BREAKING: Youtubers Grand Angle Meta (GAM) expose to NFTEvening evidence of possible market manipulation by the Immutable X (IMX) platform with regards to certain games on their digital marketplace. The report states that IMX trading volumes of certain games are artificially inflated, particularly for their top sellers Gods Unchained and Blocklords. These games are developed and published by Immutable and its partners. Let’s dive into what the research reports.

How Is Immutable X Manipulating Their Market Prices?

This investigation is conducted by popular Youtubers GA Meta to uncover what is going on. The Grand Angle reports question whether Immutable is artificially boosting certain games to make them appear successful or (possibly) if there is a hack of the platform or both. It is noted that other collections are not affected by these artificial exchanges.

So what exactly is happening with IMX and their top-selling games? Here’s what they discover:

Part 1 – Hyper Inflated Trading Cards

Immutable X is a platform that allows collections of NFTs to remove gas charges and trading volume constraints thanks to their integration of Starknet technology. While researching for a video on IMX, the team looked at the trading volumes on Immutascan.io, which ranks projects by volume of exchange. The first five games on the list are metaverse games, which aligns with the GAM channel’s expectations.

Please keep the 7-day and 30-day volumes in mind for the top 2 games as you read further.

On Immutascan, the GA Meta team observes that Gods Unchained is the undefeated leader in terms of the trading volume. But what stands out is the significant gap in trading volumes between the top two games and the rest. There is a difference of one to ten for Cross the Ages and Illuvium and one to one hundred for Undead Blocks. The report notes that Gods Unchained and Blocklords must be exceptional to justify such interest.

Upon further investigation of the God’s Unchained marketplace, a startling revelation comes to light. Firstly, most of the cards on the Gods Unchained marketplace are worth just a few cents. This is expected because the game mechanics for this game are similar to traditional card games. To clarify, this means that as the seasons pass, the old cards lose their value over time. This is because they are rendered useless by the new seasons and newer cards.

The Problem With Gods Unchained Cards

This is already somewhat of a dicey situation for web3 play-to-earn purists. Meaning that it is a problem when the cards a player holds start to lose their value. This move completely defeats the purpose and ethos of digital collectibles and NFTs in web3 gaming. The games in the metaverse can’t simply be a transposition of classic game mechanics by sticking NFTs and crypto on them. To remain functional, a fair and sensible economic and financial system must exist for these games.

In older game models, the problems of inflation or the proliferation of certain assets are resolved by adding a “one-size-fits-all” update. There is no discernible long-term value for game assets, whereas blockchain technology changes that by adding value via community, ownership, digital scarcity, and other perks of NFTs. Moreover, this is exactly the kind of “axe update” that is said to have inspired Vitalik Buterin to create the Ethereum network. This is why it is important to update and innovate the gaming systems for any web3/NFT-based game.

The GU market place on Immutable displays a bunch of cards exchangeable for a few cents. Furthermore, when the GAM team sorted the recent sales and their prices in USDC, they predicted that there may have been massive trades for ultra-rare cards to hit a weekly $3 million volume. But, to nobody’s surprise, this was not the case. They observe that only 50 trades take place within a week, with lots of cards going for a few cents. Not even adding up to $100!

