Key Takeaways

- Despite being best known for its ties to the Bored Ape Yacht Club (BAYC) ecosystem, ApeCoin was designed for broader adoption as a Web3-native medium of exchange.

- Holding ApeCoin also represents membership within the ApeCoin DAO, an organization formed to further the adoption of APE through decentralized governance.

- Though early grant funding through the DAO treasury has primarily centered around the BAYC brand, the scope of APE integrations is expected to broaden over time to reflect the diversifying DAO member base.

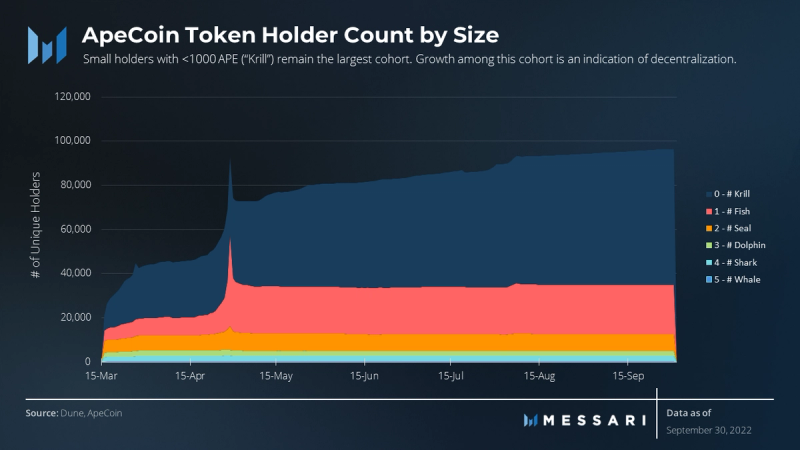

- The number of unique holders of APE has steadily risen since launch, crossing above 90,000 wallets as of Q3’22.

- The value of ApeCoin will largely be determined by the success at which APE proliferates as a medium of exchange and utility token that becomes widely utilized across digital economies.

Introduction

ApeCoin (APE) is the type of mind-bending phenomenon that can only be found in crypto. At the token launch on Mar. 17, 2022, Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) NFT holders had the privilege of claiming 15% of the 1 billion max token supply as an “airdrop.” APE holders proceeded to ride the initial price action rollercoaster, as the relatively illiquid token ran from ~$8 to a peak of $39.40 before settling back down near $10 all within the first twenty-four hours of trading; an impressive feat, even by crypto standards.

By the end of April, the token price had experienced another run-up, this time more organically through a combination of 1) “meme-power” and 2) hype surrounding the launch of a mysterious new metaverse that many expected would take both the BAYC ecosystem and ApeCoin to an entirely new level. And indeed on Apr. 23, 2022 Yuga Labs, the creators of BAYC, unveiled The Otherside.

The Otherside is an open metaverse centered around the growing list of Yuga Labs NFT collections where ApeCoin would be the native currency. The official reveal came just a week before the first of two minting events for The Otherdeed NFT collection (200,000 virtual land plots within The Otherside metaverse). As expected, the only way to purchase one of the 55,000 plots available for sale was through the exchange of 305 APE (~$6,100 based on $20/APE at the time of mint). After the end of the sale, BAYC or MAYC holders could claim one Otherdeed plot for each BAYC or MAYC NFT they held.

ApeCoin’s price rise in the month leading up to The Otherdeed mint highlighted the powerful economic flywheel effect made possible through the use of ApeCoin as a highly-sought-after currency. Of course without consistent demand as a medium of exchange, or what economists call high money velocity, ApeCoin’s value has remained volatile. In the ~six months since launch the token price has cooled considerably, down to an average of ~$5.60 in Q3’22.

However, this young currency’s journey has only just begun, and the ApeCoin DAO has been established among APE holders to guide the way. With a growing list of influential backers and builders all working toward developing new forms of utility and use cases for APE, The Otherside is likely only to be the first of many announcements to come.

