Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

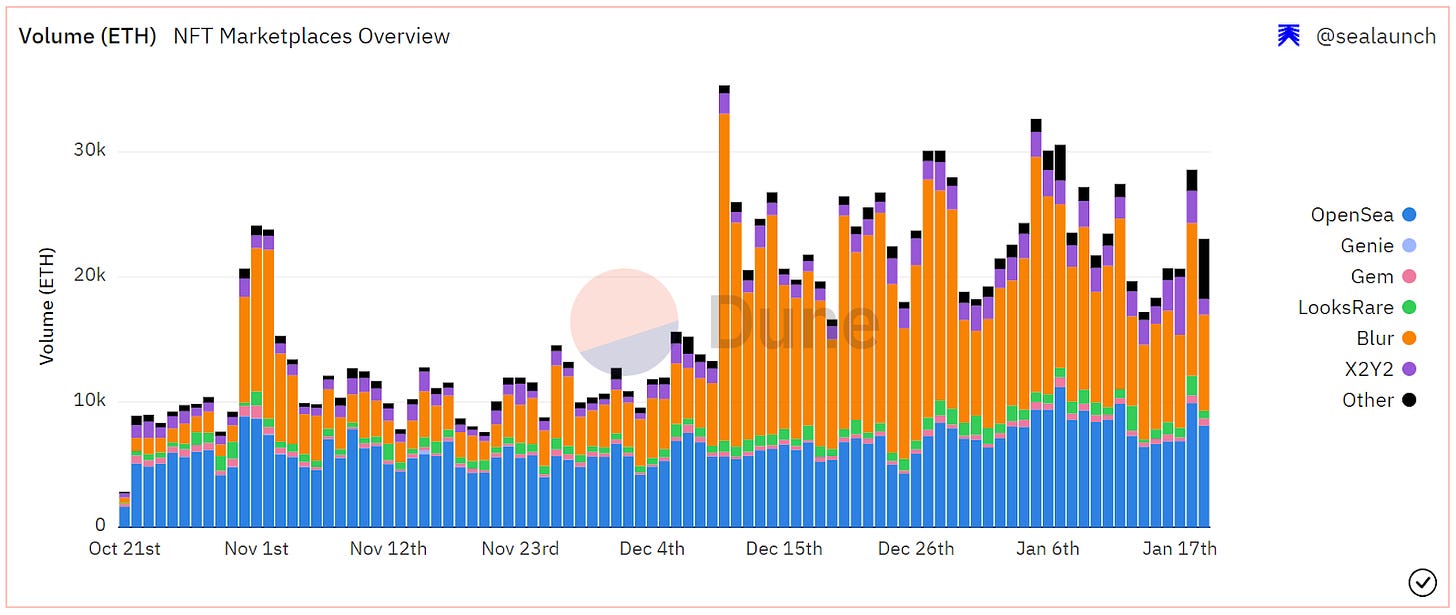

Blur, a newer NFT marketplace aggregator, has been facilitating considerable trading volume in recent months.

A big part of this rise has been anticipation of Blur’s coming $BLUR token, which will be airdropped to users of the platform.

The catch? This retroactive airdrop campaign is being tracked across three phases, and each phase has emphasized rewarding a certain activity. In the ongoing and final phase, bidding is the focus.

While originally slated for later this month, the $BLUR airdrop is now set to launch on February 14th. Accordingly, let’s walk through the basics of Blur bidding in case you haven’t tried it yet and want to squeeze in some bids between now and the deadline!

-WMP

👉 Across.to is the bridge you deserve!

Blur, the “NFT marketplace for pro traders,” goes big on speed and UX.

However, another major factor in the project’s market share surge was the announcement of protocol governance and the upcoming $BLUR token airdrop in October 2022.

The Blur airdrop is being calculated across three phases: Airdrop 1, Airdrop 2, and Airdrop 3. During these stages, it’s been possible to accrue mixed-rarity Care Packages that can later be redeemed for $BLUR once the token’s live.