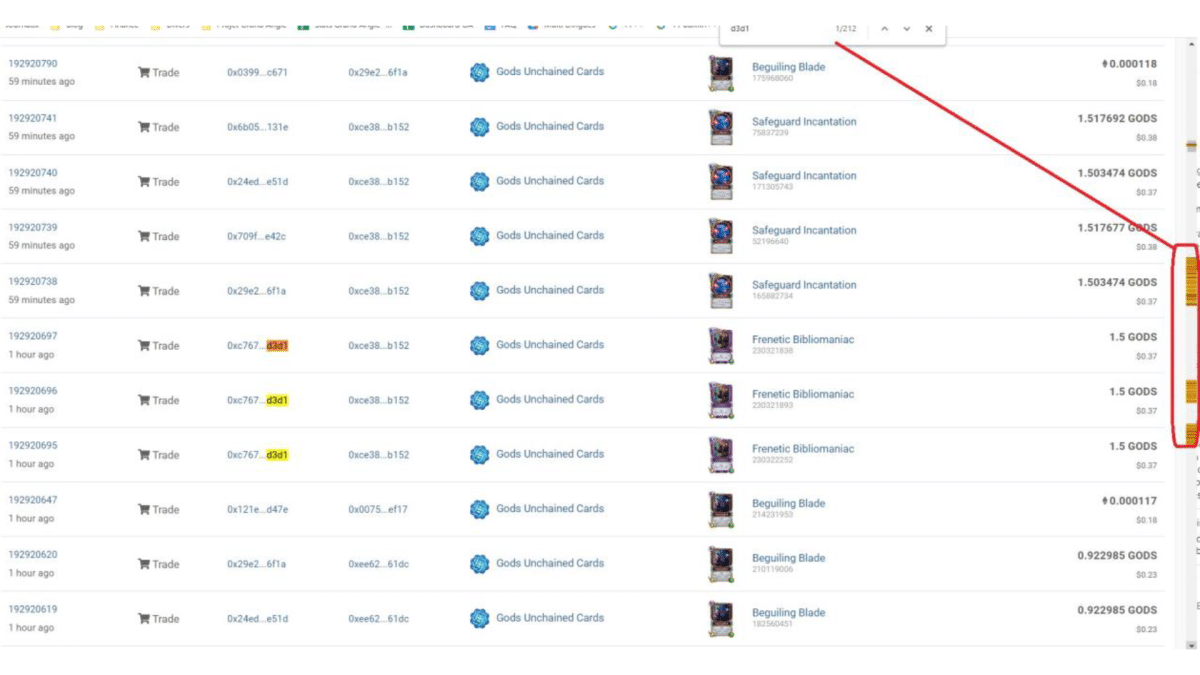

Switching to recent trade volumes in ETH, the team observes thousands of hourly trades, but the numbers still do not add up to the ~$3 million figure. This begs the question – where is all that money pouring in from?

