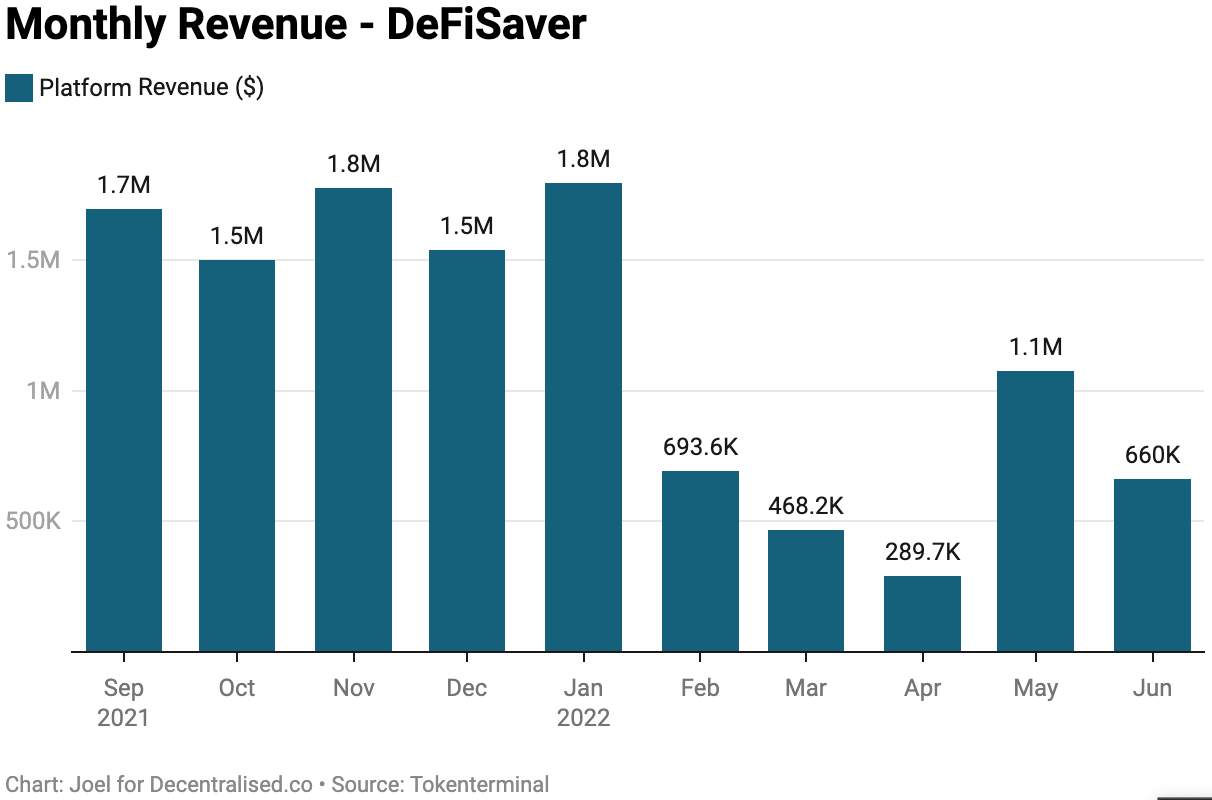

Recently, I stumbled across a business that did some ~5.6 billion in volume with a team of less than 10. I found it pretty intriguing because they fit what I have considered “thin layers”. Typically these are businesses that don’t have custody of the asset or make a direct sale for a single value proposition such as lending or trading. Instead – they are interfaces that can plug into different businesses, thanks to composability. Wallets are the simplest example of a ‘thin layer” venture. The team was kind enough to spend a while discussing what they do and share their data with me. This piece is what came from a conversation with them.

The Liquidation That Started It

DeFi Saver is a wallet automation platform that allows users to leave their desks without worrying about how their on-chain positions are doing. What does that mean? When you take loans on platforms like MakerDAO, Aave or Compound, a certain amount of Ethereum (or other assets) is tied up. These are used as collateral for the loan, much like gold is used in traditional markets. If the value of the tied-up assets goes lower, the user could get liquidated. Tools – like the ones offered by DeFi Saver allow users to automate how these positions (referred to as collateralized debt positions) are managed on-chain.