The first stage rewarded Care Packages to people who actively traded NFTs in the six months before Blur’s October 2022 launch, while the second stage rewarded traders who listed NFTs for sale on Blur through November 2022.

The final stage, Airdrop 3, will distribute up to x2 more Care Packages than Airdrop 2 and is tallying reward points according to users’ collection-wide bidding activities on Blur through February 14th.

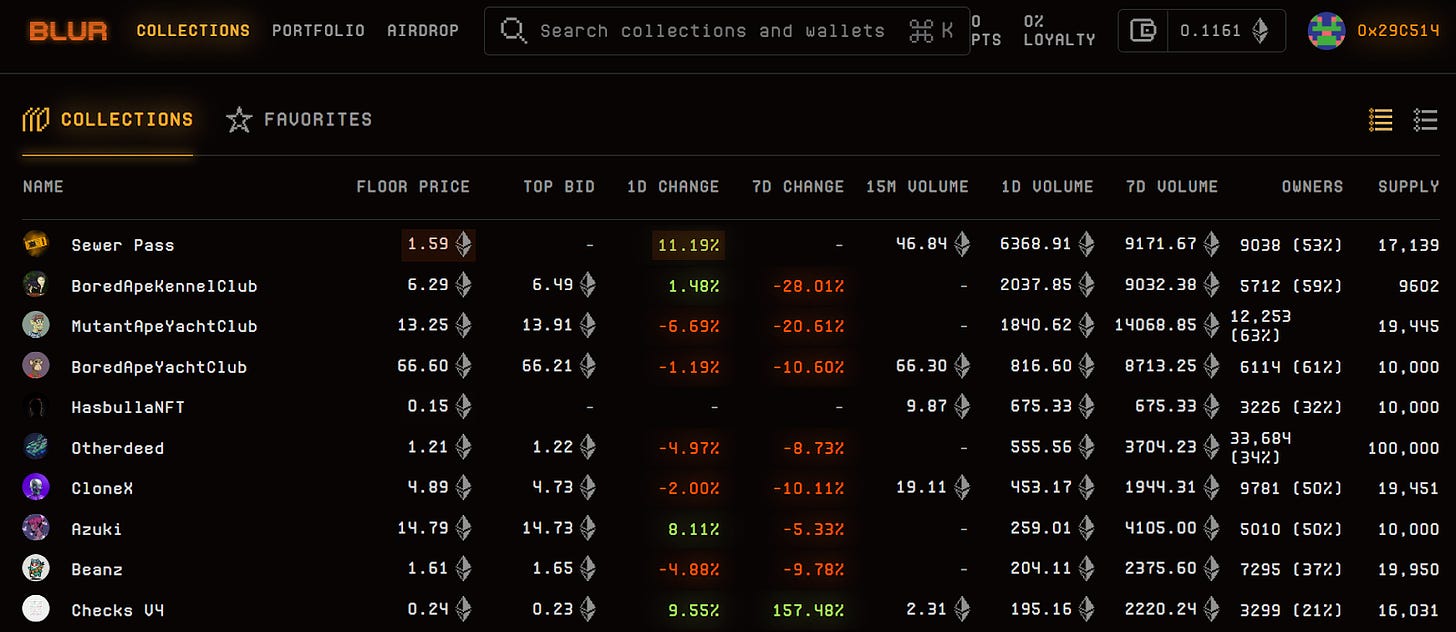

Here, keep in mind that the more 24-hour volume a collection has, the more points Blur rewards to bidders for Airdrop 3. Thus no collections are out of bounds per se, but if you want to get more efficient and strategic with your bidding then target NFT projects that are doing at least decent volume on the day.