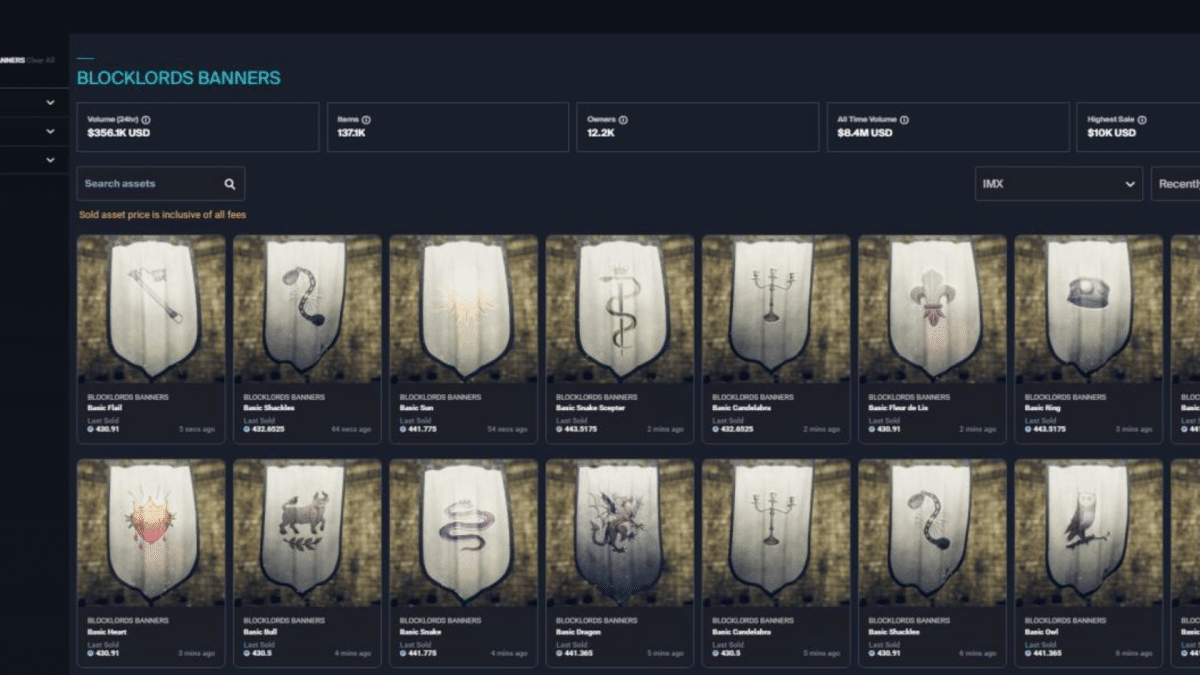

Blocklords

The team also discovers the same pattern in another title – Blocklords. A game that rakes in ~$2.5 million volume a week. Still, the Blocklords “Banners” marketplace states there are minimal USDC or ETH transactions across the board. On the other hand, as the GA team switches the buy option to IMX (the native cryptocurrency of Immutable X), the story flips completely.

The team discovers that IMX transactions are super expensive on each of these gaming platforms. Some cards run upwards of $400, whereas the same items in USDC only cost a few dollars.

There is no justifiable logic behind why the prices of a digital item should multiply by x200 just by switching to a different cryptocurrency.

