Have you visited The Inner Circle?

It’s a community resource we launched to help you level-up your open finance skills at warp speed, and you get immediate access when you upgrade to Bankless Premium.

You don’t have to figure this stuff out alone.

Dear Bankless Nation,

Crypto means something different to people.

It depends on where you’re from.

If you’re in the U.S., U.K., or Singapore, it could be a fun way to speculate on sh*tcoins and ape into monkey JPEGs.

But if you’re in Russia, Nigeria or Afghanistan, crypto can be a means of survival.

Authoritarian governments won’t think twice before turning the financial system against dissenters.

It’s literally a matter of life and death.

Today, Neeraj Agrawal of Coin Center makes the case for why crypto privacy is not only a right, but a humanitarian need.

Check your financial privilege.

– Bankless team

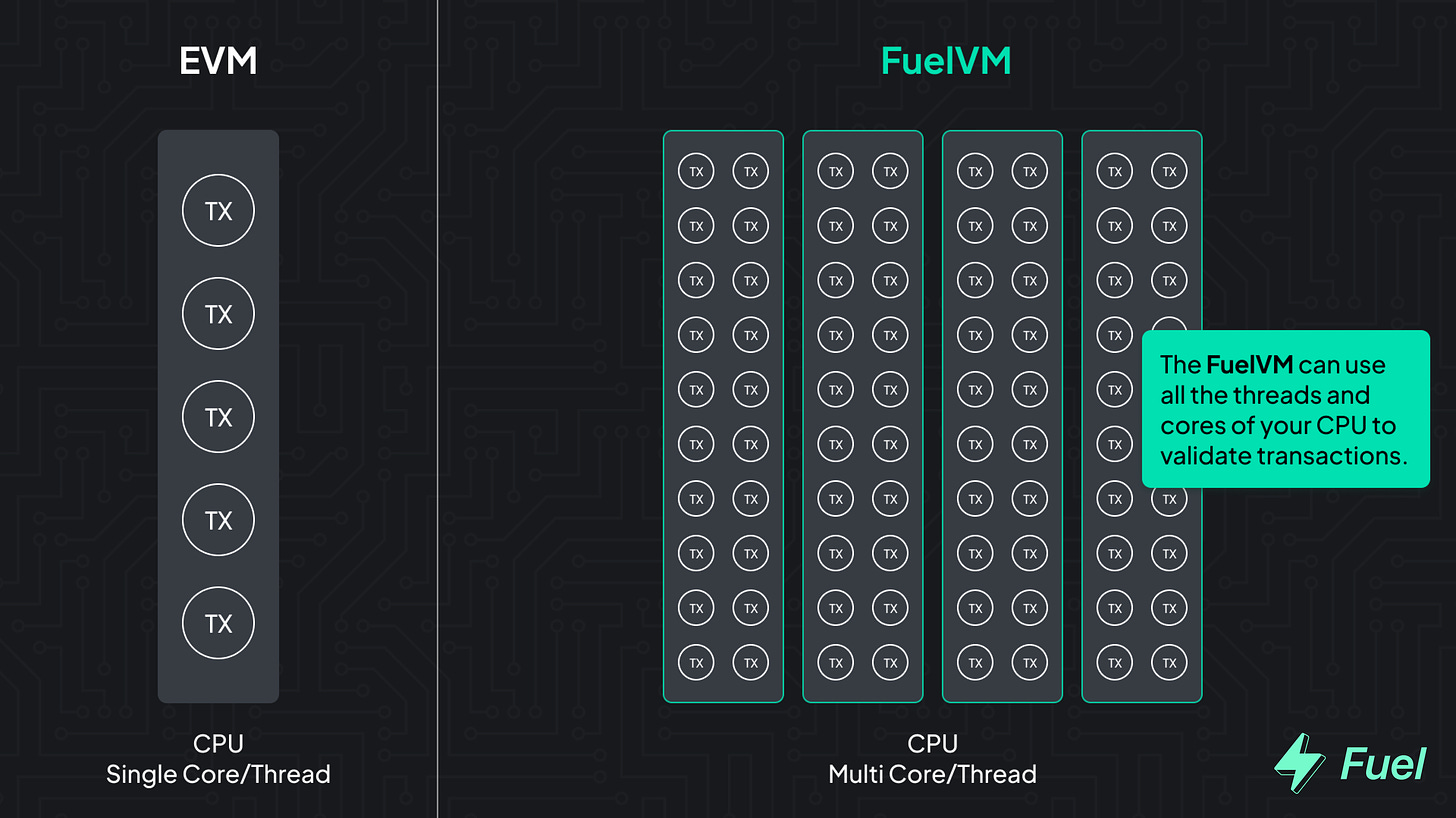

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

👉 Go beyond the limitations of the EVM: explore the FuelVM

Guest Writer: Neeraj Agrawal, Director of Communications at Coin Center

Financial intermediaries can become tools of oppression. Cryptocurrency privacy is the only way out.