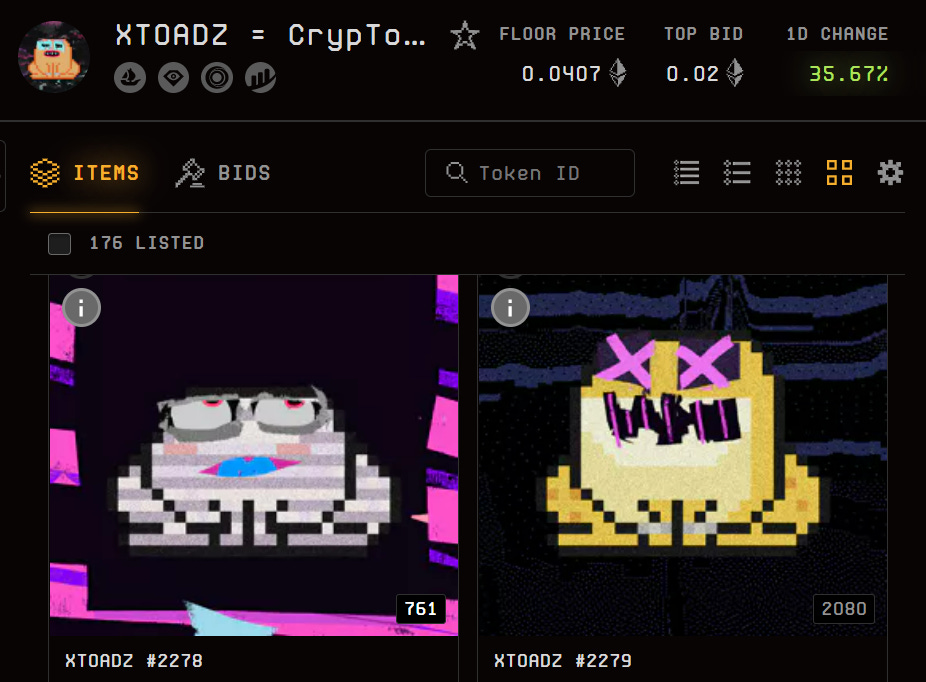

Additionally, the closer a bid is to a collection’s current floor price, the more airdrop points bidders receive. For example, let’s consider the XTOADZ project, whose floor is presently just over Ξ0.04.

As you can see in the image above, the current top collection-wide bid is for Ξ0.02. Blur only allows bids in intervals of Ξ0.01, so if we were to come in and place higher bids of Ξ0.03 or Ξ0.04, then we’d receive more points toward Airdrop 3 than anyone who bids at Ξ0.02, and so on and so forth.

It’s also important to note here that your bids don’t actually have to get accepted for you to earn points toward Airdrop 3. By taking volume out of the equation, wash traders aren’t able to inflate their points with tons of arbitrary trades.

That all sounds straightforward enough, right?