Like many good stories in crypto, getting liquidated is where DeFi Saver’s story starts. The team was in Thailand on a hike in late 2018. One of the founders had a collateralized debt position trending towards liquidation while they were deep in the jungles surrounding Chiang Mai. During bear markets, users routinely take debt positions to avoid selling their crypto at low prices. The rationale is that the collateral would be worth a lot more in a few months, and the user could pay off the dollar-denominated debt over time.

The challenge is when the underlying trends are lower in price. Then, you lose most of the collateral you gave for the loan as the protocol liquidates it. One way to avoid losing all your collateral is to pay back parts of the debt. This is what we saw recently with Celsius paying back their debt worth some $700 million at this CDP recently. Once the team was back in Serbia, they set out to build a tool that helps with automatically managing debt positions on MakerDAO. They started bringing together an initial group of users through marketing themselves on Reddit.

Back in 2019, the hype around DeFi was at a low. Most of the early users were developers themselves or finance enthusiasts. So the queries from existing users were low. This allowed the team to focus on the product while staying small and nimble. Add to this the fact that very few DeFi-position management products existed back then. So the users that came were extremely sticky. The product started generating revenue when a 0.3% fee was added to positions managed through DeFi Saver. Up until that point, most of the transactions were for MakerDAO CDPs. DeFi was a distant thing, but it was all about to change.

March 2020 and DeFi Summer

The first significant stress test for the venture came on March 12, 2020. It was the day Bitcoin plummeted to almost $3500 and Ethereum to $80. Oracles were failing, and many people transacting on the network meant congestion. In addition, it was difficult for the product to liquidate assets as their collateral ratios went lower.

During periods of high volatility, DeFi platforms have the equivalent of a bank run in traditional finance. Smart contracts can ensure a debt position is fully collateralised. But they cannot guarantee a CDP is liquidated at the exact right time as networks limit how many transactions can occur in a minute. For example, MakerDAO lost around 5.4 million on March 12, 2020, thanks to faulty oracles and bots struggling to liquidate the bad debt on time.

But it was also a turning point for DeFi Saver and the broader DeFi ecosystem. Crypto had trended towards a new low in market capitalisation as an asset. Low prices meant more people were willing to take loans -either to trade or out of desperation. There was one more category of users. Core believers of Ethereum – that wanted a way to go leveraged long on it. Most people using DeFi Saver made money on the debt they opened as the price was at its lowest.

Assuming you opened a $50 debt position on MakerDAO when ETH was at $100. As the price of ETH returned to $300, you only had to give back $50 to reclaim an asset that is now worth $300. A different way DeFi-proponents used DeFi Saver at the time was to short assets that seemed overpriced through Aave or Compound. An individual could borrow an asset, sell it in the market and then repurchase it to repay the debt when the price is much lower. Users were making money, and DeFi summer was about to kick off. In the months following, unique wallets interacting with DeFi ventures on Ethereum alone jumped four times.

In June 2020, Compound launched a token. It rewarded users for borrowing and lending on the platform. DeFi went from being a niche in the corner of the market to a sector with hedge funds and billionaires moving large sums of money routinely in. Suddenly you needed interfaces that gave you accurate information on your position and a record of your interactions with it. DeFi Saver was just in the right spot at the time to capture the inbound users. The challenge? Gas prices were surging, and they would soon exclude most retail users.

The chart above from Etherscan is a good colour for the situation. Average gas prices were around 9 Gwei for most of early 2020. On March 12, 2020 – it surged to 77. When Compound launched its token, it would cost up to 700 Gwei on Ethereum to do a transaction. The following months saw gas prices stay constant around the 100 gwei mark. What did this mean? DeFi just went out of budget for most retail markets as transaction costs were often higher than the profits users would make.