The Origins: Yuga Labs, BAYC, The Otherside and more

Though ApeCoin DAO and Yuga Labs may seem closely linked, with the Bored Ape ecosystem being the common thread, ApeCoin’s genesis has been officially attributed to an entirely separate organization called the APE Foundation. The APE Foundation is the steward of ApeCoin, a legal entity that exists to administer the decisions of the ApeCoin DAO. It’s easy to understand how Yuga and ApeCoin are often conflated, given the close interdependence both organizations seemingly have – at least in the near term – toward the success of the Bored Ape ecosystem. As early as October 2021, BAYC’s official involvement in the early planning and development of a token was made public. In fact, ApeCoin’s highly-recognizable logo was actually gifted to the APE Foundation by Yuga Labs. This move ultimately leaves all future decisions regarding the use of the IP in the hands of the DAO.

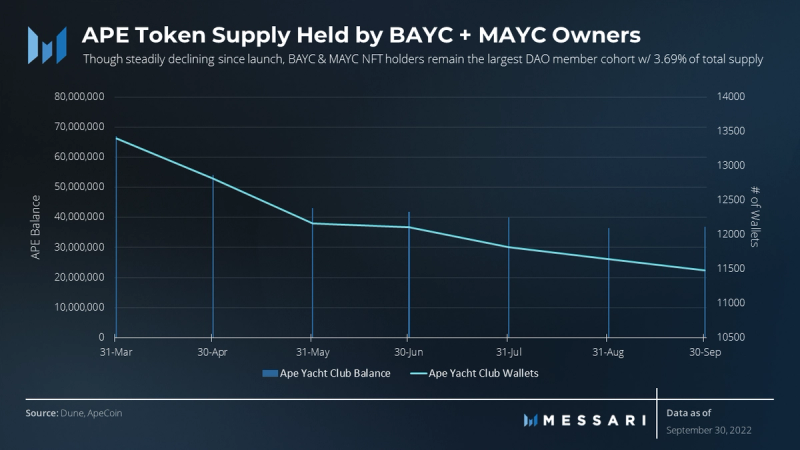

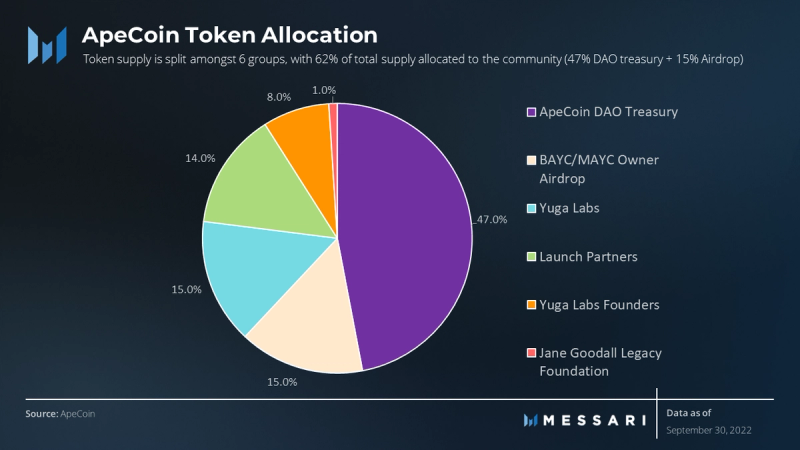

It’s important to understand that the largest voting cohort of ApeCoin DAO members since its launch has been BAYC and MAYC holders due to the initial airdrop claim eligibility. In addition to the allocation for BAYC / MAYC NFT holders, a ~16% share of token supply was allocated to Yuga Labs itself (6.25% of this allocation marked for donation to the Jane Goodall Legacy Foundation, amounting to 1% of the token supply), with another 8% of the supply divided among the four Yuga Labs founders. In total, at least 39% of APE’s total supply can be closely linked to BAYC stakeholders.