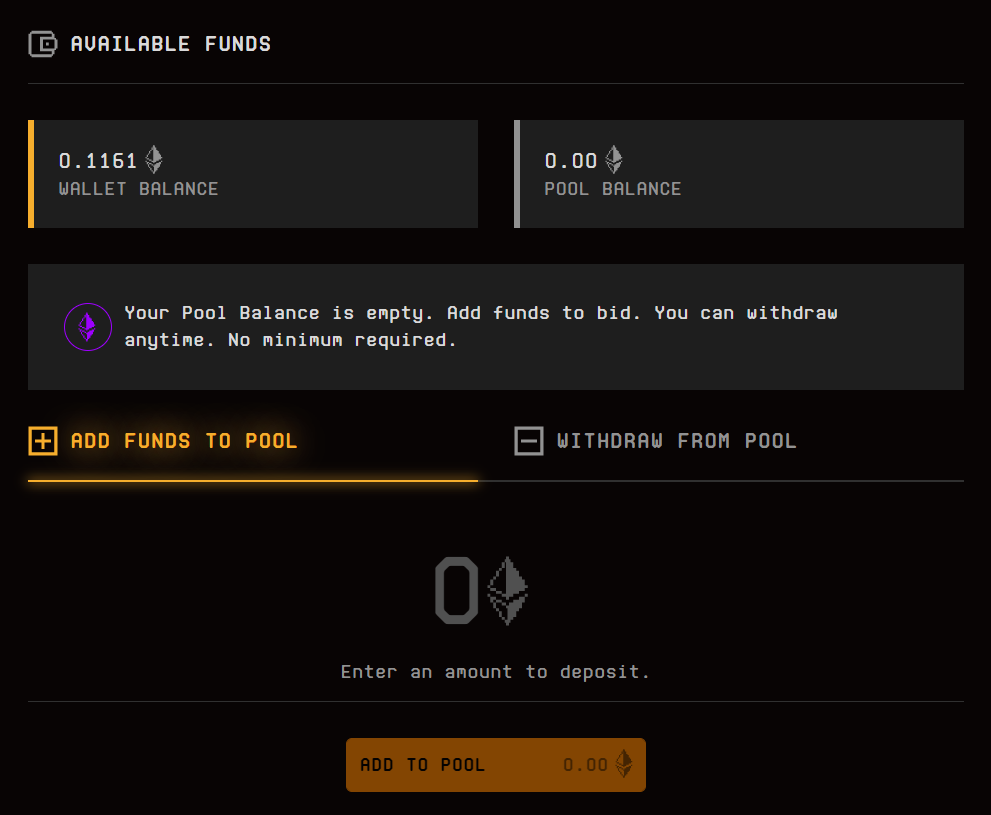

Well next let’s zoom into Blur’s Bidding Pool system, then, which is what you’d actually go through if you want to start making collection bids. Once you sign into Blur with your desired wallet, you can click the wallet icon by your account name. This will take you to the Bidding Pool UI, like so:

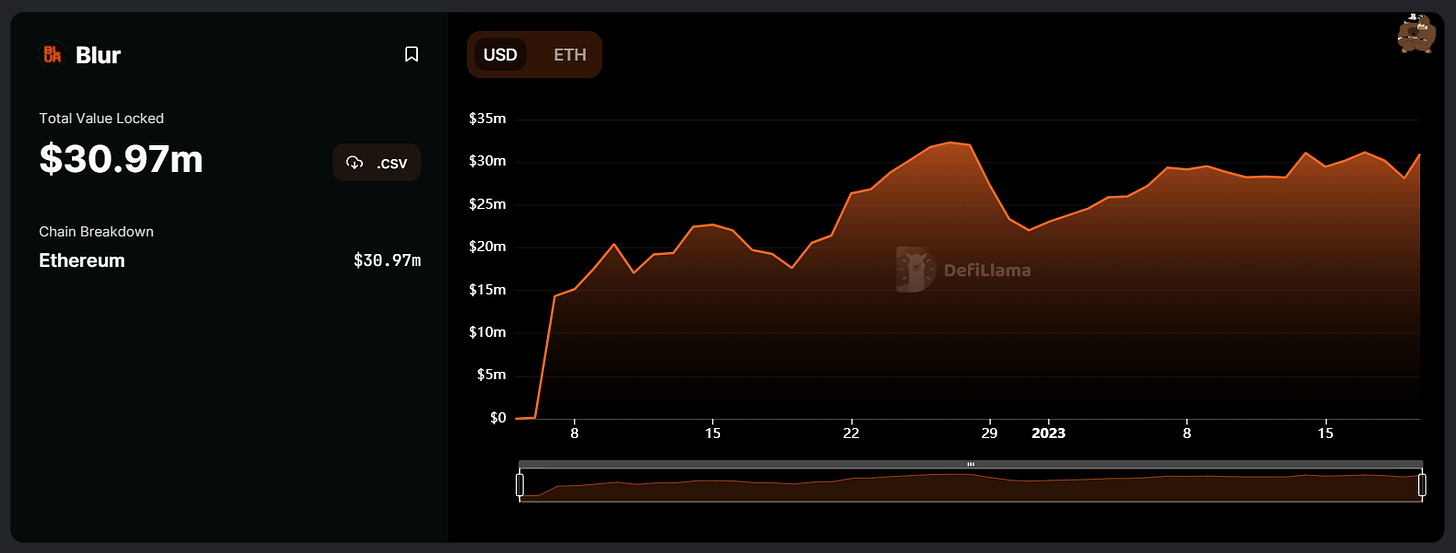

While you can buy NFTs listed or aggregated on Blur directly with the ETH you have in your wallet, you’d have to deposit ETH to Blur’s Bidding Pool address to make bids on collections.