The team decided to double down on power users because it is how they got their start. Throughout DeFi summer, they resisted the urge to list new farms, even while their peers steadily captured market share. This was the golden age of forks, ponzinomics and massive liquidity moving towards DeFi, but the team had to consciously avoid adding new farms in the best interest of users. This is where an aggregation business needs to be very careful. When industries move fast – it becomes hard to vet the kind of people building new products. If a poorly designed product is integrated and your users lose money, it becomes costly to regain their trust. Slow is sometimes better. That is how the team escaped the massive crash UST had last month.

The kind of users that came to DeFi saver were typically whales that handled position sizes north of $50,000. The product remained free for ±90% of the users, but those using more sophisticated strategies had to pay a small fee to keep the venture’s lights on. There were no performance fees either. The whole thing had no venture funding while scaling. It was just one small team of fewer than ten people until 2021, handling some ±400 million in monthly volume. Even today, the venture has only about 15 people working on it.

Layer 2 and The Future

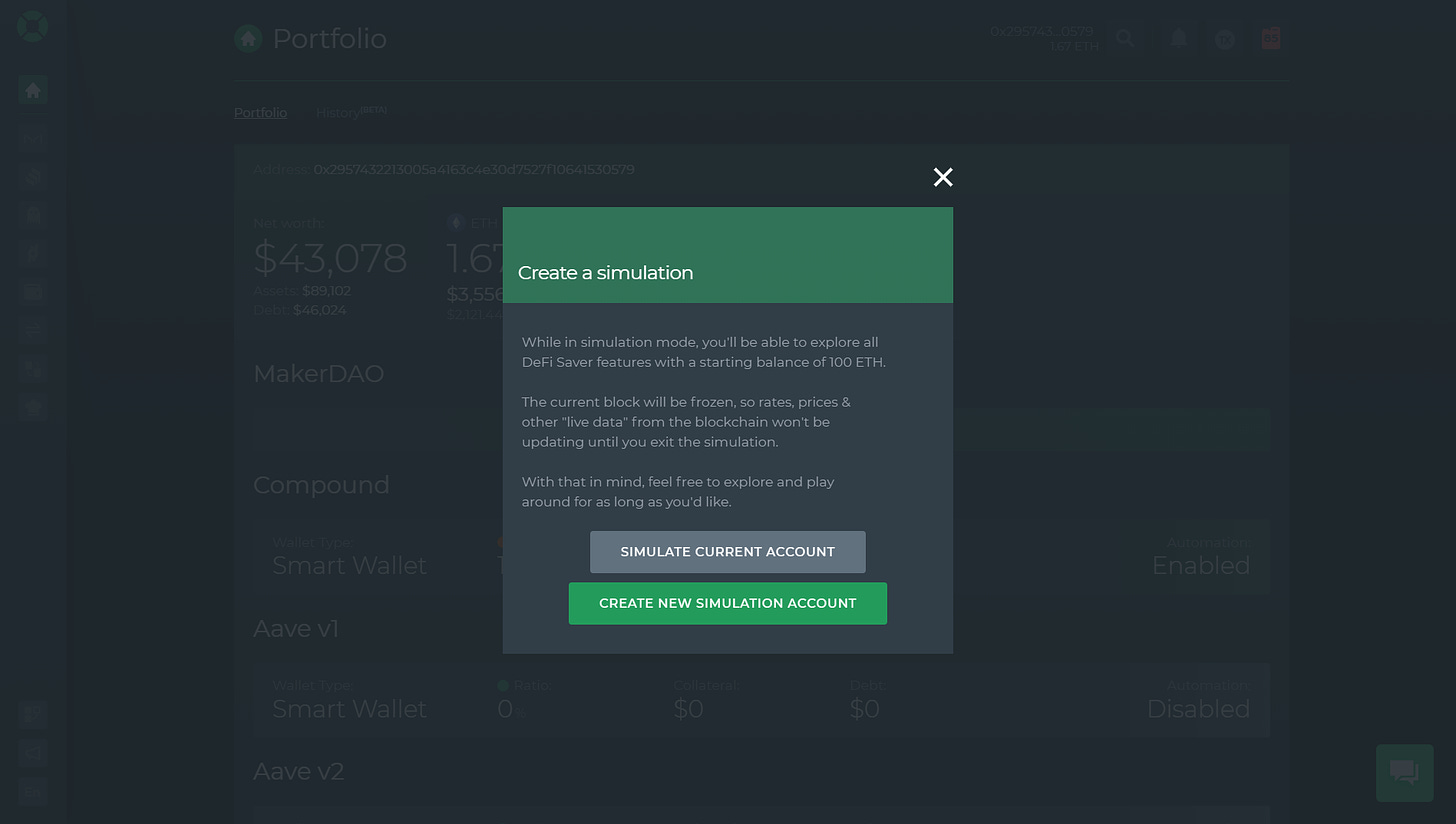

The average month sees around 50,000 users doing anywhere between 30 to 50 thousand a month in average volume on DeFi saver. Users come to the platform for a mix of features that help them improvise on how they generate yield. For instance, the platform offers a simulation mode that gives users $100k worth of assets to experiment with different strategies. Most users use it to see if a specific strategy would work in terms of its logic.

People throw around the term “composability” often. But for most non-technical people, doing it in a way that is neither technical nor confusing is rare. This is where “recipes” come into the picture. Think of it like IFTT (if this, then that) – for DeFi. Users can mix and match different dApps to conduct specific actions that may have taken multiple transactions.

A different way this feature is positioned in the product is in the form of a loan shifter. Thanks to variable interest rates on MakerDAO, Compound and Aave – it is often cheaper to lend from a different platform depending on the interest rate. So DeFi Saver has a single-click solution that repays the debt position using assets from the wallet and moves it to a cheaper lending platform. While this feature is not unique to DeFi Saver – it’s the mix of recipes, a token-swap exchange and an integrated bridge to move assets between networks that makes it powerful.