Even though more than 60% of token supply remains locked, this linkage inherently forms a tight alignment of incentives between the BAYC community and ApeCoin DAO. Like many other Web3 projects, the ApeCoin DAO is expected to further decentralize over time as tokens flow through the ecosystem across a more diverse group of holders and communities. By extension, the underlying priorities of the ApeCoin DAO should gradually shift as a reflection of its member base. One could expect the rate of decentralization to experience a snowballing effect, as an increasing number of novel pathways form, promoting the exchange of APE (metaverses, shops, experiences, etc).

In the near-to-medium term, however, the BAYC and ApeCoin communities are likely to remain closely allied, bolstered by the fact that The Otherside metaverse in development by Yuga Labs will become one of the first major project to integrate ApeCoin as its native currency. The Otherside integration can be seen as a “minimum-viable-product.” If the economy within Yuga’s metaverse grows prosperous while using APE as the medium of exchange, other Web3 communities may grow convinced to adopt the token in some capacity as well. Of course, an increase in usage across a greater number of ecosystems would likely benefit the early adopters and holders of APE.

Token Summary

The ApeCoin asset is a digital token built using the popular ERC-20 token standard, which is a framework commonly used to develop highly-fungible and functional tokens on the Ethereum Blockchain. APE has a fixed issuance of 1 billion tokens distributed across 6 distinct allocation groups, as expressed in the chart below:

Within the 15% allocation to BAYC / MAYC holders, 10,094 tokens were allocated for each Bored Ape while each Mutant Ape was eligible to claim 2,042 tokens. Owning a Bored Ape Kennel Club (BAKC) companion NFT in addition to a BAYC or MAYC received a bonus 856 APE (10,950 per BAYC and 2898 per MAYC). However, stand-alone BAKC NFTs were not eligible for any airdropped APE.

Liquid Supply Curve

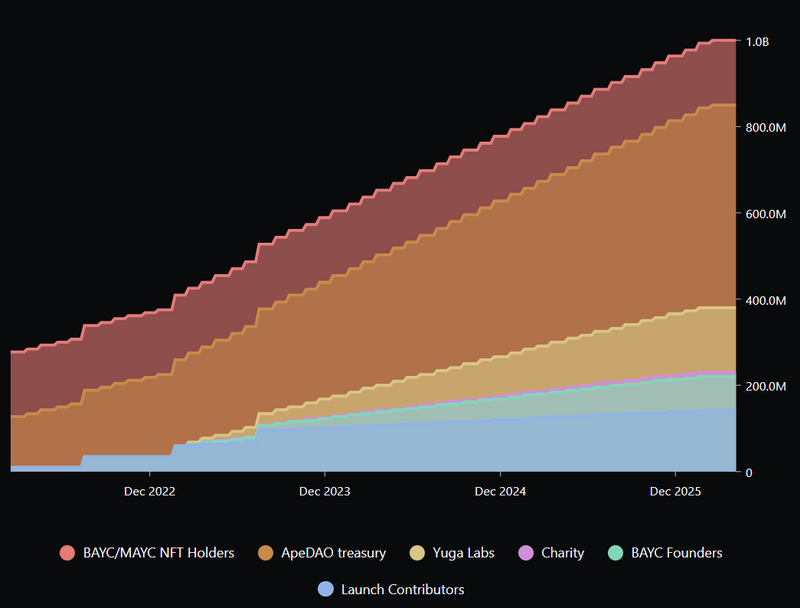

At launch, roughly 27.75% of the total token supply was unlocked. The remaining tokens will be unlocked over the subsequent 48 months, with an average 1.5% of total supply unlocked monthly.

ApeCoin serves four primary purposes:

- Governance: a governance token for the APE ecosystem, allowing ApeCoin holders to participate in ApeCoin DAO.

- Unification of Spend: a utility token for any ecosystem interested in adopting a shared, open currency that can be used without centralized intermediaries.

- Access: a tool for gated access to certain parts of the ecosystem that would otherwise be unavailable, such as exclusive games, events, services, and merch.