After the initial deposit transaction to the Bidding Pool, this system lets you make gas-less bids so you don’t have to pay ETH transaction fees every time you decide to do some bidding.

That said, the deposit process here is straightforward: under the Add Funds to Pool tab input how much ETH you’d like to deposit, press Add to Pool, and complete the transaction with your wallet.

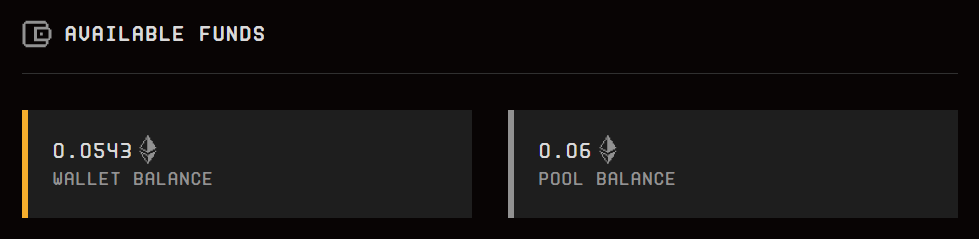

Once that’s done, you’re ready to start bidding with your pool balance, which you can check at any time in your wallet dashboard.

At this point it’s up to you to decide which, if any, collections you want to lay bids down on. Either scroll through Blur’s main Collection’s page until you find something that strikes your fancy, or use the search bar to go directly to a project you’re interested in.