The On-Chain Story

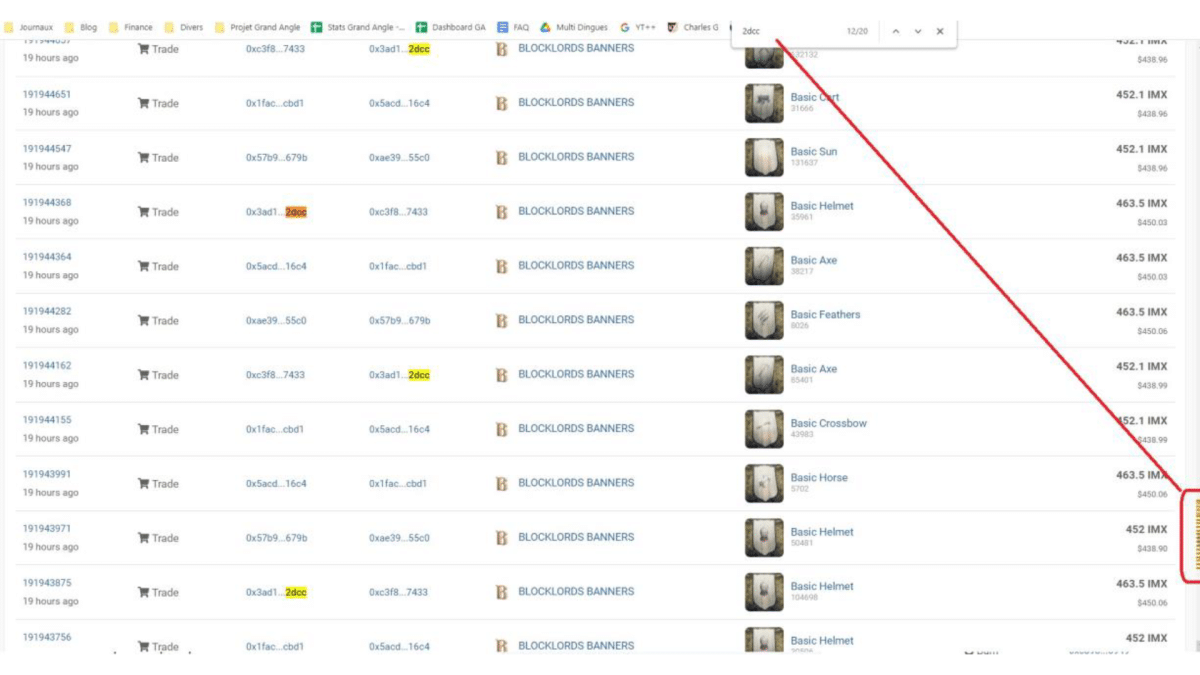

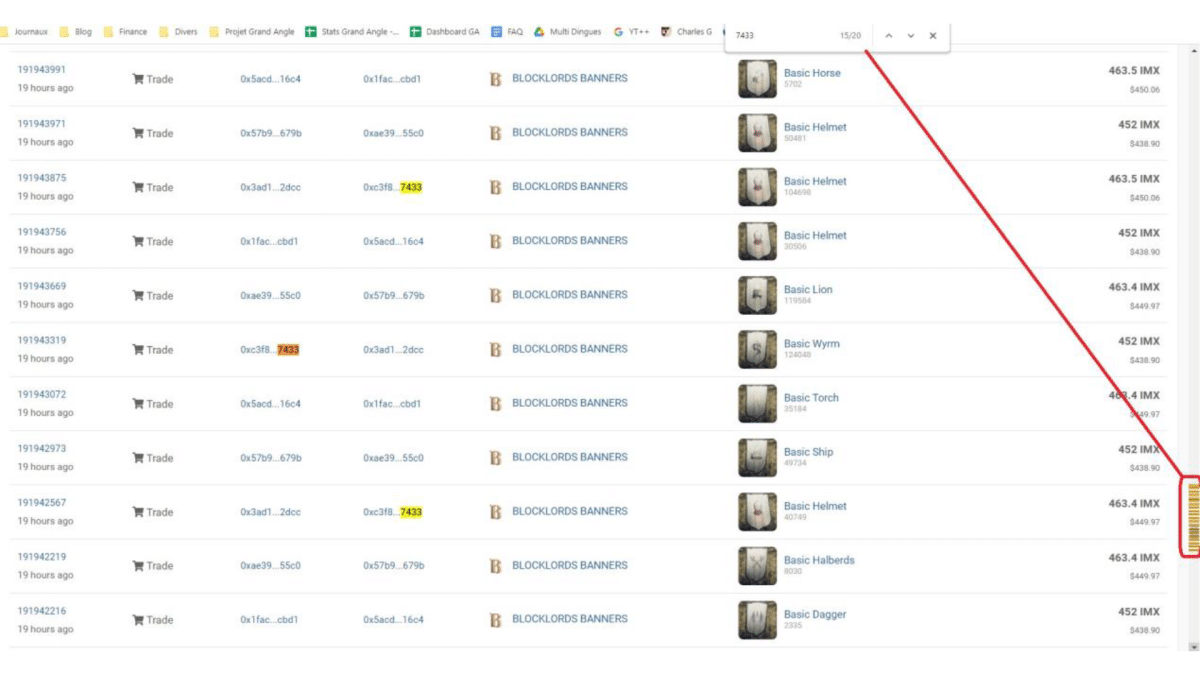

The team then ventures into Immutascan once more to verify transactions for the Blocklord card game. This is where they discover multiple addresses transacting with one another in the IMX currency.

For instance, In the image above, the wallet number 2dcc interacts with other wallets with a bunch of transactions all within a short period. The same is observed with other wallet numbers.

The report states that all these accounts are linked to one another as they continuously exchange cards with each other. Strangely, these accounts have a pattern of doing up to 20 trades at regular time intervals.

This leads the team to believe that these wallets are automated. 20 transactions for similar amounts with addresses that answer each other on IMX.