- Incentivization: a tool for permissionless participation in the ecosystem available to third-party developers who choose to incorporate APE into their services, games, and other projects.

DAO Overview

ApeCoin DAO was formed to embody the open-source protocol layer of the APE ecosystem powered by a decentralized Web3 community of builders. As part of the greater “Ecosystem Fund” allocation, 47% of total APE supply (470 million APE) was assigned to a treasury, with ~118 million of total supply unlocked at launch. The DAO governs the treasury, which is currently valued at over $2 billion based on the total 470 million APE allocation (more than $600 million liquid supply). Through a standardized governance process, ApeCoin holders determine the disbursement of funds via community grant awards. The overarching goal of these grants is to fund projects that are net accretive to the APE ecosystem over the long-term.

After a thorough drafting process overseen by the APE Foundation, community-submitted APE Improvement Proposals (AIPs) are voted on by APE holders via Snapshot (1 APE = 1 Vote). Proposals can fall under three categories: Core, Process, or Informational. These votes carried out by the APE community effectively cover any range of decisions that can impact the internal operations of the DAO or the assets under management. Decisions reached by the ApeCoin DAO are implemented by the APE Foundation, which is also responsible for disbursal of funds, coordinating with third-party vendors, and maintaining orderly operation of the DAO.

The APE Foundation is overseen by an annually-appointed five-member “Board” serving both as administrators as well as community leaders. This special council meets regularly to review large proposals or events of importance to the DAO. Five prominent stakeholders of the BAYC ecosystem were chosen to serve on the initial council for a shortened initial six-month term, after which DAO members will officially vote to elect a new Board. The initial council members, hand-selected by the APE Foundation prior to the launch of ApeCoin, are all well-known Web3 advocates and leaders within the NFT space:

- Alexis Ohanian: Co-founder of Reddit; General Partner & Founder of Seven Seven Six

- Amy Wu: Head of Ventures & Gaming at FTX

- Maaria Bajwa: Principal at Sound Ventures

- Yat Siu: Co-founder & Chairman of Animoca Brands

- Dean Steinbeck: President & General Counsel at Horizen Labs

Note: The Board’s initial six-month term would have ended on October 17. However, on September 22, the DAO voted to extend the term by an additional three months, providing time for the development of a formal process to administer Board nominations and elections. The APE Foundation will collect community input to be condensed into a congruent policy.

Despite ApeCoin DAO sharing some operational similarities with that of a traditional top-down organizational structure, the power truly lies directly in the hands of APE holders. Oversight of the daily operations of the foundation is currently concentrated in the hands of just a few elected leaders known as The Board along with community moderators, but any substantive decision must clear the public proposal process and be put to a governance vote.

On several occasions, proposals introduced by the APE foundation have not passed (such as AIP-4 and AIP-5) and the council leaders have even refrained from voting on governance decisions to date. The leadership’s role is primarily to ensure the implementation of the DAO’s collective will. Over time, the ApeCoin Foundation plans to transition the operational complexities on-chain as much as possible to create a more transparent and self-regulating community. The intent is to create a community that can function in a truly decentralized manner.

Traction / Membership

In the ~six months since launch, ApeCoin has traveled through over 257,000 unique wallets in aggregate, with the current unique holder count sitting at ~91,000. The token experienced its largest surge in new user growth in April during the runup to The Otherdeed minting event. New user interactions with APE gradually grew from ~1,000 unique wallets/day on April 1 to a peak of 29,464 on April 30. This growth coincided with the launch of the virtual land collection that could only be purchased with APE. The previous single-day peak in new user growth unsurprisingly occurred the day of the official APE airdrop on March 17.

A similar spike in user growth is likely to occur once the second Otherdeed minting event goes live (date TBD) with the remaining 100,000 Otherdeed plots.