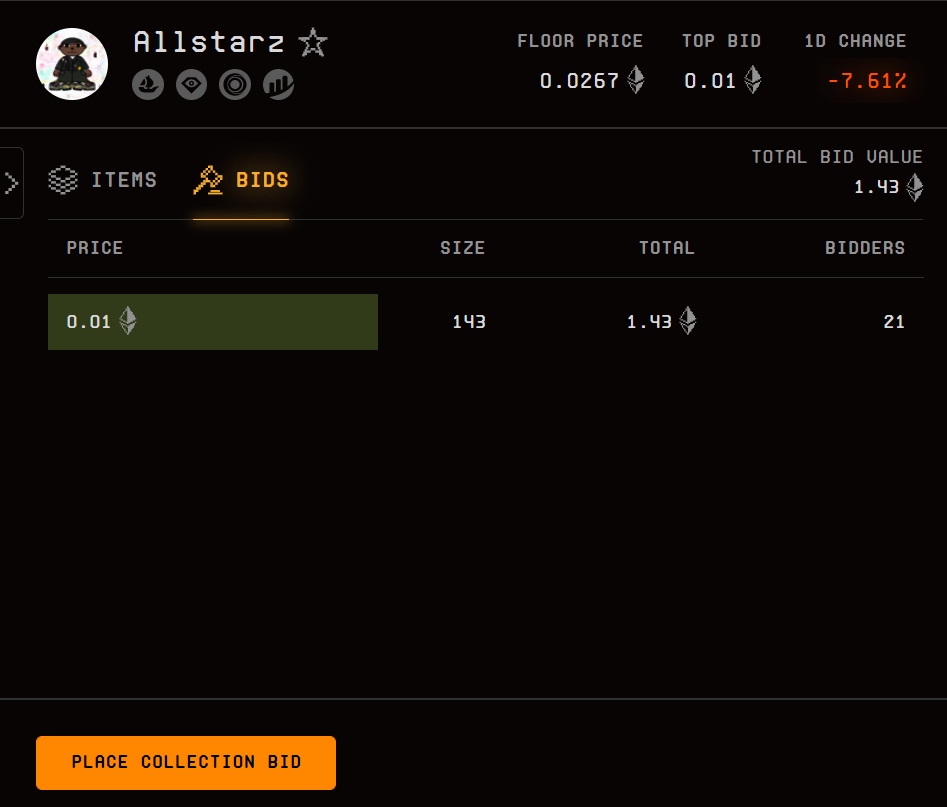

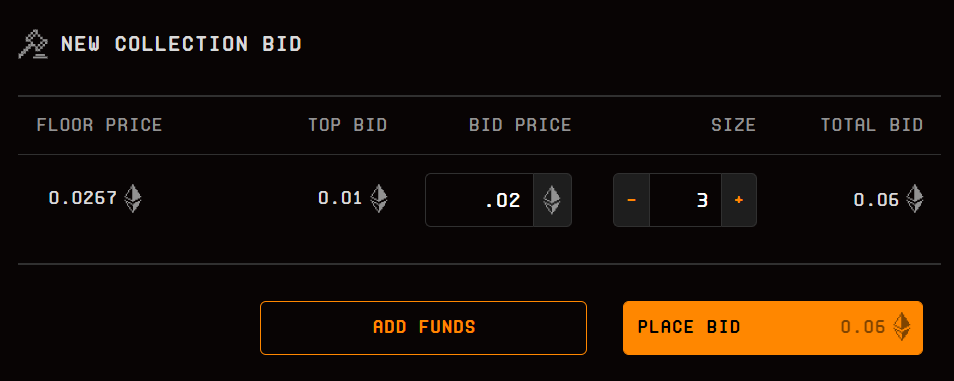

Once on a specific project’s dashboard, click over to the Bids button to see how many active bids are placed on the collection and to place any bids you want with the Place Collection Bid button.

For example, as you can see with the Allstarz in the screenshot above the collection’s current top bid is Ξ0.01 (143 bids and Ξ1.43 deep) but the current floor price is 0.0267. In order to accrue Airdrop 3 points more efficiently, slapping a few bids down for Ξ0.02 each would do the trick.

To finish up press Place Bid and sign the gas-less approval transaction that your wallet prompts you with. Once that’s done, you’re bids will be active like so:

And that’s what it takes to bid on Blur! Just remember that people can and will often actually fill these orders, so only bid on projects you like and with ETH you can afford to spend.

Of course, don’t go wild and try to spam as many bids as humanly possible between now and February 14th, doing that will certainly overstretch you. Just use Blur regularly, place bids that make sense for you on projects you’ve been interested in picking up for some time, and that alone should land you some $BLUR Care Packages when the time comes.

Lastly, you might be wondering what the “Loyalty” score means on Blur. Remember earlier how I mentioned the varying rarity possibilities of Care Packages? The rarest Legendary packages will contain the most $BLUR, and the better your loyalty score, the better your chances will be at scoring these and the other rarer packages.

Specifically, your loyalty points are calculated depending on how you list your NFTs.

“When you list on other marketplaces, as long as you list on Blur at the same price or lower, it won’t affect your loyalty score,” the Blur team has previously explained. “You can use Blur’s advanced listing tools to list across all marketplaces in one go.”

As such, your loyalty score will go down if you list an NFT for a higher price on Blur than on another marketplace, e.g. Ξ0.05 on Blur and Ξ0.025 on OpenSea.

Conversely, your loyalty score will go up if you list only on Blur or if you list an NFT for a lower price on Blur than on other marketplaces, e.g. Ξ0.05 on Blur and Ξ0.075 on OpenSea. Keep this loyalty system in mind if you’re interested in optimizing for the rarest Care Packages possible while Airdrop 3 tracking is still live!

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Across is the bridge you deserve: fast speeds, low fees, great support, no hacks, and we love our users. Try it once and you’ll understand why Across users love us back and have bridged $billions with it.

Yield farmers will also find attractive yields for providing bridge liquidity! 👀

👉 If you have questions, check Twitter or the Discord!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.