A look at two blockchains with an interwoven past

Cardano grew out of a dispute when two people disagreed on how the Ethereum blockchain should be managed and developed. So it’s no wonder that the debate over Ethereum versus Cardano often sees acolytes lining up on each side with fervent views on which network is the best. Being blockchain-agnostic, DappRadar takes no sides in this argument. But we have laid out some facts to provide everyone with a bit more insight.

Contents

Who, Where, When?

Ethereum was first described in a white paper in 2013 before it was officially announced at the North American Bitcoin Conference in Miami in 2014. On 30th July, 2015, the first block in the chain was created.

Ethereum has a long list of founders. In December 2013, there were five: Vitalik Buterin, Charles Hoskinson, Anthony Di Iorio, Mihai Alisie and Amir Chetrit. Gavin Wood, Jeffrey Wilcke and Joseph Lubin joined in 2014.

Cardano was founded in 2015, in Zug, Switzerland. Charles Hoskinson wanted to accept venture capital money and make Ethereum for-profit. Vitalik Buterin wanted the blockchain to remain as a nonprofit organization.

Eventually Hoskinson left the Ethereum project and co-founded IOHK. The company develops Cardano, in conjunction with the Cardano Foundation and Emurgo. On 27th September 2017, Cardano was launched.

Technology

Proof-of-Work

Ethereum currently runs as a Proof-of-Work (PoW) network. PoW is a consensus mechanism that requires members of the network to solve arbitrary mathematical puzzles. Once all members have done the work and created a block, that block is locked up forever and added to a chain, hence “blockchain”.

The reason this system is so secure is that it would take more than half of all block miners to agree to change a hash. Since it would be nearly impossible to coordinate this, the blocks of records on a PoW network will never be altered.

As a reward for securing a PoW network in this way, miners are paid in the blockchain’s cryptocurrency. In the case of Ethereum, the native token is ETH. As things stand, miners get two ETH for every Ethereum block they create.

Proof-of-Stake

Soon, Ethereum will move to a Proof-of-Stake (PoS) consensus mechanism. With PoS, instead of validators needing to solve puzzles to secure blocks, they lock up their ETH in the network and are given the responsibility of validating blocks of records when they’re created. This locking up of cryptocurrency is called staking.

In essence, coin holders are offering up their coins as collateral for the chance to keep the secure network. For anyone to take control of the Ethereum network, they would need to spend tens of billions of dollars to acquire enough ETH.

At this stage, now that they own so much ETH, if a hacker attempted to exploit the system, they would lose all of the money they’d invested. Ethereum has an in-built security measure that ensures anyone who tries to revert a block will lose all of their staked ETH.

Cardano was designed and launched with a consensus mechanism called Ouroboros. It’s similar to a PoS system and validators are rewarded with the native cryptocurrency ADA. With Ouroboros, time is divided into epochs and slots. In practice, each epoch lasts about five days and contains 21,600 slots, each lasting 20 seconds.

When each slot begins, a slot leader is randomly selected from a pool of validators. Once selected, they are responsible for verifying transactions and turning this into a block. When another epoch begins, a new randomizing seed number is created and different validators are selected to create blocks.

Costs and Speeds

Costs

Cardano gas fees are currently lower than those on Ethereum. As things stand, Cardano transactions cost, on average, about 0.16-0.17 ADA. You can find out the current cost of ADA by using a token price website.

Because of ETH’s high dollar value and the huge amount of trading activity that takes place on the blockchain, the cost of Ethereum transactions is significantly more.

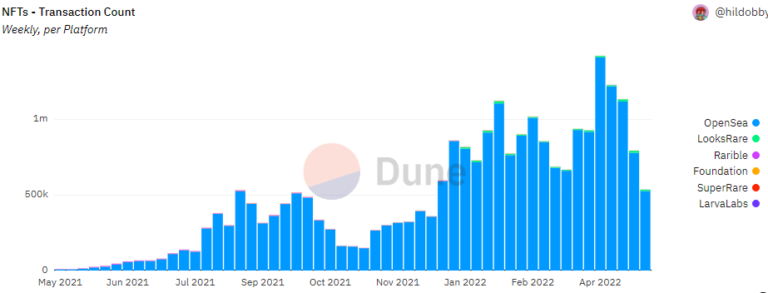

The popularity of NFTs, alongside the growth in DeFi and the bull market, contributed to average daily gas fees climbing as high as $197. Fortunately, costs have recently come down from these highs, but Ethereum is still one of the most expensive networks to trade on.

Speeds

Not only is Cardano less expensive than Ethereum, transactions per second (TPS) across the blockchain are also faster. Cardano can process around 250 TPS while Ethereum can currently process 30 TPS.

Claims from the Ethereum development team suggest that their blockchain will soon be able to handle up to 100,000 TPS, following the anticipated Merge. If this happens, it will put the network up there with some of the fastest ones we currently have.

Bear in mind that the Cardano and Ethereum teams are always working on developments to improve their blockchains. So expect even higher TPS numbers and, fingers crossed, lower transaction fees in future.

Let’s talk NFTs

Ethereum is also the number one block chain for NFT trading. Taking a look at DappRadar’s NFT Marketplace rankings for Ethereum, we can see that all-time sales across the five biggest marketplaces amount to more than $36.5 billion.

All of the best-known NFT projects exist on the Ethereum blockchain. The blue chips, such as CryptoPunks, Bored Ape Yacht Club, Mutant Ape Yacht Club, Art Blocks, Azuki and Moonbirds, are all built on Ethereum.

Cardano, on the other hand, has no collections of particular note. Jpg.store is the most well-known marketplace for Cardano NFTs and has processed 63.36% of the sales volumes. Overall, $207.4 million worth Cardano NFTs have been sold (with the ADA price at the time of writing).

Tokens

Ethereum’s native token is called ETH. It’s the cryptocurrency with the second highest market cap behind Bitcoin. It reached its current all-time high of $4,878 on 10th November, 2021.

There is no limit on how much ETH is minted and issued to network validators. The supply is kept in check when a small portion of each gas fee is burned. Secondary marketplace OpenSea is the biggest burner of ETH because so many Ethereum NFTs are traded on its platform.

Cardano’s token is called ADA and it reached its own current all-time high of $3.09 on 2nd September, 2021. ADA currently sits in eighth place for overall market cap.

Fresh ADA is minted with every block and distributed to slot leaders for validating and creating new blocks. Unlike with Ethereum, there is a lifetime limit of 45 billion ADA. So far 33.8 billion ADA have been issued.

When all 45 billion tokens have been minted, validators will get their rewards solely via transaction fees.

Ethereum versus Cardano

As mentioned at the top, DappRadar takes no view on which blockchain is the best or might win out in the battle for web3 supremacy. We believe there’s room for everyone in a decentralized world. Some networks are better for some tasks, while other ones are not built for certain purposes.

Ethereum clearly leads the market in terms of NFT count, token market cap, PR, Layer2 networks and sidechains, and the overall number of dapps it hosts.

Cardano has cheaper transaction fees, a higher TPS rate (for now), is developed to peer-reviewed standards and is slowly building up the number of dapps built on its blockchain.

The beauty of the current web3 moment is that thousands of developers are creating hundreds of tools, dapps and blockchains that we can all choose from for whatever purpose we want. But if you do want to pick a single blockchain and go all in on its future prospects, please, remember, to DYOR.