Key Integrations, Partnerships, and Adoption

APE and the ApeCoin DAO have been busy in the six months since launch, demonstrated by a growing list of partnership and integration announcements that have surrounded the APE community. This comes as no surprise to many in the NFT space, given ApeCoin’s close association with Yuga Labs, BAYC, and other heavy hitters in the space such as Animoca Brands. In fact, it seems ApeCoin’s powerful network of stakeholders is largely to thank for several of the biggest announcements to-date.

For example Benji Bananas and nWayPlay, two gaming platforms backed by Animoca Brands, have agreed to accept APE as a form of in-game currency. Separately, the major fashion brand Gucci launched a pilot program with BitPay to accept certain cryptocurrencies as payment at select US stores — one of those currencies being ApeCoin. And of course, The Otherside remains one of the most highly anticipated APE integrations still in development.

Even if not yet implemented, partnerships such as these have a positive effect on the public’s perception of APE’s potential to become a widely accepted native currency across digital economies. In turn, these announcements drive demand from new users looking to gain exposure to the young currency. As highlighted in the graph above, unique wallets holding less than 1000 APE (Krill) continue rising despite the number of larger holders (Fish through Whales) remaining relatively stagnant since The Otherdeed mint back in April. Additionally, these smaller holders have remained the largest cohort since the initial airdrop. These factors provide some indication that ApeCoin’s early efforts thus far have made progress on the gradual journey toward decentralization.

Competition / Risks

APE and the ApeCoin DAO are an example of one of an endless number of exciting experiments that tend to emerge in the burgeoning crypto space. However, as crypto natives are well aware, these experiments are not without their risks, and ApeCoin is no exception. One of ApeCoin DAO’s biggest strengths also encapsulates its largest risk: the DAO treasury or “Ecosystem Fund.”

More specifically, there is a risk that ApeCoin DAO’s massive warchest is drained over time in any number of ways that may ultimately result in value flowing away from, not back to, the APE token. Whether it be an unfortunate hack, fraudulent mismanagement of funds, or just a long series of poor bets and grant awards on mediocre projects, the $2 billion+ DAO treasury is impressive. Nonetheless, the treasury is not infinite, regardless of size.

This risk becomes exponentially more dangerous under an assumption that treasury funds are not diversified and remain 100% denominated in APE. Under such a scenario, unforeseen circumstances could lead to a sudden surge in negative sentiment toward the ApeCoin ecosystem, leading to a rapid decline in APE’s price. A 90%+ decline is not unheard of in the crypto industry — if the DAO treasury were to experience such a decline it could severely hobble the ecosystem’s ability to gain lasting influence and become the dominant metaverse token.

Of course, prudent diversification of funds across various assets, projects, and communities could easily mitigate some of these risks. In fact, the ApeCoin network of stakeholders includes some of the most prolific investors in the crypto space, hence, a diversification plan may very well already be in the works.

Closing Summary – The Economic Flywheel

To an outside observer, “ApeCoin” may seem indistinguishable from an endless supply of other “meme coins” that clutter the crypto-sphere. But this comparison fails to tell the whole story.

APE’s value is anchored by the ApeCoin DAO’s “Guiding Values,” as detailed on their Governance page:

- Boldness: We don’t shy away from the weird, the hard, or the new.

- Equality: One APE equals one APE.

- Transparency: Processes and decisions are shared openly with the community.

- Collective Responsibility: We leave everything better than we found it.

- Persistence: Success is an ouroboros, not a straight line.

Once paired with an understanding that ApeCoin DAO is a group of Web3-natives, creatives, and influencers backed by a massive “Ecosystem Fund” used to crowdfund the best and brightest community-sourced ideas — the value proposition for APE becomes clearer.

ApeCoin is an intriguing experiment that seeks to uncover the potential of linking several sources of raw potential: human capital, a Web3 decentralized organizational structure, token-based incentive alignment, and a seemingly boundless source of funds (for the foreseeable future, at least). Assuredly, there will be bumps along the way and not all of ApeCoin DAO’s grants will pan out. But when building in this young industry, one must look no further than Bored Ape Yacht Club to recognize the potential upside one good idea can have.