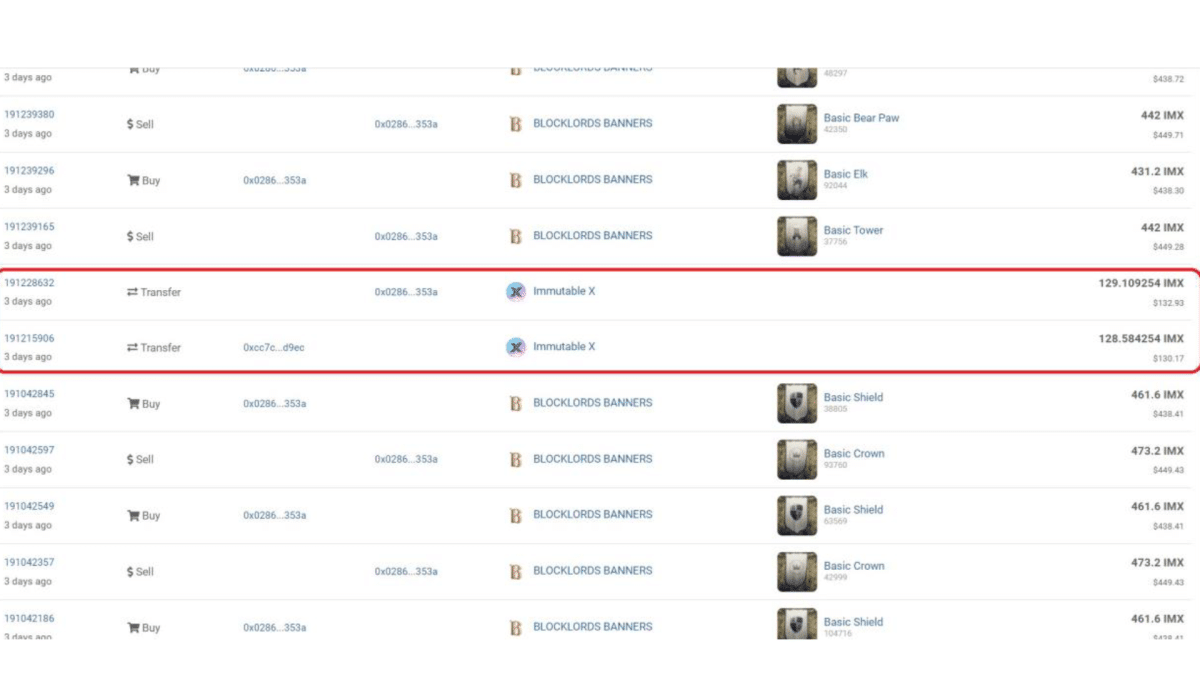

Moving on, the team discovers that these addresses also regularly take out the crypto on IMX, as shown below.

Most of these addresses have a consistent pattern. They buy and resell the same assets endlessly.

Part 2 – IMX Rewards & Dodging Fees

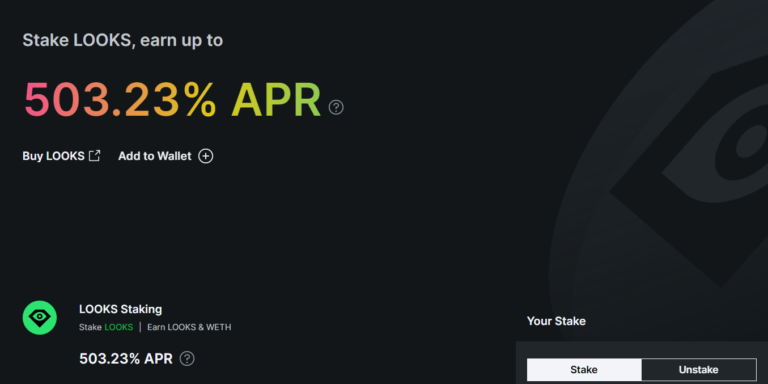

The multiple wash trades would also mean there are fees and other costs to break even and become profitable. This is where the IMX Reward System comes in. Immutable X incentivizes traders on their platform. When you trade on the platform, you earn IMX, which is the native token/currency of the Immutable X ecosystem.

How To Earn “Free” IMX?

To earn points and IMX tokens on ImmutableX, you need to have a registered wallet. When you trade between $10 and $10,000 worth of NFTs from an Eligible Collection, you earn points based on your trading volume for that day. Eligible Collections are determined by quality, community engagement, royalty fees, and other criteria.

Points are earned in a non-linear fashion and increase as you trade more. Once your wallet reaches $10,000 in trading volume for that day, you no longer accumulate points. Points earned are converted into IMX tokens based on the number of points earned relative to everyone else. Daily earnings are distributed cumulatively each week by end of day Friday UTC.

The most important factor here is that the more you are among the big traders, the more your share of the daily rewards increase. This means these wallets must do high volumes to gain as much IMX as possible. However, the platform itself contains transaction fees for each collection. And hence, the addresses need to find the collections that take the lowest fees to break even and earn a profit over investment.