It’s no secret that digital authoritarianism is on the rise globally. Our internet is structured around chokepoints and centralized data warehouses.

Most substantive internet activities flow through the servers of companies like Facebook, Google, or Amazon. Financial activity similarly has moved through networks of intermediaries like PayPal and the banking system. Ultimately these companies can be controlled by the state.

A tempting proposition for a leader looking to control their population.

This is why the recent move by the United States Treasury Department to sanction cryptocurrency privacy tool Tornado Cash is all the more worrying.

Let’s set aside the arguments that Coin Center is making in its court challenge of the sanction about whether an autonomous smart contract is even a sanctionable entity. This sanction has opened up a larger conversation about financial privacy in general.

A cryptocurrency skeptic might ask why such a tool is even needed in the first place. This is of course the latest example of “why do you need privacy if you have nothing to hide.” It’s a fact that most cryptocurrency activity happens on public blockchains that can be easily tracked.

And it is a fact that most activity that happens on these blockchains is not illicit.

So, the skeptic might say a person who does not want their financial activity to be public should just use a traditional intermediary that does not broadcast their information. While this would eliminate the risk of blockchain analysis, it would be walking into a buzzsaw in the event that the intermediary is somehow captured or working against you.

Perhaps that idea is silly to those of us who enjoy living in a democracy with rule of law. But the state controls the financial system and not all states value free expression and association.

When protests against a rigged election erupted in Belarus, the Putin-backed government moved swiftly to crack down. A particular element of this crackdown was financial punishment. Protestors received heavy fines. Employers were pressured for the dissent of their employees, meaning protestors lost their jobs.

The non-profit BYSOL began helping protestors with financial aid.

The group established in Belgium because, as the protest was labeled illegal, they were technically funding illegal activity. This convenient use of criminal designation is something we see often. Now their bank, having no choice but to remain compliant with the law, would seize their funds and freeze their account. The intermediary could not be trusted.

But how to get the money into the hands of protestors? All electronic transfers were being monitored in the name of preventing illegal activity, and cash was being confiscated at the border.

The group turned to Bitcoin. Protestors were able to receive funds to personal Bitcoin wallets, and then make small swaps with locals to fly under the radar of the financial surveillance apparatus.

Weaponizing intermediaries with the law has become a favored tactic. In Russia, Putin’s political opposition was labeled an extremist group, so donating to the organization was banned by financial intermediaries complying with anti-terror laws.

In Myanmar, the Junta began implementing strict Know Your Customer rules, forcing all users of the digital banking system to more fully identify themselves to their providers. This was paired with a crackdown on the availability of physical cash. Now all economic activity has been forced into a better surveilled system that is marked by the aggressive and seemingly random freezing of bank accounts, with little recourse, as the government attempts to stem flows of money to resistance fighters.

This issue may even come to the U.S., which is perhaps unthinkable to some.

The recent overturning of Roe v. Wade has put abortion access at risk. If providing financial services to fund an abortion becomes illegal, it’s not hard to imagine payment providers losing access to do business by breaking that law. Or, if not fully freeze the activity, provide evidence to law enforcement that the “crime” took place.

Many abortion pill websites use services like PayPal and Stripe to process payments.

It’s a developing area, but if PayPal needs to cut them off, crypto will still work.

If authoritarianism is on the rise and trust in intermediaries is going down, it follows that people who need to make transactions that are unpalatable to the state will begin to use more cash and perhaps more cryptocurrency. Cash is great, but limited to in-person transactions.

For the digital age we need digital cash, and cryptocurrency is our best bet in that regard.

In cases like in Belarus, Russia, Nigeria, Afghanistan, China, and many other countries, cryptocurrency has been a lifeline for dissent and survival. However, the sad truth is that this technology has been useful despite its own privacy limitations.

While publicly readable blockchains are an excellent tool for law enforcement to track genuinely harmful activities, they are just as useful to an authoritarian regime trying to track the flow of donations to activists.

There is little known about the blockchain surveillance capabilities of most countries, but we can assume that sophisticated internet censors like China and Russia are rapidly developing tactics in this area. China in particular is known for exporting its tools for technological authoritarianism.

It is not hard to imagine authorities in Belarus or Myanmar taking an interest in tools that can stem the cryptocurrency hole in their surveillance dragnet.

We should be encouraging privacy tools like Tornado Cash that can help people when the full apparatus of the state is turned against them.

The intermediated financial system is an easy target for surveillance and control. With the right tools, cryptocurrency can be a check on this power and escape valve for desperate people.

Neeraj Agrawal is Director of Communications at Coin Center, a cryptocurrency policy think tank. You can follow him on Twitter here.

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

👉 Explore the FuelVM and discover its superior developer experience!

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.