Fees are still a cause of concern for users. Doing complex transactions involving multiple dapps can cost up to $500. For most of it, a portfolio has to be worth ~$50k to justify a 1% transaction fee on Ethereum. The team has been slowly integrating layer two solutions as a fix. The team has launched support for Optimism and Arbitrum – but only Aave V3 is currently supported. More roll-ups are under due diligence, but the team is in no rush to integrate them all.

Observations

I liked DeFi Saver because they are one of the few ventures reducing the complexities of DeFi. Nobody needs to spend hundreds of dollars to get a feel for what the product does. Instead, anybody curious about DeFi strategies can spin up a test simulation in the product. For those who know what they are doing – DeFi saver saves time and money.

If I had to summarise all of it in a playbook – it would look like this

-

Focused on a niche problem, early on in the evolution of DeFi – or a new segment like NFTs or gaming.

-

Created a sticky userbase consisting of power-users instead of chasing small ticket users

-

Avoided integrating new ventures early on and saved users from getting burnt

-

The team scaled through technical improvements instead of hype and noise. Smart contracts compensate for the lack of new employees.

In my opinion, thin-layer businesses like DeFi Saver are bear market resilient. They hold strong treasuries from the activity uptick during the last year. The burn is pretty low, thanks to the team being small. And we have barely scratched the surface on what bridges, GameFi, and NFTs would look like on DeFi Saver. The team has been practising what I consider “optimistic caution”. Instead of chasing every shiny new thing, they have focused on what their core, niche user base needs. This translates to higher revenue and, by extension, more fees. Observing where they go over the next few years would be interesting.

I will see you guys next with a breakdown on bridges. It has been pending for a while. Join us here on telegram if you enjoyed reading this.

Also, consider reading these published pieces that were not sent out as a newsletter.

-

Summary of the state of web3 report by Chainalysis

-

Spotlight Series: VTVL

-

Spotlight Series: Supermind

Peace,

Joel

Disclosure: Entities I have exposure to have an existing commercial relationship with the team at DFS.

Potential Hire Alert

A very good friend – and an active contributor to this publication is looking for senior strategy roles (at a startup) or a break into a venture-related role. The person has had a startup exit in the past and comes with an incredible amount of experience analysing and assessing crypto. Drop me a message if you are hiring someone hungry, analytical and experienced.