Wash Trading On Immutable X…Gone Wrong.

The trading rewards for the least trading fee ratio applies to five collections on IMX. Not surprisingly, they are Blocklords, Gods Unchained, Immortal Game, Sparkadia, and Undead Blocks. These games take up to 0.5% trading fees as compared to other gaming titles that go up to 4, 5, 7, or even 9% trading fees.

To earn the $21,000 daily reward on ImmutableX, players need to earn a high percentage of points compared to other traders. This requires a daily trading volume of at least $700,000, generating $3,500 in fees at 0.5%.

In this case. however, it’s unlikely that this volume is solely from IMX as these traders may have created their own marketplace or negotiated fee reductions with some of the five (low-fee) game creators. The $20,000 reward is profitable but doesn’t account for project costs or fees paid by average users. The operation is very profitable at 0.5% fees but that’s just Immutable’s fees. This doesn’t take into account project costs. So in a reverse calculation, $20,000 in IMX rewards corresponds to a maximum of $450,000 for 4.5% fees, which is what an average user pays when he wants to sell an asset on Blocklord. The reality is likely somewhere in between.

Dead Twitter & Discords

Looking at the dollar transactions, Gods Unchained, and Blocklord generate very little revenue each day. The most popular projects on IMX are Cross the Ages, the HRO collection, and Illuvium (which currently has low activity). This is supported by BOTH the communities’ activity on Twitter and Discord, which is minimal with low reach and engagement.

For example, on the Blocklord servers with one scroll pulling users back to days of previous activity on the server. This is highly strange, for a game that supposedly makes ~$3 million a month.

The community engagement on Twitter and Discord for this project is low, with only tweets containing giveaways or major announcements generating some noise. While Discord is more active, it’s still not comparable to games with millions of monthly users. In larger-scale projects, the general chat is usually very active, but in this case, a single screenshot can cover more than an hour and scrolling through several days is possible.

Part 3 – Illuvium

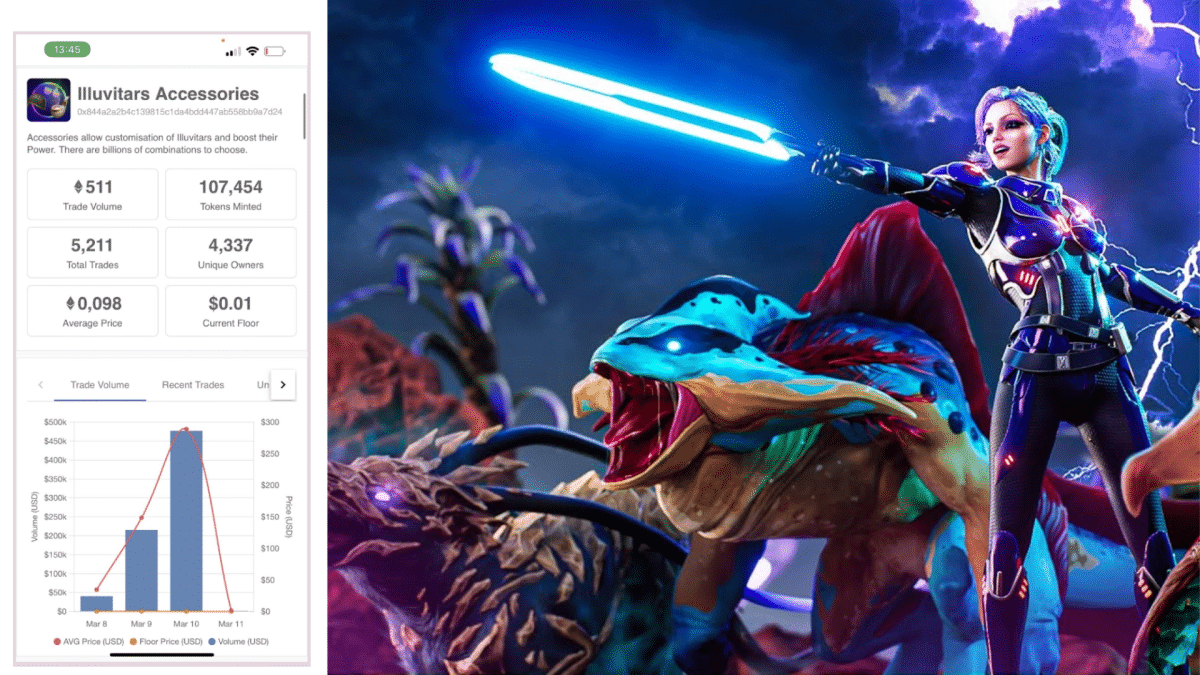

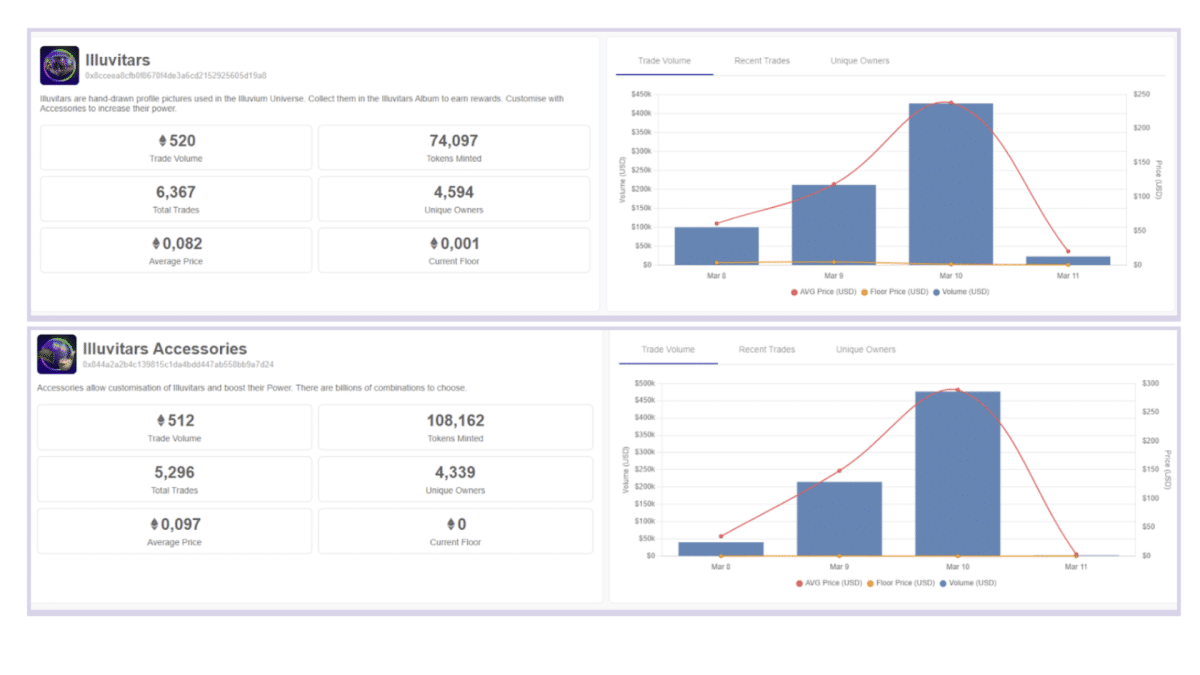

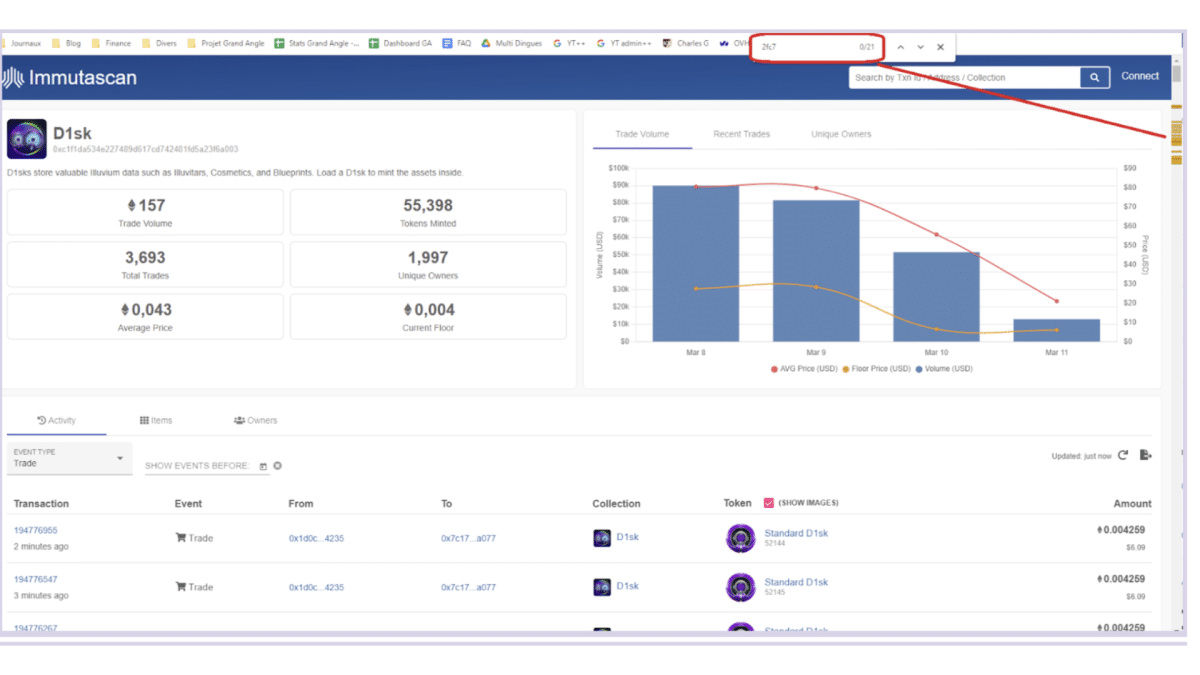

On Saturday, March 11th, the GAM team realized that a significant portion of these abnormal volumes has moved to Illuvium since Thursday, March 9th. The Illuvium project recently launched a series of cosmetic NFTs called the Illuvitars. While the initial sales volumes were low, they exploded over the following days. The collection reaches over $1 million on Friday alone. However, upon closer inspection, it appears that a significant portion of the traffic driving these sales may be artificial.

Upon investigation, the GA Meta team discovered that about 90% of the activity on Illuvium may be artificial. They found a pattern of addresses that were responding to each other and conducting thousands of transactions in a short amount of time at standardized prices, suggesting that a well-defined entity is driving these crafted volumes.

On March 8th, the sales volumes for a certain collection were below $50,000. This isn’t surprising as the interest in the collection was not apparent among players. However, on Thursday, Friday, and Saturday, the sales volumes surged to over $1 million. This leads to suspicions of artificial traffic.

After analyzing the block explorer, the team notes that 90% of the traffic was indeed artificial. It follows the earlier pattern of similar addresses answering each other. Moreover, the volumes of other games, such as Gods Unchained and Blocklords, decreased while Illuvium’s increased. This suggested the presence of a well-defined entity driving the volumes.

Moreover, Illuvium was the only game left on the list of projects offering IMX rewards based on trade volumes. The Immutable platform should put an end to these practices. Or else, they risk being perceived as manipulating the volumes in the marketplace.

Why This Even Matters In Web3?

It is important to note that the metaverse is still very young and carries a high level of risk for those who enter it. While Immutable is a promising project, metaverse platforms need to prioritize serious projects over high-volume displays. This helps promote genuine growth and add long-term value to the industry. It is crucial to avoid allowing smart individuals to manipulate volumes, as this sends negative signals to the general public and undermines the credibility of crypto projects.

GA Meta is currently interested in only two metaverses, Cross the Ages and Illuvium. Moreover, the focus is on an in-depth analysis through their lab. The team recognizes the need to stay patient and remain in the web3 dream for a while, but is convinced that the future of gaming lies in the metaverse.

Next Action Steps from GAM

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.